"The main limit for new AI growth is not chips. Instead, the main limit is power."

Jensen Huang, Nvidia CEO, said this sentence in a podcast in December 2025.

Introduction

A different topic to Iran today, so why not take a look at my research?

Spending on AI is enormous. According to estimates (Gartner), 2500 billion dollars will be invested in AI infrastructure this year (2026). Much of this will go directly to NVIDIA, but it's not just AI chips that are needed. Other companies benefit because they sell gas power plants, cooling technology or memory chips. Memory chip manufacturers, such as SanDisk or Micron, recently experienced a huge boom because a bottleneck had formed here. Prices for memory chips quadrupled within a few months, in some cases even quintupling! As soon as supply and demand diverge, the price rises exponentially.

However, this boom was only a reflection of what I believe lies ahead of us in a completely different area.

Energy infrastructure. The global electricity grid is growing by around 2.5-3% per year. The annual growth rates of energy consumption, of AI data centers, are estimated to be between 40-70% by 2030. This difference becomes a problem, because as soon as something becomes scarce, the price rises exponentially. Welcome to a company that has secured this supply for the long term and with which we as investors can leverage this difference between supply and demand, which is yet to emerge, into our portfolio...

I will try to explain why I believe that the analysts' forecasts only reflect a pessimistic scenario and why they will probably raise their forecasts massively in the future. I will try to explain why, for example, I am not $NBIS (+5,18%) but $IREN (+1,41%) and why I see the greatest potential here...

Please just accept my reasoning, even if you are convinced that you don't think much of the company or that this is just hype, over-indebtedness etc...

My deep dive is divided into the following aspects:

- History, foundation and vision

- Data centers at a glance

- Direct-to-chip liquid cooling

- AI capital expenditure

- Energy as a bottleneck

- Microsoft deal

- Quarterly figures (short)

- Conclusion, my opinion

Foundation and history

I will only briefly go into this here, but the foundation and vision represent a basic building block for the potential in terms of AI and energy supply.

IREN (formerly Iris Energy) was founded in November 2018 by brothers Daniel and William Roberts. The two founders brought a specific perspective and expertise from the financial world, having previously worked at the Macquarie Group - a company known globally for its infrastructure investments. With this basic knowledge, they founded the company, which initially specialized in crypto mining.

From the beginning, their approach differed from many other companies in the crypto sector: while many miners were looking for cheap energy sources in the short term (mostly regardless of origin), the Roberts brothers saw Bitcoin mining primarily as a solution to the infrastructure and energy problem. infrastructure and energy problem. The vision was to see Bitcoin mining and the expansion of renewable energy not as a contradiction, but as a combination. They wanted to show that large-scale data centers can function as flexible consumers for power grids that are struggling with fluctuating feed-ins from wind and solar power.

This also makes sense in the area of Bitcoin mining. I will not go into this in detail here. If you are interested in Bitcoin mining, you can take a look at @stefan_21 look around ;)

In recent years, however, IREN has realized something else;

-> that the infrastructure they have built - all the contracts, land, power connections and cooling systems - can be used for more than just Bitcoin mining. But first of all, which data centers does the company actually own?

