$NDX1 (-5.64%) cashed out of Nordex today after years. Originally bought 500 shares in 2019 with the hope of a takeover and belief in sustainable energies. Then bought more during Corona at 7 euros. Completed my best German investment today.

Discussion about NDX1

Posts

37Nordex conquers the American market

$NDX1 (-5.64%) surprised positively again today after very good figures last month (see my last comment) and secured a major order in the USA with $LNT (+0%) secured. Accordingly, 190 wind turbines will soon be delivered to the US plant. Although the official approvals are still pending, Alty is already responding to the largest order in the company's history.

Nordex ignites the Tuebo

$NDX1 (-5.64%) The Nordex Group has significantly raised its EBITDA margin forecast for 2025. This is based on strong preliminary figures for the third quarter, which show operational strength in the Projects and Service divisions and point to a stable macroeconomic environment. The share ignites the turbo.

For the full year 2025, Nordex now expects an EBITDA margin of 7.5 to 8.5 percent instead of the previous 5.0 to 7.0 percent. Preliminary EBITDA for the third quarter amounted to EUR 136 million, with sales of around EUR 1.706 billion. CEO José Luis Blanco emphasizes the successful implementation of the projects and the positive free cash flow development.

Bank of America bets on 14 rising infrastructure stocks

Bank of America (BofA) has put together a basket of stocks to list the winners of the German infrastructure package.

The basket contains 14 stocks that the US bank expects to benefit in particular.

- The German technology group Siemens

$SIE (-4.49%) (weighted at 10.3 percent, as of August 21) - The French construction group Eiffage $FGR (-3.44%) (9 percent)

- The German building materials manufacturer Heidelberg Materials

$HEI (-1.89%) (8.8 percent) - The German energy technology group Siemens Energy $ENR (-5.27%) (8.6 percent)

- The German truck manufacturer Daimler Truck

$DTG (-4.13%) (8.4 percent) - The Italian building materials company Buzzi S.p.A.

$BZU (-2.93%) (7.9 percent) - The Swiss cement group Holcim $HOLN (-1.01%) (7.6 percent)

- The Swiss chemicals group Sika AG $SIKA (-3.27%)

(7.4 percent) - The German forklift manufacturer Kion

$KGX (-6.14%) (6.7 percent) - The French communications and energy company Spie $SPIE (-0.77%) (6.4 percent)

- The German industrial group Thyssen-Krupp $TKA (-6.69%) (6.4 percent)

- The German wind turbine manufacturer Nordex

$NDX1 (-5.64%) (4.6 percent) - The Swedish steel group SSAB $SSAB A (-6.23%)

(4.1 percent) - The German industrial services provider Bilfinger

$GBF (-7%) (4.0 percent)

Hopes for the infrastructure package have already caused the shares to rise significantly in some cases in recent months. Since the beginning of the year, the shares included in the basket have risen by around 47 percent. BofA has been offering the share basket to its major clients since the beginning of July.

Despite the jump in the prices of many infrastructure stocks in the first half of the year, BofA manager Klein is confident that the stocks in the basket will continue to rise. According to him, it now depends on when the investments really show up in the profits of the companies.

Oliver Schneider, portfolio advisor at US asset manager Wellington, says: "In the past six to nine months, investor interest in infrastructure stocks has grown rapidly." This is particularly true for European investors.

He cites two factors that he believes will drive infrastructure stocks worldwide in the future. Firstly, there is a great need to modernize infrastructure. Secondly, the demand for electricity is growing due to artificial intelligence. Schneider says: "This is a growth topic that will be with us for the next ten to 20 years."

