While all about $MC (-0,61%) and $RMS (-0,54%) one share is flying under the radar of many investors: Prada $1913 (-7,7%) . Thanks to Miu Miu, the company is growing despite the recessionary environment. In recent years, it has achieved 17 % sales growth per year - the best figure in the industry.

Basics about Prada

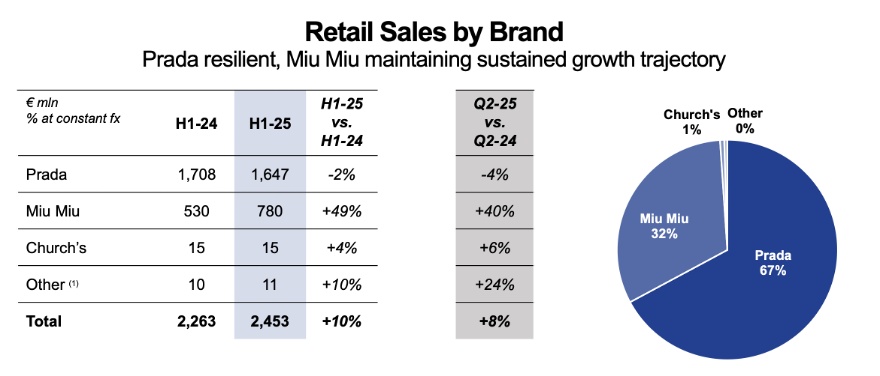

The Italian fashion group is listed in Hong Kong - which could also be a reason for its favorable valuation. In addition to Miu Miu and Prada, the company also owns other brands. However, these are not relevant for sales. Prada currently accounts for 67% of sales and Miu Miu for a further 32%.

Most of the items are produced in Italy. A small proportion is produced by "selected producers" - a paraphrase for production in low-wage countries such as China. This is the first potential risk for Prada. Made in Italy is probably the most important figurehead, together with the brand history.

The rise of Miu Miu

The brand is the reason for Prada's strong growth. It originates from Prada itself and has been experiencing a sustained boom for years. While it still accounted for 15% of sales in 2018, it now accounts for 32% - and the trend continues to rise. The larger the share of total sales, the greater the impact of Miu Miu's growth on the Group as a whole.

The combination of Prada and Miu Miu is exciting, as Prada can focus on classic and timeless fashion, while Miu Miu is more in tune with the times. The clear demarcation ensures that each brand can remain true to its target group.

This clear brand identity is important for the long-term relevance of a brand. Gucci and Louis Vuitton have been less loyal to their core customers in recent years and have sacrificed long-term brand identity for short-term growth.

Additional growth through the Versace takeover

Even though the management ruled out becoming a fashion holding company similar to LVMH some time ago, Prada took over the Italian fashion label Versace from Capri Holdings this year. $CPRI (-4,04%) The Versace takeover is to be completed by the end of 2025. Prada paid 1.25 billion euros for the struggling luxury company. The expected Versace turnover for 2025 was 810 million euros. The favorable purchase price is due to the fact that Versace is not profitable and its turnover shrank by around 20% in the previous year.

Versace has become too mainstream in recent years and, like Gucci (part of: $KER (-1,4%) ), has lost its core clientele. Prada now has the task of returning the company to its roots. In the valuation, I therefore assume that Versace will be slimmed down by 20%. More on this in a moment. Versace is a bargain overall - but only if Prada manages to bring Versace back to its roots.

