Having recently parted with Shitcoins and terminated my building society savings contract, I opened or increased several positions today. I doubled my exposure to the copper mining ETF, increased the Stoxx 600 slightly and added twice to small caps, as I didn't have them in my portfolio before. Let's see how I balance everything out in the future.

iShares MSCI World Small Cap ETF

Price

Discussione su WSML

Messaggi

128Backtest of a lower-risk 3xGTAA variant (MATT)

I always like to test promising systematic strategies. On Getquin and especially from @Epi there are a lot of them. Most recently, GTAA and especially the 3x variant with the certificate received a lot of attention (https://getqu.in/2Ya4VP/). As I would like to expand my momentum strategies, I have now also taken a look at GTAA.

1) Starting point

First of all, I wanted to replicate the GTAA strategy of @Epi to replicate it. Mainly because I am interested in daily data and Epi only looked at monthly data in the backtest.

For this I used the following universe (from Epi's GTAA Max):

3xQQQ, BTC, PRIDX, VUSTX

Period from 01.01.2016

How @Epi I use 200SMA and Dual Momentum as a signal and trade once a month:

I get a strong 42% CAGR, 30% Vola, -50% Max Drawdown and end up pretty much with Epi's numbers. It should be noted that my drawdown is calculated daily and not monthly as with Epi.

Now I have categorized the numbers a bit:

- BTC from 2016 is of course subject to survivorship bias. Nobody would have allocated 33% of the portfolio to BTC in 2016.

- I looked at the performance distribution and realized that 60% of the performance was generated by BTC and 37% by TQQQ. So together they generated 97% of the performance and it doesn't matter which assets are still in the universe. I modified the universe and added bonds, for example. The result was the same.

- The weakest day was -25% on 12.03.2020, which is pretty heavy

- If you extend the strategy to the period from 2007 (BTC is added from 2016), you only get 28% with 24% vola and -50% MaxDD

- If you now only use BTC from 2018 onwards, you get 20% CAGR, 23% vola, -50% MaxDD. So not so great anymore. Whereby 64% of the performance is attributable to TQQQ. You might as well invest directly in the QQQQ.

Please have a look at the backtest of @Jesko (https://getqu.in/0ydHY0/). We have also seen drawdowns of -60% and more. @Jesko has rebuilt 3xGTAA better than me (I only used GTAA MAX and did a rather inaccurate test).

2) Target

I would like to add GTAA to my portfolio. But the presented variants of Epi are either too defensive (10-15%CAGR) or too risky (-50% daily drawdown) for me. Epi's 3xGTAA will probably also experience drawdowns of this magnitude. In April it was already 37% (again the reference to @Jesko ).

Therefore, I would like to optimize my GTAA variant for special parameters, which should achieve the following:

- highest possible CAGR

- maximum drawdown as low as possible (small drawdowns are not bad, larger drawdowns should be significant)

- the shortest possible periods of sideways movement. It is a big risk if you think that the strategy is not working because it has been going sideways for years while all indices are at record highs and you therefore abandon the strategy. Epi also mentioned this point. I am happy to accept a few percent long-term performance in return.

I also want to achieve the best possible performance distribution. This allows me to achieve better diversification. If the performance drivers are not so strong, then hopefully there are enough other assets that can at least partially fill the gap.

To do this, it was first necessary to determine the universe. In doing so, I only considered assets that have delivered performance and/or reduced risk.

3) The universe

The following assets are included in my universe:

3xSPY (US equities) $3USL (-1,45%)

3xEEM (developing country equities) $3EML (-2,06%)

EXUS (industrialized countries without US equities) $EXUS (+0,34%)

2xWSML (world small cap equities) $null (-0,64%)

IXC (Utilities) $IXC (+1,4%)

3xTLT (long US bonds) Cash + $TLT5 (+2,61%)

3xIEF (medium US bonds) $3TYL (+0,87%)

XBCU (commodities) $XBCU (+1,01%)

2xGOLD (gold) $LBUL (+2,06%)

BTC (Bitcoin) $BTC (+0,13%)

This achieves the first goal: diversification in the universe.

All regions are covered and, with the small cap ETF, almost the entire investable market. In addition, there are cyclical components such as commodities or utilities, which are highly correlated, but in my tests have synergies that reduce the risk. In addition, gold and BTC + US bonds, as they have provided the best and safest long-term returns.

I would also like to mention that the STOXX50 or oil performed very poorly in my tests and are therefore not in the universe.

In addition, ETFs exist almost everywhere except for the leveraged small caps. There is only one factor certificate that leverages in EUR, i.e. contains the exchange rate twice. My tests reflect this situation. The strategy also works with the unleveraged $WSML (+0,42%) . This leads to 1-2% CAGR less.

4) Parameters to be optimized

Maximize CAGR - 1.1^MaxDD and Minimize 10%MTU. (Explanation follows)

The most important parameter for me is CAGR - 1.1^MaxDD. In other words, the average growth rate minus the drawdown. The drawdown is weighted with an exponential function so that small drawdowns have little influence.

With 20% CAGR and 20% DD, we can accept +1.5% DD for +1% CAGR. At 20% CAGR and 30% DD, only +0.5% DD is acceptable for +1% CAGR. The higher the drawdown, the more excess return we have to achieve in order to accept an even higher drawdown.

The second parameter is 10%MTU. This describes the following situation:

At each point in time, the share price 3, 5 and 7 years ago is considered. The current price is forecast using the CAGR of the entire strategy. The 3 differences between the actual price and the forecast are then added together. The result is the Medium-Term Underperformance (MTU) of this point in time. Example:

The portfolio is at €100 at time x. Three years ago it was at €100, five years ago at €80 and seven years ago at €60. The CAGR of the strategy is 10%.

Now the current value is forecast based on the past:

3 years ago: 100€ with 10% CAGR in 3 years results in 100€*1.1^3 = 133€

5 years ago: 80€ -> results in 129€

7 years ago: 60€ -> results in 117€

But the current price is only €100. The MTU is now the sum of the percentage deviations:

(100-133€)/133€ +(100€-129€)/129€ + (100€-117€)/117€

= -24.8% - 22.5% - 14.5% = -61.8% MTU at time x.

