$UCG (-4,39%)

$MNDY (-1,02%)

$KER (-4,92%)

$BARC (-3,4%)

$OSCR (-1,89%)

$CVS (+0,6%)

$SPOT (-0,98%)

$DDOG (-0,68%)

$BP. (-0,02%)

$SPGI (+0,1%)

$HAS (-1,11%)

$KO (+0,04%)

$JMIA (-1,91%)

$MAR (-0,71%)

$RACE (-2,75%)

$UPST (-2,99%)

$NET (-2,59%)

$LYFT (-0,93%)

$981

$NCH2 (-5,27%)

$DSY (-1,57%)

$1SXP (-1,86%)

$HEIA (-2,46%)

$ENR (-6,14%)

$DOU (-1,61%)

$OTLY (-1,9%)

$TMUS (+0,57%)

$SHOP (-2,02%)

$KHC (+0,19%)

$FSLY (-2,76%)

$HUBS (-1,15%)

$CSCO (-0,41%)

$APP (-2,06%)

$SIE (-4,61%)

$RMS (-3,74%)

$BATS (-1,13%)

$MBG (-2,8%)

$TKA (-6,71%)

$VBK (-5,92%)

$DB1 (+2,21%)

$NBIS (-1,94%)

$ALB (-5,04%)

$BIRK (-2,72%)

$ADYEN (-3,61%)

$ANET (-1,53%)

$PINS (+10,1%)

$AMAT (-2,05%)

$ABNB (-1,59%)

$TWLO (-1,18%)

$RIVN (-1,63%)

$COIN (-2,62%)

$TOM (-3,5%)

$OR (-2,81%)

$MRNA (-2,84%)

$CCO (-3,97%)

$DKNG (-1,01%)

Uni Credit

Price

Discussione su UCG

Messaggi

55Quarterly figures 09.02-13.02.26

Market Update: Sector Analysis & Daily Sentiment - eToro Portfolio

Good morning everyone! ☕️ Today the market is moving on mixed tracks, with some top performers continuing to outshine while traditional sectors reflect recent macroeconomic dynamics. Here is a detailed breakdown of what’s driving today’s movements:

🚀 Communications & Space Economy ($ASTS (+3,11%) ) The satellite communications sector remains the undisputed protagonist. $ASTS (+3,11%) continues to show impressive relative strength, driven by operational progress on the BlueBird constellation. Investors are rewarding the company's ability to scale direct-to-cell broadband services, positioning it as a leader in a high-barrier market.

🏛️ Finance & Banking ($UCG (-4,39%) , $BBVA (-4,07%) , $ISP (-4,54%) ) European banks are showing resilience despite slight pullbacks in local markets.

UniCredit & Intesa Sanpaolo: Benefiting from solid fundamentals and shareholder remuneration policies (dividends and buybacks) among the highest in the sector.

2026 Scenario: The banking sector remains "value-oriented," trading at attractive multiples compared to tech, with an increasing focus on M&A and resilient fee-based income.

💻 Big Tech & AI ($META (-0,63%) , $MSFT (-0,8%) ,$GOOGL (-1,67%) ) The tech sector is in a "wait-and-see" mode ahead of next week's earnings. $META (-0,63%) leads the pack thanks to optimized AI ad spending, while $MSFT (-0,8%) and $GOOGL (-1,77%) reflect a tactical rotation toward more concrete AI infrastructure. Growth is solid, but the market is demanding clear proof of direct monetization.

🛍️ Retail & E-commerce ($BABA (-1,9%) , $CVNA (-1,93%) , $AMZN (-1,29%) )

China: Signs of recovery for $BABA (-1,9%) , supported by improving domestic consumer sentiment.

Personal Note: To be honest, I spent too much time studying the fundamentals and entered $BABA (-1,9%) late. Currently, the position is at a slight loss (approx -1%), but my long-term conviction remains intact. I plan to strengthen this position during my next rebalancing to optimize the entry price.

Consumer: $CVNA (-1,93%) is benefiting from a stabilizing used car market thanks to less aggressive interest rates compared to previous peaks.

