$DPZ (-0,38%)

$HIMS (-0,67%)

$KTOS (-9,24%)

$DOCN (-4,89%)

$FME (+1,61%)

$KDP (+1,54%)

$AMT (+1,11%)

$HD (+0,84%)

$WDAY (-1,52%)

$FSLR (+2,98%)

$TEM (-2,07%)

$O (+1,13%)

$MELI (-0,16%)

$HPQ (+0,9%)

$LCID (-1,81%)

$DRO (-0,77%)

$HSBA (+1,43%)

$FRE (-0,06%)

$AG1 (+2,62%)

$CRCL (+2,48%)

$UTHR (-1,54%)

$LDO (+0,24%)

$IDR (+1,17%)

$NTNX (-3,65%)

$PARA (-1,35%)

$NVDA (+1%)

$TTD (+0,14%)

$AI (-2,75%)

$CRM (-0,11%)

$SNPS (-0,54%)

$SNOW (-3,7%)

$PSTG (+0,82%)

$ZIP (+11,17%)

$ZM (-0,43%)

$NU (+1,09%)

$RR. (+1,31%)

$MUV2 (+0,8%)

$BIDU (-1,12%)

$CELH

$DTE (+0,29%)

$STLAM (+2,73%)

$WBD (+0,08%)

$HAG (+0,69%)

$QBTS (-7,11%)

$LKNCY (+0,91%)

$BABA (+0%)

$G24 (+1,36%)

$HTZ (-1%)

$PUM (+0,37%)

$AIXA (-0,54%)

$RUN (+1,53%)

$INTU (-0,11%)

$WULF (-2,68%)

$MNST (+1,52%)

$SQ (+0,2%)

$ADSK (-1,05%)

$MP (-5,53%)

$RKLB (-6,56%)

$SOUN

$SMR

$CRWV (-9,31%)

$CPNG (+1,03%)

$DUOL

Stellantis

Price

Discussão sobre STLAM

Postos

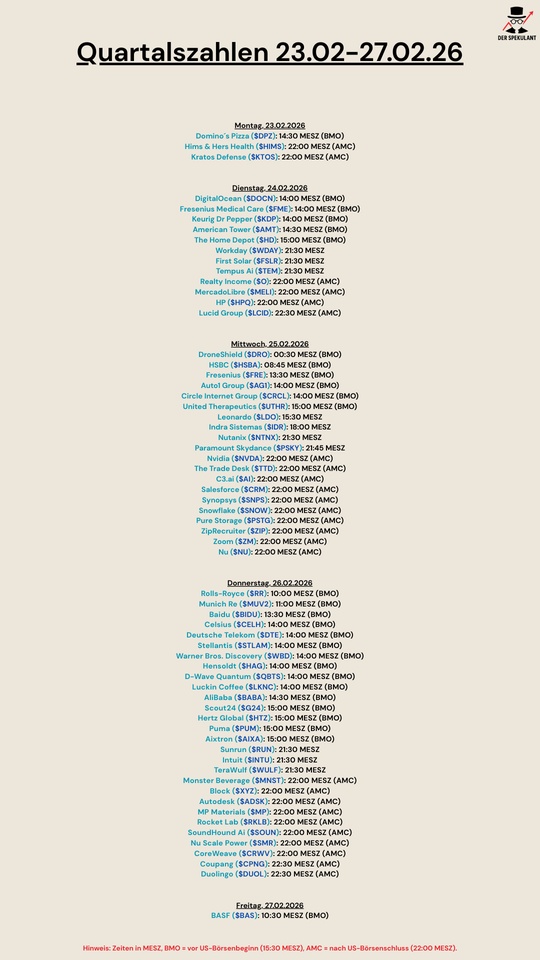

63Quartalszahlen 23.02-27.02.2026

BYD & Co. on the rise - Western car bosses speak of "existential threat" 😅

Leading managers of western car manufacturers $STLAM (+2,73%)

$GM (-0,12%)

$F (+1,37%)

$RIVN (-1,6%) among others, are sounding the alarm in the face of growing competition from China.

