Holcim

Price

Discussion about HOLN

Posts

13Energy 4.0 - The foundation of a new industry Part 1.2

Good morning, dear getquin community.

I've been looking closely at the CSP hybrid ecosystem from China recently and listened to an interesting article by futurologist Lars Thomsen. Today I would like to tell you why I think this system is one of the most exciting energy projects of the coming years. I don't want to withhold the results of this research from you.

Before we get into the topic, a quick word about the last post.

Thank you for your strong interaction, support, likes and participation. It was good to see that so many of you sent a clear signal to getquin to finally get things moving. It was just as nice to see that it @Tenbagger2024 motivated you to carry on and give new impetus. It's moments like this that keep the community together.

Speaking of momentum.

Today I'm giving you a new one. Because what is currently being built in China is more than just an energy project. It is a blueprint for an infrastructure that, in my eyes, puts coal and nuclear power plants in the shade.

Before we start, a quick note. I already wrote a first post on this topic. I'm now building on this, but in a much more comprehensive, clearly structured way and with more details so that the connections are easier for you to grasp.

I also @SAUgut777 had already addressed the topic back then, so I would like to mention him here as well. I'm including the link to my earlier article, China is reshaping the sun and Energy 4.0 Part 1. https://getqu.in/OIMCfh/

https://getqu.in/G4f1Tk/

The global energy transition will not be won by individual technologies but by integrative systems that must fulfill two decisive factors: Scalability and base load capability . What we are currently seeing in China is the construction of the most modern energy infrastructure that radically solves the decades-old problem of solar and wind volatility. Not with wind turbines and solar panels alone, but with a system that supplies base load, integrates storage and enables scaling. The centerpiece is the CSP Hybrid Ecosystemin which solar thermal energy, photovoltaics and gigantic battery storage units are combined to create a continuous 24/7 power source power source.

Technically explained: The new paradigm is the CSP hybrid ecosystem. It combines the rapidly erected photovoltaic (PV) fields with the thermal storage of Concentrated Solar Power (CSP) plants and complements both with massive Battery Energy Storage System (BESS). This intelligent coupling provides stable electricity 24 hours a day, 7 days a week and makes the system a direct and superior competitor to coal and nuclear power.

