$UCG

$MNDY

$KER (-1,72%)

$BARC

$OSCR

$CVS

$SPOT

$DDOG

$BP.

$SPGI (+0,78%)

$HAS

$KO

$JMIA

$MAR

$RACE

$UPST (-8,13%)

$NET

$LYFT

$981

$NCH2

$DSY

$1SXP

$HEIA

$ENR

$DOU

$OTLY

$TMUS (+1,49%)

$SHOP (-4,37%)

$KHC (-0,1%)

$FSLY

$HUBS

$CSCO (+0,68%)

$APP

$SIE (-1,35%)

$RMS (-1,33%)

$BATS

$MBG (-0,47%)

$TKA (-0,88%)

$VBK

$DB1 (+2,61%)

$NBIS

$ALB

$BIRK

$ADYEN

$ANET

$PINS

$AMAT

$ABNB

$TWLO (+1,32%)

$RIVN (-1,89%)

$COIN

$TOM

$OR

$MRNA

$CCO (+0,41%)

$DKNG

Kering

Price

Discussione su KER

Messaggi

43Quarterly figures 09.02-13.02.26

Depot roast

Dear Community,

After reading all the posts with great enthusiasm, I would like to hear your opinion on my portfolio today.

A few words about me:

I am 27 years old and bought my first share around 2019. Since then, I've unfortunately made a few mistakes and made a mistake ($KER (-1,72%) , $NOVO B (-0,91%) , $PUM (-4,19%) ). At that time, I unfortunately always had the approach that if it had fallen sharply, it had to go up again at some point...

That's why I've now increased my ETF holdings somewhat. The idea is to build up the portfolio mainly with ETFs and to improve the return with a few shares. However, I'm not really satisfied with the return yet...

I currently invest €3100 a month together with my partner, mainly in the $IWDA (-0,42%) and $VWCE (-0,51%) .

500€ flow into $BTC (-2,45%) .

I am looking forward to your opinion.

P.s.: I am aware that the stocks in the MSCI world, ftse world and s&p are duplicated. There are historical reasons why they are in my portfolio and they don't bother me at the moment.

Prada is the best luxury stock on the market

While all about $MC (-3,08%) and $RMS (-1,33%) one share is flying under the radar of many investors: Prada $1913 (+1,88%) . Thanks to Miu Miu, the company is growing despite the recessionary environment. In recent years, it has achieved 17 % sales growth per year - the best figure in the industry.

Basics about Prada

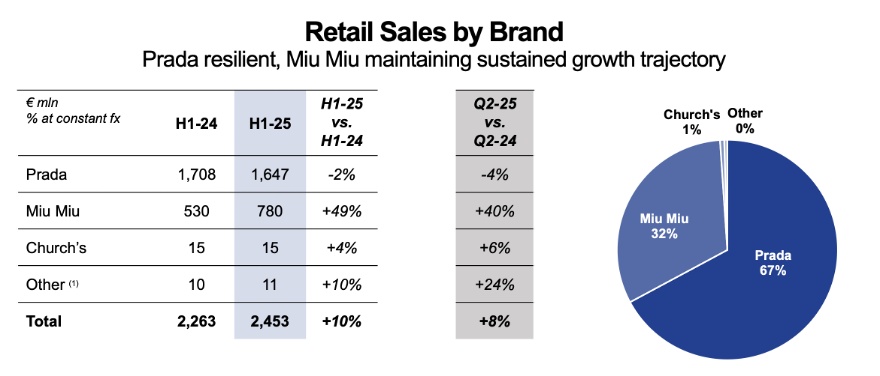

The Italian fashion group is listed in Hong Kong - which could also be a reason for its favorable valuation. In addition to Miu Miu and Prada, the company also owns other brands. However, these are not relevant for sales. Prada currently accounts for 67% of sales and Miu Miu for a further 32%.

Most of the items are produced in Italy. A small proportion is produced by "selected producers" - a paraphrase for production in low-wage countries such as China. This is the first potential risk for Prada. Made in Italy is probably the most important figurehead, together with the brand history.

The rise of Miu Miu

The brand is the reason for Prada's strong growth. It originates from Prada itself and has been experiencing a sustained boom for years. While it still accounted for 15% of sales in 2018, it now accounts for 32% - and the trend continues to rise. The larger the share of total sales, the greater the impact of Miu Miu's growth on the Group as a whole.

