SMA Solar

Price

Debate sobre S92

Puestos

58Dealing with losses

How do you deal with losses? Do you realize them promptly or do you wait and see?

I mostly invest for the long term. At least until I found this portal here 😇

I actually buy stocks that I'm convinced of and then leave them. Always with money that I don't need elsewhere.

Now, for example, I have titles like $EVT (-0,36 %)

$SRT (+0,78 %) or $S92 (-2,11 %) . All deep red. Wouldn't really bother me, I don't need the money. I have enough cash to buy other stocks.

Is it still worth selling because of taxes or how do you handle such cases?

What are your portfolio corpses?

Dax under pressure - US stock markets expected to suffer losses

The German stock market was weak on Tuesday. Pressure was exerted on the indices not least by weak US stock markets, following the absence of trading in the USA on Monday due to Labor Day. The Dax slipped more sharply below the psychologically important 24,000-point mark, which has come back into focus since last week.

"Recently, buyers have always entered the market at the 24,000-point threshold," commented portfolio manager Thomas Altmann from QC Partners. "However, it is quite conceivable that this buying threshold will gradually shift downwards."

At lunchtime, the leading German index was down 1.1 percent at 23,784 points. The MDax fell below 30,000 points. Most recently, the index of medium-sized companies lost 1.8 percent to 29,914 points.

With regard to the USA, the main focus is on the reaction of the US stock markets after an appeals court denied President Donald Trump the authority to impose far-reaching tariffs on imported products on Friday, citing an emergency law.

"In Asian trade, the continuing uncertainty about the economic impact of the US punitive tariffs was used for profit-taking," said market expert Andreas Lipkow. In view of the power struggle taking place behind the scenes around the US Federal Reserve, there are currently many questions and the upcoming meeting in September is the subject of much discussion.

"An interest rate cut is far from a foregone conclusion." The upcoming economic data from the US, such as the labor market report on Friday, is therefore likely to play an important role. "Many new risk clusters are currently forming, which could still cause considerable fluctuations on the financial markets."

Among the individual stocks in the Dax, the FMC-Aktie ($FMC (-1,74 %) ) brought up the rear, losing 4.9 percent. A sell recommendation from the major Swiss bank UBS weighed on the stock. Analyst Graham Doyle referred to structural risks with regard to business development in the USA and the danger of falling consensus estimates for the operating result.

Siemens ($SIE (+1,82 %) ) fell by 2.8 percent. They suffered from a downgrade to "market perform" by Bernstein Research. Analyst Nicholas Green justified his move with the strong share price gains in recent years. Commerzbank ($CBK (+1,34 %) ) , downgraded to "Equal-weight" by Morgan Stanley, lost 2.4 percent. At the current valuation level, analyst Alvaro Serrano wrote that further progress in the Frankfurt-based company's business plan is needed first.

In the SDax the share price of SMA Solar ($S92 (-2,11 %) ) fell by 28 percent. The manufacturer of inverters for photovoltaic systems lowered its forecast for the current year and now expects an operating loss. The restructuring efforts that have already been initiated are to be intensified further.

The fact that the motor manufacturer Deutz ($DEZ (+0,83 %) ) is expanding its still small business in the defense market with the planned acquisition of the Sobek Group. The share gained 6.0 percent at the top of the index. The Sobek Group is a drive specialist for drones.

SMA expects loss and intensifies reconstruction

SMA Solar ($S92 (-2,11 %) ) is lowering its forecast for the current year due to the persistently weak market development for residential and commercial systems and now expects an operating loss. The company announced on Monday in Niestetal that the expected sales development of the Home & Business Solutions division for 2025 and the following years had once again deteriorated significantly in the course of the third quarter. SMA Solar intends to further intensify the restructuring efforts already initiated. The costs for this and write-downs would amount to between 170 million and 220 million euros in 2025.

The SDax-listed company therefore anticipates a loss in earnings before interest, taxes, depreciation and amortization of between €30 million and €80 million. SMA had previously forecast a profit of 70 to 80 million euros. Sales are expected to reach 1.45 to 1.5 billion euros, slightly below the previous forecast of 1.5 to 1.55 billion euros for the current year.

The extended restructuring measures provide for the adjustment and development of the product portfolio and the depth of added value, greater use of the international locations and a more efficient service strategy, it said. As a result, SMA expects to save more than €100 million annually by the end of 2027.

The inverter group has been struggling for some time with continued weak demand and competitive pressure from Asian manufacturers. SMA had already become more cautious in May due to worsening conditions and the volatile US customs policy when looking ahead to the year.

