$DIS (-0,97 %)

$PLTR (-3,31 %)

$SRT (-4,43 %)

$NXPI (+0 %)

$PYPL (+6,17 %)

$PEP (+2,05 %)

$TER (-1,72 %)

$CPRI (-7,61 %)

$MRK (+0,96 %)

$PFE (+1,51 %)

$TTWO (-2,07 %)

$EA (+0,38 %)

$AMD (-1,72 %)

$MDLZ (+2,1 %)

$LUMN (-4,66 %)

$SMCI (-4,78 %)

$7011 (-0,51 %)

$6752 (+0,07 %)

$6367 (-0,94 %)

$UBSG (-2,1 %)

$GSK (-0,56 %)

$UBER (-4,08 %)

$ABBV (+1,68 %)

$LLY (+4,37 %)

$GOOG (-0,89 %)

$ELF (-4,1 %)

$QCOM (-1,88 %)

$SNAP (-4,13 %)

$WOLF (-1,58 %)

$ARM (-1,31 %)

$VOLCAR B (-4,87 %)

$6758 (-1,1 %)

$SHL (-1,7 %)

$SAAB B (-3,25 %)

$5401 (+2,32 %)

$MAERSK A (-3,9 %)

$R3NK (-2,59 %)

$BMY (+1,13 %)

$BMW (-2,81 %)

$EL (-1,03 %)

$ROK (-2,72 %)

$PTON (-5,96 %)

$KKR (-8,53 %)

$LIN (-0,56 %)

$RL (-6,37 %)

$AGCO (-1,97 %)

$RBLX (+0 %)

$FTNT (-5,61 %)

$REDDIT (-0 %)

$ILMN (+1,9 %)

$WMG (-4,69 %)

$IREN (+4,77 %)

$MSTR (-5,48 %)

$AMZN (-2,4 %)

$KOG (-2,58 %)

$ORSTED (-2,13 %)

$PM (+2,1 %)

$WEED (-3,03 %)

