After years of dominance, the US stock market is showing signs of weakness as a result of Trump's actions: political uncertainty, the threat of tariffs, stagnating AI/tech stocks and a gloomy outlook for the US economy are bringing the Narrativ des „US-Exceptionalism“ ins Wanken. . Even the highly weighted "Magnificent Seven" are no longer outperforming the market as a whole.

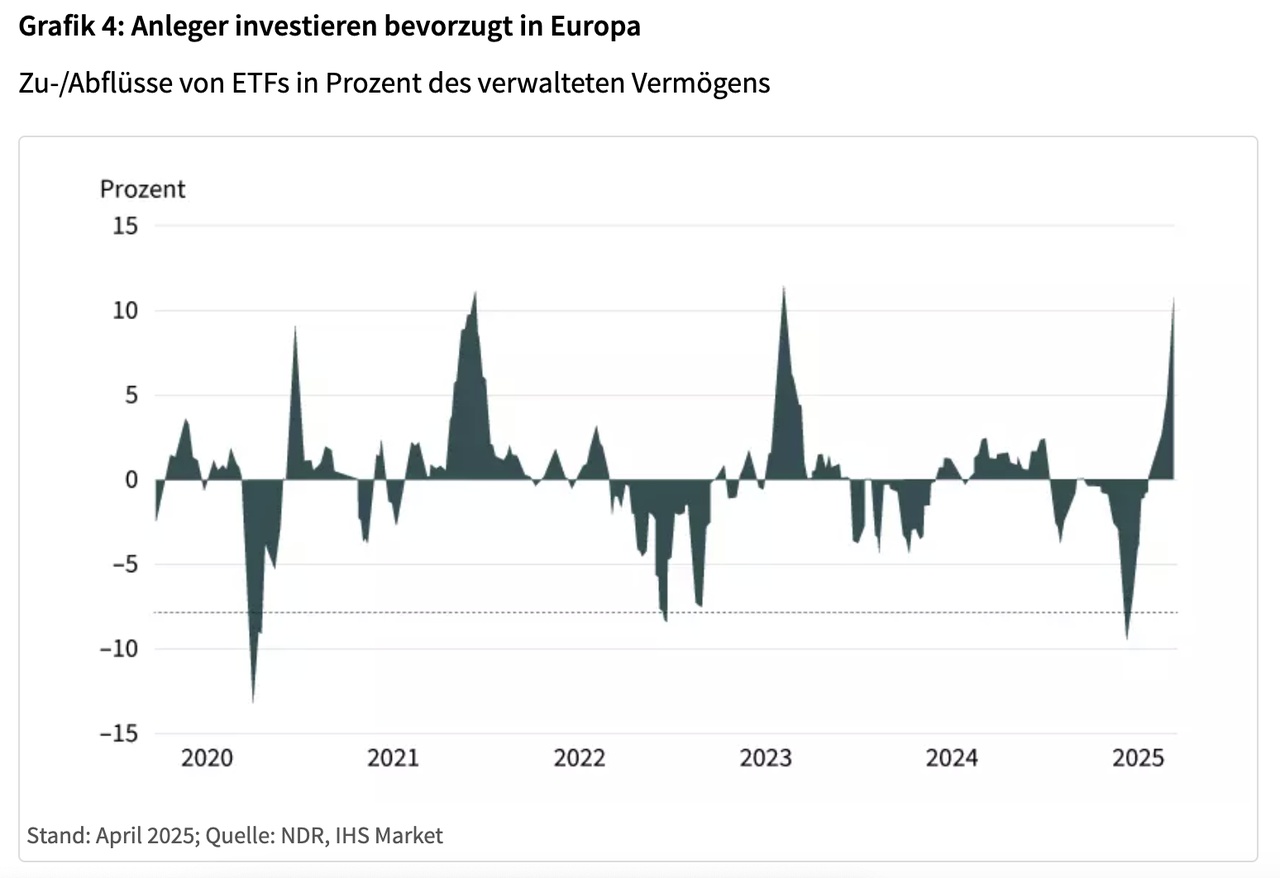

🇪🇺 Meanwhile, Europe is scoring points with improved investor sentiment. The German market and the $LYY7 (-2,45%) have benefited since the announcement of the soon-to-be government's fiscal package. ETF inflows show: Institutional investors are reallocating. In the short term, Europe offers attractive opportunities - even if global risks, such as a possible US recession, continue to lurk in the background.

🇯🇵 Japan and $EXX7 (-4,3%) remains volatile. Interest rate hikes, the strength of the yen and China's weak consumption are a burden - but the valuation level remains attractive, similar to Europe

The US market is in consolidation mode, new impetus is lacking - Europe is showing relative strength, even if exaggerated optimism is misplaced. But will there now be further setbacks on the US stock markets?

Read the full market commentary now: 🔗 Die Ausnahmestellung der USA ist (zunächst) beendet

This article is part of an advertising partnership with Société Générale