Data centers at a glance

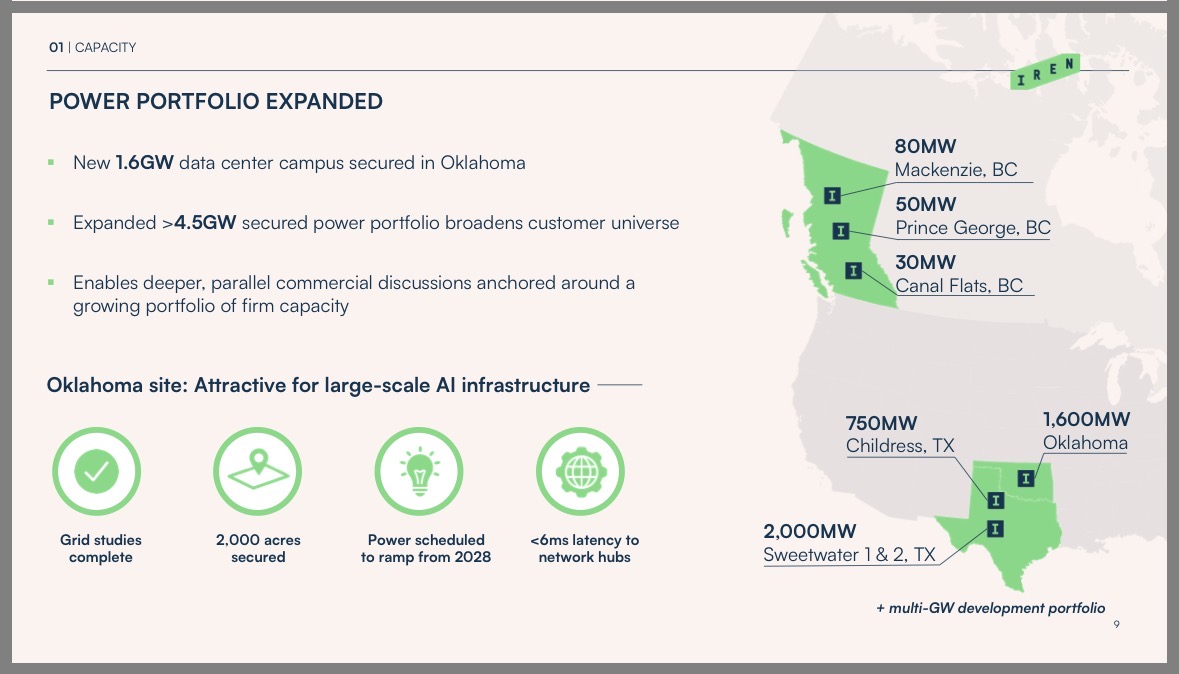

British Columbia (Canada)

In Western Canada, IREN operates three established sites: Canal Flats, Mackenzie and Prince George with a combined capacity of 160 MW. These facilities take advantage of the region's cool climatic conditions and are powered 100% by renewable hydropower. Originally designed for Bitcoin mining, these sites are being successively modernized to also provide GPU-based computing power for AI applications.

Oklahoma (USA) - Future expansion

This site is currently still under development.

- Planned capacity: A massive site with up to 1.6 GW potential on an area of around 2,000 hectares.

Sweetwater, Texas (USA)

Sweetwater represents IREN's next expansion boom. With a total potential of up to 2 GW, it is one of the largest data center projects in the world. The first phase (Sweetwater 1) with a capacity of 1.4 GW is scheduled to go online in April 2026. This site serves as a strategic reserve to meet the enormous long-term demand for data centers for NVIDIA Blackwell clusters and other energy-intensive AI hardware.

Despite its size, 100% renewable energy is also used here.

Childress, Texas (USA)

This is IREN's flagship center and technological pioneer. The site is specially designed to meet the requirements of high-performance computing (HPC) and AI applications. Part of this infrastructure, namely 200 MW, is leased to Microsoft under a capacity contract.

With a target capacity of 750 MW, the data centers in Childress accommodate a considerable amount of capacity that has not yet been contracted. These data centers have state-of-the-art direct-to-chip liquid cooling. As I didn't know what this was either, I will briefly explain why this is an advantage for IREN

Direct-to-chip liquid cooling

A short excursion into the technology behind data centers, simply to show one aspect of why the company is at the forefront of technology...

In a standard data center used for conventional Internet applications or cloud storage, the power consumption per server cabinet (rack) is usually only 5 to 10 kW. Even state-of-the-art facilities recently built for the first AI chips (such as the NVIDIA H100) have reached their physical limits at 40 to 60 kW.

In Texas, for example, IREN has a power density of 200 kW per rack. This marks an extreme technological leap compared to conventional IT infrastructure, because at 200 kW, IREN delivers 20 to 40 times the energy density of a normal data center and 3 to 5 times the density of the latest technology standard.