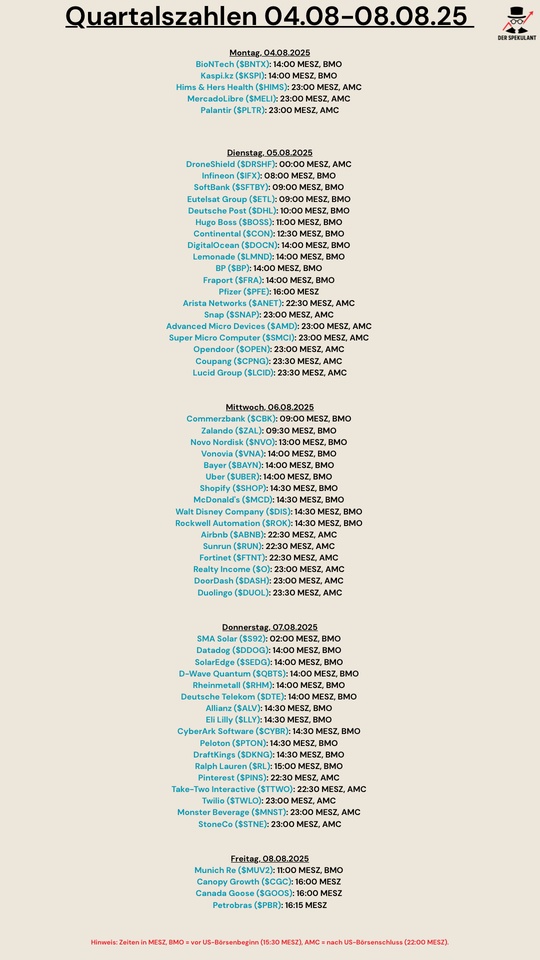

Quartalszahlen 04.08-08.08.2025

$BNTX (-0,32 %)

$KSPI (-0,96 %)

$HIMS (-0,67 %)

$MELI

$PLTR (+0,16 %)

$DRO (-0,77 %)

$IFX (-1,28 %)

$9434

$FR0010108928

$DHL (+0,52 %)

$BOSS (+0,57 %)

$CONTININS

$DOCN (-4,89 %)

$LMND (-7,45 %)

$BP.

$FRA (-1,1 %)

$PFIZER

$SNAP (+2,58 %)

$AMD (-1,53 %)

$SMCI (+0,62 %)

$OPEN (-5,9 %)

$CPNG (+1,03 %)

$LCID (-1,81 %)

$CBK (+1,34 %)

$ZAL (-0,93 %)

$NOVO B (-2,32 %)

$VNA (+0,18 %)

$BAYN (-4,34 %)

$UBER

$SHOP (+2,19 %)

$MCD

$DIS (-0,28 %)

$ROK (+0,64 %)

$ABNB (+1,55 %)

$RUN (+1,53 %)

$FTNT (-1,83 %)

$O (+1,13 %)

$DASH (+0,21 %)

$DUOL

$S92 (-2,11 %)

$DDOG (-4,15 %)

$SEDG (+8,15 %)

$QBTS

$RHM (-0,17 %)

$DTE (+0,29 %)

$ALV (+1,65 %)

$LLY (-1,18 %)

$CYBR

$PTON

$DKNG (-0,68 %)

$RL

$PINS (+5,61 %)

$TTWO

$TWLO (+1,26 %)

$MNST

$STNE (+5,13 %)

$MUV2 (+0,8 %)

$WEED (+1 %)

$GOOS (+0,86 %)

$PETR3T

$ANET

SMA Solar - Preliminary Figures H1 2025 (July 21, 2025)

SMA expects in the 1st half of 2025:

- Sales: €684.9 million (H1 2024: €759.3 million)

- EBITDA: € 9.1 million (H1 2024: € 80.6 million)

- EBIT: € -19.0 million (H1 2024: € 56.2 million)

Q2 2025 (preliminary):

- EBITDA: € -15.5 million (consensus: € -4.0 million)

- EBIT: € -30.4 million (consensus: € -19.0 million)

- Reason: Inventory write-downs in the Home & Business Solutions division (€ 46.8 million)

- Adjusted operating EBITDA: € 31.3 million (Q2 2024: € 30.6 million)

📉 Decline in earnings due to one-off effects - operationally stable.