Competition

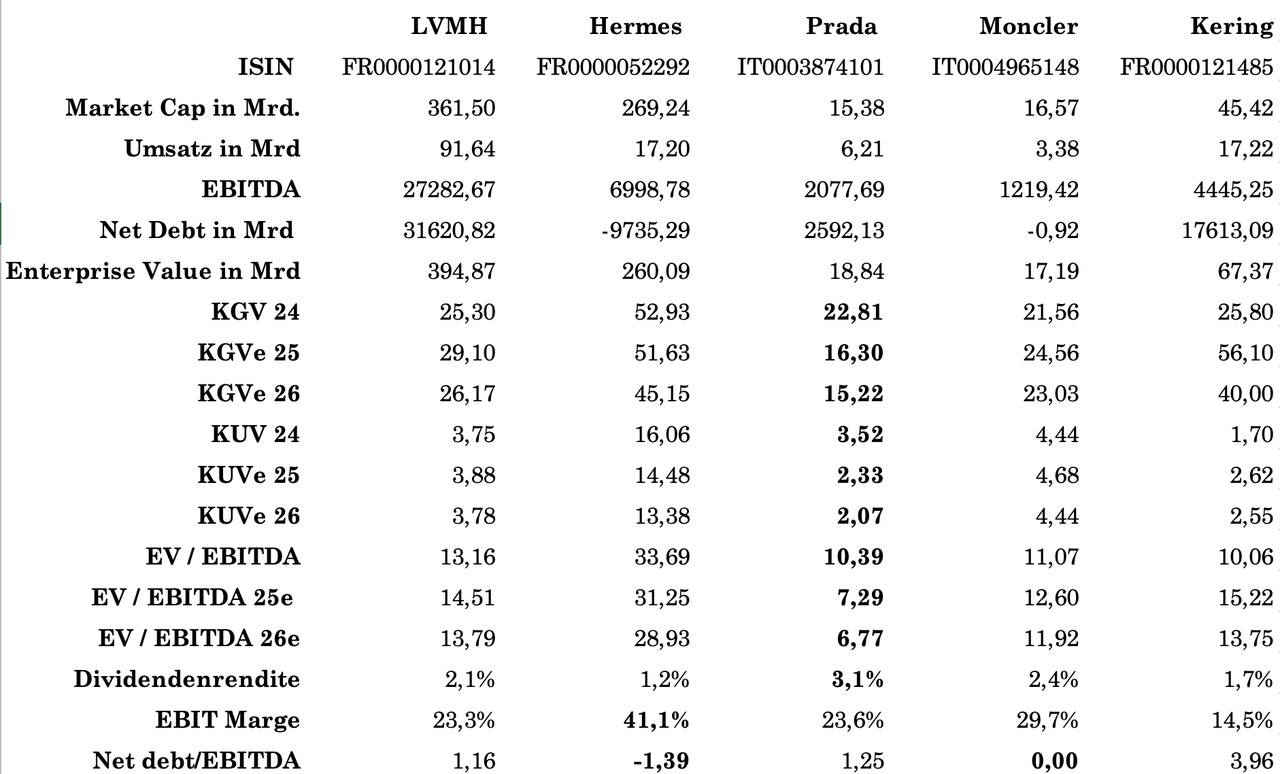

In order to better assess the current valuation multiple, I have compared Prada with its most important competitors.

It is immediately apparent that the EBIT margin of 24% is significantly lower than that of Hermès or $MONC (+1,53%) . This justifies a certain valuation discount - but However, with an EV/EBITDA of 10, Prada is worth around two thirds of Hermès. The multiples are also falling further due to the strong growth.

Prada is currently valued similarly to LVMH, but the valuation is falling much faster. There is also a 3.1% dividend yield. The debt is conservative at 1.25 net debt/EBITDA.

Valuation

The Prada brand is growing organically only slightly. Future growth depends heavily on Miu Miu. I have created a multiple valuation model to better estimate the influence of Miu Miu and Versace.

My assumptions:

- Miu Miu's growth is leveling off. Growth is expected to fall to 8% per year by 2029.

- The other brands will grow organically by 2% in line with inflation.

- Profitability will decrease due to Versace, but will recover within the next five years.

- Versace sales decline by 20% due to efficiency measures and artificial scarcity.

