$DIS (-0,28 %)

$PLTR (+0,16 %)

$SRT (+0,78 %)

$NXPI (+0 %)

$PYPL (-0,08 %)

$PEP (+0,19 %)

$TER (+2,15 %)

$CPRI (+3,64 %)

$MRK (+0,19 %)

$PFE (-0,75 %)

$TTWO (-1,49 %)

$EA (-0,19 %)

$AMD (-1,53 %)

$MDLZ (+0,12 %)

$LUMN (-2,64 %)

$SMCI (+0,62 %)

$7011 (+2,44 %)

$6752 (+0,8 %)

$6367 (+0 %)

$UBSG (+0,03 %)

$GSK (-1 %)

$UBER (+0,99 %)

$ABBV (-0,21 %)

$LLY (-1,18 %)

$GOOG (+3,65 %)

$ELF (+3,54 %)

$QCOM (+1,33 %)

$SNAP (+2,58 %)

$WOLF (-2,76 %)

$ARM (-0,93 %)

$VOLCAR B (+1,47 %)

$6758 (-2,22 %)

$SHL (+2,12 %)

$SAAB B (-0,74 %)

$5401 (-0,52 %)

$MAERSK A (+1,53 %)

$R3NK (-0,34 %)

$BMY (+0,67 %)

$BMW (+0,52 %)

$EL (+2 %)

$ROK (+0,64 %)

$PTON (-0,81 %)

$KKR (+0,32 %)

$LIN (+2,09 %)

$RL (+3,3 %)

$AGCO (-0,64 %)

$RBLX (-3,65 %)

$FTNT (-1,83 %)

$REDDIT (-0 %)

$ILMN (-2,03 %)

$WMG (+2,26 %)

$IREN (-6,41 %)

$MSTR (+1,9 %)

$AMZN (+2,51 %)

$KOG (+2,62 %)

$ORSTED (+1,5 %)

$PM (-0,29 %)

$WEED (+1 %)

Sartorius

Price

Debate sobre SRT

Puestos

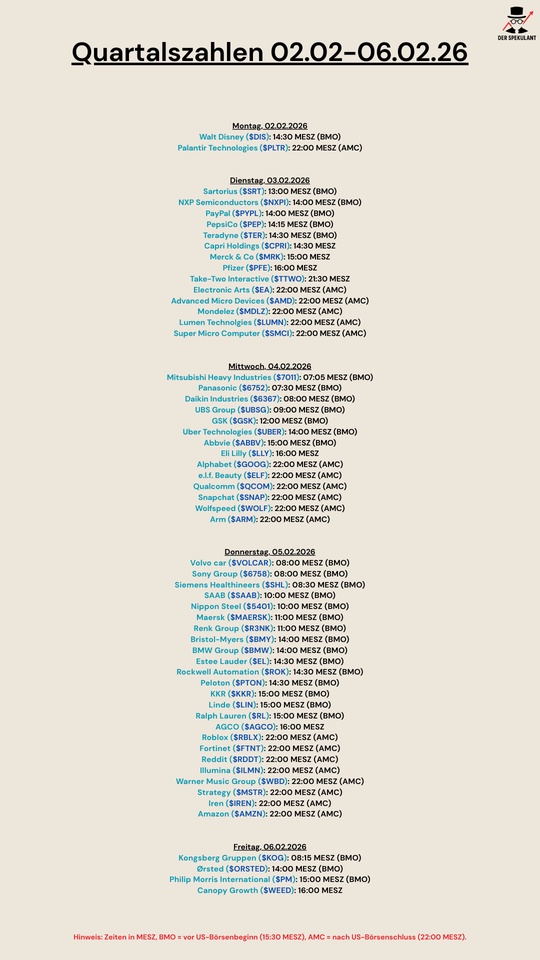

42Quarterly figures 02.02-06.02.26

Sartorius on the upswing again?

What do you think of $SRT (+0,78 %) ? Analysts see an average of €245, which would mean considerable potential. The company is currently hiring again and the management considers the trough to be over. The last figures were optimistic.

Is an entry around 210€ worthwhile?

!Preference shares $SRT3 (+3,31 %) are at 260 and are not common!

Quartalsberichte 13.10-17.10.25

$ERIC A (+0,62 %)

$DPZ (-0,38 %)

$JNJ (-0,5 %)

$JPM (+0,53 %)

$WFC (+1,28 %)

$BLK (+1,63 %)

$GS (+0,66 %)

$C (+0,36 %)

$MC (+4,98 %)

$ASML (+0,76 %)

$BAC (+0,56 %)

$MS (+0,22 %)

$JBHT (+1,88 %)

$EQT (+1,42 %)

$SRT (+0,78 %)

$NESNE

$TSM (+2,62 %)

$ABBN (+0,61 %)

$UAL (+2,33 %)

$TOM (+0 %)

$VOLV B (+0,12 %)

$AXP (+0,94 %)

$SLBG34

$STT (-0,03 %)

Dealing with losses

How do you deal with losses? Do you realize them promptly or do you wait and see?

I mostly invest for the long term. At least until I found this portal here 😇

I actually buy stocks that I'm convinced of and then leave them. Always with money that I don't need elsewhere.

Now, for example, I have titles like $EVT (-0,36 %)

$SRT (+0,78 %) or $S92 (-2,11 %) . All deep red. Wouldn't really bother me, I don't need the money. I have enough cash to buy other stocks.

Is it still worth selling because of taxes or how do you handle such cases?

What are your portfolio corpses?

My portfolio corpses are Porsche, VW, Grenke, Conagra Brands and Western Union. And I still believe in a good outcome for all of them! 👍🏼

Sartorius confirms annual targets despite challenges

Sartorius sees itself on track after a solid Q2 2025 and confirms the forecast for the full year.

📈 H1 figures at a glance:

▪️ Sales revenue: +6.1% to €1.77 billion

▪️ Adjusted EBITDA: € 527 million

▪️ Bioprocess Solutions division: +8.8%

🎯 Forecast 2025 confirmed:

▪️ Organic sales growth ~6%

▪️ Operating EBITDA margin: 29-30%

🔎 Despite global uncertainties, Sartorius remains confident.

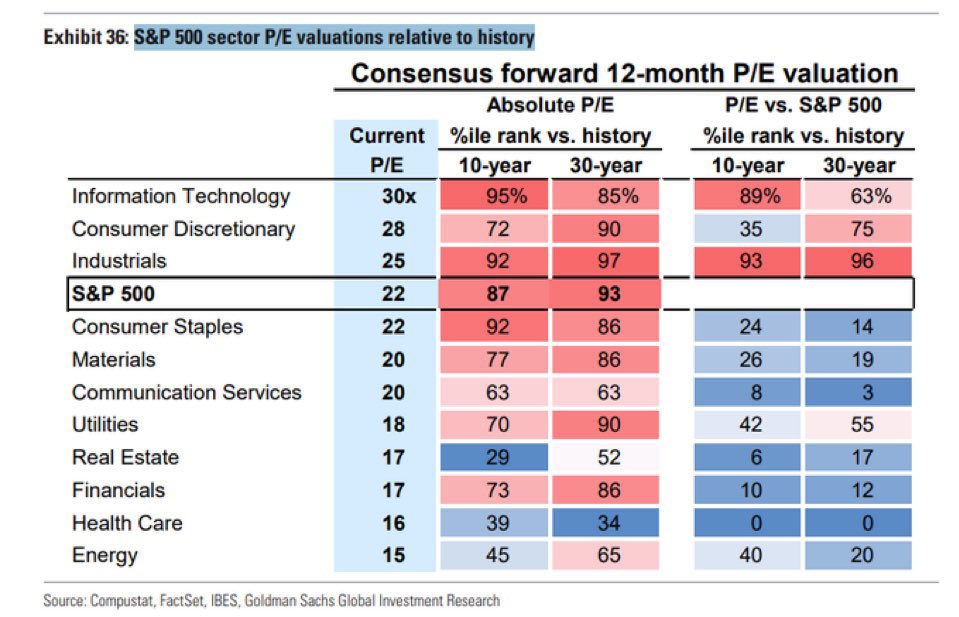

Valuation Healthcare sector - Goldman Sachs

$XDWH (+0,02 %)

