Week in review 28.09.

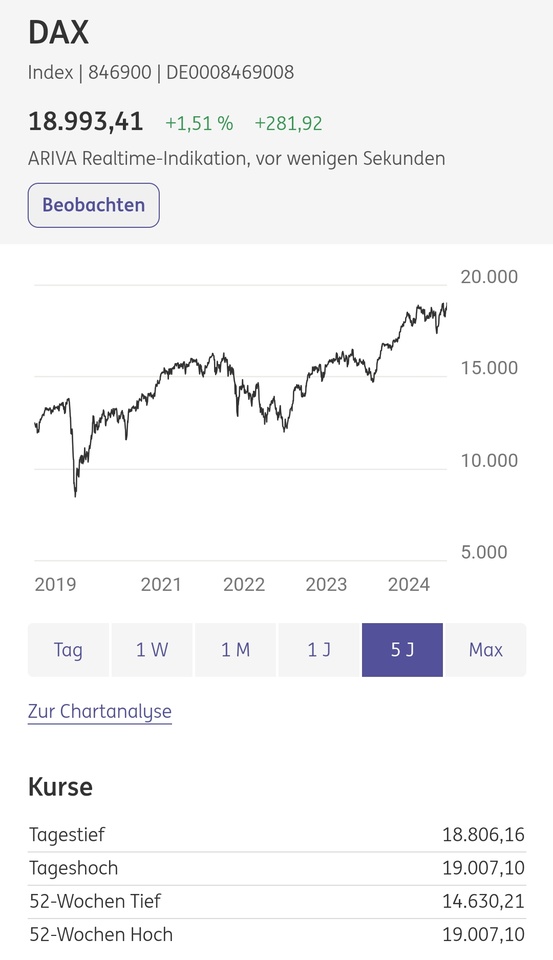

New all-time highs for DAX, Dow Jones, S&P 500, Gold, GE Vernova, Meta, Netflix, SAP, Vistra Corp, Walmart 👑🥇 $LYY7 (+0,14%)

$CSPX (+0,19%)

$ABX

$GEV (-0,71%)

$META (+0,28%)

$NFLX (-0,35%)

$SAP (-0,49%)

$VST (+0%)

$WMT (-3,83%)

New 52-week highs for 3M, Air Products, Alibaba, Arista Networks, Barrick Gold, Bank of Nova Scotia, BlackRock, Caterpillar, Constellation Energy, DuPont, HSBC, Infosys, Live Nation, McDonald's, Palantir, PayPal, Public Storage, Royal Bank of Canada, Royal Caribbean, Sea Ltd, Spotify, Tangier 💵📈 $PLTR (-0,13%)

$9988 (-0,36%)

$BABA (-0,16%)

$BLK

$CAT (+0,81%)

$BNS (+0,69%)

$STZ (-1,52%)

$DD (-1,16%)

$HSBA (-0,07%)

$HSBC (+0,37%)

$INFY

$LYV (-0,06%)

$MCD (-2,11%)$PUB

$PUB

$RCL (-2,9%)

$SEA (-0%)

$SKT (-1,1%)

Bitcoin with new 1-month high, +22% in three weeks since the low on 07.09. from 52k$ to 66k$, +150% in 12 months📉📈 $BTC (-0,4%)

PayPal's own stablecoin PYUSD (crypto) is growing strongly and is now one of the top 100 cryptos by market capitalization at 95th place 💰 $PYPL (-1,08%)

Palantir with inclusion in the S&P 500 on Monday #PLTRgang 🤜🤛👊✊ $PLTR (-0,13%)

Uber is working with Google's Waymo (Alphabet) and wants to offer robotaxis for a surcharge 🚗🤖 $UBER (-0,86%)

$GOOGL (+1,6%)

$GOOG (+1,56%)

After the ECB and FED, China has also turned on the money printer *brrr brrr*, plus a big economic stimulus program, China stocks therefore have their best week in 10 years, car and luxury stocks with Chinese business are therefore rising 🖨🇨🇳 $MC (+0,41%)

$P911 (-0,57%)

$BMW (-1%)

$MBG (-0,06%)

AMD CEO and Nvidia CEO confirm continued high demand for AI chips 🧠🤖, Nvidia CEO does not want to sell any more of his own shares for the time being. $AMD (-0,4%)

$NVDA (+2,51%)

Upcoming Playstation 6 with AMD chip again, but AMD will leave the high-end graphics card market for PC gamers and try to scale more strongly in the mid and lower segments. Nvidia would then have a monopoly 🎮 $SONY (+2,33%)

$6758 (+2,26%)

Super Micro suspected of accounting fraud. US justice is apparently already investigating according to an insider, -62% share price in three months 🔍👮 $SMCI

AI needs a lot of electricity and nuclear power plants are being reactivated in the USA. In Germany, it's the other way around due to the world's stupidest energy policy. US electricity provider shares, uranium mines - shares and ETFs are rising. ⚛️⚡️ (see podcast episode 57 "Buy High. Sell Low." pinned to my profile at the top) $URNM

$URA (+0,67%)

$UEC (-0,94%)

Micron with good quarterly figures and +13% share price, semiconductor stocks rally 💻📈 $MU (-0,4%)

Costco - quarterly figures mixed, EPS exceeds estimates but sales worse than expected, share price falls slightly 🛒 $COST (+0,29%)

McDonald's increases quarterly dividend by 6% to 1.77$. Since the first dividend payment in 1976, the payout has been increased 48 years in a row. 🍟🍔 $MCD (-2,11%)

Investigation initiated against Visa 💳 and SAP 💻 in the USA for illegal price fixing $V (+0,54%)

$SAP (-0,49%)

Oil price falls again, Shell & Co. on the way to 1-year low 🛢⛽️ $SHEL (+0,15%)

$GB00B03MM408

$RDS.A

Meta releases VR glasses Quest 3s for €330 from 15.10.24 📱👓

Intel launches AI accelerator "Gaudi 3" as an alternative to Nvidia's H100. IBM, Google & Dell as first customers. 🧠 $INTC (-0,48%)

US debt level climbs above 35 trillion dollars for the first time 🖨💵

Ubisoft share price collapses due to postponement of "Assassin's Creed: Shadows", -70% 1-year performance 🎮📉 $UBI (-0,17%)

DHL raises outlook / growth forecast until 2030 and increases letter postage by 10.5% in Germany from 2025 📦✉️📯 $DHL (-0,17%)

BASF struggles with high energy prices and weak demand, threat of plant closure and dividend cut 🇩🇪📉 $BAS (+0%)

Adidas (+28%) significantly better than Nike (-18%) since the beginning of the year ⚽️🏀👟 $ADS (-1,32%)

$NKE (+0,18%)

Takeover poker at Commerzbank by Ital. Unicredit continues 🏦🇮🇹🇩🇪 $CBK (+0,14%)

$UCG (-0,66%)

Jefferies issued a buy recommendation for BioNTech and sees the antibody BNT327 against cancer as a potential massive sales driver. 👨⚕️⚕️💊 $DE000A0V9BC4

Mutares -14% because shortseller Gotham City raises serious allegations against the SDAX member: Ponzi scheme, false accounting and circular business model 🔍👮 $MUX (+0,34%)

>> If you want to read a review like this every week, leave a like & subscribe. What important news have I forgotten? 👍❤️