The MTU is therefore a measure of performance over the medium term (3-7 years) and whether the total return was exceeded or underperformed during this period.

10%MTU is obtained by sorting all MTU values and taking the largest value of the lowest decile (10% quantile).

A higher 10%MTU value indicates that the weakest 10% of all mean time periods have performed better than a lower 10%MTU value.

This means that the higher the 10%MTU, the fewer sideways phases there are.

5) Parameters on Epis GTAA Max

(since 2007, with BTC only from 2018)

GTAA MAX:

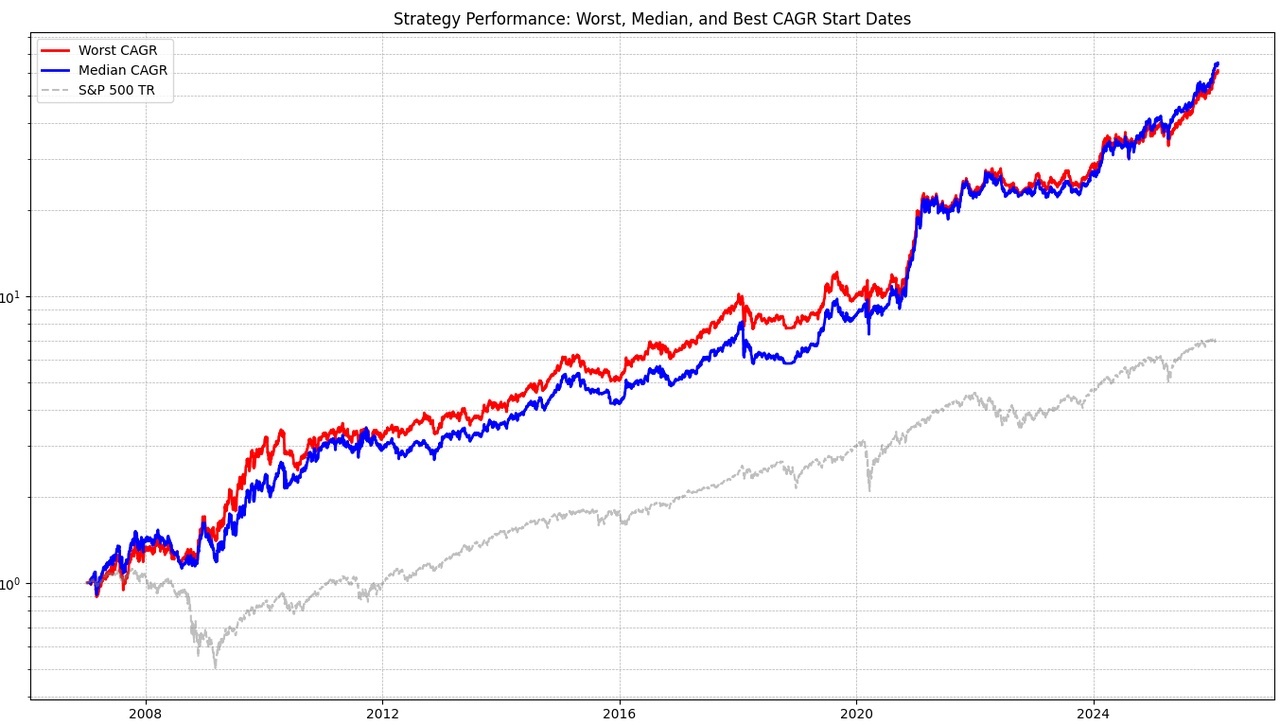

I will always show 3 graphs. The gray one is the benchmark (S&P 500 TR). I have abstracted Epi's strategy again to get a better comparison to my strategy. It is not traded at the beginning or end of the month, but a simulation for every possible trading day (e.g. the 1st, 15th, 20th, etc.) in the month. The median is shown in blue and the worst case in red. All the above metrics always refer to the worst case in order to calculate as conservatively as possible.

You can already see very few sideways phases, the 10% MTU value is therefore very strong (for the vola) at -35%. Here all metrics (in brackets the benchmark S&P 500 TR):

CAGR 17.36% (10.74%)

Volatility 23.58% (19.5%)

Sharpe Ratio 0.81 (0.6)

Max Drawdown -49.37% (-55.25%)

Worst Day -24.57% (-11.98%)

10%MTU -35.35% (-21.2%)

CAGR - 1.1^MaxDD -91.2 (-180)

The metrics look quite good, but the value for CAGR - 1.1^MaxDD is very low and the worst day is also very weak at 25%. In addition, my diversification target was not met: TQQQ is responsible for 70% of all gains.

