$DPZ (-0,38%)

$HIMS (-0,67%)

$KTOS (-9,24%)

$DOCN (-4,89%)

$FME (+1,61%)

$KDP (+1,54%)

$AMT (+1,11%)

$HD (+0,84%)

$WDAY (-1,52%)

$FSLR (+2,98%)

$TEM (-2,07%)

$O (+1,13%)

$MELI (-0,16%)

$HPQ (+0,9%)

$LCID (-1,81%)

$DRO (-0,77%)

$HSBA (+1,43%)

$FRE (-0,06%)

$AG1 (+2,62%)

$CRCL (+2,48%)

$UTHR (-1,54%)

$LDO (+0,24%)

$IDR (+1,17%)

$NTNX (-3,65%)

$PARA (-1,35%)

$NVDA (+1%)

$TTD (+0,14%)

$AI (-2,75%)

$CRM (-0,11%)

$SNPS (-0,54%)

$SNOW (-3,7%)

$PSTG (+0,82%)

$ZIP (+11,17%)

$ZM (-0,43%)

$NU (+1,09%)

$RR. (+1,31%)

$MUV2 (+0,8%)

$BIDU (-1,12%)

$CELH

$DTE (+0,29%)

$STLAM (+2,73%)

$WBD (+0,08%)

$HAG (+0,69%)

$QBTS (-7,11%)

$LKNCY (+0,91%)

$BABA (+0%)

$G24 (+1,36%)

$HTZ (-1%)

$PUM (+0,37%)

$AIXA (-0,54%)

$RUN (+1,53%)

$INTU (-0,11%)

$WULF (-2,68%)

$MNST (+1,52%)

$SQ (+0,2%)

$ADSK (-1,05%)

$MP (-5,53%)

$RKLB (-6,56%)

$SOUN

$SMR

$CRWV (-9,31%)

$CPNG (+1,03%)

$DUOL

Leonardo

Price

Discussione su LDO

Messaggi

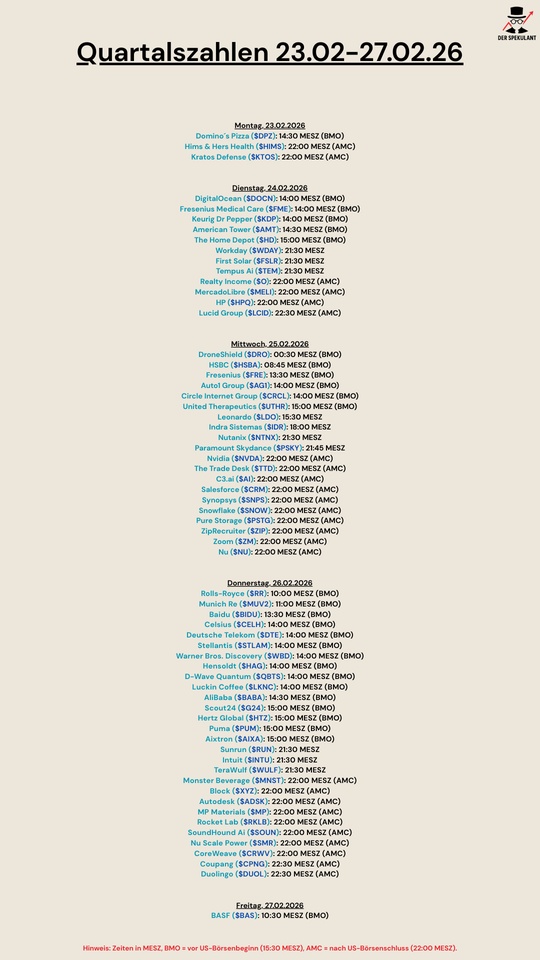

57Quartalszahlen 23.02-27.02.2026

What to expect next week

$DPZ (-0,38%)

$D (+1,58%)

$AXSM (-1,41%)

$HIMS (-0,67%)