💊 Health & MedTech ($HIMS (-1,9%) , $INSM (-0,4%) ) There is strong interest in companies integrating AI and healthcare. However, $HIMS is the most "volatile" part of my portfolio. I’ve seen virtual gains swing from +120% to -5%. While I believe in the business model, its volatility increases my risk score. With a future Popular Investor application in mind, risk stability is my priority. Therefore, I plan to liquidate the position at the next turn-up once my minimum gain target is met to stabilize my portfolio stats. 📉⚖️

🪙 Commodities & Safe Havens ($GLD (-1,69%) , $TRX (-5,92%) )

Gold: With $GLD (-1,69%) nearing all-time highs (around the $4,900+ area), investors are seeking protection against geopolitical uncertainties.

Crypto: Besides my $BTC (-2,5%) stack in cold storage, $TRX (-5,92%) is the only altcoin I’ve chosen to hold here on eToro. I strongly believe in the sustainability of the Tron network for global transactions. I am seriously considering increasing exposure in the coming days, viewing it as an asymmetric bet with great potential.

🎯 Towards the Popular Investor Program: As mentioned at the beginning of the year, I am working to make this portfolio as balanced as possible for future copiers. Risk management comes before spectacular but unstable profits.

How are you managing volatility in the more aggressive Tech stocks? What do you think about the rotation toward European banks? Let me know in the comments! 👇

🚀 Mid-January Update: eToro Portfolio Surges to +5.01%!

We are almost at the mid-month mark, and the portfolio results are exceptional. Despite general market uncertainty, our strategy is paying off with a growth of +5.01%, bolstered by a strong push over the last few days.

🏆 Benchmark Challenge: 2026 Goals in Sight

As I previously shared, outperforming the major U.S. indices is one of my primary goals for 2026. Mid-January data confirms we are on the right track:

🟢 My eToro Portfolio (farlys): +5.01%

🔵 $SPX500: +1.66%

🟣 $NSDQ100: +2.04%

We are significantly beating Wall Street, currently trailing only the most volatile assets of the moment: $BTC (-2,5%) (+7.85%), the Japanese $JPN225 (+7.12%), and $GOLD (+6.2%). As a reminder, I manage my Bitcoin exposure in a private portfolio outside of eToro for security, but its rally validates the return of a global "risk-on" sentiment.

🔥 What drove the push in the last few days?

This jump above 5% isn't accidental. Three key factors moved the market this week:

Rotation to Value and Europe: We've seen capital rotating out of "overcrowded" U.S. Tech names into sectors with stronger fundamentals. This favored our positions in $UCG (-4,39%) (UniCredit Commercial Bank) (+1.16%), $BBVA (-4,07%) (+1.14%), and $IBE (-3,39%) (Iberdrola) (+1.29%), which offer solid dividends and more attractive valuations.

The Chinese Awakening: The Chinese tech sector received a fundamental boost from new government plans to integrate AI into manufacturing. This propelled $BABA (Alibaba-ADR) (+3.59%), which remains our main engine for the start of the year.

Macro Stability: Recent inflation data has reassured investors that central banks might not need to be more aggressive than expected, fueling the momentum for "risk-on" assets and discounted growth stocks.

🛠️ The Power of Rebalancing

These results are the direct outcome of the slight rebalancing performed at the beginning of January. Reducing weight in some U.S. tech giants that dominated 2025 (like $NVDA (-1,41%) NVDA (NVIDIA Corporation) or $MSFT (-0,8%) (Microsoft), which are currently flat or slightly red in our heatmap) to pivot toward the Asian recovery and European banking solidity has allowed us to capture this "extra-return" compared to general indices.

🎯 Outlook

Beating the $SPX500 and $NSDQ100 by about 3 percentage points in just two weeks is a perfect start to our annual goal. The road is long, but our geographic and sectoral diversification is proving to be our best compass for navigating 2026.

How is your year starting? Are you keeping up with the Gold/Nikkei rally or are you still heavily anchored to U.S. indices? Let me know in the comments! 👇

Which shares have potential for you in 2026?