6) First tests

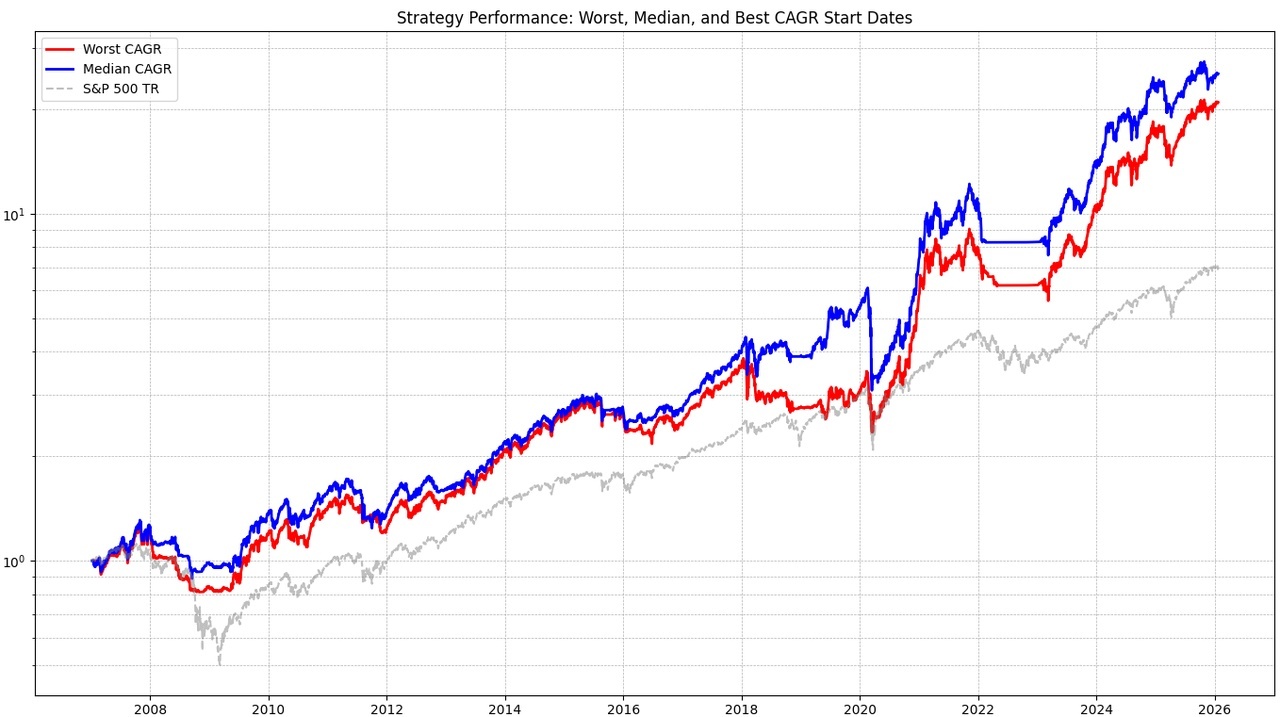

First, I tested my universe with the same parameters as Epi.

This looks very similar to GTAA MAX with lower yield and MTU:

CAGR 15.48% (10.74%)

Volatility 25.04% (19.5%)

Sharpe Ratio 0.68 (0.6)

Max Drawdown -51.32% (-55.25%)

Worst Day -22.77% (-11.98%)

10%MTU -45.68% (-21.2%)

CAGR - 1.1^MaxDD -118 (-180)

However, the diversification target has been met. The strongest asset (gold) only accounts for just under 28% of all gains.

7) Optimizations

The result is okay. However, there are still some adjustments to be made. First of all, I checked whether it makes more sense to react to signals less frequently or more often. In times of crisis, you can be invested in a high-risk product for up to a month, even though the momentum has long since reversed. I ran a simulation for this purpose:

As you can clearly see, shorter periods are better. From 3 weeks, the maximum drawdown is considerably lower. But I don't want to trade weekly either, as that would be too much effort. So I will check the signals every 14 days and then trade.

Here you also have to be careful not to fall into a fallacy. The data shown is again the worst case. As higher weekly figures look at more cases, the probability that one of them is bad is also higher. However, the median looks similar, with the exception of 1-2 weeks. These have very similar values and support the thesis that 14 days between trades is sufficient.

Then I remembered that I use the SPY and actually wanted to diversify the Spytips strategy. So why not use the TIPS indicator for the SPY?

So the new rule is:

3xSPY is only considered when TIPS is above its own SMA.

CAGR 19.24% (10.74%)

Volatility 23.30% (19.5%)

Sharpe Ratio 0.86 (0.6)

Max Drawdown -36.59% (-55.25%)

Worst Day -12.59% (-11.98%)

10%MTU -43.39% (-21.2%)

CAGR - 1.1^MaxDD -13.5 (-180)

More return with less vola and lower drawdown. The weakest day is also much better. The 10%MTU is also better.

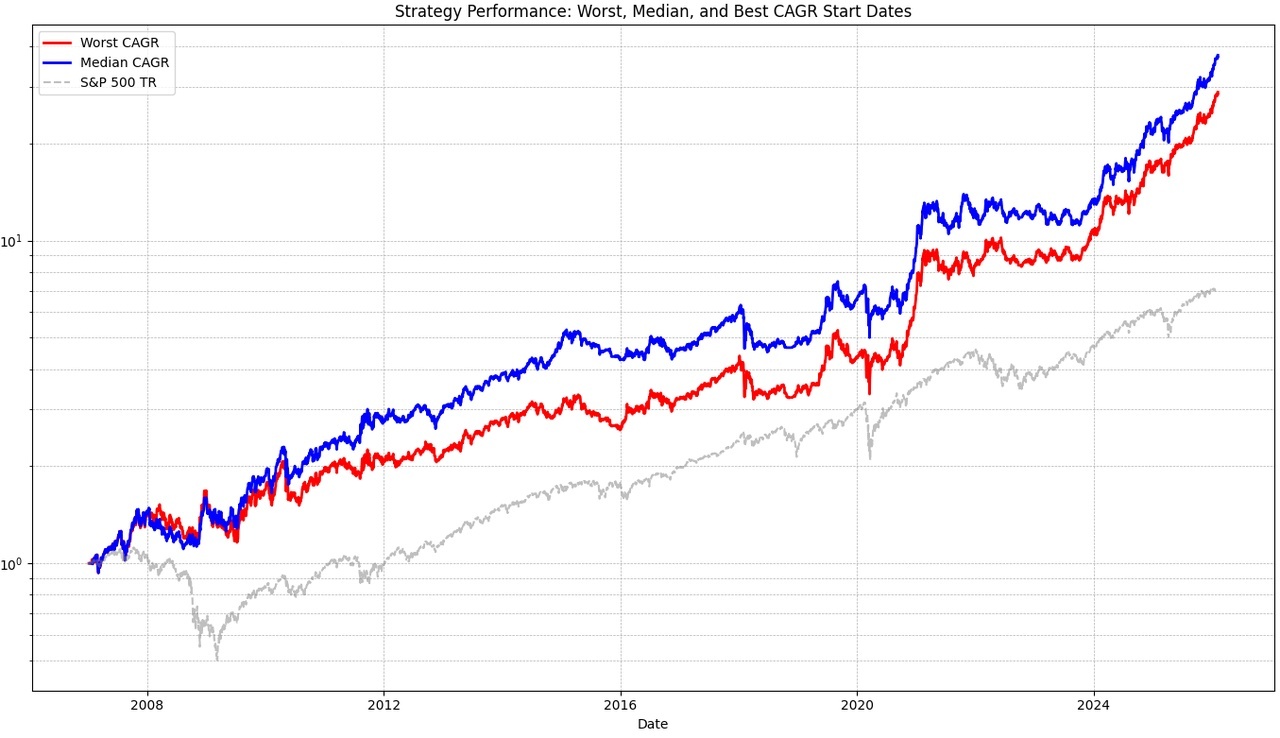

Next, I would like to hold a maximum of 4 (instead of 3) assets at the same time to further reduce the risk profile.

