$TMV (+0,54%)

Hello everyone, a tech stock is currently selling off at a more than attractive P/E ratio.

What is your opinion on this?

Get in at a bargain price or stay away?

TeamViewer: MWB Research and JPMorgan see over 115% price potential after the panic sell-off!

Is this already the bottom?

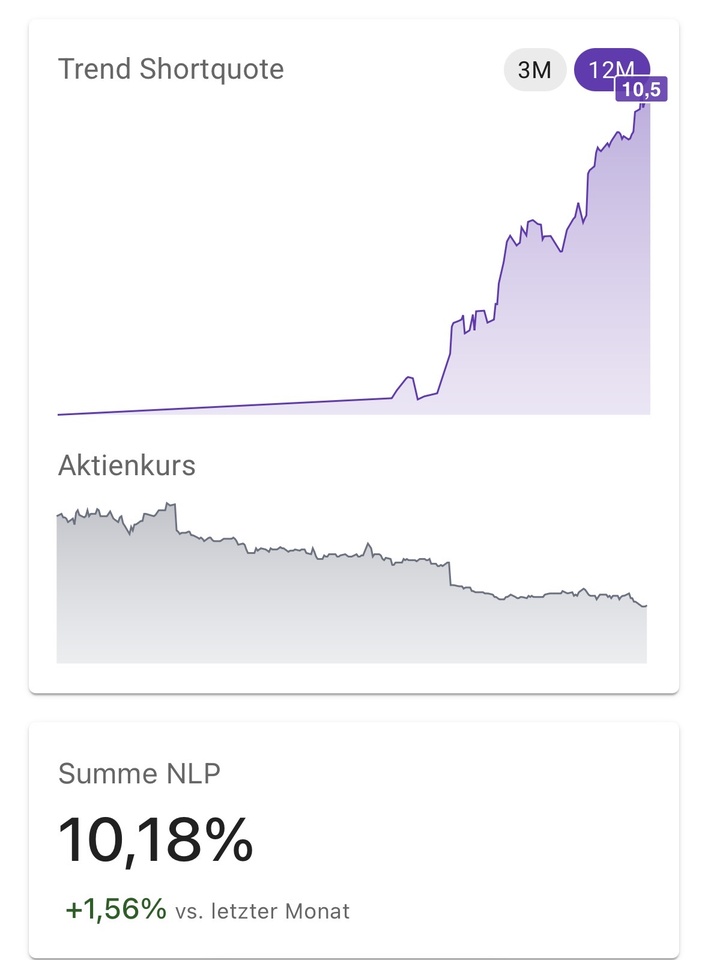

The TeamViewer share has been in a steep downward channel for over two years. The fact that just a few days ago it looked as if the 3-year low of EUR 8.30 would hold is a bitter pill to swallow.

As a result of today's crash, the MDAX share has fallen to a new all-time low. Whether the TeamViewer share has already found a bottom remains questionable.

A very exciting turnaround case

In my opinion, the TeamViewer share is one of the most interesting turnaround cases on the German stock market. The share price has fallen by over -60% since its all-time high in summer 2023. In my view, this is once again a clear case of investor overreaction.

TeamViewer is still a growing company. Over the past three years, the software manufacturer has grown by an average of 10%. In the current year, sales are even expected to increase by around 15% due to the takeover by 1E.

For the coming year, TeamViewer is hardly expecting any growth for the reasons mentioned above. However, I assume that 2026 will be an exceptional year and that the tech company will be able to resume its growth momentum from 2027.

TeamViewer has also been able to increase its operating margin in recent years. Profits therefore rise with increasing company size. The integration of 1E is proving to be more difficult than expected, but should be successful in the coming months.

Last but not least, the valuation of the TeamViewer share speaks in favor of a rebound. With a forward P/E ratio of just under 8, the tech stock is cheaper than it has been for a long time.

I am not in a position to predict whether the TeamViewer share has already bottomed out as a result of today's price fall. Investors must be prepared for the fact that it has not yet found its footing. But the MDAX stock has plenty of upside in the long term. However, investors will need a lot of patience and nerves of steel to realize this potential.

https://www.sharedeals.de/teamviewer-aktie-20-jetzt-ein-schnaeppchen-machen/

Targets canceled: TeamViewer share crashes to all-time low

An unexpected setback for TeamViewer: the software provider has revised its sales and growth targets downwards - and the share price promptly reacted with a slide of more than 20 percent on Wednesday.