$FRPT (-0,32%)

$BWXT (-0,89%)

$KEYS (+1,52%)

$KTOS (-9,24%)

$CIFR (-6,57%)

$HD (+0,84%)

$DOCN (-4,89%)

$XMTR (-3,83%)

$MELI (-0,16%)

$CAVA

$ZETA (+4,32%)

$WDAY (-1,52%)

$TEM (-2,07%)

$FSLR (+2,98%)

$HUT (-2,47%)

$TJX (+1,14%)

$CIRC

$RXRX

$NVDA (+1%)

$TTD (+0,14%)

$CRM (-0,11%)

$SNOW (-3,7%)

$IONQ (-4,24%)

$SNPS (-0,54%)

$NU (+1,09%)

$ZM (-0,43%)

$QBTS (-7,11%)

$VST (-0,75%)

$CELH

$ACMR (+1,87%)

$9888 (-1,05%)

$Q (+0,41%)

$CRWV (-9,31%)

$DELL (+2,6%)

$INOD (-1,3%)

$SOUN

$ZS (-5,46%)

$DUOL

$RKLB (-6,56%)

$AXON (-1,23%)

$LDO (+0,24%)

$FANG (+0,73%)

$ALV (+1,65%)

Leonardo

$LDO (+0,24%) ...Italian armaments company, builds helicopters and torpedoes for the German submarines, among other things. Owns 20% of Hensoldt AG. Part of the European MBDA Group. New focus on integration and coordination of different air defense areas (drone, cruise missiles,

jets and ballistic missiles) also through mobile fire control stations (decentralized).

🚀 Good morning, Community!

📊 Today’s session is looking extremely dynamic. While European markets consolidate the gains from their 2026 debut, the US Premarket is sending significant rotation signals. Here is what I’m monitoring in my portfolio:

🇮🇹 Europe (Market Open): Defense and Banking in Focus

The portfolio is benefiting from the push in Piazza Affari, which is among the most resilient indices today.

- $LDO (+0,24%)

🚀: This is the top performer. The surge comes from news of a new international contract and a general climate of confidence in the European Defense sector, which is seeing upward target price revisions for 2026. - $CE (+1,02%)

🟢: Excellent holding for Italian financials. The sector is benefiting from expectations of "higher for longer" interest rates compared to late 2025 forecasts, which favors net interest margins.

🇺🇸 US Premarket: The Clash of the Tech Giants

Wall Street is preparing for a mixed opening with clear technical movements:

- $GOOGL (+3,81%)

🟢: Google’s golden moment continues in the premarket. Cantor Fitzgerald just upgraded the rating to "Overweight" with a price target of $370, citing dominance in Generative AI and the success of Gemini. The market is rewarding its market cap flip over Apple. - $NVDA (+1%)

🟢: Remains in the green despite general caution. Investors are looking toward new announcements from CES 2026 and the sustained demand for H200 chips. - $MSFT (-0,3%)

🔴: Slight pressure in pre-opening. This is mainly technical profit-taking after the stock hit all-time highs yesterday. No change in fundamentals—just a physiological consolidation.

🔬 Semiconductors & Growth

- $TSM (+2,62%)

🟢: The Taiwanese giant reflects the optimism of Goldman Sachs, which raised its price target, forecasting a record-breaking 2026 thanks to 2nm production. - $RGTI (-4,09%)

🔴& $OKLO

🔴: More speculative stocks are suffering in the premarket due to a rotation toward safer "Large Caps" (like Google). Volatility remains high here, typical for stocks linked to Quantum Computing and Advanced Nuclear. These were two year-end bets, and I believe they could still deliver satisfaction in the short term.

🎯 Session Outlook

The strategy remains focused on quality. While Europe pushes into Defense and Banking, in the US, I am monitoring Alphabet’s volume to see if the rally has the legs to continue past the opening bell.

