$SDZ (+10,46%)

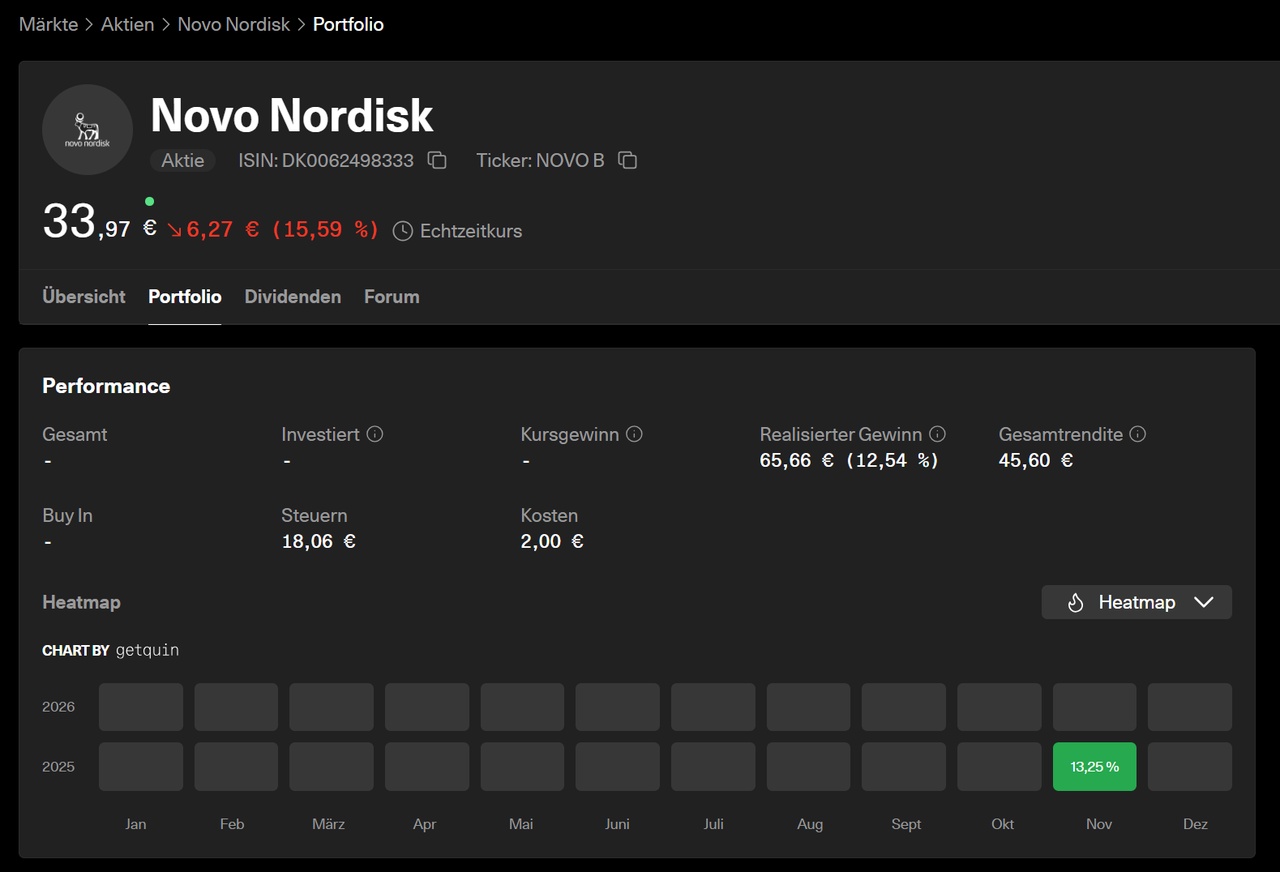

$NOVO B (-2,11%)

$LLY (-1,6%)

$HIMS (+3,23%)

Basel (awp) - In its second year as an independent company, the generics specialist Sandoz has grown as planned. In an interview with journalists, CEO Richard Saynor and CFO Remco Steenbergen emphasized that both divisions and all regions contributed to the good performance.

The CFO said he was particularly proud of the 160 basis point increase in the core EBITDA margin to 21.7%. "This is in line with our medium-term targets for 2028 (between 24% and 26%)." The higher proportion of biosimilars in the sales mix contributed significantly to the margin improvement, Steenbergen adds.

While Sandoz is therefore moving towards its medium-term margin targets, the Group has already achieved another target ahead of schedule. "Our biosimilar mix ratio was already 30 percent in 2025, originally planned for 2028 - so we are ahead of schedule," announces Steenbergen. CEO Saynor adds that the "30 percent was more of a guideline than an exact figure." Ultimately, Sandoz wants to further accelerate this development.

Looking ahead, Sandoz CEO Saynor also emphasizes once again that the Group is facing a "golden decade" in which a record number of biologics patents are expiring, while regulations are also changing.

The generics specialist should clearly benefit from this thanks to its broad and deep product pipeline, the CEO is convinced. "Around 600 billion US dollars in drug patents will expire in the next few years, of which we currently cover around 60 percent." Biosimars account for around half of this.

Both pillars important

With its two main pillars - generics and biosimilars - Sandoz is also well positioned to benefit from future trends, Saynor emphasized in an interview with AWP Financial News after the conference call. "The generics business continues to be important as a stable cash generator, as small molecules can be developed quickly and cost-effectively." Although biologics are more expensive to develop, they offer greater value in the long term. "We see the combination of both segments as our strategic strength."

Challenges exist in the antibiotics segment in particular, where price falls due to global overproduction are putting pressure on profitability. The management is therefore calling for support from the European and Swiss governments to keep these important medicines available. "Europe must recognize how important these products are," appeals Saynor. "We are the last major producer of penicillin antibiotics in the West. Prices for raw materials are falling too much, which is not sustainable."

Meanwhile, the market is expecting new products such as the novel diabetes and weight loss GLP1 preparations to be launched in 2026 as soon as they have been approved in Canada and Brazil. However, no approval has yet been granted. "We expect a launch later this year."