EUR/USD

Price

Discussione su 965275

Messaggi

16Commodities | Copper on the long lever

Copper is currently continuing its strong rally. Further price increases are now also expected from $C (+2,3%) expected. Citi expects a structural deficit resulting from strong demand from the USA & Europe, but also from limited supply expansion over the coming years. $UBSG (-0,19%) & $JPM (+0,25%) even expect 12-13k tons for the 2nd quarter of 2026. An increase in copper can have an inflationary effect due to the high import costs, while the direct economic benefit for the domestic industry is low. $965275 (-1,1%) would be burdened in the medium term under these circumstances, as the US economy benefits more from the positive effects, while Europe suffers more from the negative effects.

📊 Market Update (October 15, 2025)

🇺🇸 USA

U.S. markets closed yesterday's session with mixed and predominantly negative sentiment as traders wait to see which direction the market will take next.

- $SPX500 — Closed slightly down (-0.15%), showing uncertainty after a volatile day.

- $DJ30 — The only index showing strength, it closed in positive territory (+0.45%), supported by industrial stocks.

- $NSDQ100 — Experienced a sharper decline (-0.76%), with tech stocks facing profit-taking.

💻 Tech Snapshot

- $AVGO (+0,56%) — In a clear downturn (-3.52%), the semiconductor sector appears to be under pressure.

- $AMZN (+0,19%) — Down (-1.66%), the stock is affected by the risk-averse climate in the tech sector.

- $META (+2,07%) — Closed essentially flat (+0.02%), showing relative strength compared to the sector.

- $MSFT (+1,99%) — Slight decline (-0.09%), in line with the general uncertainty in the tech space.

- $BABA (-0,9%) — In negative territory (-2.37%), hit by the sell-off in Chinese stocks listed on Wall Street.

🇪🇺 Europe (Closing data from 10/14 and today's open)

European stock exchanges closed weak yesterday, but today's futures point to a recovery at the open, following the positive wave from Asia.

- STOXX 600 — Finished yesterday down (-0.37%) with widespread selling.

- GER40 futures — Are moving in negative territory today (-1.05% in the last 24h), still reflecting yesterday's weakness but with potential for recovery at the open.

🏦 European & Italian Banks (Closing data from 10/14)

The banking sector showed weakness in the previous session.

- $$ISP (-3,29%) — Closed lower (-0.18%).

- $$BAMI (-2,68%) — In decline (-0.24%).

- $$BPE (-3,52%) — Negative performance (-0.27%).

- $$CE (-2,18%) — Was up on Friday, but today's data is awaited.

- $$BBVA (-3,58%) — Closed positive (+0.44%), bucking the trend seen in the Italian sector.

🌏 Asia (Today's closing data)

Asia is the true engine of the day, with a strong wave of buying improving global sentiment.

- $JPN225 — Closed with a strong gain (+1.82%), leading the region's optimism.

- $HK50 — Excellent performance, closing with a gain of +1.78%, driven by local tech stocks.

💱 Forex

- $965275 (-1,1%) — Stable around the 1.1620 area, with the dollar waiting for the next moves after yesterday's mixed data.

💰 Crypto (Today's data) The crypto sector is showing signs of weakness in the early hours of the day, moving against the trend of Asian equities.

- $BTC (-1,59%) — Trending down, trading below €97,000 after starting the day above this level. The performance in the last few hours is approximately -1.02%.

- $ETH (-2,33%) — Following Bitcoin's weakness with a similar trend.

🔎 Deep Dive: Asia Leads, the West Waits

Today's session is marked by a clear divergence between Asia and the West. While Asian markets, particularly Japan ($JPN225) and Hong Kong ($HK50), posted strong gains and fueled a positive global sentiment, European and American markets are coming off a session of weakness and uncertainty.

- Stock Markets: The optimism from Asia is positively influencing the European open. The real question is whether this momentum will be enough to reverse the negative trend seen on Wall Street yesterday, especially in the tech sector ($NSDQ100). All eyes are on the U.S. market open to see if the Asian risk-on sentiment will be sustained.

- Crypto Market: The crypto world seems disconnected from the positive equity sentiment today. The decline in Bitcoin and Ethereum suggests that crypto investors are proceeding with more caution, perhaps waiting for confirmation from Western markets before pushing higher. This period of weakness could present an interesting accumulation zone if the global sentiment continues to improve.

PS: The strong push from Asia is an encouraging sign. I am closely monitoring the European open to see if the rebound materializes. If Europe follows Asia, we could see a return of confidence in the U.S. as well. I'm holding my positions but remain ready to manage volatility.