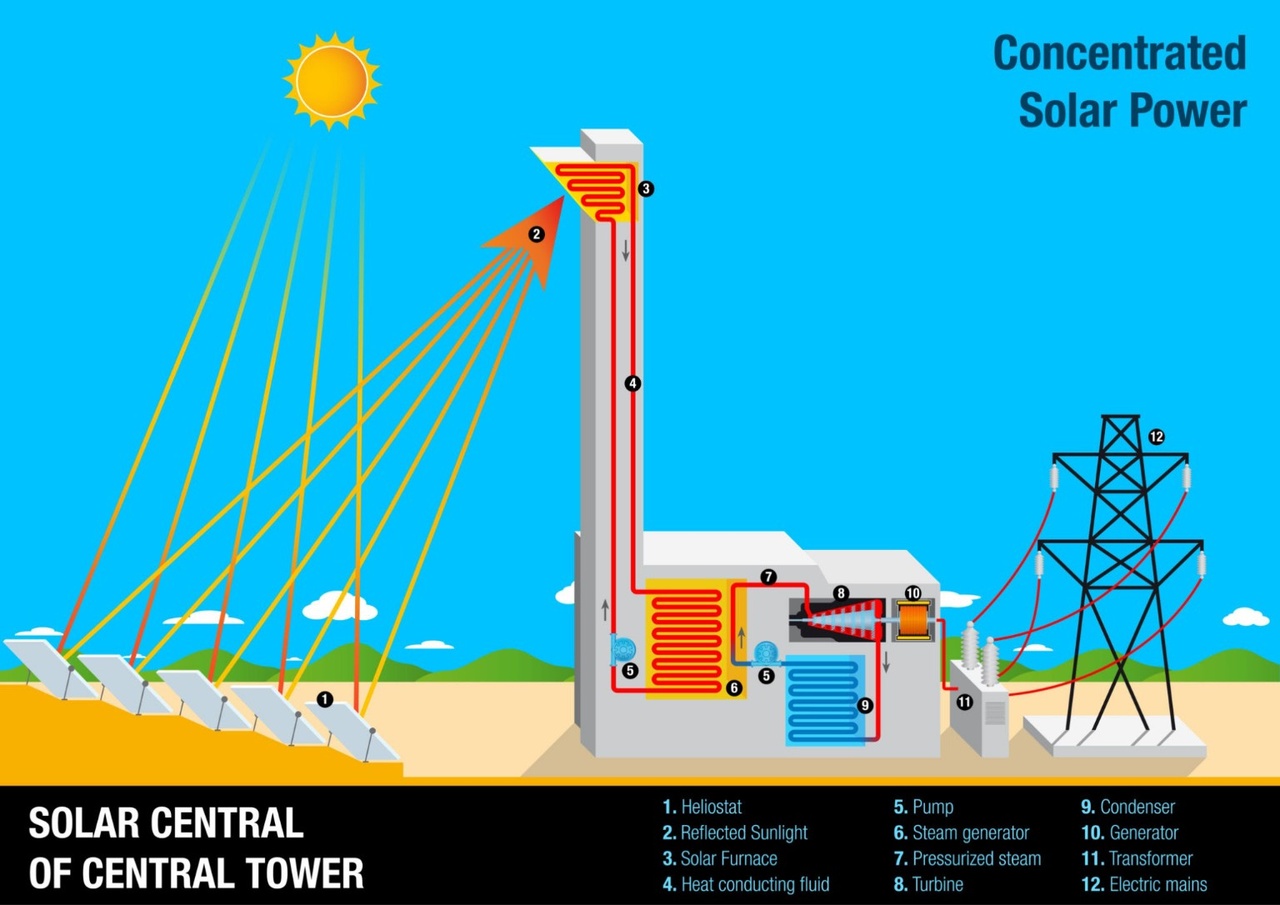

How the system works

1. mirrors collect sunlight

The surface at the bottom left consists of many movable mirrors (heliostats, point 1).

They are constantly aligned with the sun and focus the light onto the top of the tower (reflected sunlight, point 2).

2. the tower heats a heat medium

The solar oven (3) is located at the top of the tower.

There, the concentrated light hits a system of pipes through which a heat-conducting fluid runs (typically molten salts or oil).

This fluid becomes extremely hot, often several hundred degrees (4).

3. heat is converted into vapor

At the bottom of the building, the hot fluid transfers its energy to water in the steam generator (6), turning it into steam under high pressure (7). Pumps (5) keep the cycle going: hot fluid → cooled fluid → back up into the tower.

4. turbine and generator produce electricity

The pressurized steam drives a turbine (8). The turbine is connected to a generator (10), which converts the mechanical energy into electricity.

5. steam is liquefied again

The steam then enters the condenser (9), cools down and becomes water again. Then it goes back into the steam generator.

6. feed into the power grid

The electricity is brought to a higher voltage via a transformer (11) and fed into the grid via the high-voltage lines (12).

The gigawatt comparison and the true added value. A modern nuclear power plant constantly supplies around 1 GW to 1.6 GW of power. This output is continuous but extremely expensive, inflexible and ties up capital for over a decade. A CSP hybrid park in the Chinese desert can achieve a peak output of 5 GW. However, the real added value is the guaranteed base load capacity of 1 GW to 3 GW that can be called up 24/7 thanks to integrated thermal storage and batteries. This intelligent coupling provides stable electricity and makes the plant a direct and superior competitor to coal and nuclear power. This is the disruptive difference: the new generation delivers the same necessary base load but with much higher capital efficiency and 10 years shorter construction time. This makes nuclear power plants an outdated investment model.

The economic key lies in China Speed. It takes ten to 15 years for a nuclear power plant to produce any electricity at all. The Chinese mega bases reach base load capability in 18 to 24 months. This rapid time to market reduces capital costs and raises profitability to a level that is unattainable for traditional power generation.