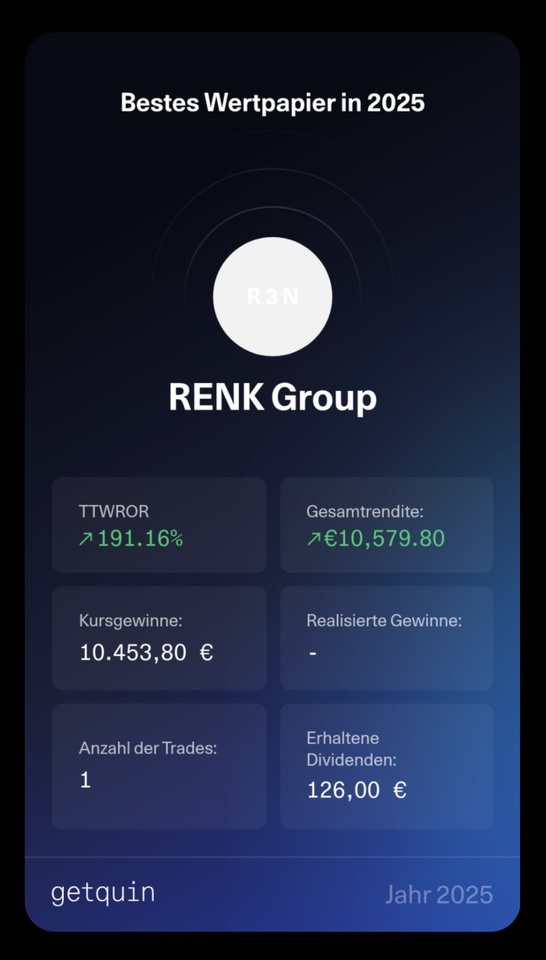

RENK Group

Price

Debate sobre R3NK

Puestos

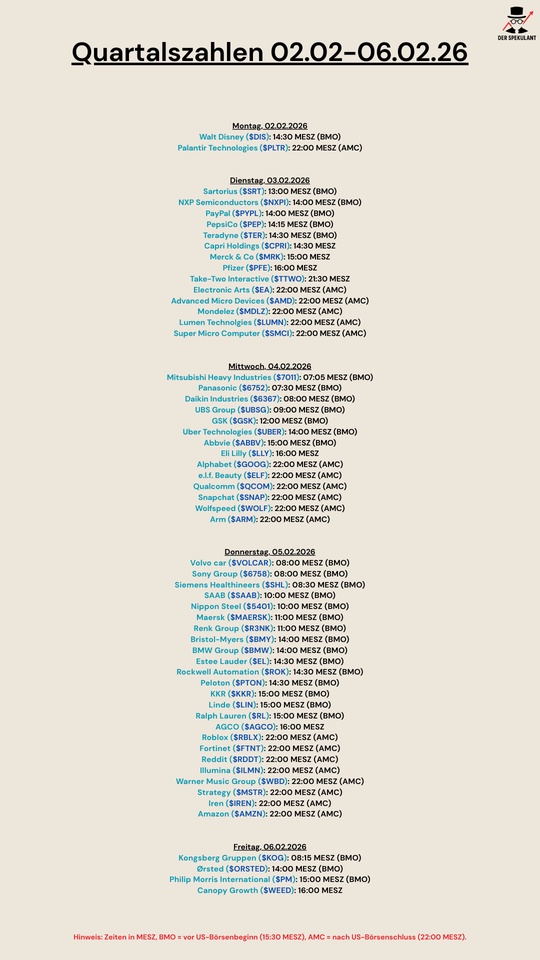

40Quarterly figures 02.02-06.02.26

Water can wait, now it's time for armor 💧➡️🛡️

Originally I had intended to use Badger Meter ($BMI (-2,07 %) ). A company that, in my view, is investing cleanly in a long-term, structural megatrend: Digital water infrastructure, efficiency and supply. This topic remains important and exciting.

Nevertheless, in the short term reoriented and invested in RENK ($R3NK (-2,59 %) ) invested.

The reason:

The current market and capital allocation clearly signals that defense and security-related industries are currently seeing more capital inflows, higher priority in political budgets and more active demand than traditional industries, which, as important as they are, are priced in with less "urgency".