How are you positioned? Are you riding the Leonardo rally or waiting for the "dips" on US Tech? 👇

Would you like me to analyze the specific technical levels for any of these stocks or summarize the latest news on the CES 2026 announcements?

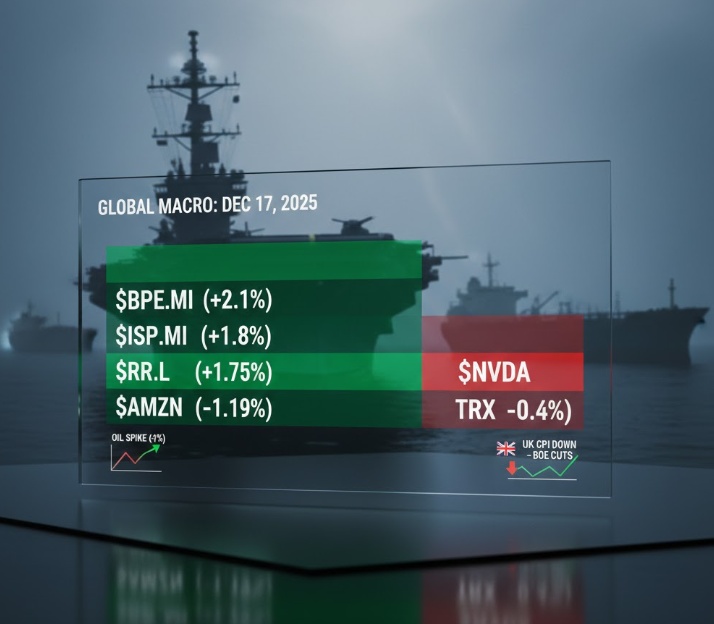

📈 MARKET UPDATE | DEC 17, 2025: BUYBACKS & BLOCKADES

The mid-week session is defined by an aggressive shift from overextended Tech into Financials and Aerospace.

🌍 THE MACRO SHOCK: TRUMP’S VENEZUELA BLOCKADE

The biggest geopolitical mover today is the U.S. naval blockade of sanctioned oil tankers into Venezuela.

The Impact: Crude prices spiked >1% instantly. This is providing a massive tailwind for energy and commodity-linked sectors.

The Shift: This "geopolitical premium" is forcing capital into hard assets. Silver just hit a record high above $66, with Gold following. 🛢️🔥🥈

🇪🇺 EUROPE: INFLATION COLLAPSE & CENTRAL BANK FEVER

EU indices are ripping because UK CPI fell sharper than expected this morning (3.2% vs 3.4% exp).

The Reaction: A shockwave through the bond market. Traders are now pricing in a near-certain Bank of England (BoE) rate cut tomorrow.

The "Trifecta": We are in a "relief rally" ahead of tomorrow’s massive data dump: ECB, BoE, and U.S. CPI. Markets are front-running a Dovish pivot from Lagarde. 🏦📉

🏦 THE ITALIAN BANKING RALLY

$$BPE (+4,11%) (+2.1%) | $ISP (+1,92%) (+1.8%) | $UCG (+1,16%) (+1.7%)

The Driver: Resilience in Net Interest Margins (NIM) as the ECB easing cycle appears slower than feared.

The Catalyst: Massive shareholder distribution. $UCG (+1,16%) and $ISP (+1,92%) are acting as "cash machines," using buybacks to floor the price against any macro noise.

⚙️ AEROSPACE & DEFENSE MOMENTUM

$$RR. (+1,31%) (+1.75%) | $LDO (+0,24%) (+1.4%) | $RKLB (-6,56%) (+1.3%)

The Driver: Rolls-Royce ($RR.L) just initiated a new £200M interim buyback starting Jan 2, immediately following their £1B 2025 program.

Context: Institutional accumulation in Defense is at peak levels as a structural hedge against 2026 geopolitical uncertainty.

