$ERIC A (-1,37 %)

$DPZ (+3,33 %)

$JNJ (+0,28 %)

$JPM (+1,57 %)

$WFC (+0,45 %)

$BLK (-0,94 %)

$GS (+0,8 %)

$C (-0,11 %)

$MC (-2,68 %)

$ASML (-3,73 %)

$BAC (+0,96 %)

$MS (-0,05 %)

$JBHT (+0,05 %)

$EQT (+0,67 %)

$SRT (-2,44 %)

$NESNE

$TSM (-3,64 %)

$ABBN (-3,67 %)

$UAL (-0,02 %)

$TOM (-1,92 %)

$VOLV B (-2,99 %)

$AXP (+0,87 %)

$SLBG34

$STT (-2,09 %)

Volvo

Price

Debate sobre VOLV B

Puestos

10Quartalsberichte 13.10-17.10.25

Sixth Aurora-class vessel in the Höegh Autoliners fleet

Höegh Autoliners $HAUTO (+2,01 %) has christened its sixth Aurora-class vessel operating in Sweden's leading port and the largest in the Nordic region.

The vessel was sponsored by Jenny Westermark, Senior Vice President, GTO Production Logistics at Volvo Group $VOLV A (-3,09 %)

$VOLV B (-2,99 %)who performed the traditional bottle breaking ceremony.

With a capacity of 9,100 car equivalent units (CEU), the Höegh Moonlight is part of Höegh Autoliners' flagship series of 12 next-generation pure car and truck carriers (PCTC).

All 12 vessels are designed from the keel up for the transition to clean fuels, with the first eight running on LNG via dual-fuel engines.

They are also equipped to run on clean ammonia with reinforced decks and an integrated tank developed by TGE Marine at the heart of the design, allowing for easy conversion.

The final four units of the Aurora newbuilding program, scheduled for delivery from 2027, will be dual-fuel vessels capable of running on ammonia from day one.

The eight first LNG-powered dual-fuel vessels will produce an estimated 58% less emissions per vehicle transported compared to the industry average.

The Aurora class plays a central role in the company's ambition to become zero-emission by 2040.

All ships are classified by DNV and fly the Norwegian flag. The fifth sister ship, the Höegh Sunrise, was christened in the port of Omaezaki in Japan in June this year.

The Managing Director of Höegh Autoliners, Andreas Enger, commented: "The christening of the Höegh Moonlight demonstrates our strong commitment to decarbonizing ocean shipping - not in the future, but now, today. These ships are not concepts, but working, sailing answers to one of the most pressing challenges in our industry. I would like to thank Jenny Westermark for generously sponsoring the ship."

European Premarket Movers

Upside ⬆️

- Idorsia $IDIA (+1,41 %) +7.5-8.0% (exclusive negotiations for global rights to aprocitentan)

- Grieg Seaf $GSF (-1,73 %) +2.0% (Q3 results)

- Avia $AVVIY+2.0% (Keefe raised to outperform)

- iomart $IOM (-6,74 %) +2.0% (H1 results)

- Melexis [$MELE.BE] +1.5-2.0% (UBS raised to neutral)

- Frontline $FRO (-5,03 %) +1.5% (Q3 results)

- Henkel $HEN (-3,26 %) +1.5% (JPMorgan raised to overweight)

- Volvo $VOLV B (-2,99 %) +1.5% (JPMorgan raised to overweight)

- Equinor $EQNR (-1,86 %) +0.5-1.0% (Berenberg raised to buy)

- Nestle $NESN (-0,99 %) +0.5% (Morgan Stanley raised to equal weight)

- Volkswagen $VOW3 (-2,86 %) +0.5% (Agrees with SAIC to sell Xinjiang plant in China)

Downside ⬇️

- Pets at Home $PETS (-2,78 %) -8.5% (H1 results)

- Elekta $EKTA B (-2,4 %) -7.0% (Q2 results, misses estimates, affirms guidance)

