Buongiorno a tutti, avrei una domanda per i possessori di questa azienda, per ricevere l’orologio, quale azione devo comprare? Isin: CH0012255151 oppure isin: CH0012255144

Swatch CH

Price

Discussione su UHR

Messaggi

6Donald Trump is massively punishing Switzerland with his tariff policy. He is imposing a punitive tariff of 39 percent.

A good buying opportunity for some Swiss stocks at the end of the month? What do you think?

$SIKA (-0,94%)

$LOGN (-0,51%)

$CFR (+0,5%)

$BARN (-1,04%)

$EMMN (-1,85%)

$UHR (+0,41%)

Swiss bank account as a European

Hey everyone,

after a long period of inactivity (university + internships send my regards), here finally comes the first of the announced posts, today on the topic: Swiss bank account

I spent a good six months in Switzerland in 2024, was also officially registered there (residence, ID, etc.) and was able to try out a few things. This post is about that:

- How do you even get an account in Switzerland?

- Which banks are there and what have I tested myself?

- What are the advantages?

- And what happens when you go back abroad?

How do you get the account?

In short: if you live in Switzerland, it's easy.

Just show your ID, fill in a few forms and you're done. If you're not a resident, it's more difficult - most traditional banks tend to wave you off.

Yuh is the only exception I know of where you can open an account without a Swiss address. (I haven't tested it myself, but it's much easier with Swiss papers).

A UBS employee once said to me:

"Honestly, normal banking is not worthwhile for us for someone without a Swiss residence, too much effort, too little return."

(This was of course from the bank's point of view - don't take it personally, if you're in asset management or private banking, UBS still offers you something)

Which banks are there - and what have I used?

The three providers I used:

- UBS (incl. Credit Suisse) - the top dog

- PostFinance - basically the Swiss Postbank

- Yuh - Neobank, cheap, runs completely via cell phone.

Other relevant players:

- Cantonal banks (comparable with LBBW, for example)

- Neon (Neobank)

- Coop, Migros (yes, they also have banks)

- Raiffeisen Switzerland

- Julius Bär (for those with more zeros on their account)

Advantages of a Swiss account:

An account in Switzerland is not a must-have, but it does have a few advantages:

- Multi-currency accounts (e.g. CHF, EUR, USD in one account with neobanks) are practical for emergency savings in several currencies or for traveling abroad.

- The franc is a strong currency, especially in turbulent times.

- UBS is systemically relevant for Switzerland

- Contracts (rent, cell phone, etc.) are easier to arrange with a Swiss account.

- Transfers within Switzerland and to Liechtenstein are quick and inexpensive.

- TWINT: extremely important. Hardly anyone in Switzerland uses PayPal, Twint is sometimes more accepted than cash

- With an account you get the full version, without an account you get the prepaid version.

- And if you buy Swiss shares, it's easier to be entered in the share register (keyword: dividends in kind $UHR (+0,41%)

$LISN (-0,5%) etc.)

As a small bonus: tax deferral effect: as taxes are not paid automatically, you only have to pay them when you file your tax return, but you also have more work to do

And if you move away again?

As soon as you are no longer a Swiss resident, most banks charge CHF 25-30 per month and credit cards (at least at UBS) must be secured (interest-free)

- Exception: You are a pupil, student or similar (even without a CH address)

Conclusion:

A Swiss account is not a must, but can be really useful in certain cases:

If you live, work or visit Switzerland often, it makes things a lot easier.

It can also be useful for currency diversification or for TWINT & Co.

But:

After moving away, you should take a close look.

The monthly fees (except for neobanks like Yuh) can quickly pile up. And there can also be restrictions on credit cards.

Bottom line: good if you use it consciously, expensive if you forget.

If you have any questions or want to add something, please feel free to leave a comment!

- Yuh Solala (ps. the neobank of Post&Swissquote)

- UBS has massively missed the digital transformation. Externally as well as internally. UX is quite poor compared to others.

- Alternatives for simple banking: Neon, Kaspar&

- Alternative for investing: Swissquote / Neon / Yuh, depending on trading behavior.

- Credit cards: Swisscard or Migros credit card are the best (1% cashback - 0 costs)

In general, CH has a lot of catching up to do in banking imo. On the other hand, many providers are more transparent than foreign competitors.

PS: Formatting in the post is, mobile, quite unpleasant and untidy.