📦 RETAIL & CLOUD RESILIENCE

$AMZN (+2,51%) (+1.19%)

The Driver: Wall Street is digesting the delayed Non-Farm Payrolls (64k added, but unemployment at 2021 highs).

The Sentiment: "Bad news is good news." A weakening labor market gives the Fed more ammo to cut. $AMZN (+2,51%) is catching the bid as BMO Capital hikes PT to $304, citing AWS cloud acceleration. 📊💼

⚠️ SECTOR ROTATION: THE "AI BUBBLE" PAUSE

$NVDA (+1%) (-0.25%) | $BTC (-4,46%) (~$86.7k) | $TRX (-1,33%) (-0.4%)

The Analysis: Pure profit-taking. Capital is bleeding out of high-beta Tech and Crypto to fund the rally in "Value" equities (Banks/Industrials).

The Risk: If $NVDA (+1%) loses its 20-day EMA at the US open, expect a broader drag on the Nasdaq. 🏛️➡️💻

Naval aviators in Nordholz receive high-tech helicopter

NHIndustries was established as a specialized company for the planning, manufacture, implementation, production and logistics support of the NH90 helicopters.

Airbus Helicopters: 62.5 %

of which Airbus Helicopters Deutschland GmbH: 31.25 %

Leonardo Helicopters: 32 %

Fokker: 5.5 %.

Netherlands Aircraft Company

This morning, the Sea Tiger helicopter will be handed over to the German Navy by Federal Minister of Defense Boris Pistorius (SPD) in Berlin. It will be stationed at the naval aviation base in Nordholz.

The NH-90 MRFH Sea Tiger on-board helicopter is the Navy's most modern helicopter. It is specially designed for use on frigates and is intended to help combat submarines, among other things. To this end, it has a diving sonar and a sonar buoy system to locate submarines. It is also designed to monitor the sea space above water with the help of electro-optical sensors and a camera system. The Sea Tiger is armed with torpedoes and anti-ship missiles.

NH-90 Sea Tiger: A "milestone for submarine hunting"

A total of 30 helicopters of this type are to be stationed at Naval Air Wing 5 in Nordholz, Lower Saxony. The first one will be handed over to the Navy in Berlin on Tuesday morning. In the afternoon, it is then expected to arrive at its stationing location with the naval aviators in Nordholz. For the Inspector of the Navy, Vice Admiral Jan Christian Kaack, the Sea Tiger represents a technological milestone for submarine hunting and naval warfare from the air.

1) NATO states pledge weapons to Ukraine for four billion dollars and 2) German Armed Forces put Arrow 3 missile defense system into operation

$BA. (+0,02%)

https://www.mdr.de/nachrichten/welt/osteuropa/politik/ukraine-krieg-nato-waffen-vier-milliarden-zusage-100.html

My research revealed:

In order to get to know the companies behind this deal, I wanted to research this for myself, maybe it will be interesting for you too:

The companies involved in the construction of the Arrow 3 missile defense system are listed on the stock exchange. Here is the current financial data (as of December 3, 2025, 12:55 pm ET for US stock exchanges and 5:25 pm CET for European stock exchanges):

- Boeing (BA):

$BA (-0,81%) The US company involved in the development is listed on the New York Stock Exchange (NYSE). The current share price is 198.38 USD per share with a market capitalization of around 150.7 billion USD. - Airbus (EADSY): $EADSY (+1,07%) As a co-owner of MBDA, Airbus is listed on several European stock exchanges and also as an ADR (American Depositary Receipt) in the US. The US share price (EADSY) is USD 57.788. In Europe, the share price is approx. 49.50 EUR per share.

- BAE Systems (BA.L): $BA. (+0,02%) Also a co-owner of MBDA, BAE Systems is listed on the London Stock Exchange. The share price in Germany (XETRA) is around EUR 18.57 per share.

- Leonardo (LDO.MI):

$LDO (+0,24%) The third co-owner of MBDA, Leonardo, is traded on the Borsa Italiana (Milan). The current share price is EUR 46.61 per share with a market capitalization of approx. EUR 26.9 billion.

