$UCG (+1,16%)

$MNDY (-0,84%)

$KER (+1,36%)

$BARC (+1,39%)

$OSCR (-3,64%)

$CVS (-0,72%)

$SPOT (+1,17%)

$DDOG (-4,15%)

$BP. (-1,45%)

$SPGI (-0,01%)

$HAS (+0,27%)

$KO (+0,78%)

$JMIA (-0,25%)

$MAR (-0,64%)

$RACE (-0,43%)

$UPST (-4,3%)

$NET (-7,53%)

$LYFT (+0,25%)

$981 (+0%)

$NCH2 (-0,32%)

$DSY (-0,14%)

$1SXP (+0%)

$HEIA (+0,43%)

$ENR (+0,35%)

$DOU (+2,68%)

$OTLY (-3,81%)

$TMUS (+0,47%)

$SHOP (+2,19%)

$KHC (+1,13%)

$FSLY (+0,79%)

$HUBS (-2,72%)

$CSCO (+1,04%)

$APP (-5,89%)

$SIE (+1,82%)

$RMS (+4,02%)

$BATS (+2,33%)

$MBG (+1,16%)

$TKA (+5,16%)

$VBK (-2,02%)

$DB1 (+1,23%)

$NBIS (-9,32%)

$ALB (-0,08%)

$BIRK (+0,75%)

$ADYEN (+0,81%)

$ANET (-3,29%)

$PINS (+5,61%)

$AMAT (+1,53%)

$ABNB (+1,55%)

$TWLO (+1,26%)

$RIVN (-1,6%)

$COIN (+3,15%)

$TOM (+0%)

$OR (+1,71%)

$MRNA (+0,22%)

$CCO (+2,34%)

$DKNG (-0,68%)

Discussione su VBK

Messaggi

49Quarterly figures 09.02-13.02.26

GHG quota

$VBK (-2,02%) Turnaround GHG quota price means turnaround at Verbio. Profitable times ahead.🤓

Cabinet decision on the further development of the GHG quota is imminent.

Quarterly figures 10.11-14.11.25

$MNDY (-0,84%)

$TSN (-0,73%)

$OXY (+0,48%)

$WULF (-2,68%)

$PLUG (-3,07%)

$RKLB (-6,56%)

$CRWV (-9,31%)

$9984 (-2,04%)

$IOS (+0,53%)

$MUV2 (+0,8%)

$SE (+0,41%)

$NBIS (-9,32%)

$RGTI (-4,09%)

$$BYND (-7,46%)

$OKLO

$IFX (-1,28%)

$EOAN (-0,64%)

$TME (+0%)

$VBK (-2,02%)

$HDD (+1,13%)

$ONON (+3,08%)

$JMIA (-0,25%)

$MRX (+1,34%)

$HTG (-0,69%)

$DTE (+0,29%)

$R3NK (-0,34%)

$HLAG (+0,9%)

$JD (+0,43%)

$700 (-0,38%)

$DIS (-0,28%)

$ENEL (+1,57%)

$AMAT (+1,53%)

$NU (+1,09%)

$ALV (+1,65%)

$SREN (+1,28%)

$BAVA (+0,4%)