Source: Text (excerpt) & graphic, Handelsblatt 01.09.25

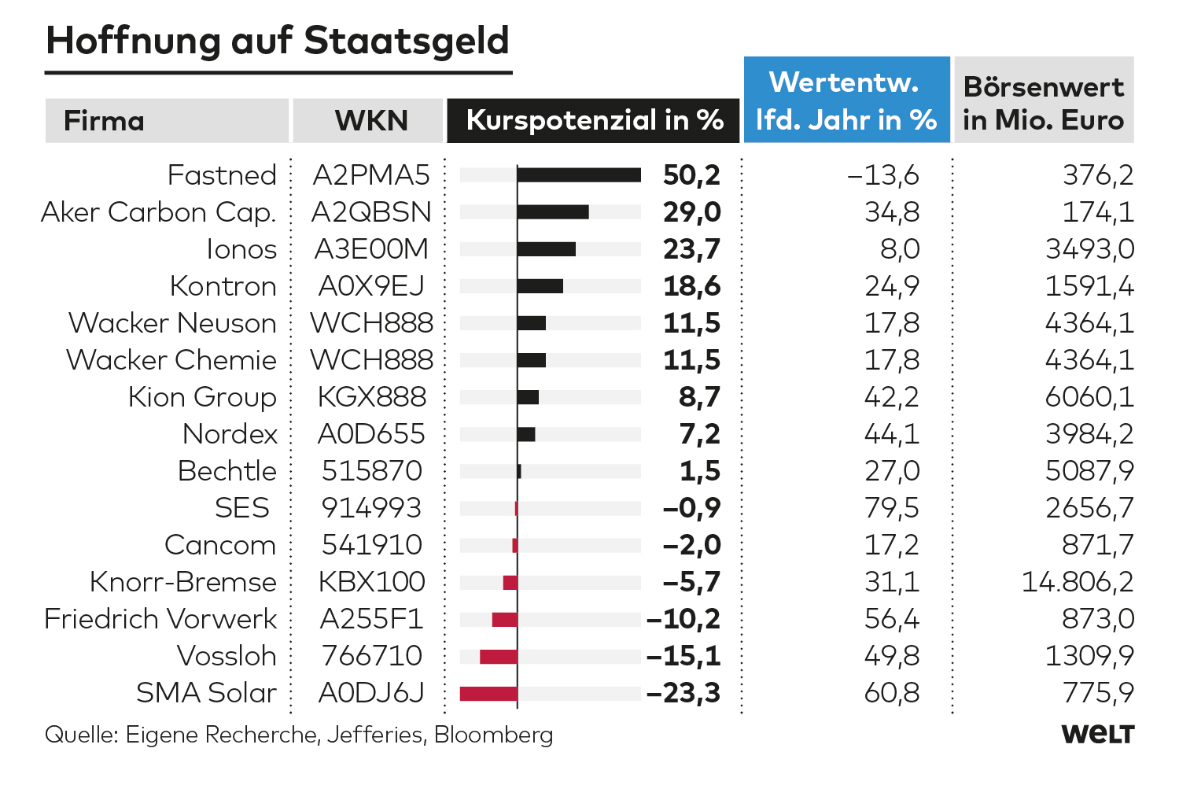

Beneficiaries of the debt package - these 15 German stocks have the best chances

According to "Welt", companies active in construction, rail infrastructure, digitalization and the energy industry are considered to be beneficiaries of the debt pact. So-called green sectors are also likely to benefit.

A few examples:

$FAST (-1.85%) - Fastned

$ACC - Aker Corp

$IOS (-2.45%) - Ionos

$KTN (-2.24%) - Kontron

$NDX1 (-5.64%) - Nordex

$BC8 (-0.45%) - Bechtle

$VOS (-5.66%) - Vossloh

$S92 (-9.87%) - SMA Solar

Despite all the debt euphoria, however, investors should bear in mind that the infrastructure companies are smaller stocks that are not without risk.

Source (excerpt) & chart: World

Nordex and Vestas - sustainable rise?

Hi everyone,

This is my first contribution. I have been observing the two wind power values for some time now $NDX1 (-5.64%) and $VWS (-3.2%) - and am also invested in both.

Gradually, both seem to be profitable or becoming more and more profitable, which could explain the current upward movement in the market, among other things. While many tech and crypto stocks are currently correcting massively, the last few days have seen a further sharp rise in both candidates.

But is it enough to end the prolonged downward trend and build a sustainable bottom or reverse the trend? It remains exciting.

It will also be interesting to see how Nordex performs tomorrow after the presentation of the figures for the full year 2024 and what reactions will follow in the market.

Also nice: some analysts are currently attesting to considerable upside potential. Goldman Sachs, for example, recently confirmed its buy rating for both stocks. Nordex €20.10; Vestas DKK 197 (~€26.41).

