Today I reduced my semi-ETF by 20% to bring the weighting from 15% to 10%.

No single position has a total weighting (ETF+single stock) above 5%, which is also my threshold. I always want to stay below 5% exposure.

My forward P/E of the portfolio has also fallen to 23, which is below my target of <25, despite the high tech allocation.

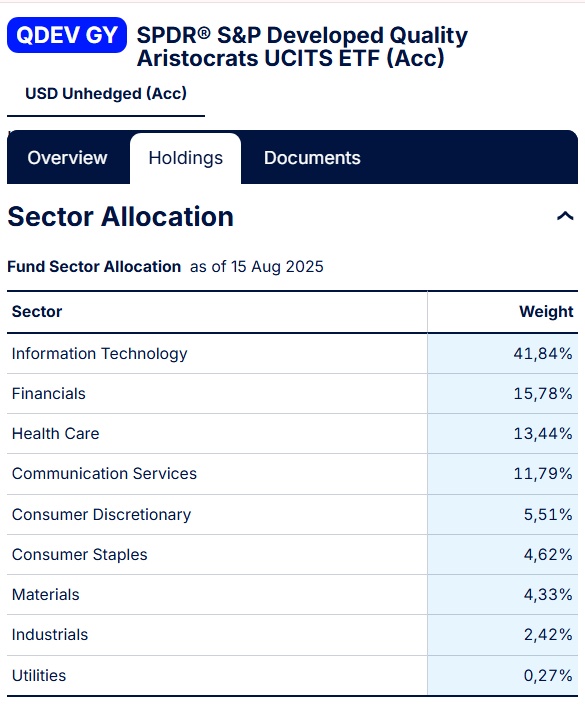

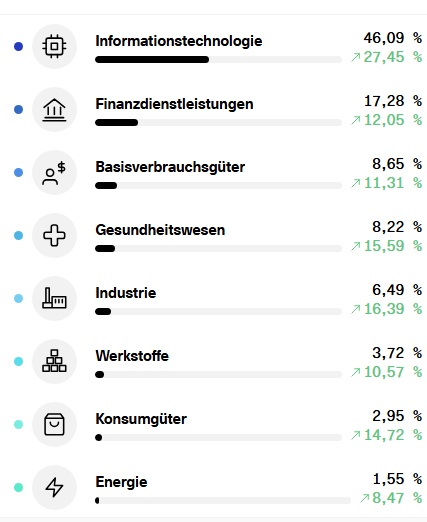

This means that my tech sector weighting is now in line with my world ETF $QDEV (+0,75%)which contains around 40-49% tech. I'm happy with that. I'm just still tech-bullish.

I have also reduced the USA region to 63%, almost identical to my world ETF (61%), and thus within my target range of 60-69%.

My favorites in the semi area remain anyway $TSM (+2,62%) and $HY9H (+8,21%) which I bought cheaply and undervalued as individual positions.

$NVDA (+1%) is and remains king, but I do not believe that the annual return will remain above 10% in the next few years, for this the market cap would have to grow by 400 billion every year, which I think would be difficult. $AVGO (-0,41%) currently has a P/E 5x greater than forward P/E, which shows that analysts are extremely bullish on future earnings. I am also bullish, but not as strongly, so the stock has already run very hot.

My top 10 holdings with 32% total weighting are currently:

4.95% $TSM (+2,62%) Taiwan Semi

4.65% $NVDA (+1%) NVIDIA

4.55% $GOOG (+3,65%) Google

4.47% $AVGO (-0,41%) Broadcom

2.85% $MSFT (-0,3%) Microsoft

2.63% $META (+1,59%) Meta

2.37% $AAPL (+1,51%) Apple

2.04% $ASML (+0,76%) Asml

1.95% $MA (+1,25%) Mastercard

1.91% $JPM (+0,53%) JPMorgan