I do this a little differently than EPI: If there are no 4 assets to hold, only 1,2 or 3 will be held with 100, 50-50 or 33-33-33 weighting respectively. Maximum weightings per asset have been set so that the weighting is not too high:

e.g. 3xTLT, 3xIEF, BTC, IXC, Commodities may only account for a maximum of 30% each and 3xEEM only 20% (effectively reducing the leverage from 3x to 2-2.4. Unfortunately, there is no 2x EM). The rest is filled with cash. This means that in market phases in which few assets are running, these can be weighted higher (30-40%):

CAGR 19.20% (10.74%)

Volatility 24.42% (19.5%)

Sharpe Ratio 0.82 (0.6)

Max Drawdown -29.04% (-55.25%)

Worst Day -12.06% (-11.98%)

10%MTU -44.70% (-21.2%)

CAGR - 1.1^MaxDD 3.3 (-180)

Drawdown is significantly better, but performance remains the same. Here you can also see that the median case performed even better than the last test (blue graph)

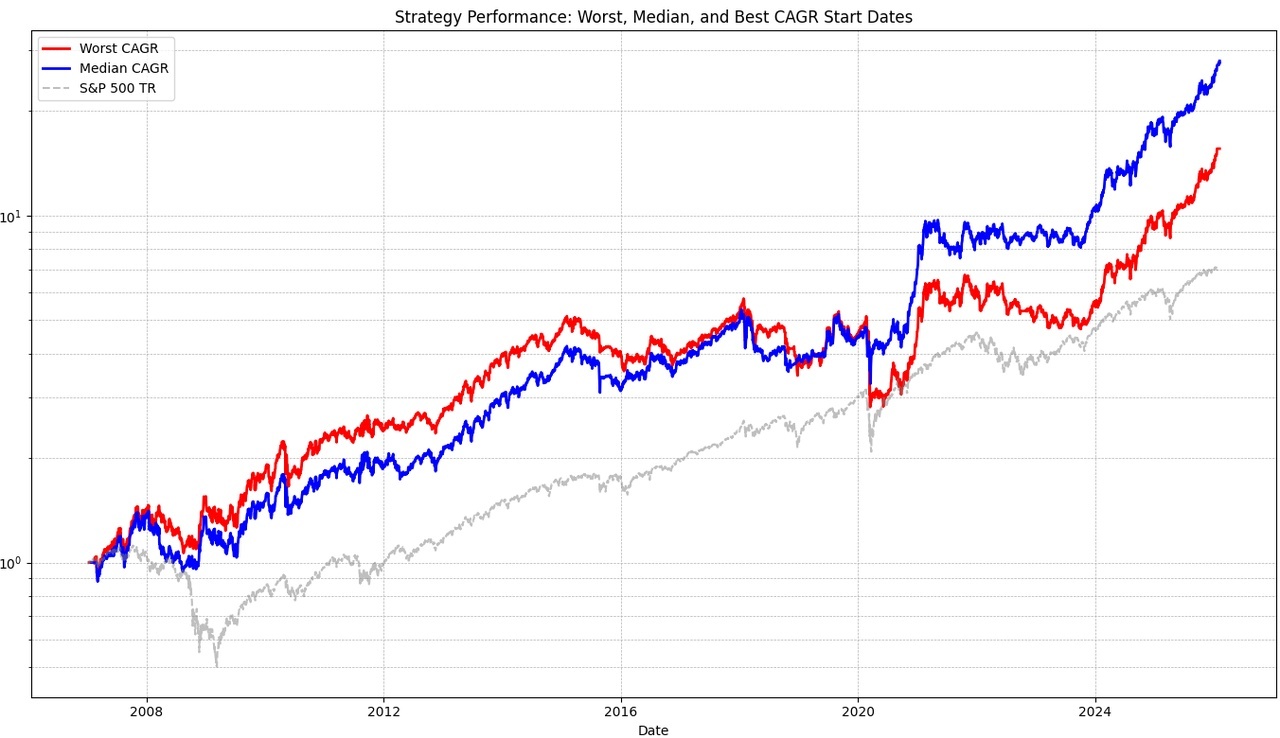

Finally, I optimized the SMA values. It should be mentioned that this test is overfitted and should only give an insight into what is possible.

CAGR 24.04% (10.74%)

Volatility 24.33% (19.5%)

Sharpe Ratio 0.98 (0.6)

Max Drawdown -28.79% (-55.25%)

Worst Day -12.06% (-11.98%)

10%MTU -38.81% (-21.2%)

CAGR - 1.1^MaxDD 8.5 (-180)

The best asset (3xSPY) only accounts for 20% of the total return. 10%MTU is over -40%.

Again the performance contribution of all assets:

20% 3xSPY

19% 2xGOLD

13.5% BTC

12.5% 3xEEM

11% 3xTLT

11% 2xWSML

5.5% 3xIEF

5.5% EXUS

2% XBCU

0% IXC

Although XBCU and IXC (commodities and utilities) do not generate a return, they reduce the risk in the portfolio.