- Nokian $TYRES (-2,18 %) -2.2% (JPMorgan cuts to underweight)

- easyJet $EZJ (+1,04 %) -1.0% (FY results and guidance)

- Reckitt Benckiser $RKT (-4,06 %) -0.5% (board update)

- Air France-KLM $AF (-7,33 %) -0.5% (in talks to acquire 20% of Air Europa)

- TotalEnergies $TTE (-3,37 %) -0.5% (Exane cuts to neutral)

- Norsk Hydro $NHY (-2,02 %) -0.5% (launches NOK6.5B improvement program)

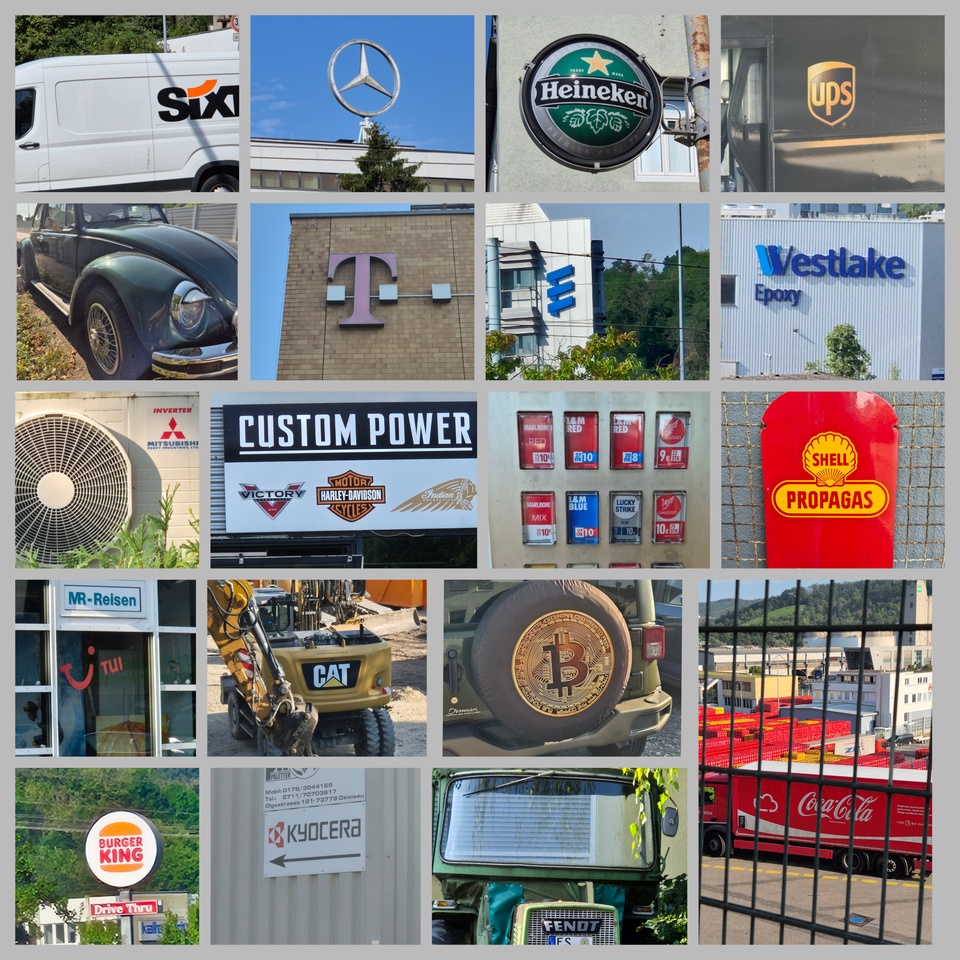

Share march, 30km route with 35 share companies

First day of vacation, 32°C and a 30km walk towards Stuttgart. I was able to find over 35 stock companies along the route.

Highlight, $BTC (-0,73 %) Bitcoin logo on the wheel arch of the Jeep.

