$DIS (-0,08%)

$PLTR (-0,04%)

$SRT (-0,75%)

$NXPI (-0,27%)

$PYPL (-0,5%)

$PEP (-0,05%)

$TER (-0,71%)

$CPRI (-0,71%)

$MRK (-0,39%)

$PFE (-0,04%)

$TTWO (+0,44%)

$EA (-0,57%)

$AMD (-0,96%)

$MDLZ (-0,19%)

$LUMN (+0,7%)

$SMCI (+0,3%)

$7011 (-1,39%)

$6752 (+0,31%)

$6367 (+1,41%)

$UBSG (-0,58%)

$GSK (-0,14%)

$UBER (+0,02%)

$ABBV (+0%)

$LLY (+0,35%)

$GOOG (+0,58%)

$ELF (+0,52%)

$QCOM (-0,46%)

$SNAP (-0,03%)

$WOLF (-0,56%)

$ARM (-0,09%)

$VOLCAR B (+0,58%)

$6758 (-1,09%)

$SHL (-2,77%)

$SAAB B (-1,98%)

$5401 (-4,34%)

$MAERSK A (-0,45%)

$R3NK (-5,97%)

$BMY (+0,3%)

$BMW (+0,01%)

$EL (+0,47%)

$ROK (+0,06%)

$PTON (+0,06%)

$KKR (+0,91%)

$LIN (-0,05%)

$RL (-0,51%)

$AGCO (-0,28%)

$RBLX (+0,43%)

$FTNT (-0,36%)

$REDDIT (-0%)

$ILMN (+0,1%)

$WMG (-0,04%)

$IREN (-3,09%)

$MSTR (+1,26%)

$AMZN (-0,32%)

$KOG (-1,85%)

$ORSTED (+0,82%)

$PM (-0,29%)

$WEED (+2,26%)

MHI

Price

Discussão sobre 7011

Postos

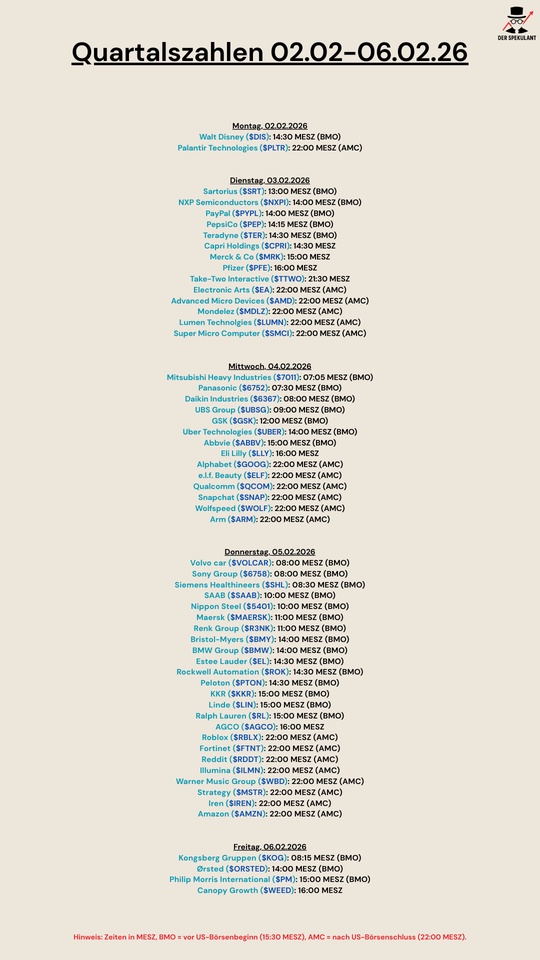

15Quarterly figures 02.02-06.02.26

☀️ OHISAMA - Electricity from space: Japan's vision of a new energy source

Exciting future technology or distant sci-fi?

Hello everyone,

in the course of my Rocket Lab research

I stumbled across the Japanese OHISAMA project and wanted to put it up for discussion here. It is nothing less than solar power from space that is transmitted wirelessly to earth.

Short version:

☀️ Collecting sunlight in space → ⚡ Generating electricity → 📡 Sending it to Earth via microwaves.

🚀 What exactly is OHISAMA?

OHISAMA is a research project of the Japanese space agency JAXA.

The aim is to demonstrate that:

- satellites in orbit can permanently collect solar energy

- this energy is converted into microwaves

- and a ground station converts the beam back into usable electricity

The big advantage:

In space, the sun shines almost around the clock - no night, no clouds, no seasons.

➡️ Theoretically, a constant, CO₂-free source of energy.

⚠️ Very important first of all

OHISAMA is currently a pure research and demonstration project.

- ❌ Not a commercial power plant

- ❌ No foreseeable turnover

- ❌ No timetable for when or whether this will be commercially viable

- ⏳ Realistic: if at all, then in many years or decades

For us as investors, this means

👉 Not a direct investment story, but rather a look at companies that are technologically involved.

🏭 Which companies could benefit?

You can't invest in JAXA - but you can invest in companies that are active in the fields of space travel, satellite construction and energy technology and are involved in such projects or supply technologies for them.

A few Japanese candidates:

🔹 Mitsubishi Heavy Industries ($7011 (-1,39%) )

📍 Ticker: 7011 (TSE)

- Space, rockets, satellites

- Energy and large-scale technology

- ➡️ One of the most important industrial partners in Japan's space programs.

🔹 Mitsubishi Electric

📍 Ticker: 6503 ($6503 (-0,67%) )

- Electronics, control systems, energy technology

- Space components

- ➡️ Could play a role in electronics, energy conversion and control systems.

🔹 IHI Corporation

📍 Ticker: 7013 ($7013 (-5,29%) )

- Mechanical Engineering & Aerospace

- Structures and propulsion systems

- ➡️ Classic supplier for aerospace hardware.