8) Classification of the figures

Once again, I would like to list arguments for and against the strategy that result from my methodology:

For:

- worst trading interval considered

- BTC from 2018 is unfortunate. It would look much better from 2019 onwards

- Broad diversification (entire equity universe covered, bonds only US, as bonds from other regions have little momentum, BTC, gold and utilities as commodity/energy exposure)

- 4 assets instead of 3 reduces risk

- TIPS indicator tested several times is used and again sees a significant improvement

- The 3x leverage is "hedged" elsewhere: For EEM the max weight is reduced to 20%, which always results in at least 5% cash and 3xSPY is paired with the TIPS indicator. The 3x on bonds is less risky as bonds are less volatile.

- Survived all crises since 2000

Against:

- SMA optimization is safely overfitted

- There is always a risk of a rapid crash, which can have a major impact on leveraged products.

9) Conclusion

Even if the last test is overfitted, the following metrics result from the backtest:

CAGR: approx. 20%

MaxDD: 30-35%

This means that the GTAA variant, which I called MATT (Multi-Asset Trend Targeting), is a lower-risk alternative to 3xGTAA (a kind of 2-2.5xGTAA).

I am very curious to hear your ideas and suggestions.

10) Wikifolio

Yes, I have also created a wikifolio so that I and others can later invest in this strategy in a tax-efficient manner.

Unfortunately, I was not quite at the end of my development when I set it up, which is why gold is included with 3x leverage and the universe was still significantly smaller. I will change this at the next rebalancing. In fact, it would have performed better as a result.

You can already see the strong correlation with 3xGTAA, although it contains less vola. I'm looking forward to the future, because past performance is no indicator of future performance.

Here is the link to the wikifolio if you are interested:

https://www.wikifolio.com/de/de/w/wf000matt0

11) Further

I have tested the final strategy again from 2000:

CAGR 22.17% (8.11%)

Volatility 22.56% (19.00%)

Sharpe Ratio 0.97 (0.49)

Max Drawdown -29.27% (-55.25%)

Worst Day -12.06% (-11.98%)

10%MTU -33.64% (-29.85%)

While the benchmark yields less, MATT does quite well and loses only 10% instead of 25% CAGR. 10%MTU looks even better.

In general, the development can be divided into the following phases (with the respective performance drivers):

2000 - 2003

CAGR: 0% (-10%)

+ Gold, TLT

- EXUS

2003-2011

CAGR: 33.35% (5.2%)

+ EEM, gold, WSML

- nothing

2010-2020

CAGR: 13.8% (13.98%)

+ SPY, TLT, IEF

- IXC, BTC

2020-2026

CAGR: 38% (15%)

+ SPY, Gold, BTC

- nothing

+ 3

Portfolio

Hello everyone,

What do you think of this portfolio?

Are there any improvements? Do you have any suggestions?

Thank you

Hello everyone!

After about a year and a half as a silent reader, I'm taking the plunge today and writing my first post.

Briefly about me: I'm 20 years old, studying economics and started investing in January 2024. My goal is to build up a substantial financial base with discipline and perseverance.

My strategy: Growth & buy-and-hold

- Core: A solid foundation from which $VWCE (-0,51%) and $WSML (+0,42%) (small caps).

- Satellites: Supplemented by individual stocks and a $BTC (+0,13%) -position that is currently being built up additionally (target: 5 %) and a share in the wikifolio of @Epi (target: 10 %) in order to accelerate growth somewhat.

In the early days, I made the classic mistake of rebalancing too often. I now rely on calm and tactics. True to the motto "The journey is the reward", I want to keep learning and refining my strategy.

I am open to all tips and welcome constructive feedback on my current allocation.

Here's to a good exchange!

Commodities could be a smart addition.

A look back

I have looked at my portfolio review of 2025 and my start to 2026 - not just "how much", but above all: why and what I have learned from it. I am happy to share this with you and look forward to discussion & feedback and, above all, your views: what was the result and also your perception of your stock market year 2025 - and what set-up are you starting the new year with?

Time to reflect 🧘♂️

1) Change of mood at the end of 2024

After a rather sobering (for me) stock market year 2024, there was a clear turnaround in sentiment in November 24: on the day of Trump's election victory in Nov 24, the market jumped significantly (Dow +3.57 %, S&P 500 +2.53 %, Nasdaq +2.95 %). This made the "risk-on" narrative credible again - and you could see it in the behavior of many portfolios. At least in mine, if I'm honest with myself ;)

2) Q1/Spring 2025: Unusually Europe-friendly

The first few weeks of 2025 were indeed unusually Europe-heavy: in the first six weeks of 2025, the STOXX 600 was up >5.5%, while the S&P 500 was only up +2.7% in the same period.

This also became clear later in hindsight: in 2025, defense and banks were extremely strong drivers in Europe at times. I was also right in this upswing ($DHL (+0,03%) , $GBF (-1,83%) , $RIO (-0,45%) ) but unfortunately also some disastrous ($NESN (+1,84%) , $MC (-3,08%) , $NKE (-2,79%) ,$NOVO B (-0,91%) ) decisions were made. Partly also trend- and community-driven -> yes, you are to blame ;)

3) Beginning of April: Bad times

Then came the break: The strong start to the year was literally "wiped out" in just a few sessions, partly due to the customs/trade war shock. YTD turned completely negative, and by April 7 the STOXX 600 was around 12% below the closing price on April 2. $TSLA (-1,42%) and $NVDA (-4,4%) purchases. I also $PEP (+0,69%) I bought cheaply, but a real breakout is still a long way off.

4) Shortly afterwards: fireworks

Then a tailwind came back in the US from the middle/end of April, when the market repriced parts of the Trump escalation in the direction of "negotiations/de-escalation". The Donald kept a few election promises that were perhaps not quite official .-)

5) H2/late year: AI + interest rates as a "macro tailwind"

Towards the end of the year, the environment was then more strongly characterized by two factors: AI-driven risk assets and falling interest rates. It was an AI-driven rally, which also supported sentiment and inflows into US equity again.

And on the interest rate side: the Fed set the key interest rate at 3.50 % to 3.75 % in December after a further cut.

At the end of the year, the major benchmarks were also closer together again: STOXX 600 +16.66 % in 2025, S&P 500 ~+17 %.