The combination of Prada and Miu Miu is exciting, as Prada can focus on classic and timeless fashion, while Miu Miu is more in tune with the times. The clear demarcation ensures that each brand can remain true to its target group.

This clear brand identity is important for the long-term relevance of a brand. Gucci and Louis Vuitton have been less loyal to their core customers in recent years and have sacrificed long-term brand identity for short-term growth.

Additional growth through the Versace takeover

Even though the management ruled out becoming a fashion holding company similar to LVMH some time ago, Prada took over the Italian fashion label Versace from Capri Holdings this year. $CPRI (-1,43%) The Versace takeover is to be completed by the end of 2025. Prada paid 1.25 billion euros for the struggling luxury company. The expected Versace turnover for 2025 was 810 million euros. The favorable purchase price is due to the fact that Versace is not profitable and its turnover shrank by around 20% in the previous year.

Versace has become too mainstream in recent years and, like Gucci (part of: $KER (-1,72%) ), has lost its core clientele. Prada now has the task of returning the company to its roots. In the valuation, I therefore assume that Versace will be slimmed down by 20%. More on this in a moment. Versace is a bargain overall - but only if Prada manages to bring Versace back to its roots.

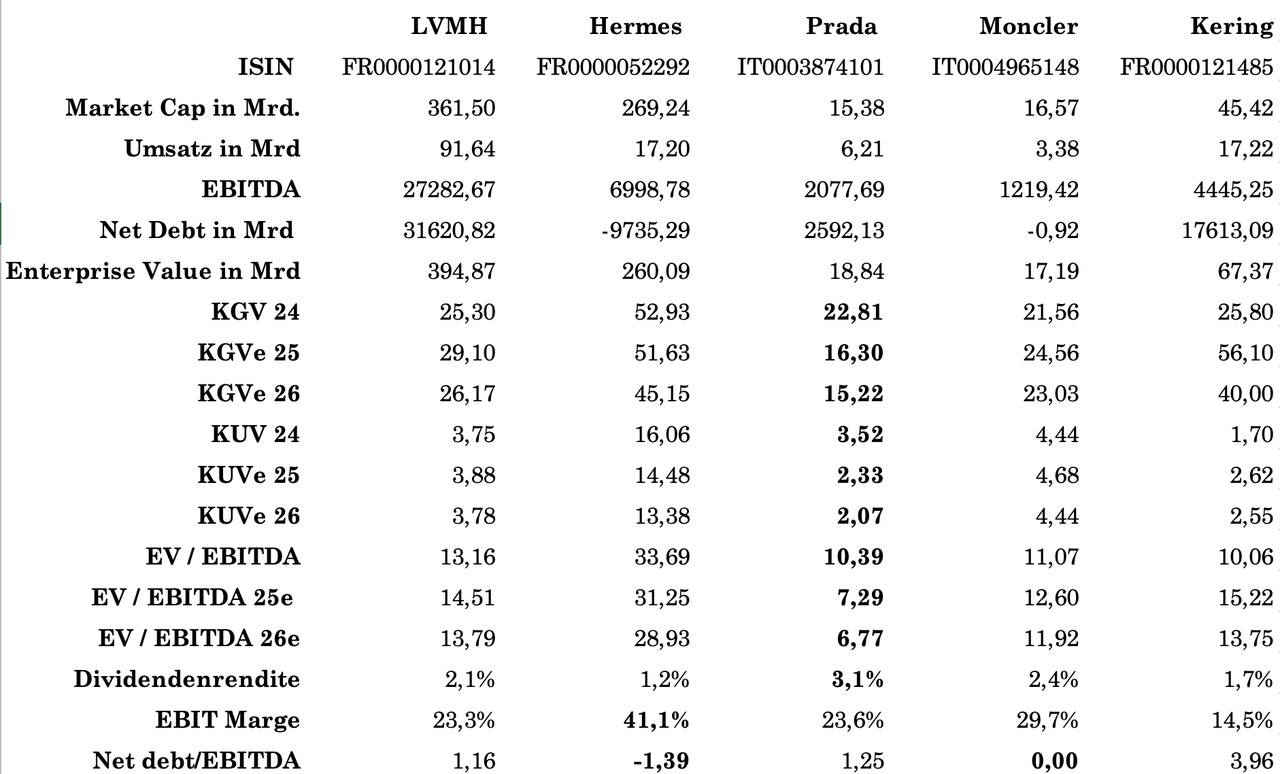

Competition

In order to better assess the current valuation multiple, I have compared Prada with its most important competitors.