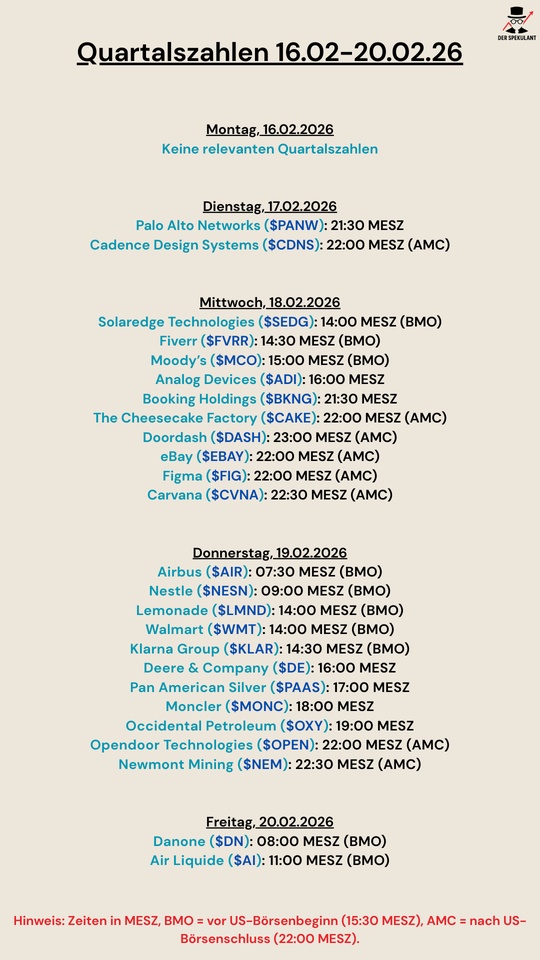

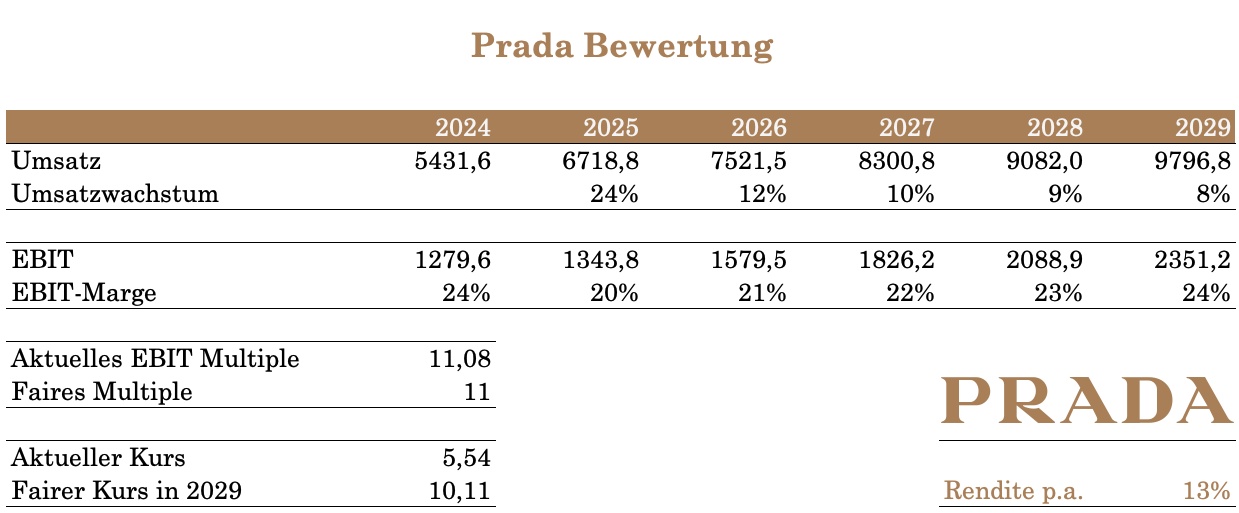

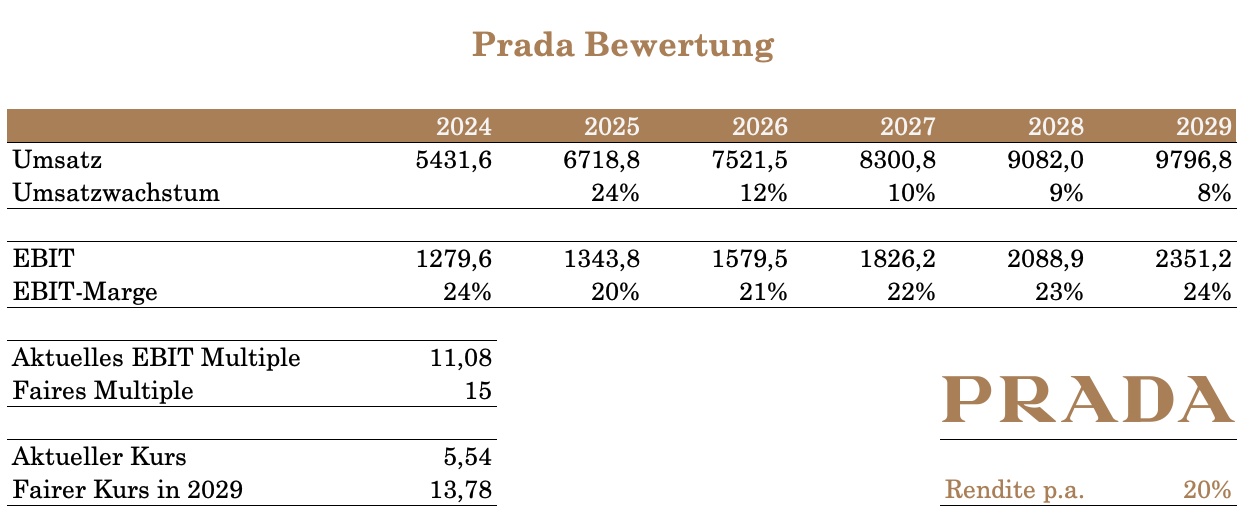

I am also of the opinion that the valuation multiple is currently too low. is currently too low. The industry is in crisis and is punishing Prada as well. In addition, the EBIT margin is currently lower. I have therefore created a conservative estimate with a constant multiple and a (for me) realistic model with a multiple increase from 11 to 14.

With multiple increase

Without multiple increase

Even without the increase in the multiple, Prada currently looks attractive. The expected return together with the products make Prada the best luxury stock in my eyes!

Note: The article contains my personal opinion and is not investment advice! The share is in my personal portfolio.

ps: this is my first post. Leave some love or constructive feedback there😘