🌍 Globalization of the Sun Belt: 8 investment pillars

China is exporting the hybrid model to the entire global sunbelt. MENA, North Africa, South America, Australia and Central Asia are among the new core markets. The pipeline is growing every year. The investment opportunities lie in the 8 fundamental pillars that make this infrastructure possible:

1. optics and mirror technology - These companies provide the optical basis for every CSP park

Big players

$SGO (-4.44%) Saint-Gobain (EPA: SGO) - France - World leader in specialty glass and high-tech materials. Supplies glass solutions and coatings for heliostats and CSP mirror systems.

Schott AG - Germany, private - Specialty glass and receiver tubes for many of the existing CSP plants. Key role in collector efficiency and lifetime.

Hidden champions

Rioglass Solar - Spain, private - Market leader for curved mirrors and receiver components especially for CSP parks. Strong in projects in Spain, MENA and Latin America.

Flabeg FE - Germany, private - High-precision mirrors for solar thermal energy. Supplies optics that directly determine the efficiency of power plants.

$000012 CSG Holding - China, Shenzhen - Large Chinese glass manufacturer with a growing focus on solar and CSP glass products.

2. storage chemistry and thermal media - They supply the chemical storage media for molten salt storage and heat transfer

Big player

$NTR (-1.24%) Nutrien (NYSE: NTR / TSX: NTR) - Canada - One of the largest fertilizer and nitrate suppliers in the world. Supplies nitrates for thermal storage and molten salt mixtures.

$YAR (+1.6%) Yara International (OSE: YAR) - Norway - Global fertilizer company. Produces nitrates and nitrogen chemicals that can be used in molten salt storage facilities.

$OCI (+0.84%) OCI N.V. (AMS: OCI) - Netherlands - Produces hydrogen and natural gas-based products, including nitrogen chemicals for thermal storage solutions.

Hidden Champions

$SQM (-8.53%) Sociedad Química y Minera (NYSE: SQM) - Chile - Lithium and specialty chemicals producer. Supplies lithium and nitrate salts for battery and thermal storage.

$MIN (-9.37%) Mineral Resources (ASX: MIN) - Australia - Combines lithium mining and processing. Important for lithium-based storage chains.

$SOLB (-2.39%) Solvay (EBR: SOLB) - Belgium - Specialty chemicals and heat transfer fluids, relevant for CSP and storage applications.

3. battery and energy storage systems (BESS) - The combination of BESS and thermal storage is the real 24/7 engine of CSP parks

Big player

$3750 (+1.7%) CATL - China - World market leader for EV batteries and large-scale storage. Supplies complete BESS systems for grids and CSP hybrid parks.

$1211 (-2.98%) BYD Co Ltd - China - Integrated battery and system provider. Provides energy storage systems for industrial and utility-scale applications.

$373220 LG Energy Solution (KRX: 373220) - South Korea - Global cell supplier with a strong focus on high-performance cells for e-mobility and stationary storage.

$SMSN (-9.2%) Samsung SDI (KRX: 006400) - South Korea - Premium cells and modular storage solutions for grid and industrial applications.

Hidden Champions

$FLNC (-1.34%) Fluence Energy (NASDAQ: FLNC) - USA - Joint venture between Siemens Energy and AES. Market leader in turnkey large-scale storage projects and operating software.

Powin Energy - USA, private - System integrator for utility-scale storage with a strong presence in North America and Asia.

$300274 Sungrow Power Supply (SZSE: 300274) - China - Well-known for inverters, growing strongly in the area of integrated BESS solutions for large-scale projects.

4. HVDC, cables and power transmission - HVDC turns desert power into exportable base load power

Big player

$HTHIY (-7.27%) Hitachi Energy - Switzerland / Japan, part of the Hitachi Group $HTHIY - World leader in HVDC converters, substations and grid control.

$PRY (-5.09%) Prysmian (BIT: PRY) - Italy - Largest manufacturer of high-voltage cables and submarine cables, central role in European HVDC projects.

$NEX (-4.15%) Nexans (EPA: NEX) - France - Specialized in power and submarine cables, important for long-distance transmission of desert electricity to Europe.