6) Golden times 🥇🏅

Then there was the beautiful gold (u.W.). 2025 was a real exclamation mark: spot gold was up around 66% over the year (according to Reuters, the strongest increase since 1979).

Silver was even more extreme at around +168 % per year.

I have already written about gold in more detail here on getquin - if you are interested in the topic, you can find the article in my profile.

Personal performance 2025

- Internal rate of return: approx. +10 %

- TTWROR: approx. -33 %

- Dividend yield: approx. 1.3 % p.a.

The figures confirm what I described above: in my opinion, I made very good operational decisions (realized profits, used tax aspects, built up cash flow). At the same time, the TTWROR shows quite clearly that the portfolio structure was too volatile and too strongly growth/trend-oriented in the meantime. Too often, I have taken the "falling knife".

Before the turn of the year, I invested in $NVDA (-4,4%) , $TSLA (-1,42%) , $GBF (-1,83%) and $DHL (+0,03%) - each with positive returns - for the following reasons:

- Utilize saver's allowance

- Reduce tech-heaviness

- Cash generation (you can read why below)

Starting point Jan 2026:

Brief overview of the 2026 start setup

Asset mix

- Individual shares: 71.4 %

- ETFs: 16.0 %

- Gold: 9.2 %

- Crypto: 3.4 %

Regional breakdown

- North America: approx. 45.7 %

- Europe developed: approx. 26.0

- Rest of the world (including EM/Asia/Australasia): approx. 22.5 %

Sector structure

- Financial services: 20.5 %

- Consumer goods (cyclical): 19,2 %

- Consumer staples: 15.7

- Information technology: 14.8

- Materials: 7.9

- Healthcare: 4.7

Start to the new year

Parallel to the sales at the end of 2025, I reallocated or increased my holdings in January, including in $O (+0,76%), $VNA (+1,28%) and $ZAL (-1,01%)- with the logic:

- Strengthen cash flow/dividend components

- Turnaround opportunities as a limited admixture

- Reduce volatility in the portfolio

Why I am thinking more defensively in 2026

Next week, the purchase of an apartment on beautiful Lake Tegernsee 🏝️ will be notarized. This is a step into a completely new asset class for me, as it's my first property of my own. - In addition to construction financing, it will of course also be a liquidity issue over the next few weeks.

I may make a separate post about this, perhaps some of you are also currently facing this step?

I can mentally cope well with drawdowns. But: being able to bear risk does not automatically mean having to bear risk.

My portfolio should fit in with this new phase of my life.

What I will do differently in 2026

Because a new asset class will be added to my portfolio in 2026 with the purchase of an apartment, I want to position my portfolio more defensively in future - without completely foregoing opportunities for returns : risk. Otherwise we would be completely wrong on the stock market :)

1) ETF core should dominate

I want my portfolio to be dominated by my ETFs in future. My target scenario is therefore

- 60% of the deposits via a savings plan in my 4 core ETFs ($VWRL (+0,1%) , $COMM (+0,6%) , $WSML (+0,42%) , $IEMS (-0,61%) ).

- 30 % stocks

- 10 % commodities

- Play money: crypto, certificates, pennies (weighting < 5%)

Important! This is a start-in-2026 setup

Of course, as always in life, a plan is there to be thrown overboard - so you have to wait and see how assets perform in the year ahead and reassess regularly.

2) Stocks yes - but with more discipline

Turnaround/opportunity stocks and trends remain part of my approach, but clearly limited. I want these positions to be what they should be again: An addition, not a foundation.

I will reduce (basic) consumption and strengthen healthcare. And tech?

3) Tech: more controlled

Tech will remain a driver of returns in 2025 - but I want to build it up again in a controlled manner after my sales. I will monitor the trend from a distance for the first few weeks and possibly months and bet on corrections. You can't do without it - as you can see from the Mag-7 performance in 2025:

- $GOOGL (+0,91%) : +65,3 %

- $NVDA (-4,4%) : +38,9 %

- $MSFT (+0,04%) : +14,7 %

- $META (-1,33%) : +12,7 %

- $TSLA (-1,42%) : +11,4 %

- $AAPL (-3,6%) : +8,6 %

- $AMZN (+1,32%) : +5,2 %

On that note, happy new year!

$VWRL (+0,1%)

$EWG2 (+1,32%)

$O (+0,76%)

$PEP (+0,69%)

$MSFT (+0,04%)

$P911 (-0,83%)

$BLK (-2,67%)

$NKE (-2,79%)

$RIO (-0,45%)

$MC (-3,08%)

$NOVO B (-0,91%)

$NESN (+1,84%)

$ZAL (-1,01%)

$COMM (+0,6%)

$IEMS (-0,61%)

$BTC (+0,13%)

$ETH (+2,31%)

$XRP (+2,16%)

$PEPE (-0,27%)

If you do this consistently, your plan will work. I wish you every success and lots of fun with your new apartment

Portfolio

Hello everyone,

after almost 1 1/2 years as a silent partner on gq, I have decided to have my portfolio taken apart 😋

A few words about me and then about my portfolio.

I am 31 years old, live with my girlfriend and our 4-month-old son in the heart of Bavaria in our small home.

My girlfriend and I both work as employees in an automobile company. (She is currently on parental leave, of course)

About my portfolio.

I started my investment career with physical precious metals and shortly afterwards with cryptos.

When it came to cryptos, I got carried away by friends, I didn't know my way around them back then (I probably wouldn't take such a risk today). Fortunately, this turned out to be a good thing in hindsight.

A good three years ago, I added the first of what are now three portfolios with different strategies.

Depot (presumably for retirement)

$IWDA (-0,42%) / $MEUD (-0,17%) / $CSPX (-0,56%) / $EXS1 (-0,61%) / $EIMI (+0,71%) / $WSML (+0,42%)

2.dividend deposit (for cash flow as a reward on the joint account)

$HMWO (-0,36%) / $ISPA (+0,75%) / $TDIV (+1,29%) / $VFEM (-0,48%)

3.JuniorDepot

$VHYG (+0%) / $VWRL (+0,1%) as an accumulator.