📝 Important to note:

These companies do not do OHISAMA as their core business. Space travel and such future projects are only small parts of a broad industrial portfolio.

➡️ An investment here is not a bet on OHISAMA, but on:

- Space in general

- high-tech industry

- long-term energy trends

🌱 Why is this exciting for future investors?

If the technology becomes marketable one day, it would have:

✅ Base-load capable solar energy

✅ No space problems on the earth

✅ No emissions

✅ Potentially global significance

But:

⚠️ Huge technical hurdles

⚠️ Enormous costs

⚠️ Political and regulatory issues

⚠️ Unclear business case

🧾 Conclusion

OHISAMA is a fascinating vision:

☀️ Electricity from space as a new source of energy for mankind.

For investors, however, it is currently rather:

🧠 Technological leading indicator

👀 Candidate for observation

🚫 Not a short-term investment driver

Anyone investing today is not betting on OHISAMA itself, but on companies that could generally benefit from space and high-tech trends.

What do you think?

👉 Pure sci-fi?

👉 Or comparable to solar 30 years ago in the long term?

👉 Does anyone have the stocks mentioned on their watchlist?

Looking forward to your opinions! 📊🚀

I think it will be a long time before it is really up and running and possibly generating sales.

Quartalszahlen 03.11.25-07.11.15

$BNTX (-0,64%)

$ON (-0,56%)

$HIMS (+0,79%)

$PLTR (-0,04%)

$O (-0,15%)

$8058 (-0,58%)

$7974 (-3,2%)

$BP. (+1,26%)

$BOSS (-0,06%)

$SWK (+0,03%)

$SPOT (+0,5%)

$N1CL34

$UBER (+0,02%)

$CPRI (-0,71%)

$SHOP (-0,16%)

$RACE (-0,03%)

$HOG (+0,78%)

$HTZ (+0,21%)

$PFIZER

$UPST (+0,18%)

$ANET (+1,64%)

$PINS (+0,3%)

$TEM (+0,45%)

$AMD (-0,96%)

$SMCI (+0,3%)

$RIVN (+0,47%)

$BYND (-1,24%)

$KTOS (+1,43%)

$CPNG (+0,63%)

$BMW (+0,01%)

$NOVO B (+0,69%)

$FRE (-3,32%)

$ORSTED (+0,82%)

$AG1 (-2,17%)

$EVT (-1,22%)

$CCO (+0,16%)

$DOCN (+0,3%)

$LMND (+0,1%)

$SONO (-0,32%)

$MCD (-0,19%)

$HOOD (+2,62%)

$QCOM (-0,46%)

$FTNT (-0,36%)

$FSLY (-0,45%)

$HUBS (-0,58%)

$ELF (+0,52%)

$ARM (-0,09%)

$SNAP (-0,03%)

$DASH (+0,91%)

$APP (+0,93%)

$AMC (+0,94%)

$ZIP (+0,11%)

$FIG (+0,39%)

$LCID (-0,57%)

$DUOL

$UN0 (+0,15%)

$CBK (-1,11%)

$DEZ (-0,64%)

$ZAL (+1,2%)

$HEN (-0,9%)

$MAERSK A (-0,45%)

$HEI (+0,2%)

$CON (-2%)

$AZN (-0,33%)

$ALB (+0,59%)

$MRNA (-1,1%)

$QBTS (+0,17%)

$WBD (-0,18%)

$LI (-1,36%)

$RHM (-2,07%)

$DDOG (+0,05%)

$RL (-0,51%)

$OPEN (-0,58%)

$ABNB (-0,4%)

$PTON (+0,06%)

$MP (+0,57%)

$TTD (+22,03%)

$STNE (+0,28%)

$SQ (+0,28%)

$GRND (-0,26%)

$IREN (-3,09%)

$AFRM (+3,4%)

$CRISP (+5,47%)

$RUN (-0,84%)

$7011 (-1,39%)

$DTG (-0,37%)

$HAG (-2,73%)

$DKNG (+0,24%)

$LAC (-1,14%)

$KKR (+0,91%)

$PETR3 (+1,65%)

$CEG

$WEED (+2,26%)

The security of supply report promises opportunities for selected shares

In the new Security of Supply Report of the Federal Network Agency states that Germany needs many new gas-fired power plants very quickly so that the lights do not go out.

A total of 71 new large gas-fired power plants will be needed in the next ten years. Previously, the security of supply reports stated that around 40 power plants were needed. Now the new German government has apparently recalculated and come to the conclusion that an additional 35.5 gigawatts are needed to be on the safe side. As a gas-fired power plant of the larger type can supply around 500 megawatts, more is now needed.

A single one of these power plants costs between 600 and 800 million euros. So in total, we are talking about 50 billion euros. When it comes to such investment sums, it also becomes interesting for investors, as companies have to build the new power plants and connect others to the grid.

In the gas turbine business in particular, there are not so many players at the forefront. One of them is the German stock market star Siemens Energy $ENR (-1,06%). Together with its competitors GE Vernova

$GEV (+0,34%) and Mitsubishi Power

$7011 (-1,39%) the Germans share around two thirds of the global market for gas turbines.

The power plants also have to be operated and there are not many companies vying for the job. The main reason for this is that gas-fired power plants are only supposed to step in when there is not enough renewable energy available. With state support/subsidies, this will still be a good business for energy companies such as RWE $RWE (+0,06%) , EnBW

$EBK (-2,22%) and E.on $EOAN (+0,83%).

Source text (excerpt): Welt, 05.09.25 | Graphic: Wikipedia

These were the ten most successful CEOs for shareholders in 2024

Hello my dears,

The CEO makes a major contribution to how successful a company is.