$ABBN (-3.67%) ABB (SWX: ABBN) - Switzerland - HVDC converters, switchgear and grid automation for large-scale projects.

Hidden Champions

$NKT (-2.72%) NKT A/S (CPH: NKT) - Denmark - Cable specialist with a focus on high-voltage and offshore wind connections.

Taihan - South Korea, private - Major Asian manufacturer of high-voltage cables with a growing export share.

$ANA (-11.03%) Acciona (BME: ANA) - Spain - Not only EPC, but also active in grid connections and infrastructure for large-scale renewable projects.

5. hydrogen and Power-to-X - Surplus electricity from hybrid parks is processed into green hydrogen

Big player

$LIN (-0.94%) Linde plc (NASDAQ: LIN) - Ireland / global - The world's largest industrial gases group. Plans, builds and operates large-scale electrolysis and liquefaction plants for green hydrogen.

$NCH2 (-6.63%) thyssenkrupp nucera (XETRA: NCH2) - Germany - Specialist for multi-gigawatt scale alkaline electrolyzers, key supplier for industrial H2 projects.

$NEL (-3.19%) Nel ASA (OSE: NEL) - Norway - Pure hydrogen player with focus on electrolyzers and H2 tank infrastructure.

Hidden Champions

$PLUG (+13.86%) Plug Power (NASDAQ: PLUG) - USA - PEM electrolysis, fuel cells and H2 infrastructure, increasingly involved in large-scale projects.

$BE (-7.92%) Bloom Energy (NYSE: BE) - USA - Develops higher efficiency solid oxide electrolyzers for industrial H2 generation.

$ITM (+0.39%) ITM Power (LSE: ITM) - United Kingdom - Focused on utility-scale PEM electrolysis, strong in European project business.

$HPUR (-4.28%) Hexagon Purus (OSL: HPUR) - Norway - Specialist in high-pressure tanks and transportation solutions for compressed hydrogen.

6. EPC, engineering and construction - These companies enable construction in less than two years

Big players

$601669 Power Construction Corporation of China (SSE: 601669) - China - One of the largest engineering and construction groups in the world. Builds dams, large-scale PV and CSP plants, including grid connection.

$601727 Shanghai Electric Group (SSE: 601727) - China - Full-service provider for CSP, turbines, storage integration and EPC services.

$ANA (-11.03%) Acciona (BME: ANA) - Spain - Global EPC player for solar, wind and CSP, strong in MENA and Latin America.

Hidden champions

SEPCO III - China, private - Highly specialized EPC for large power plants and CSP projects, often partner in Saudi Arabia and North Africa.

$WOR (-1.42%) Worley Limited (ASX: WOR) - Australia - Engineering and project services provider for energy infrastructure, including hybrid and storage projects.

$3996 (-2.72%) China Energy Engineering Corp (HKEX: 3996) - China - Large state-owned EPC group, active in the development of solar and grid projects in Asia, Africa and MENA.

7. turbines and power plant technology - CSP Hybrid is ultimately based on modern thermal power technology, only climate neutral

Big player

$ENR (-4.63%) Siemens Energy (XETRA: ENR) - Germany - Turbines, generators, switchgear and grid solutions. Core supplier for the thermal side of CSP hybrids.

$GE (-2.71%) General Electric (NYSE: GE) - USA - Steam turbines and power plant technology used directly in hybrid farms and thermal storage systems.

Hidden champions

$1072 (-12.85%) Dongfang Electric (HKEX: 1072) - China - Major turbine and power plant equipment supplier, strong in domestic market and MENA project.

$1133 (-7.33%) Harbin Electric (HKEX: 1133) - China - Manufacturer of turbines, generators and power plant components, active in large-scale conventional and renewable power plants.

8. blade manufacturers and construction materials for CSP hybrid parks

8.1 Construction and mining equipment

Big Player

$CAT (-3.73%) Caterpillar (USA, NYSE: CAT) - World's largest manufacturer of construction and mining equipment, dozers, excavators, dump trucks, generators. Provides heavy equipment for earthmoving, foundation construction and park infrastructure.