It is immediately apparent that the EBIT margin of 24% is significantly lower than that of Hermès or $MONC (-1,27%) . This justifies a certain valuation discount - but However, with an EV/EBITDA of 10, Prada is worth around two thirds of Hermès. The multiples are also falling further due to the strong growth.

Prada is currently valued similarly to LVMH, but the valuation is falling much faster. There is also a 3.1% dividend yield. The debt is conservative at 1.25 net debt/EBITDA.

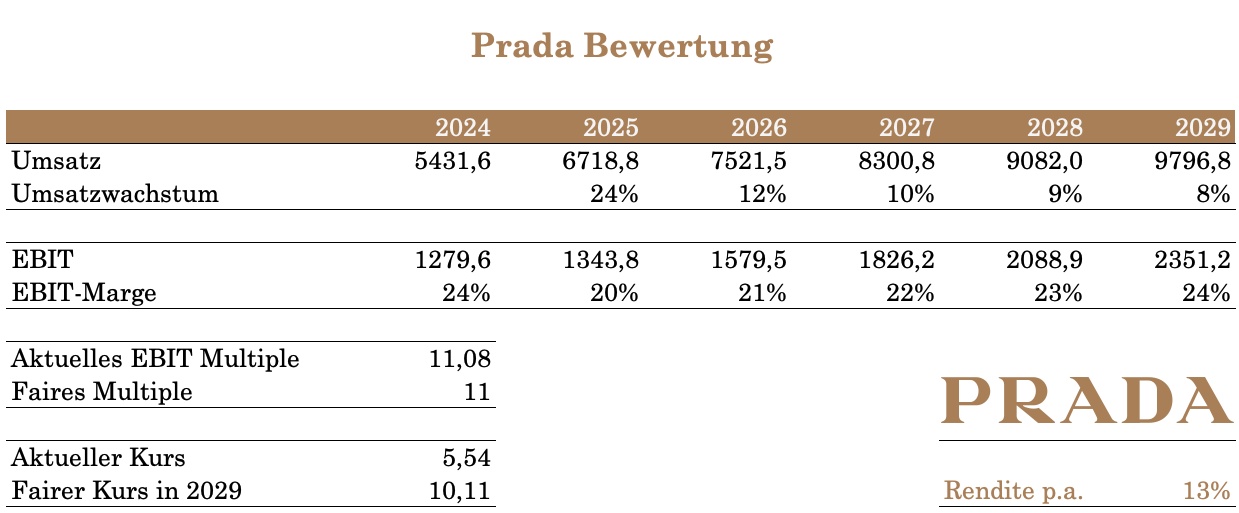

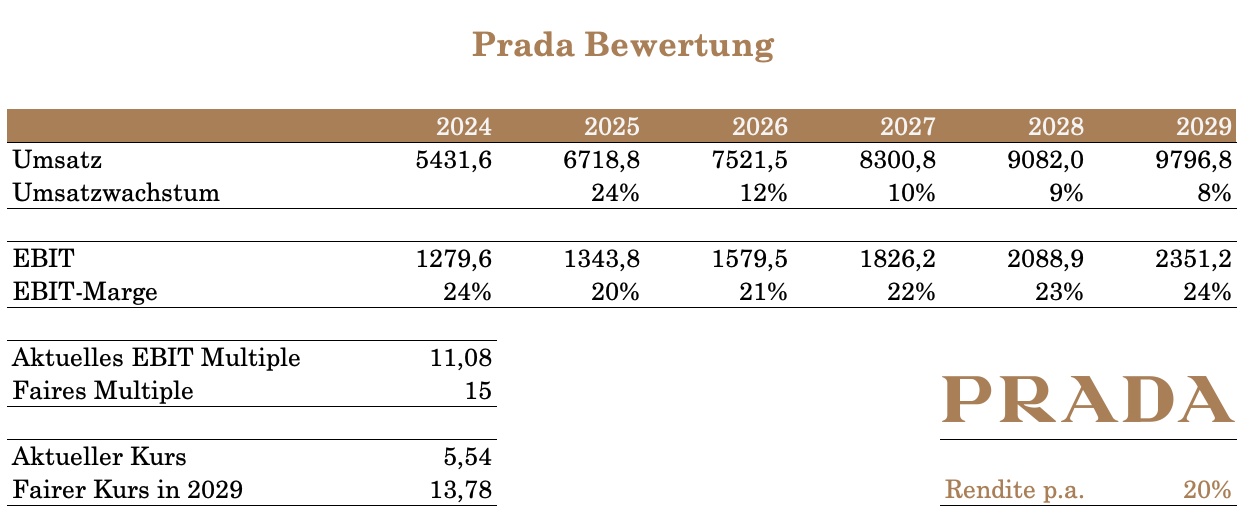

Valuation

The Prada brand is growing organically only slightly. Future growth depends heavily on Miu Miu. I have created a multiple valuation model to better estimate the influence of Miu Miu and Versace.

My assumptions:

- Miu Miu's growth is leveling off. Growth is expected to fall to 8% per year by 2029.

- The other brands will grow organically by 2% in line with inflation.

- Profitability will decrease due to Versace, but will recover within the next five years.

- Versace sales decline by 20% due to efficiency measures and artificial scarcity.

I am also of the opinion that the valuation multiple is currently too low. is currently too low. The industry is in crisis and is punishing Prada as well. In addition, the EBIT margin is currently lower. I have therefore created a conservative estimate with a constant multiple and a (for me) realistic model with a multiple increase from 11 to 14.

With multiple increase

Without multiple increase