A CEO plays a crucial role in the success of a company. According to studies, a CEO's performance has a significant impact on company performance, with estimates ranging up to 45%. An effective CEO can increase company value through strategic direction, leadership and decision-making, while poor leadership can lead to stagnation or even decline.

Here are some aspects of how a CEO contributes to a company's success:

Strategic direction:

The CEO sets the long-term vision and strategy of the company and ensures that resources are utilized efficiently.

Leadership and motivation:

A good CEO motivates and leads employees, creates a positive corporate culture and promotes collaboration.

Decision-making:

The CEO makes important decisions that drive the company forward, whether in terms of products, markets or investments.

Communication:

The CEO is the mouthpiece of the company and communicates both internally and externally to create trust and transparency.

Crisis management:

A capable CEO can react quickly and effectively in crisis situations to avert damage to the company.

A CEO change can have a significant impact on a company, both positive and negative. If a new CEO comes in with a clear vision and effective leadership style, this can lead to a significant upturn, whereas a change to a less capable leader can lead to problems.

The role of the CEO is therefore of great importance for the success or failure of a company. A good CEO is more than just a manager; he or she is a visionary, a leader and a crisis manager who leads the company through all the ups and downs.

Dear ones, which are your favorite CEOs?

And do you even know the CEOs of your investments?

I have to admit I don't know all 59 🙈🙈

But maybe one of your CEOs is one of the 10 from 2024.

To determine the ten most successful CEOs of the year for shareholders, the business medium "The Economist" has compiled a list of CEOs whose total shareholder returns were particularly high compared to the average of listed companies in the S&P Global 1200. The S&P Global 1200 comprises the most valuable companies outside China and India. The information is based on data from "Bloomberg" and was collected between January and December 19, 2024.

10 John-Christophe Tellier (UCB) $UCB (-0,09%)

Jean-Christophe Tellier is the CEO of UCB, a global biopharmaceutical company based in Brussels. UCB specializes in the development of therapies for people with serious diseases, particularly in the fields of neurology and immunology.

In 2024, the launch of the anti-inflammatory drug Bimzelx in the US led to a sharp rise in the share price. UCB thus achieved a total shareholder return 133 percent higher than the average of the companies in the S&P 1200 over the period under review.

9 Rick Smith (Axon Enterprise). $AXON (-0,12%)

Rick Smith is the founder and CEO of Axon Enterprise, a technology company that develops public safety solutions. Originally founded in 1993 as Taser International, the company made a name for itself with the development of stun guns used by law enforcement agencies worldwide.

Despite repeated reports of a toxic workplace culture at Axon, the company has had a successful year. The rise in the share price was spurred on by the comments of the newly elected US President Donald Trump, who wants to further militarize the US federal police force. Axon Enterprise generated a 149% higher total shareholder return in 2024 than the average company in the S&P 1200.

8th Tyler Glover (Texas Pacific Land). $TPL (+0,09%)

Tyler Glover is the CEO of Texas Pacific Land Corporation (TPL), one of the largest private landowners in Texas and an influential company in the energy and real estate industries. TPL owns millions of acres of land in West Texas, particularly in the Permian Basin, one of the most productive oil and gas regions. In 2024, the company's share price rose on expectations that the high energy consumption of AI data centers will boost the business. Texas Pacific Land delivered a 158% higher total shareholder return than the average company in the S&P 1200 over the period.

7 Geir Haoy (Kongsberg). $KOG (-1,85%)

Geir Haoy is the CEO of Kongsberg Gruppen, a Norwegian technology company operating in various industries, including defense, space, shipping, oil and gas, and digital solutions. In 2024, the company benefited from increasing orders for weapon systems. CEO Haoy achieved a 174 percent higher total return for his shareholders in 2024. 174 percent higher total return than the S&P 1200 average.

6. Yasuhito Hirota (Asics). $7936 (-4,04%)

Yasuhito Hirota is the CEO of Asics, one of the world's leading sportswear and footwear companies, which is particularly well known for its running and training shoes. This year, one model in particular has been a success for the company: Onitsuka Tiger.

The shoe is trending thanks to posts on social media and has recorded high sales figures. Asics thus achieved a 176% higher total shareholder return than the S&P 1200 average in the period under review.

5 Seiji Izumisawa (Mitsubishi Heavy Industries)

Seiji Izumisawa is the CEO of Mitsubishi Heavy Industries (MHI), a Japanese industrial conglomerate that operates in a variety of sectors, including aerospace, power generation, shipbuilding, engineering and defense. Izumisawa has bundled the company's strengths - and focused primarily on the energy and defense sectors. This year, he delivered a 177 percent higher total return to shareholders than the average company in the S&P 1200.

4. Jensen Huang (Nvidia). $NVDA (-0,06%)

Jensen Huang is the co-founder and CEO of Nvidia, a leader in graphics processing units (GPUs) and artificial intelligence (AI). Under his leadership, Nvidia has evolved from a manufacturer of graphics chips for computers to a global technology giant that also offers solutions for AI, deep learning, cloud computing and self-driving cars.

The rapid growth resulting from the AI hype slowed down this year. The high expectations of analysts were not quite met. Nevertheless, Huang was able to achieve a 180% higher total return for its shareholders in 2024 than the S&P 1200 average.

3rd Jim Burke (Vistra). $VST (-0,02%)

Jim Burke is the CEO of Vistra, an energy supply company based in Irving, Texas. Vistra is engaged in the generation and distribution of electricity and operates a broad portfolio of energy assets, including gas, coal, wind and solar power plants.

Similar to Texas Pacific Land, his company benefited from increasing energy consumption due to AI data centers. In 2024, it generated a 288% higher total return than the S&P 1200 average.