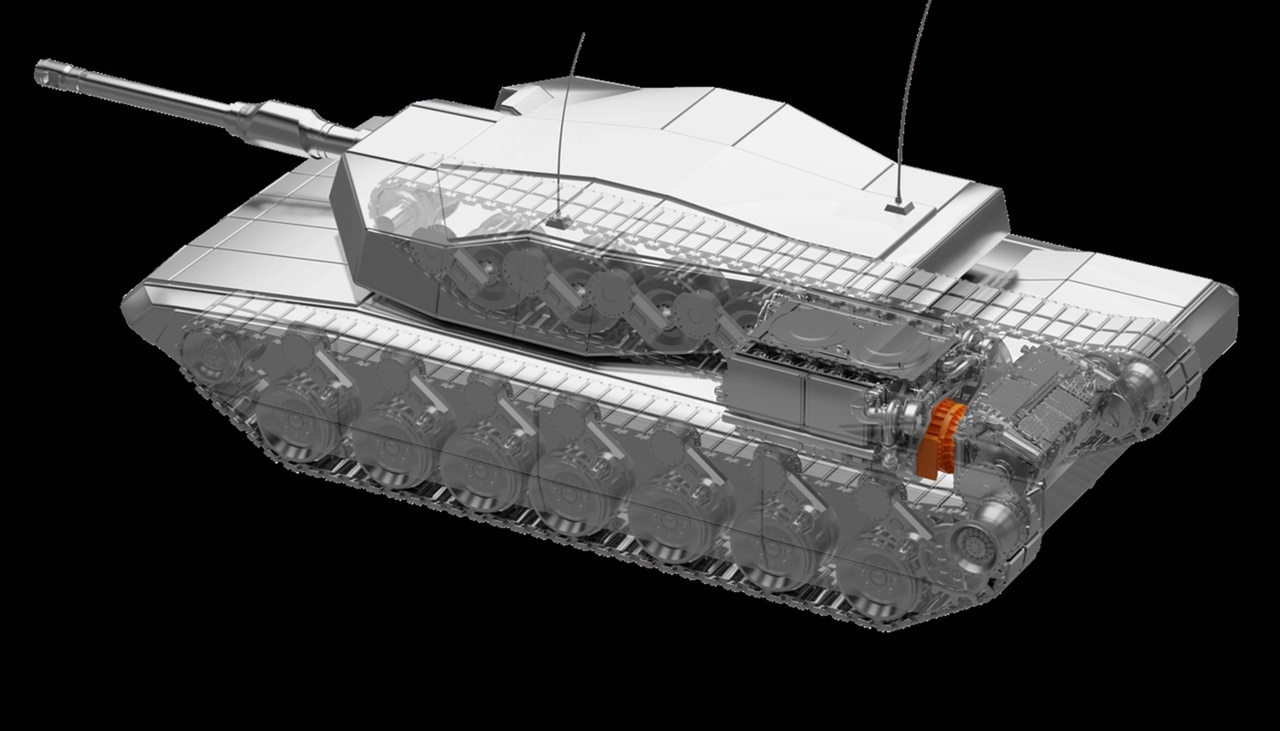

With RENK, I am betting on a company that is positioned in a defensive, but politically highly prioritized sector sector: Propulsion systems and gear units for high-performance military and civilian systems.

Brief company overview - RENK Group AG 📍

Headquarters: Augsburg, Germany

Industry: Special gearboxes & drive solutions for defense, marine, industry and energy

Employees: around 4,000 globally

IPO: February 2024, SDAX member

History: Founded in 1873, long-standing tradition as a technology partner in gear and drive technology.

Today, RENK is a specialized manufacturer of mission-critical propulsion and drive solutionsthat have to function in very demanding environments. From tanks and ships to large industrial plants. The product portfolio covers gearboxes, hybrid drives, power packs, couplings, plain bearings and test systems.

Business Model & Products ⚙️

RENK supplies technical components that are "invisible" but crucial for mobility, performance and reliability and reliability:

- Transmissions for wheeled and tracked military vehiclesincluding main battle tanks

- Drive systems for naval platforms

- Hybrid and electric drive solutions

- Industrial gearboxes and test systems for energy & production plants

RENK covers both defense and civil-technical fields of application, with the defense part traditionally dominating.