How do you see the whole thing? Do you still believe in wind energy stocks? Who is still invested?

Kind regards ✌️

I'm neither an investor nor do I deal with the topic of "wind power", but I would be careful here myself. I could imagine that political decisions could have a strong influence on the share price. Take the example of Germany - if the new government moves back in the direction of coal and nuclear power (just one example - whether this will be true is another matter...) then a correction is virtually pre-programmed here. 😅

However, you also mentioned in your post that GS has confirmed the valuation for both stocks, which is basically a good indication. I always preach the Warren Buffet principle "Only buy what you understand" - so if you understand the issues surrounding wind power such as politics and the economy in the next few years and are sure that you will be successful or even beat the market - then GO FOR IT! 🚀

Analyst updates, 17.12.

⬆️⬆️⬆️

- - UBS raises the price target for AMAZON from USD 230 to USD 264. Buy. $AMZN (-0.25%)

- - CITIGROUP raises the target price for ALLIANZ SE from EUR 286 to EUR 314.40. Neutral. $ALV (-3.48%)

- - BARCLAYS raises the target price for DHL GROUP from EUR 37.50 to EUR 38. Equal-Weight. $DHL (-3.74%)

- - DEUTSCHE BANK RESEARCH upgrades AIRBUS from Hold to Buy and raises target price from EUR 155 to EUR 185. $AIR (-2.18%)

- - BERENBERG raises the price target for MUNICH RE from EUR 525 to EUR 552. Hold. $MUV2 (-4.18%)

- - KEPLER CHEUVREUX raises the price target for ADESSO from EUR 80 to EUR 100. Hold. $ADN1 (-0.49%)

- - WARBURG RESEARCH raises the price target for FMC from EUR 31 to EUR 36. Sell. $FME (-1%)

- - DEUTSCHE BANK RESEARCH raises the target price for AUTO1 from EUR 12 to EUR 20. Buy. $AG1 (-2.03%)

- - DEUTSCHE BANK RESEARCH raises the price target for MTU from EUR 329 to EUR 337. Hold. $MTX (-1.49%)

- - DEUTSCHE BANK RESEARCH raises the price target for HENSOLDT from EUR 37 to EUR 41. Buy. $HAG (-3.08%)

- - DEUTSCHE BANK RESEARCH raises the target price for ROLLS-ROYCE from GBP 5.55 to GBP 6.30. Buy. $RR. (-5.58%)

- - BOFA raises the target price for INFINEON from EUR 36 to EUR 40. Buy. $IFX (-6.51%)

- - BOFA raises the price target for STMICRO from EUR 29 to EUR 30. Buy. $STMPA (-5.82%)

- - BOFA raises the target price for NOKIA from EUR 4.07 to EUR 4.58. Neutral. $NOKIA (-3.01%)

⬇️⬇️⬇️

- - JPMORGAN downgrades TRANSMEDICS from Overweight to Neutral and lowers target price from 116 USD to 75 USD. $TMDX (-0.08%)

- - BOFA lowers the price target for SILTRONIC from EUR 59 to EUR 46. Underperform. $WAF (-4.18%)

- - HSBC lowers the price target for CARL ZEISS MEDITEC from EUR 66 to EUR 54. Hold. $AFX (-1.31%)

- - KEPLER CHEUVREUX lowers the price target for HEIDELBERGER DRUCK from EUR 1.25 to EUR 1. Hold. $HBGRY (-4.31%)

- - KEPLER CHEUVREUX lowers the price target for EVONIK from EUR 25 to EUR 21. Buy. $EVK (-3.6%)

- - KEPLER CHEUVREUX lowers the price target for NORDEX from EUR 17 to EUR 14. Buy. $NDX1 (-5.64%)

Analyst updates, 29.11.