2nd Christian Bruch (Siemens Energy). $ENR (-1,06%)

Christian Bruch is the CEO of Siemens Energy, a global company specializing in the development, manufacture and maintenance of technologies for power generation, transmission and distribution. Siemens Energy was created in 2020 as an independent company from the spin-off of the Siemens Energy Division.

In 2024, the company recovered after Siemens Energy posted a loss of more than 4.5 billion euros in 2023. The German government provided billions in guarantees for the troubled company. In 2024, Siemens Energy achieved a total return 312 percent higher than the S&P 1200 average due to the recovery of the share price.

1 Alex Karp (Palantir). $PLTR (-0,04%)

Alex Karp is the co-founder and CEO of Palantir, a company specializing in data analytics and software solutions. Founded in 2003, Palantir provides big data analytics platforms that are mainly used by government agencies but also by companies in various sectors - and are controversial.

By 2024, the company's market capitalization had risen from USD 36 billion to over USD 180 billion. In September, Palantir was included in the S&P 500 Index of the most valuable companies in the USA. In 2024, Palantir thus achieved a total return 322 percent higher than the S&P 1200 average.

I would have expected some of the CEOs here, but there are also a few that I would not have expected.

I am invested in Siemens Energy, Vistra and NVIDIA

Unfortunately, UCB didn't make it from the Watch into my portfolio.

I hope you enjoyed the presentation of the CEOs.

Please let me know in the comments.

https://www.businessinsider.de/wirtschaft/ranking-die-besten-ceos-fuer-aktionaere-im-jahr-2024/

Restructuring of the portfolio:

$ASML (-0,67%) is out, as I want to focus more on stocks with a healthy trend in the growth part of my portfolio. See the weekly chart.

At the moment I am running a 75/25 strategy with which I feel most comfortable, 15K divided as follows:

Growth 75%: $AVGO (+5,52%)

$COST (-0,2%)

$7011 (-1,39%)

$MUV2 (-0,45%)

$GOOG (+0,58%)

$MUX (+1,23%) (mutares is under observation by me) $2768 (-1,41%)

Dividend 25%: $OBDC (-0,15%)

$HTGC (-0,7%)

$PSA (-0,06%)

$JEGP (-0,17%)

🧠 AI boom: How data centers are driving the global hunger for energy

Graphic: AI generated

The rapid development of AI has triggered a veritable boom in data centers. Companies such as OpenAI and DeepSeek are driving this revolution and the demand for high-performance servers is growing exponentially.

However, the increase in computing power is also accompanied by massive energy consumption, an issue that is leading to global discussions about infrastructure, efficiency and future investments [1].

At the same time, the question arises as to whether there is currently an overinvestment in computing power. The Chinese AI company DeepSeek, for example, has presented a model that works more efficiently than previous large language models (LLMs).

Does this mean that we will soon need less computing power?

Or will the Jevons paradox occur instead, i.e. the effect that more efficient technologies actually increase overall consumption in the long term? [2, 3]

In this article, I will focus on the key developments in the data center sector, the growing demand for energy, regional characteristics, current challenges and potential investment opportunities.

As always, the article is intended to shed light on the background to current events, provide food for thought and give impetus. The stocks mentioned do not, of course, constitute investment advice.

🤖 Data centers: the foundation of the AI revolution

The growing global demand for AI-supported software and digital applications requires powerful data centers. Goldman Sachs analysts forecast that the global demand for power from data centers will increase by 50% by 2027 and by up to 165 % could increase [1].