$XLV (+0,04 %)

$CSPX (+0,58 %)

$VUSA (+0,6 %)

$UNH (-0,11 %)

$OSCR (-3,64 %)

According to Goldman Sachs, healthcare is the only sector in the S& P 500 that is cheaper than the 10- and 30-year averages.

This is an extremely attractive risk/reward ratio and the coming months will be exciting.

$ELV (-1,46 %)

$CNC (-0,86 %)

$DHR (-0,42 %)

$SRT (+0,78 %)

$LLY (-1,18 %)

$NOVO B (-2,32 %)

$NVO (-2,18 %)

$ISRG (+1,04 %)

$JNJ (-0,5 %)

$ABBV (-0,21 %)

$PFE (-0,75 %)

$SAN (-0,37 %)

$MRK (+0,19 %)

$BMY (+0,67 %)

$TMO (-0,59 %)

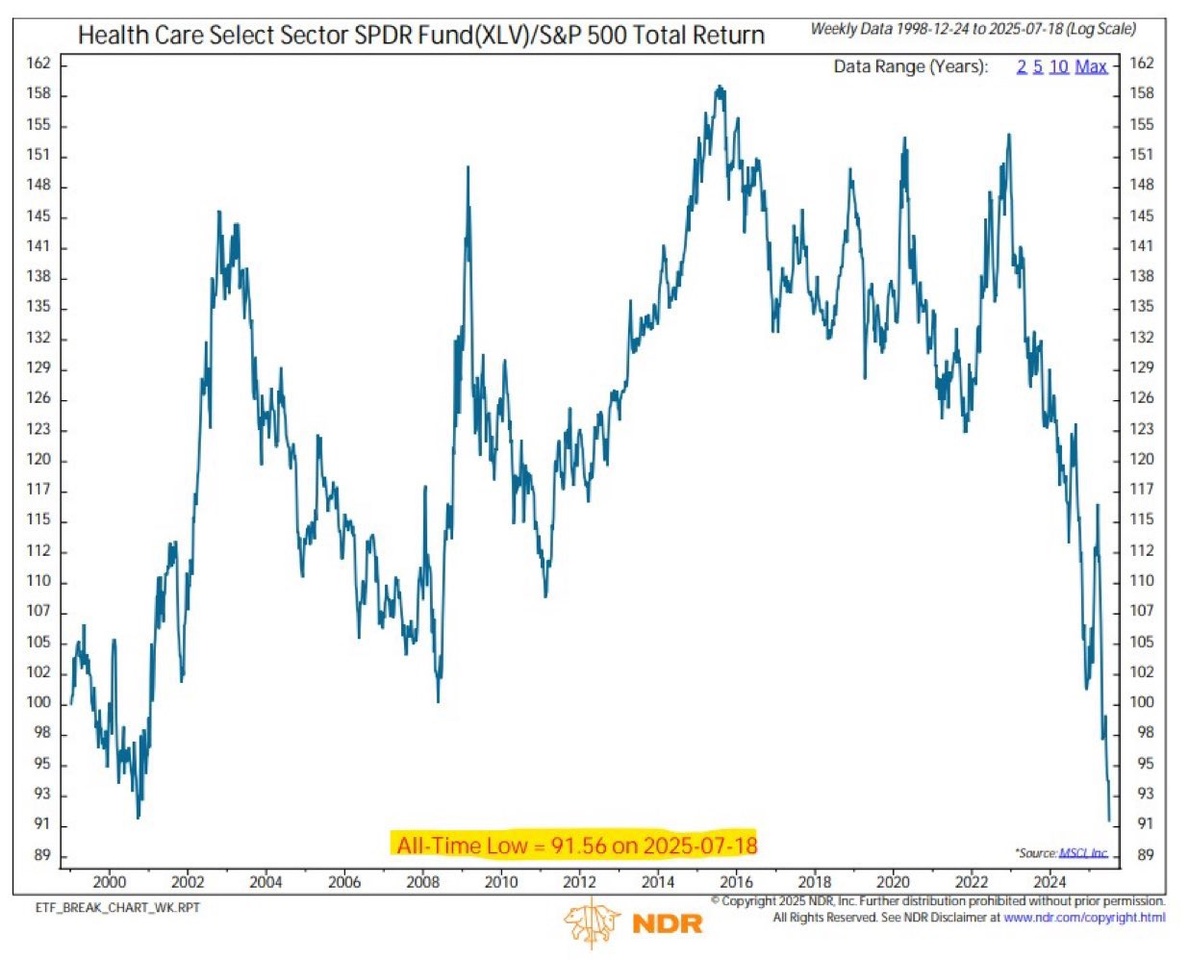

Weak US healthcare sector

$UNH (-0,11 %)

$OSCR (-3,64 %)

$XDWH (+0,02 %)

$ELV (-1,46 %)

$LLY (-1,18 %)

$XLV (+0,04 %)

The US healthcare sector is experiencing its biggest crash in the last 20 years.

If the strong weighting no. 1 $LLY (-1,18 %) (over 12%), one would have to go back even further/longer. (probably before the existence of the ETF).

I have positioned myself strongly here as I believe this is a great opportunity.

I also believe that a lot of capital will flow into the sector in the coming months. ✌️

Do you have a similar view? ✌️

But I'm wondering whether I should get in before August.

Was the pandemic a bad time to start investing? (Market review & €100,000 portfolio performance update)

It is April 2020, and I am a young and hopeful student who has been studying the theory of financial education for several years and decide to take advantage of the supposedly unique opportunity of the "crash" to finally enter the stock market despite limited capital.

Theoretically, the idea was that it should be easy to get in during a difficult market phase, as all assets should be cheap due to the uncertainty. At least cheaper than they were before. When markets fall, multiples fall too. So even if you don't get everything right or even get a lot wrong, from a purely mathematical point of view you should still be better off than someone who got in in 2018 or 2019. So far, this logic is actually conclusive.

But the pandemic crash was not a normal crash. And I actually find it far too interesting not to talk about it.

In my experience, there is still a lot of talk today about the new markets in 2001 and the real estate bubble in 2008. However, the exciting market phase of the pandemic has hardly been looked back on at all. This may also be due to the fact that we don't feel we can look back at it yet, as we can still feel the effects and have barely really overcome them. However, it is now slowly becoming apparent that a new era has dawned on the market, which is primarily about tariffs, trade deficits and currencies.