Both ETFs are being saved in because the grandparents are financing one of them and I would like to keep them separate and not open an extra custody account.

All custody accounts are saved monthly.

So much for me and my portolio.

I would be very happy to receive any criticism, suggestions for improvement or similar and wish everyone happy holidays ✌🏻

ETF setup

Hello everyone,

I am 20 and would like to build up a portfolio for long-term growth and security.

The breakdown of my monthly savings plans:

66,7% $ISAC (+0,29%)

8,3% $WSML (+0,42%)

8,3% $MEUD (-0,17%)

8,3% $QDV5 (-0,84%)

8,3% $IGLN (+1,98%)

I would like to hear your opinion on whether you think this makes sense or would exchange/add a position or maybe you also say it is smarter to just save the $ISAC (+0,29%) to save.

Personally, I think msci acwi 80% and 10% each bitcoin and gold are enough. The acwi automatically weights what is doing well higher. In 5 years the european share may be higher in 15 years the emerging markets share. That's the great thing about ETFs. But you lose performance if you bet on the EU and EM for years now but all the performance is in the USA.

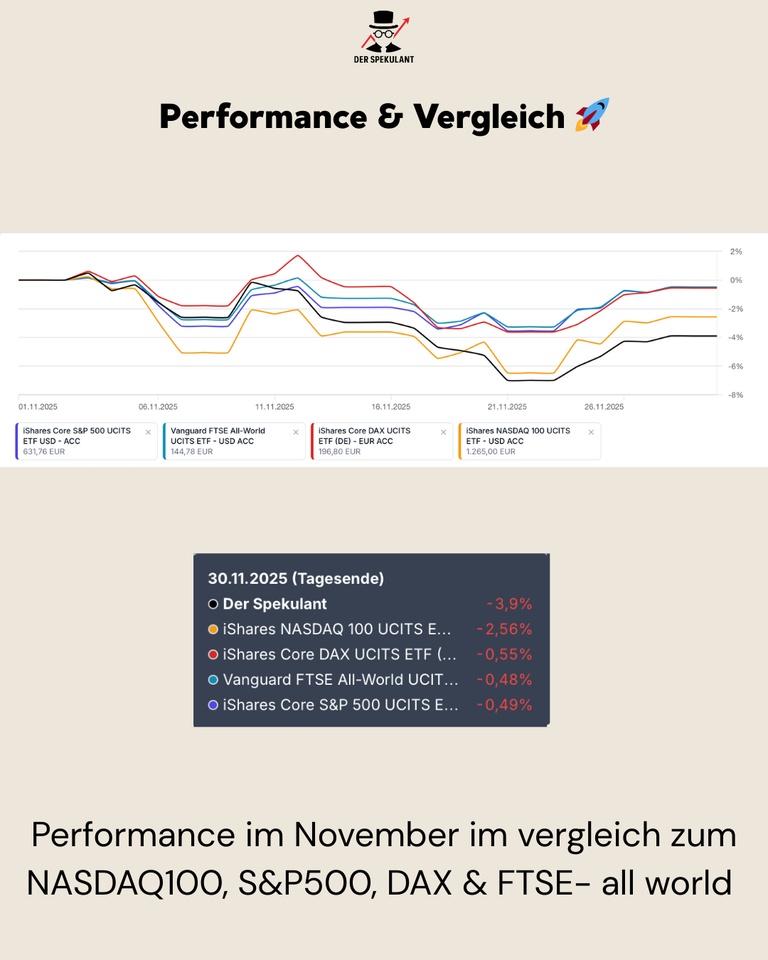

📊 My portfolio update November 2025

After a stable October (+6.2%), there was a clear countermovement in November.

My portfolio fell to 39.328€ and was thus -3,9% compared to the previous month.

The main drivers were the strong sell-offs in AI software, uranium, mining and defense - precisely those areas that are overweighted in my allocation.

Despite the setback, the year as a whole remains strong:

👉 Year-to-date I am still at +20.4% - solidly in the green.

1st performance & comparison 🚀

November was clearly characterized by risk-off mode. While broader indices remained stable, highly volatile future themes corrected much more strongly.

My portfolio:

-3,9%

NASDAQ 100:

-2,56%

S&P 500:

-0,49%

DAX:

-0,55%

FTSE All-World:

-0,48%

The underperformance is fully explainable:

Uranium, AI software, bitcoin mining and defense were under pressure - all segments that my portfolio partly tracks. But we remain calm and use attractive setbacks to buy.

Positive:

The long-term trend structure remains intact, YTD +20,4% clearly show: The overall path is right.

2. my savings plans & allocation 💶

The focus remains unchanged on strategic liquidity and consistent allocation.

Important in November:

👉 I bought Bitcoin for the first time.

This expands my structure specifically in the direction of digital assets - a building block that has shown relative strength despite market volatility. We entered at €74665 and are trying to use the 30% drop since the ATH to build up a small anti-cyclical position.

My savings plans are continuing as usual and remain the tactical tool for exploiting market opportunities in a disciplined and unemotional manner.

3rd top mover in November 🟢

The month was led by Nubank ($NU (-0,85%)), which was up +8,06 % benefited from strong user numbers and continued high demand for credit in Latin America. Berkshire Hathaway ($BRK.B (+0,43%)) gained +7,40 % driven by solid insurance profits and defensive positioning in the current market environment.

American Lithium (+4.44 %) showed a technical recovery, while the Bitcoin purchase ($BTC (+0,13%)) in my portfolio with +3,39 % had a direct positive effect. Also small caps (MSCI World Small Cap ($WSML (+0,42%)) +1.31 %) also performed stably. Tomra Systems ($TOM (+0,39%)) rounded off the list of winners with a slight gain of +0,28 % driven by an incipient recovery in demand in the recycling segment.

