I was surprised to see that the portfolio value has fallen quite a bit today. But this is mainly due to the ex-days of $RIO (+1,13%) and $TDIV (+0,6%) which coincide on one day and make up a large chunk of my portfolio as positions.

Rio Tinto PLC

Price

Discussione su RIO

Messaggi

262Ares Capital added to the portfolio

Somehow I think I'm rebuilding the depot from @Dividendenopi after.

$BATS (+0,8%) , $RIO (+1,13%) , $DTE (-0,27%) , $PFE (-0,43%) , $ARCC (-0,93%) - all identical.

Instead of $ALV (+0,3%) I have $MUV2 (+0,82%) , Instead of $HAUTO (+0,55%) I have $WAWI (+1,68%) . 🙂

I missed HSBC, I was too slow. The ETF position is different and @Dividendenopi there is even more "smoke" in the portfolio with other tobacco stocks...

Reallocation Immo->Depot

At the turn of the year I had already mentioned that I would try to shift a little more from real estate investments into securities, as I already have a very strong imbalance towards real estate.

The first part has now worked. I sold a small apartment that no longer really fitted into my real estate strategy. The money is now (partly) going into the portfolio and into securities that pay out dividends (to overcompensate for the rental income that no longer exists). However, part of the proceeds will probably go into a new real estate project as an equity share, which will then have relatively strong debt leverage, but is not yet signed at the moment.

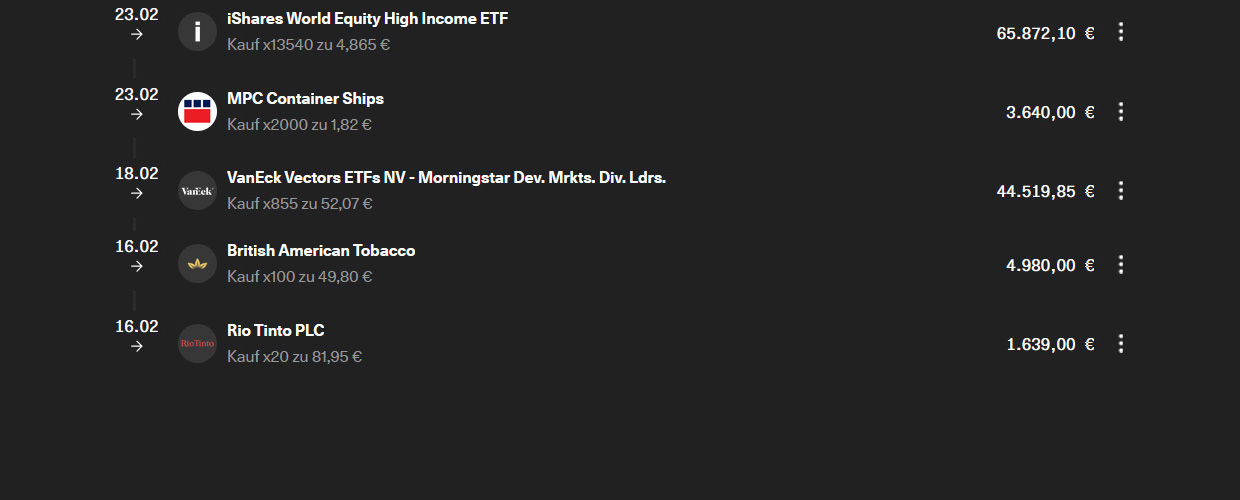

$TDIV (+0,6%) , $WINC (-0,01%) , $BATS (+0,8%) and $RIO (+1,13%) are all additions. $MPCC (+2,77%) is a new addition.

Rio Tinto share: Copper saves the balance sheet

The mining giant reports stable annual profits, supported by a doubling of the copper result. The strategic shift towards copper and lithium is underpinned by an investment offensive in Canada.

The figures for the 2025 financial year are on the table - and they reveal a remarkable development: while the iron ore business is weakening, copper of all things is stepping into the breach. The world's largest iron ore producer today reported a profit of 10.87 billion dollars, exactly the same as the previous year. But behind this stable façade, a fundamental change in the business mix is taking place.

The operating result (EBITDA) climbed by 9 percent to 25.4 billion dollars - driven by an impressive 8 percent increase in production in copper equivalents. The Oyu Tolgoi mine in Mongolia is finally running at full speed and catapulted copper production up by a whopping 61%. At the same time, the Pilbara iron ore mines in Western Australia have been delivering record volumes since April.