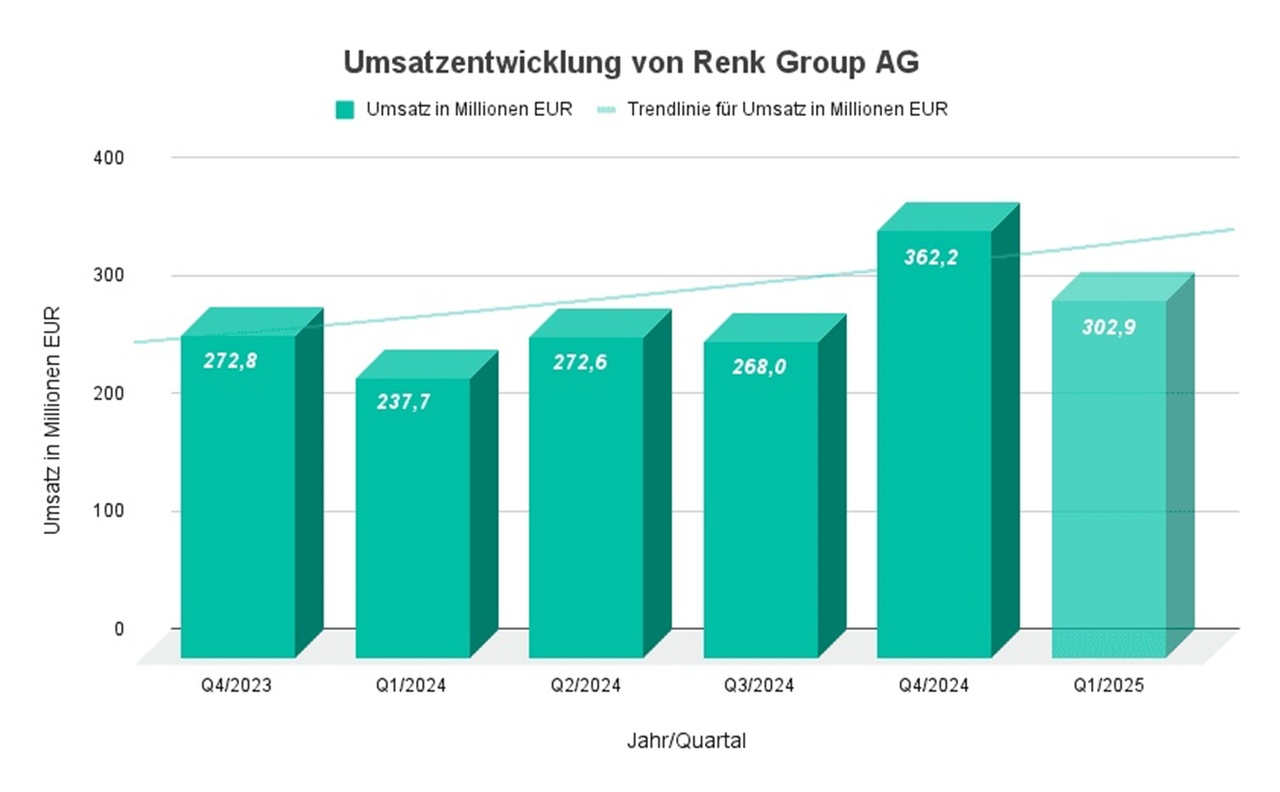

Financial data - sales, orders, growth 📊

- Turnover 2024: approx. 1.1 billion euros, incoming orders ~€1.4 billion

First quarter of 2025 ⚙️

- Turnover: 273 million euros

- Growth compared to previous year: +14,7 %

- Adjusted EBIT: 38 million euros

Solid start to the year, with a clear increase in profitability despite ongoing production adjustments

First half of 2025 📈

- Turnover: 620 million euros

- Growth compared to the previous year: +21,5 %

- Adjusted EBIT: 89 million euros

This clearly shows that demand is not only picking up, it is also materializing in significantly higher sales and earnings.

First nine months of 2025 📦📊

- Turnover: 928 million euros

- Growth compared to the previous year: +19,2 %

- Adjusted EBIT: 141 million euros

- Order backlog: around 6.4 billion euros (record level)

The high order backlog is one of the most important points: It ensures multi-year sales visibility and significantly reduces short-term planning risks.

This is remarkable in such a narrow field of technology, because Order backlog and visibility are available over several years. A rare luxury in the military supply business.

Strategic orientation & market position 🎯

RENK has a very clear focus:

➡️ Focus on defense applications Armored and marine gear units form the core of the business.

➡️ Technological moat through high specialization and certification.

➡️ Expansion of the production capacityto meet the increasing demand.

➡️ Development of modular, high-performance systems for various classes of main battle tank.

➡️ Medium-term sales target of 2.8 - 3.2 billion euros by 2030 with a high EBIT margin if the defense cycle continues.

RENK has a strong international presence: 11 plants in Europe, North America, India and other regions, over 20 support and maintenance locations worldwide.

Growth drivers in detail 🚀

1) Geopolitical situation & defense budgets

Rising military budgets in Europe, NATO spending and modernization programmes are creating demand that goes far beyond short-term stimuli. These findings support medium to long-term visibility for incoming orders.

2) Technological lead

RENK supplies components that have to withstand extreme loads. This creates high switch costs for customers and stable margins. Technological complexity acts as a barrier to entry.

3) Production scaling

Conversion from classic manufacturing to modular series production should significantly increase annual production capacity - a quantitative lever for growth.

4) Aftermarket & Services

A large proportion of turnover comes from maintenance, spare parts and long-term service contracts - an often underestimated stabilizing factor.

