$SAP (-0,45%)

The fall in the share price of SAP came as a surprise, but not without reason. The key question, however, is whether the sell-off is justified.

When expectations are disappointed

The slump in the SAP share price came as a surprise to many investors, but had several clearly identifiable causes. The disappointing development in the cloud business was cited as the main reason for the sell-off.

SAP is regarded as one of the most important European beacons of hope here, but growth in the cloud backlog was weaker than forecast. This is explosive, as this order volume represents future revenue. When SAP also signaled that cloud growth could slow down in 2026, the mood tipped abruptly. Confidence turned into skepticism, which immediately led to selling pressure.

This was compounded by the fact that individual Kennzahlen did not meet expectations. This was enough to make analysts nervous. Several banks and research houses lowered their price targets or downgraded the share. In a tense market environment, such signals act as an accelerant.

Added to this is the generally negative sentiment towards software companies. Increasing uncertainty about economic development, coupled with doubts about traditional business models in the age of artificial intelligence, are weighing on the entire sector.

SAP as an AI loser?

And AI is currently being used as an argument for everything anyway, as in the case of SAP. In the course of the share price slump, SAP was also described as an AI loser in some places. However, I have not found any tangible arguments for this thesis. Nor do I understand the logic behind this idea.

SAP's products are deeply embedded in the core operational processes of companies.

Purchasing, financial accounting, logistics, human resources and production planning are highly complex, data-intensive and business-critical.

AI is used here as a tool to increase efficiency, but not as a replacement product for SAP. As a rule, AI providers have no direct access to these processes at all, unlike SAP.

Furthermore, SAP has a structural advantage that pure AI companies do not have: high-quality, company-specific data. AI is only as good as the data it works with. The most valuable data is not in open models, but in ERP systems. SAP has controlled this level of data for decades. Anyone who wants to optimize business processes can hardly avoid this database.

More likely psychology

Furthermore, ERP systems are not replaced lightly. The switching costs are high, the integrations are deep and the risks are enormous. AI can improve, accelerate and simplify these systems - it does not replace them.

SAP offers exactly what corporate customers need: Control, security, compliance and traceability. Many generative AI solutions are difficult for companies to manage from a regulatory or operational perspective and are unthinkable as an alternative, especially for larger companies.

In my view, the narrative of "AI loser SAP" is ultimately based less on facts than on stock market psychology.

Really disappointing?

But all this is just my assessment. There is probably another way of looking at it. In the end, the truth is in the figures. So let's take a look at them.

In this analysis, I would like to focus on the question of what is "disappointing" and what is not.

SAP's quarterly figures and outlook have been widely described as disappointing, but that is in the eye of the beholder.

In this case, the dividing line should be clear. On the Börse more weight was given to the fact that expectations were not met - which is usually the case.

For investors, however, the decisive factors are whether the company is developing in the right direction, whether the outlook is positive and whether the valuation is right.