Iron ore loses, copper gains

The shift in the portfolio is striking: iron ore profits slumped by 11 percent as benchmark prices fell by 6 percent. In contrast, copper EBITDA more than doubled - a clear signal of where the strategic journey is heading. CEO Simon Trott confirmed the growth target of 3 percent per year until 2030, supported by major projects such as the Simandou iron ore in Guinea and lithium expansions.

At 2.54 dollars per share, the dividend is slightly lower than in the previous year (2.55 dollars), but remains at the usual payout ratio of 60 percent. For the tenth time in a row, Rio Tinto has maintained this ratio at the upper end of the range - a statement for investors who rely on reliable cash flows.

Lithium offensive in Canada picks up speed

Alongside the annual report, a strategic announcement was made today: Rio Tinto is increasing its stake in Nemaska Lithium in Canada to 53.9 percent. The Quebec government holds the remaining 46.1 percent. The plan is to create an integrated lithium value chain from mining to chemical processing - especially for the North American electric car industry.

The Group plans to invest over 300 million dollars in Nemaska in 2026 alone, with Quebec contributing a further 200 million. The investment stems from the Arcadium takeover at the beginning of 2025, which was completed ahead of schedule. Rio Tinto is targeting a capacity of 200,000 tons of lithium carbonate equivalent by 2028. The share reacted in Sydney with a plus of 2 percent to 169.63 Australian dollars.

Net profit fell by 14 percent to 9.97 billion dollars - burdened by higher debt and one-off effects from acquisitions. However, the operating strength is intact: 16.8 billion dollars cash inflow from operating activities, an increase of 8 percent. However, net debt climbed to 14.4 billion dollars, more than twice as much as a year ago. A tribute to the aggressive expansion strategy, which has yet to prove itself.

Source: www.boerse-express.com

What do you think?

Personally, I'm not worried about the iron ore, rather I see a great opportunity in the rising copper prices, as you can see in the report. I think there is still potential there. Stable dividend, even if it was unfortunately not increased. But it is a nice constant cash flow for investors. Further opinions are welcome. Kind regards

Rio Tinto abandons possible merger with Glencore

Mining giant Rio Tinto $RIO (+1,13%)

$RIO (-0,53%) announced on Thursday that it has decided against a possible merger or business combination with Glencore plc $GLEN (+2,77%) as no agreement could be reached that would have added value for shareholders.

The decision comes almost a month after Rio Tinto first announced on January 8 that such a deal was under consideration. In a statement to the London and Australian stock exchanges, the company said it had assessed the opportunity against its "disciplined view" set out at its Capital Markets Day in December 2025, which prioritizes long-term value and shareholder returns.

The announcement was made in accordance with Rule 2.8 of the City Code on Takeovers and Mergers, which imposes restrictions on Rio Tinto making a further offer for Glencore. However, these restrictions could be lifted in certain circumstances, for example, with the consent of the Glencore Board or if a third party expresses a firm intention to make an offer for Glencore.

Rio Tinto, one of the world's largest mining companies, is listed on both the London Stock Exchange and the Australian Securities Exchange. The company's announcement effectively ends speculation of a potentially significant consolidation in the global mining industry.

Rio Tinto secures Chinese supplies for the global mining industry

If you were to take a look at Rio Tinto's global "shopping cart" for 2025 $RIO (+1,13%)

$RIO (-0,53%) for 2025, you would find more than just the usual mining basics.

You would see a record US$4.3 billion bill from Chinese suppliers, a clear sign that the global mining giant has gone from being China's "favorite stone seller" to one of its most enthusiastic business partners.

Rio Tinto's recent purchases in China, including massive 230-tonne dump trucks and powerful graders for the Simandou project in Guinea, state-of-the-art 90-tonne electric dump trucks with swappable batteries for Oyu Tolgoi in Mongolia and specialized rail components for Pilbara in Australia, are proof that China has transformed from Rio Tinto's largest customer to an indispensable architect of its global supply chain ecosystem.

The relationship between China, the world's largest importer and consumer of iron ore, and Rio Tinto, the world's largest producer of seaborne iron ore, has officially entered an "upgrade" phase as global mining giants rely on China's high-tech manufacturing and rapid innovation to power their mines around the world, industry experts said.

"Made in China" is now the high-tech centerpiece of the world's most ambitious industrial projects, said Zhao Xiangbin, chief strategist at Beijing Gold and Forex Fortune Investment Management.

It's no longer just about transporting iron ore from the red dust of Australia to the steel mills of China, he said.

"China is our biggest customer and also an important supply base for us," said Jamie Sanders, head of global procurement at Rio Tinto. "We clearly recognize the distinct advantages of the Chinese supply chain."

Sanders pointed out that the capabilities of Chinese suppliers in terms of fast response times and rapid innovation are unique in the world.