From the "Big Three" in the USA to European corporations $VOW (+0,93%)

$MBG (+1,16%)

$BMW (+0,52%) concerns are growing that Chinese manufacturers - including BYD $1211 (-0,75%) - could become an existential threat in the long term.

Ahead of a hearing of the US House of Representatives, the Alliance for Automotive Innovation (AAI), which represents Ford, General Motors and Stellantis, among others, warned: "China poses a clear and imminent threat to the automotive industry in the US."

The association called on Congress to maintain existing import restrictions on certain Chinese technologies, which effectively limit market access for Chinese vehicles.

Rivian CEO RJ Scaringe points above all to the structural advantages of Chinese manufacturers. "It's not that the Chinese cost structure magically works. There are really two things that you can understand very clearly," Yahoo Finance quotes him as saying. Firstly, capital costs are "close to zero in most cases", as factories are heavily subsidized. Secondly, labor costs are only a quarter to a fifth of the US level. Tariffs would currently "even out" these differences, but only temporarily.

Ford boss Jim Farley also warns of the pace of development. "We are a year behind our Chinese competitors. They are now even more present worldwide," he said. In Europe, Chinese brands recently achieved a market share of around 6.1 percent - almost twice as much as in the previous year. Farley repeatedly referred to Chinese vehicles as an "existential threat" and emphasized: "They pose a major threat to the local workforce and receive huge subsidies from the government for their exports." He added: "As a country, we have to decide what is a fair playing field."

》Companies like BYD are exemplary of this rise《

The group is expanding aggressively in Europe and other markets and is benefiting from government support and vertically integrated supply chains, particularly for batteries.

Rivian CEO RJ Scaringe points above all to the structural advantages of Chinese manufacturers. "It's not that the Chinese cost structure magically works. It's really two things that you can understand very clearly," Yahoo Finance quotes him as saying.

Firstly, capital costs are "close to zero in most cases", as factories are heavily subsidized. Secondly, labor costs are only a quarter to a fifth of the US level.

Tariffs would currently "even out" these differences, but only temporarily (as with all other tariffs, mainly to the detriment of US citizens; in Europe, the tariffs already have little to no effect and are being replaced by European factories anyway 🤫😅)

Ford boss Jim Farley also warns of the pace of development. "We are a year behind our Chinese competitors (to put it charitably 😂). They are now even more globally present," he said.

In Europe, Chinese brands recently achieved a market share of around 6.1 percent - almost double that of the previous year. Farley repeatedly referred to Chinese vehicles as an "existential threat" and emphasized: "They pose a major threat to the local workforce and receive huge subsidies from the government for their exports." He added: "As a country, we have to decide what is a fair playing field."

Companies like BYD are exemplary of this rise. The group is aggressively expanding into Europe and other markets, benefiting from government support and vertically integrated supply chains, especially for batteries.

General Motors CEO Mary Barra also criticized Canada's decision to allow up to 49,000 electric vehicles to be produced in China each year. "I can't explain why this decision was made in Canada," she said and warned: "This is becoming a very dangerous development."

Pressure is also growing in Europe. Stellantis CEO Antonio Filosa and Porsche CEO Oliver Blume are calling for CO₂ incentives to be specifically linked to locally produced vehicles. "Europe is currently witnessing the emergence of new geopolitical rivalries," they wrote. "Trade, technology and industrial capacities are being mobilized more than ever to serve national interests. The European Union must choose a path quickly." (clearly they are already building in Europe and then the single market should be taxed 🤷🏻♂️🫣😂👍🏻)

Industry experts expect Chinese manufacturers to further accelerate their expansion in view of the saturation of their domestic market. For Western car manufacturers, this is not just about market share - but about the strategic future of their existence.

》Conclusion《

Whining at the highest level, first they all sleep through everything, then it's all about the money and then they wake up and whine about why nobody woke them up, that's how disenchantment with politics/lobbying works 🤷🏻♂️

The Chinese will literally overrun us, but cheers to the management, lobbying and, above all, the politicians who made this possible in the first place 🤫👍🏻😂

❌ No shopping this month

Hi, for this month I decided not to buy anything but I still loaded €750 into the account, I have many companies on my watchlist and for this month I decided not to make any rash moves and take some time to analyze them, next month I will make up for it with a €1750/1850 purchase, what have you done or what will you do this month? What have you bought or sold?

