This should have been my last purchase in this portfolio for this year; from March onwards, this portfolio will only run with savings plans, financed from the distributions and dividends. Savings are made, $EQQQ (+0,54%) , $WITS (+0,9%) and $IUIT (+0,89%) Let's see what it looks like at the end of the year.

Invesco EQQQ NASDAQ-100 ETF

Price

Discussione su EQQQ

Messaggi

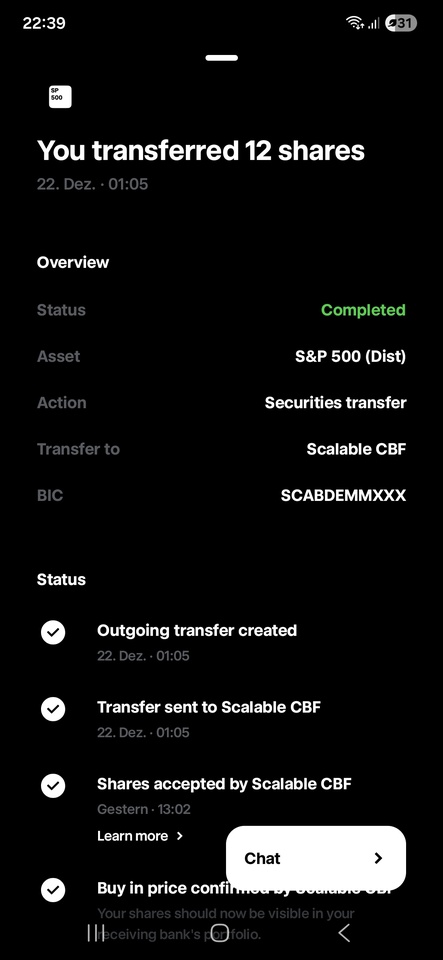

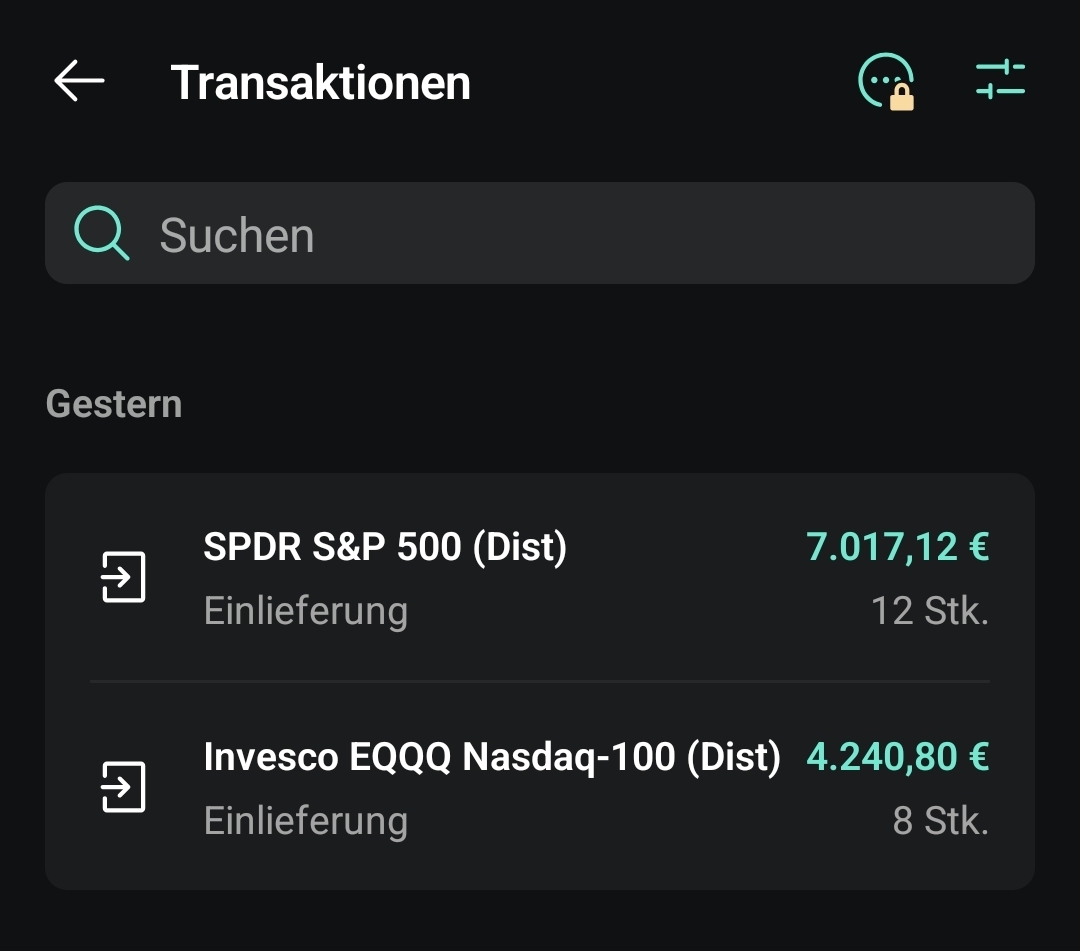

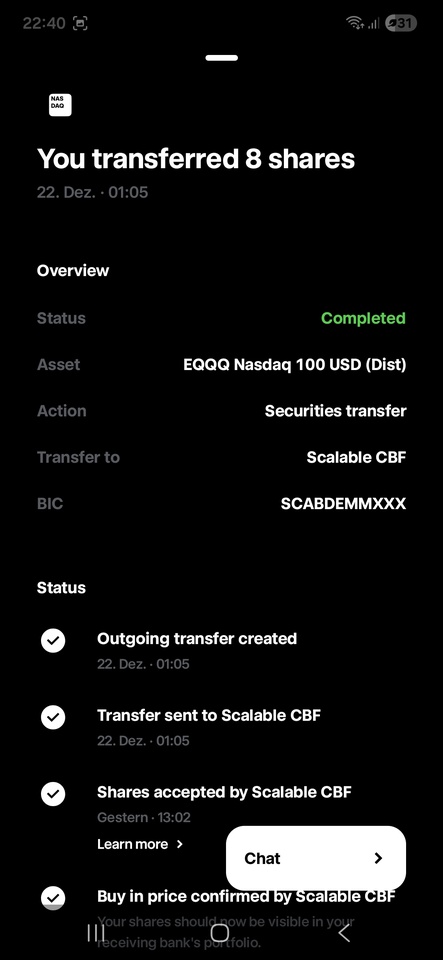

53Experience Depotübertrag trade Republic to scalable

I would like to share my experience here, which I recently made when I transferred my securities account from trade Republic to scalable. Spoiler Alert to the conclusion: you have to praise sometimes.

So scalable is currently advertising a bonus if you make a portfolio transfer. When I read that, I remembered that I had a few small shares from the $SPY5 (+0,25%) and from $EQQQ (+0,54%) at trade Republic, but the larger items are at scalable. so I thought this was the right time to combine them and take another €25 with me.

So far I've hesitated to do this because all my previous portfolio transfers, no matter from whom to whom, always required a complaint and the involvement of BaFin and it took months.

The deadline for the transfer premium ends on January 18 and I was very worried about whether it would work by then.

First of all, I realized that this was different from previous custody account transfers, where I had always placed the order with the receiving bank. Here, scalable immediately pointed out to me that I would have to do this in the Trade Republic app instead. So I searched for 10 minutes to find out exactly where to do this, finally found it, entered the data and sent it off. that was on Monday 22.12.

Today, unsuspectingly, I open the scalable app and realize that the shares are already there and the transfer is complete. And it has been since yesterday.

The initial values have also already been transferred.

Holy crap, what's going on? Has digitalization broken out or what? Not even three days and it's Christmas week.

In any case, despite all the justified complaints about Trade Republic, I think you also have to share some positive experiences. Good job.

I almost bought Novo, luckily something came up 😅

I had actually planned to buy Novo this week at around DKK 300.

