Hardly gives way $HIMS (+0,7%) for $ONDS (+2,79%) the project is doing well again. 📈

Let's take a look at the current status of the project together Tenbagger der Zukunft together:

As a reminder, the project started with around €2,500, which was divided almost equally between the five titles in the portfolio.

$HIMS (+0,7%) was completed with almost exactly 50% loss was sold. For the new value $ONDS (+2,79%) was topped up again to €500 - in the end, 64 shares ended up in the Tenbagger portfolio.

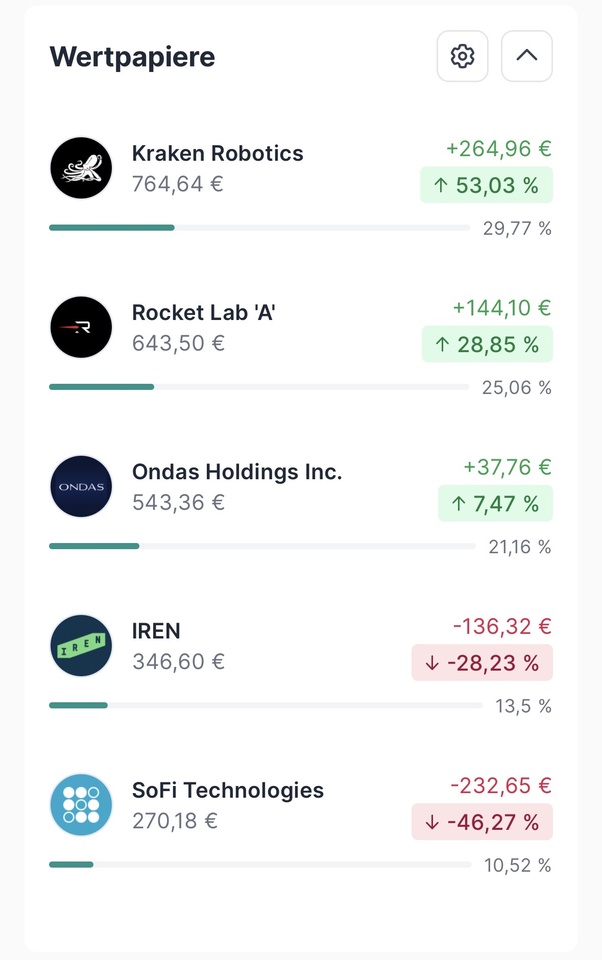

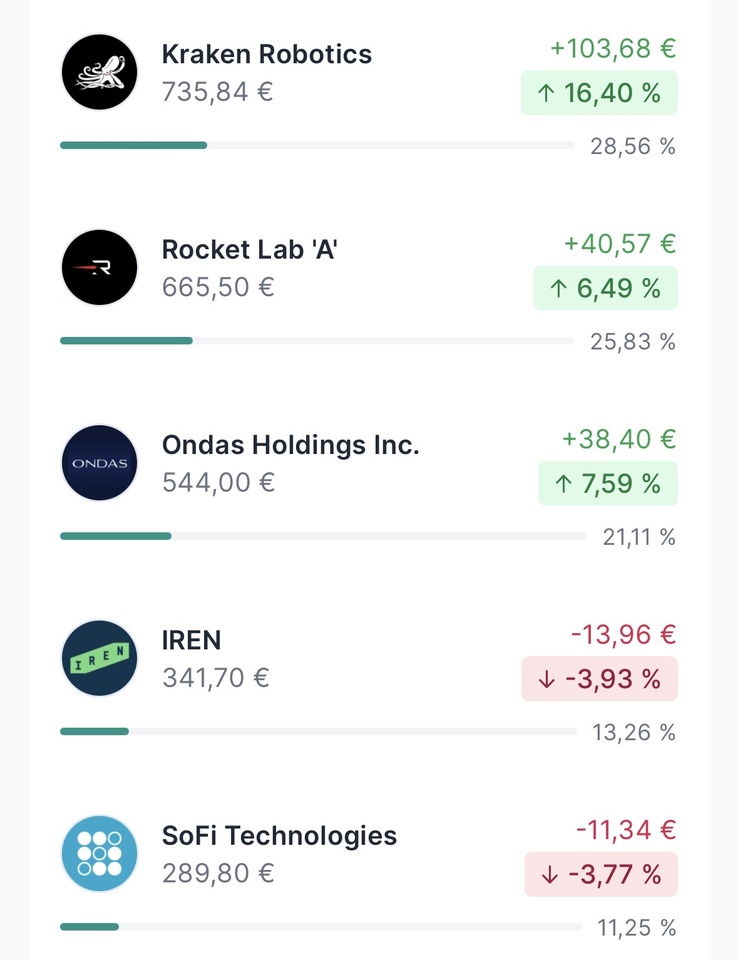

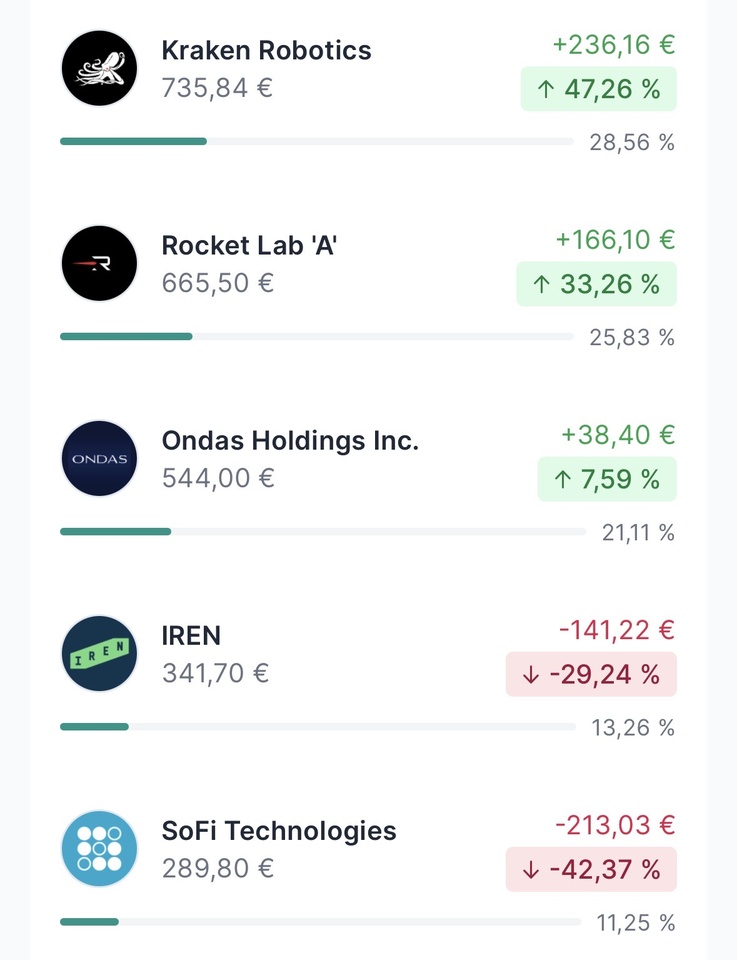

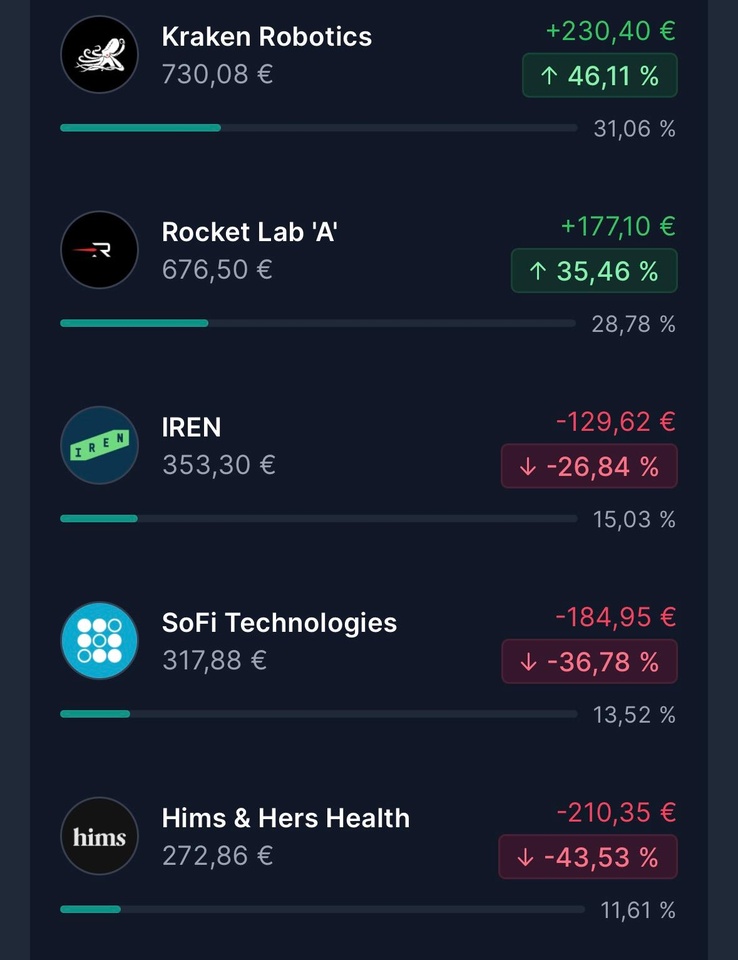

Below are the five values of the project selected by you and their development to date since 12.11.2025:

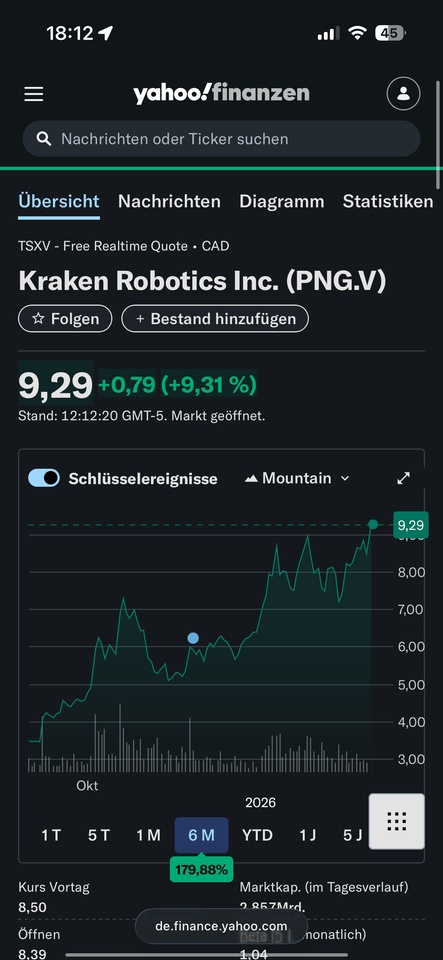

- Kraken Robotics +47% 📈

- Since last week: +16% 📈

- Rocket Lab +33% 📈

- Since last week: +6% 📈

- Ondas Holdings +8% 📈

- In the portfolio since Tuesday

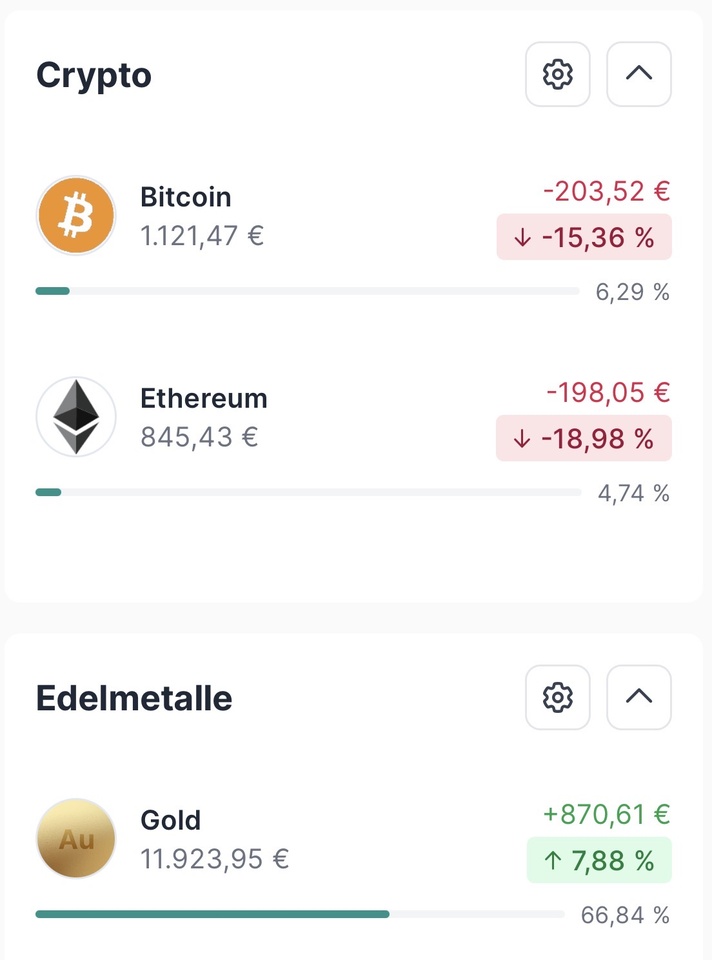

- Iris Energy -29% 📉

- Since last week: -4% 📉

- SoFi Technologies -42% 📉

- Since last week: -4% 📉

Since start:

Last 7 days:

This week was able to $PNG (+0%) catch up well and $RKLB (+1,26%) from the throne.

Bringing up the rear, as so often $IREN (+4,15%) and $SOFI (+1,55%) which are among the most volatile stocks in the project.

_________________________

The beta value is: 2,08

The beta value (β) of a share measures its performance

Marktvolatilität compared to the overall market: a beta of 1 means the share moves in sync with the market; a beta > 1 means it fluctuates more (e.g. at 1.5 it rises or falls by 1.5 % if the market rises/falls by 1 %); a beta < 1 shows less fluctuation, while a beta < 0 indicates an opposite movement to the market. It helps investors to assess the systematic risk (market risk) of a share.

