$UCG (-0,59%)

$MNDY (+1,68%)

$KER (+0,22%)

$BARC (-0,46%)

$OSCR (+5,24%)

$CVS (+2,46%)

$SPOT (+6,65%)

$DDOG (+2,64%)

$BP. (+0,21%)

$SPGI (+2,45%)

$HAS (+0,71%)

$KO (+0,14%)

$JMIA (+3,1%)

$MAR (+1,07%)

$RACE (+0,17%)

$UPST (+3,98%)

$NET (+2,68%)

$LYFT (+5,11%)

$981 (+0%)

$NCH2 (-0,85%)

$DSY (+0,61%)

$1SXP (+0,95%)

$HEIA (+0,7%)

$ENR (-2,87%)

$DOU (+2,83%)

$OTLY (+0%)

$TMUS (-2,52%)

$SHOP (+4,45%)

$KHC (+0,72%)

$FSLY (-1,49%)

$HUBS (+8,28%)

$CSCO (-1,33%)

$APP (+4,15%)

$SIE (+1,41%)

$RMS (+0,73%)

$BATS (-0,56%)

$MBG (+0,09%)

$TKA (-1,35%)

$VBK (-1,84%)

$DB1 (+3,27%)

$NBIS (-4,93%)

$ALB (-6,85%)

$BIRK (+3,77%)

$ADYEN (+3,13%)

$ANET (-2,66%)

$PINS (+2,02%)

$AMAT (-5,4%)

$ABNB (+3,36%)

$TWLO (+1,72%)

$RIVN (+2,24%)

$COIN (-2,41%)

$TOM (+1,13%)

$OR (+0,13%)

$MRNA (+0,41%)

$CCO (-2,09%)

$DKNG (+0,93%)

Deutsche Boerse

Price

Discussione su DB1

Messaggi

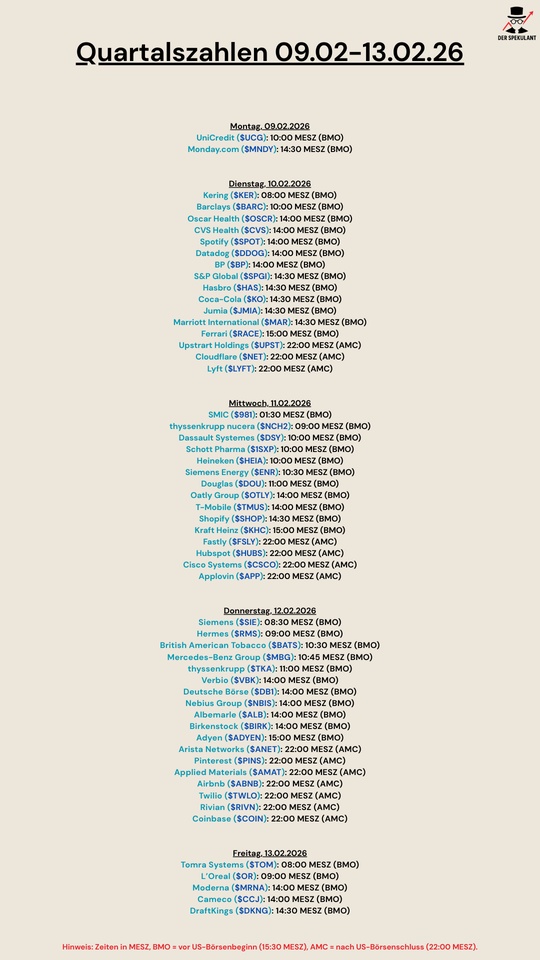

35Quarterly figures 09.02-13.02.26

Punished but profitable companies

Good morning dear community.

As things have become a little more uncomfortable on the stock market recently, I'm wondering where there are now good opportunities to invest money in good, profitable companies.

Which stocks do you have on your radar?

For me it is among others in the USA

In Europe

These are just a few examples.