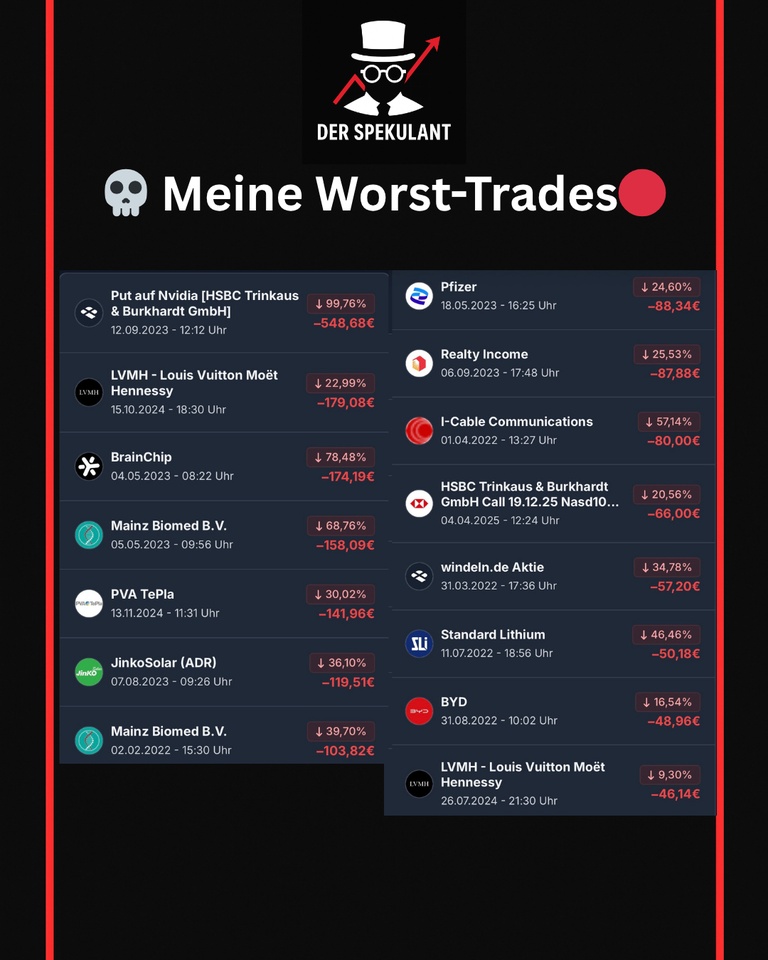

💥 15 top trades vs. 15 flop trades - full transparency!

Today I'm going to show you my best and worst trades since the start of my investment journey. No show, no excuses - just real numbers and learnings.

🟢 My top 15 trades

📈 From Rheinmetall to Palantir to Ferrari - some positions really took off.

Biggest single gain: +131 % for Rheinmetall💪

→ The majority came from strategically placed opportunities, not luck.

🔴 My flop 15 trades

📉 Nvidia put, Mainz Biomed, BrainChip... The biggest flop?

-99.76 % with a warrant on Nvidia 😬

→ The lesson: highly speculative bets quickly go against you - especially without a plan.

📘 My most important learning

I learned this lesson in my first year of investing:

Short-term trading may work from time to time - but not in the long term.

Today I have a clear strategy:

✅ Core-satellite

✅ Focus on quality

✅ Discipline & long-termism

🧠 Why am I sharing this?

Transparency is not a buzzword for me - it's a duty.

Losses are part of it. If you only talk about your profits, you're only telling half the truth.

#Trading

#Fehler

#Investieren

#Transparenz

#Learnings

#DepotEinblick

#DerSpekulant

#Getquin

$RHM (-0,17%)

$NVDA (+1%)

$MC (+4,98%)

$MYNZ

$BRN (+1,7%)

$COIN (+3,15%)

$RACE (-0,43%)

$TSLA (-0,19%)

$WDL1 (+0,13%)

$PLTR (+0,16%)

$PTON (-0,81%)

$9866 (+3,08%)

$MULN

$MRNA (+0,22%)

$VBK (-2,02%)

$JKS (+1,46%)

$TPE (-1,47%)

$PFIZER

$SLI (+1,93%)

So hopefully you're now keeping your hands off, wait, what does the basic information for securities say about "derivative financial instruments"?😅🤷🏼♂️

Verbio assessment

Palim Palim dear swarm intelligence,

Can someone tell me more about $VBK (-2,02%) tell me more? I find the title quite interesting, just can't tell whether it's a media flash in the pan or a possible 🚀?

Have a nice weekend everyone!

Verbio

$VBK (-2,02%) What is your opinion on the share?

I have now started to invest in it and would like your opinion on Verbio.

It still looked good here

https://getqu.in/BO1mJo/ https://getqu.in/BO1mJo/

Titoli di tendenza

I migliori creatori della settimana