I am realizing more and more that I am hardly interested in loud promises and short-term hypes anymore. When I think about 2026, I tend to ask myself: which companies will still be in a stable position - no matter what the market environment looks like?

I am currently attracted to companies that work quietly, do their homework and don't need a new story every week. Banks like $UBSG (-3,85%) or $UCG (-4,39%) have had difficult years and that's exactly what makes them interesting for me. Companies that get through periods of stress and learn from them often emerge stronger.

At the same time, I find companies whose business you can touch exciting. Raw materials, for example. Nothing works without them - neither industry nor the energy transition. That's not a trend, it's reality.

Ultimately, I'm not interested in predicting the next big thing. For me, it's about consistency, reliability and business models that are sustainable even when things get uncomfortable.

I would really be interested:

Which stock do you have on your radar for 2026 - and why exactly this one?

suggestion

i’m new at investing, before i ad $UCG (-4,39%) , that is an italian bank/insurance company, now i wanna reduce some assets and increase the growth potential, so i’m thinking to swap it with something similar but with more growth, like $V (-0,51%) , $MA (-0,42%) or $PYPL (-1,9%) what should i do?

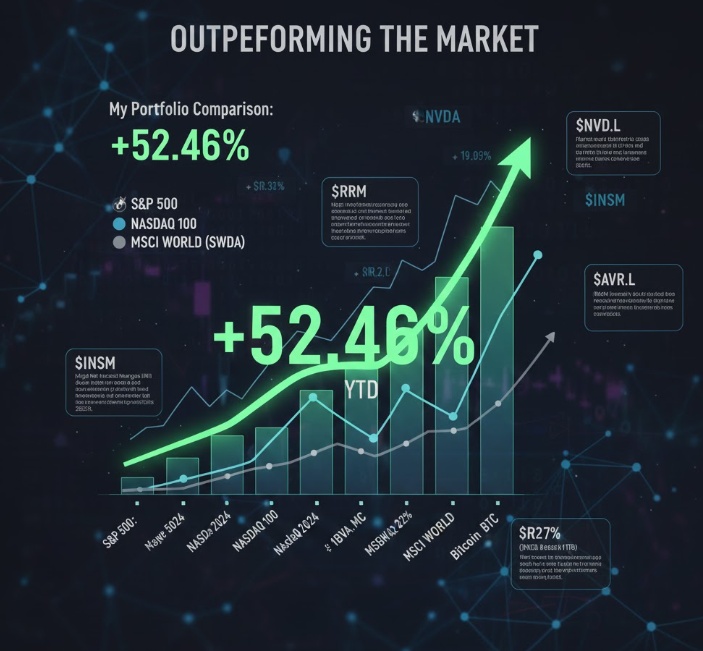

🚀 2025 eToro Recap: Outperforming the Market

An extraordinary year comes to a close. The numbers speak for themselves: 2025 has been the year that confirmed my strategy, closing with a +52.46% return that significantly outperformed all major global benchmarks.

🏁 Benchmark Comparison:

🏆 My Portfolio: +52.46%

📊 S&P 500: +16.37%

💻 Nasdaq 100: +19.05%

🌍 MSCI World (SWDA): +14.50%

₿ Bitcoin (BTC): +35.20%

The strength of this portfolio lies not only in the total return but in its resilience. Despite natural market fluctuations, we maintained steady growth, closing almost every month in the green and managing the rare moments of drawdown with strict discipline.

📊 Monthly Performance:

📈 January 2025: +4.35%

📈 February 2025: +0.95%

📉 March 2025: −4.4%

📈 April 2025: +3.68%

📈 May 2025: +13.32%

📈 June 2025: +6.35%

📈 July 2025: +6.06%

📈 August 2025: +2.04%

📈 September 2025: +6.87%

📈 October 2025: +1.55%

📉 November 2025: -0.39%

📈 December 2025: +2.94%

Performance Summary: ✅ 2024: +4.75% ✅ 2025: +52.46% (YTD) 🔥 Since Inception (1.5 years): +59.7%

🏦 Focus: The Strategic Move on European Banks

Massive exposure to the European banking sector with stocks such as $UCG (-4,39%) , $BPE (-4,41%), $BBVA (-4,07%) , $ISP (-4,54%) , and $BMPS (-4,28%) was a primary key to our success. Here is why they performed so brilliantly:

Record Margins: Financial institutions fully capitalized on interest rates remaining elevated longer than expected, maximizing net interest margins.