TeamViewer shares plummeted on Wednesday morning after the company lowered its revenue expectations. At the Xetra start, the shares were down more than 20 percent at just 6.69 euros. This represents a new all-time low for the MDAX software stock.

The main reason for the correction is the disappointing development of the recently acquired British IT company 1E, which specializes in software for identifying and rectifying system problems. TeamViewer acquired the company at the end of 2024, but business has been significantly worse than expected. The Stuttgart-based company attributes this to ongoing macroeconomic weakness and longer decision-making processes at customers - particularly in the USA, 1E's most important market.

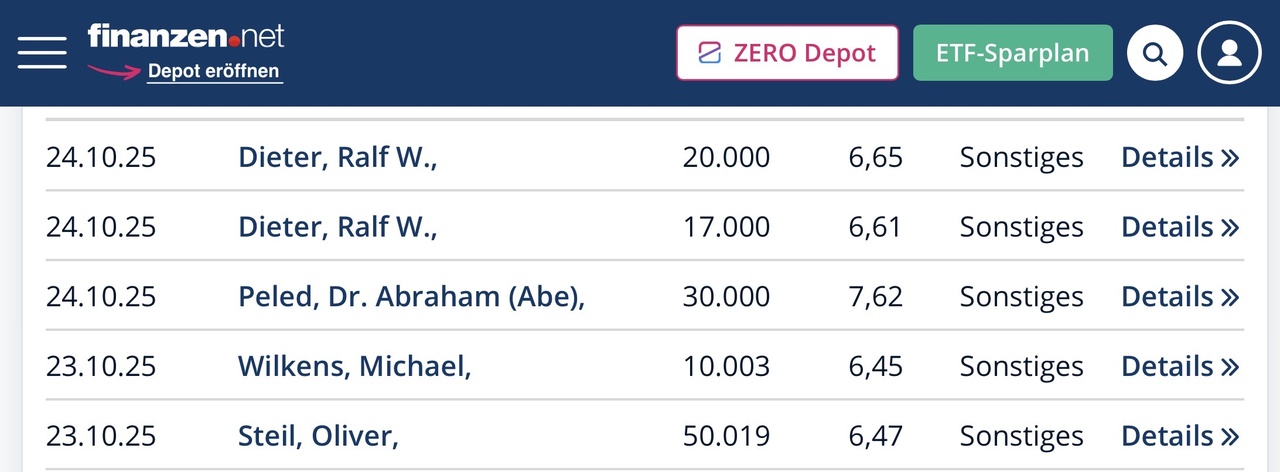

CFO Michael Wilkens admitted that the ongoing restructuring measures at 1E would take time, which would slow down short-term growth. Accordingly, TeamViewer now only expects recurring revenue (ARR) of EUR 780 to 800 million for the year as a whole, compared to EUR 815 to 840 million previously. For 2026, the Group only expects an increase of two to six percent to EUR 790 to 825 million, instead of the previously forecast EUR 850 to 870 million.

"However, the reduced growth expectations and the weak development of 1E, which is questionable as to how it can be remedied in the short term, are likely to overshadow the other factors and have a negative impact on investor sentiment towards the share," writes DZ Bank analyst Armin Kremser.

https://www.wallstreet-online.de/nachricht/20058259-britische-tochter-sorgen-ziele-gestrichen-teamviewer-aktie-crasht-allzeittief

TeamViewer - Extremely favorable valuation makes remote maintenance specialist a takeover candidate.

https://aktienmagazin.de/blog/analystenempfehlungen/teamviewer-extrem-gunstige-bewertung-macht-spezialisten-fur-fernwartun-153110.html

Teamviewer: A share with AI fantasy at a P/E ratio of 8.5!

https://aktienmagazin.de/nachrichten/chart-tweets/teamviewer-eine-aktie-mit-ki-fantasie-zum-85er-kgv-152794.html