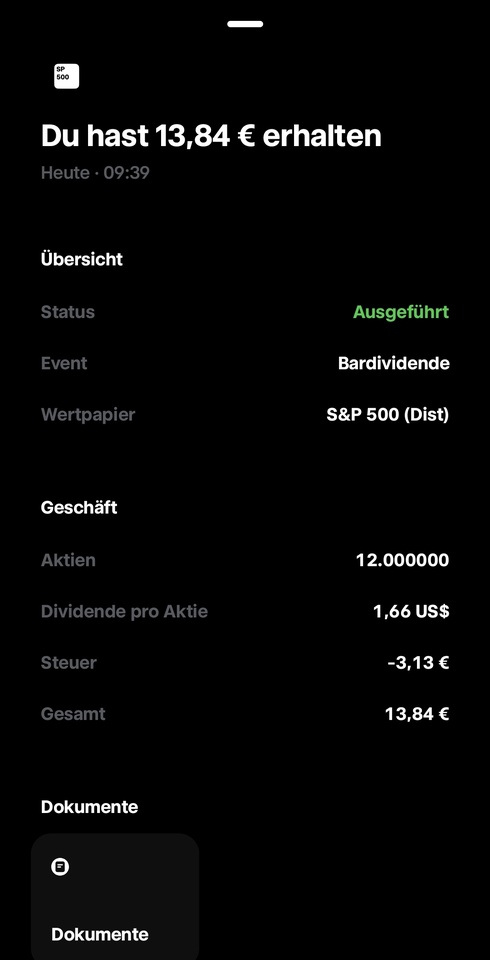

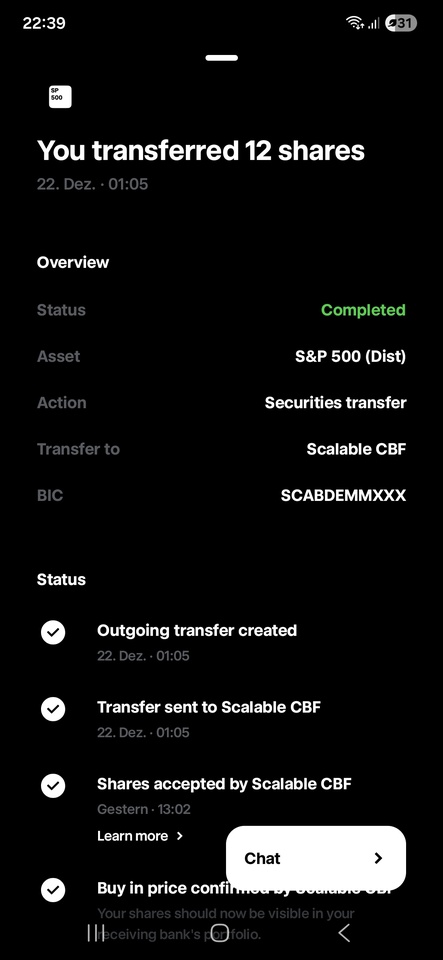

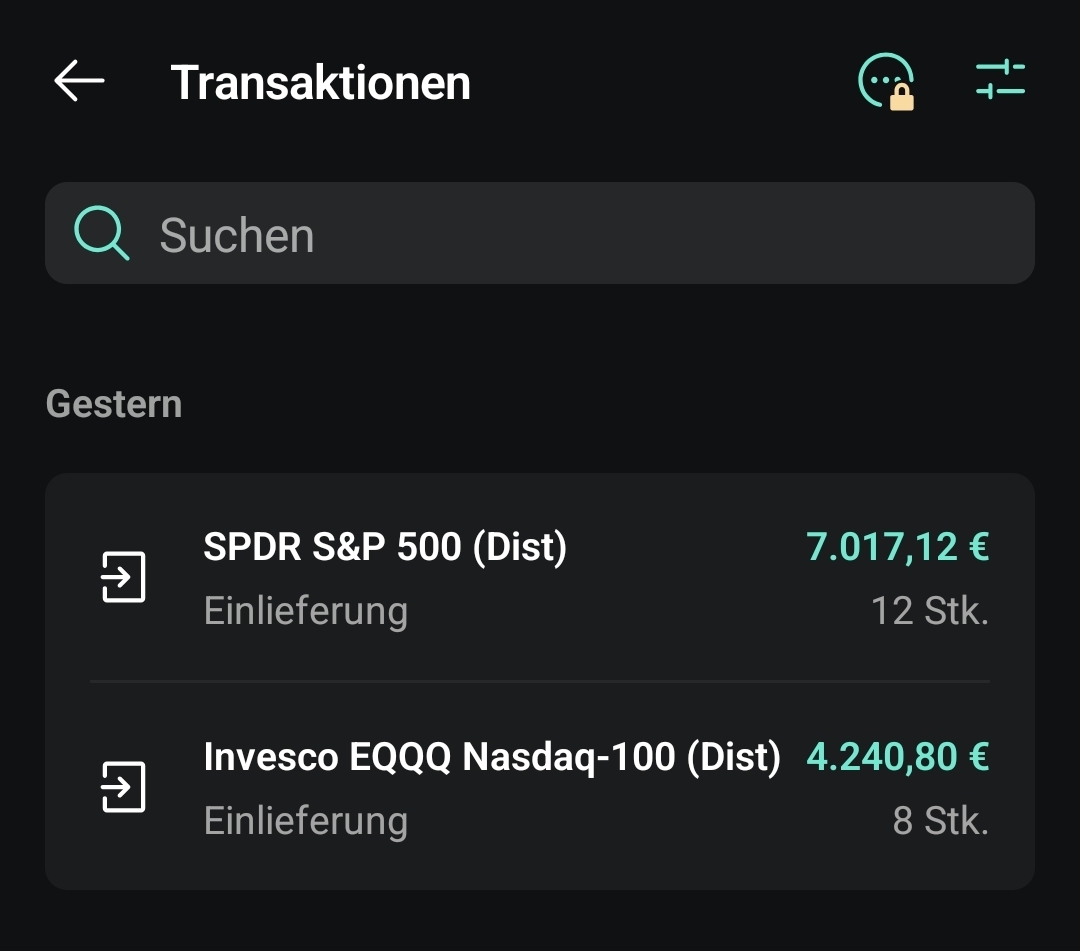

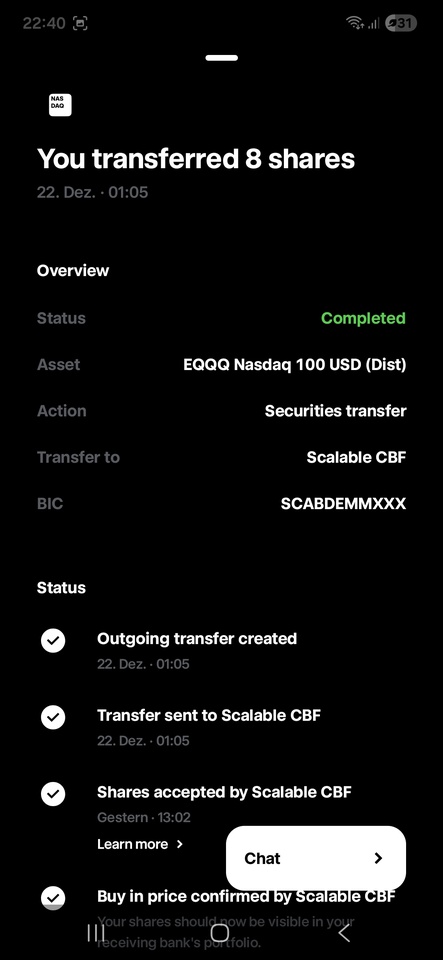

I actually transferred the few shares from $SPY5 (-0,87%) I have actually transferred to scalable, but apparently after the ex-date. However, the larger part at scalable is still missing.