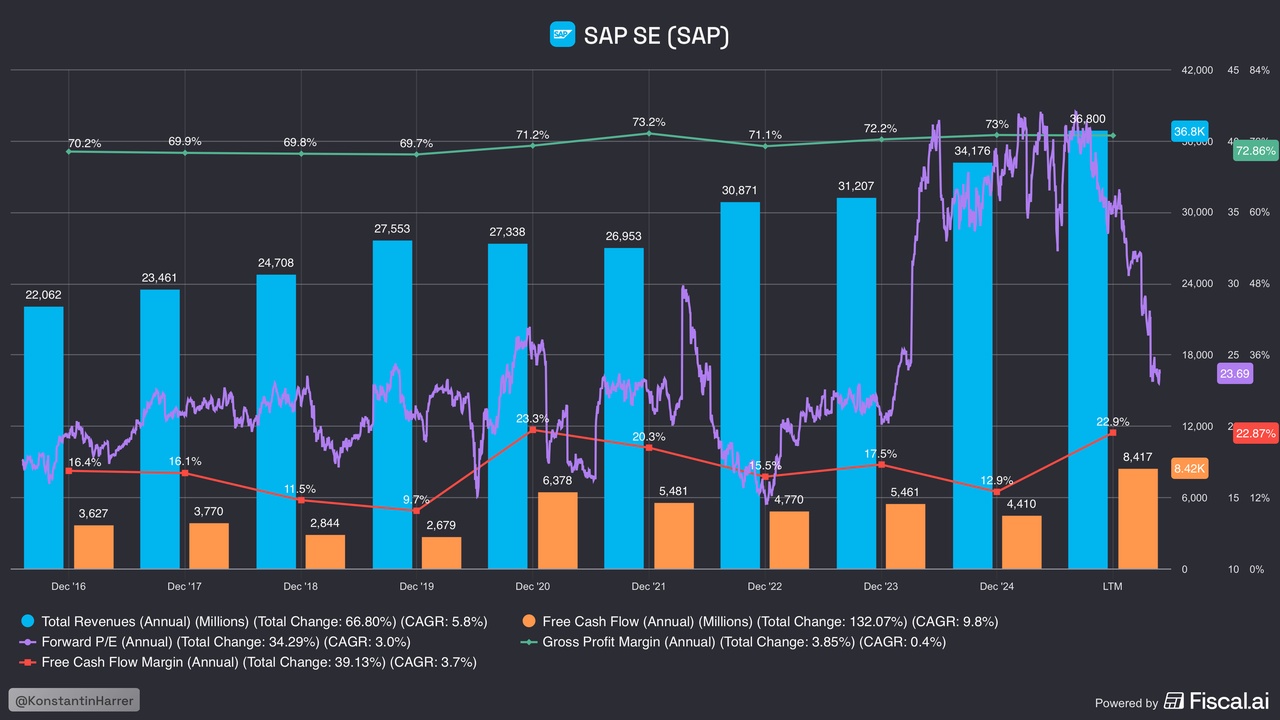

In the fourth quarter, sales increased by 3% to EUR 9.68 billion, but adjusted for currency effects, the increase was 9% and therefore only just below the figure for the full financial year of 11%.

However, the sales figures are still distorted by the transformation towards the cloud.

Profit and cash flow increase massively

The operating result increased by 27% to 1.90 billion euros in the fourth quarter. Profit improved by 16% to 1.62 euros per share. You can be disappointed by this - or not.

The operating result improved from EUR 8.15 billion to EUR 10.42 billion in the 2025 financial year, an increase of 31%.

Earnings per share climbed by 36% from EUR 4.53 to EUR 6.15 per share (both non-IFRS).

Free cash flow almost doubled over the year from EUR 4.22 billion to EUR 8.24 billion.

You can also be disappointed by this - or not. It is in the eye of the beholder. Rationally, however, it is perfectly clear how such business figures should be classified - there is no need to comment further.

Outlook and valuation

The order intake suggests that the positive trend is likely to continue for the time being. The current cloud backlog increased by 16% to EUR 21.05 billion. Adjusted for currency effects, the increase was even 25%.

For 2026, SAP is forecasting an increase in cloud revenue from EUR 21.0 billion to EUR 25.8 - 26.2 billion, which corresponds to growth of 23 - 25 %.

Cloud and software revenue is expected to increase from EUR 32.54 billion to EUR 36.3 - 36.8 billion and the operating result from EUR 10.42 billion to EUR 11.9 - 12.3 billion.

Free cash flow is expected to increase from EUR 8.24 billion to EUR 10 billion. SAP therefore expects a jump in profit of around 16% and an increase in free cash flow of 22%.

This may also disappoint - or not.