What else could you add?

Best regards 💥🗡️

🛠️ Automatix introduces itself

Salvete, investors!

My name is Automatix - the name says it all.

Like my namesake from the Gallic village, I prefer to focus on craftsmanship, substance and consistency rather than magic potions or short-term success.

I'm 37 (turning 38 this year) and have only been actively investing in the capital market since the end of 2024 - a pretty bumpy journey so far

But my goal has now become clear to me:

long-term wealth accumulation with a focus on dividends.

I am aware that it is ambitious - perhaps even unrealistic - to live entirely from dividends one day.

But it is precisely this idea that drives me, not my promise.

Professionally, I have been working full-time for a large German tech company for 15 years.

Here I have worked my way up from the very bottom - call center supporter to key account manager to my current position as senior project manager - so structured work, long-term thinking and risk assessment are part of my everyday life.

At the same time, I run a family farm as a sideline

- approx. 80% horse boarding (yes, I also ride 🏇)

- approx. 20 % forestry business

This combination of technology, project work and real economic substance also characterizes my investment approach.

Before I became intensively involved with shares, my first major investments were in real assets:

- two apartments (already paid off & rented out)

- a plot of land (financed by rental income) on which one or two apartment buildings are to be built for rent in the future

For me, shares are therefore not a substitute, but a supplement to existing tangible assets.

I invest at least €750 per month, usually more, and focus on:

- 🌍 global ETFs $VWRL (-0,39%) & $TDIV (+0,07%) as a stable foundation

- 🏗️ Individual stocks, deliberately selected, with a focus on Germany & Europe

For individual stocks, I prefer healthy, growing companies.

I prefer dividend growth to high initial yields without substance.

The core of my portfolio will be $SIE (+1,41%) supplemented by stocks such as

$ALV (+0,47%) , $DTE (-1,43%) , $SAP (+3,03%) , $MUV2 (-1,26%) and $DB1 (+3,27%) .

Each position is built up gradually - first €500, then €1,000, and significantly more in the long term.

No more hectic reallocations, no more chasing - just buy and hold!

I was a silent reader here for a long time, but would like to share my thoughts, decisions and learnings in the future - objectively & long-term (if there is interest)

No trading, no noise -

but patience, discipline and a stable anvil 🛠️

I am looking forward to your feedback - constructive criticism is always welcome.

Here's to a good exchange!

Presentation

Hello everyone

I thought it was time for an introduction to me and my current portfolio.

Briefly about me, I'm Chris, 27 years old, work in IT and moved to Switzerland a good 7 months ago. I'm definitely very happy with my decision, even though it wasn't easy.

Apart from that, I love good food and am absolutely fascinated by cars and motor racing. I'm neglecting traveling a bit at the moment, but I also really enjoy it.

My dad laid the foundation stone of my depot when I was born. I saw it for the first time after my 18th birthday and was pretty excited. Unfortunately, I wasn't excited enough to continue with it. I then became more interested at the end of 2024, beginning of 2025 and so it was that I made my first transaction in April and $NVDA (-7,72%) bought shares.

My approach is to build a highly focused portfolio of high-quality individual stocks. Around 10% of my portfolio is currently in $BTC (+0,14%) , $ETH (+0,6%) & $Sol are currently invested.

There are basically two reasons why I decided against a core-satellite structure.

A fee of CHF 50 + stamp duty has to be paid for each transaction and therefore a savings plan does not make sense in my opinion. My basic idea was to save in 3 different ETFs each month.

Furthermore, I find $BRK.B (+1,69%) as a core position more attractive than an ETF, as they benefit from their capital strength especially in times of crisis and can make strategic acquisitions.

My next sales are as follows:

- Sale $BV0Z6G (-0,38%)

25% partial sale of my $SHEL (-0,94%) position

Once the sales are completed, my cash position will be around 20%. I currently have the following shares on my list that are eligible for purchase:

$RKLB (-2,51%) I actually wanted to buy this stock in December, but couldn't because it is not traded at my bank.