_________________________

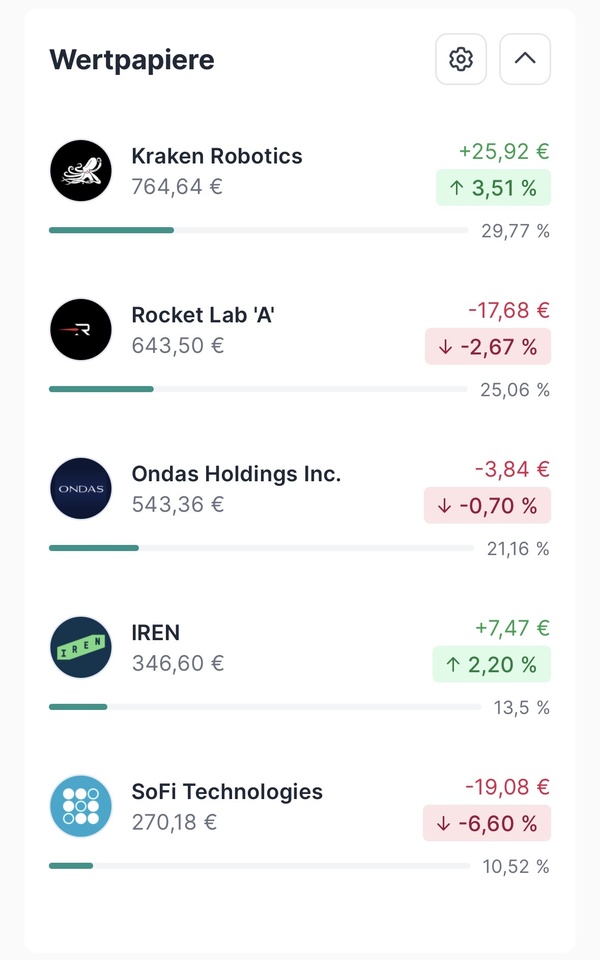

Due to the sometimes high volatility, the stocks are represented as follows

Rocket Lab: 26%

Kraken Robotics: 29%

Ondas Holdings: 21%

