Hello folks 💁♂️

I wanted to introduce myself again

The last time was almost three years ago.

Since then I've been reading along and have learned a lot, even though I'm currently pursuing a slightly different strategy... I've learned a lot about dividends and many interesting companies that I would concentrate on if my strategy doesn't work out. And since the topic often came up here in recent weeks that there is too little added value and always the same posts, I sat down and summarized my strategy. But let's start with the background :)

Background:

I've been invested in BTC since I was 15 and took part in my first full cycle. At that time I observed the phases, but never touched my BTC position according to the classic HODL HODL principle.

(I am now 19)

In advance:

In the strategy I explain how I want to approach the coming cycle.

I am aware of the risk but am prepared to take it as I am still young and hope you can take something away from the following description ;)

1 Portfolio architecture

Core BTC

- 40-60% of my BTC position

- No rotation

- Always stay in the market

Why?

As a hedge in case the 4 year cycle is broken and we have a "supercycle"

Growth Layer

- Remaining $BTC (+0.5%) Position

- Satellites (e.g. MSTR, Solana) max. 10-15 % of the portfolio value

- Source of return for later rotation

Why?

Historically outperformed $MSTR (+0.68%) and $SOL (+0.02%) from bear market bottom to ATH Btc (i.e. as a small booster)

However, this layer will be fully reallocated to the value layer (as described later)

Value Layer

- $VWRL (+0.29%)

- Cash position/ call money account

- Gold

Why?

Mainly as a store of value in hype phases and long-term risk minimization

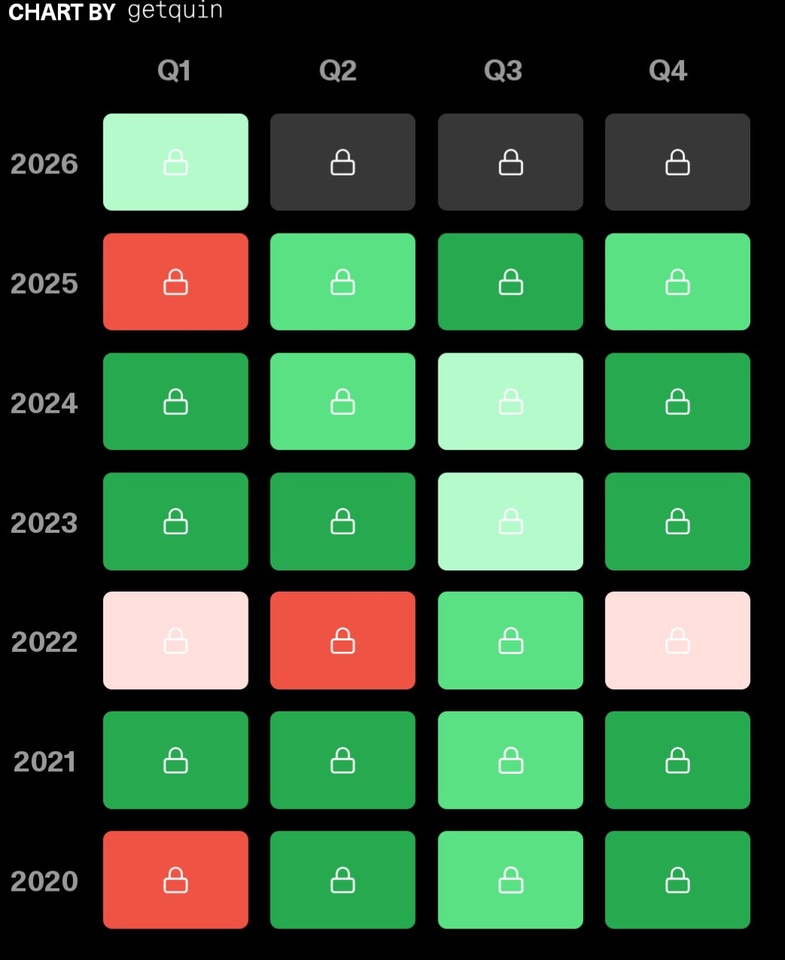

2 How do I want to time the market?

I have looked at the following indicators to make it easier to assess which market phase you are in.

- Distance to the 200WMA

- Funding rates

- Open interest

- BTC dominance

- Weekly RSI

- Fear & Greed Inedx

- Drawdown from last major high

(Since it would be time-consuming to re-evaluate the data every week, I have commissioned a Ki agent to evaluate the data for me on a weekly basis. And then use the data to divide the current price into the following phases)

Phase 1 - Accumulation phase

Signs:

- Price 0-30 % above 200WMA

- Fear & Greed low

- Funding neutral or negative

- Dominance stable or rising

- Drawdown 30-50 % from last ATH

Action?

In this phase, I am buying more BTC and place a monthly limit order 5% below the price at the beginning of the month

But since it can go lower, I continue to build up the FTSE position at the same time in order to be liquid in the event of another drawdown...

Phase 2 - Possible bottom phase

Signs would be:

- 55% drawdown

- Price close to or below 200WMA

- Negative funding

- And you hear "BTC is dead" again 🤡

Action:

- Savings plan completely on BTC

- Additional staggered limit orders

- Partial rotation from FTSE into $MSTR and $BTC

Phase 3 - Recovery

Typical:

- 30-100 % above 200WMA

- RSI >60

- Funding moderately positive

- High volatility

When?

Mostly before halving 2028 and post halving

Action:

- Reduce BTC savings plan slightly

- Savings rate on $VWCE higher again

- No capital rotation yet

Phase 4 - Overheating

Typical:

- 100% over 200WMA

- Funding high

- Open interest rising sharply

- Fear & Greed >75

- Dominance begins to fall

Action:

- First tranche Growth → Value Layer

- Reduce $MSTR first

3 Capital rotation rules (hit ATH)

Trigger 1

- 3-4 parabolic weekly candles

- High funding rates

- Retail hype (Google Trends etc.)

Action:

→ Rotate 15% growth layer into value layer

→ whereby $MSTR is reduced first

Trigger 2

- BTC dominance falls sharply (historically close to ATH as capital is rotated into ALTs)

Action:

→ further 20% rotation into value layer

Trigger 3 - Euphoria phase

- Supercycle narrative

- Strong media presence

- Exuberance in the market

Action:

→ Rest from growth layer to value layer

Reload system (bear market 2031+)

Drawdown measured from new major high.

-30 % → first tranche back in $BTC (+0.5%)

-45 % → second tranche

- close to / below 200WMA → third tranche

And then the whole thing from the beginning :)

Conclusion

Core position remains in any case if we really suddenly break out of the cycle...

@stefan_21 presented an exciting opportunity for this yesterday ;)

I hope it has somehow become comprehensible, I am not yet so experienced in writing...

I'm looking forward to your opinion 😉