$6301 (-5.81%) Komatsu (Japan, TSE: 6301) - Number two worldwide in construction and mining equipment. Excavators, wheel loaders, large dump trucks and special machines used in desert projects and large construction sites.

$SAND (-2.76%) Sandvik (Sweden, OMX: SAND) - Drilling technology, rock processing, wear parts. Important for foundation construction, cable routes and the raw materials side of the value chain.

$EPI A (-2.83%) Epiroc (Sweden, OMX: EPI A) - Drilling rigs and underground equipment, wherever CSP infrastructure is built on difficult terrain.

Hidden champions

$6305 (-8.53%) Hitachi Construction Machinery (Japan, TSE: 6305) - Strong presence in Asia and MENA, large excavators and wheel loaders for deserts and large construction sites.

$DE (-1.13%) Wirtgen Group / John Deere $DE (USA) - Road construction, milling, compaction. Benefit from the expansion of access roads, platforms and logistics around CSP parks.

8.2 Steel, tubes and sections

Big player

$MT (-6.36%) ArcelorMittal (Luxembourg, NYSE: MT) - Global steel group with flat and long products. Supplies beams, sections and structural steel for tower structures, racks and infrastructure.

$5401 (-1.48%) Nippon Steel (Japan, TSE: 5401) - High-quality steel for energy and infrastructure applications, including heat-resistant steels.

$TEN (-2.46%) Tenaris (Luxembourg/Argentina, NYSE: TS) - Leading manufacturer of seamless steel tubes for energy, pipelines and high-pressure systems. Relevant for heat exchanger circuits, media pipelines and infrastructure in the CSP environment.

$VK (+0.5%) Vallourec (France, EPA: VK) - Specialty tubes and high-performance steels for energy projects, including high-temperature pipelines.

Hidden Champions

$5411 (-6.9%) JFE Holdings (Japan, TSE: 5411) - steels and tubes for large-scale projects, with a focus on Asia.

$TUB (-7.69%) Tubacex (Spain, BME: TUB) - Seamless stainless steel tubes for high temperature and corrosive environments, directly relevant for CSP heat and process piping.

$NXT Nextpower (USA) - Steel-intensive tracker systems for PV fields. Important in hybrid parks where PV and CSP are combined.

$ARRY (-1.23%) Array Technologies (USA) - Similar to Nextracker, focus on utility-scale tracking systems.

8.3 Cement, concrete and construction chemicals

Big player

$HOLN (-0.38%) Holcim (Switzerland, SIX: HOLN) - The world's leading supplier of cement and concrete. Supplies foundation concrete, specialty mortars and infrastructure construction materials for major projects, including desert locations.

$HEI (-1.13%) Heidelberg Materials (Germany, Xetra: HEI) - Strong player in Europe, North Africa and Asia. Cement, concrete and aggregates for foundations, turbine houses, storage blocks.

$CX (-5.53%) Cemex (Mexico, NYSE: CX) - Globally active in cement and concrete, supplier for infrastructure in MENA and the Americas.

$CRH (-2.89%) CRH plc (Ireland, NYSE: CRH) - Building materials group with a focus on infrastructure, road construction and precast concrete products.

Hidden Champions

$ULTRACEMCO UltraTech Cement (India, NSE) - India's largest cement manufacturer, relevant for CSP projects in the subcontinent and neighboring regions.

Votorantim Cimentos (Brazil, private / regionally listed) - Strong supplier in Latin America with a direct link to infrastructure and energy projects.

8.4 Industrial components, heat exchangers and process equipment

Big player

$ALFA (-2.58%) Alfa Laval (Sweden, OMX: ALFA) - Heat exchangers, pumps and separators. Key components for thermal storage, steam generation and process heat in CSP plants.

$FLS (-4.01%) Flowserve (USA, NYSE: FLS) - Pumps, valves and sealing systems for high-temperature and high-pressure circuits in energy plants.

$SPX (-3.34%) Spirax Group (UK, LSE: SPX) - Steam and condensate technology, control valves and heat exchange systems, important for the fine control of thermal circuits.