In any case, the companies I am keeping an eye on are. $STLAM (+2,73%) , $NOVO B (-2,32%) , $ORS (-0,37%) , $NWL (+1,02%) , so an industrial, a pharmaceutical and 2 small caps in the food sector, these are the main ones but I also watch a lot of American consumer staples.

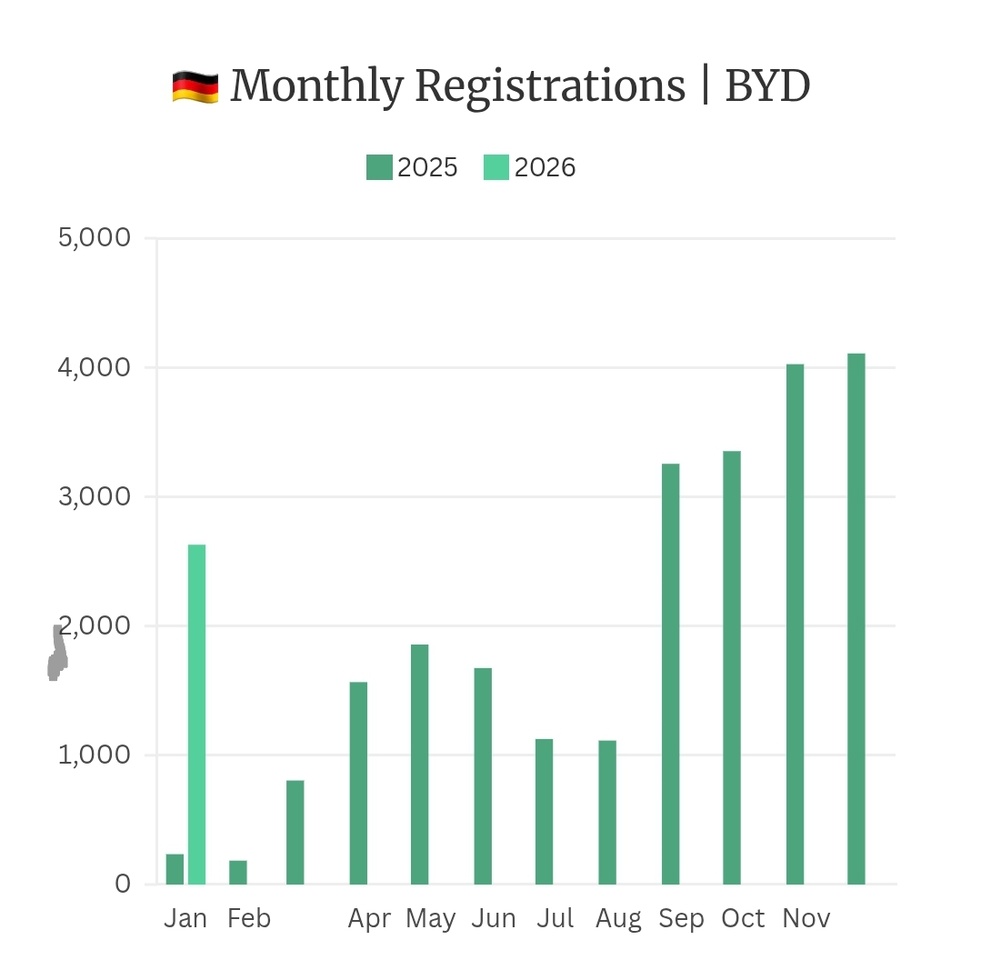

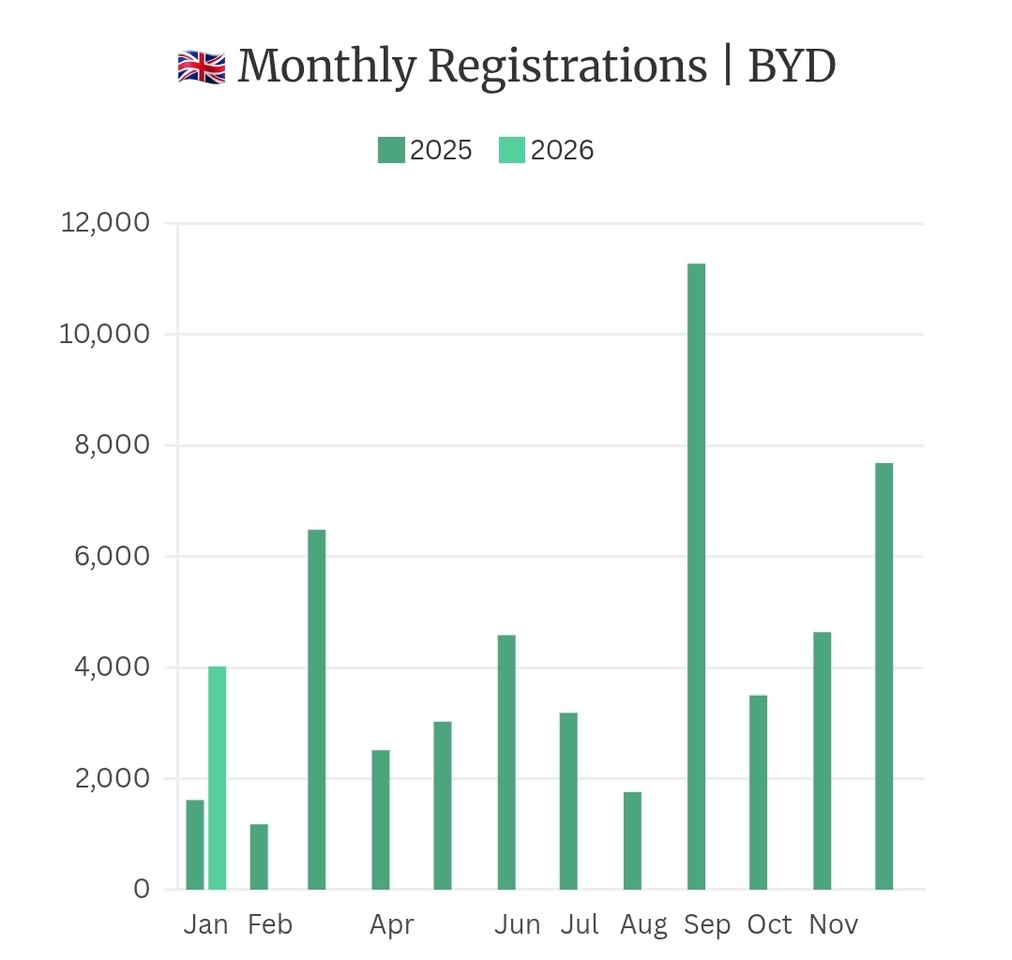

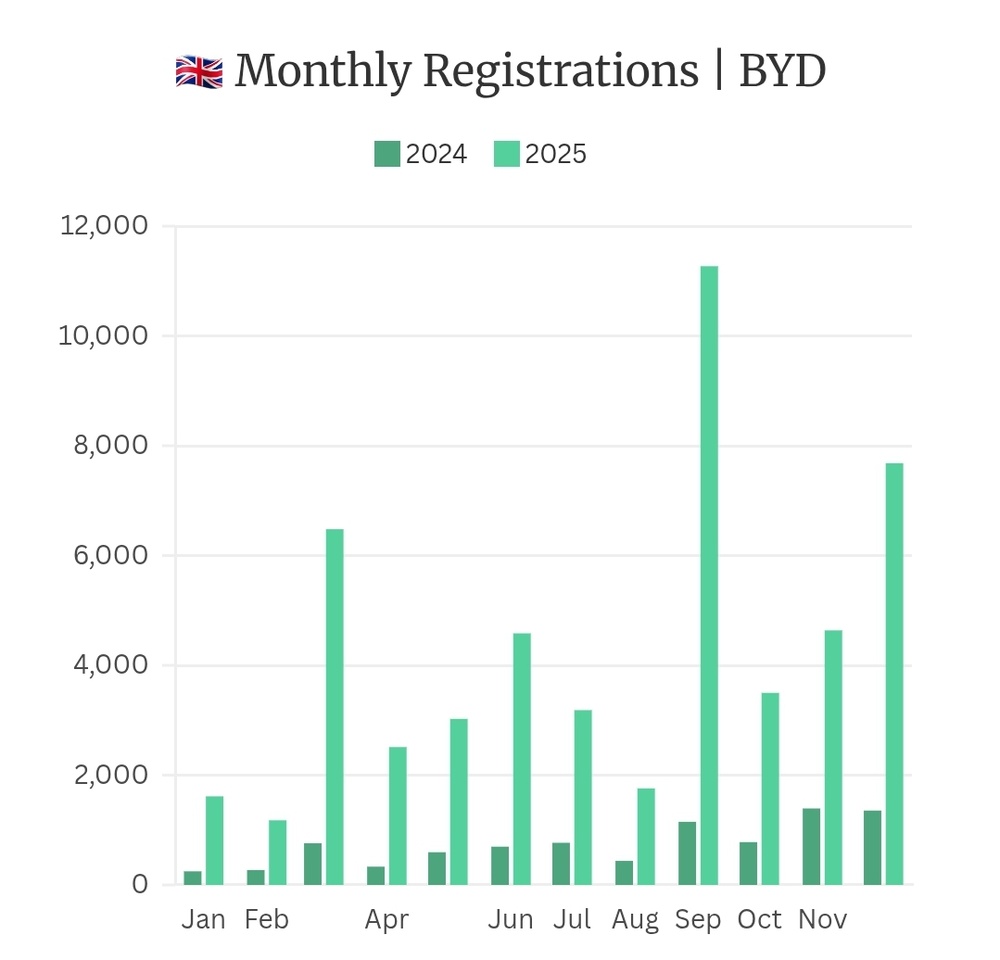

BYD sales doubled in the UK in January and jumped in Germany

The sales of BYD$1211 (-0,75%) in Germany and the UK - the two largest automotive markets in Europe - increased significantly in January.

In the German market, the Chinese giant's vehicle registrations rose by over 1,000%, while they doubled in the UK.

BYD entered both markets in early 2023, but sales figures only began to rise last year, when monthly registrations consistently exceeded 1,000 units.

According to the monthly registration figures published by the Society of Motor Manufacturers & Traders (SMMT), the BYD Seal U DM-i plug-in hybrid ranked sixth among the best-selling models of all drive types.

