Hello my dears,

after my last company presentation caused quite a discussion. I would like to return to somewhat calmer waters with today's presentation. In other words, in the Traderfox 🟢area.

Yesterday I saw a question about KSB in a post $KSB (-3.62%) in a post yesterday.

I immediately fired up my machine and found an exciting 100-year-old company that also deals with pumps, among other things. In contrast to KSB, however, it has a much broader base. And pumps are only part of the business model.

That's why, as always, I'm interested in your opinion of the company.

And is it an alternative for you, or perhaps the better KSB?

I look forward to many comments on DXP Enterprise.

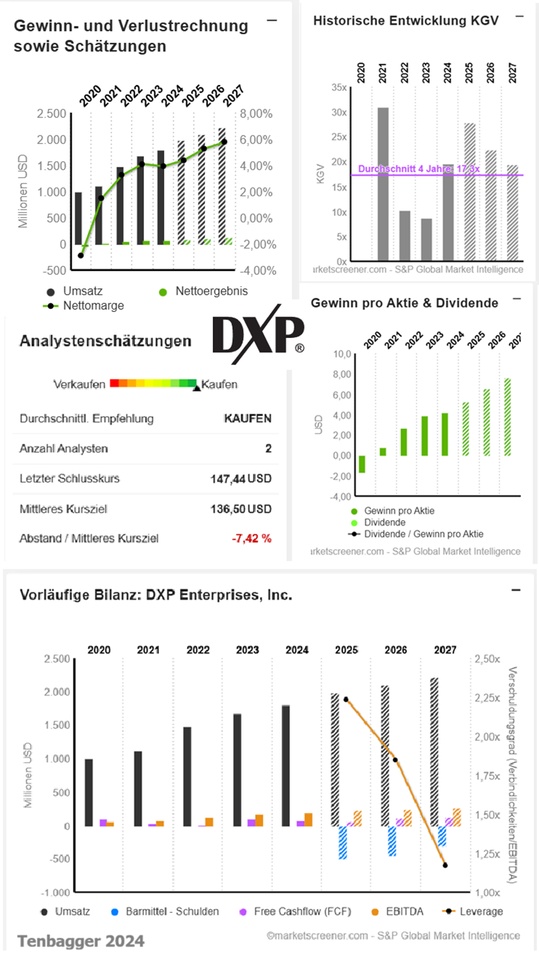

A small positive assessment at the beginning:

