📈✨ Patito’s June Performance Recap ✨🦆

(aka “The Month Patito Found a Forgotten Coin in the Couch Cushion”) powered by getquin

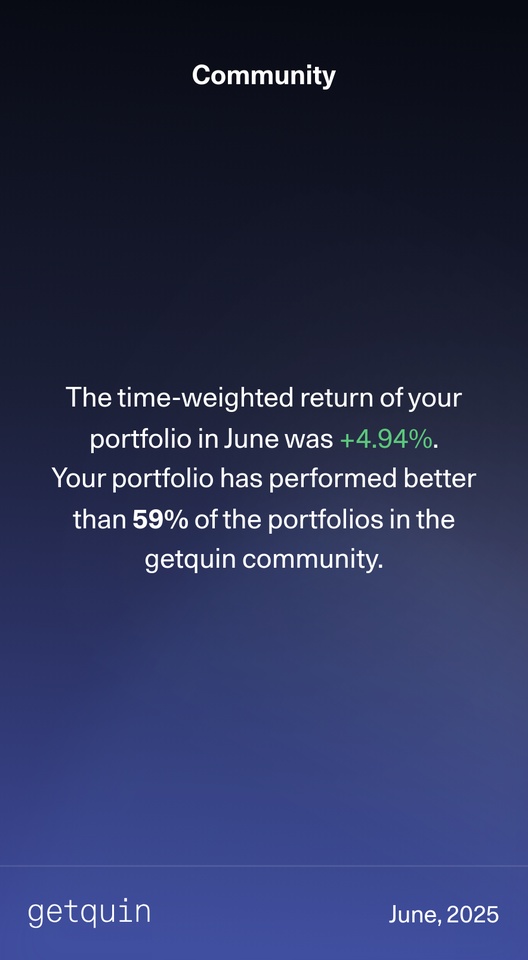

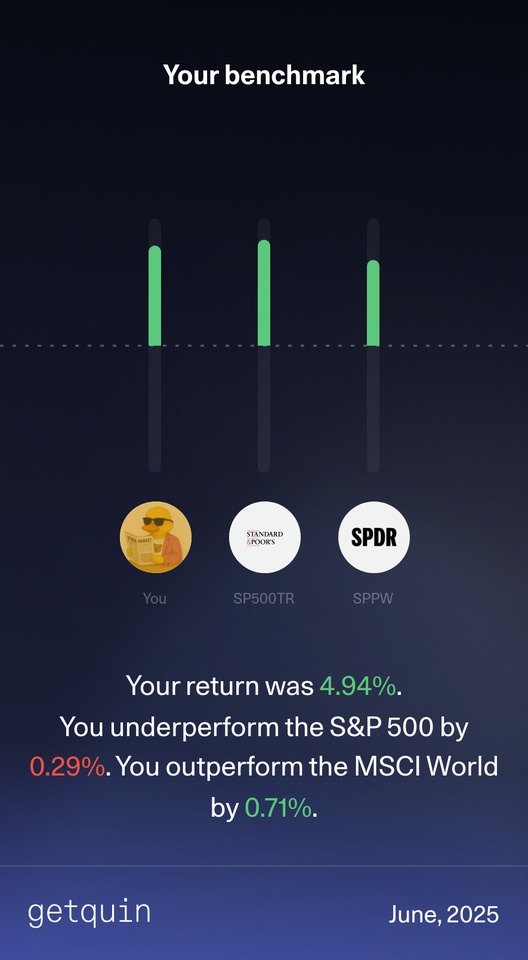

💚 Time-Weighted Return: +4.94%

Patito finally didn’t just float — 🦆 soared just below the mighty S&P 500 🛩️ and still somehow outperformed the MSCI World by +0.71% 🌍

Not bad for a duck with a spreadsheet and a dream.

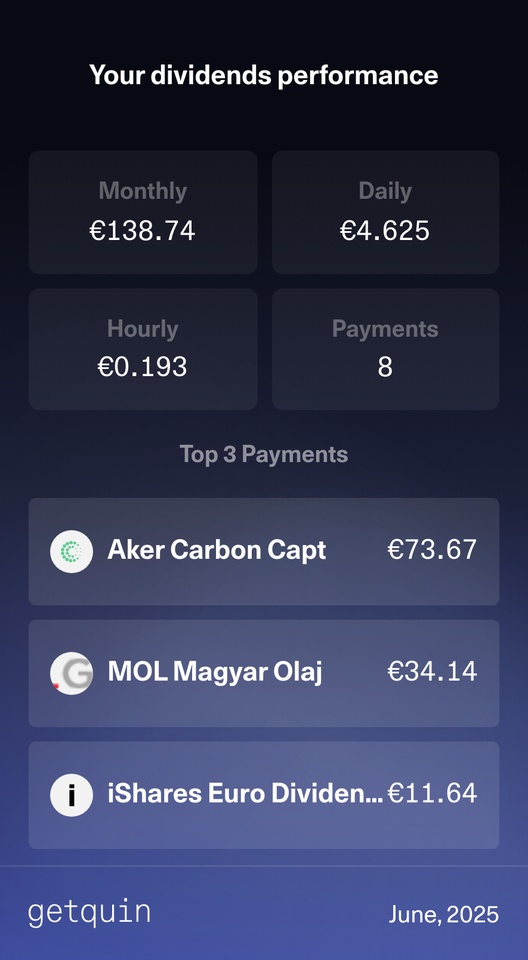

🪙 Dividends Collected: €138.74

That’s €4.63 a day, or €0.19 every hour — all while playing Baldur’s Gate 3 and hoping Astarion doesn’t make things weird again 🎮🦇