SPDR State Street SPDR S&P 500 UCITS ETF USD

Price

Discussione su SPY5

Messaggi

21Experience Depotübertrag trade Republic to scalable

I would like to share my experience here, which I recently made when I transferred my securities account from trade Republic to scalable. Spoiler Alert to the conclusion: you have to praise sometimes.

So scalable is currently advertising a bonus if you make a portfolio transfer. When I read that, I remembered that I had a few small shares from the $SPY5 (-0,87%) and from $EQQQ (-1,18%) at trade Republic, but the larger items are at scalable. so I thought this was the right time to combine them and take another €25 with me.

So far I've hesitated to do this because all my previous portfolio transfers, no matter from whom to whom, always required a complaint and the involvement of BaFin and it took months.

The deadline for the transfer premium ends on January 18 and I was very worried about whether it would work by then.

First of all, I realized that this was different from previous custody account transfers, where I had always placed the order with the receiving bank. Here, scalable immediately pointed out to me that I would have to do this in the Trade Republic app instead. So I searched for 10 minutes to find out exactly where to do this, finally found it, entered the data and sent it off. that was on Monday 22.12.

Today, unsuspectingly, I open the scalable app and realize that the shares are already there and the transfer is complete. And it has been since yesterday.

The initial values have also already been transferred.

Holy crap, what's going on? Has digitalization broken out or what? Not even three days and it's Christmas week.

In any case, despite all the justified complaints about Trade Republic, I think you also have to share some positive experiences. Good job.

Shares, ETFs, savings plans & real estate - our freedom roadmap ✨📈

👋 Introduction & background

Hey everyone!

I'm 33, married and dad to two small children (18 months and 2 months old). I've been working in the automotive industry since 2011 and in management consulting since 2019. ⚙️🚗💼

My wife is an engineer and also works in the automotive industry. 👩🔧🚗

I've been with getquin since 2022, but so far I've been reading along rather than actively posting. 👀

My wife is currently on parental leave and receives parental allowance. I will go on parental leave in Q2 2026 (also with parental allowance), then she will start working again. This means that only one of us will receive a full salary until the end of 2026 - but we'll still be sticking to our savings and investment quota. 👶💶

💰 Current status:

A good mid-six-figure amount has already been saved in our custody accounts. 📈

👶 Children & investments

For each child, we invested €10,000 in the Vanguard FTSE All World ($VWRL) (-1,7%) invested. In addition, each child receives €150 per month in the same ETF - via junior custody accounts at ING. 📊

💍 My wife's investments

She invests monthly:

- 🌎 500 € in the MSCI World ($XDWL) (-1,39%)

- 💸 500 € in the Vanguard FTSE All World High Dividend ($VHYL) (-2,03%)

📈 My investment strategy

Long-term, diversified and with a focus on cash flow & wealth accumulation.

🔹Core portfolio (ETF & Bitcoin)

€1,000 flows in every month:

- 💵 €600 in SPDR S&P 500 ($SPY5) (-0,87%)

- 🌍 €200 in Vaneck Morningstar Developed Markets Dividend Leaders ($TDIV) (-1,44%)

- ₿ 200 € in Bitcoin ($BTC) (-3,06%)

🔹 Individual share savings plans (€25/ €600 each)

Target per company: €10,000 investment amount.

Currently participating:

$DB1 (+2,55%) , $UNP (-0,38%), $RACE (-1,87%) , $MRK (-0,29%) , $MUV2 (-2,8%) , $DGE (-2,97%) , $DE (+0,02%) , $TXN (-0,75%) , $AWK (+1,32%) , $ADP (+0,7%) , $PLD (-0,89%) , $HEN (-2,92%) , $ITW (-0,62%) , $UNH (-0,55%) , $LLY (-0,02%) , $BEI (-9,32%) , $MCD (-0,64%) , $DTE (-1,84%) , $WMT (-0,12%) , $COST (-0,16%) , $WM (-0,34%) , $JPM (-0,93%) , $BLK (-1,45%) , $SY1 (-2,69%)

🔹 Cash reserve

💰 Set aside at least €1,000 every month to be able to strike flexibly when opportunities arise.