⬆️⬆️⬆️

- BOFA raises the price target for SIEMENS ENERGY from EUR 48 to EUR 52. Neutral. $ENR (-5.27%)

- GOLDMAN raises the target price for DEUTSCHE TELEKOM from EUR 37 to EUR 39. Buy. $DTE (-1%)

- BERENBERG raises the price target for PFIZER from USD 27 to USD 29. Hold. $PFE (-2.16%)

- JPMORGAN raises the target price for JUST EAT TAKEAWAY from GBP 14.15 to GBP 16.02. Overweight. $TKWY

- WARBURG RESEARCH raises the target price for RATIONAL from EUR 800 to EUR 810. Hold. $RAA (-1.96%)

- BOFA upgrades SCHNEIDER ELECTRIC from Underperform to Neutral and raises target price from 175 EUR to 255 EUR. $SU (-5.33%)

- BOFA raises the price target for NORDEX from 17.90 EUR to 19.30 EUR. Buy. $NDX1 (-5.64%)

- BERENBERG raises the target price for ZALANDO from EUR 29.70 to EUR 38. Buy. $ZAL (-3.32%)

- WARBURG RESEARCH upgrades WACKER NEUSON from Hold to Buy. Target price EUR 17. $WAC (-4.04%)

- WARBURG RESEARCH raises the price target for ALZCHEM from EUR 75 to EUR 77.50. Buy. $ACT (+0.32%)

- ODDO BHF upgrades NORMA GROUP from Neutral to Outperform. Target price EUR 18.10. $NOEJ (-4.66%)

- BOFA raises the price target for KNORR-BREMSE from EUR 68 to EUR 70. Underperform. $KBX (-4.08%)

- BOFA upgrades ABB to Buy. $ABBNY (-4.64%)

- BOFA upgrades KION from Neutral to Buy and raises target price from EUR 39.50 to EUR 48.50. $KGX (-6.14%)

- BOFA upgrades JUNGHEINRICH from Underperform to Neutral and raises target price from EUR 24 to EUR 26. $JUN3 (-3.57%)

- BERENBERG raises the price target for GLOBAL FASHION GROUP from EUR 0.23 to EUR 0.27. Hold. $GFG (-2.47%)

- HSBC raises the price target for DEUTSCHE BÖRSE from EUR 230 to EUR 236. Buy. $DB1 (+2.94%)

⬇️⬇️⬇️

- KEPLER CHEUVREUX lowers the price target for HUGO BOSS from EUR 59 to EUR 41. Buy. $BOSS (-1.68%)

- BOFA downgrades GENERALI from Neutral to Underperform and raises target price from EUR 26 to EUR 27. $G (-4.22%)

- DEUTSCHE BANK RESEARCH lowers the price target for L'OREAL from EUR 335 to EUR 280. Sell. $OR (-3.87%)

- BOFA lowers the target price for BAE SYSTEMS from GBP 13.75 to GBP 12.40. Underperform. $BA. (-0.17%)

- BERENBERG lowers the price target for ALLGEIER from EUR 22 to EUR 19. Buy. $0RQZ

Analsyst updates, 08.11.

⬆️⬆️⬆️

- GOLDMAN upgrades BIONTECH from Neutral to Buy and raises price target from USD 90 to USD 137. $BNTX (-6.36%)

- BOFA raises target price for UNDER ARMOUR from USD 9 to USD 13. Neutral. $UAA (-2.65%)

- DEUTSCHE BANK RESEARCH raises the price target for DELIVERY HERO from EUR 29 to EUR 35. Hold. $DHE

- DEUTSCHE BANK RESEARCH raises the price target for SIEMENS from EUR 197 to EUR 200. Buy. $SIE (-4.49%)

- JEFFERIES raises the price target for HOCHTIEF from EUR 135 to EUR 138. Buy. $HOT (-4.64%)

- DEUTSCHE BANK RESEARCH raises the price target for SIEMENS HEALTHINEERS from EUR 60 to EUR 62. Buy. $SHL (-2.6%)

- DEUTSCHE BANK RESEARCH raises the price target for NORDEX from EUR 18 to EUR 19. Buy. $NDX1 (-5.64%)

- DEUTSCHE BANK RESEARCH raises the price target for RATIONAL from 832 EUR to 841 EUR. Hold. $RAA (-1.96%)

- DEUTSCHE BANK RESEARCH raises the target price for AXA from 37 EUR to 39 EUR. Buy. $CS (-3.48%)