But what makes the pandemic a bad time to start?

If you look back at the charts of some securities (and for the sake of clarity, I would like to refer mainly to equities here), you can see several things.

In the case of shares with a gravitas such as $BRK.B (+0,06 %) only a tiny corona dent can be seen on the long-term chart. From this you can see that it didn't really matter when you invested. However, the earlier the better. It was important to invest at all, but it was not necessary to wait for a specific point in time. However, this even applies to clear pandemic losers such as $BKNG (+1,8 %) and $EVD (+2,01 %) .

For some stocks like $AMZN (+2,51 %) and $MSFT (-0,3 %) the entry point during the actual crash was not ideal. There was an optimal entry point for both stocks recently, but this would not have been apparent until 2-3 years after the crash. Both stocks survived the pandemic almost unscathed, but were then affected by severe secondary factors that put the business under pressure.

Stocks like $TMO (-0,59 %) or $AFX (+1,34 %) were considered pandemic winners. You could have picked them up at the beginning of the crash ... or you could have left them alone and got them back 5 years later at exactly the same price as before the pandemic started.

And now the worst category: hype stocks. The absolute catastrophe happened to all those who were looking for opportunities where there were actually none. Whether investments in emerging markets or hopes for the future in $ZM (-0,43 %) and $FVRR (+2,83 %) - Money that was taken out of the broad market ended up largely concentrated in assets that will not reach their ATH for another 20 years. Anyone wanting to be in it for the long term found their Waterloo in the pandemic. Some companies such as $EUZ (+0,97 %) or $SRT (+0,78 %) may well be doing great things. But here the "crash" was simply the absolute worst entry opportunity of the entire decade.

Correction Edit: I only found a group of stocks that I really needed to buy in the crash and that was Big Oil. There were certainly other stocks that were a bit cheaper at the time. But for the most part, it was not essential to enter at the low point in order to make good returns. That is what made this market phase so difficult. The good stocks were NOT extremely cheap, but there were many bad stocks that were extremely expensive. For newcomers, such a situation is incredibly difficult to navigate.

I closed 2020 with +12% and 2021 with +8% only to get a -22% in 2022. So I didn't make any returns at all in the first 3 years and just paid a lesson.

I thought I would have been smart at least not to have entered in 2018/2019 when all shares were valued much higher on average. But I might have gained experience in these two years so that I would have had more guidance in 2020. Or I could have started in 2022/2023, when there were no more hype stocks and you could pour money into the market with a watering can and it almost always turned into a flower.

I recently saw the portfolio of a friend who restarted his portfolio in 2022. Almost the same portfolio size as mine. However, while I have made 7% p.a. since the start of my portfolio, he has an IZF of 15%. With a portfolio size of 100k, this means that I am sitting on €12,000 book profits and he on €33,000

Backtests are currently showing that my strategy has really put me to sleep and put me to sleep by ALL known and common indices over 5 years. The only consolation here is really the 3-year performance, where it is clear that I can keep up with the major indices and also leave a few big names behind me.

So on a positive note: I'm getting better.

Maybe your friend drives with more risk to get the 15%, but you might have more stability🧐

Comprehensive insurance is more expensive than third-party liability, but you're in a better position in the event of a claim. And no, I don't work for Check24😄

And then I have another idea

$G24 (+1,36 %) is currently No.1 in the MDAX in terms of market capitalization and free flow and is on the verge of moving up the Dax. As it will not be enough for an almost entry in June, an entry in September would be possible for $PAH3 (+2,68 %) or $SRT (+0,78 %) probable. Speculating on this in a stock that is performing well anyway with a humane derivative with leverage 3 such as UM88M3 would be a charming option. Shares are of course also an option.

Cells, numbers, doubts: What will BICO print next? (Deep Dive)

🧬 BICO

$BICO (+4,49 %) has been on my watchlist since my early days on getquin.

In 2021, the company was on everyone's lips, celebrated as the company of the future in bioprinting.

But what followed was a classic hype cycle: the share price rose rapidly, was cheered by quite a few "finfluencers" and then plummeted just as sharply.

Many people got their fingers burnt back then. What remains is the image of an overvalued tech fantasy, fueled by empty promises and loud voices without substance.

And yet: The company has remained. So has the vision, and in recent months a lot seems to have changed structurally.

Today, more than 80 % below its all-time high, the question arises anew:

Is BICO simply an overrated stock market experiment...

... or is the current valuation realistic for the first time and BICO on the way to translating its technological substance into a genuine business model?

Over the past few weeks, I have been taking a closer look at the company's structure, history and current developments, including the latest figures [1] and the earnings call [2] from 29.04.25.

In this article, I share my collected insights, thoughts and assessments for those who also have the company on their watchlist.

As always:

No investment advice. I don't want to contribute to more burnt fingers, but to encourage reflection.

Have fun!

BICO Group AB (formerly CELLINK) is a Swedish life science company founded in 2016.

The original innovation: a biocompatible ink for 3D printing of living cells, a small revolution in research.

Today, BICO stands for a big goal: Bioconvergence.

This means merging biology, technology, software and automation to make research, diagnostics and drug development faster, cheaper and more efficient.

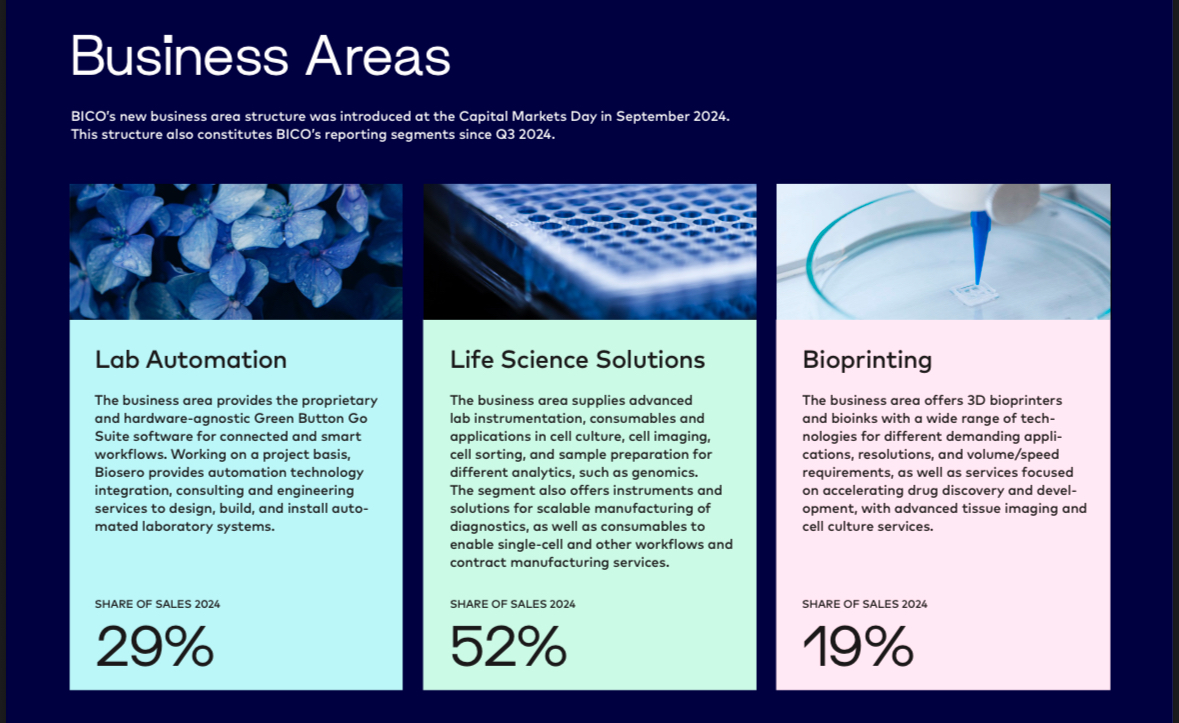

What is the vision and how does BICO make money?