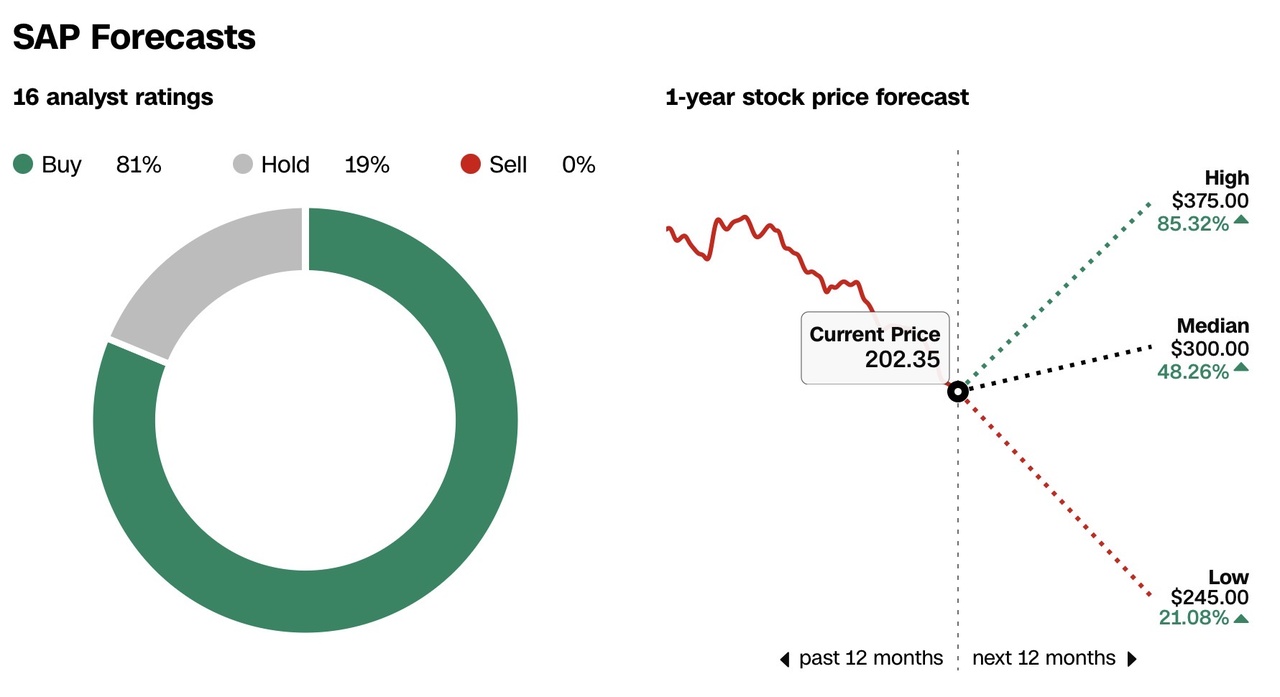

According to the report, SAP has a P/E ratio of 23.8 and a forward P/FCF of 20.8, which is reasonable in view of the double-digit growth rates.

Over the last five years, the P/E ratio has averaged 26.3 and the P/FCF 27.5.

In the course of the quarterly figures, a two-year share buyback program with a volume of up to EUR 10 billion was approved, which corresponds to around 5% of the market capitalization

SAP share: Chart from February 9, 2026, price: EUR 173.42 - symbol: SAP | Source: TWS

A return above EUR 175 would ease the situation from a technical perspective. Above EUR 183 there would be a procyclical uptrend Kaufsignal with possible price targets at EUR 200 and EUR 214.

If, on the other hand, the share falls below EUR 165, an extension of the correction towards EUR 148 - 150 must be expected.

Source

https://www.lynxbroker.de/boerse/boerse-kurse/aktien/sap-aktie/sap-analyse/?a=3355991664&utm_medium=email&utm_source=newsletter&utm_campaign=newsletter-boersenblick&newsletter=true&mc-rss-cache-bypass=2026021007&goal=0_d93daae099-3e7ba2c904-410756260#sap-enttaeuschend-oder-nicht-das-ist-die-eigentliche-frage