- WARBURG RESEARCH raises the price target for BASTEI LÜBBE from EUR 11.70 to EUR 12.20. Buy. $BST (-0.58%)

- DEUTSCHE BANK RESEARCH raises the price target for ARCELORMITTAL from EUR 28 to EUR 29. Buy. $MT (-8.01%)

- DZ BANK raises the price target for SWISS RE from CHF 130 to CHF 140. Buy. $SREN (-2.5%)

- ODDO BHF raises the price target for HEIDELBERG MATERIALS from EUR 99 to EUR 110. Neutral. $HEI (-1.89%)

- KEPLER CHEUVREUX raises the price target for DAIMLER TRUCK from EUR 35 to EUR 41. Hold. $DTG (-4.13%)

- KEPLER CHEUVREUX upgrades REDCARE PHARMACY from Reduce to Hold. $RDC (-8.39%)

- ODDO BHF raises the price target for HENKEL from EUR 67 to EUR 73. Neutral. $HEN (-3.66%)

- ODDO BHF raises the price target for FREENET from EUR 27 to EUR 28. Neutral. $FNTN (-1.62%)

- BARCLAYS raises the target price for ABOUT YOU from EUR 3.10 to EUR 3.40. Underweight. $YOU

- BARCLAYS raises the target price for NEMETSCHEK from EUR 108 to EUR 125. Overweight. $NEM (+0.07%)

⬇️⬇️⬇️

- BOFA lowers the price target for PINTEREST from USD 45 to USD 39. Buy. $PINS (+10.1%)

- WARBURG RESEARCH lowers the price target for DAIMLER TRUCK from EUR 56 to EUR 55. Buy. $DTG (-4.13%)

- UBS lowers the price target for JCDECAUX from EUR 21.60 to EUR 18.50. Neutral. $DEC (-2.22%)

- WARBURG RESEARCH lowers the price target for ADTRAN HOLDING from EUR 9.70 to EUR 9.30. Buy. $ADTN (+0.63%)

- ODDO BHF lowers the price target for NORDEX from EUR 18 to EUR 17. Outperform. $NDX1 (-5.64%)

- BARCLAYS lowers the target price for VESTAS from DKK 99 to DKK 80. Underweight. $VWS (-3.2%)

- KEPLER CHEUVREUX lowers the price target for FRAPORT from EUR 62 to EUR 59. Buy. $FRA (-3.19%)

- BARCLAYS lowers the target price for GSK from GBP 15.50 to GBP 14.50. Equal-Weight. $GSK

- BERENBERG lowers the price target for COMPUGROUP from EUR 23 to EUR 21. Buy. $COP (-1.03%)

- BERENBERG lowers the price target for JUNGHEINRICH from EUR 41 to EUR 39. Buy. $JUN3 (-3.57%)

- JEFFERIES lowers the target price for SUSS MICROTEC from EUR 87 to EUR 75. Buy. $SMHN (-3.46%)

Summary Earnings, 07.11.

$MUV2 (-4.18%)

| Munich Re Q3 24 Earnings

EPS EU7.02 (est EU6.67)

Sees FY Insurance Rev. About EU61B, Saw About EU59B

Sees FY Profit Above EU5B, Saw EU5B

$RHM (-3.97%) | Rheinmetall AG Q3 24 Earnings

Sales EU2.45B (est EU2.42B)

Still Sees FY Sales About EU10B (est EU9.99B)

Sees FY Operating Margin At Upper End Of Guidance

Nissan Motor Q2 2024 Earnings $7201 (-10.36%)

Q2 Operating Income 31.91B Yen (est 65.25B Yen)

Q2 Net Loss 9.34B Yen (est Profit 49.07B Yen)

Sees FY Oper Income 150.00B Yen, Saw 500.00B Yen

To Cut 9,000 Jobs Globally

To Reduce Global Production Capacity By 20%

To Sell Back Up To 10.02% Of Mitsubishi Motors Shares

Air France KLM Q3 24 Earnings $AF

EBITDA EU1.90B (est EU1.9B)

Rev EU8.98B (est EU8.88B)

Net Income EU780M (est EU874.3M)

Sees FY Capex EU3B, Saw Below EU3B

$TEF (-4.5%) | Telefonica Q3 24 Earnings

REV. EU10.02B (est EU10B)

