I'm having a discussion with friends and would like to hear what you think.

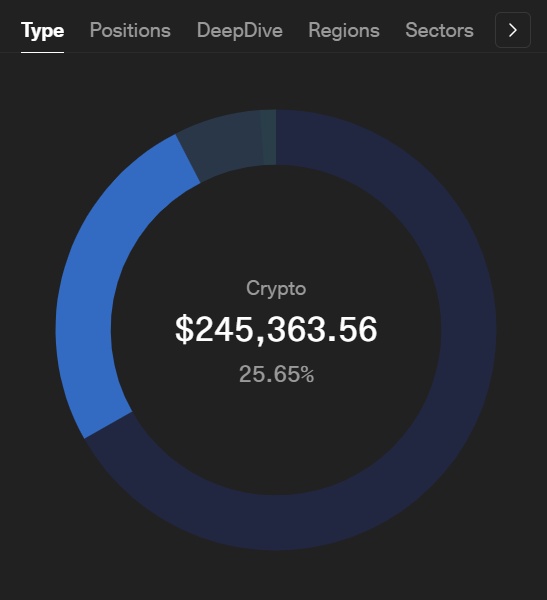

I currently hold around 0.208 BTC. Some of it was bought over the years, but some of it also came as a gift from family (birthday, Christmas, etc.).

The total amount of money I have invested in Bitcoin is around €5,536.

If I do the simple math:

€5,536 / 0.208 BTC = about €26,600 per BTC.

For me, that honestly feels like my "real" entry price, because that's the money I actually put in myself.

But now comes the point where the discussion started.

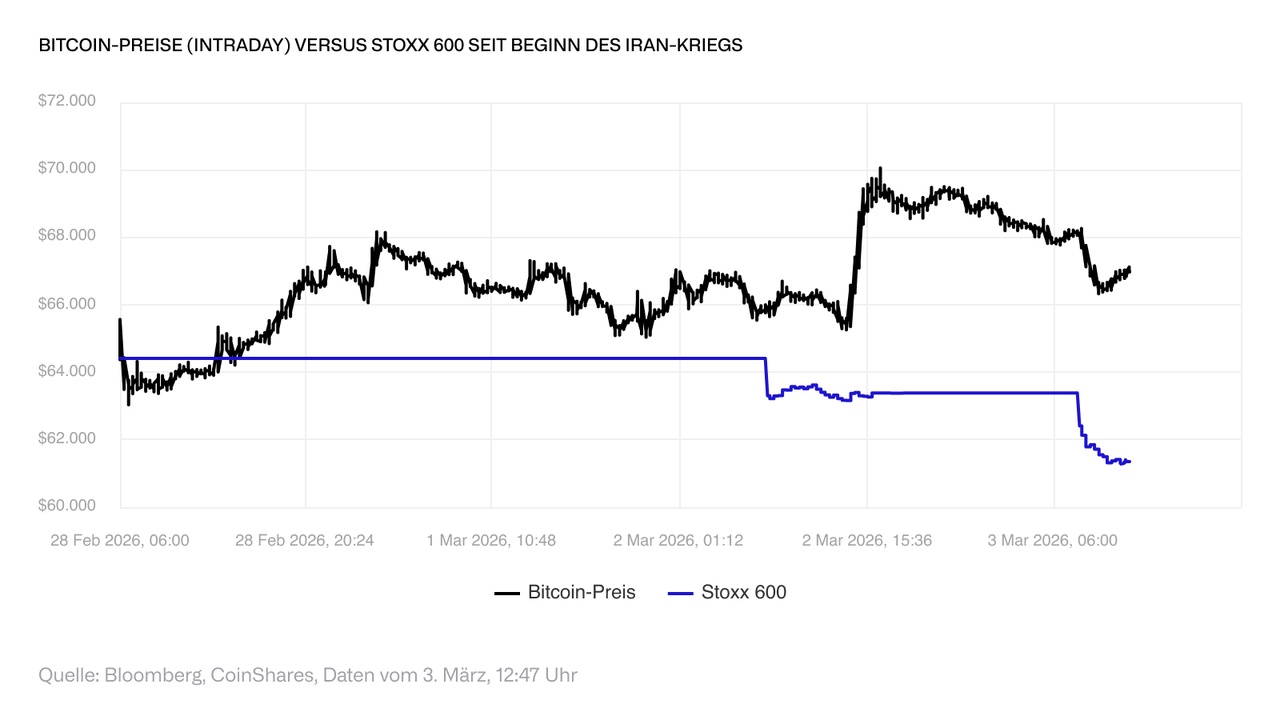

I exchanged some altcoins for Bitcoin in November 2024, when the price was already relatively high. As a result, some people say that my average price should actually be much higher, in some cases closer to 70k, because this exchange practically counts as a new purchase.

Others say the same thing:

The Bitcoins I received as a gift shouldn't actually be included in the average because I didn't pay anything for them.

In the end - depending on how you do the math - I end up with completely different "entry prices".

Once around 26k,

sometimes significantly higher due to the trades,

or theoretically even lower if you look at the gifts differently.

So I'll just ask around:

How would you calculate your entry?

- Just your own invested money?

- Include every trade at the price at the time?

- Or are donated coins simply a bonus without an entry price?

I just realized that the "average entry" is much less clear than I always thought.

😂😆😂😆

$BTC (-1,17%)

$ETH (-1,07%)

$SOL (-2,34%)

$XRP (-1,01%)

$PEPE (-3,85%)

$ADA (-1,85%)

#crypto