The Arrow 3 missile defense system is mainly produced by Israel Aerospace Industries (IAI) and produced by Israel Aerospace Industries (IAI). Israel Aerospace Industries is a state-owned company and therefore not listed on the stock exchange.

The system was developed in collaboration with the US company Boeing and under the supervision of the Israeli Missile Defense Organization (IMDO) and the U.S. Missile Defense Agency (MDA). Boeing is a listed company.

MBDA Germany is the prime contractor and partner of IAI for sales and maintenance in Europe, in particular for the purchase by Germany. MBDA is a private multinational company owned by Airbus (37.5%), BAE Systems (37.5%)

$BA. (+0,02%) and Leonardo (25%), all of which are listed on the stock exchange. $BA. (+0,02%)

The VanEck Defense UCITS ETF (DFEN)

DFEN, the VanEck Defense UCITS ETF, offers investors a powerful way to tap into the global defense industry’s growth, backed by strong fundamentals and rising geopolitical demand.

The VanEck Defense ETF (ticker: DFEN) tracks the MarketVector Global Defense Industry Index, giving investors diversified exposure to leading defense and aerospace companies worldwide. With holdings such as Palantir Technologies, RTX Corporation, Leonardo S.p.A., and Hanwha Aerospace, DFEN captures both established giants and innovative disruptors driving the sector forward.

Over the past year, DFEN has delivered an impressive +41.7% return, significantly outperforming many broad market benchmarks. This surge reflects the reality of increased global defense spending, particularly in Europe and Asia, as nations strengthen military capabilities amid heightened geopolitical tensions. For investors, this translates into a sector with resilient demand, government-backed contracts, and long-term growth potential.

Key bullish points:

- Strong performance: 1-year return of over 40%.

- Diversification: Exposure to 40+ companies across the defense and aerospace value chain.

- Macro tailwinds: Rising defense budgets worldwide, especially in NATO and Asia.

- Liquidity & scale: Assets under management exceed €6 billion, with daily trading on Deutsche Börse Xetra.

- Cost efficiency: Competitive expense ratio of 0.55%.

For potential investors, DFEN represents not just a tactical play but a strategic allocation to a sector poised for sustained growth. Defense spending is no longer cyclical—it’s structural, driven by global security needs. By investing in DFEN, you gain access to a diversified, liquid, and high-performing ETF that aligns with today’s geopolitical and economic realities.

I am invested and will remain so.

Where is it possible to set a stop loss correctly?

It has happened again.

I worked with a stop loss for the second time and it was a disaster again.

The first time I sold "by mistake" $LDO (+0,24%) and then missed a tenbagger. Now I have once again been stopped out at a completely lunar price at $TTWO (-1,49%) . I had put in a stop-loss because I was expecting that the game GTA VI might be postponed again and I wanted to prepare for this wisely

What's the problem? Well, to make a long story short the stop price was €201 and not 196€ of course the thing was triggered after-market again with a gas-sick spread. So of course the whole thing makes no sense and has nothing at all to do with tactical investing.

Of course, in the end it's down to the fancy broker who is once again trying to offer a function that he can't use sensibly with his trading venue.

Now the question is this the case with all neobrokers? I'm sure that stop-loss will work with almost all real commercial banks and special brokers designed for trading - but I only really need the function every few years. But it's an absolute disaster if the stop is only ever triggered 5% below the set stop price because the broker can't set a price.

How is it with Scalable or Smartbroker? Do they work? Which trading venues need to be supported because Lang & Schwarz Exchange doesn't seem to get it right at all.

📊 Market Update (November 5, 2025)

Today's market is showing a mixed but generally positive tone across key sectors. While some tech giants are lagging, traditional finance, certain industrials, and defensive plays are showing strength, indicating a selective "risk-on" sentiment.