This enormous concentration of energy in a very small space is necessary to operate the latest NVIDIA Blackwell systems efficiently. Since a single Blackwell chip can consume over 1,200 watts and up to 72 such GPUs work together in a modern server cabinet (rack), heat is generated that could not be cooled with air cooling and fans. IREN therefore uses direct-to-chip liquid cooling, in which the coolant absorbs the heat directly at the processors. This not only saves a massive amount of space - as the computing power is bundled much more compactly - but also greatly reduces the energy loss for the cooling itself, which helps IREN to increase margins and be more cost-effective. This means that IREN will be able to use the latest chips in the future, while other providers will have to go to the trouble of retrofitting. However, if this were the only competitive advantage, then I would not be invested. The following is much more important:

AI capital expenditure

As I wrote at the beginning, capital expenditure on artificial intelligence is increasing from quarter to quarter. All major tech companies are pumping the money they earn from their current business into the expansion of new data centers and the development of new AI models. This year alone, the figure is expected to be around USD 2,500 billion (!) and rising. Just for comparison, the German government's infrastructure program, which is spread over many years, comprises around $600 billion (500 billion euros in debt)...

But what is this money actually being spent on? The first thing that comes to mind is certainly correct: chips on which all the AI models are trained and operated.

Who benefits from this? Clearly NVIDIA, and to a lesser extent other chip manufacturers such as AMD. NVIDIA had supply problems for a while, but is now able to deliver again and can still claim a margin of over 70%.

But what else do you need? Memory chips. Neglected or overlooked for a while. However, if you look at the share price performance of SanDisk, Micron or Western Digital, you can see that money is increasingly being invested in the secondary, downstream products and companies, such as memory chips.

The subsequent shortage did not lead to a constant price increase due to rising demand, but to an exponential price increase of several hundred percent in just a few months for memory chips. This is because most money is spent where there is a shortage.

And now let's take a quick look at what the CEO of the world's No. 1 AI company has to say:

"The main limit for new AI growth is not chips. Instead, the main limit is power."

Jensen Huang, Nvidia CEO, December 2025

This begs the question: could it be that electricity is the new bottleneck?

Energy as the new bottleneck

Let's take a closer look at the power consumption of data centers:

The energy consumption of data centers worldwide in 2022, the year of the ChatGPT launch, was around 460 TWH. Now I've done some research and found that the predicted energy consumption for 2030 is around two to three times higher, namely around 945 to 1100 TWH.

There is currently not even the infrastructure to generate these huge amounts of energy, let alone provide it!

This is discussed in a study by Gartner, for example. Gartner estimates that 40% of data centers worldwide will not be fully operational in 2030 due to a lack of electricity. The reason given is that network operators and energy suppliers will not be able to provide the infrastructure as quickly as the new AI servers are installed.

What does this mean? Many data centers will not be able to connect to the grid at all due to a lack of infrastructure, not to mention the constantly rising price of electricity and the grid fees for expansion! Even today, some projects cannot be realized simply because the mass of money is reaching the physical limits of the infrastructure. Those who already have long-term contracts now have contracts that will be worth their weight in gold in a few years' time. In regions such as Frankfurt or the data center "hot spots" in the United States, projects are already being delayed by years because it is not possible to connect to the regional power grid...

And now there is a company that already has long-term contracts with energy suppliers to purchase almost 4.5 GWH at low prices (0.028 ct/KWh in Texas). IREN has understood this and is now switching fully to AI. The data centers are being converted and talks are already being held with well-known customers. Bitcoin mining now only serves as a springboard for the new business. There is even already a deal in place with Microsoft that is quite something...

Microsoft deal

Press:

"In November 2025, IREN signed a groundbreaking 5-year contract worth 9.7 billion US dollars with Microsoft. Microsoft secures AI compute capacity (200MW) in IREN's liquid-cooled data centers in Texas (Childress), equipped with state-of-the-art Nvidia GPUs. The deal includes a 20% upfront payment."

Let's take a closer look at the deal together. Microsoft should be familiar to everyone. 9.7 billion is also not insignificant when you consider that IREN itself is only worth around 15 billion dollars. Microsoft is already paying almost 2 billion in advance, which has the advantage that you don't need too much debt and that Microsoft won't simply jump ship.