⚠️ Disclaimer: Past performance is not an indication of future results. Investing involves risks, including the loss of capital.

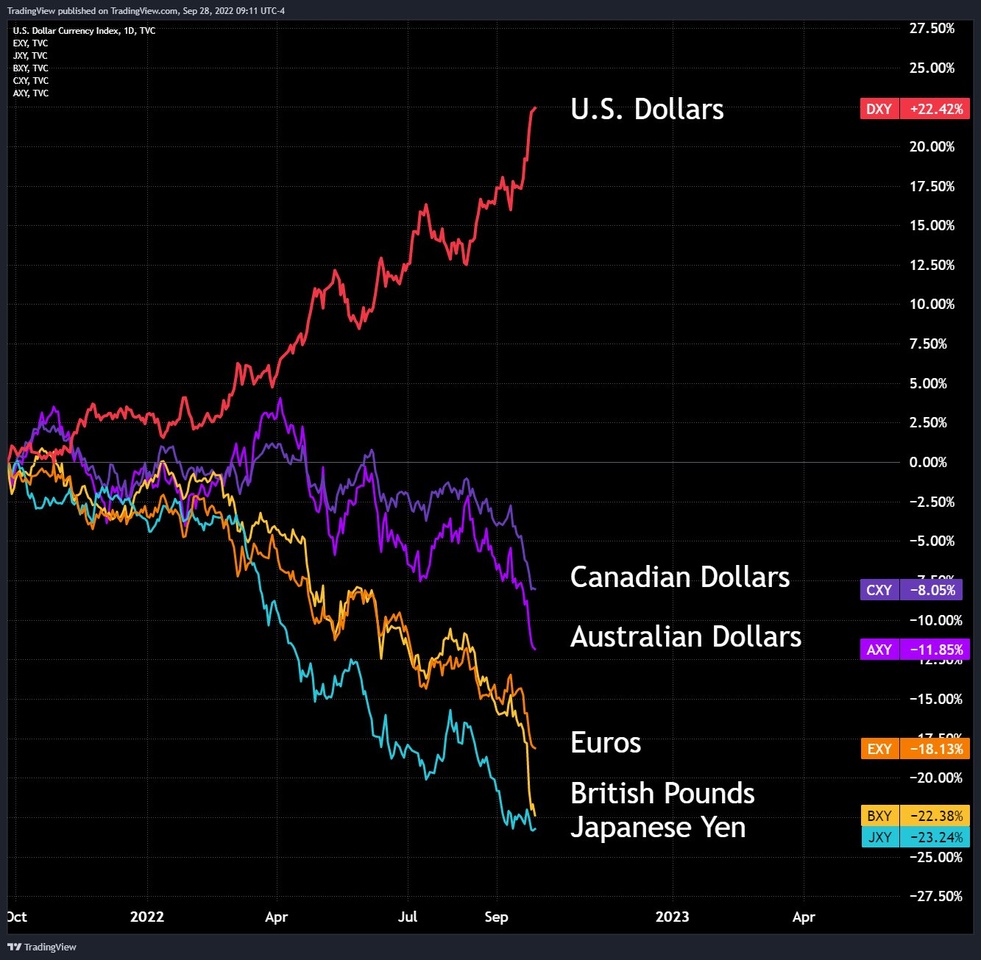

📉 Strong Euro, Weak Dollar: What It Means for Crypto & U.S. Stocks Investors

With EUR/USD trading at 1.18, European investors are getting more bang for their buck—literally. A weaker dollar means U.S.-based assets like crypto and American stocks are effectively “on sale” for euro holders. That Tesla share or Ethereum token now costs less in euros than it did months ago, making it an opportune moment to increase exposure without overextending your capital.

For crypto traders, this can be a double win: cheaper entry in USD terms and potential upside if the dollar rebounds. Same goes for U.S. equities—especially tech stocks, which tend to benefit from international inflows during dollar dips.

But it’s not all upside. A weak dollar often signals economic uncertainty in the U.S., which can ripple through global markets. Plus, if the dollar strengthens later, your euro-based gains could shrink when converting back. Currency risk is real—and often overlooked.

Bottom line: a soft dollar opens doors, but only for those who manage FX risk wisely.

