Hey everyone,

after a long period of inactivity (university + internships send my regards), here finally comes the first of the announced posts, today on the topic: Swiss bank account

I spent a good six months in Switzerland in 2024, was also officially registered there (residence, ID, etc.) and was able to try out a few things. This post is about that:

- How do you even get an account in Switzerland?

- Which banks are there and what have I tested myself?

- What are the advantages?

- And what happens when you go back abroad?

How do you get the account?

In short: if you live in Switzerland, it's easy.

Just show your ID, fill in a few forms and you're done. If you're not a resident, it's more difficult - most traditional banks tend to wave you off.

Yuh is the only exception I know of where you can open an account without a Swiss address. (I haven't tested it myself, but it's much easier with Swiss papers).

A UBS employee once said to me:

"Honestly, normal banking is not worthwhile for us for someone without a Swiss residence, too much effort, too little return."

(This was of course from the bank's point of view - don't take it personally, if you're in asset management or private banking, UBS still offers you something)

Which banks are there - and what have I used?

The three providers I used:

- UBS (incl. Credit Suisse) - the top dog

- PostFinance - basically the Swiss Postbank

- Yuh - Neobank, cheap, runs completely via cell phone.

Other relevant players:

- Cantonal banks (comparable with LBBW, for example)

- Neon (Neobank)

- Coop, Migros (yes, they also have banks)

- Raiffeisen Switzerland

- Julius Bär (for those with more zeros on their account)

Advantages of a Swiss account:

An account in Switzerland is not a must-have, but it does have a few advantages:

- Multi-currency accounts (e.g. CHF, EUR, USD in one account with neobanks) are practical for emergency savings in several currencies or for traveling abroad.

- The franc is a strong currency, especially in turbulent times.

- UBS is systemically relevant for Switzerland

- Contracts (rent, cell phone, etc.) are easier to arrange with a Swiss account.

- Transfers within Switzerland and to Liechtenstein are quick and inexpensive.

- TWINT: extremely important. Hardly anyone in Switzerland uses PayPal, Twint is sometimes more accepted than cash

- With an account you get the full version, without an account you get the prepaid version.

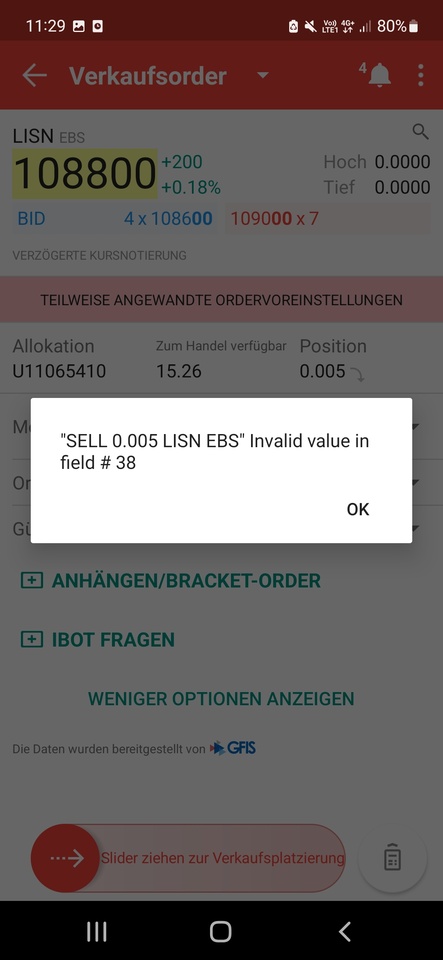

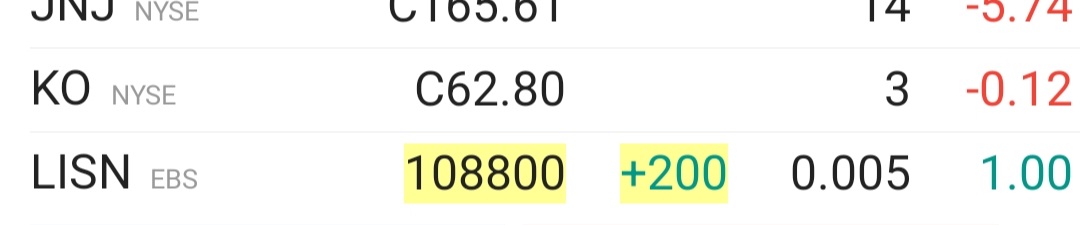

- And if you buy Swiss shares, it's easier to be entered in the share register (keyword: dividends in kind $UHR (-1,52%)

$LISN (-1,59%) etc.)

As a small bonus: tax deferral effect: as taxes are not paid automatically, you only have to pay them when you file your tax return, but you also have more work to do

And if you move away again?

As soon as you are no longer a Swiss resident, most banks charge CHF 25-30 per month and credit cards (at least at UBS) must be secured (interest-free)

- Exception: You are a pupil, student or similar (even without a CH address)

Conclusion:

A Swiss account is not a must, but can be really useful in certain cases:

If you live, work or visit Switzerland often, it makes things a lot easier.

It can also be useful for currency diversification or for TWINT & Co.

But:

After moving away, you should take a close look.

The monthly fees (except for neobanks like Yuh) can quickly pile up. And there can also be restrictions on credit cards.

Bottom line: good if you use it consciously, expensive if you forget.

If you have any questions or want to add something, please feel free to leave a comment!