SMA Solar slumps | HOCHTIEF loses profits after record high

SMA Solar slumps after Jefferies downgrade

The recovery of SMA Solar that started at the beginning of March $S92 (-2,11 %)which was boosted by the planned infrastructure investments in Germany, is now showing clear signs of weakness. On Monday, the share price of the solar technology manufacturer fell by 4.86% to 16.84 euros, its lowest level since the beginning of March. This is already the third trading day in a row with heavy losses. The share price has now retreated by a third from the annual high reached in mid-March. The original annual gain of a good 20 percent has thus been greatly reduced. Jefferies, the investment house, withdrew its buy recommendation on Monday, which put further pressure on the share price. Two weeks ago, the share price appeared to be at a high since August, with an annual gain of up to 82%. Analyst Constantin Hesse attributed the downgrade to the reduced predictability of order development at the inverter manufacturer, in particular due to more cautious demand from US customers. Hesse would like to wait and see until the order situation stabilizes. In 2024, SMA Solar was already the biggest loser in the small-cap index SDax, with a drop of almost 80%. Competition from China and high inventories in particular had caused the company problems. In mid-June, a drastic sales and profit warning led to a massive fall in the share price. In November, the North Hessian company lowered its targets once again and announced the reduction of 1,100 jobs, which brought the share price to its lowest level since 2015.

HOCHTIEF share price setback: gains evaporate after record high

The HOCHTIEF share price $HOT are living up to the company name these days. After reaching a record high in mid-March on the back of hopes for billions in German infrastructure funding, the share price has now entered a phase of disillusionment, falling for four weeks. On Monday, it fell by almost four percent on XETRA after Jefferies dropped its buy recommendation. The price gains that were achieved after the financial package of the CDU/CSU and SPD have thus almost disappeared again. The approval of the financial package by the Bundestag and Bundesrat around a week and a half ago did not provide any new momentum for the share, which has lost momentum after its rally. In his analysis, Graham Hunt from Jefferies limited the significance of the German infrastructure billions for HOCHTIEF. He noted that the company generates around half of its profits in the USA, while only three percent are generated in Germany. In his sector study, he recommends companies with a stronger focus on Europe, such as Balfour Beatty and Eiffage, as they offer better opportunities and an attractive free cash flow yield. Hunt also sees the priced-in fantasy for the construction of AI data centers as a risk to HOCHTIEF's high valuation.

Sources:

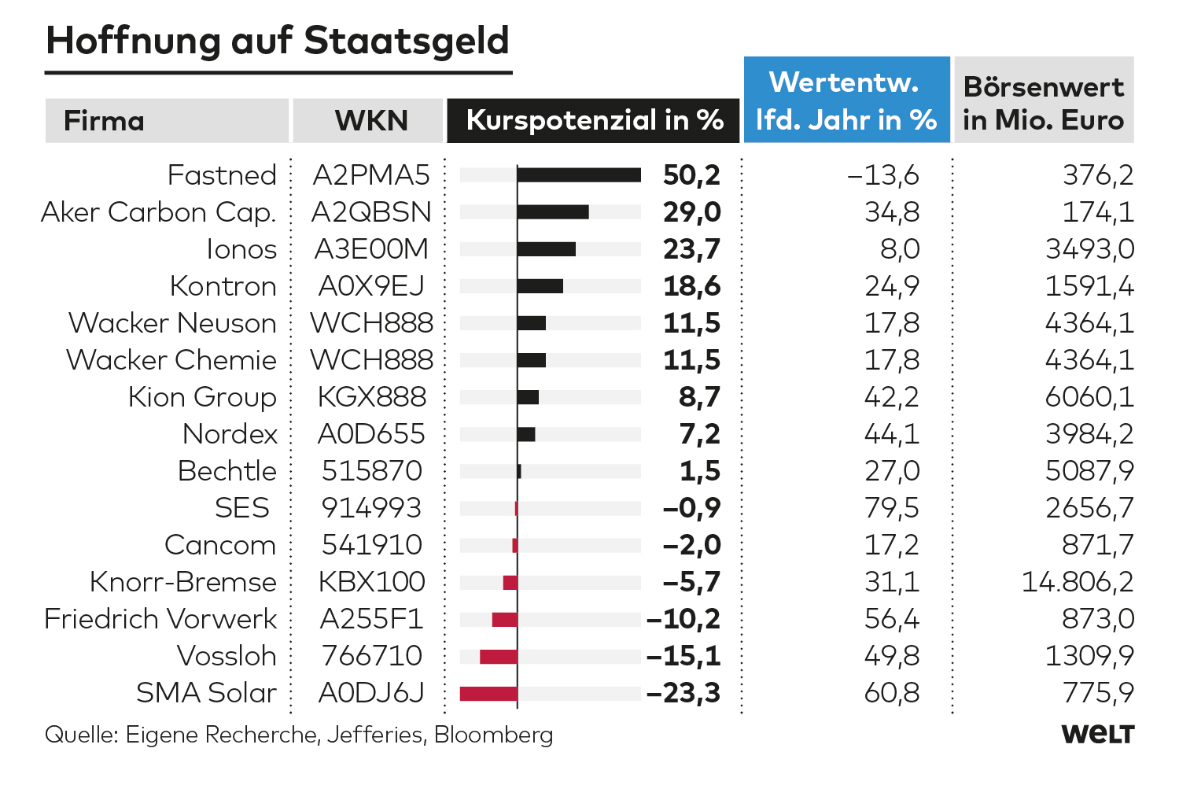

Beneficiaries of the debt package - these 15 German stocks have the best chances

According to "Welt", companies active in construction, rail infrastructure, digitalization and the energy industry are considered to be beneficiaries of the debt pact. So-called green sectors are also likely to benefit.

A few examples:

$FAST (+2,7 %) - Fastned

$ACC - Aker Corp

$IOS (+0,53 %) - Ionos

$KTN (+0,82 %) - Kontron

$NDX1 (-0,44 %) - Nordex

$BC8 - Bechtle

$VOS (-0,96 %) - Vossloh

$S92 (-2,11 %) - SMA Solar

Despite all the debt euphoria, however, investors should bear in mind that the infrastructure companies are smaller stocks that are not without risk.

Source (excerpt) & chart: World

I was laughed at for this pick in October and November

today at over 20€

3 months ago 12€ and this post:

📉 SMA Solar Technology AG: An underestimated opportunity despite scaremongering 📈

- 📊 Share price declineSMA Solar Technology AG has fallen to the sales level before the last hype. P/B ratio is at 0,73which indicates a clear undervaluation indicating a clear undervaluation.

- 🛡️ Financial stability: With an Altman Z-Score of 7 the company is financially stable.

- 🚫 Varta comparison unfounded: Despite challenging market conditions and high inventories, SMA remains strong, continues to invest in production capacities and demonstrates confidence in future growth.

- 🎯 Price target of €25: In the next three quarters, SMA could show that there is potential for recovery. A decisive release is due in 6 days coming up - more insights to follow!

VW plans contingency plan due to US tariffs | Eutelsat share price jumps | SMA Solar targets profit and rises sharply

VW plans emergency plan due to US tariffs

In the USA, Volkswagen has $VOW (+0,93 %) has activated a comprehensive emergency plan due to new tariffs against Mexico, which comes as a surprise to many observers. These strategic measures are designed to protect business and supply chains in the USA. VW operates a large plant in Puebla, Mexico, which is critical to the production of models for the US market. The tariffs are already having a noticeable impact on the automotive industry and dealers in the United States. An open appeal to US President Donald Trump emphasizes the need to reconsider the tariffs as they could potentially have a negative impact on jobs and economic growth in the US. Nevertheless, VW shares were unimpressed by possible tariffs on Wednesday and rose by around 4%.

Eutelsat share price jumps

The Eutelsat share $ETL (+1,75 %) made an impressive leap on Wednesday, leaving even experienced investors in awe. Since last Friday, the French-British satellite group, which is pushing its OneWeb systems onto the market, has gained almost 200% in value. Yesterday, the share price shot up by up to 123% to EUR 4.50 before settling at EUR 3.57, an increase of around 77%. And that's not all: today the share price surpassed the magical EUR 5 mark and reached EUR 5.87, its highest level since July last year. A week ago, the share price was still below 1.15 euros - a dramatic rise that has analysts sitting up and taking notice. They see Eutelsat's OneWeb systems as a promising European alternative to Elon Musk's Starlink, especially when it comes to supplying Ukraine with communication services.

SMA Solar targets profit

In Germany, SMA Solar $S92 (-2,11 %) is putting its cards on the table and has ambitious plans to return to profit following an operating loss last year. CEO Jürgen Reinert has set the target of achieving EBITDA of €70 million to €110 million by 2025, which is in line with analysts' expectations. However, the road ahead is rocky: an operating loss of EUR 16 million is forecast for 2024, a severe setback after an impressive profit of EUR 311 million in the previous year. The share price jumped 23.90% to EUR 16.95 in the morning, boosted by the prospect of a historic financial package in Germany that promotes investment in energy technology. In order to reduce costs and streamline the corporate structure, SMA is also planning a cost-cutting program that could potentially result in the elimination of up to 1,100 jobs.

Sources:

Valores en tendencia

Principales creadores de la semana