200 MW is just a fraction of what IREN can actually provide. And if the hyperscalers are already prepared to pay almost 10 billion dollars for 200 MW, then I would just like to calculate what else could be in there...

In purely mathematical terms, a full capacity utilization of 4.5 GW results in a contract volume of over 220 billion dollars over several years!

And now it gets even more absurd, the price has probably even risen again in the meantime because capacities are becoming scarcer. This means that even if, for example, only half of the data centers can be used to capacity, but all data centers are equipped with the latest chips, IREN will be able to secure contracts worth hundreds of billions of dollars.

And this is exactly what was announced at the last quarterly results. The company is already in talks with several major partners who are interested in contracts.

The advantage of the negotiations is that every month that the contracts are postponed offers the potential to get more money for the same computing power. This is because the cost of computing capacity is currently rising quarter by quarter.

That's exactly why I'm invested in this company. It's a bet that all the capital expenditure will fail because the physical power infrastructure can't grow at the same rate. If this bet works out, I still see a tenbagger possible here, even from the current level. A tripling or multiplication is even very likely.

Quarterly figures

The latest quarterly figures have confirmed this trend. Progress in the expansion of data centers is evident, but contracts are still being delayed. Bitcoin mining is becoming increasingly less relevant and, in my opinion, the debt is more than justified in view of the potential.

The company currently has debts of around 3.6 billion dollars and the debts have been concluded on favorable terms through the well-known partner Microsoft.