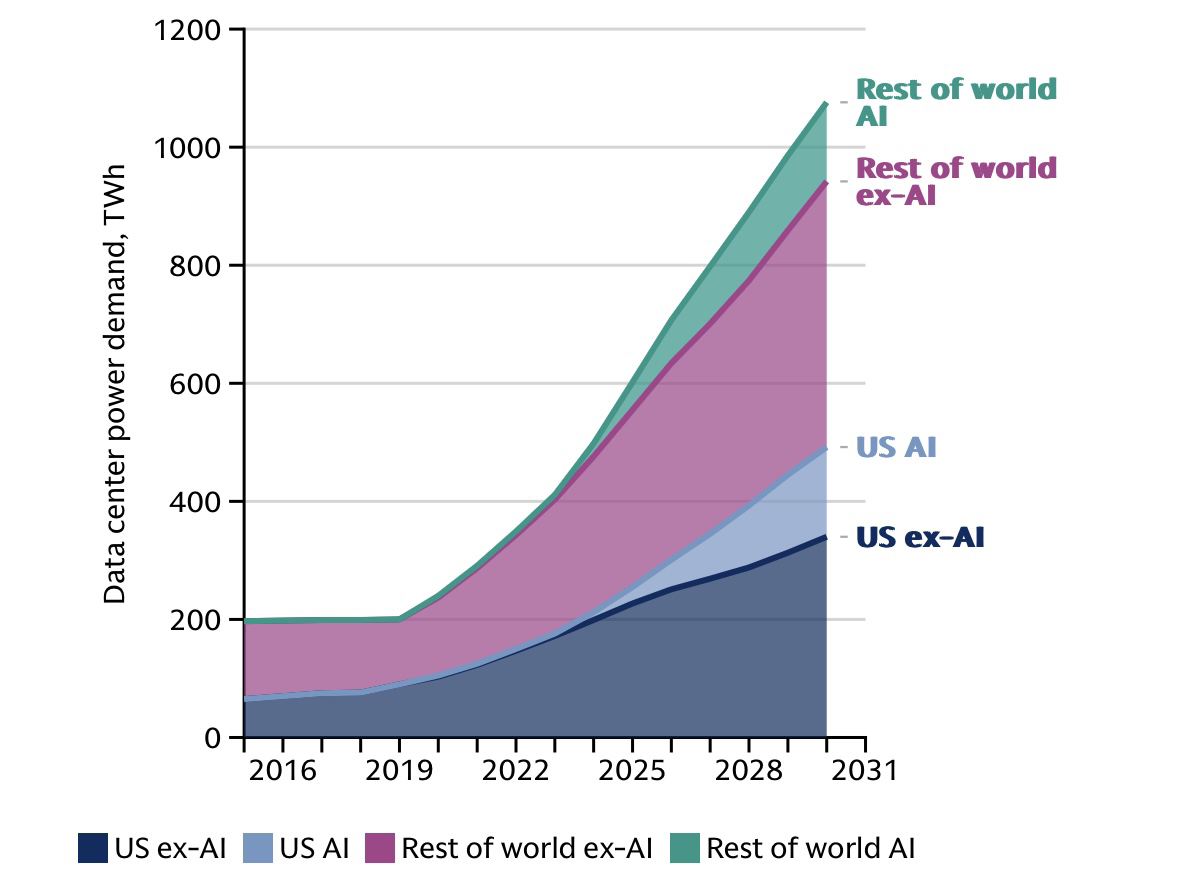

This chart below forecasts the energy consumption of data centers (in terawatt hours) by 2030, distinguishing between AI- and non-AI-based applications in the US and the rest of the world. Total consumption is expected to rise to over 1,000 TWh by 2030 [4].

Our analysts expect data center power consumption to increase by more than 160% by 2030

Source: [4], primary: Masanet et al. (2020), Cisco, IEA, Goldman Sachs Research

This data shows how AI applications will massively increase energy consumption. The rapid increase in the area of "US AI" and "Rest of world AI" is particularly striking.

The three main reasons for this increase are

- Larger AI models:

New models such as GPT-5 or DeepSeek AI require more and more computing power. Training and operating these models requires trillions of calculations [1].

- Real-time AI applications:

Companies are integrating AI into numerous applications: from search engines to personalized financial and healthcare services.

- Cloud computing & data storage:

As digitalization progresses, the global demand for data storage and cloud services is increasing [1].

Which companies dominate the market?

On the demand side for data centers, large hyperscale cloud providers and other companies are building large language models (LLMs) that are capable of processing and understanding natural language. These models need to be trained on huge amounts of information using power-intensive processors [4].

On the supply side, hyperscale cloud companies, data center operators and asset managers are deploying large amounts of capital to build new high-capacity data centers.

These include, among others:

- Microsoft $MSFT (+0,04%) : Operator of Azure Cloud and partner of OpenAI

- Alphabet $GOOGL (+0,64%) : With Google Cloud and DeepMind

- Amazon $AMZN (-0,32%) : AWS, the world's leading cloud provider

- Meta $META (-0,25%) : Develops its own AI chips and continues to expand its infrastructure

In addition, specialized data center providers such as Equinix $EQIX (-0,1%) and Digital Realty $DLR (+0,11%) as they supply physical infrastructure to the hyperscalers [6].

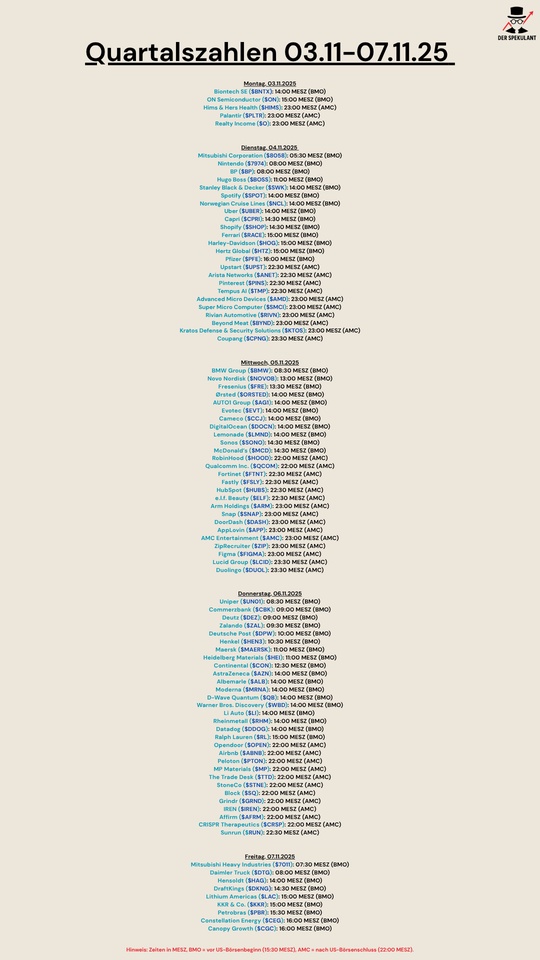

According to Goldman Sachs Research, demand for data center infrastructure will increasingly outstrip supply in the coming years.

The utilization rate of existing data centers is expected to rise from around 85% in 2023 to more than 95% by the end of 2026. However, the situation is expected to ease from 2027 onwards as new data centers are commissioned and demand growth driven by AI slows down (see chart below) [1].

Goldman Sachs currently estimates that the global power consumption of the data center market is around 55 gigawatts (GW). This is made up of cloud computing workloads (54%), traditional workloads such as email or data storage (32%) and AI (14%) [1].

For the future, analysts predict that electricity demand will increase to 84 GW by 2027. The share of AI is expected to grow to 27%, while the cloud share will fall to 50% and traditional workloads to 23% [1].

By the end of 2030, around 122 gigawatts (GW) of data center capacity will be online.

At this point, I asked myself as a layman how the units mentioned so far are to be understood, in my first graphic I speak of 1,000 TWh of energy consumption of all data centers by 2030 and now here is talk of 122 GW of data center capacity? In order not to go completely beyond the scope of the article, I have added a section at the very end in case some of you also feel like a layman and want to put the "units" into perspective.