Shareholder Returns: Aggressive dividend policies and massive buyback programs provided constant support to stock valuations.

Efficiency & Quality: Rigorous risk management kept non-performing loans (NPLs) at historic lows, while digitalization significantly reduced operational costs.

🔥 Top Performers: The Growth Engines

Beyond the banking sector, the portfolio was driven by exceptional assets:

$INSM (-0,4%): Performance fueled by the clinical and commercial success of ARIKAYCE and pipeline advancements in rare diseases, with 2025 revenue growth hitting 52%.

$RR. (-5,26%) A powerful industrial turnaround based on drastic restructuring, the global recovery of air travel (engine maintenance), and new defense sector contracts.

$NVDA (-1,41%) & $AVGO (-1,29%) : Undisputed leaders of the AI revolution. NVIDIA dominates data center infrastructure, while Broadcom benefits from record demand for custom AI chips and networking hardware.

🎯 Strategy for 2026

My objective remains the same: to outperform major global indices while maintaining a balanced risk profile. As you can see, our asset selection successfully captured the best of the bullish trend.

To those following me: thank you for your trust. If you are looking for a long-term investment aiming to consistently beat the benchmark, consider adding me to your copy traders in 2026—I intend to open this possibility soon.

Let's start 2026 with the same discipline! 🥂

⚠️ DISCLAIMER: All content in this post is for informational and entertainment purposes only. It does not constitute a solicitation for public savings, personalized financial advice, or an investment suggestion. Trading involves the risk of capital loss. Remember that past performance is no guarantee of future results. Before investing or copying a portfolio, do your own research (DYOR) and evaluate your risk tolerance.

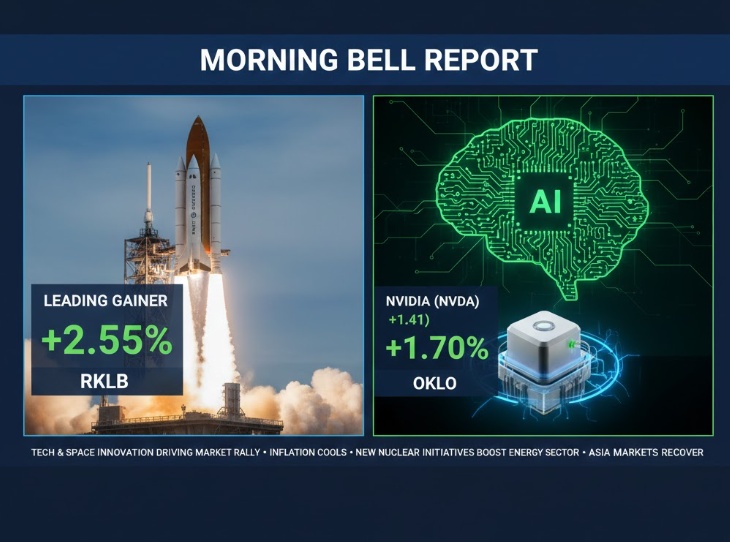

📈 Market Analysis: Why Growth is Bouncing Back Today!

The pre-market session is showing strong resilience. It's not just a "green day," but a clear reaction to specific fundamental catalysts. Here is why the key players are moving:

🚀 Aerospace - $RKLB (-2,47%) (+2.55%): Rocket Lab's outperformance is driven by its increasing "launch cadence" and the de-risking of its Neutron program. As the space economy shifts from speculative to industrial, RKLB is capturing a massive share of the small-to-medium satellite market.

💻 Semiconductors - $NVDA (-1,41%) (+1.41%): The bounce is fueled by softer-than-expected inflation data, which provides a "green light" for high-multiple tech stocks. With AI demand still outstripping supply, the fundamental case for Nvidia remains bulletproof heading into 2026.