It is quite possible that the portfolio performance is not quite right because I have linked the positions manually, as getquin does not offer a link to my bank.

Thanks also to those who post so many interesting articles on strategies and reviews of stocks here, such as @Tenbagger2024, @Multibagger, @Epi, @BamBamInvest & many many others! Thank you, thank you, thank you!

To anticipate the obvious question of why I don't transfer my custody account to another provider due to high fees and limited share availability:

- I work for a bank and therefore have compliance regulations that restrict me somewhat in that regard.

Please let me know what you think of my custody account. 😃

Have a nice Sunday evening!

Best regards

Chris

5 undervalued quality stocks

Handelsblatt searched the Dax, Stoxx 50 and Dow Jones for so-called quality stocks that are undervalued - i.e. whose price level is lower than the long-term average.

In order to be selected as a quality stock, the companies must have consistently fulfilled five conditions over the past five years:

- Rising or at least stable earnings before interest and taxes (EBIT),

- high liquid funds from the core business (operating cash flow) to cover ongoing costs at all times,

- low to moderate net debt in relation to equity; well below 100 percent,

- Rising dividends year after year,

- lower valuation than the company's own ten-year average - calculated from the ratio of consolidated earnings to market capitalization.

The sharp rise in share prices in recent years means that only five out of a total of 120 companies listed on the Dow, Stoxx and Dax fulfill all five conditions. Only one stock from the leading German index is included.

Visa $V (+0,74%): The moat stock is available with a six percent valuation discount

Current dividend yield: 0.8%

Several million merchants worldwide accept payments in supermarkets, when shopping online or when traveling abroad. More than half of the group's revenues remain as profit, making Visa one of the most profitable companies worldwide and at the same time a typical moat share.

Higher prices and thus inflation have a positive effect, as they mean higher revenues for Visa because the credit card fees are linked to the merchant's turnover as a percentage.

L'Oréal $OR (+0,13%): Ten percent valuation discount and the Group is growing faster than the market

Current dividend yield: 1.9%

When the world's largest cosmetics manufacturer reported sales growth of 4.2 percent in the past quarter, the share was one of the biggest losers of the day. Analysts had expected more. The share is trading 20 percent below its record high.

According to analysts' average forecasts, L'Oréal should earn 6.7 billion euros before interest and taxes in the current full year. That would be more than ever before and almost twice as much as five years ago. In the same period, the dividend per share rose from 3.85 euros to seven euros.

With a P/E ratio of 27.4 based on the earnings forecast for the next four quarters, the share is valued ten percent lower than its ten-year average.

Procter & Gamble $PG (+0,15%): The dividend is safe and always rising

Current dividend yield: 2.9%

Branded products such as Ariel, Pampers, Braun and Gillette provide the American consumer goods manufacturer with reliably rising earnings. Over the past five years, earnings before interest and taxes have risen by 23%.

However, this year has shown that even such defensive shares are not resistant to price losses. Procter & Gamble is currently trading just under 20 percent below the record high it reached twelve months ago.

There are two reasons for this: the preference of many investors for more speculative technology shares, but also higher financial burdens for many consumers due to the rising cost of living. As a result, more consumers preferred cheaper own brands from retailers such as Walmart in the USA or Edeka and Rewe in Germany.

In the long history of the stock market, such price setbacks have almost always proved to be good opportunities to enter the market. The share is currently valued at a P/E ratio of 20.8 based on the earnings forecast for the next four quarters. This is seven percent below the average of the past ten years - after P&G had been valued above the historical average in recent years.

The strongest argument is probably the profit distributions. The Group has paid dividends every year since 1890. Since the end of the 1950s, Procter & Gamble has increased its dividend every year. Around 50 percent of profits go to shareholders.