Evaluation & personal classification

RENK is not a broadly diversified industrial stock. Its strength lies in a strategic niche with a technological focus and high transparency of the order situation.

I got in for the following reasons:

✔️ Strong demand and high order pipeline

✔️ Technological market leadership in specialty segments

✔️ Production expansion and rising margins

✔️ Long-term political prioritization in the defense sector

At the same time:

⚠️ political dependence

⚠️ sectoral concentration

⚠️ Valuation pressure in anticipation of future prospects

In my opinion, RENK is not a short-term "hype", but a strategic sector playwhich, despite all the risks, can have a place in a long-term portfolio, especially if the perspective of security and political prioritization is taken into account.

Conclusion

RENK is a specialized gear and drive manufacturer with a strong strong presence in the defense sector and a clear growth strategy for the coming years. The excellent order situation, production expansion, technological edge and robust forecasts provide a solid foundation. At the same time, the business model is heavily dependent on political decisions and defense budgets - which represents both an opportunity and a risk.

No investment advice - just my well-founded, personal assessment.

Lg Don

For your information

The article here was partly created with AI

Renk receives order worth millions from the USA

Dividendenopi inside ( Part 2 )

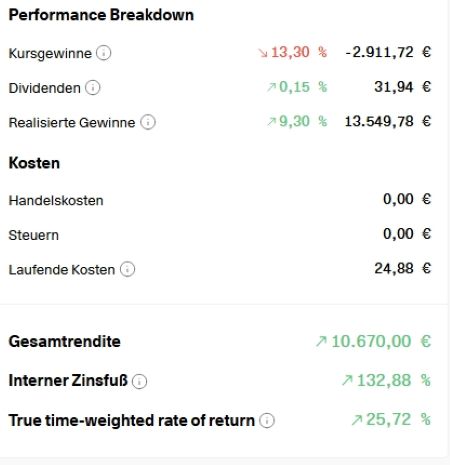

We continue with insights into the goings-on of the dividend opi. If you missed the first part, you can find it here: Dividendenopi inside Teil 1 Dividendenopi Rewind2025

As the second part is less about shares, I'll at least start with the rest and the question from @Epi about the Zockeropi. I still have one position each in the, let's say, hidden area of $EKT (-1,85 %) and $NOVO B (-15,64 %) each. Neither trading nor dividend stocks as I see it, so they are bobbing around in the middle of nowhere. Both are currently in negative territory and have a current market value of around €30,000. To be honest, I still don't really know what I'm going to do with them. In my opinion, EKT is still a rock-solid value and clearly undervalued. Despite all my understanding for the delays, which are apparently through no fault of their own, they have to deliver this year. Otherwise I will actually realize the losses, but they are absolutely manageable. And about Novo, well, what more can I say... Ignored the warnings during the high phase and took the crash in its stride. Due to the recovery over the last few days, the share is moderately down by just over 10%. Depending on my mood on the day, however, this could quickly disappear.

And to ensure that my strategy as a whole doesn't get boring and that the gambling child in me is kept in mind so that it doesn't do anything stupid with larger investments, I have turned more intensively to short-term trades since the middle of last year. In June with $DEFI (-5,26 %) and $HIMS (-4,35 %) initial modest successes have encouraged and "hooked" me by, among other things @Multibagger one or two copy trades. My play money is strictly limited to a maximum of 5% of my total capital. I haven't invested that much yet, but despite everything $IREN (+4,77 %) , $CIFR (+3,82 %) and some other trades have brought me nice profits on the side. Most recently I closed yesterday $AII (+0,64 %) closed yesterday with 40% plus. The largest position in the trading portfolio at the moment is again $IREN (+4,77 %) with EK 35€ and a slight plus. The rest, $CA1 (-6,41 %) , $DEFI (-5,26 %) , $LYC (+1,61 %) , $NB (+3,53 %) and $null are not doing so well at the moment, which is why I am currently in the red. I currently have € 20,000 invested there, but the holding period for these shares and the long is also designed for a maximum of 6 months, so I will look again in April.