In addition to the car brands, $MBG (-0,99 %)

$DTG (-4,2 %)

$VOW (-2,43 %)

$BMW (-2,46 %)

$VOLV B (-2,99 %)

$TSLA (-2,19 %)

$1211 (-2,98 %)

$P911 (-2,3 %)

$F (-4,45 %)

$8058 (-3,09 %) I was able to discover numerous other companies that were new to me.

New for me was $6971 (-4,25 %) Kyocera, a manufacturer of electronic devices from Japan and $WLK (-2,74 %) Westlake Chemical from the USA.

From Germany there were also $SIX2 (-2,01 %) Sixt $DTE (-0,62 %) Telekom $TUI1 (-1,96 %) Tui $AGCO (-2,24 %) (Fendt) $256940 Eberspächer (supplier to the automotive industry) $SIE (-4,13 %) Siemens $EBK (+3,36 %) ENBW $DHL (-2,43 %) Post and $ALV (-2,77 %) in the process.

Other companies:

$CAT (-3,73 %) Caterpillar $HEIA (-2,16 %) Heineken $HOG (+5,5 %) Harley Davidson $PM (-3 %) Philip Morris $NKE (-1,95 %) Nike $AAPL (+0,14 %) Apple $005930 Samsung $UPS (-0,9 %) UPS $SHEL (-1,72 %) Shell $V (+0,88 %) Visa $MA (+1,09 %) Mastercard $KER (-5,43 %) Kering

$KO (-0,35 %) Coca-Cola $QSR (+0,68 %) Restaurant Brands (Burger King)

$O (-0,56 %) Reality Income (leased to Decathlon)

Would you have recognized everything? It's interesting what you discover when you consciously look around.

Out of interest, please link if you post something similar 🫡 or use the #aktienmarsch

Operating margin car manufacturers Q1/24

+38.2% Ferrari

+15.7% Porsche

+11.2% Stellantis

+10.8% Mercedes

+10.0% Toyota

+8.8%% BMW

+5.5% General Motors

+7.6% Renault

+7.2% Volvo

+6.6% Volkswagen

+5.8% Hyundai

+5.6% Honda

+5.5% Tesla

+4.7% BYD

+2.9% Ford

>> Opinions?

$TSLA (-2,19 %)

$RACE (+0,21 %)

$P911 (-2,3 %)

$STLAM (-1,26 %)

$MBG (-0,99 %)

$7203 (-4,8 %)

$BMW (-2,46 %)

$GM (+0,36 %)

$RNO (-3,43 %)

$VOLV B (-2,99 %)

$VOLV A (-3,09 %)

$VOW (-2,43 %)

$005380

$1211 (-2,98 %)

$81211

$F (-4,45 %)

$7267 (-3,5 %)

Here is a summary of important events & the Formatting is Getquin's fault!

US MARKET🇺🇸

Monday

Publication of the Empire State Manufacturing Survey of the New York Fed for April.

Publication of the retail sales in the USA for March.

Publication of the business inventories for February.

Publication of the homebuilder confidence for April.

Speeches by Lorie LoganPresident of the FED of Dallasand Mary C. DalyPresident of the FED Bank of San Francisco.

Quarterly reports from Goldman Sachs ($GS (+0,8 %) ), Charles Schwab ($SCHW (+0,31 %) ) and M&T Bank ($MTB (+0,43 %) ).

Tuesday

Publication of the building permits for March.

Publication of the industrial production for March.

Quarterly reports from UnitedHealth Group ($UNH (-1,16 %) ) , Johnson & Johnson ($JNJ (+0,28 %) ), Bank of America ($BAC (+0,96 %) ), Morgan Stanley ($MS (-0,05 %) ), BNY Mellon ($BK (-0,57 %) ) and PNC Bank ($PNC (+0 %) ).

Wednesday

Publication of the mortgage applications for the week ending April 12.

Publication of the FED Beige Books.