- Net income increases better than sales and rises in the double-digit range

- Net debt decreases and is acceptable

- Free cash flow increases

- EBIT margin rises into the double-digit range

- P/E ratio falls and PEG is below 1

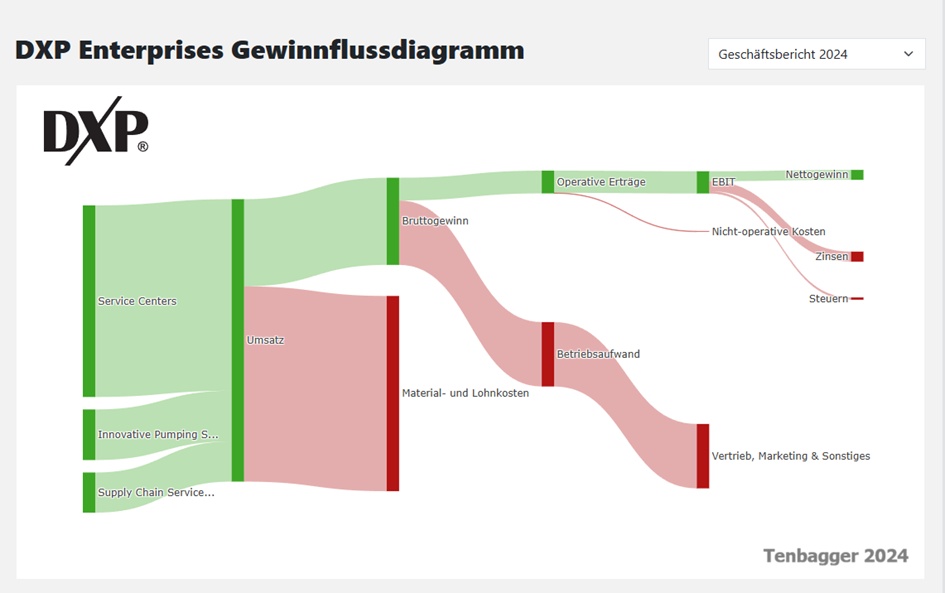

For more than 100 years, DXP Enterprises has been a leading industrial distribution expert in the industry. Product specialties include rotierende Geräte, Lager und Kraftübertragung, Metallverarbeitung, Industriebedarf and more. The company continues to stay at the forefront of Technologie, training and products and attracts and retains the best people. From der Luftfahrt and Landwirtschaft to Fertigung und Bauwesen DXP provides dedicated service and support for a variety of Branchen.

DXP Enterprises, Inc. is a product and service company providing solutions to industrial customers in the United States, Canada, Mexico and Dubai. The company offers pumping solutions, supply chain services and maintenance, repair, operations and production (MROP) services. Its segments include Service Center (SC), Innovative Pumping Solutions (IPS) and Supply Chain Services (SCS). The SC segment provides MRO products, equipment and integrated services, including logistics capabilities, to business-to-business customers. The IPS segment manufactures and assembles customized pump packages, remanufactures pumps, produces branded pumps and offers products and process lines for the water and wastewater treatment industry. The SCS segment offers a range of MRO products and manages all or part of a customer's supply chain, including warehouse and inventory management. It also offers the sale, repair and maintenance of vacuum pumps.