⚛️ Energy - $OKLO (+1.70%) & $NNE : We are witnessing a "Nuclear Renaissance." The market is pricing in the massive power requirements of next-gen data centers. OKLO is benefiting from the positive spillover of recent regulatory breakthroughs in the SMR (Small Modular Reactor) space.

🌏 China Tech - $BABA (-1,9%) (+1.48%): Sentiment on Chinese equities is improving as macro data points to a stabilizing export machine. Alibaba remains the primary vehicle for investors looking to play the recovery of the Eastern consumer.

The "Red" Side: What's Cooling Down? 🧊

Banking & Finance: We see slight pressure on $UCG (-4,39%) (-0.50%) and $AXP (-0,69%) (-0.27%). This isn't a crash, but profit-taking. After a strong run for financial stocks, investors are rotating capital out of Value to fund the new leg of the Tech rally.

Big Tech Lagging: While $MSFT (-0,8%) and $GOOGL (-1,77%) are slightly positive, they are underperforming the broader tech market. The focus has shifted from software platforms to hardware providers and infrastructure.

Conclusion: I am staying long on Energy Infrastructure and Specialized Tech. The convergence of AI power needs and Space logistics is the strongest narrative for the upcoming year.

What’s your top conviction for the final sessions of 2025? Let’s talk in the comments! 👇

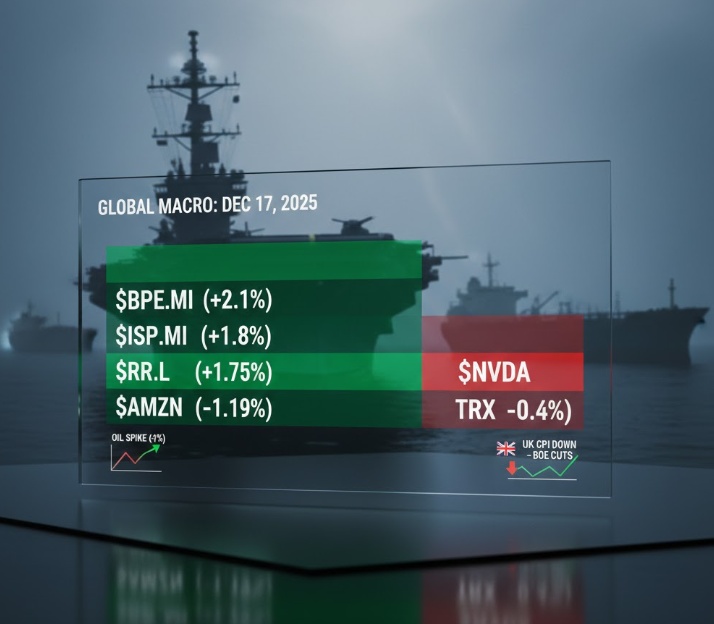

📈 MARKET UPDATE | DEC 17, 2025: BUYBACKS & BLOCKADES

The mid-week session is defined by an aggressive shift from overextended Tech into Financials and Aerospace.

🌍 THE MACRO SHOCK: TRUMP’S VENEZUELA BLOCKADE

The biggest geopolitical mover today is the U.S. naval blockade of sanctioned oil tankers into Venezuela.

The Impact: Crude prices spiked >1% instantly. This is providing a massive tailwind for energy and commodity-linked sectors.

The Shift: This "geopolitical premium" is forcing capital into hard assets. Silver just hit a record high above $66, with Gold following. 🛢️🔥🥈

🇪🇺 EUROPE: INFLATION COLLAPSE & CENTRAL BANK FEVER

EU indices are ripping because UK CPI fell sharper than expected this morning (3.2% vs 3.4% exp).

The Reaction: A shockwave through the bond market. Traders are now pricing in a near-certain Bank of England (BoE) rate cut tomorrow.

The "Trifecta": We are in a "relief rally" ahead of tomorrow’s massive data dump: ECB, BoE, and U.S. CPI. Markets are front-running a Dovish pivot from Lagarde. 🏦📉

🏦 THE ITALIAN BANKING RALLY

$$BPE (-4,41%) (+2.1%) | $ISP (-4,54%) (+1.8%) | $UCG (-4,39%) (+1.7%)

The Driver: Resilience in Net Interest Margins (NIM) as the ECB easing cycle appears slower than feared.