Iris Energy: 13%

SoFi Technologies: 11%

_________________________

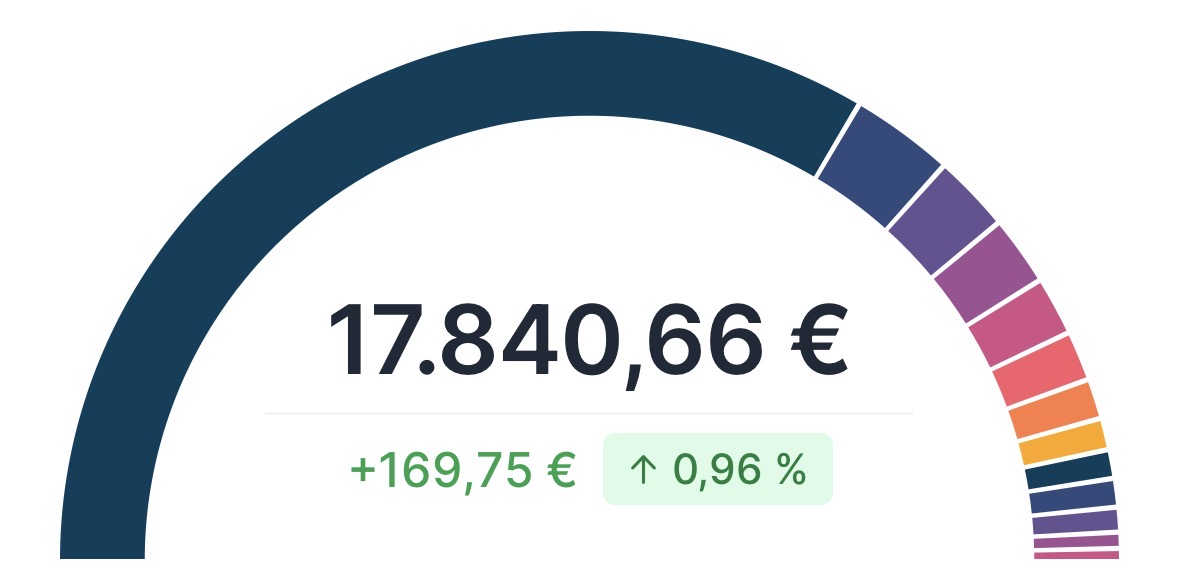

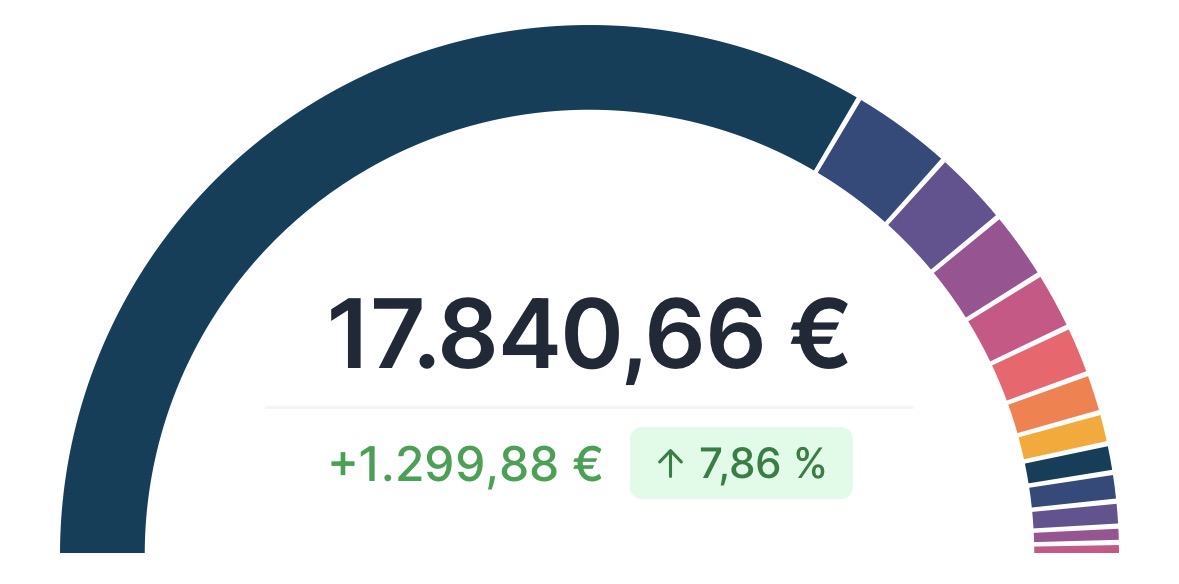

Return without taking into account the loss of $HIMS (+0,7%):