The model sold 2,550 units - that is 63.4% of all BYD sales in January.

The brand offers ten models in the UK: five battery electric vehicles (BEVs) and five plug-in hybrids (PHEVs).

The model range consists mainly of sport utility vehicles as well as the Seal saloon and the Dolphin and Dolphin Surf compact city cars.

While the SMMT does not provide a breakdown of figures by model or drive type, data from the EU EVs platform, which records electric vehicle registrations, shows that 1,285 of the total 4,021 units sold in January were all-electric.

This means that BEVs accounted for 32% of registrations and that while PHEVs made up the remaining 68%, PHEV models other than the Seal U only accounted for 4.6% of sales.

According to the platform, the Seal saloon was the best-selling EV in the range with 318 units registered in January.

Tesla $TSLA (-0,19%) saw both year-over-year and month-over-month sales decline, as 718 vehicles were sold last month - 51% fewer than a year ago.

The Geely $175 (+0,33%) backed Polestar, for which the UK is one of its largest markets, saw a 43% increase in sales compared to 2025 with 1,070 units registered in January.

》Figures for 2025《

BYD was the best-selling new energy vehicle (NEV) brand in the country in 2025, with the exception of traditional carmakers and the originally British, now SAIC-backed MG brand.

Last year, sales increased almost fivefold to 51,422 units - a staggering increase on the 8,788 vehicles registered in the whole of 2024.

Sales in Germany

In Germany, the Shenzhen-based company registered 2,629 vehicles last month, according to data released by the KBA on Wednesday.

The figures represent an eleven-fold increase compared to the 235 units sold a year ago.

Compared to December, sales fell by around 37% from 4,109 units. The last month of 2025 recorded an increase of 1,172% compared to the previous year.

In contrast to the UK, where there is a balanced range of powertrains and hybrids lead the market, BYD's portfolio in Germany mainly comprises BEVs.