Adj. EBITDA EU3.26B (est EU3.26B)

Net Income EU10M (est EU357M)

To Book €314 Million Non-Cash Impairment For Peru

ArcelorMittal Q3 24 Earnings: $MT (-8.01%)

- Sales $15.20B (est $15.23B)

- EBITDA $1.58B (est $1.47B)

- Still Sees FY CAPEX $4.5B To $5.0B

- Markets Conditions Are 'Unsustainable'

- Positive On Medium/Long Term Outlook

Daimler Truck Holdings Q3 24 Earnings: $DTG (-4.13%)

- Rev EU13.14B (est EU12.98B)

- Adj EBIT EU1.19B (est EU1.13B)

- Still Sees FY Rev EU53B To EU55B (est EU53.45B)

Adyen disappoints with lower than expected sales growth and loses 13% on the stock market. $ADYEN (-1.68%)

Lanxess-shares rise by 4.4% to 26.80 euros after a positive quarterly report, having previously fallen by 13%. The operating margin exceeds expectations, although prices weaken. $LXS (-7.32%)

National Grid increased its adjusted operating profit by 14% to 2 billion pounds in the first half of the financial year and expects an increase of around 10% for the year as a whole. Higher fees in New York and higher revenues in the UK are supporting growth. $NG. (-3.12%)

AMS-Osram increased its profitability in the third quarter despite a decline in sales, but expects business development to be subdued in the fourth quarter and early 2025. To ensure profitability, the company plans further cost reductions of 225 million euros by the end of 2026. $AMS

Suess Microtec is more optimistic after a strong third quarter and now expects to achieve its annual targets in the upper half of the forecast range. Sales are expected to reach 380 to 410 million euros, with an EBIT margin of 14 to 16 percent. $SMHN (-3.46%)

The investment company Mutares slips into the red operationally in the third quarter with an adjusted EBITDA loss of EUR 16.5 million. However, sales increased by 14% to 3.9 billion euros. $MUX (-3%)

Delivery Hero expects a free cash flow of EUR 50 to 100 million for 2024 and anticipates GMV growth at the upper end of the forecast of 7 to 9 percent. However, the Group expects adjusted EBITDA to be at the lower end of the range of EUR 725 to 775 million. $DHE

Deutz recorded an 80% drop in profits to EUR 7.2 million in the third quarter and slipped into the red with a bottom line of EUR 2 million. Turnover falls by 14.9% to 430.4 million euros due to a slump in demand. $DEZ (-10.08%)

Compugroup Medical records a decline in EBITDA in the third quarter

EBITDA fell by 12% to 54.9 million euros in the third quarter, but slightly exceeded

analysts' expectations slightly. Turnover falls by 1% to 283.4 million euros

euros, and the company confirms its reduced forecast for 2024. $COP (-1.03%)

Alzchem reports a jump in profits for the first nine months with

a 36% increase in EBITDA to EUR 76.8 million and increases the EBITDA margin to

EBITDA margin to 18.5 %. The Group is sticking to its profit target for 2024

but is aiming for the lower end of the sales forecast due to the discontinuation of low-margin

the lower end of the sales forecast. $ACT (+0.32%)

Nordex is raising its forecast for the EBITDA margin for 2024 and

now expects it to be closer to the upper end of the range of three to four

percent. In the first nine months of the year, the company recorded

an increase in revenue of 14 percent to EUR 5.1 billion and an improved

improved EBITDA margin of 3.7 percent. $NDX1 (-5.64%)

Nemetschek recorded an increase in revenue in the third quarter thanks to the

thanks to the GoCanvas acquisition, Nemetschek recorded a 15.1% increase in revenues to 253 million euros,

however, earnings remained slightly below expectations. The

The operating costs of the acquisition put pressure on profits, so that EBITDA

increases by 6.7 %. $NEM (+0.07%)

Rational increases earnings before interest and taxes in the third quarter

taxes by 18% to just under 78 million euros, exceeding analysts'

analysts' expectations, while sales revenues grew by 8% to 294 million

euros. The company confirms its forecast for the year. $RAA (-1.96%)

Trending Securities

Top creators this week