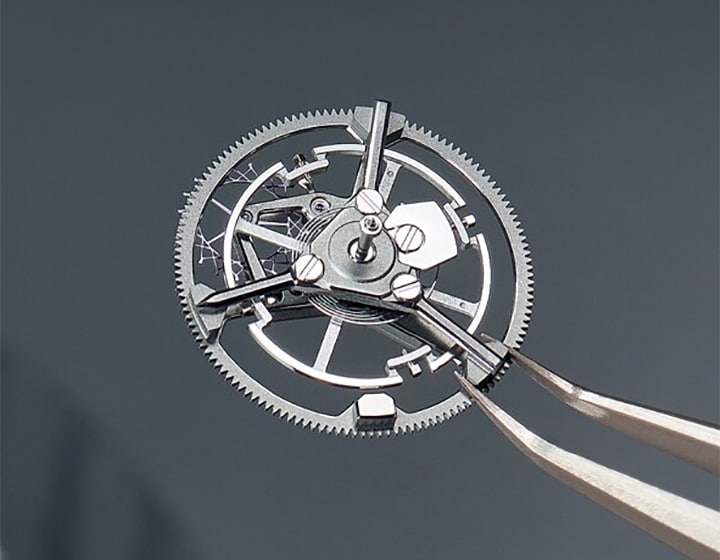

Half-Year Report 2024 of the Swatch Group ($UHRN (-0,56%) / $UHR (+0,41%) ): An overview

Swatch Group published its half-year report for 2024 today, and I would like to summarize the most important information and an outlook for the second half of the year. The figures show both challenges and positive developments in the Group.

Key figures

- Net sales: CHF 3,445 million, a decrease of 14.3% compared to the previous year

- Operating profit: CHF 204 million, significantly lower than the CHF 686 million in the previous year.

- Net profit: CHF 147 million, a decrease of 70.5% compared to CHF 498 million in the previous year.

- Equity: CHF 12.2 billion, almost unchanged compared to CHF 12.3 billion in December 2023

Causes and developments

- Decline in demand in China: A major reason for the decline in sales was the sharp drop in demand for luxury goods in China, including Hong Kong SAR and Macau SAR. Interestingly, the Swatch brand was able to increase its sales in China by 10%, bucking the negative trend.

- Regional differences: While stable sales were achieved in Europe, there were uncertainties due to geopolitical conflicts. Record sales were achieved in the USA and Japan, with remarkable growth of over 30% in Japan.

- Production: The production area recorded a strongly negative operating result due to the deliberate maintenance of all production capacities, despite declining orders.

Outlook for the second half of 2024

Swatch Group expects the market in China to remain challenging, but sees great potential in the lower price segments. Further strong growth is expected in the USA and Japan, supported by investments in its own retail network. The outlook in Europe is also promising. Omega's role as the official timepiece at the Olympic Games in Paris, which will give the brand a global media presence, is highlighted as particularly positive.

The cost-cutting program introduced at the beginning of the year is showing initial success and will have further positive effects in the second half of the year. Overall, the Group expects the situation to improve significantly in the second half of the year.

What's next?

The Swatch Group is facing challenges, particularly in the Chinese market, but is also seeing positive developments in other regions. The Swatch brand and the investments in the retail network are bright spots. The coming months will be crucial to see how effective the measures introduced are and whether the positive development can be continued.

Hope helps!

Happy Investing

GG

Source:

Evil traded companies in my professional life

Thanks to @Koenigmidas for linking and for the nomination! #börsengehandelteralltag

#boersengehandelteralltag

Exchange traded companies in my professional everyday life in precious metals and foreign exchange trading:

- Umicore $UMI (-6,33%) (refinery)

- Prosegur $PSG (-0,45%) (security, logistics, cashrecyling)

- Johnson Controls $JCI (-1,04%) (security)

- Swiss National Bank $SNBN (-0,52%) (foreign exchange trading)

- National Bank of Japan $8301 (foreign exchange trading)

- FedEx $FDX (-1,74%) (logistics)

- United Parcel Service $UPS (-2,23%) (logistics)

- Cloudflare $NET (-10,26%) (IT Security, Web)

- Fortinet $FTNT (-6,34%) (IT Security)

- Teamviewer $TMV (-4,41%) (Software)

- Microsoft $MSFT (-2,85%) (Software)

- Cancom $COK (-0,31%) (IT system house)

- Kyocera $6971 (-0,34%) (printer and scan hardware)

- Alphabet $GOOGL (-0,81%) (Who doesn't know it...?, research)

Naturally, I still have to do with various things which are traded on the stock exchange, but are not companies... these include: $965515 (+1,99%) (gold), $965310 (+3,59%) (silver), platinum and the various currency pairs like $965275 (+0,08%) (EUR/USD) but also all other currencies (AUD, NOK, GBP, JPN, SEK, PLN, CZK, SAR, etc. etc. etc.). Subordinately, we also have to deal with $BTC (-4,49%) (Bitcoin), although it is rather negligible.

In our other parts of the company we also deal with $UHR (+0,41%) (SwatchGroup).

What strikes me personally when I look at my professional environment:

There are dozens of companies in this sector, which are not traded on the stock exchange. Among them are some refineries (partly huge company constructs), service providers and luxury goods manufacturers. Also in the area of analysis technology (physical), equipment and software, there are some well-known manufacturers who have so far shied away from the stock exchange or are family-run.

In my private environment I have to do of course like each of you with various products and brands. A separate listing should be interesting for the fewest...

But the most extraordinary might be $RI (-2,47%) (Pernod Ricard), which is not least due to one of my hobbies: ABSOLUT VODKA bottles in the various designs and Limiteditions collect.

Basically I nominate all Getquin friendsbut especially @Der_Dividenden_Monteur , @Staatsmann

@Simpson !

Titoli di tendenza

I migliori creatori della settimana