So far so good.... Now comes the outing and the boring part of my investments, which still make up the majority of the capital invested. Expiring fixed-term deposits have already been and will be put into the market. Due to my age, I tend to be a bit conservative when it comes to choosing my broker and would have a stomach ache with a neo-broker for this amount. For a while I had my investments diversified with S-Broker, ING and Consors. Overnight deposits at various institutions in recent years, where the best new customer offers were available. I'm still hopping and currently have a good €370,000 in call money. The best interest rate for 12 months until mid-26 is with BBVA, where I'm realizing 3.25% thanks to a promotional bonus. Volkswagenbank, Fordbank, Stellantisbank and Renaultbank are always offering special promotions for existing customers with interest conditions to compensate for inflation. The advantage of all the aforementioned banks is the monthly interest payout for regular income, and the trend at the moment is again towards higher offers for new customers of just under 3%, so I will be shifting around a little over the next few days and weeks. Longer-term fixed-term deposits will gradually expire over the next 2 years, where I have conditions from the beginning of 24, e.g. at Kommunal Kredit for 4.5%, the others are between 3.4 and 4.1%. In total, this currently amounts to € 125,000 with annual interest payments for further cash flow.

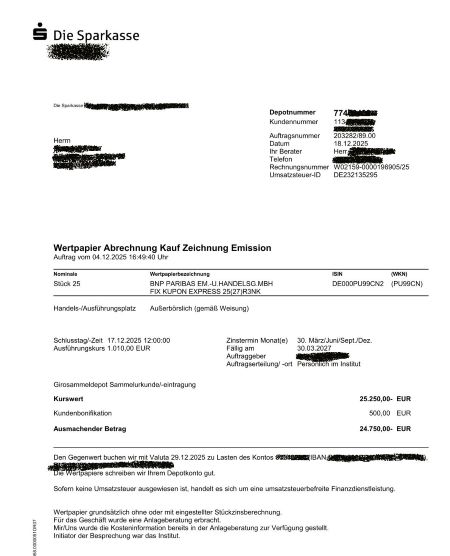

The third large chunk, and therefore the rest of my capital, is invested in bonds and certificates. More on this in a moment. Where do I have my securities account now? Drum roll... 😇😇At the savings bank, sic!🤷♀️ At a large savings bank in the big city around the corner as part of a private banking agreement. I have an all-in-fee that costs really fat fees every year. 1.25% of my average portfolio value p.a. And that's a four-figure sum at the top end. Before everyone faints or thinks I'm out of my depth, a few words of explanation and insight into my decision. I can trade where I want, as much as I want and what I want within the limits of these fees. Of course, I can also pay less for a used small car, but as I mentioned, it's just not for me. One of the reasons I took this route was because of the annual costs I would otherwise incur with ING and S-Broker. Given the trading volumes, that wasn't exactly low either. For me, these costs would have been costs anyway. The decisive advantage, in addition to almost 24-hour all-round support and a personal portfolio manager, lies in trading certificates. I like to use fixed coupon express certificates for cash flow. They are available on many stocks. This year I was / am invested in Siemens, LVMH, BMW, Daimler Truck, Vonovia, Renk, among others. They all had / have interest rates between 6.5% and 9.75%. Latest "deal" a certificate on $R3NK (-2,59 %) on 29.12 with 11.7% and a new one now starting in January with 11.5%. The interest is paid out quarterly on a pro rata basis and makes a not insignificant contribution to my monthly income. I am always offered these certificates for subscription before they are issued, the issue premium is waived as part of my agreement and I receive a large part of the "internal commission" from the savings bank, which is called a customer bonus. I am attaching the statement of my Renk certificate from December 29th to make it easier to understand.