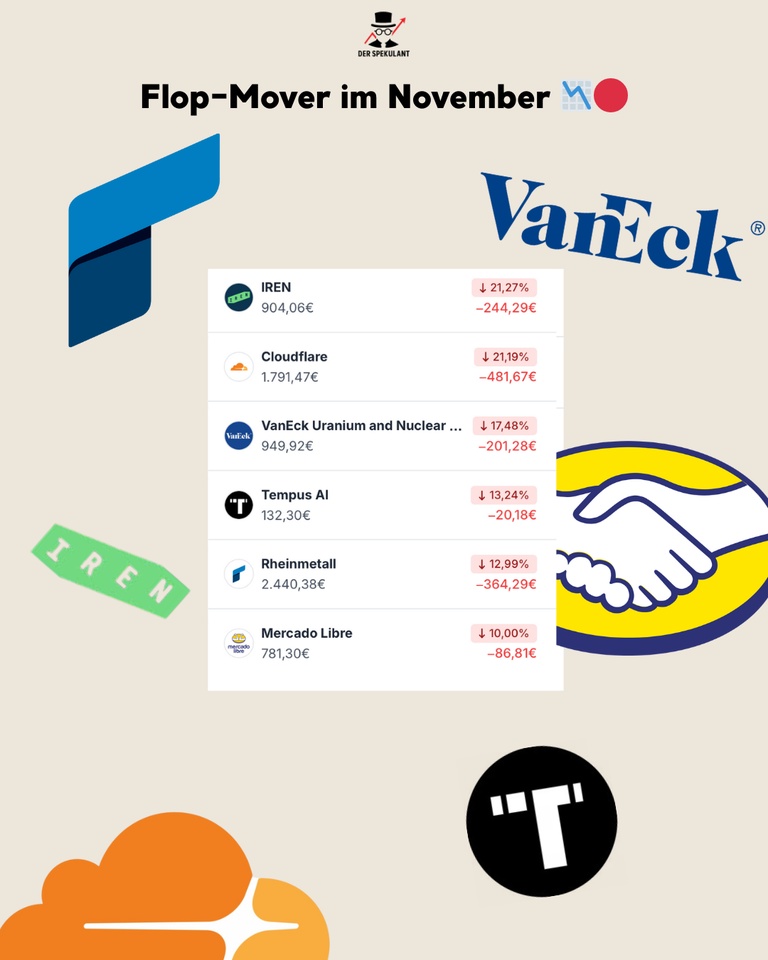

4th flop mover in November 🔴

The month was much weaker for my highly volatile AI and energy segments.

IREN ($IREN (-6,09%)) fell by -21,27 % the strongest - burdened by pressure in the mining sector and falling BTC margins. Also Cloudflare ($NET (-2,3%)) also fell -21,19 % triggered by risk-off in the entire software/infrastructure tech sector.

The VanEck Uranium ETF ($NUKL (-1,63%)) slipped -17,48% after falling spot prices and geopolitical uncertainties led to widespread profit-taking.

Tempus AI ($TEM (-3,02%)) (-13,24%) and Rheinmetall ($RHM (-0,42%)) (-12,99%) suffered from a general revaluation of growth and defense stocks. Mercado Libre ($MELI (+1%)) closed the month with -10,00 % also significantly weaker, weighed down by consumer data from Latin America.

5. conclusion 💡

November was a classic rotation month: risk-off in speculative future themes, stability in value, fintech and more defensive positions.

❓Question for the community

Which position surprised you the most in November - positive or negative?

👇 Write it in the comments!

+ 2

🇺🇸🇨🇳 President Trump meets officially with Chinese President Xi Jinping to discuss a trade agreement.

$IWDA (-0,42%)

$CSPX (-0,56%)

$EIMI (+0,71%)

$CSNDX (-0,5%)

$ISAC (+0,29%)

$VUSA (-0,59%)

$HMWO (-0,36%)

$XDWD (-0,37%)

$SPPW (-0,37%)

$WSML (+0,42%)

President Trump shakes hands with Chinese President Xi Jinping.

"He is a VERY tough negotiator. That's not good!" 🤣

"Nice to see you again!"

"We're going to have a very successful meeting!"

"We have ALWAYS had a great relationship."

Chinese President Xi Jinping says he is happy to finally meet President Trump.

"It's very nice to see you again! It's been many years. Since your re-election, we have spoken on the phone three times, exchanged several letters and stayed in close contact."

"Given our different national circumstances, we don't always see eye to eye. It's normal for there to be friction between the world's two leading economies."

"In the face of winds, waves and challenges, you and I, who are at the helm of Sino-US relations, should stay the right course and ensure the steady progress of these relations."

Chinese President Xi Jinping declares President Trump the PEACE PRESIDENT of the whole world!

"Mr. President, you care deeply about world peace! You are deeply committed to resolving regional conflicts. I greatly appreciate your significant contribution to the ceasefire in Gaza."

"During your visit to Malaysia, you witnessed the signing of the joint peace declaration along the Cambodian-Thai border, to which you also contributed."

Portfolio feedback

Hello everyone,

It's time for some criticism again.

Briefly about myself, I am 24 years old

and my strategy is a mix of growth and dividends with quality. I have the MSCI World as my basis.

I have bought very few shares recently, I hold a fairly high cash ratio. Only my ETF savings plans on $IWDA (-0,42%)

$EIMI (+0,71%)

$WSML (+0,42%) are executed monthly.

I also have one or two speculative stocks in my portfolio, such as $ORSTED (-1,41%)

$FXPO (+4,53%)

$PYPL (+0,13%) . I will sell these when the prices are attractive.

The absolute losers at the moment are $DGE (+3,42%) & $PAH3 (-1,09%) . With $DGE (+3,42%) I am, however, considering buying more.

With $NKE (-2,79%)

$TGT (-1,24%)

$UPS (-0,59%)

$NOVO B (-0,91%) I am quite relaxed about the poor performance. I think patience will pay off here.

Feel free to give me feedback, I'm happy to receive any kind of constructive criticism! 😊

Many good stocks, but also a lot of crap, here I would sell at least all the stocks you mentioned above and switch to a distributing EFT.

Thanks to various dividend stocks, you will already have a passive 200 euros a month from next year, keep it up!

Titoli di tendenza

I migliori creatori della settimana