The vision: The laboratory of the future. Automated, networked, efficient with AI, robotics and bioprinting.

This is how BICO earns money today:

- Bioprinting3D printing of living cells & tissue (CELLINK) read more...

- Diagnostic solutions & microdosing (SCIENION)

- Lab AutomationFully automated workflows through software such as Green Button Go® (Biosero)

- Consumables & services for laboratories and research facilities

Share of Sales 2024:

Excursus

Bioprinting:

BICO was with CELLINK was one of the first suppliers worldwide to offer bioprinters plus matching "bioinks" commercially.

The basic idea:

- A 3D printer (e.g. the CELLINK BIO X6) prints cells in layers, similar to how a normal 3D printer layers plastic.

- Instead of plastic, a special "ink" is used: Bioink.

Bioink and what it is made of:

Bioink is a gel-like substance that is mixed with living cells. It contains, for example:

- Alginate (from algae)

- gelatine

- collagen

- hyaluronic acid

- Cell nutrient solutions

This matrix keeps the cells alive and makes it possible to print biologically active structures, e.g. tissue samples, tumor models or skin structures.

Is this already being done today or is it all future?

Yes, it is being done, but not clinically.

Bioprinting is currently being used, for example:

- Cell models for drug testing (in research & at pharmaceutical companies)

- printing tumor tissue to better test therapies

- Tissue samples used for toxicology tests (e.g. skin, cartilage, blood vessels)

What is not yet possible:

- Complete organs (hearts, livers, kidneys) for transplants

Because...

- Organs are extremely complex (blood vessels, nerves, functions)

- Currently lack the ability to keep them alive in the long term

- This is also a huge step in regulatory terms

🔮 Future potential: unrealistic or groundbreaking

If bioprinting really breaks through in medicine, we will be talking about one of the biggest breakthroughs of the 21st century:

- organs on demand (no donor needed)

- personalized medicine

- Animal-free drug development

RealisticFirst functional organs could be available in 10 -20 years clinically relevant, but first in small pilot studies or animal models.

Are there any research results or publications on this?

Yes, BICO (especially CELLINK) is a regular co-author or technology partner in publications.

Especially in areas such as:

- Tumor models

- tissue modeling

- biocompatibility

- Skin and cartilage models

Several universities and research institutions use the BIO X printers, including for example MIT and Harvard

Trusted partners:

- Sartorius$SRT (+0,78 %) (has taken over MatTek/Visikol, remains cooperation partner)

- AstraZeneca $AZN (+0,3 %)

- Pfizer $PFE (-0,75 %) (individual case studies)

- Top 20 pharmaceutical companies with Biosero projects (Lab Automation)

- Research centers worldwide

- Cooperation with Sartorius in the APAC region (e.g. Japan, South Korea)

Digression Conclusion

Bioprinting sounds like science fiction and yes, it is a long way from everyday transplantation. But in research and diagnostics it is real, applicable and in demand.

- BICO is not selling promises for the future, but tools that are used in leading laboratories today. The big leap is yet to come, but the foundations have been laid.

__________

History in brief From bioink to platform

- 2016: Founded as CELLINK, the first bioink worldwide

- 2020: Renamed BICO (for Bio Convergence)

- 2021-202315+ acquisitions (including SCIENION, Biosero, MatTek)

- 2024-2025: Streamlining of the structure (sales to Sartorius), withdrawal from non-strategic areas

- 2025: Focus on automation, diagnostics and bioprinting with a clear industry orientation

New CEO since 2024: Maria Forss

- PredecessorErik Gatenholm (co-founder & CEO for many years)

- Change: Gatenholm stepped down in fall 2023, Maria Forss officially became CEO in January 2024

Maria Forss brings decades of experience from leading life science companies:

At Vitrolife (2018 - 2023), she led global expansion and M&A projects, including the billion-euro deal with Igenomix. Prior to that (2014 - 2018), she was at Elekta (radiotherapy, oncology) where she was responsible for global marketing and product strategies.

She started her career at AstraZenecawhere she gained international experience in sales, regulatory affairs and market launch. There she learned what makes large pharmaceutical companies tick, particularly in terms of approval, market launch and regulatory navigation

She is an expert in:

- Business Development

- transformation & strategy

- international expansion

The retirement of founder Gatenholm points to a clear change in strategy, away from visionary, growth-driven development and towards cost control, profitability and integration.

In the Earnings Call Q1 2025 Forss emphasizes several times:

"We have implemented a new operational structure, are harmonizing global functions and are focusing on efficiency and selected growth areas."

📊 Q1 2025 in figures and what's really behind it (Caution currency: Swedish krona, 1 SEK ~ 0.10 USD)

- TurnoverSEK 389 million (-17 %)

- Organic growth: -19 %

- EBITDASEK -12 million

- Cash flow from operating activitiesSEK +77 million

- Net lossSEK -235 million

- Cash positionSEK 684 million

- Convertible bondSEK 1.1 bn outstanding (maturity: March 2026)

Supplement:

Q1 is seasonally weak as many customers (especially in research) do not make large investments at the beginning of the year. At the same time, Q4 was strong, which pulled sales forward.

Comparison of the three previous segments (Q1 2025)

With a view to organic growth:

👩🔬 Life Science Solutions:

- SalesSEK 191 million

- Organic growth: +4 % 👀

- ApplicationsDiagnostics, cell research, microdosing

🧬 Bioprinting:

- Sales105 million SEK

- Organic growth: +41 % 👀

- Applications: 3D cell printing, bioinks, in-vitro models

🔬Lab Automation:

- SalesSEK 94 million

- Organic growth: - 58 %

- ApplicationsAutomation of complete laboratory processes

What do the individual divisions do?

👩🔬 Life Science Solutions:

This is where BICO develops laboratory technologies for diagnostics and cell research, such as devices for high-precision dosing of tiny quantities of liquids, consumables and special analysis platforms.

Examples:

Cancer diagnostics:

- SCIENION devices help to precisely apply tumor markers to test chips, the basis for modern blood tests for early detection.

Allergy tests:

- Using microdosing technology, mini test fields are loaded with allergens to create personalized skin or blood tests.

Genetic testing & DNA analysis:

- Systems from BICO precisely dose minute amounts of liquid onto gene chips, which then analyze intolerances or genetic risk factors, for example.

Point-of-care diagnostics:

- Production of compact rapid test cartridges (e.g. for influenza, RSV, bacterial infections) for home use or the doctor's surgery.

🧬 Bioprinting (see excursus above)

- BICO sells 3D printers for living cells (e.g. from CELLINK) and bioinks, i.e. cell carrier gels for printing tissue.