The return with consideration of the loss of $HIMS (+0,7%) is -6.5% 📉

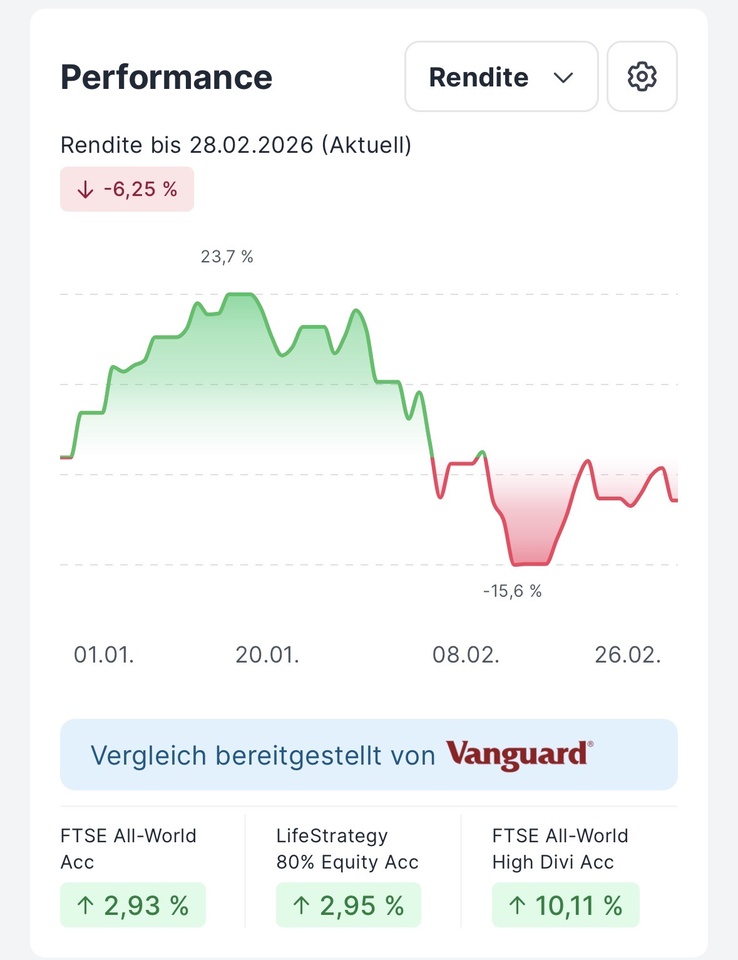

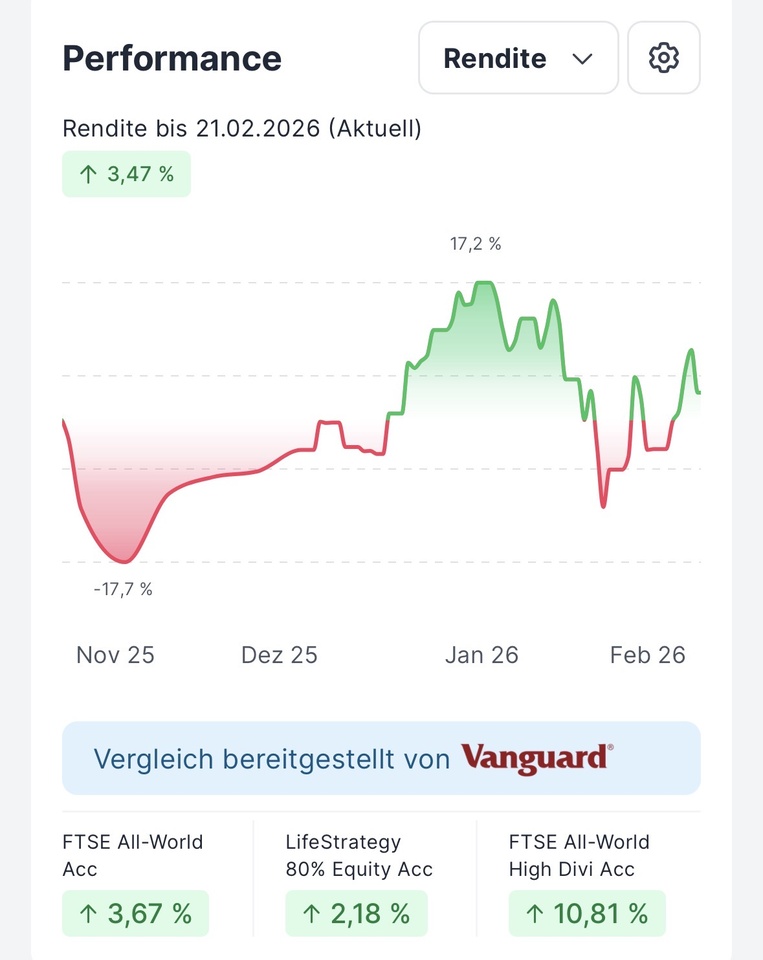

Since the start of the project:

The return on the portfolio is (without taking into account the loss of $HIMS (+0,7%) ) is currently positive and stands at +3,5% 📈, at the last update it was still at +4,7%📈.

The return on the portfolio is (with taking into account the loss of $HIMS (+0,7%) ) is currently negative and stands at -6,5% 📉, at the last update it was still at +4,7%📈.