The cooperation model with Chinese companies has evolved from a traditional buyer-supplier relationship to a "much closer partnership" focused on creating shared value across the company's international project portfolio, he said.

According to Rio Tinto, Chinese companies have played a fundamental role in the construction of major infrastructure projects overseas.

The company recently announced the first shipment of high-grade iron ore from the Simandou deposit to the port of Rizhao in Shandong province, another cooperation project between Rio Tinto and Chinese partners, including China Railway 18th Bureau Group, China Harbour Engineering Co Ltd and Chinese construction machinery manufacturer XCMG Group.

While China Harbour Engineering provided key equipment and services to support the construction, XCMG provided essential engineering services and heavy equipment to bridge the gap between the inland mines and the coast, it said.

The contract with XCMG also includes an order worth 800 million yuan (US$110 million) for a full range of mining equipment, including dozens of 230-ton dump trucks and massive 350-horsepower and 550-horsepower bulldozers, to serve as the high-tech muscle Rio Tinto has selected to build a new global resource hub from the ground up.

Rio Tinto also purchased eight battery-powered electric dump trucks from China's State Power Investment Corp for its Oyu Tolgoi copper mine, which is set to become the fourth largest copper mine in the world by 2030.

The increase in procurement underscores a strategic realignment by the Anglo-Australian mining company, which is increasingly looking to Chinese technology and equipment to support massive infrastructure developments, Zhao said.

By taking advantage of the Chinese supply chain, the company aims to increase its operational efficiency while accelerating the transition to lower-emission mining technologies, he said.

While China has long been an important market for global mining giants due to its huge market size, major players such as Rio Tinto, BHP and Vale are keen to buy equipment from Chinese manufacturers, he added.

"The capabilities of Chinese suppliers in terms of fast response times and rapid innovation are second to none in the world," Sanders said.

As China accelerates the development of new productive forces, Rio Tinto is at the forefront of capitalizing on these new opportunities, he said.

For Rio Tinto, the $4.3 billion spent in 2025 is not the target - it is the new baseline. The company has now set itself the task of penetrating even deeper into the Chinese market and seeking regional partners who can solve the next mining challenges.

"We need to develop a deeper understanding of which regions and partners in China we can work more closely with," said Sanders.

"By combining Rio Tinto's century of mining experience with China's relentless pursuit of new high-value productive forces, both are doing more than just moving rocks: they are building a faster, greener and more connected version of the global mining industry - one $4.3 billion investment at a time."

Neometals extends letter of intent with Rio Tinto for ELi process

Neometals Ltd $NMT (+2,78%) together with Mineral Resources Limited, has announced an extension of its Memorandum of Understanding (MoU) with Livent USA Corp, a subsidiary of Rio Tinto Group $RIO (+1,13%)

$RIO (-0,53%)announced.

Neometals is focused on creating value for its stakeholders through the sustainable production of critical and valuable materials essential for a cleaner future.

The company markets a portfolio of low-cost, sustainable processing solutions for key materials, while also exploring and developing mining operations at its Barrambie Gold Project.

The extension allows for further collaboration in the validation and advancement of RAM's lithium processing technology, known as the ELi process. RAM is a company jointly owned 70:30 by Neometals and Mineral Resources Limited.

The original Letter of Intent was signed on June 24, 2025 with an initial term of eight months. The extension provides for a further twelve months to complete testing of new brine feedstock from Rio Tinto's existing brine operations. It also allows for the involvement of Industrie De Nora S.p.A. and its subsidiary De Nora Permelec Ltd in the pilot validation program for the ELi process, focusing on the integration of De Nora's electrolysis equipment into RAM's process flow.

RAM and De Nora have recently entered into a collaboration agreement to jointly design, build and commission a pilot plant that integrates De Nora's electrolysis system with RAM's ELi process. The aim is to further develop the integrated solution for industrial validation at an end user's site, subject to Rio Tinto's approval where required. The announcement was approved on behalf of Neometals by Christopher Reed, Managing Director.

Month in review January 2026

What a start to the new year - everything from high spirits to geopolitical tensions to a historic correction - and it seems to be continuing just as turbulently as it began...

