Hello my dears,

September is over.

That's why I'd like to give you a little overview of the month.

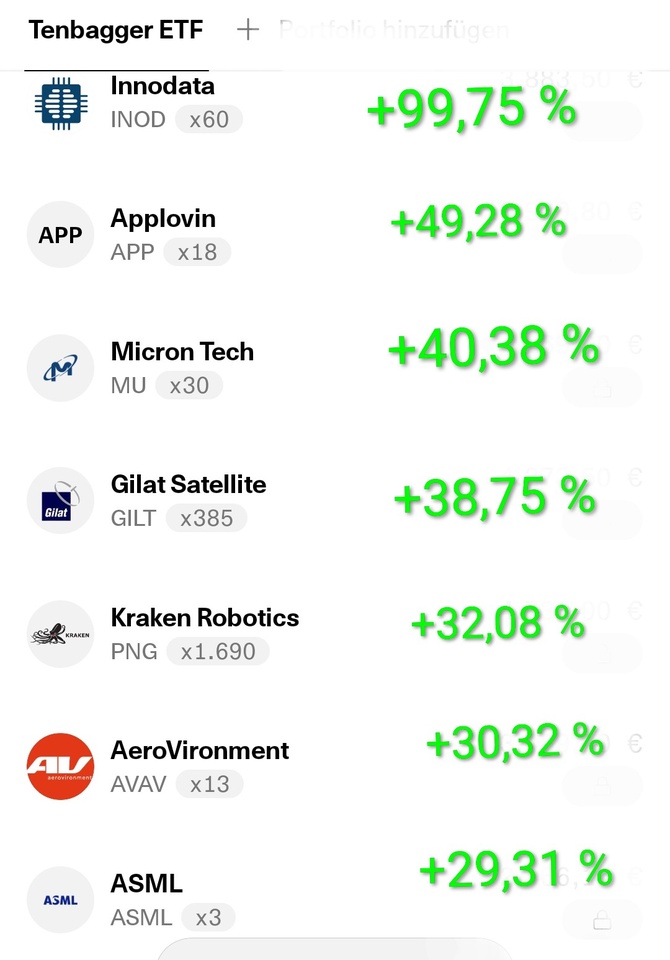

Tops: 📉

$INOD (-0.68%)

$APP (-1.53%)

$MU (-5.88%)

$GILT (-3.47%)

$PNG (-4.95%)

$AVAV (+5.64%)

$ASML (-5.28%)

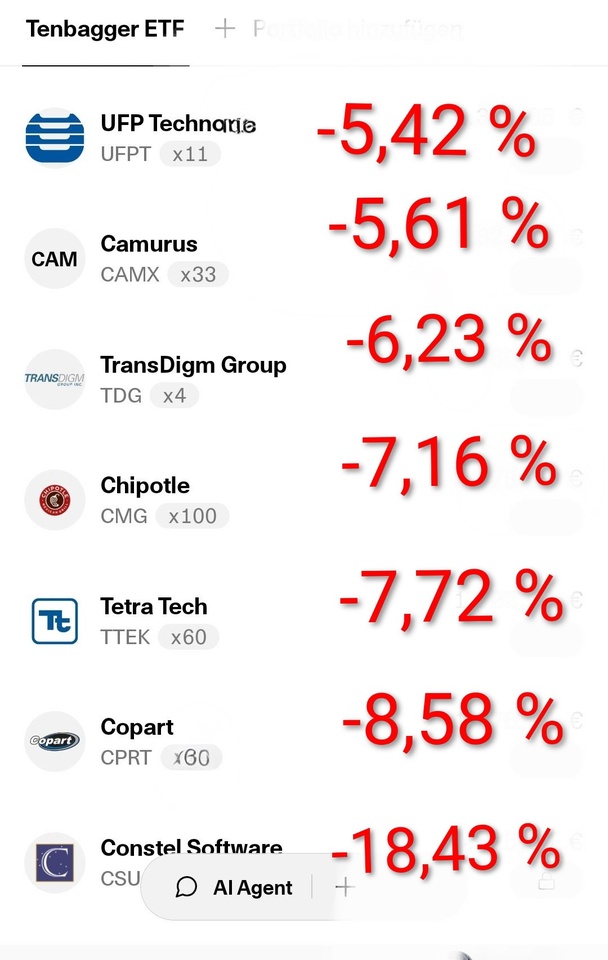

Flops: 📈

$UFPT (-0.06%)

$CAMX (+0.24%)

$TDG (-0.13%)

$CMG (-4.73%)

$TTEK (-3.22%)

$CPRT (-1.53%)

$CSU (+6.34%)

It was noticeable in September that there were a lot of long runners and compounders among the flops. For this reason, I am relaxed for the time being and will stick to the values.

📉

My overall portfolio closed the month up 8.64 %.

$EQQQ (-1.56%) NASDAQ 100. +4.81 %

$IWDA (-1.16%) MSCI World. +2,62 %