Quarterly reports from United Airlines ($UAL (-0,02 %) ), Abbott Laboratories ($ABT (-0,42 %) ), U.S. Bancorp ($USB (-1,34 %) ), Travelers Cos. ($TRVC34 ), Citizens Financial ($FCNCA (+1,8 %) ), First Horizon ($FHN (-2,9 %) ) and Discover Financial Services ($DFS ).

Thursday

Publication of initial jobless claims for the week ending April 13.

Publication of the Philadelphia Fed Manufacturing Survey for April.

Publication of existing home sales for March.

Speeches by John C. WilliamsPresident of the FED of New Yorkand Raphael BosticPresident of the FED of Atlanta.

Quarterly reports from Netflix ($NFLX (+1,35 %) ), Intuitive Surgical ($ISRG (+0,47 %) ) and Infosys ($INFY ).

Friday

Speech by Austan GoolsbeePresident of the FED of Chicago.

Quarterly reports from Procter & Gamble ($PG (-1,83 %) ), American Express ($AXP (+0,87 %) ), Fifth Third Bancorp ($FITB (+0,09 %) ) and Huntington Bancshares ($HBAN (-0,96 %) ).

Saturday

Possible events in connection with the Bitcoin halving.

EU MARKET

Monday

Release of industrial production

Speech by Philip Lane, Member of the Executive Board of the ECB

Quarterly reports from Pagegroup ($PAGE (-0 %) ) 🇬🇧, Playtech $PTEC (+1,13 %) ) 🇬🇧

Tuesday

Trade Balance (Feb)

ZEW Economic Sentiment

Eurogroup Meetings

Publication of the quarterly reports of Ashmore ($ASHM (-2,43 %) ) 🇬🇧

Wednesday

Publication of CPI data

EU Summit & Eurogroup Meetings

Speech by Isabel Schnabel, Member of the Executive Board of the ECB

Quarterly figures from Severstal ($CHMF ) 🇷🇺, Volvo B ($VOLV B (-2,99 %) ) 🇸🇪, Viscofan $VIS (-2,56 %) ) 🇪🇸, Petershill Partners ($PHLL ) 🇬🇧, Hays ($HAS (+2,9 %) ) 🇬🇧

thursday

Speech by Luis de GuindosVice President of the ECB

EU Summit & Eurogroup Meetings

Speech by Isabel Schnabel, Member of the Executive Board of the ECB

- Quarterly figures from EQT AB ($EQT (-1,3 %) ) 🇸🇪, EssilorLuxottica ($EL (-1,75 %) ) 🇫🇷, Nordea Bank ($NDA FI (-2,54 %) ) 🇸🇪, Sartorius Stedim ($DIM (-6,09 %) ) 🇩🇪, Nokia Oyj $NOKIA (-2,02 %) ) 🇫🇮, Inter Cars SA ($n/a) 🇵🇱, Tauron Polska Energia ($TPE (-7,72 %) ) 🇵🇱, Forvia ($FRVIA (-5,36 %) ) 🇫🇮, Dunelm ($DNLM (-2,2 %) ) 🇬🇧, Adtran Networks SE ($ADV (-0,44 %) ) 🇩🇪, Olvi Oyj A ($OLVAS (-1,33 %) ) 🇫🇮, Econocom ($ECOM ) 🇧🇪, Talenom Oyj $TNOM ) 🇫🇮, Alisa Pankki Oyj ($ALISA (-1,05 %) ) 🇫🇮

Friday

Eurogroup Meetings

CFTC EUR speculative net positions

Quarterly figures from Sodexo ($SW (-0,24 %) ) 🇫🇷, Linea Directa Aseguradora ($LDA (-3,02 %) ) 🇪🇸, Alma Media ($002950 ) 🇫🇮, Gofore ($GOFORE (-1,27 %) ) 🇫🇮

The market overview for 🇺🇸 & 🇪🇺:

US MARKET🇺🇸

Monday

- PACS Group ($PACS) and UL Solutions ($ULS) have potential IPOs.