🏘️ Real estate strategy

We live in our own home and own a rental apartment that pays for itself. ✅

Further real estate purchases are planned. 🏡📈

🎯 Target (15-20 years)

Financial freedom - with the option of part-time or complete independence from employment. Focus on more time for family, projects and quality of life. ✨

How do you structure your portfolios? What is your strategy and what are your long-term goals?

I look forward to the exchange!

My portfolio is structured in

Normal risk sectors ETF and share savings plans

High risk with small caps

High risk leveraged with derivatives.

So fully focused on maximizing returns

Chaos in the depot

Dear Community,

Thanks to many tips from the gq community, I have invested in many stocks that I found interesting. This is still the case now, but I have started to get a little order in my portfolio.

At the beginning of my stock market journey, my portfolio consisted almost exclusively of ETFs. Then I had to find money to pick up tips and realize them by buying shares.

All without any real plan or strategy.

Now I've been reading more and more and thinking about it, and I've put together an initial basic strategy. As I am a late entrant to the stock market at just over 50 and my portfolio is intended to provide for my old age, I have now thought about a weighting of the invested funds.

Instead of keeping just under 50% of the portfolio value in the S&P 500 $SPY5 (-0,87%) I have decided to keep only 30% to 40% in ETFs and to divide them up more.

My allocation is now as follows:

$SPY5 (-0,87%) 19%

$SMPA 3%

A further 15% is still in cash as a reserve for further purchases.

I have reduced some of the individual stocks so that no more than 5% of the portfolio is invested in any one stock. That feels like a good value to me

The rest is currently scattered across a large number of individual stocks, which I sometimes think are already too many, but which are all so damn interesting. 😉

What do you think of this chaos?