The company offers seven all-electric models, from the more affordable Dolphin Surf compact car to the premium Tang SUV, as well as three plug-in hybrids - including the recently launched Atto 2 model.

The German KBA does not break down monthly registrations by model, and figures for January were not yet available on EU EVs at the time of going to press.

German market

In January, total passenger car sales in Germany fell by 6.6% year-on-year to 193,981 units.

However, the share of electric vehicles increased compared to January 2025, as electric vehicles accounted for 42,692 of the cars sold last month - with a market share of 22%.

Other Chinese automakers increased their share of the German market last month compared to record deliveries in 2025, including XPeng $9868 (-0,95%) and the Stellantis $STLAM (+2,73%) backed company Leapmotor.

+ 1

Stellantis has to write off 22 billion on electrical business

The car manufacturer Stellantis $STLAM (+2,73%) is pulling the emergency brake on electric cars in response to high costs and a lack of demand. Investors are shocked by the news.

I'm really not a fan of automotive shares, but if they don't cut the already heavily reduced dividend even further, they are currently offering a dividend yield of over 11%. But if they do cut the dividend completely, as suggested, then good night. A reason to take a closer look at the company?

Stellantis is significantly slowing down its electrical ambitions and writing off around 22 billion euros. The Group announced this on Friday. The background to this is a change of course due to high costs and weak sales figures for electric vehicles.

Almost 15 billion of this will go towards the reversal of electric cars on the important US market. As a result of the electric car subsidy canceled by US President Donald Trump and changes to emissions regulations, the company is eliminating Stellantis models and will probably earn less money with the technical platforms in future.

In addition, cash payments of around 6.5 billion euros are expected to be made over the next four years. The management therefore does not intend to pay a dividend to shareholders this year. The company also intends to raise fresh money of up to five billion euros by issuing new bonds.

The Stellantis share, which is traded on the Paris stock exchange, fell by almost 30 percent at its peak on Friday. This is the biggest single-day slump in the history of the car company, which was founded in 2021. The market capitalization was thus at times less than 17 billion euros.

Stellantis CEO Antonio Filosa explained: "The charges announced today largely reflect the costs that have arisen from overestimating the pace of the energy transition and which have distanced us from the real needs, opportunities and desires of many car buyers." They also showed the effects of "previous poor operational implementation", the consequences of which should now be gradually remedied.

Stellantis is now talking about a "reset" ahead of the presentation of its new strategic plan in May. For the second half of 2025, the Group is expecting a preliminary loss of 19 to 21 billion euros. Turnover is expected to be between 78 and 80 billion euros, in line with analysts' expectations.

End of ambitious battery project

In terms of adjusted operating profit, management expects a loss of 1.2 to 1.5 billion euros and cash outflows of 1.4 to 1.6 billion euros. Stellantis plans to publish its full annual figures on February 26.

At the same time, Stellantis announced the end of its joint venture with LG Energy in Canada on Friday. Nextstar was regarded as a flagship project for the production of lithium batteries, which was driven forward by former Group CEO Carlos Tavares. So far, more than five billion Canadian dollars (around 3.4 billion euros) have been invested in the site. Stellantis will now sell its 49 percent stake.

USB analyst Patrick Hummel described the 22 billion euro write-down as "negative" for the moment. But: "It could be the clarifying event we have been waiting for." He emphasized that the decisive factor is that the 6.5 billion euros in cash payments will be spread over four years.

"From a balance sheet perspective, annual cash outflows of EUR 1.6 billion can be absorbed," writes Hummel. It is true that the write-downs are significantly higher than the five to ten billion euros that were generally expected. "But it is more important that the cash portion is roughly in line with expectations."

Group CEO Filosa had den Job im vergangenen Sommer übernommenafter the long-standing CEO Carlos Tavares stepped down at the end of 2024. There were reportedly strategic differences between Tavares, who was considered a tough reorganizer, and the Board of Directors of Stellantis. In the meantime, Chairman of the Board of Directors John Elkann managed the 14-brand group before Filosa took over.

Group CEO sees signs of improvement

Tavares had announced in 2022 that the automotive group would be fully electrified in Europe by 2030, but had to gradually abandon this line. In the USA Stellantis, which includes brands such as Jeep and Dodge, was to grow primarily electrically.