This leaves enough of a buffer to increase the dividend even in years with slightly falling profits. Over the past five years, the dividend has risen by around one euro to 3.75 euros per share.

German Stock Exchange $DB1 (+3,27%): Not only the stock market business drives profits

Current dividend yield: 1.8%

The Frankfurt stock exchange operator is set for its seventh record profit year in a row in 2025. In the third quarter, net revenue, pre-tax profits and earnings per share continued to rise as usual. Nevertheless, the share, which has risen sharply in recent years, has come under pressure in recent months: down 25% since the beginning of May.

Deutsche Börse is currently negotiating the purchase of the fund management platform Allfunds for 5.3 billion euros. Allfunds offers fund managers and distributors a platform for trading, data analysis and compliance systems.

The result of so much consistency is reliable dividends: The dividend has risen for nine years in a row, and the tenth increase is due next spring.

In view of the recent share price losses - coupled with rising consolidated profits - the share is no longer overvalued after a long time. With a P/E ratio of 18.7 based on the expected profits in the next four quarters, the share is valued three percent lower than its ten-year average.

Novo-Nordisk $NOVO B (-0,81%): Highest valuation discount and highly speculative

Current dividend yield: 3.8%

The most speculative share among the stocks portrayed here is Novo Nordisk. With the presentation of its third-quarter results, the Danish pharmaceutical group once again lowered its sales and earnings targets. In addition, the management, under its new CEO since August, Maziar Mike Doustdar, cut its investment plans.

The company had grown strongly with the sales injection Wegovy, which had made Novo Nordisk the most valuable stock market group in Europe for a time, before competitors, above all the US group Eli Lilly $LLY (-0,72%)successfully competed with similar products. Mass redundancies at Novo Nordisk were the result.

Despite all the setbacks, the pharmaceutical company is still increasing its profits - but at a slower rate. In the current year, analysts are forecasting average earnings before interest and taxes of the equivalent of 14.1 billion euros, compared to 13.5 billion euros in the previous year.

Since last summer's record high, the share price has fallen by 70 percent. This constellation - rising profits, collapsing share price - makes the once very highly valued share with a P/E ratio of 12.9 suddenly inexpensive. The ten-year average is almost twice as high with a P/E ratio of 23.4. No other quality share is currently trading at such a high valuation discount.

Novo Nordisk recently achieved positive results in tests with the drug Amycretin in diabetes patients. According to the company, these patients reduced their weight considerably and were also able to significantly lower their blood sugar levels.

This was Novo Nordisk's core business before the hype surrounding weight loss injections began. Over the past 30 years, the number of diabetics worldwide has quadrupled to around half a billion. According to the market research institute Mordor Intelligence, the Group has a 45 to 50 percent share of insulin products, making it the undisputed global market leader.