- ApplicationResearch, drug testing, animal-free toxicology

🔬 Lab automation

This is about the complete automation of laboratories, e.g. robots that create cell cultures, carry out analyses or coordinate samples. Everything is controlled centrally via the Green Button Go® software from Biosero.

💰 How profitable is BICO currently?

BICO is not yet profitable in the traditional sense, as EBIT (operating result) was clearly negative at SEK -290 million in 2024.

However, the operating cash flow a completely different picture: this was 2024 positive at SEK +259 million, as well as in Q1 2025 at +77 MSEK.

This means that BICO is now earning money in its core business, meaning that liquidity is flowing into the company.

The EBIT is still burdened by high depreciation and amortization on earlier acquisitions, research expenditure and, in some cases, one-off restructuring costs.

Conclusion

up to here:

BICO is not yet "through", but the path to operational profitability is recognizable. The company is heading in the right direction, now it depends on whether it can stabilize its operating base and continue to scale its high-margin business areas.

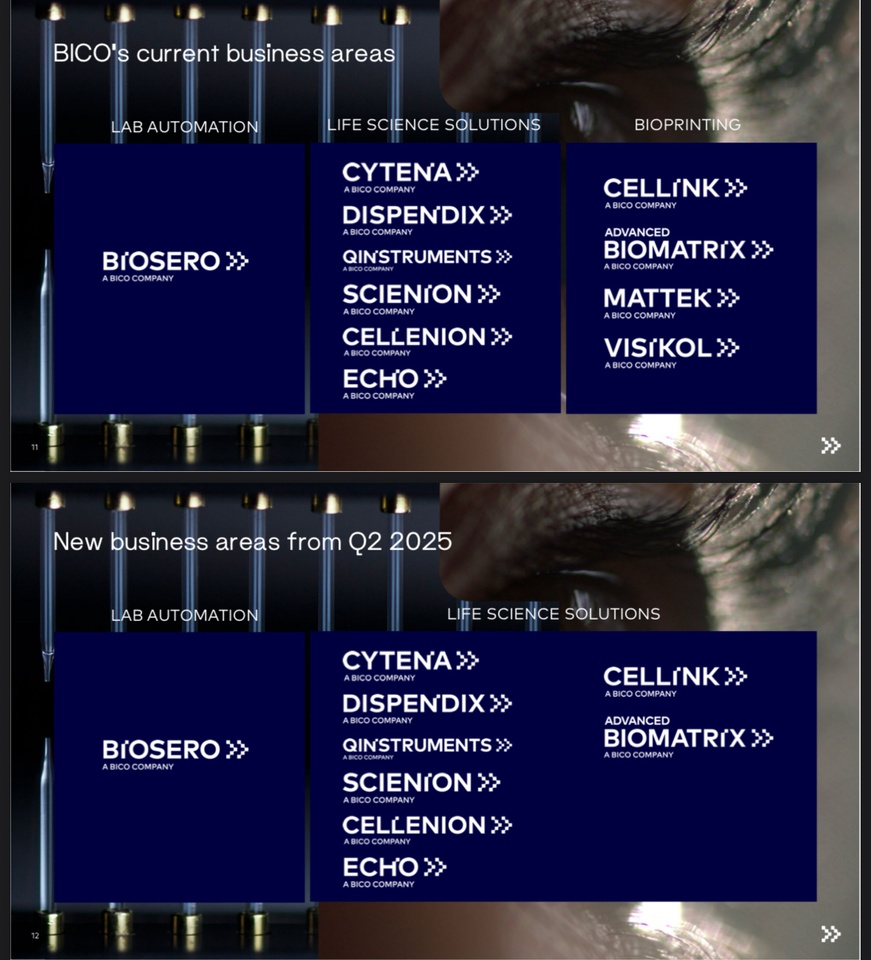

🤝 Business divisions & restructuring (from Q2 2025)

BICO previously operated in 3 segments:

- Bioprinting (e.g. CELLINK)

- Life Science Solutions (e.g. SCIENION)

- Lab Automation (e.g. Biosero)

New from Q2 2025:

Only two divisions, as Bioprinting will be integrated into "Life Science Solutions". Why?

Because CELLINK & Co. are now closely interlinked with diagnostics and consumables. The new setup is intended to increase efficiency, leverage synergies and simplify reporting.

📊 Classification of the figures and why Lab Automation is not growing, even though it is strategically so important

Bioprinting & Life Science Solutions show positive organic growth, while Lab Automationthe third-largest division, shrank massively (-58%).

Automation in particular is one of the main growth drivers in the bioconvergence strategy.

Explanation according to earnings call:

Q1 2024 (PY) was an upward outlier:

- An exceptionally large order from Biosero was booked at that time (project business).

- This effect distorts the basis for comparison, which exaggerates the decline in 2025.

Fewer project starts and completions in Q1 2025:

- Projects in Lab Automation are not distributed linearly, but are completed in phases

- There were simply fewer completed milestones in Q1 = less sales.

Macro-related reluctance on the part of major customers (pharma):

- Investment decisions were delayed, not canceled.

According to CEO Maria Forss:

"The underlying demand for Lab Automation continues to be strong."

"Project cycles are longer - but demand from pharma remains intact."

Project business is naturally volatile:

- Lab Automation is not recurring, but order-based.

- This leads to strong quarterly fluctuations - even with a stable order backlog.

BICO's strategic response

Standardization of project packages:

- Shorter durations, modular solutions to cushion order fluctuations

Strengthening project management:

- To better control time delays and resource commitment

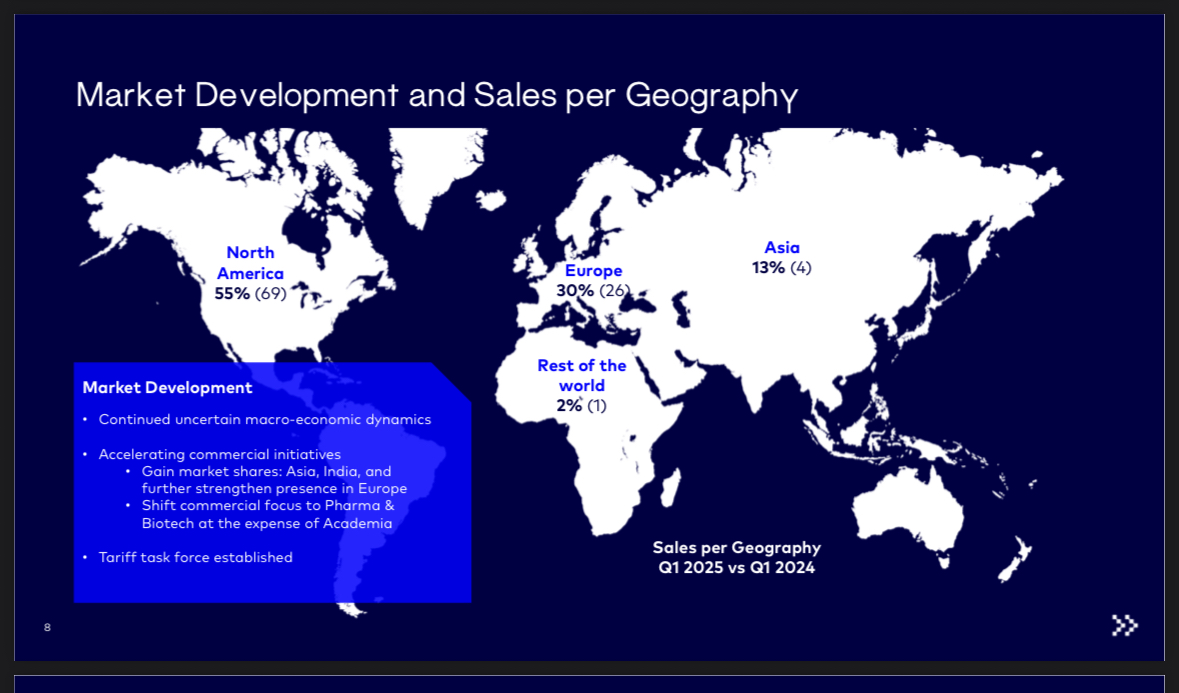

Focus on pharmaceutical customers:

- Cooperation with "Top 20 Pharma Companies" is being expanded, geographically flexible (USA, EU, Asia)

➡️ The decline in sales in Lab Automation looks dramatic, but is primarily due to timing and not a structural problem.

BICO is responding with strategic adjustments to its product portfolio and points to continued strong demand, only with longer lead times.

For investors, this means that the decline is unfavorable but explainable, not alarming

Further statements from the earnings call

CEO Maria Forss:

"Despite a decline in sales, Life Science Solutions and Bioprinting are showing positive development. Our strategy adjustment is taking effect."

- Bioprinting is booming: +41 % organic, CELLINK +130 % (on a low basis)

- SCIENION stabilizes Diagnostics: Miniaturization & home testing drive demand

- USA weakness in research: Reluctance to invest among academic customers due to uncertain NIH funding

- Tariffs & macro volatility: BICO has shifted production out of China, flexed supply chain

- Divestments: MatTek & Visikol sold, enables net cash position in Q2 2025

Why is bioprinting booming right now?

- New regulatory trends: FDA allows animal testing alternatives

- Increasing demand for in-vitro tissue models

- International expansion (e.g. India, Asia)

- Favorable product mix (bioinks, consumables)

Excursus in-vitro tissue models:

"In vitro" means: outside the living body, e.g. in a petri dish, on a chip or in a laboratory device.

Tissue models are replicated biological structures that resemble real human (or animal) tissue.

Example:

A skin tissue printed with cells that is used for cosmetic or drug tests, without animal testing.

What's the point?

- Safety & efficacy tests (e.g. for drugs, chemicals)

- Disease models (e.g. tumor tissue for cancer research)

- Personalized medicine (tissue from own cells)

In vitro tissue models are an ethically and scientifically attractive alternative to animal testing and BICO supplies the printing technology for this, among other things.

Is BICO a unique company in bioprinting?

No, but one of the pioneers with a broad portfolio.

There are competitors such as Allevi, Aspect Biosystems and Organovo, but BICO combines hardware, software and services under one roof - a strategic advantage.

Where does the market currently stand and what does the future look like?

- The market for bioconvergence is still young, provocatively speaking perhaps comparable to the cloud in 2010

- Applications such as automated laboratories, in-vitro models and AI-supported diagnostics are in their infancy

- Long-term demand is enormous for personalized medicine, increased efficiency and ethics (e.g. avoidance of animal testing)

Possible future scenarios

1 . BICO becomes a global playerBICO continues to grow, automates laboratories worldwide

2 . BICO becomes a takeover candidate: Groups such as Sartorius $SRT (+0,78 %) , Danaher $DHR (-0,42 %) or Thermo Fisher $TMO (-0,59 %) could strike

3 . BICO remains niche leader: Focused on profitable segments with high innovation density

Risks & critical voices

- Unprofitable: No sustainable EBIT coverage yet

- Convertible bond (SEK 1.1bn, equivalent to USD 114m): Maturity 2026, repayment depends on cash flow & divestments

- Risk of dilution if convertible bond is serviced via shares

- Strong dependence on projects -> sales fluctuations

- Competitive pressure from large corporations

The topic of the convertible bond has made me sit up and take notice again; here are some more deep dives:

What's the deal with BICO's convertible bonds until 2026?

Convertible bonds are a kind of hybrid between a bond and a share. They work like this:

- Investors lend money to BICO (e.g. SEK 1,000)

- BICO pays interest in return

At the end of the term (March 2026), investors receive either:

- the money back

- or can convert the bond into shares - depending on the agreed price

The whole thing is attractive for companies because they:

- only have to pay interest at first, no return of capital

- and can often offer a lower interest rate because the conversion option is attractive

What this means in concrete terms:

- BICO originally had convertible bonds with a volume of over SEK 1.5 billion

- SEK 394 million have already been repurchased in 2024 & 2025

- Currently open (as of Q1 2025): SEK 1.106 billion (114.5 million USD)

- Maturity date: March 2026

Why is this an issue for investors

1 . Repayment or dilution:

If BICO cannot repay the amount, new shares must be issued, this is called dilution because your stake in the company decreases.

2 . Cash flow burden:

If BICO wants to repay the amount from its own resources, it needs a lot of liquidity, which can slow down other investments.

3 . Refinancing risk:

If the market is weak in 2025/26, refinancing could become expensive or not possible at all.

What is the current situation?

Positive:

- BICO currently has SEK 684m in cash (USD 71m)

- The sale of MatTek & Visikol will put BICO in a net cash position in Q2 2025

- Target: Early extinguishment of convertible bond 2026

Statement on financing / repayment

CFO Jacob Thornberg said:

"The closing of the divestment of MatTek and Visikol for USD 80 million is expected to take place during Q2 2025 [...]

The proceeds from the transaction will be used to resolve the outstanding convertible bond, which matures in March 2026."

Translated:

The entire proceeds from the sale of MatTek & Visikol to Sartorius (USD 80 million) are earmarked for the repayment of the convertible bond.

Management's assessment of the financial position:

"We expect to move into a net cash position during Q2 2025."

This means:

- After the transaction, BICO will have more cash and cash equivalents than debt

- These funds should enable repayment in 2026 without further dilution

Assessment: How credible is this?

Positive:

- BICO shows clear plan: repayment of convertible bond is top priority

- Cash position Q1: SEK 684m

- Sale of MatTek & Visikol: approx. SEK 870m (converted)

-> Repayment can be financed if no new setback occurs

But:

- The operating business is not yet making a stable contribution to financing

- New investments or declining sales could jeopardize the plan

- Market environment remains volatile (interest rates, project delays, etc.)

➡️ Management is actively pursuing the plan to redeem the convertible bond in full before maturity in 2026 without dilution.

The sale of MatTek & Visikol has freed up concrete capital for this.

The direction is right, but BICO remains a risky stock with operational debt.

More on profitability:

In the Q1 2025 Earnings Call BICO's management did not give a specific date for break-even or profitability

... which is typical for growth companies with highly volatile project business.

What was said instead?

On profitability in Q1 itself:

EBITDA was negative (SEK -12m), but:

"Adjusted EBITDA was in line with Q1 2024 due to the positive development in Life Science Solutions and Bioprinting."

-> Improvement due to mix effects and operational measures

- The positive margins from Q4 2024 could not be maintained, mainly due to Lab Automation weakness.