In reality, however, the Stellantis brands in North America continued to lose market share and sales. Filosa, who lives in America himself, is now trying to turn the business around in this important market by focusing more on large classic combustion engines such as the Ram 1500 pick-up and the Jeep Cherokee, which were all discontinued under Tavares.

However, according to the press release, Filosa is already seeing signs of improvement: the necessary changes to the product range have already met with a positive response from customers. "In 2026, we will continue to focus on closing previous gaps in implementation in order to give further impetus to these first signs of renewed growth," said the Italian.

In the second half of 2025, Stellantis achieved consolidated sales of 2.8 million cars, an increase of 277,000 units or eleven percent compared to the previous year. Growth was led by North America, where deliveries rose by 39 percent.

Analyst Hummel also sees reason for hope for the current year: "The high depreciation and amortization in the second half of 2025 could have a positive effect of over one billion euros on the adjusted operating result due to lower future depreciation and amortization."

Source: Text (excerpts) and picture Handelsblatt from 06.02.2026

Long live the combustion engine.😂🤣

First purchase of the year

Hello everyone, to start the year off right I have decided to give my distribution a boost, $STHY (-0,12%) it does not give any capital growth but its distribution will give a strong hand to the portfolio, next month we go back to Europe, I intend to buy $STLAM (+2,73%) given the recent deal with MERCOSUR, a region where Stellantis sells well. A small bet on European automotive recovery, this year should bode well for the industrial sector in Europe.

What was your first purchase of the year?

Biggest losers in 2025 (in euros 🐻)📉 Which ones do you see potential in?

-72% The Trade Desk $TTD (+0,14%)

-72% Fiserv $FI (-0,58%)

-65% Dogecoin $DOGE (-3,68%)

-65% Cardano

-61% Gerresheimer

-60% Enphase Energy $ENPH (+4,71%)

-59% CarMax $KMX (-0,26%)

-57% Strategy $MSTR (+1,9%)

-56% Deckers Outdoor

-56% Alexandria Real Estate

-50% Redcare Pharmacy

-50% PUMA $PUM (+0,37%)

-50% lululemon

-49% Dow

-49% Novo Nordisk $NOVO B (-2,32%)

-48% MARA $MARA (+0,14%)

-48% Molina Healthcare

-47% FactSet

-47% Charter Communications

-47% HelloFresh

-45% Wolters Kluwer

-43% Solana $SOL (-2,66%)

-43% Cocoa

-42% UnitedHealth $UNH (-0,11%)

-41% Atlassian

-41% Li Auto

-40% Copart

-40% Meituan

-38% PayPal

-38% Chipotle Mexican Grill

-36% TeamViewer

-35% GameStop $GME (-1,92%)

-35% Orsted $ORSTED (+1,5%)

-33% Pernod Ricard $RI (+3,49%)

-33% Evotec

-33% Symrise

-31% Marvell Technology $MRVL (-0,16%)

-30% Comcast

-30% Natural Gas

-30% Kraft Heinz $KHC (+1,13%)

-30% Adobe $ADBE (-0,23%)

-29% Salesforce $CRM (-0,11%)

-28% Nike $NKE (-0,41%)

-28% Adidas $ADS (+1,94%)

-27% Sugar

-27% XRP $XRP (-2,64%)

-26% Stellantis $STLAM (+2,73%)

-25% JD .com

-24% Procter & Gamble $PG (+0,98%)

-23% Arm $ARM (-0,93%)

-22% Ferrari $RACE (-0,43%)

-22% Porsche AG $P911 (+1,21%)

-21% Zalando $ZAL (-0,93%)

-21% NEL ASA $NEL (-0,11%)

-21% Ethereum $ETH (-1,01%)

-18% Bitcoin $BTC (-0,82%)

-16% Brent Oil

-16% Delivery Hero

-13% Vonovia $VNA (+0,18%)

-12% Coinbase $COIN (+3,15%)

-11% SAP $SAP (+1,12%)

-7% Amazon $ (+2,51%)AMZN (+2,51%)

CATL and Stellantis start plant construction in Spain

CATL $3750 (-0,87%) and Stellantis $STLAM (+2,73%) committed to the major project almost a year ago and announced the prospect of 4.1 billion euros in investment. The plant for LFP battery cells and modules is being built in Figueruelas near Zaragoza. As Reuters reports, construction has now begun. And specifies: "Around 2,000 Chinese workers will help build the plant, and later 3,000 Spanish employees will be hired and trained." The latter figure is congruent with the 3,000 direct jobs that the project is expected to create. According to the regional government of the Autonomous Region of Aragon, it is currently organizing work permits for the new arrivals and is working in parallel to bring other parts of the battery supply chain to the region.