... and now on with the article...

One central problem remains:

Where does all the energy come from?

⚡️Energieversorgung: Can the grid keep up?

According to estimates by Goldman Sachs, more than 720 billion US dollars will have to be invested in expanding the power grid worldwide by 2030 in order to supply the new data centers with sufficient energy [1].

Europe in particular, where electricity consumption was expected to decline for many years, is experiencing a veritable "demand shock" [1].

Which energy sources supply data centers?

- Natural gas & battery storage:

Natural gas is seen as a realistic short-term solution to meet continuous demand. It serves as a bridging technology until renewable energy and storage solutions are further developed, as renewable energy is not available around the clock [4].

- Renewable energies:

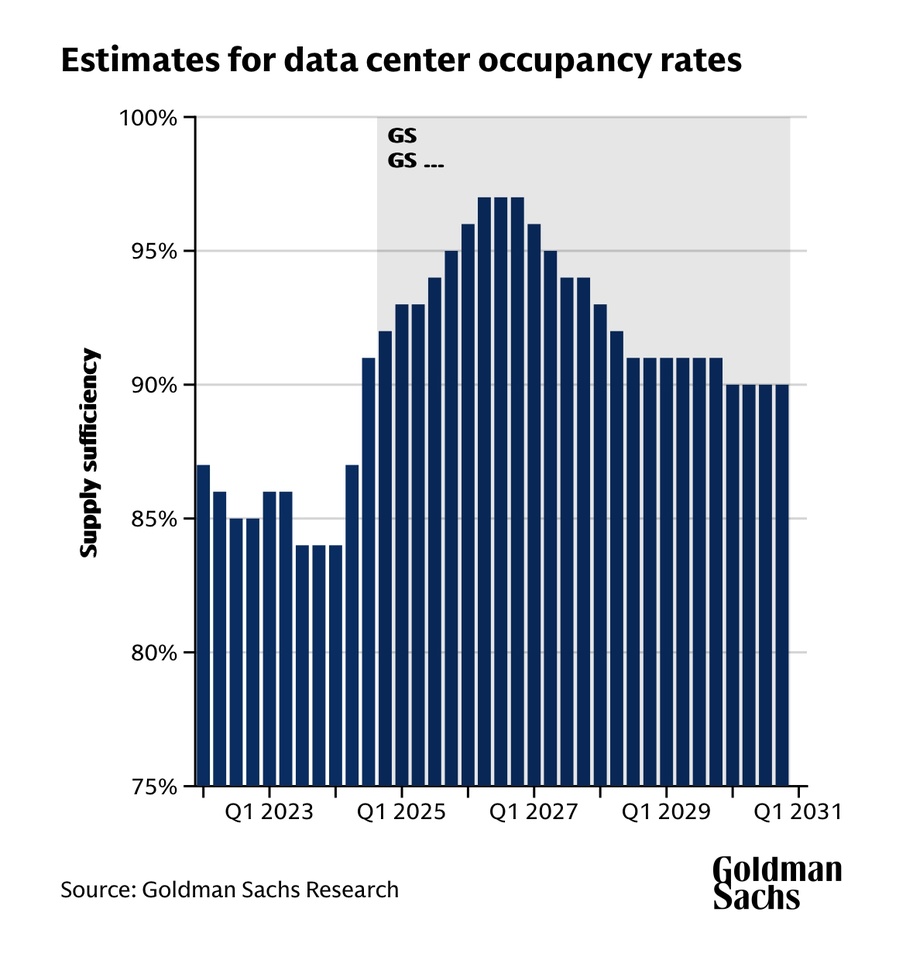

Wind and solar energy could cover around 80 % of demand in the long term, provided that sufficient storage solutions are integrated [4].

In practice, solar plants run on average only about 6 hours per day, while wind power plants run on average 9 hours per day. There is also a daily volatility in the capacity of these sources, depending on the radiation of the sun and the strength of the wind [4].

The graph shows the fluctuations in capacity factors for wind and solar energy in the USA in 2023. The capacity factor indicates how efficiently an energy source utilizes its maximum output throughout the year.

- Wind energy (light blue line): The highest capacity factors occur in the winter months (Jan-March) and drop significantly in the summer months (Jun-Aug).

- Solar energy (dark blue line): Efficiency rises in the spring (Mar-May) and reaches its maximum in the summer months (Jun-Aug) before falling in the winter (Nov-Dec).

The graph illustrates that wind and solar energy can complement each other seasonally: While wind is more efficient in winter, solar energy provides the highest yields in summer. This shows how important a balanced energy mix is to ensure security of supply.

In addition to finding environmentally friendly energy sources to power data centers, technology providers can reduce emissions intensity through efficiency gains.

The following chart shows the development of the workload and energy consumption of data centers between 2015 and 2023. Although the workload almost tripled, energy consumption remained almost constant until 2019 thanks to efficiency gains. The efficiency gains then slowed down from 2020 onwards.

Source: [4], primary: Masanet et al. (2020), IEA, Cisco, Goldman Sachs Research

This chart supports the discussion on the Jevons paradox (see below). Efficiency gains could be offset or even exceeded in the long term by higher workloads and AI demand. This highlights the need to make data center energy sources more sustainable.

- Nuclear energy:

Meanwhile, governments are also becoming more supportive of nuclear energy on the whole. Switzerland is reconsidering the use of nuclear generators for its electricity supply, while nuclear energy enjoys bipartisan support in the US and the Australian opposition party has put forward plans to introduce nuclear reactors [4].

Participants at the COP28 conference at the end of 2023, an annual summit convened by the United Nations to combat climate change, agreed to triple global nuclear capacity by 2050 [4].

