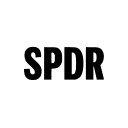

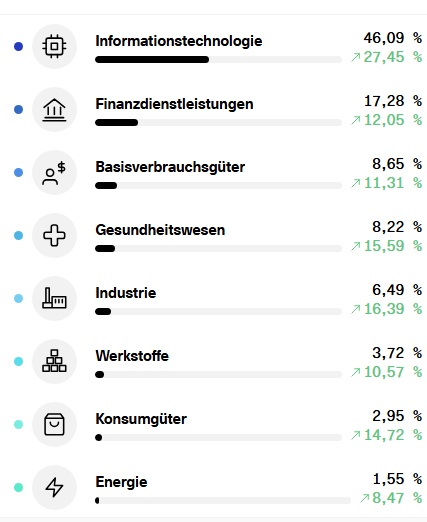

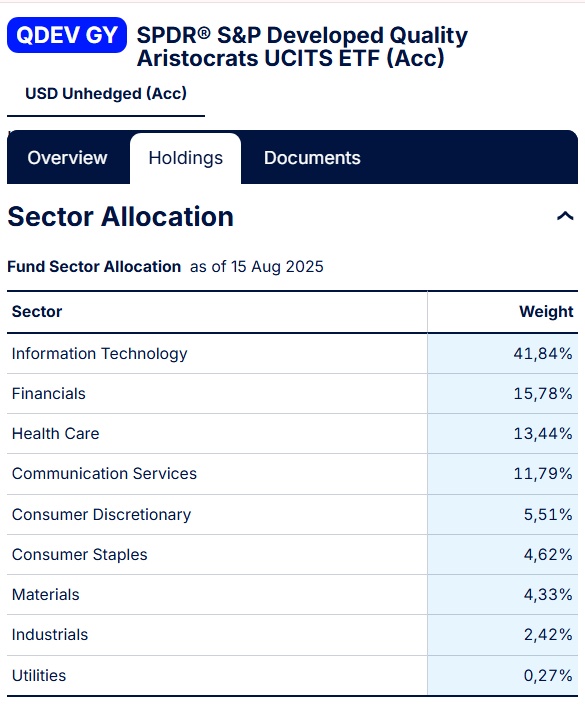

Following the rebalancing of the S&P Quality Aristocrats last Friday, the following stocks were removed from or added to my two ETF indices (50% weighting):

New additions:

$QDEV (-0,79%): $NOVN (+0,53%) , $REL (-0,17%) , $ITX (-0,89%) , $LSEG (+3,82%) , $DB1 (+2,35%) and more

$QUS5 (-0,46%): $BKNG (-0,39%) , $MRK (-0,2%) , $CRM (+2,18%) , $UNP (-1,66%) , $COR (+3,3%) , $CAH (+2,31%) and more

Kicked out of both indices and therefore according to S&P no longer Quality Aristocrats are among others: $BATS (+1,97%) , $7974 (-0,2%) , $HD (-2,37%) , $LOW (-1,52%) , $HLT (+0%)

In addition, the allocation of all individual stocks in the indices was reduced again to max. 5 % was limited.

Thanks to the recent rally of $$HY9H (-7,12%) my current top 10 weighting (ETFs+shares) is as follows:

3.48% Alphabet

3.04% SK Hynix

3.04% Broadcom

2.93% Meta

2.75% Microsoft

2.71% Apple

2.71% NVIDIA

2.55% Taiwan Semiconductor

2.13% Mastercard

2.08% Visa

New portfolio key figures:

P/E: 27.1 (<30) 🟢

Forward P/E: 21.1 (<25) 🟢

P/Β: 11.5 (<5) 🔴

EV/FCF: 28.7 (<25) 🟡

ROE: 42% (>15%) 🟢

ROIC: 19% (>15%) 🟡

EPS growth for the next 5 years: 15% (>7%) 🟢

Sales growth for the next 5 years: 9% (>5%) 🟡

My internal rate of return is currently 20.19%