📊 Market Update (Aug 21, 2025)

🇺🇸 USA

$SPX500 slightly down (~–0.3%)

$DJ30 modestly higher

Tech snapshot:

• $NVDA (+3,71%) ~USD 175.40 (–0.14%)

•$AVGO (+0,56%) ~USD 291.17 (–1.28%)

🇪🇺 Europe

Markets cautious ahead of Powell’s Jackson Hole speech

$EUSTX50 futures ~–0.4%

$GER40 futures ~–0.3%

Selected Stocks:

• $RR. (+0,77%) (Rolls-Royce) ~1,035 GBp (+0.9%)

•$LDO (+3,45%) (Leonardo S.p.A.) ~€46.65 (+4.0%)

•$GOOGL (-0,21%) (Alphabet) ~USD 168.20 (+0.5%)

•$META (+2,07%) (Meta Platforms) ~USD 562.70 (+0.7%)

•$NVDA (+3,71%) A (NVIDIA) ~USD 175.40 (–0.14%)

• $AVGO (+0,56%) ~USD 291.17 (–1.28%)

🌏 Asia

Nikkei –0.6% — $JPN225

KOSPI +0.7%, Australia at record highs

China & Hong Kong flat

💱 Forex

$965275 (-1,1%) EUR/USD ~1.163 — $EURUSD (USD steady pre-Powell)

🥇 Gold (ETF GLD)

$GLD (+1,95%) ~ $304.80 (–0.2%) — gold softer, Jackson Hole in focus

🛢 Oil

$WTI ~ $79.50 (+0.8%) — boosted by lower US inventories

💰 Crypto

$BTC (-1,59%) ~113,735 (–0.1%)

$ETH (-2,33%) ~4,294 (+1.7%)

$TRX (-0,04%) ~0.354 (+1.4%)

🔎 Crypto Insight:

Bitcoin is stabilizing after testing recent lows, showing resilience above the $110k level. Ethereum rebounded with strength, holding above $4,200, while TRON continues its steady climb, attracting attention for its strong on-chain activity. Overall, crypto sentiment remains cautiously bullish despite broader market volatility.

👉 Follow for daily market insights and updates! - https://www.etoro.com/people/farlys

Double discount - shares & dollars on sale! 🔥

Twice as attractive! A drawdown for no fundamental reason - just panic and speculation that companies will suddenly earn less? I don't see it. Added to this is a stronger euro $965275 (-1,1%)which makes entry into US equities even more favorable. An opportunity that should be seized!

Evil traded companies in my professional life

Thanks to @Koenigmidas for linking and for the nomination! #börsengehandelteralltag

#boersengehandelteralltag

Exchange traded companies in my professional everyday life in precious metals and foreign exchange trading:

- Umicore $UMI (-0,11%) (refinery)

- Prosegur $PSG (-3,67%) (security, logistics, cashrecyling)

- Johnson Controls $JCI (+1,38%) (security)

- Swiss National Bank $SNBN (-0,13%) (foreign exchange trading)

- National Bank of Japan $8301 (foreign exchange trading)

- FedEx $FDX (+1,02%) (logistics)

- United Parcel Service $UPS (-0,12%) (logistics)

- Cloudflare $NET (+6,18%) (IT Security, Web)

- Fortinet $FTNT (+0,28%) (IT Security)

- Teamviewer $TMV (-1,95%) (Software)

- Microsoft $MSFT (+1,99%) (Software)

- Cancom $COK (-2,31%) (IT system house)

- Kyocera $6971 (+0,3%) (printer and scan hardware)

- Alphabet $GOOGL (-0,21%) (Who doesn't know it...?, research)

Naturally, I still have to do with various things which are traded on the stock exchange, but are not companies... these include: $965515 (+1,81%) (gold), $965310 (-3,56%) (silver), platinum and the various currency pairs like $965275 (-1,1%) (EUR/USD) but also all other currencies (AUD, NOK, GBP, JPN, SEK, PLN, CZK, SAR, etc. etc. etc.). Subordinately, we also have to deal with $BTC (-1,59%) (Bitcoin), although it is rather negligible.

In our other parts of the company we also deal with $UHR (-6,16%) (SwatchGroup).

What strikes me personally when I look at my professional environment:

There are dozens of companies in this sector, which are not traded on the stock exchange. Among them are some refineries (partly huge company constructs), service providers and luxury goods manufacturers. Also in the area of analysis technology (physical), equipment and software, there are some well-known manufacturers who have so far shied away from the stock exchange or are family-run.

In my private environment I have to do of course like each of you with various products and brands. A separate listing should be interesting for the fewest...

But the most extraordinary might be $RI (-0,96%) (Pernod Ricard), which is not least due to one of my hobbies: ABSOLUT VODKA bottles in the various designs and Limiteditions collect.

Basically I nominate all Getquin friendsbut especially @Der_Dividenden_Monteur , @Staatsmann

@Simpson !

Titoli di tendenza

I migliori creatori della settimana