- Neel KashkariPresident of the Minneapolis Fed, delivers remarks.

Tuesday

- Release of the NFIB Small Business Optimism Index (March).

- Quarterly reports from WD-40 ($WDFC (+1,95 %) ) and Tilray Brands ($TLRY (-2,08 %) ).

Wednesday

- Publication of the consumer price index (March).

- Publication of the wholesale stocks (March).

- Publication of the minutes of the March meeting of the Federal Open Market Committee (FOMC).

- Publication of the monthly federal budget of the USA (March).

- Speeches by Austan GoolsbeePresident of the Chicago Fed.

- Quarterly reports from Delta Air Lines ($DAL (+0,86 %) ) and Applied Digital ($APLD (-5,47 %) ).

Thursday

- Publication of the initial applications for unemployment benefits (April 5).

- Publication of the producer price index (March).

- Speeches by John C. WilliamsPresident of the New York Fed, and Raphael BosticPresident of the Atlanta Fed.

- Quarterly reports from Constellation Brands ($STZ (+0,39 %) ), Fastenal ($FAST (+0,63 %) ) and CarMax ($KMX (-0,08 %) ).

Friday

- Publication of the preliminary Michigan Consumer Sentiment Index (April).

- Speeches by Raphael Bostic, President of the Atlanta Fed, and Mary C. DalyPresident of the San Francisco Fed.

- Quarterly reports from JPMorgan Chase ($JPM (+1,57 %) ), Wells Fargo ($WFC (+0,45 %) ), BlackRock ($BLK ), Citigroup ($C (-0,11 %) ), State Street ($STT (-2,09 %) ) and Progressive ($PGR (+0,51 %) ).

EUROPEAN MARKET🇪🇺

Monday

- Publication of Industrial Production Index🇪🇺

Tuesday

- ZEW Economic Sentiment🇩🇪 will be published

- Quarterly reports from Ericsson ($ERIC A (-1,37 %) )🇸🇪, Beiersdorf AG ($BEI (-12,55 %) )🇩🇪, Sika ($SIKA (-2,45 %) )🇨🇭, Rio Tinto PLC ($RIO (-4 %) )🇬🇧

Wednesday

- Release of CPI data🇪🇺

- Quarterly reports from Hays ($HAS (+2,9 %) )🇬🇧, Petershill Partners ($PHLL )🇬🇧, Just Eat Takeaway ($TKWY )🇬🇧, Entain ($ENT (-0,06 %) )🇬🇧, La Francaise ($FDJ (+0,31 %) )🇫🇷, Legal & General ($LGEN (-2,41 %) ), Tryg ($TRYG (-1,48 %) )🇩🇰, BHP Group Ltd ($BHP (-4,35 %) )🇬🇧, ASML Holding ($ASML (-3,73 %) )🇳🇱Volvo B ($VOLV B (-2,99 %) )🇸🇪, Severstal ($CHMF )🇷🇺

thursday

- Publication of Construction Output🇪🇺

- Quarterly reports from Danone ($BN (-1,93 %) )🇫🇷, Nokia Oyj ($NOKIA (-2,02 %) )🇫🇮, Tele2 AB ($TEL2 B (-1,26 %) )🇸🇪

𝗠𝗮𝗿𝗸𝗲𝘁 𝗡𝗲𝘄𝘀 🗞️

𝗪𝗲𝗪𝗼𝗿𝗸 𝟮.𝟬 / 𝗠𝗶𝘁 𝗱𝗲𝗺 "𝗚𝗿𝗲𝘆𝗵𝗼𝘂𝗻𝗱" 𝗮𝘂𝗳 𝗱𝗲𝗺 𝗪𝗲𝗴 𝘇𝘂𝗺 𝗜𝗣𝗢 / 𝗪𝗼𝗹𝗸𝗶𝗴 𝗺𝗶𝘁 𝗔𝘂𝘀𝘀𝗶𝗰𝗵𝘁 𝗮𝘂𝗳 𝗚𝗲𝘄𝗶𝗻𝗻𝘇𝘂𝘄𝗮𝗰𝗵𝘀