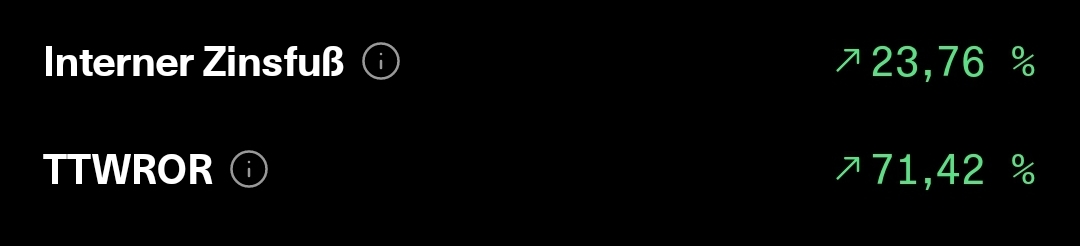

...but despite the events and the fact that there were only 2 small additional purchases last month, these circumstances don't really seem to bother my portfolio and so a new ATH was reached on the penultimate trading day and closed just below it on the last day.

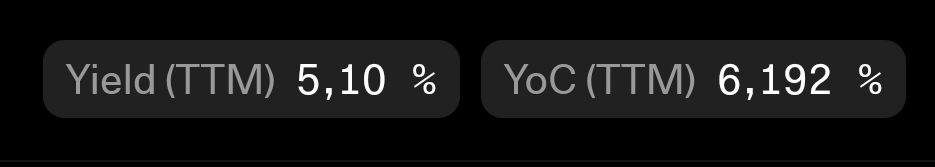

I am quite satisfied with the 4.70% achieved under the circumstances and it shows me that my selection (.oO dividends do not hurt) is not so bad at all in order not to get under water even in such waters.

In the long term, my strategy continues to pay off positively and there is no reason for me to really change anything here...

...except that this year there will be a little more focus on growth in addition to dividends.

Which brings us directly to the next topic...

...after a good +3804.58% dividend growth in 2024, it was another +148.57% last year and, with the +40.37% forecast so far this year, should easily be enough to achieve my basic target of €2000 net dividend.

In my view, the overall rate of return is also suitable for the time being and will of course change somewhat over the course of the year...

...it is also fitting that January is a somewhat weaker dividend month, but still tastes good with a net dividend of € 104.16.

》Single stocks top 3《

$HAUTO (+0,55%) +11,28% (+35,55%)

$RIO (+1,13%) +10,28% (+41,03%)

$VAR (-1,47%) +9,50% (+10,20%)

》 Individual stocks Flop 3《

$YYYY (+0,6%) -7,96% (-4,27%)

$3750 (+0,36%) -2,58% (+46,54%)

$VICI (-0,41%) -0,84% (+17,41%)

》Additions/departures 《

none

》Increased《

$VICI (-0,41%) (10x)

$1211 (+5,82%) (10x)

Apart from that, there were 2 other pieces of positive news in my private life...firstly, the next check-up is still without findings and secondly, I now have confirmation from the pension provider that I can continue my further training as an accounting specialist (IHK) this year, which was interrupted by the operation. What's more, this will now be taken a little further and I'll also be taking the certification in DATEV and DATEV payroll accounting at the same time...can't hurt 🤫👍🏻

And so I wish us all continued good luck, a nice rest of the Sunday and maximum profits ✌🏻

+ 1

Bradda Head Lithium: Shareholders to approve agreement with Rio Tinto

Bradda Head Lithium Ltd $BHLL announced on Friday the publication and mailing of a circular to its shareholders.

The subject matter is the recently announced "option to joint venture" agreement with Kennecott Exploration Inc, a subsidiary of Rio Tinto Mining Group $RIO (+1,13%)

$RIO (-0,53%).

The lithium development company, which focuses on North America, has scheduled an Annual General Meeting for February 17 at The Claremont Hotel in Douglas, Isle of Man. Shareholders are to vote on two resolutions in connection with the agreement announced on January 27.

The first resolution is for shareholder approval of the earn-in acquisition. The second resolution is to approve the issue of ordinary shares to Galloway Limited and Promaco Limited under convertible loan agreements.

The Circular, which contains details of the Agreement, the Whistlejacket Project and the Convertible Loan Agreements, has been made available on the Company's website.

Rio Tinto and Glencore extend deadline for merger talks, according to Bloomberg

The Rio Tinto Group $RIO (+1,13%)

$RIO (-0,53%) and Glencore Plc $GLEN (+2,77%) are expected to apply to the UK Takeover Panel for an extension to their ongoing merger talks as the companies need more time to clarify valuation issues. This was reported by Bloomberg, citing people familiar with the matter.

The two commodities giants have been negotiating the creation of the world's largest mining company since the beginning of January. The merged group would have a market value of around $235 billion and would become one of the largest copper producers in the world.

Both companies are still interested in completing the transaction, but disagreements over valuation have slowed the process. Glencore is pushing for a premium that reflects its position as a smaller company acquired by a larger competitor, while Rio Tinto shareholders are insisting that the group maintain financial discipline in its merger and acquisition strategy.

Titoli di tendenza

I migliori creatori della settimana