Even without the increase in the multiple, Prada currently looks attractive. The expected return together with the products make Prada the best luxury stock in my eyes!

Note: The article contains my personal opinion and is not investment advice! The share is in my personal portfolio.

ps: this is my first post. Leave some love or constructive feedback there😘

Ciao Gucci

I have decided to sell my $KER (-1,72%) -shares. The position has been clearly in the red for some time and I am no longer convinced by the fundamental development. The problems at Gucci in particular are weighing on the outlook and make $KER (-1,72%) currently more of a risky turnaround bet. Instead of tying up capital in an unclear recovery, I would like to deploy it more efficiently. My focus is now on stocks with more stable fundamentals and better prospects: value and dividend stocks such as $ALV (-0,68%) or $ZURN (+0,41%) as well as growth stocks in areas such as cloud, cybersecurity or AI, such as $CRWD (-1,21%) . A global ETF such as $VWRL (+0,1%) remains interesting for broad hedging.

👉 What would you invest the freed-up capital in?

Kering after purchase?

Hi folks,

I had $KER (-1,72%) at €171.90 and then, in my opinion, the ball started rolling! Do you think now is a good time to buy now that the share seems to be recovering?

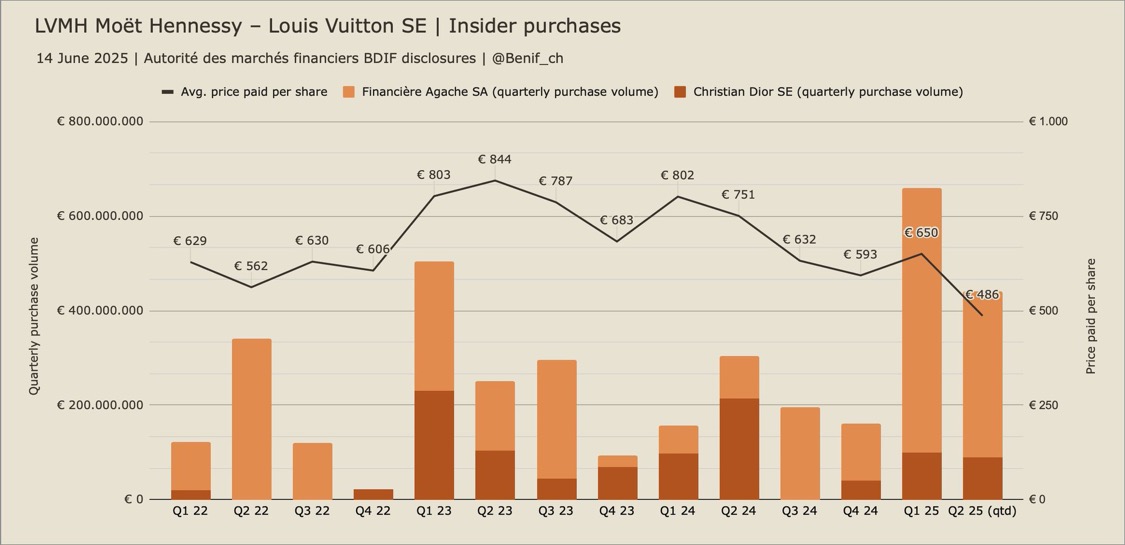

Purchases Arnault family

The Arnault family has bought almost € 3.7 billion in the last 3.5 years. $MC (-3,08%) in the last 3.5 years.