"We don't know this technology, these components - we've never produced them before," David Romeral, General Director of CAAR Aragon, a network of automotive companies in Aragon, is quoted as saying by Reuters. "They are years ahead of us. We can only watch and learn." José Juan Arceiz, General Secretary of the UGT trade union in Aragon, expressed a similar view: "They are the ones who know how to build a gigafactory." The unions were waiting for CATL's qualification requirements in order to set up training programs together with the local university.

Some Chinese technicians and managers from China are said to have already arrived in Figueruelas. The approach of bringing skilled workers from China is new for CATL. At its plant in Debrecen, Hungary, mainly locals were employed for construction. However, there are said to have been bottlenecks in recruitment - and the start of production has now been postponed from the end of 2025 to 2026.

Stellantis and CATL have placed the construction and operation of the factory in the hands of a 50:50 joint venture. The planned site is located next to the existing Stellantis vehicle plant in Zaragoza. The investment volume is expected to amount to the aforementioned 4.1 billion euros, with the project receiving over 300 million euros in EU funding.

The start of production has so far been somewhat unclear. Construction work is due to be completed in March 2028 with an annual capacity of 50 GWh. However, Stellantis and CATL intend to start production in the "existing Zaragoza vehicle plant" at the end of 2026, as Jorge Azcon, President of the Autonomous Community of Aragon, was quoted as saying in "La Tribuna de Automoción" at the end of 2024. It is known that the cell factory is to be built right next to the existing Stellantis vehicle plant on an 80-hectare site. However, Azcon did not specify why production is to start at the car factory. The current Reuters report also does not provide any further details.

Be that as it may, the alliance between CATL and Stellantis in battery production did not come as a surprise. The fact that Stellantis is looking for a location for a European battery cell factory outside of the Automotive Cells Company (ACC) joint venture already leaked out almost two years ago. Even then, Spain was considered the most likely location, as Stellantis operates three vehicle plants there (Madrid, Vigo and Zaragoza). The name CATL was also mentioned early on in the Spanish media as a likely project partner. At the end of November 2023, the automotive group had already made a partnership with CATL for LFP batteries in Europe official.

The background to the new initiative is that things are not going well at ACC. The battery joint venture between Stellantis, Total and Mercedes-Benz has announced three battery factories in Douvrin, Kaiserslautern and Termoli, but the latter two projects are currently on hold. In both cities, work is officially on hold "in order to switch from nickel-based cell chemistry to more cost-effective battery technologies while still in the early construction phase", as stated in the early summer of 2024. In the middle of this month, we received the news that the Italian ACC battery factory in Termoli is probably on the verge of being shut down for good.

Stellantis has now paved the way with the CATL cooperation to secure its own LFP batteries. It is unclear what will happen to the ACC site in Germany in parallel. In any case, Stellantis is now pursuing a "dual-chemistry approach" - NMC batteries have not been written off, but will continue to exist alongside LFP batteries. The question that remains unanswered, however, is what the mix will look like and how many NMC cell plants will actually be needed in the end.

EU car industry

When I picked up shares of $VOW (+0,93%) 12X and $STLAM (+2,73%) 118X , it wasn’t because the market looked rosy—in fact, the whole European car scene felt like it was limping through a cold spell. That slump made the prices look oddly inviting, like overlooked machines waiting for someone to believe they’d run again. I figured that if I was ever going to take a risk like this, it made sense to do it while I still have the time and energy to bounce back. So I clicked “buy,” half-nervous, half-excited, knowing the gamble was mine to grow into.

Títulos em alta

Principais criadores desta semana