Hidden champions

$IMI (-2.77%) IMI plc (UK, LSE: IMI) - Specialty valves and control technology for the energy and process industries, especially for demanding media.

$KSB (-3.56%) KSB SE (Germany, Xetra) - Pumps and valves for the energy, water and process industries. Suitable for cooling water, heat transfer media and storage systems in CSP parks.

🎯 Conclusion and outlook

The CSP hybrid ecosystem eliminates the weaknesses of renewable energies and uses China Speed as an economic lever. This combination creates a capital efficiency that will overtake traditional energy generation in the long term. The investment opportunities range from the Asian battery giants to the European HVDC specialists.

The fundamental question is whether European regulators can adjust the speed of the approval process to allow the continent to keep up with the pace of the Sahara projects and the European EPC companies operating there, or whether the continent will be left behind in terms of energy self-sufficiency.

Takeaway

The real investment case lies in the efficiency superiority of the CSP hybrid system. The ability to provide gigawatts of base load within two years, coupled with thermal storage and BESS, makes this infrastructure one of the strongest energy models of the future. This benefits optics, chemistry, BESS, HVDC, hydrogen, EPC and turbine manufacturers.

Sources: own research + IEA, IRENA, NREL, Fraunhofer ISE, SolarPACES, World Bank, Ember Climate, company reports & technical documentation of the companies mentioned.

Image: https://videos.winfuture.de/27754.mp4

Getty Images, Illustrative image - JLStock / Shutterstock.com

From cement to energy: restructuring with foresight

Since $BKW (-2.27%) fell recently, I took the opportunity to realign my portfolio. $HOLN (-0.38%) I sold with a nice profit - cement out, electricity in.

Why BKW?

- Solid utility structure

- Attractive dividend

- Long-term stability for your portfolio

I am curious to see how this develops.

Bank of America bets on 14 rising infrastructure stocks

Bank of America (BofA) has put together a basket of stocks to list the winners of the German infrastructure package.

The basket contains 14 stocks that the US bank expects to benefit in particular.

- The German technology group Siemens

$SIE (-4.13%) (weighted at 10.3 percent, as of August 21) - The French construction group Eiffage $FGR (-2.68%) (9 percent)

- The German building materials manufacturer Heidelberg Materials

$HEI (-1.13%) (8.8 percent) - The German energy technology group Siemens Energy $ENR (-4.63%) (8.6 percent)

- The German truck manufacturer Daimler Truck

$DTG (-4.2%) (8.4 percent) - The Italian building materials company Buzzi S.p.A.

$BZU (-2.55%) (7.9 percent) - The Swiss cement group Holcim $HOLN (-0.38%) (7.6 percent)

- The Swiss chemicals group Sika AG $SIKA (-2.45%)

(7.4 percent) - The German forklift manufacturer Kion

$KGX (-7.67%) (6.7 percent) - The French communications and energy company Spie $SPIE (-0.34%) (6.4 percent)

- The German industrial group Thyssen-Krupp $TKA (-4.85%) (6.4 percent)

- The German wind turbine manufacturer Nordex

$NDX1 (-4.71%) (4.6 percent) - The Swedish steel group SSAB $SSAB A (-5.33%)

(4.1 percent) - The German industrial services provider Bilfinger

$GBF (-4.67%) (4.0 percent)

Hopes for the infrastructure package have already caused the shares to rise significantly in some cases in recent months. Since the beginning of the year, the shares included in the basket have risen by around 47 percent. BofA has been offering the share basket to its major clients since the beginning of July.

Despite the jump in the prices of many infrastructure stocks in the first half of the year, BofA manager Klein is confident that the stocks in the basket will continue to rise. According to him, it now depends on when the investments really show up in the profits of the companies.

Oliver Schneider, portfolio advisor at US asset manager Wellington, says: "In the past six to nine months, investor interest in infrastructure stocks has grown rapidly." This is particularly true for European investors.

He cites two factors that he believes will drive infrastructure stocks worldwide in the future. Firstly, there is a great need to modernize infrastructure. Secondly, the demand for electricity is growing due to artificial intelligence. Schneider says: "This is a growth topic that will be with us for the next ten to 20 years."