Source text (excerpt) & image, Handelsblatt 01.12.25

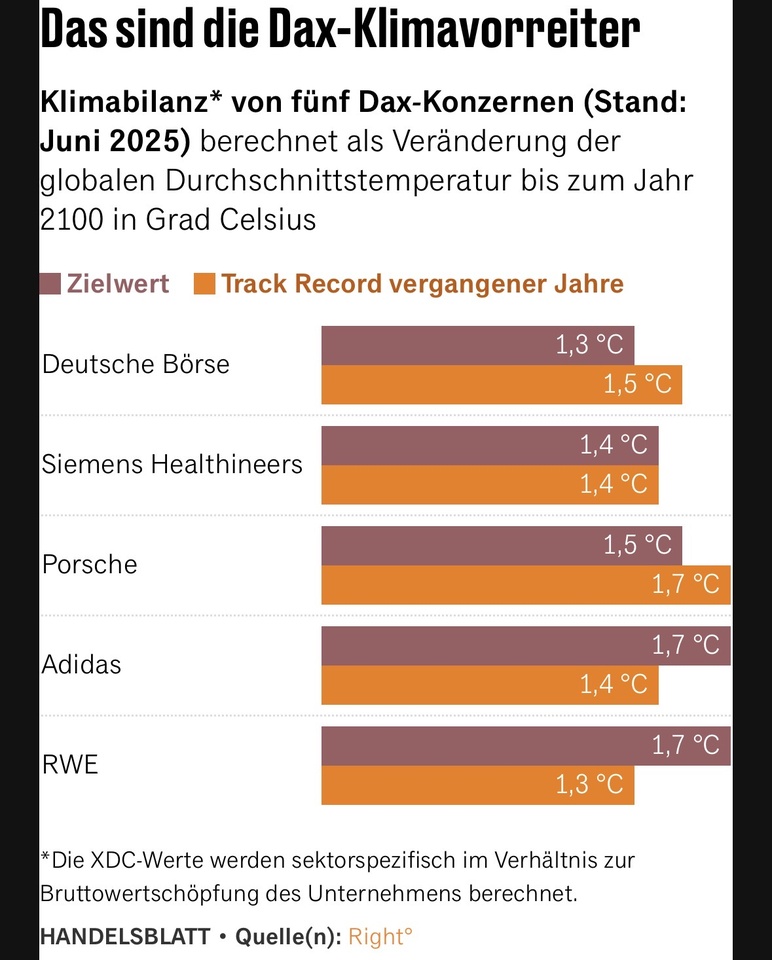

5 companies are climate pioneers in the DAX

The second "What if" report by climate tech company Right° was published on Thursday. Right° compares company data with the goals of the Paris Climate Agreement. Right° sets the limit value at a global warming of 1.7 degrees by 2100.

None of the 34 DAX companies analyzed would be Paris-compatible if no further measures were taken to reduce emissions. However, according to the data, twelve companies have decoupled their value creation from climate-damaging emissions in recent years to such an extent that they are on a Paris-compatible path.

And five of these companies also have a Paris-compatible climate target.

For companies, doing business in line with Paris means decoupling their value creation from climate-damaging emissions.

According to the "What if" report, the climate pioneers RWE $RWESiemens Healthineers $SHL (+0,94%)Adidas $ADS (+2,48%)Deutsche Börse $DB1 (+3,27%) and Porsche, which was relegated from the DAX $P911 (+0,36%). Both the climate targets and the track record of these companies are on a Paris-compatible path.

However, there are clear differences between the DAX companies in terms of their track record. Many are a long way off the targets of the Paris Climate Agreement.

Source text (excerpt) & graphic: Handelsblatt, 31.10.25

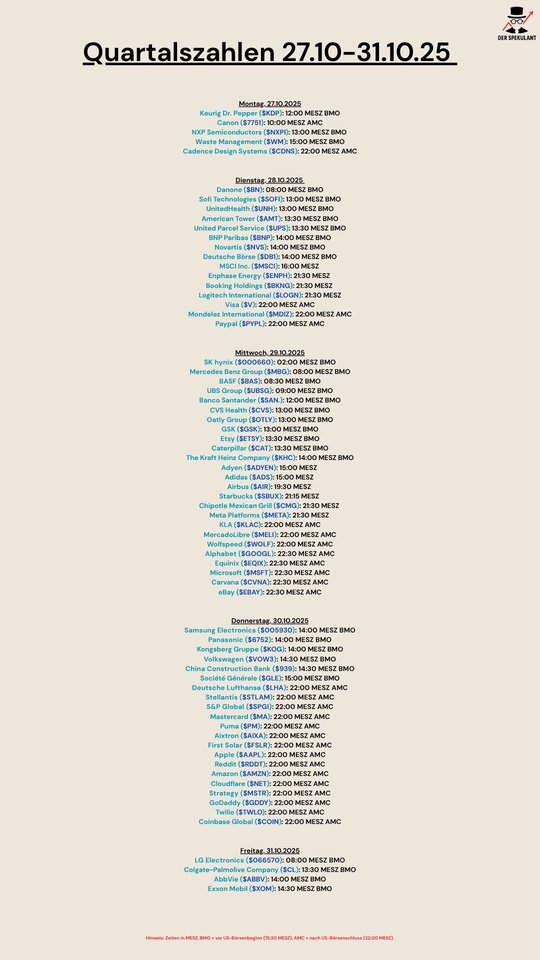

Quarterly figures 27.10-31.10.25

$KDP (+1,45%)