Number of employees: 3,028

Product expertise

- Zentrifugalpumpen

- Verdrängungspumpen

- Tauchpumpen

- Messpumpen

- Spezialpumpen

- Vakuumpumpen und Gebläse

- Luftkompressoren

- Mechanische Dichtungen und Packung

- Elektromotoren

- Umbau

- Prozesssteuerung & Automatisierung

- Technische Fertigung

- Predict-Plus

- Gefertigte Messbahnen

- Energierückgewinnung

- Pumpentraining

- Chemikalien

- Lager

- Fluid Power

- Schlauch

- Lineare Bewegungsprodukte

- Materialhandhabung

- Mechanische Kraftübertragung

- Siegel

- Kupplungen & Bremsen

- Abschleifmittel

- Spannen und Werkhaltung

- Lochmacherei

- Schmiermittel, Flüssigkeiten und Kühlmittel

- Markierung und Etikettierung

- Materialhandhabung und -lagerung

- Endmühlen

- Fräshalter

- Elektrowerkzeuge

- Präzisionsinstrumente & Messgeräte

- Sägeblätter

- Gewinde

- Drehbank

- Drehen und Bohren

- Sicherheitsbekleidung

- Ergonomie & Wellness

- Sicherheit der Einrichtung

- Sturz- und Brandschutz

- Erste Hilfe & Notfall

- Fuß- und Handschutz

- Kopf-, Augen- und Gehörschutz

- Atmung

- Saisonal – PSA

- Schweißen

- Abschleifmittel

- Chemikalien & Beschichtungen

- Elektrische Versorgung

- Befestigungselemente

- Hausmeistergeräte

- Industrierohre, Ventile und Anschlüsse

- Werkzeuge

- Schweißzubehör und -ausrüstung

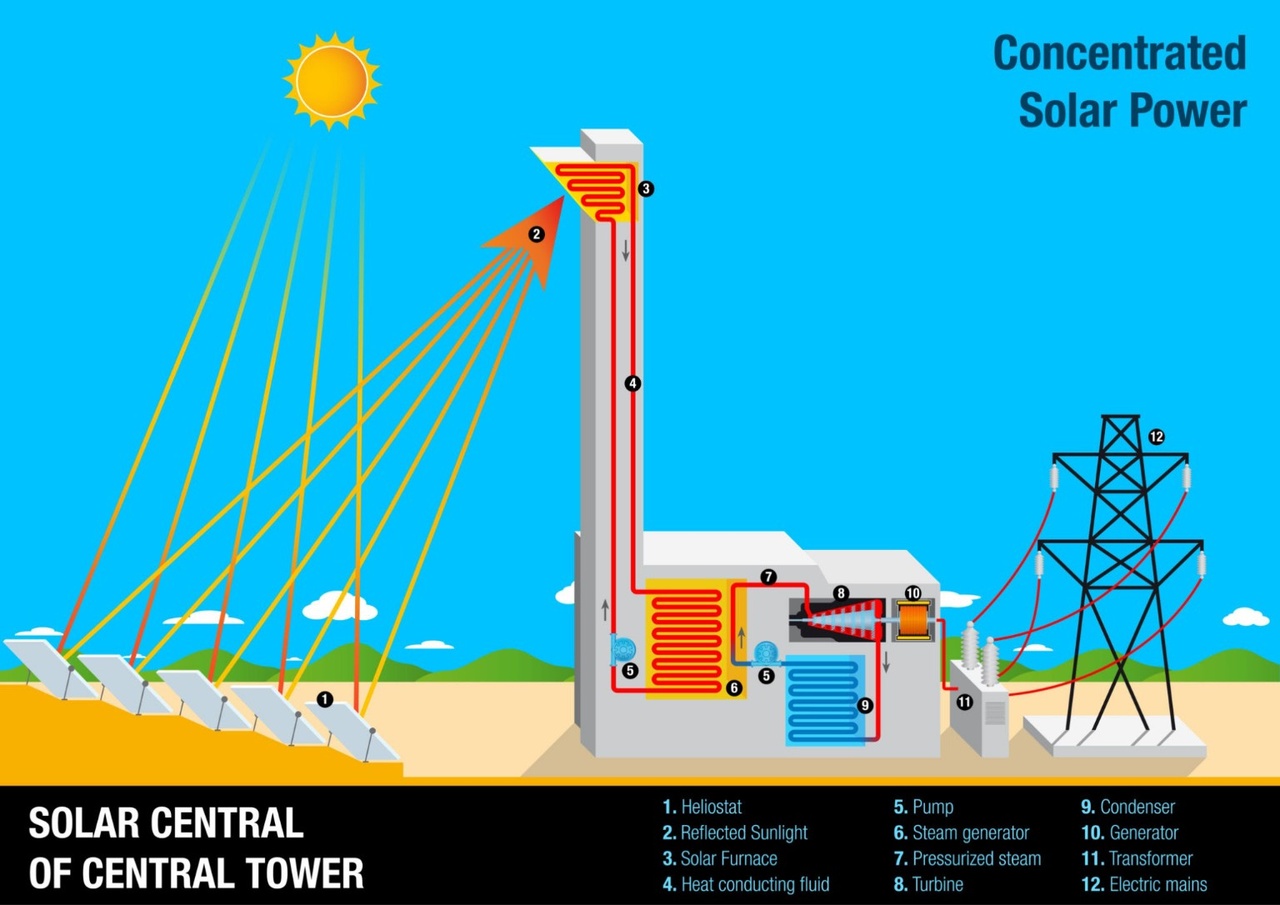

- Biomethan-Erfassungssystem

- Biodiesel-Schlammpumpen

- Be- und Entladen von Biogas-Tanklastwagen

- Bioethanolpumpen und -systeme

- Wärmetauscher von Biokraftstoffanlagen

- Vakuumpumpen und Kompressoren

- Wiedereinspritzung von geothermischer Salzlake

- System zur Herstellung von erneuerbarem Wasserstoff

Dear DXP, we also offer some services, I will list a few of them:

Confined space rescue -Underground maintenance and repair

- In a confined space, when hazards such as oxygen deficiency, toxic gases and explosive atmospheres are present, it is necessary to have highly trained and specialized rescue teams on site for immediate deployment. DXP's confined space rescue teams are trained in accordance with OSHA 29 CFR 1910.146 and undergo annual recertification and simulated rescue scenarios.

Measurements

- DXP is the total solutions provider for downhole and midstream measurement as well as crude oil and produced water products, instrumentation and filtration products. For years, customers have trusted DXP LACT Skids and products for the storage, transportation of crude oil and pumping of petroleum products into storage tanks, pipelines, rail cars and barges. Their measurement and flow team is dedicated to providing accurate results and maintaining the products they sell.

Pumps, maintenance and repair

- With over 100 years of experience in the rotating equipment industry, DXP can proudly assure their customers that they can handle whatever the customer needs. Whether the customer purchased the equipment from DXP or not, DXP services and repairs all makes and models - large or small - throughout the United States and Canada.