In this case, with an otherwise regular issue price of € 1,010 for a € 1,000 share, I have in any case already "recouped" part of my fees (saved issue premium plus lower subscription price), with other providers and lower interest rates this can be up to 2.5% and more. These express certificates usually come back in the next 6 to 9 months when the early payout levels are reached and I get back the € 1,000 nominal value, plus the interest accrued up to that point. Unfortunately, I have to pay tax on the difference between my cheaper purchase and the nominal value as a profit. The money is then immediately reinvested in corresponding new certificates. This means that I have a regular annual circulation with a corresponding volume, not every certificate is returned, and in total this recoups my fees. Sounds a bit like a milkmaid's calculation, but it works out. We can discuss this in more detail. For now, this is only part of my motivation. However, these certificates are one of the main pillars of my cash flow and are relatively default-proof thanks to downward barriers of 40 to 50%, but of course you have to look at the underlying securities.

Other investments are in capped bonus certificates with a barrier. These offer no ongoing cash flow, but "reward" you with decent returns if they perform well and are particularly suitable for sideways or slightly falling markets. For both variants, it must be said that dividends from the reference stocks are excluded and a strong upward trend in the individual underlying stocks does not lead to overperformance and in the latter case is also limited (capped) or leads to premature liquidation in the case of express certificates. If you keep abreast of the market, the risks are manageable and the maturities are limited to a maximum of 2 years, usually less.

There are other variants of these certificates, if there is interest I would present these in a separate series. They are not performance boosters, but with the right selection they can lead to stability and ongoing cash flow or pre-defined potential price gains even if the markets do not perform as everyone would like.

That's it from my side, I've let my pants down and shown how I, as an old fart with an appropriate amount of capital, try to structure my monthly returns without taking excessive risks and why and how I do it. Perhaps it will help some investors who are not so risk-averse to think about alternatives. I would like to thank everyone who has stuck with me to the end and see you soon. Your Dividend Topi

2025 in the final stages

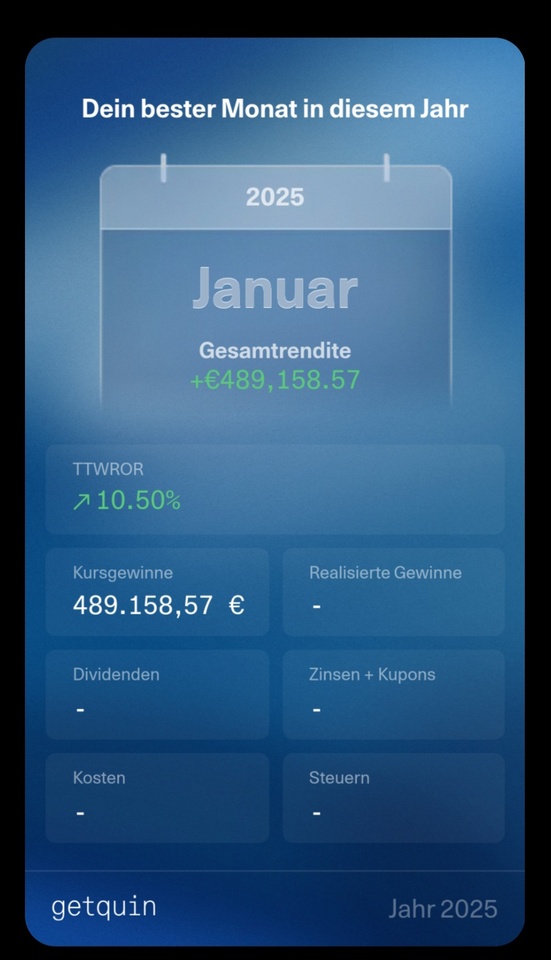

January probably due to the bank shares, among other things, and $R3NK (-2,59 %) I would not have expected now...

Return of the high performers! These 3 stocks could EXPLODE (analyses + entries)

In this video I analyze the three exciting high-potentials Accenture, Renk and Alibaba. You'll get my specific entries, realistic price targets, hedges, as well as a complete technical & fundamental analysis. Perfect for anyone who wants to identify strong stocks before the next push.

ACCENTURE - 50% potential thanks to undervaluation + completed ABC correction I'll show you why $ACN (-5,89 %) is one of the most interesting tech service providers in the medium term. The company is fundamentally undervalued, impresses with stable growth figures and has completed an ABC correction on the chart, which favors new upward structures.