Source: Text (excerpt) & graphic, Handelsblatt 01.09.25

The whole thing is slowly picking up speed

With the latest events in EU-US customs policy, I am confident that I will soon reach the 20k mark. A few more stocks will follow in the next few months and the ETFs will continue to be saved with the highest weighting. My savings rate can also be increased by completing my further training soon.

Concrete new additions to the portfolio will be:

- $HOLN (-0.38%) I see potential, as Holcim will be a big player in the reconstruction of Ukraine. It is also a sustainable addition to my dividend-oriented portfolio, as the distributions are paid from capital contribution reserves and are therefore tax-free in Switzerland.

- $$FLXI (-1.63%) India is expected to become the 3rd largest economy in the world by 2035. GDP is growing confidently and I see opportunities for additional returns in the portfolio.

- $BABA (-3.64%) Solid long-term growth stock to expand diversification with China. 1.67% dividend

Opinions? Suggestions?

Amrize IPO

One of the world's leading cement manufacturers $HOLN (-0.38%) will spin off its North American business on Monday, June 23, 2025 and go public as Amrize $AMRZ (-2.63%) to the stock exchange.

For each share held $HOLN (-0.38%) share held, shareholders will receive one $AMRZ (-2.63%) share. This will be done without a capital increase.

The exciting thing for me is that Holcim will continue to pursue an attractive dividend strategy with a profit distribution of >50%, but at the same time I can benefit from the strongly growing business in North America with a separate stock.

Analysts see growth potential in both stocks.

https://www.cash.ch/news/top-news/borsengang-von-amrize-das-mussen-anleger-uber-die-holcim-abspaltung-wissen-831022#comments

Allianz with record profit and share buyback | Holcim increases profit and plans spin-off | Berenberg rates Lanxess Hold

Allianz $ALV (-2.77%) with record profit and share buyback

Allianz has achieved a record profit in day-to-day business in 2024. Operating profit rose by almost nine percent to over 16 billion euros. CEO Oliver Bäte is targeting an operating profit of between 15 and 17 billion euros for 2025. Despite this positive news, the Allianz share fell temporarily by 0.84 percent to 330.50 euros. However, there is good news for shareholders: The dividend will be increased by 11.6 percent to 15.40 euros, and share buybacks worth up to 2 billion euros are planned. The Group has set itself ambitious targets and wants to increase earnings per share to 31.50 euros by 2027. Allianz plans to improve its efficiency through new technologies such as artificial intelligence and wants to spend at least 75% of net profit on dividends and buybacks over the next few years.

Holcim $HOLN (-0.38%) increases profit and plans spin-off

Holcim, the world's largest building materials group, increased its recurring operating profit EBIT by 6.1 percent to a record CHF 5.05 billion last year. Despite a decline in net profit of 4.4 percent to 2.93 billion Swiss francs, the Group is optimistic about the future. Holcim is planning to spin off its North American business, which is expected to be completed by mid-2025. Sales in North America stagnated at 11.7 billion dollars in 2024, but operating profit rose by 16 percent to 2.2 billion dollars. Group CEO Miljan Gutovic expects 2025 to be another record year for Holcim, supported by infrastructure projects in the USA. Further acquisitions are also planned in Europe and Latin America.

Berenberg rates Lanxess $LXS (-6.41%) to Hold

The private bank Berenberg has downgraded the Lanxess share to 'Hold' and left the price target at 31 euros. Analyst Andres Castanos-Mollor justifies this decision with the assessment that the shares have risen too much. This movement was influenced by positive quarterly figures as well as factors such as hopes for peace in Ukraine and lower energy prices. Berenberg does not see any further upside potential in the current valuation, which is why the shares will now remain in the holding position.

Sources:

The peace profiteers

I was inspired by a Focus Money article and because many people here are asking.

I won't be investing myself, it's too short-term for me. But there are still some very interesting companies.

