Everyone has long been recommending to put most of your 'foundational ETF' money in some sort of All World ETF . For years this has been a great approach, and for good reason. It's easy, low cost, low maintenance. But times have changed and I've been noticing a decoupling between the US and the rest of the world. The US is overpriced and slowing down and the USD/EUR valuation sucks. So late last year I changed my strategy and decided that I wanted to build my own All World ex-US ETF, because I've always learned to trade the market you have, not the market you want.

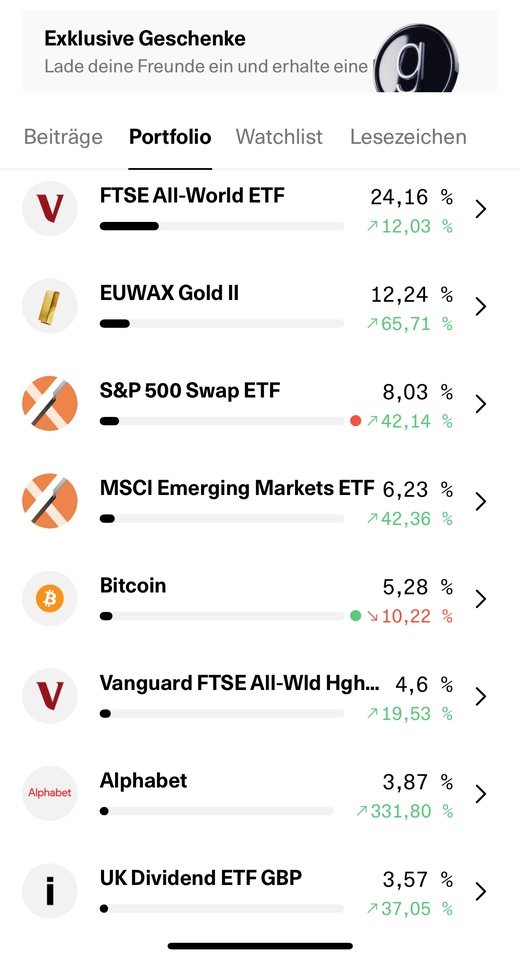

So I sold my $VWCE (+0,68%) position and compiled my own ETF pack. Europe to start with, $SMEA (+0,25%) and $ESIN (+0,07%) , then Emerging Markets, Asia and the Pacific ex-Japan consisting of $IEMA (+2,8%) and $VAPU (+1,41%) , and Japan $VJPB (+0,45%) . I've been distributing these more or less equally to what the FTSE All World would have looked like without the US. It needs some restructuring every now and then but to me it's more than worth it when you look at the rewards:

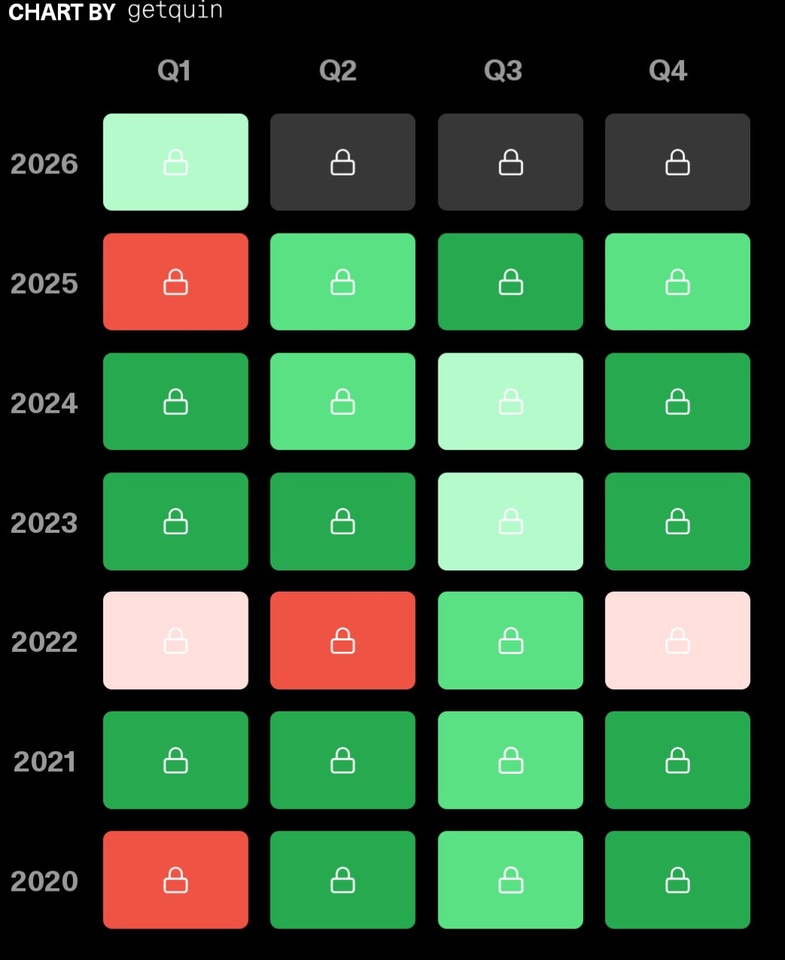

I currently made a YTD performance of about 16% with my "custom ex-US ETF", compared to only 4.3% if I kept the $VWCE (+0,68%) or $ACWI as my foundation.

”Never bet against the US” is valid, until it isn’t! That’s my opinion. Trade the market you have, not the market you want. And when times change again, I will act accordingly. But for now, I'm happy I made this decision 😁

For the record: this is a post about my ETFs and their performance, NOT about my portfolio as a whole as 47% consists of individual stocks that aren’t doing so well at the moment.

I'm keen to hear what your thoughts on this are!