Nuclear energy is considered the ideal option for basic power supply as it provides a reliable and constant supply of energy.

As a result, more and more large tech companies such as Alphabet, Amazon and Microsoft are turning to small modular nuclear power plants (SMRs).

📊 Increasing efficiency & the Jevons paradox

With new technologies such as DeepSeek, AI could work more efficiently in the future. But does greater efficiency automatically mean that less computing power is required?

The Jevons paradox: More efficiency = more consumption?

The Jevons paradox describes the fact that increases in efficiency often do not lead to lower consumption, but to higher consumption overall.

-Example:

In the 19th century, more efficient steam engines did not lead to lower coal consumption; on the contrary, as the machines became cheaper and more versatile, coal consumption actually increased.

With cars: more fuel-efficient engines did not lead to less gasoline consumption, but to people driving more cars.

-Applied to AI:

As AI models become more efficient, the cost per computation decreases. This makes AI applications attractive in even more areas, which in turn leads to a higher overall demand for computing power.

🌎 Regional distribution and global expansion of data center infrastructure

Current distribution: Where are the data centers located today?

Today, most data centers are located in the Asia-Pacific region and North America. Well-known locations are:

North America:

- Northern Virginia

- San Francisco Bay Area

Asia: Beijing

- Beijing

- Shanghai

These regions are characterized by high computing power, intensive data traffic and strong demand from corporate campuses [1].

The chart also shows the historical development of data center capacity by region (North America, APAC, etc.) from 2017 to 2024. The figures illustrate how fast the infrastructure for the AI revolution is growing and underlines why the energy requirements of data centers are increasing so rapidly.

The increase in capacity from around 20 GW in 2017 to almost 60 GW in 2024 shows an enormous growth trend. This correlates directly with the increasing demand for AI applications and cloud computing.

How is supply growing?

Goldman Sachs Research estimates that global data center capacity will increase to around 122 GW by the end of 2030, as mentioned above. The share of hyperscalers and specialized operators will increase from the current 60% to around 70% [1].

- Asia-Pacific:

The largest expansion of data centers has been recorded here in the past ten years.

- North America:

The largest expansion of new data centers is planned in North America over the next five years.

📈 Investment opportunities: Some winners of the AI and data center revolution

US shares e.g.:

- Carrier Global $CARR (+1,05%) : Precise cooling technology and air conditioning for data centers

- Vertiv Holdings $VRT (+0,68%) : Specialist in cooling and power solutions specifically for data centers

- Brookfield Renewable Partners $BEP.UN : Leading provider of renewable energy (hydropower, solar, wind) - supply contracts (PPAs) with data centers

- ON Semiconductor $ON (-0,56%) : Leader in chips for energy efficiency and thermal management. Solutions reduce power consumption in data centers and support AI integration

- Texas Instrumentes $TXN (-0,01%) : Energy-saving semiconductor products used in data center servers

- Equinix $EQIX (-0,1%) : Specialized in data center infrastructure

- Digital Realty $DLR (+0,11%) : Provider of physical infrastructure for data centers

- IBM $IBM (-0,29%) : Quantum computing technologies that potentially consume less energy and development of energy-efficient AI solutions

- Arista Networks $ANET (+1,64%) : Specialist in high-speed networking products for data centers

- Nvidia $NVDA (-0,06%) : Leader in AI GPUs, Leader in AI training market. Best choice for large AI models and data center training

- AMD $AMD (-0,96%) Competing with Nvidia with its own AI chips, but better positioned in the AI interference market where energy efficiency and cost-effectiveness are key. The interference market will be the next most important market, perhaps even the more important one.

- Broadcom $AVGO (+5,52%) Profits from network solutions for data centers

- Microsoft $MSFT (+0,04%) Google $GOOGL (+0,64%) Amazon $AMZN (-0,32%) : The big hyperscalers investing heavily in AI and cloud

European stocks e.g.:

- Siemens Energy $ENR (-1,06%) Important role in modernizing power grids, integrating renewable energies and improving storage solutions for data center reliability

- Schneider Electric $SU (-1,72%) : Leader in the development of energy management and cooling technology for data centers - specialty in the automation of both systems.

- ASML $ASML (-0,67%) : Indispensable for modern chip production

- Infineon $IFX (-0,54%) and STMicroelectronics $STM (+1,74%) : Leading semiconductor companies with a focus on AI applications

- RWE $RWE (+0,06%) and Enel $ENEL (-0,74%) Utilities that are increasingly focusing on renewable energies for data centers

Japanese stocks e.g:

- Daikin Industries $6367 (+1,41%) World market leader in air conditioning and cooling, offers specialized cooling systems for data centers and AI-supported plant management systems to further increase efficiency

- Tokyo Electron $8035 (-1,12%) : Important supplier for semiconductor manufacturing

- Mitsubishi Heavy Industries $7011 (-1,39%) : Works on the development of new nuclear power plants to secure the energy supply

🧠 Conclusion: AI, data centers & energy as the trend of the century?

Although some analysts warn of possible overinvestment, the figures indicate that the demand for computing power and energy for AI data centers will continue to rise sharply.

- Efficiency gains from models such as DeepSeek or new chip technologies could reduce energy consumption per computer, but the Jevons paradox means that overall demand will increase because more efficient systems will be used more often.

The biggest winners are therefore:

- Semiconductor companies: They supply the AI chips needed.

- Data center operators: They build the necessary infrastructure.

- Energy suppliers: They ensure the energy supply for the AI revolution.

In the long term, these companies could be among the biggest beneficiaries of the coming decades.

👨🏽💻 How do I position myself?

Personally, I think I am well positioned with the NASDAQ 100 $CSNDX (+0,2%) (portfolio share of 23%), as the focus is on US technology and growth stocks. The ETF complements my All-World with a stronger weighting in innovative sectors such as AI and cloud computing.