The average price per share was € 659.

The current share price is € 455.50

$LVMUY (-1,81%)

$MC (-3,08%)

$RMS (-1,33%)

$MONC (-1,27%)

$KER (-1,72%)

$MC (-3,08%) - Failed takeovers of LVMH

and activities of the children of Bernard

Arnault

Did you know the following:

In the late 90s, LVMH tried to take over Gucci, but CEO Domenico De Sole resisted.

He diluted the share price and gave employees a stake, weakening LVMH's control. Then Kering stepped in and secured Gucci.

He also tried Hermes:

In 2010, LVMH secretly acquired 17 percent of Hermès ($RMS (-1,33%) ), triggering a storm of indignation. Hermès fought back with legal disputes and accused LVMH of insider trading and share manipulation.

After years of conflict, LVMH agreed to sell its 23% stake in 2014, ending the intense rivalry.

Who will be the next takeover candidate?

Thanks to all the successful takeovers, LVMH now has an extensive portfolio of 75 brands, which can be seen in the picture.

LVMH is the largest luxury company in the world.

The Arnault family:

Bernard will probably keep the company in the family. As he has five children who are already integrated into the company, these are the potential successors:

1. Delphine

2. Antoine

3. Alexandre

4. Frederic

5. Jean

Delphine (49) is Executive VP of Louis Vuitton.

Delphine has been with LVMH since 2001 and is in charge of brand development and strategy. She plays an important role in the success of LV.

Antoine (47) is CEO of Berluti and Chairman of Loro Piana.

Antoine focuses on expanding LVMH's presence in luxury fashion and plays a role in brand communication and acquisitions.

Alexandre Arnault (32) is CEO of Tiffany & Co.

Alexandre revitalized Tiffany by targeting younger audiences and improving its digital presence. As a result, profits doubled within a year.

Frédéric Arnault (29) is CEO of LVMH Watches. After being CEO of Tag Heuer.

Jean Arnault (26) is Director of Product & Communications at Louis Vuitton Watches.

Finally, a few examples of LVMH's pricing power and price trends:

$MC (-3,08%)

$KER (-1,72%)

$RMS (-1,33%)

$MONC (-1,27%)

$BRBY (-2,31%)

$BOSS (-1,21%)

+ 6

You are in demand

Hi folks ,

I would like to add more stocks to my portfolio and would appreciate your opinion and vote. Which company/sector do you think is missing? And no, I'm not looking for ETF advice😂.

Also, I've been on the stock market since 2021 and have invested around €80,000 in the last 12 months.

The following stocks are available:

$MMM (-1,76%) - $3350 (-4,08%) - $1211 (-0,39%) - $UNH (+2,39%) - $KER (-1,72%) - $PEP (+0,69%) - $DJT (-2,38%)

I look forward to your opinion!

Podcast episode 85 "Buy High. Sell Low."

Subscribe to the podcast to prevent China from taking Taiwan.

00:00:00 Weekend trading stocks

00:03:40 Market environment

00:16:00 Delta Air Lines

00:20:00 LVMH, Grok AI

00:43:30 Hermès, Richemont, Kering

01:03:20 TSMC, ASML

01:26:50 Coalition agreement

Spotify

https://open.spotify.com/episode/36OedAqU7ZcTYd3PpnHRFQ?si=99nQieH0Qh6Hy1QhQ5hQzA

YouTube

Apple Podcast

$MC (-3,08%)

$RMS (-1,33%)

$KER (-1,72%)

$DAL (-6,61%)

$2330

$ASML (-1,57%)

$GOOG (+0,92%)

$GOOGL (+0,91%)

$SPOT

$AAPL (-3,6%)

$CFR (-3,29%)

Titoli di tendenza

I migliori creatori della settimana