Long-term statements?

No specific annual figure or guidance on profitability. But:

"We have launched a new operating model [...] to achieve improved commercial as well as operational efficiencies."

"We will continue to optimize our cost base and drive efficiency through integration."

Interpretation:

- Management is actively working on profitability

The focus is on the short term:

- Cash flow

- Efficiency gains

- Segment focus

Butunfortunately no clear words like: "We plan to be profitable in 2025 or 2026." 😬

Will BICO be the company that prints organs, or is it more likely to be taken over?

Technologically, BICO is very well positioned today when it comes to bioprinting infrastructure:

- Hardware (BIO X printers)

- Bioinks (cell-compatible inks)

- Software & automation

- Worldwide customer base

ButPrinting fully functional organs for clinical applications is a gigantic leap, not only technologically, but also in regulatory, medical and logistical terms. This is what is needed:

- billions in long-term capital

- Clinical studies over many years

- integration into healthcare systems and transplant networks

These are competencies that are more common in corporations like Johnson & Johnson $JJ, Medtronic $MDT (-0,66 %) , GE Healthcare $GEHC (+1,39 %)

, Siemens Healthineers $SHL (+2,12 %) or Thermo Fisher $TMO not a smaller platform provider like BICO.

Which is more likely?

1 . BICO remains the "toolmaker" of the bioprinting world:

Just like ASML for semiconductors or Illumina for genomics, but without building drugs/organs itself.

2 . BICO will be taken over when the topic becomes clinically concrete:

For example, when the first major organ projects enter the clinical phase, it is likely that a giant will strike to secure access to the technology.

3 . BICO remains an enabler, but not the final provider of clinical bioprinted organs

When organs are actually printed, will BICO become the global market leader?

🏷️ Unlikely.

➡️ More realistic is that BICO becomes one of the key technology suppliers or is taken over by one of the big players beforehand.

This can still be highly attractive for investors. After all, whoever supplies technology will be needed, regardless of who ends up operating on the patient.

Should we now focus on BICO or rather on a large corporation with bioprinting potential? 🤔

1 . Buy BICO for speculative returns

Pros:

- Favorable valuation after the "crash/hype" (more than 80 % below all-time high)

- One of the technology leaders in bioprinting

- Strategic focus, efficiency program, divestments, clear direction

- Enabler position in a highly scalable future market

- Possible takeover candidate = extra share price potential

Contra:

- Not yet profitable, operational risks exist

- Market for organs is still many years away

- Capital structure (convertible bond) is a medium-term uncertainty factor

- If large investors fail to materialize, BICO could be technologically overtaken

2 . Alternatively: back a large corporation for more stability

Which big players have the potential to drive bioprinting forward (or take over BICO)?

Sartorius

- Already has close cooperation with BICO (and acquired MatTek/Visikol)

- Focus on cell biology, diagnostics & laboratory automation

- Strong in APAC region and with biotech customers

-> Best-case candidate for takeover or joint venture

Thermo Fisher Scientific

- Global leader in laboratory equipment, genomics, diagnostics

- Great financial strength, active M&A strategy

- So far, however, more focused on classic diagnostics

-> Comes into play when bioprinting is more closely integrated into pharmaceutical production

Danaher

- Parent company of brands such as Cytiva and Beckman Coulter

- Very active in diagnostics and research technology

- M&A-driven, high margin focus

-> Could strike when the market matures, but rather late and strategically

3D Systems / Stratasys

- Directly active in 3D printing

- Have already acquired bioprinting units (e.g. Allevi)

- Fluctuating in strategy & implementation

-> Riskier than classic medtechs, but a direct bioprinting play

Personal classification: substance or science fiction on credit?

What makes more strategic sense? Which investment is "the right one"?

- High potential return and very high risk tolerance: Then BICO

- Takeover speculation: Then BICO or e.g. Sartorius

- Stable yield and dividend: Then Sartorius, Dabaher or Thermo Fisher

- Bet on "market leader of the future": Then wait and see, today there is no clear bioprinting world leader

OR

Combination strategy:

I invest a small position in BICO as a "moonshot", combine this with a solid underlying position in Sartorius or Thermo Fisher and cover the technology and protect the capital if BICO fails.

The two underlying positions mentioned can of course also represent a global ETF.

My personal assessment of BICO currently fluctuates between cautious optimism and realistic doubt.

On the one hand, I see a clear technological lead and a strategy that, unlike a year or two ago, now appears more well thought-out and focused. Partnerships with established players such as Sartorius also give me the feeling that BICO is not operating alone in a vacuum.

On the other hand, the operational foundation is still shaky. Profitability has not been achieved and the issue of the 2026 convertible bond hangs over the company.

Without sufficient cash flow or fresh capital, the ambitious vision could stumble, and despite all the enthusiasm for bioprinting and automation, we should always be aware of this.

BICO is not a stock for quiet nights, but for visionaries with patience it may be a ticket to the future of medicine.

I am currently waiting for an entry opportunity with a good feeling. The goal could be a portfolio share of up to approx. 3-4%, which then remains in place and is reduced in the future through portfolio growth without selling.

Thanks for reading! 🤝

______________

Sources:

[1] https://storage.mfn.se/5a3030c0-d13b-4177-80d0-94da59c7302d/bico-q1-2025-eng.pdf

[2] https://bico.events.inderes.com/q1-report-2025/register

/ https://web.quartr.com/link/companies/4484/events/247443/transcript?targetTime=0.0

More:

https://www.sartorius.com/en/company/investor-relations

I've been in BICO before and looked into it a bit back then. However, I got in at the wrong time and bought a bit on the dip, as it happens XD. At some point I threw the position out at a loss, BUT I still like it and keep it on my watchlist.

I don't see any "good" reason to get in right now. If you want to gamble, now would of course be a better time than back then. But it is what it is, and if you're looking for excitement and thrills, you've come to the right place. But then don't invest more than you think is appropriate for a rollercoaster for fun....

They don't have a long cash runway, as you describe, and still have a lot to do to reposition themselves after all the acquisitions. They are currently restructuring themselves, that's true, but in my view there's nothing to be said against waiting until there are the first signs that this will lead to something.

You say below that it is not a stock for quiet nights but for "visionary investors with patience". I would question whether the visionary investor "with patience" should not simply stay tuned at this point and patiently inform himself about the company and leave it on the WL until then...

PS: I also have something in my portfolio that has more in it because I enjoy finding out about the company and it's kind of nice to be in it. But it's not an investment case, it's more of a hobby and an emotion, inspired by an interesting idea etc....

23.04.2025

Tesla with sales decline + SAP maintains cloud growth rate and confirms outlook + Danaher's statements also drive Sartorius, Stedim and Evotec

Tesla $TSLA (-0,19 %)with decline in sales

- Tesla recorded a nine percent drop in sales to 19.3 billion dollars and a 71 percent drop in profits to 409 million dollars in the past quarter.

- Analyst Dan Ives from Wedbush Securities estimates that Elon Musk's political activities could permanently reduce demand for Tesla by 15 to 20 percent.

- In its current quarterly report, Tesla refrains from its usual forecast of a return to growth.

- For the first time in its Q1 earnings report, Tesla does not mention when the company intends to return to growth.

