Good morning everyone! ☕️ Today the market is moving on mixed tracks, with some top performers continuing to outshine while traditional sectors reflect recent macroeconomic dynamics. Here is a detailed breakdown of what’s driving today’s movements:

🚀 Communications & Space Economy ($ASTS (+7,49%) ) The satellite communications sector remains the undisputed protagonist. $ASTS (+7,49%) continues to show impressive relative strength, driven by operational progress on the BlueBird constellation. Investors are rewarding the company's ability to scale direct-to-cell broadband services, positioning it as a leader in a high-barrier market.

🏛️ Finance & Banking ($UCG (-2,23%) , $BBVA (-3,3%) , $ISP (-3,01%) ) European banks are showing resilience despite slight pullbacks in local markets.

UniCredit & Intesa Sanpaolo: Benefiting from solid fundamentals and shareholder remuneration policies (dividends and buybacks) among the highest in the sector.

2026 Scenario: The banking sector remains "value-oriented," trading at attractive multiples compared to tech, with an increasing focus on M&A and resilient fee-based income.

💻 Big Tech & AI ($META (+2,23%) , $MSFT (+2,11%) ,$GOOGL (-0,02%) ) The tech sector is in a "wait-and-see" mode ahead of next week's earnings. $META (+2,23%) leads the pack thanks to optimized AI ad spending, while $MSFT (+2,11%) and $GOOGL (-0,04%) reflect a tactical rotation toward more concrete AI infrastructure. Growth is solid, but the market is demanding clear proof of direct monetization.

🛍️ Retail & E-commerce ($BABA (-0,08%) , $CVNA (-2,98%) , $AMZN (+0,07%) )

China: Signs of recovery for $BABA (-0,08%) , supported by improving domestic consumer sentiment.

Personal Note: To be honest, I spent too much time studying the fundamentals and entered $BABA (-0,08%) late. Currently, the position is at a slight loss (approx -1%), but my long-term conviction remains intact. I plan to strengthen this position during my next rebalancing to optimize the entry price.

Consumer: $CVNA (-2,98%) is benefiting from a stabilizing used car market thanks to less aggressive interest rates compared to previous peaks.

💊 Health & MedTech ($HIMS (+11,23%) , $INSM (+0%) ) There is strong interest in companies integrating AI and healthcare. However, $HIMS is the most "volatile" part of my portfolio. I’ve seen virtual gains swing from +120% to -5%. While I believe in the business model, its volatility increases my risk score. With a future Popular Investor application in mind, risk stability is my priority. Therefore, I plan to liquidate the position at the next turn-up once my minimum gain target is met to stabilize my portfolio stats. 📉⚖️

🪙 Commodities & Safe Havens ($GLD (+1,78%) , $TRX (+9,48%) )

Gold: With $GLD (+1,78%) nearing all-time highs (around the $4,900+ area), investors are seeking protection against geopolitical uncertainties.

Crypto: Besides my $BTC (+6,05%) stack in cold storage, $TRX (+9,48%) is the only altcoin I’ve chosen to hold here on eToro. I strongly believe in the sustainability of the Tron network for global transactions. I am seriously considering increasing exposure in the coming days, viewing it as an asymmetric bet with great potential.

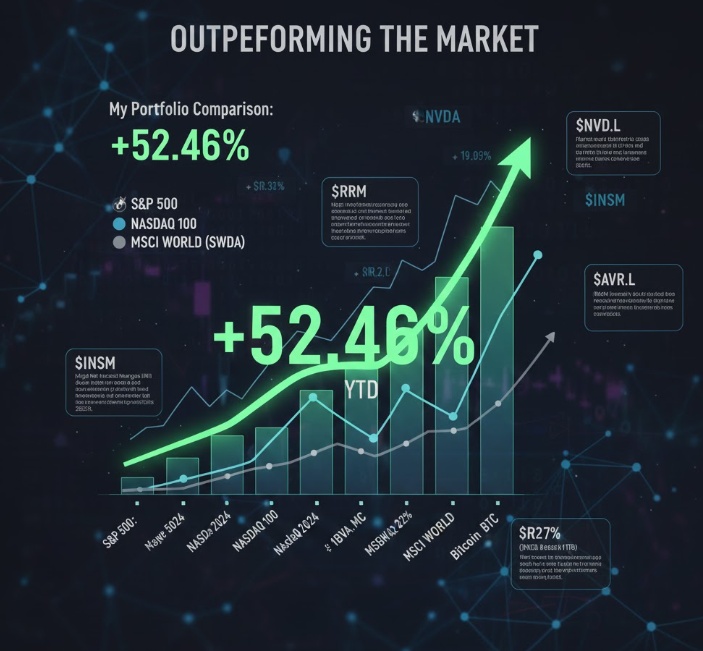

🎯 Towards the Popular Investor Program: As mentioned at the beginning of the year, I am working to make this portfolio as balanced as possible for future copiers. Risk management comes before spectacular but unstable profits.

How are you managing volatility in the more aggressive Tech stocks? What do you think about the rotation toward European banks? Let me know in the comments! 👇