🏆 Top 3 Dividend Drops:

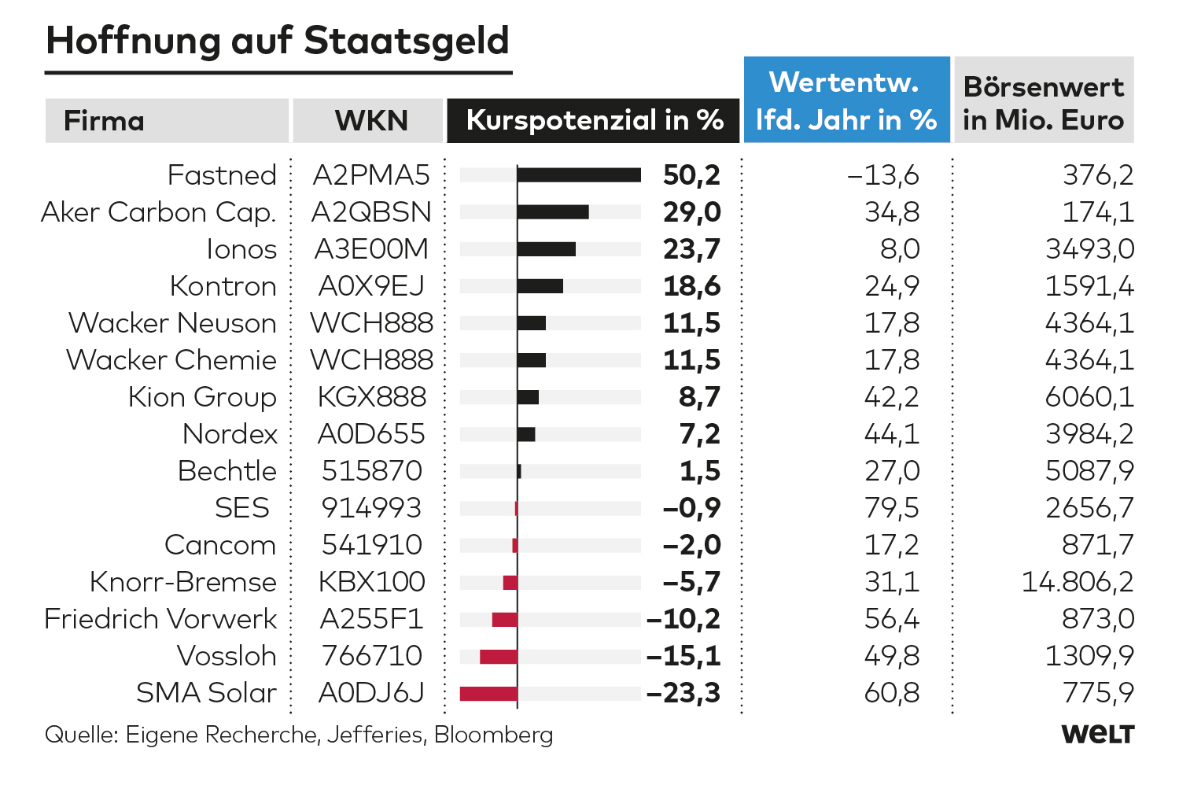

- Aker Carbon Capt. $ACC – €73.67 💣

🧨 “A true cigar butt” — the last puff before it fizzled out. But hey, it still paid 💶 wondering if there’s something left there

- $MOL (+2.97%) Magyar Olaj – €34.14 🛢️ I’m digging this Hungarian stock. Took forever to receive the funds in IBKR but they finally showed up.

- $IDVY (+0.83%) iShares Euro Dividend ETF – €11.64 💼 patito said goodbye to this ETF though

📊 Position Count: 21

A nimble mix of Patito picks — not too crowded, not too lonely. Just right to stay diversified and focused 🪺

📉 Benchmark Check:

• Missed the S&P 500 by -0.29%

• But somehow still beat 59% of Getquin portfolios 🏆

• And barely cruised past MSCI World by +0.71% 🌐

🧠 June Reflections from Patito:

• Aker might’ve been a cigar butt, but it still gave one last puff of value.

• Dividend flow smooths out the ride — even during side quests.

• Keeping the portfolio lean, mind curious, and never stop rolling perception checks 🎲🦆

For July things are taking shape. Lessons learned and on the path to holding quality stocks. Dividends are my friends!