In the near future, I will also take a closer look at Daikin Industrie $6367 (+1,41%) share in order to increase the exposure to Japan and the share price offers an entry point at first glance.

In addition, AMD $AMD (-0,96%) has also caught my attention, the reason being its positioning in the aforementioned interference market. Most of the capital is currently flowing into the expansion of new AI models. However, as soon as these become a "commodity" and everyone uses them, most of the capital will probably flow into the interference market (market for the application of AI models).

Furthermore, I have Siemens AG $SIE (-1,8%) with approx. 2.3% portfolio share (still growing to approx. 4%), which I also see as well positioned for the future for the following reasons (in the context of the article):

Network stability

- Develops technologies for intelligent power grids ("smart grids"), essential for integrating renewable energies into the supply of data centers.

Data center control

- Provides automation and monitoring systems that optimize the energy consumption and efficiency of data centers

Efficient building structure

- The "Smart Infrastructure" division supports data centers with energy-efficient solutions for lighting, air conditioning and building monitoring

Not directly cooling systems, but:

- offers technologies that increase the energy efficiency of cooling systems by optimizing energy flows and data analysis

What is your opinion❓

- Which companies do you have on your radar?

- Is there a threat of overinvestment or are we just at the beginning of a century revolution?

Thanks for reading! 🤝

...Said digression follows after the sources...

__________

Sources:

[2] "The Coal Question"

http://digamo.free.fr/peart96.pdf

[3] https://de.m.wikipedia.org/wiki/Jevons-Paradoxon

[5] https://www.mckinsey.com/capabilities/quantumblack/our-insights/the-state-of-ai

[6] https://www.cbre.com/insights/reports/global-data-center-trends-2024

__________

🧭 Digression: on gigawatts and terawatt hours

In order to understand the relationship between the two figures, 122 GW (gigawatts) and 1,000 TWh (terawatt hours), it is important to clarify the units and their meaning:

- 122 GW (gigawatts):

Refers to the current average power capacity that data centers worldwide require to function. Power (measured in GW) describes the amount of energy consumed per second. This is therefore a snapshot of energy requirements.

- 1,000 TWh (terawatt hours):

This is an indication of energy consumption over a certain period of time, in this case one year. It describes how much energy is required in total in 12 months.

The forecast of 1,000 TWh is slightly below the value resulting from the calculation. The graph shows values slightly above 1,000 TWh; according to the calculation based on 122 GW of power capacity, energy consumption should be around 1,069 TWh.

Nevertheless, general reasons for deviations may be as follows:

- Efficiency improvements: Data centers could operate more efficiently through improved cooling, optimized hardware and software and thus consume less energy.

- Peak vs. average consumption: The figure of 122 GW could reflect peak demand, while the actual average annual demand is somewhat lower.

- Adjustments to the model: It is possible that the forecast of 1,000 TWh is conservative and does not take into account all additional loads or regional differences.

This shows how much the demand for data centers and energy will increase due to AI and digitalization by 2030

__________

+ 2

Last purchase 2024 1.5

A bank transfer has just arrived from Friday, which I thought would not arrive before the new year.

So I quickly restored my Japan share in the portfolio.

$2768 (-1,41%) for dividends (and as a turnaround among the 7 Sōgō Shōsha) see my presentation of the share https://getqu.in/Xp5ocC/

$7011 (-1,39%) for div. growth, they also build and maintain the F35 and the Leo2 under license 💸💸

I currently have a problem with Finanzen.net Zero that I cannot sell my $7011 (-1,39%) Mitsibishi Heavy shares. In this regard, a stock split took place on 29.03.24. The support referred me and told me to be patient as the unblocking was initiated externally. Well, after more than 4 weeks it should work at some point. This and a few other reasons prompted me to switch to TR. Everything is currently running smoothly there.

Has anyone else had problems like this after a stock split? How long did you have to wait?

Thank you

To be honest, I've never had a single problem.

It's that time again and the Japan season is open.

As of today, due to the time change from winter to summer, you can trade Japanese stocks with a lower spread between 8 - 9 am.

My favorites:

$7011 (-1,39%) MHI Heavy Metal

YTD+61.09% KGV 12.55

$6361 (+1,6%) Ebara Services Energy, Environment

YTD +59.06% KGV 20.53

$6501 (-1,07%) Hitachi Service IT

YTD +36.95% KGV 15.58

$7974 (-3,2%) Nintendo Entertainment

YTD +17.21% KGV 19.33

$7203 (-3,5%) Toyota Automotive

YTD +10.66% KGV 10.94

$5411 (-1,35%) JFE Holdings Chipmaking IT

YTD 10.71% KGV 5.98

$8001 (-1,19%) Itochu Trading

YTD +7.60% KGV 12.82

My favorite Etf:

$XDJP (-1,11%) Nikkei 225

YTD 15.46% TER 0.09%

Semi-annual distribution Feb + August 1.33%

There are of course countless other shares, companies and ETFs. I myself have $7011 (-1,39%) and $XDJP (-1,11%) .

Good luck

Since Japan has no daylight saving time, for us German investors it means that the stock exchange is open from 2:00 to 4:30 and 5:30 to 8:00 in the summer. In winter, it is one hour earlier, from 1:00 to 3:30 and from 4:30 to 7:00.

For domestic investors, this means that the traditional stock exchanges have no overlap with the Japanese stock market. But there is a gap: The LS Exchange and also Lang & Schwarz in over-the-counter trading start trading as early as 7:30 am. This means that we have a 30-minute overlap with Japan from 7:30 to 8:00. During this time, the broker knows the reference rates in Tokyo and offers correspondingly lower spreads. You can see this here with an example:

Títulos em alta

Principais criadores desta semana