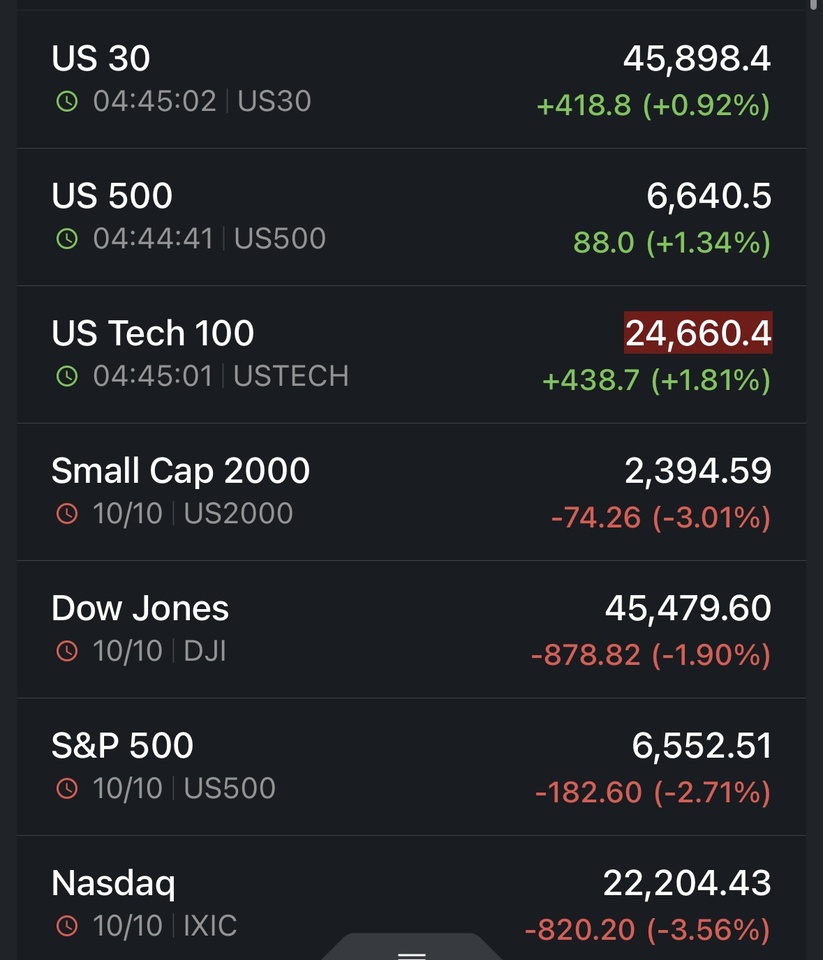

Today could have been the day, but the entire market is currently correcting.

So I'm wondering: in your opinion, are there better opportunities at the moment that should definitely be picked up?

Update:

I have then $ASTS (+0,7%)

$VST (+0,93%)

$PATH (+0,66%) and $HIMS (-3,73%) bought/repurchased

Insolvember or Moonvember after all 🌑🚀

Have a wonderful Sunday everyone!

🔔 BREAKING: The biggest de-escalation in the US-China trade conflict in years is imminent.

Under the new agreement between Donald Trump-USA and China, the following measures apply:

🇨🇳 China's measures:

1.Suspension of new export controls on rare earths

2. issuance of general export licenses for rare earths

3. "Significant measures" to curb fentanyl trade to the USA

4. suspension of all retaliatory tariffs imposed since March 4

5. suspension of all non-tariff countermeasures since March 4

6. purchase of at least 12 million tons of US soybeans

🇺🇸 Measures taken by the USA:

1.Reduction of tariffs on Chinese goods by 10 percentage points

2. extension of certain exemptions under Section 301 until November 2026

In addition:

-China will suspend all retaliatory tariffs announced since March 4 and repeal or suspend all non-tariff countermeasures imposed since then.

-China has also committed to easing export restrictions on certain automotive chips - a clear signal of a possible "thaw" in technology trade relations.

-Analysts are talking about the biggest de-escalation in the trade dispute between the US and China for years - a move that has received far too little attention so far.

Are we in for a Moonvember let us know in the comments!

Stock market - child's play?

The milestones are piling up and 99% of the price drivers are tech stocks. For over a decade, people would have simply invested in tech stocks without any analysis or knowledge and $EQQQ (+0,54%) and outperformed everything. I have also profited significantly from this. Why should you even analyze stocks and rack your brains when every dip in the tech sector, no matter how big, is bought up within months? This immediately raises the next question for me: how can there still be people who lose money on the stock market? 😕

With this in mind, copy/paste my comment that I already published this afternoon on a post similar to yours:

"If you've only been in the stock market for a few years, you definitely have a good laugh - after all, prices have only gone up and the markets have recovered from small dips like this spring within a few days. However, I would advise you not to get too cocky. Anyone who lived through the bursting of the dotcom bubble or the financial crisis remembers those times well.

It will happen again at some point. Whether it's the bursting of an AI bubble or some other event. A certain humility would do many small investors good...

But what is the point of trying to play the moralizer here? In the end, everyone has to experience this for themselves."

€5.000,00 Mark

It’s almost the and of my first year investing at 19 years old, it’s been a good time and a rollercoaster for politics but still had a fun time and I’m looking forward to 2026.

I’m planning to invest €500.00 a month in these stocks/ etf’s

$VWCE (+0,16%) : 40% ~ €200

$EQQQ (+0,54%) : 20% ~ €100

$ASML (+2,01%) : 10% ~ €50

$CRWD (+0,89%) : 10% ~ €50

$CSPX (+0,23%) : 10% ~ €50

$UNH (+0,07%) : 10% ~ €50

I have some small positions and I’m not planning to sell these but just let them run.

If you think I should change something let me know!