$7751 (+1,2%)

$NXPI (-1,01%)

$WM (+1,47%)

$CDNS (-1,22%)

$BN (+1,23%)

$SOFI (-2,08%)

$UNH (+1,11%)

$AMT (+0,8%)

$UPS (+2,25%)

$BNP (+0,32%)

$NVS (-1,06%)

$DB1 (+3,27%)

$MSCI (+2,97%)

$ENPH (-6,02%)

$BKNG (+2,19%)

$LOGN (+2,66%)

$V (+0,74%)

$MDLZ (+0%)

$PYPL (-2,52%)

$000660

$MBG (+0,09%)

$BAS (+1,31%)

$UBSG (+0,61%)

$SAN (-0,36%)

$CVS (+2,46%)

$OTLY (+0%)

$GSK (-1,9%)

$ETSY (+3,2%)

$CAT (-2,23%)

$KHC (+0,72%)

$ADYEN (+3,13%)

$ADS (+2,48%)

$AIR (+0,71%)

$SBUX (+0,05%)

$CMG (+0,72%)

$META (+0,08%)

$KLAC (-1,39%)

$MELI (-1,63%)

$WOLF (-0,87%)

$GOOGL (-1,74%)

$EQIX (-1,19%)

$MSFT (-1,55%)

$CVNA (+5,46%)

$EBAY (+3,09%)

$005930

$6752 (-1,35%)

$KOG (-1,43%)

$VOW3 (+0,72%)

$GLE (-1,19%)

$LHA (+2,55%)

$STLAM (+4,18%)

$SPGI (+2,45%)

$MA (+0,96%)

$PUM (+7,9%)

$AIXA (+4,21%)

$FSLR (-4,83%)

$AAPL (-0,23%)

$REDDIT (-0%)

$AMZN (-1,79%)

$NET (+2,68%)

$MSTR (-2,02%)

$GDDY (+5,86%)

$TWLO (+1,72%)

$COIN (-2,41%)

$066570

$CL (+0,91%)

$ABBV (-0,93%)

$XOM (-0,25%)

My portfolio update Q4 '25 IZF 20.2%

Following the rebalancing of the S&P Quality Aristocrats last Friday, the following stocks were removed from or added to my two ETF indices (50% weighting):

New additions:

$QDEV (-0,65%): $NOVN (-0,86%) , $REL (+4,95%) , $ITX (+0,7%) , $LSEG (+8,79%) , $DB1 (+3,27%) and more

$QUS5 (-0,38%): $BKNG (+2,19%) , $MRK (-3,17%) , $CRM (+4,62%) , $UNP (+0,47%) , $COR (+0,66%) , $CAH (-0,09%) and more

Kicked out of both indices and therefore according to S&P no longer Quality Aristocrats are among others: $BATS (-0,56%) , $7974 (+3,05%) , $HD (+0,02%) , $LOW (+0,48%) , $HLT (+1,76%)

In addition, the allocation of all individual stocks in the indices was reduced again to max. 5 % was limited.