- Tesla Inc. misses analysts' estimates of USD 0.42 with earnings per share of USD 0.27 in the first quarter. Revenue of USD 19.34 billion below expectations of USD 21.4 billion.

- Tech billionaire Elon Musk initiates withdrawal from Washington.

- From May, he will spend "considerably" less time in the government apparatus as President Donald Trump's cost-cutter, said the Tesla boss.

- Instead, he will focus more on the interests of the electric car manufacturer.

SAP $SAP (+1,12 %)maintains cloud growth rate and confirms outlook

- SAP maintained its cloud growth in the first quarter and significantly increased its operating profit.

- The Walldorf-based software group confirmed its outlook for the current year.

- According to the DAX-listed company, the environment is characterized by high dynamics and uncertainty and further developments are difficult to predict.

- SAP is targeting currency-adjusted cloud growth of 26 to 28 percent to 21.6 to 21.9 billion euros this year.

- Cloud and software combined are expected to grow by 11 to 13 percent to 33.1 to 33.6 billion euros.

- The non-IFRS operating result is expected to reach EUR 10.3 to 10.6 billion after EUR 8.15 billion in 2024.

- In the first quarter, cloud revenue rose by 26% in constant currency to just under EUR 5 billion.

- Analysts had expected a consensus of EUR 5.06 billion from Visible Alpha.

- Currency-adjusted growth had already amounted to 26% in the fourth quarter.

- Non-IFRS operating profit rose by 58% to EUR 2.46 billion.

- The Current Cloud Backlog (CCB), which quantifies secured orders over the course of a year, rose by 29% to EUR 18.2 billion after adjusting for currency effects.

- The initial reaction of the share in after-hours trading in Germany was positive. They rose by more than 5 percent to 231 euros at the broker Lang & Schwarz.

- The SAP share had closed 3.32 percent lower at 218.50 euros on XETRA on Tuesday.

- SAP ADRs traded on the NYSE rose 6.48 percent to 268.75 US dollars in after-hours trading.

Danaher's $DHR (-0,42 %)statements also drove Sartorius$SRT (+0,78 %)Stedim $DIM (+2,65 %)and Evotec $EVT (-0,36 %)on

- The quarterly figures of the US pharmaceutical equipment manufacturer Danaher boosted the shares of Sartorius and its subsidiary Sartorius Stedim Biotech on Tuesday.

- The shares of pharmaceutical contract researcher Evotec also benefited.

- The reason for this was not only the better than expected results in the first quarter and the confirmation of the Group's annual targets.

- The fact that Danaher performed particularly well in the bioprocess technology segment, which is also an important pillar of the Göttingen-based Sartorius Group, probably put investors in a good mood.

- In addition, Danaher spoke of continued robust spending on research and development in the pharmaceutical sector.

- In the afternoon, the Sartorius preference share rose 5.9 percent to 221.30 euros at the top of the leading German Dax index and is thus back at its highest level since the end of March.

- The 21-day line, which signals the short-term trend, had already been overcome on Wednesday.

- The 50-day line as an indicator of the medium-term trend at just under EUR 226 and the long-term 200-day line at just over EUR 234 are now the next decisive resistances.

- The shares of French company Stedim Biotech recently rose by 3.9% to EUR 194.35 in Paris.

- In the MDax, the mid-cap index below the Dax, Evotec shares rose by 6.7 percent to 6.82 euros, while in the USA Danaher shares rose by 5.0 percent to 194.09 US dollars.

- Analyst Rachel Vatnsdal from the US bank JPMorgan spoke of Danaher "comfortably exceeding expectations" and "remarkable strength" in the bioprocessing sector.

- The bioprocessing division was the leader in the first quarter, she wrote.

- Compared to the previous quarter, orders there had increased significantly, while the company had also noted that it had not noticed any pull-forward effects in view of impending tariffs.

- According to stock market analysts, this should also have a positive effect on the industry as a whole.

- Like Sartorius, Danaher is broadly positioned in the healthcare sector with businesses in biotechnology and diagnostics.

Wednesday: Stock market dates, economic data, quarterly figures

- ex-dividend of individual stocks

- Lenzing EUR 3.00

- Heineken EUR 1.17

- Proximus EUR 0.10

- Adecco Group 1.00 CHF

- Quarterly figures / company dates USA / Asia

- 12:30 AT&T | GE Vernova | Boston Scientific quarterly figures

- 13:00 Philip Morris quarterly figures

- 13:30 Boeing quarterly figures

- 15:30 Goldman Sachs AGM

- 16:00 Cigna AGM

- 22:00 IBM | Texas Instruments | Lam Research

- 22:00 ResMed | Whirlpool quarterly figures

- No time specified: BYD quarterly figures

- Quarterly figures / Company dates Europe

- 07:30 Danone | Essilor-Luxottica 1Q sales

- 07:30 Volvo AB | Akzo Nobel quarterly figures

- 08:00 Reckitt Benckiser Trading Update 1Q

- 09:00 Just Eat Takeaway Trading Update 1Q

- 10:00 ASML | Sulzer Holding AGM

- 17:45 Kering quarterly figures

- Economic data

09:15 FR: Purchasing Managers' Index/PMI non-manufacturing | Purchasing Managers' Index/PMI manufacturing (1st release)

09:30 DE: Purchasing Managers' Index/PMI non-manufacturing (1st release) April PROGNOSE: 50.3 PREVIOUS: 50.9 Total Purchasing Managers' Index (1st release) PROGNOSE: 51.0 PREVIOUS: 51.3

09:30 DE: Purchasing Managers' Index/PMI manufacturing (1st release) April FORECAST: 47.6 PREVIOUS: 48.3

10:00 EU: Purchasing Managers' Index/PMI non-manufacturing Eurozone (1st release) April FORECAST: 50.5 PREVIOUS: 51.0

10:00 EU: Purchasing Managers' Index/PMI Manufacturing Eurozone (1st release) April FORECAST: 47.5 previously: 48.6 Total Purchasing Managers' Index (1st release) FORECAST: 50.4 previously: 50.9

10:30 UK: Purchasing Managers' Index/PMI non-manufacturing (1st release) Apri PROGNOSE: 51.6 previous: 52.5 | Purchasing Managers' Index/PMI manufacturing (1st release) April PROGNOSE: 44.2 previous: 44.9

11:00 EU: Trade Balance February

15:00 US: IMF, Fiscal Monitor

15:30 US: Fed St. Louis President Musalem and Fed Governor Waller, participate in Fed Listens Event

15:45 US: Purchasing Managers' Index/PMI Services (1st release) April Forecast: 52.8 Previous: 54.4 | Purchasing Managers' Index/PMI Manufacturing (1st release) April Forecast: 49.5 Previous: 50.2

16:00 US: New Home Sales March FORECAST: +1.3% yoy previous: +1.8% yoy

16:30 US: Crude oil inventories data (week) from the Energy Information Administration (EIA) previous week

18:00 US: Governing Council member Knot, speech at Peterson Institute conference

20:00 US: Fed, Beige Book

21:15 US: ECB Chief Economist Lane, participation in panel at IMF Spring Meetings

21:45 US: ECB Director Cipollone, participation in panel at IMF Spring Meetings

No time specified: CN: Auto Shanghai 2025 exhibition in Shanghai

Valores en tendencia

Principales creadores de la semana