To celebrate the 5k mark I’m having some beers tonight… up to the 10K 🚀

Sieht ja nicht so schlecht aus vorbörslich 😁👌

$EQQQ (+0,54%)

$VUSA (+0,24%)

$CSPX (+0,23%)

$CSNDX (+0,54%)

$BTC (-2,27%)

$BTC (-2,27%)

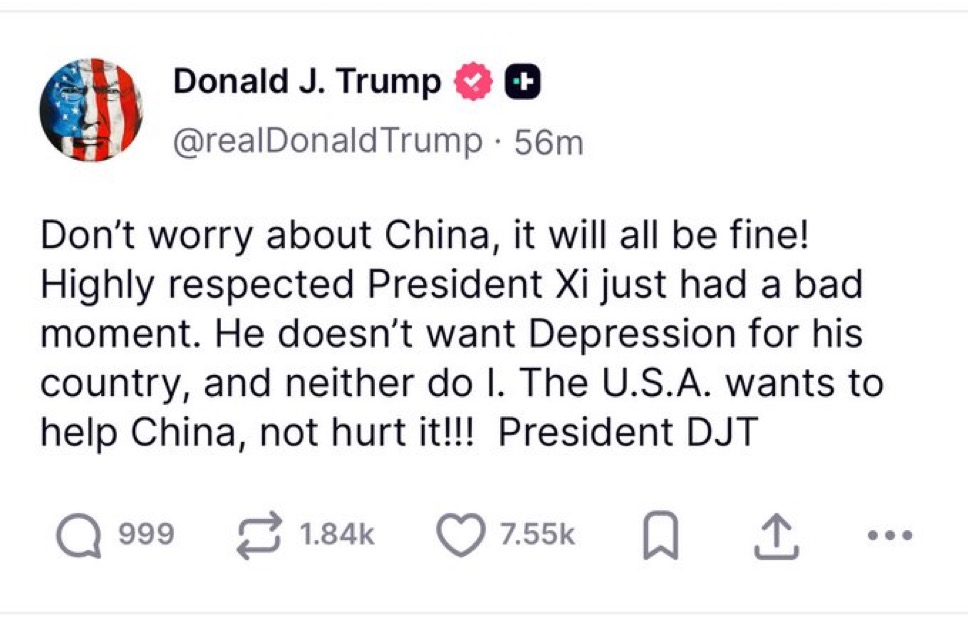

TRUMP vor kurzem in der Airforce One über China:

"I think we'll get along just fine. I have a great relationship with China. Xi had a bad moment. I'm not even saying he's wrong. But again, because of the tariffs, it's much tougher for them. 🤣

Error? What? Really, please. 🤷🏼♀️

- 50 shares $VWRL (+0,25%) bought back cheaper 😎 The rest will follow in the next few days/weeks

- $EQQQ (+0,54%) I'll wait a little longer, or maybe I'll give priority to financing 🥲

- $1810 (-1,31%) and $ARM (-0,19%) minimally topped up. Buy the dip

- $VUSA (+0,24%) - $HMWO (+0,12%) - $BTC (-2,27%) one off-plan purchase each. Buy & Hold

- My $AMD (+13,17%) short has also performed well. My other warrants have very large KO distances and are held.

(of course I'm luckier than I am smart, but on the other hand it's crazy to believe that the stock market only ever goes in one direction 🤭)

-------------------------------------------------------------------------------------------------------

It looks like I've made a terrible mistake 🤓

At the beginning of October, I sold two of my ETFs, the $VWRL (+0,25%) and the $EQQQ (+0,54%) .

I was convinced that we would see at least a short-term but significant correction in October.

And since I was planning to transfer these ETFs from Trade Republic to Flatex anyway, I thought: Sell now, pick up cheaper later 🤪

Since then, of course, the market has rallied. Fortunately, I still have the $HMWO (+0,12%) and $VUSA (+0,24%) and my shares.

My original plan was to sell, wait out the crash and then get back in. Due to the broker's fee model and position size, I would have bought back the NASDAQ in one transaction as a savings plan, the savings plan is still active on October 23 and I could have bought back the All World flexibly in large tranches as there are no order fees at all.

At the moment, however, it looks as if the plan won't work out 🥲

The total amount is €20,000. I transferred € 9999 of this to my account without any problems (no proof, no delay, approx. 24 hours) and € 7500 of this to Flatex for the QQQ on the 23rd .

The rest is still with Trade Republic and is even earning a little interest there. I hope I don't have to wait until November to get the rest of the money out of Trade Republic without any problems...

Now I see the following options:

1) Put everything into All World right away.

I can buy the NASDAQ later with fresh capital if there is another setback.

2) Pay off the last financing.

I have around €10,000 outstanding, with a monthly installment of €238.

Apart from that, I am debt-free.

The interest rate is around 6-7%, plus hidden costs such as account management fees and endowment insurance.

So it would be worth considering closing the loan completely, but that would leave very little capital for ETFs.

3) Stick to the original plan

Uptober isn't over yet 🥲

4) All in $NVDA (-0,52%) 🤣

5) Gradually in with a savings plan.

6) Or will the seasonal setbacks only occur from January/spring 2026?

Which options do you think make sense? What are your thoughts?

Titoli di tendenza

I migliori creatori della settimana