🇺🇸 US Equities (Pre-market/Early Trading)

$SPX500 — Trading solidly higher, driven by positive sentiment in various sectors, though tech is mixed.

$DJ30 — Moving up, reflecting broad positive sentiment.

$NSDQ100 — Showing mixed performance, with some mega-cap tech names under pressure.

💻 Tech & Growth Snapshot

A mixed picture in tech, with strong gains but also significant losses:

$NVDA (+1%) — Trading slightly lower, indicating some profit-taking in the semiconductor space.

$GOOGL (+3,81%) — Up strongly, showing robust performance in the mega-cap tech space.

$MSFT (-0,3%) — Down significantly, acting as a drag on the overall tech sector.

$TSM (+2,62%) — Up slightly, showing resilience in the chip sector.

$AVGO (-0,41%) — Up strongly, participating in the semiconductor rally.

$RGTI (-4,09%) — Up sharply, outperforming as some speculative growth names find renewed interest.

🛍️ Retail & Commerce

A strong day for retail and e-commerce, recovering from previous sessions:

$AMZN (+2,51%) — Up, participating in the mega-cap rally.

$BABA (+0%) — Up strongly, showing a significant rebound in the Chinese retail sector.

$SHOP (+2,19%) — Up, showing positive momentum.

⚕️ Health & Pharmaceutical

A positive session for the health sector:

$INSM (+3,7%) — Up, showing strength in biotech.

$HIMS (-0,67%) — Up, indicating positive sentiment in health services.

🇪🇺 Europe & Industrials

European markets are generally positive, with strong performances in finance and defense:

STOXX 600 — Trading higher, led by a strong rally in the banking sector.

GER40 — Trading higher, reflecting the positive sentiment.

$LDO (+0,24%) — Up strongly, the defense sector is showing significant strength.

$IBE (+0,92%) — Trading slightly lower, utilities lag as investors move towards growth.

🏦 Banking & Finance

A very strong day for European financials, leading the overall market higher:

$BBVA (+1,8%) — Up strongly, the Spanish bank is showing significant gains.

$UCG (+1,16%) — Advancing higher, part of the strong European banking rally.

$ISP (+1,92%) — Up strongly, showing clear outperformance.

$BPE (+4,11%) — Surging higher, continuing its rally and leading the Italian banks.

$CE (+1,02%) — Trading slightly lower, bucking the trend of other Italian banks.

$AXP (+0,94%) / $V (+0,55%) — Trading higher, the payments sector is positive.

🌏 Asia

Asian markets are expected to close mixed to positive, heavily impacted by the strong rebound in major Chinese names like $BABA.

💎 Commodities & Precious Metals

$GLD (+0,05%) — Up strongly. Gold is showing significant strength today, reflecting renewed safe-haven demand or inflation concerns despite the broader mixed-to-positive equity market. I have strong, unwavering confidence in Gold as a core protective and strategic asset for the long term.

$CDE (+1,9%) — Up strongly, mirroring gold's positive direction.

💰 Crypto

$BTC (-4,46%) / $ETH (-5,15%) / $TRX (-1,33%) — Likely moving lower, following the general risk-on mood.

🔎 Deep Dive: Sector Rotation and Resilience

Today's market highlights a clear sector rotation. Investors are re-engaging with European financials and select tech names, while taking profits in others. The strong rebound in $BABA suggests a renewed, albeit cautious, appetite for growth. The strength in Gold ($GLD) alongside some equity gains is particularly noteworthy, indicating a complex sentiment where both risk-taking and wealth preservation are at play.

Follow the Analysis:

For daily real-time market insights, deep dives, and trading discussions, follow me on X: https://x.com/ThomasVioli

To copy my portfolio, strategies, and complete trade insights, you can follow me on eToro: https://www.eToro.com/people/farlys

⚠️ Disclaimer: Past performance is not indicative of future results. Investing involves risks, including the loss of capital.

Titoli di tendenza

I migliori creatori della settimana