𝗜𝗣𝗢𝘀 🔔

WeWork - After its failed first attempt in 2019, office broker WeWork is trying again with a stock exchange listing. This time, however, not by means of an IPO, but via a SPAC (Special Purpose Acquisition Company) merger. The path to the stock exchange is to be paved by a merger with SPAC BowX Acquisition Corp. ($BOWXU) will pave the way. In 2019, the valuation of the former startup was $47 billion. But now it is aiming for a valuation of nine billion U.S. dollars and is looking to raise one billion U.S. dollars in fresh money from existing and new investors. It remains to be seen whether the projected business figures can be met or are too optimistic.

𝗘𝘅-𝗗𝗮𝘁𝗲𝘀 📅

Starting today, Owens Corning Inc. ($O5Q (-1,18 %)), Procter & Gamble ($PRG (-1,83 %)), Pentair plc ($PNT (+0,12 %)), Thor Industries Inc. ($TIV (-4,91 %)) and Williams-Sonoma Inc. ($WM1 (-0,2 %)) are trading ex-dividend.

𝗤𝘂𝗮𝗿𝘁𝗮𝗹𝘀𝘇𝗮𝗵𝗹𝗲𝗻 📈

Today, AT&T ($SOBA (+3,01 %)), American Airlines ($A1G (+0,09 %)), Alaska Air Group ($ALK (-0,74 %)), Barclays ($BCY (-2,1 %)), China Unicom ($XCI), Chipotle Mexican Grill ($C9F (+0,73 %)), Danaher ($DAP (-0,22 %)), Intel ($INL (-4,61 %)), SAP ($SAP (+0,68 %)), Schindler ($SHRQ (-1,02 %)), Union Pacific ($UNP (+0,07 %)) and Volvo ($VOL1 (-2,99 %)) presented their figures.

𝗠𝗮𝗿𝗸𝗲𝘁𝘀 🏛️

FlixBus - For $172 million, Munich-based FlixBus buys the legendary "Greyhound" buses in the U.S. from British company FirstGroup ($FGR (-1,42 %)). These acquisitions are intended to drive a key part of FlixMobility's growth strategy and expand its global presence as a result. This purchase will make the German mobility startup the market leader in the U.S. and it could also be another step towards an IPO.

SAP ($SAP (+0,68 %)) - SAP's quarterly revenue is boosted by double-digit growth in the cloud. But the competition of the core product S/4 Hana does not sleep. Europe's largest software company can count on many new customers through its enterprise transformation in the cloud. "Demand is enormous, which has led to a significant acceleration in cloud growth," says Group CEO Christian Klein. However, the company faces major challenges due to high competitive pressure.

𝗖𝗿𝘆𝗽𝘁𝗼 💎

Facebook ($FB2A (+0,82 %)) - Facebook has announced a pilot project by its subsidiary Novi (formerly Calibra) in the U.S. and Guatemala. The company is working on a crypto wallet on which the planned stablecoin Diem (formerly Libra), will be stored and made mailable. However, the pilot project will not use Diem, but PAX US dollars (USDP). This is a stablecoin backed by the real US dollar. This is to be securely stored on Coinbase's platform in cooperation with Coinbase ($1QZ (-1,01 %)) on their platform. The aim of the project is to make it easier for people to send money (in the form of cryptocurrencies) securely and without financial intermediaries. By using a stablecoin, the users of the wallet should be protected from possible price fluctuations. Facebook is receiving strong criticism from five high-ranking Democratic senators (including former presidential candidate Elizabeth Warren) for this plan. These make it clear that the corporation should not be trusted when it comes to introducing a digital currency. They are calling for an immediate halt to Project Novi.

Valores en tendencia

Principales creadores de la semana