The online custody account transfer to 212 is in progress and will be available soon. Of course, transferring from 212 already works now.

212 is also tax-simple and everything has worked quite well so far. I treated myself to a €100 exemption there at the beginning of the year, which didn't really make sense as I actually filled it up quickly at Volksbank. But I wanted to see if the calculations and deductions worked so far.

And for the dividend fans among you, the dividends arrive on time on payday in 99% of cases.

Of course I would be grateful if you are interested in switching, please use my link and get free shares up to 100€

https://www.trading212.com/invite/1Bl7fzXX7K

Finally, my current best pie I would not have expected 5 months ago that it outperforms my other pie's 😉

$O (+1.63%)

$MAIN (+2.49%)

$LHA (-4.26%)

$RIO (+3.37%)

$LUG (-1.22%)

$BNP (-2.06%)

$BP. (+2.43%)

$KO (-0.29%)

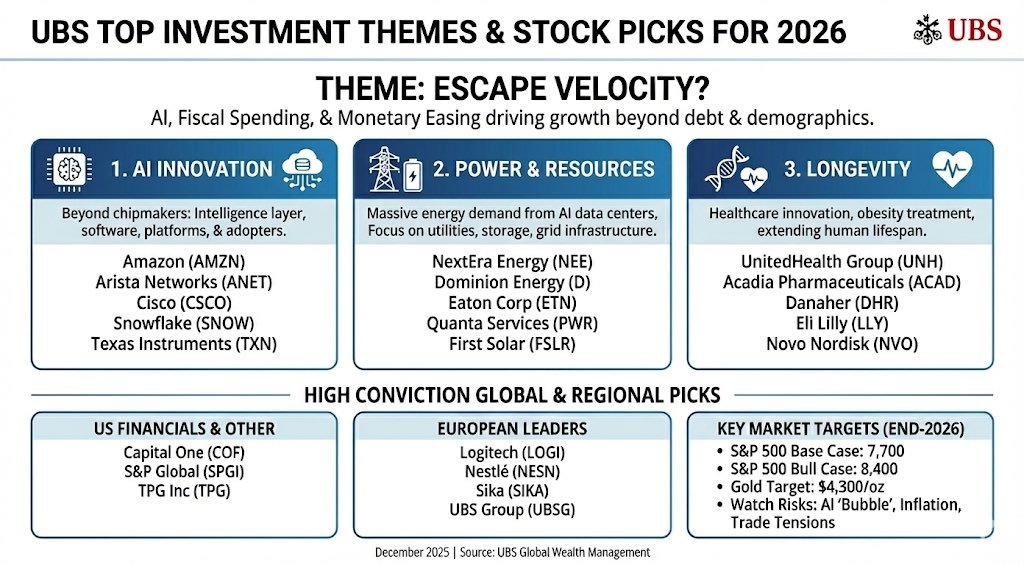

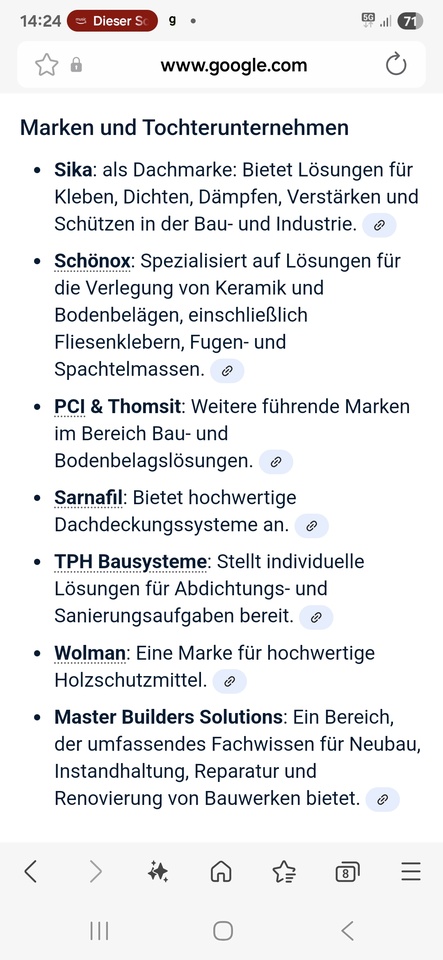

$SIKA (-1.92%)

$MO (+0.84%)