The Catalyst: Massive shareholder distribution. $UCG (-4,39%) and $ISP (-4,54%) are acting as "cash machines," using buybacks to floor the price against any macro noise.

⚙️ AEROSPACE & DEFENSE MOMENTUM

$$RR. (-5,26%) (+1.75%) | $LDO (+0,58%) (+1.4%) | $RKLB (-2,47%) (+1.3%)

The Driver: Rolls-Royce ($RR.L) just initiated a new £200M interim buyback starting Jan 2, immediately following their £1B 2025 program.

Context: Institutional accumulation in Defense is at peak levels as a structural hedge against 2026 geopolitical uncertainty.

📦 RETAIL & CLOUD RESILIENCE

$AMZN (-1,29%) (+1.19%)

The Driver: Wall Street is digesting the delayed Non-Farm Payrolls (64k added, but unemployment at 2021 highs).

The Sentiment: "Bad news is good news." A weakening labor market gives the Fed more ammo to cut. $AMZN (-1,29%) is catching the bid as BMO Capital hikes PT to $304, citing AWS cloud acceleration. 📊💼

⚠️ SECTOR ROTATION: THE "AI BUBBLE" PAUSE

$NVDA (-1,41%) (-0.25%) | $BTC (-2,5%) (~$86.7k) | $TRX (-0,1%) (-0.4%)

The Analysis: Pure profit-taking. Capital is bleeding out of high-beta Tech and Crypto to fund the rally in "Value" equities (Banks/Industrials).

The Risk: If $NVDA (-1,41%) loses its 20-day EMA at the US open, expect a broader drag on the Nasdaq. 🏛️➡️💻

Invest in banking stocks with the aim to be acquired

After having invested before in $1COV (+0,43%) with the aim to be acquired by Adnoc/XRG and another investment in $ILTY Illimity Bank in Italy giving access to $IF (-3,11%) Banca IFIS with a 10% discount.

I'm now thinking to invest in further banking consolidation. Since there seems to be a wave of banking consolidations coming up both cross boarder and within individual European countries.

Italy shows:

$UCG (-4,39%) Unicredit stakebuilding in both $ALPHA (-5,44%) Alphabank & $CBK (-3,58%) Commerzbank and a failled attempt to acquire $BAMI (-4,09%) Banco BPM. We saw $BMPS (-4,28%) Monte dei Pachi acquire $MB (-4,91%) Mediobanca. $BPE (-4,41%) Bper Banca merge with $BPSO (-4,45%) and rumored to be on the wishlist of Unicredit.

Denmark is consolidating but could be still more ongoing:

A recent merger of $SYDB (-3,1%) Sydbank, Arbejdernes Landsbank & $VJBA Vestjysk Bank.

In Spain

We've seen a major but failed attempt to forget about the Spanish attempt of $BBVA (-4,07%) Banco Bilbao of $SAB (-4,2%) Banco Sabadell.

The Netherlands:

$ING (-4,98%) ING taking a substantial stake in $VLK (-2,22%) Van Lanschot Kempen.

$ABN (-3,6%) Doing several take overs in Germany and buying the trading app Bux and rumored to be bought themselves.

When thinking this through I see a potential for take over but, if it won't happen there is still good dividends to be earned. Therefore there is less of a need of a quick turn around.

I'm now looking for a "smaller" bank that traded and a likely take over candidate.

Where would you invest?

$BPE (-4,41%) - Bper Banca - Italy

$BAMI (-4,09%) - Banca BPM - Italy

$ABN (-3,6%) - ABN Amro Bank - Netherlands

$ALPHA (-5,44%) - Alpha Bank - Greece

$JYSK (-3,01%) - Jyske Bank - Denmark

$ALR (-5,15%) - Ailor Bank - Poland

Any other alternatives, or opinions about this idea, I'm happy to read!

Titoli di tendenza

I migliori creatori della settimana