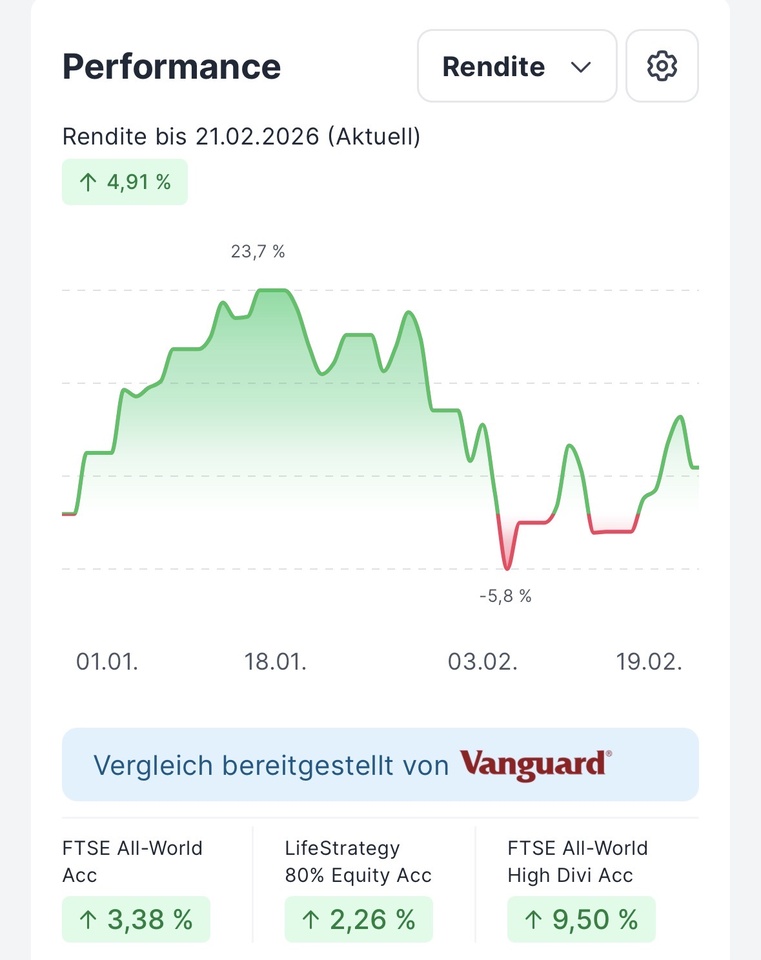

The yield reached its lowest point on 21.11. at -17,7% 📉, the high on 16.01. with +23,7% 📈.

Since the beginning of the year (without taking into account the loss of $HIMS (+0,7%) ):

+4,9% 📈

Since the beginning of the year (with taking into account the loss of $HIMS (+0,7%) ):

-5,1% 📉

_________________________

Below is the trend over the last ten days:

What do you think? Do you already have any guesses as to where we will be at the end of the year?