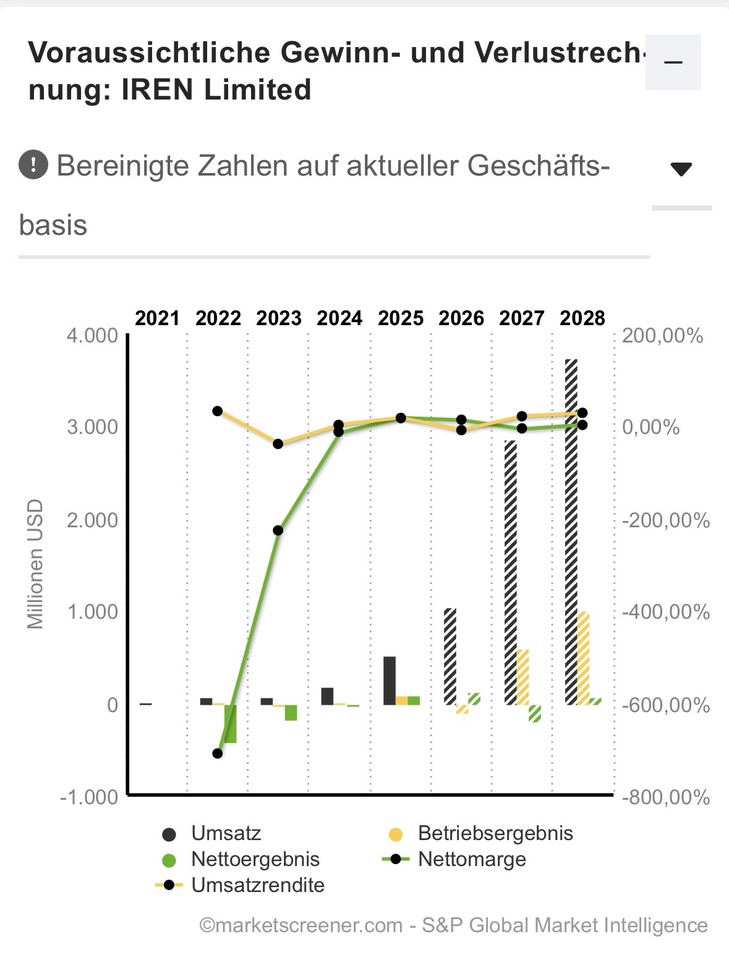

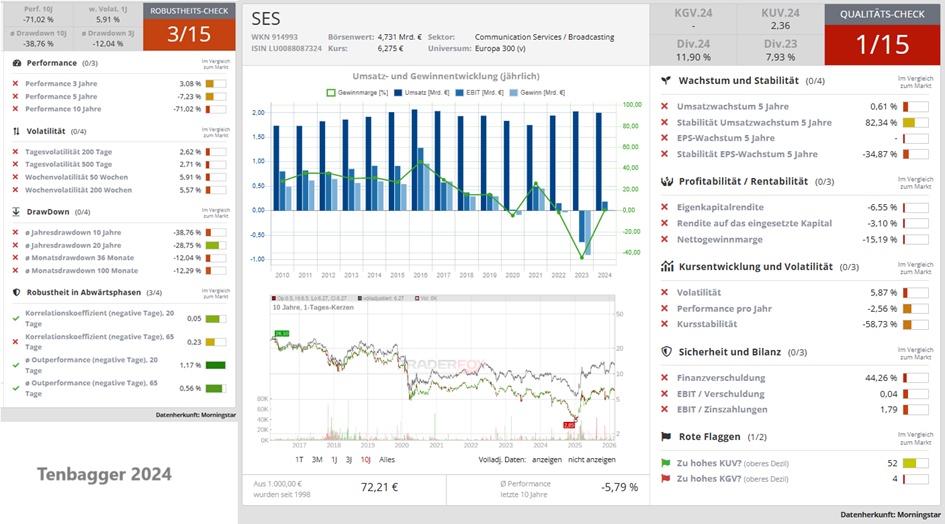

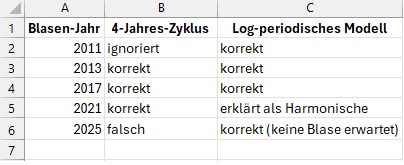

The forecasts look good at first glance, but not really attractive due to the inadequate profit development. The analysts have announced a significantly higher target price than the current share price, but I think that even these scenarios are very low in the best-case scenario. The analysts cannot yet take into account any contracts that have not yet been concluded, which is why I believe that the forecasts will have to be raised significantly several times over the next few years...

I won't go into the latest quarterly figures in such detail here because I think this article has already become too long for most of you 😏 Sorry...

Conclusion

IREN is my bet that the energy infrastructure will be the next bottleneck in the AI boom. Even if the share prices of AI companies are currently wobbling on the stock market, the figures prove otherwise. Capital expenditure is increasing quarter by quarter and the big tech companies are investing huge sums in the expansion of the AI infrastructure. I think that sooner or later, the hyperscalers will be forced to team up with companies like IREN in order to get any computing capacity at all.

The share is certainly not a sure-fire success that you can leave in your portfolio for the next 50 years, but I think that this strategic position provides a certain amount of leverage on all the AI expenditure. Around 20% of my portfolio is invested in the share and I will remain invested because I currently consider the share price to be relatively cheap. It might also be interesting to know that around 10% of the shares are held by the founders...