Feel free to write in the comments whether such "copied articles" are of any use to the community or are legally correct :)

The signs of a peace process in Ukraine are solidifying. This is triggering a run on the stock market for shares that could benefit from reconstruction

Regardless of the political interpretation, the stock market has been turning its back on the war for several days now and is betting on the coming peace. Stocks that are likely to benefit from the reconstruction in Ukraine have soared. The UBS Ukraine Reconstruction Index, which comprises 25 of these stocks, has been climbing for days and is at an all-time high. "The effects of a possible ceasefire in Ukraine are still being underestimated on the financial markets," says Bernd Meyer, Chief Investment Strategist and Head of Multi Asset at Berenberg, who is convinced that the rally will continue. Reconstruction requires enormous resources. According to estimates by the World Bank, the costs for this amount to a total of 500 billion dollars - the equivalent of Austria's gross domestic product and more than three times Ukraine's annual economic output before the war. The money is likely to benefit construction companies, suppliers, infrastructure companies and banks in particular. European companies could be the main beneficiaries - especially from neighboring countries such as Poland and Hungary, but also the Czech Republic, Austria and Germany.

With Wärtsilä $WRT1V (-3.88%) a provider of technologies for the shipping and energy markets, and Konecranes $KCR (-1.54%) a manufacturer of industrial cranes and drive technology, Finnish companies are also on the list of potential peace beneficiaries - as are Italian companies such as the cement and building materials manufacturer Buzzi $BZU (-2.55%) The list is long. There is a great need for building materials, steel and cables to restore the destroyed infrastructure and energy supply. There is still no thematic fund or ETF on the beneficiaries of the reconstruction in Ukraine. Investors who want to benefit from this are therefore well advised to combine several securities into a portfolio themselves.

Banks: Erste Group Bank $EBS (-3.19%) Powszechna K. Osz $PKO (-5.72%) Santander Polska $SPL (-5.54%) Polska K. Opieki $PEO (-5.92%) Raiffeisen Bank Int.$RBI (-3.98%)

Construction: Wienerberger $WIE (-2.86%) Sniezka Construction $SKA Strabag $STR (-2.03%)

Insulation: Kingspan Group $KRX (-3.6%) Rockwool $ROCK B

Glass: Cie de Saint-Gobain $SGO (-4.44%)

Cranes: Konecranes $KCR (-1.54%)

Cement: CRH $CRH (-2.89%) Buzzi $BZU (-2.55%) Holcim $HOLN (-0.38%) Heidelberg Mat. $HEI (-1.13%)

Construction machinery: Caterpillar $CAT (-3.73%)

Mining: Ferrexpo $FXPO (-5.88%) Metso $METSO (-2.93%)

Chemicals: BASF $BAS (-2.95%)

Industrial gases: Air Liquide $AI (-0.83%)

Infrastructure: Schneider Electric $SU (-4.66%) Rexel $RXL (-5.46%) Wärtsilä $WRT1V (-3.88%) Weir Group $WEIR (-5.23%)

Infrastructure (E): Siemens Energy $ENR (-4.63%) Prysmian $PRY (-5.09%) NKT $NKT (-2.72%) Nexans $NEX (-4.15%)

Agriculture: Kernel $KER (-3.81%)

Logistics(warehouse): Kion $KGX (-7.67%)

Steel: Arcelor Mittal $MT (-6.36%) and for stainless steels Outukompu $OUT1V (-7.88%)

Sanitary technology: Geberit $GEBN (-1.67%)

Specialty chemicals: Evonik $EVK (-4.96%) Arkema $AKE (-3.45%) Wacker Chemie $WCH (-6.41%) Lanxess $LXS (-6.41%)

So many falling prices, so many buying opportunities $AMZN (+0.57%)

$MRNA (+4.29%) ... I'm continuing my strategy anyway, as the price of $HOLN (-0.38%) has also fallen: 2nd tranche from the entry 🎉

But it's really hard to stand firm 😂

Are you also standing firm or are you changing your strategy?

It has long been $HOLN (-0.38%) on my watchlist for a long time and now the time has come for me to get in (1st tranche)

Trending Securities

Top creators this week