Comments and tips for improvement are always welcome. 👍🏼

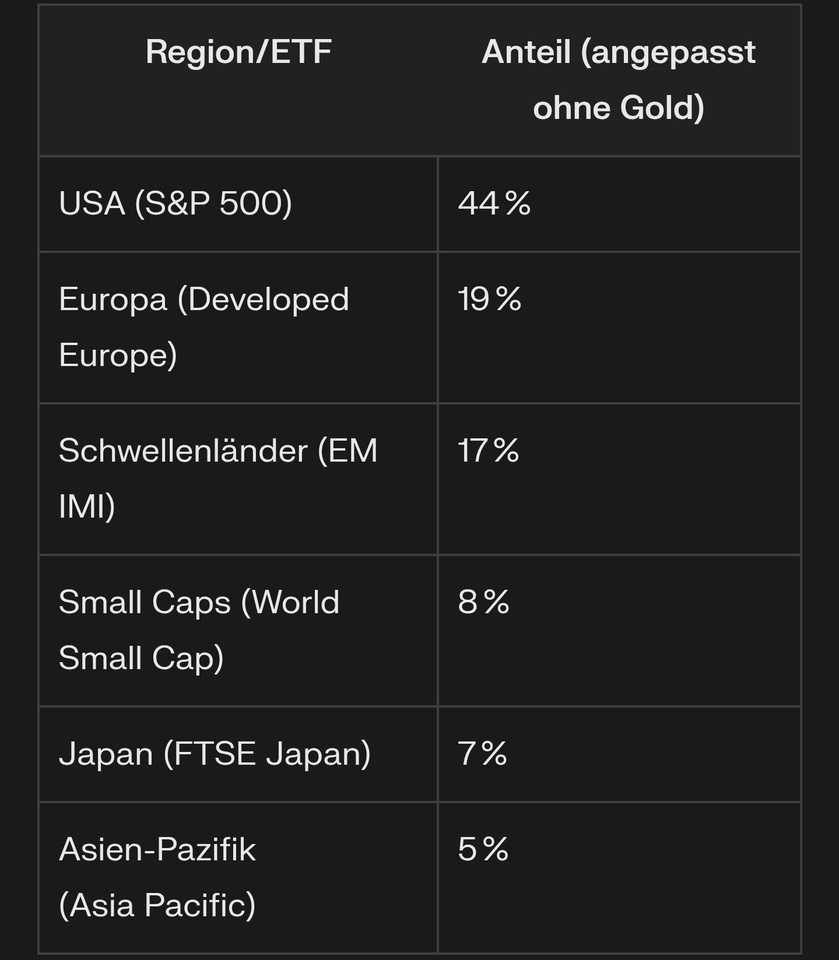

ETF allocation

$SPY5 (-0,87%)

$VWCG (-2,58%)

$EIMI (-3,47%)

$WSML (-1,62%)

$VJPB (-4,22%)

$CPXJ (-1,98%)

Which of the three allocations do you think is best for a monthly savings plan? Or would you do it completely differently? If so, how?

I'm 30 and have a long investment horizon.

I already have these ETFs as core and don't really want to sell, otherwise I'll have to pay a lot of tax.

Weak dollar

$SPY5 (-0,87%) The ETF's current book value is still approx. 11% below the ATH. According to the index, however, the S&P 500 is just below the ATH. It is clear that this is due to the weak dollar. But it doesn't help me if I have invested a lot of money in this ETF. How do you do it? Or how would you trade? Thank you

USD will rise again? No, it won't for now. The current USD cycle is over. Historically 30% devaluation potential. But it doesn't matter over 20 years, because the EUR USD ratio will remain roughly the same in the long term.

You can take a hedged ETF in the short term or hedge it yourself with derivatives.

I currently have the $DBPG again. It tracks the index x2.

Waterfall of USA economy

Beginning of this week, I had sold my full S&P position, taking some small profit (4.44%).

One day, Warren Buffett said, "don't bet against America.". This is no longer true even for him.

My sell price was €530, now it is already down 4% from this. The funny thing is that nothing yet happened (Q1 reports are yet to come). After Q1 reports index will be down more but after Q2 it will crush.

At the beginning of this year, I was predicting single-digit growth of S&P. Mainly I was thinking Trump would be saying more than he do, but since putting tariffs, turning his back against allies, it was clear to me that the US economy would be impacted a lot.

Now it is clear to me that all that has already happened will have an impact on the US economy for 10+ years with much smaller growth. For the short term, this and next yea,r we can expect S&P will be down 15-25% more from the current price.

Maybe the governments in EU or Canada are not yet that anti-US, but many ordinary people have already decided to limit or stop buying/using US products.

Keep in mind I'm not an advisor, and this is not a recommendation. It's just to share my opinion and see how other people think. You should do your own investigation.

How confident are you in the US market at the moment? $SPY5 (-0,87%)

trump tarifs and all other shit

It surprised me how few people talk about the impact that trump actions bring to the stock market.

It should be clear to everyone that it will hurt all allies, but it would be most painful for US, and in fact you can already see from the stock market.

- YTD $SPY5 (-0,87%) down 1.16% (S&P500)

- YTD $VEUR (-2,5%) up 13% (Europe ETF)

both above are nominated in US dollars.

There are only 2 countries that can gain from trade wars and it is China, and russia.

I think nobody expects it when trump was elected but it is the reality that we are currently living.

As for me, I decided already month ago that from now on I will invest only in EU stocks and ETF (plus I will use dollars I already have in my account), but I'm curious how you all see this and when the market will be more calm again.

As a bonus as EU citizen I feel that US betrayed us and shouldn't be trusted any longer for some unknown period of time.

Titoli di tendenza

I migliori creatori della settimana