- If the customer is missing a part that is not produced by the manufacturer, it's not a problem. Their in-house foundry will manufacture and deliver the exact part needed within a few days.

Testing

- PumpWorks offers testing services for a variety of pump types. From low-performance ANSI bare pumps to skid-mounted, motor-driven API multistage pumps, test labs are available for third-party testing.

Supply chain services

- DXP is the only procurement analytics solutions company that can combine technical product knowledge with data master creation and improvement, management systems and spend analysis to deliver real value to the MRO supply chain.

Security

Supply chain services, procurement management

- Procurement management makes it easier for organizations to maintain relationships with suppliers, manufacturers and distributors at every point in the procurement process. DXP provides industry-leading procurement and supply chain management services to improve the bottom line.

DXP enables effective decision making with comprehensive sourcing analytics and data improvement capabilities at all levels of the supply chain.

Vending and scanning

- SecuraStock is the most secure and flexible storage solution on the market and can replace multiple traditional vending machines. With lower issuing costs, fast transactions, advanced authentication and powerful analytics, SecuraStock helps control inventory, reduce shrinkage and increase productivity.

- AutoCrib's automated inventory control systems give customers tools to reduce spending, increase productivity and improve accountability. With demand-driven ordering, robust security and flexible dispensing options, AutoCrib ensures you get the products customers need, when they need them - reducing costs and eliminating waste.

- CribMaster delivers intelligent inventory and asset management through advanced vending, RFID-enabled storage and automated replenishment. It offers real-time tracking, high security and seamless integration with customer systems to keep critical tools and materials organized.

Sehen Sie sich den SecuraStock-Flyer an

Sehen Sie sich den SecuraChem Flyer an

Renewable Energies

- If your goal is NetZero emissions, DXP Enterprises is your ideal partner. We have more than 100 years of experience bringing equipment and expertise to the renewable energy market.

- Development of new renewable energy processes

- Equipment implementation and maintenance

- Best-in-class renewable energy expertise

- Industrien

- Landwirtschaft

- Luftfahrt

- Chemisch

- Rechenzentrum

- Herstellung und Bau

- Lebensmittel und Getränke

- Allgemeine Fertigung

- Bergbau

- Abwasser

- Öl und Gas

- Macht

- Raffinerie

- Verkehr

- Erneuerbare Energien

Takeovers have been a significant and historic part of DXP's growth strategy since the 1980s. Its acquisition growth strategy focuses on achieving stable, profitable growth. The DXP Corporate Development team's acquisition strategy is to identify and acquire companies that:

- are market leaders

- are unique in the market

- deliver strong financial performance

DXP acquires both "bolt-on" and stand-alone businesses and has a long history of implementing best practices through continuous learning and preserving brand equity.

DXP Enterprises, Inc. announces two strategic acquisitions

January 05, 2026

DXP Enterprises, Inc. – DXP Enterprises, Inc. kündigt zwei strategische Übernahmen an

USD in millions

Estimates

Year Turnover Change

2024 1.802 7,35 %

2025 1.988 10,32 %

2026 2.099 5,61 %

2027 2.219 5,68 %

Year EBIT Change

2024 145,4 4,8 %

2025 174 19,68 %

2026 196,6 13,02 %

2027 222,8 13,30 %

Year Net result Change

2024 70,4 2,44 %

2025 87 23,58 %

2026 110,4 26,9 %

2027 127,6 15,53 %

Year Net debt CAPEX

2025 494 36

2026 442 26,45

2027 309 29,15

Year Free cash flow Change

2024 77,14 -17,9 %

2025 56 -27,41 %

2026 106,6 90,27 %

2027 121 13,56 %

Year EBIT margin ROE

2024 8,07 %

2025 8,75 % 21 %

2026 9,37 % 22,8 %

2027 10,04 % 21,8 %

Year Earnings per share Change

2024 4,22 8,48 %

2025 5,28 25,12 %

2026 6,58 24,62 %

2027 7,605 15,58 %

Year P/E ratio PEG

2024 19.6x 2.31x

2025 27.9x 1.1x

2026 22.4x 0.9x

2027 19.4x 1.2x

Market value 2,312

Number of shares (in thousands) 15,679

Date of publication 06,03,2025