Thanks to the recent rally of $$HY9H (+0,31%) my current top 10 weighting (ETFs+shares) is as follows:

3.48% Alphabet

3.04% SK Hynix

3.04% Broadcom

2.93% Meta

2.75% Microsoft

2.71% Apple

2.71% NVIDIA

2.55% Taiwan Semiconductor

2.13% Mastercard

2.08% Visa

New portfolio key figures:

P/E: 27.1 (<30) 🟢

Forward P/E: 21.1 (<25) 🟢

P/Β: 11.5 (<5) 🔴

EV/FCF: 28.7 (<25) 🟡

ROE: 42% (>15%) 🟢

ROIC: 19% (>15%) 🟡

EPS growth for the next 5 years: 15% (>7%) 🟢

Sales growth for the next 5 years: 9% (>5%) 🟡

My internal rate of return is currently 20.19%

At what intervals is the $QDEV reallocated by Standard and Poor's?

Greetings

🥪

Shares, ETFs, savings plans & real estate - our freedom roadmap ✨📈

👋 Introduction & background

Hey everyone!

I'm 33, married and dad to two small children (18 months and 2 months old). I've been working in the automotive industry since 2011 and in management consulting since 2019. ⚙️🚗💼

My wife is an engineer and also works in the automotive industry. 👩🔧🚗

I've been with getquin since 2022, but so far I've been reading along rather than actively posting. 👀

My wife is currently on parental leave and receives parental allowance. I will go on parental leave in Q2 2026 (also with parental allowance), then she will start working again. This means that only one of us will receive a full salary until the end of 2026 - but we'll still be sticking to our savings and investment quota. 👶💶

💰 Current status:

A good mid-six-figure amount has already been saved in our custody accounts. 📈

👶 Children & investments

For each child, we invested €10,000 in the Vanguard FTSE All World ($VWRL) (-0,39%) invested. In addition, each child receives €150 per month in the same ETF - via junior custody accounts at ING. 📊

💍 My wife's investments

She invests monthly:

- 🌎 500 € in the MSCI World ($XDWL) (-0,75%)

- 💸 500 € in the Vanguard FTSE All World High Dividend ($VHYL) (-0,13%)

📈 My investment strategy

Long-term, diversified and with a focus on cash flow & wealth accumulation.

🔹Core portfolio (ETF & Bitcoin)

€1,000 flows in every month:

- 💵 €600 in SPDR S&P 500 ($SPY5) (-0,94%)

- 🌍 €200 in Vaneck Morningstar Developed Markets Dividend Leaders ($TDIV) (+0,07%)

- ₿ 200 € in Bitcoin ($BTC) (+0,14%)

🔹 Individual share savings plans (€25/ €600 each)

Target per company: €10,000 investment amount.

Currently participating:

$DB1 (+3,27%) , $UNP (+0,47%), $RACE (+0,17%) , $MRK (-3,17%) , $MUV2 (-1,26%) , $DGE (-0,41%) , $DE (-0,75%) , $TXN (-0,49%) , $AWK (+0,15%) , $ADP (+0,96%) , $PLD (+1,97%) , $HEN (-0,55%) , $ITW (+0,33%) , $UNH (+1,11%) , $LLY (-0,72%) , $BEI (-0,14%) , $MCD (+0,89%) , $DTE (-1,43%) , $WMT (-0,82%) , $COST (-0,74%) , $WM (+1,47%) , $JPM (+0,4%) , $BLK (+0,06%) , $SY1 (+0,35%)

🔹 Cash reserve

💰 Set aside at least €1,000 every month to be able to strike flexibly when opportunities arise.

🏘️ Real estate strategy

We live in our own home and own a rental apartment that pays for itself. ✅

Further real estate purchases are planned. 🏡📈

🎯 Target (15-20 years)

Financial freedom - with the option of part-time or complete independence from employment. Focus on more time for family, projects and quality of life. ✨

How do you structure your portfolios? What is your strategy and what are your long-term goals?

I look forward to the exchange!

My portfolio is structured in

Normal risk sectors ETF and share savings plans

High risk with small caps

High risk leveraged with derivatives.

So fully focused on maximizing returns

Titoli di tendenza

I migliori creatori della settimana