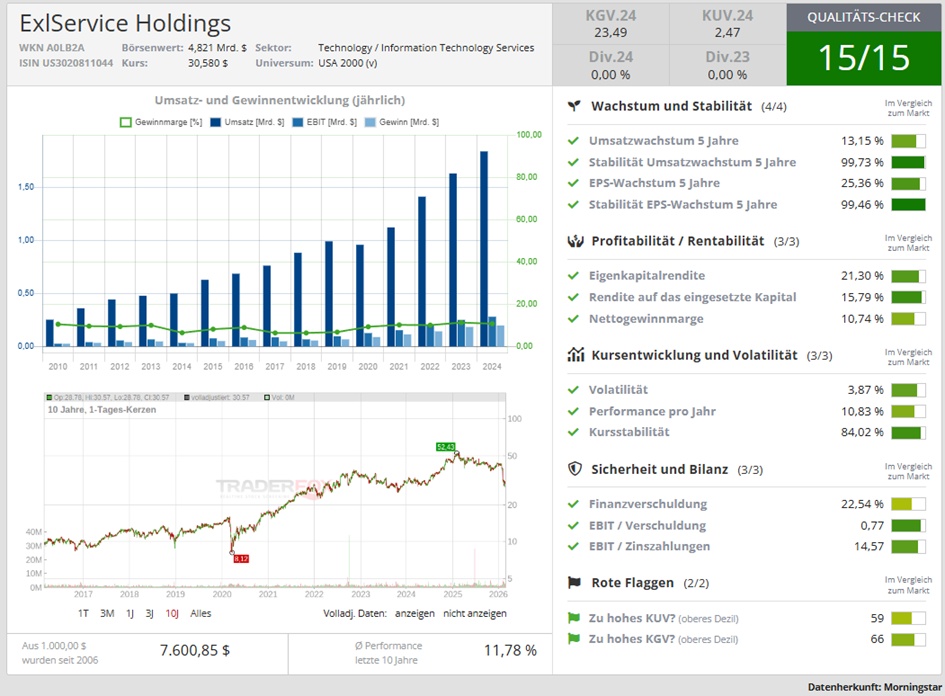

Perhaps a brief answer to the question of why I didn't opt for Nebius, for example. Firstly, Nebius has a different focus and is more broadly positioned and secondly, it has significantly less electricity contractually secured for computing power. So my thesis could only be realized in part.

There are of course risks, such as an abrupt end to the expansion of AI or a new, very energy-saving chip solution, but the opportunities clearly outweigh the risks for me in this case. As already mentioned, I see the debt as justified due to the chances of several hundred billion dollars in sales...

I hope I haven't bored you and you've understood why I'm invested here and why I see leverage in the AI market. Since I've spent a few hours researching, why don't you take the trouble to write me in the comments whether you share the thesis or why you don't share it... 🤝

Feel free to leave me feedback and write what you think...

LG KleinAnleger 😊✌️

Sources

https://www.gartner.com/en/newsroom/press-releases/2024-11-12-gartner-predicts-power-shortages-will-restrict-40-percent-of-ai-data-centers-by-20270

https://ap-verlag.de/gartner-ueber-40-prozent-der-projekte-mit-agentischer-ki-werden-bis-ende-2027-eingestellt/96908/

https://www.golem.de/news/ausfaelle-energiebedarf-von-ki-fuehrt-zu-steigenden-strompreisen-2411-190696.html

https://iren.com/solutions/gpu-cloud/ai-cloud

https://de.marketscreener.com/kurs/aktie/IREN-LIMITED-129472358/analystenerwartungen/

https://energiewende.bundeswirtschaftsministerium.de/EWD/Redaktion/Newsletter/2025/07/Meldung/direkt-erfasst.html

https://www.socomec.de/de/loesungen/maerkte/unsere-loesungen-fuer-rechenzentren/wie-hoch-ist-der-energieverbrauch-im-rechenzentrum

https://internet-weekly.de/stromversorgung-2030-droht-stromknappheit-bei-stockender-energiewende/

https://de.statista.com/infografik/amp/34392/weltweiter-stromverbrauch-von-datenzentren-nach-ausstattungsmerkmalen/

https://www.finanzen.net/schaetzungen/iren_1

https://de.investing.com/news/company-news/iren-schliest-milliardenschweren-gpucloudvertrag-mit-microsoft-93CH-3213067

https://www.kapitalmarktexperten.de/iren-aktie-positive-aufwaertsbewegung/

https://de.finance.yahoo.com/nachrichten/microsoft-schließt-ki-deal-rechenzentrum-115435320.html

https://www.sonnenseite.com/de/energie/der-weltweite-strombedarf-wird-bis-2030-stark-ansteigen/

$IREN (+1,41%)

$NBIS (+5,18%)

@Tenbagger2024

@HoldTheMike

@Multibagger

@Hotte1909

@Semos25

@value_crafter_1628

@Shiya

@Aktienfox

@TheWorst

@TomTurboInvest

@TradingHase

@ImmoHai

@Seven0815

@Iwamoto

@SAUgut777

@EpsEra

@BamBamInvest