➡️ My entry, price target + hedging explained in detail.

RENK - Profiteer of the global armaments boom (50%+ potential) $R3NK (-2,59 %) is benefiting massively from the fact that Germany, NATO and the EU want to invest up to 5% of GDP in the defense industry. The company also has a strong presence in the naval sector. The chart shows a clearly defined liquidity reversal, which favors price increases in the medium term.

➡️ You can find my trading strategy, price targets & risk setup in the video.

ALIBABA - the underestimated AI giant from China $BABA (-1,07 %) not only launches its new AI glasses on the market, but also becomes one of China's most important AI players thanks to government support. In addition to the large retail segment, a massive AI ecosystem is emerging that will significantly strengthen Alibaba's fundamentals.

➡️ I explain the entry point, price targets and why a comeback is possible here.

What to expect in the video:

✔ Entry points, price targets & hedging for Accenture, Renk & Alibaba

✔ Fundamental valuation + chart technology (incl. trend analysis)

✔ Why all three stocks promise great medium-term growth

✔ Which macroeconomic factors are favoring the rally

Would you prefer a stock from these 3?

Quarterly figures 10.11-14.11.25

$MNDY (-7,07 %)

$TSN (-1,53 %)

$OXY (+1,05 %)

$WULF (+3,93 %)

$PLUG (-0,63 %)

$RKLB (-2,07 %)

$CRWV (+2,8 %)

$9984 (-4,54 %)

$IOS (-4 %)

$MUV2 (+0,54 %)

$SE (-3,38 %)

$NBIS (+2,42 %)

$RGTI (+0,74 %)

$$BYND (-4,84 %)

$OKLO

$IFX (+1,65 %)

$EOAN (-0,54 %)

$TME (-3,47 %)

$VBK (-3,05 %)

$HDD (-3,93 %)

$ONON (-3,82 %)

$JMIA (-9,37 %)

$MRX (+0,38 %)

$HTG (+0,7 %)

$DTE (+1,5 %)

$R3NK (-2,59 %)

$HLAG (-0,53 %)

$JD (-0,65 %)

$700 (+0,47 %)

$DIS (-0,97 %)

$ENEL (+6,61 %)

$AMAT (-1,1 %)

$NU (-7,06 %)

$ALV (-0,01 %)

$SREN (-0,39 %)

$BAVA (-2,22 %)

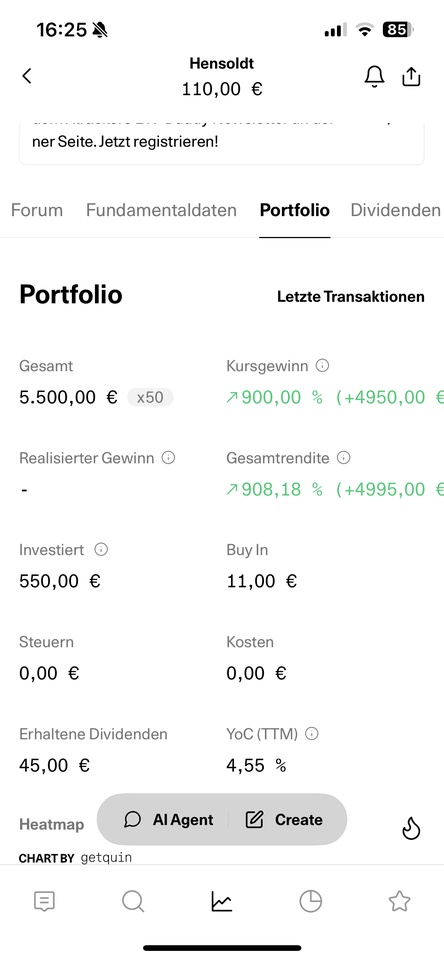

My first Tenbagger

Over the past few months, it has been a close race between $HAG (-2,92 %) and $PLTR (-3,31 %) who would be the first Tenbagger in my depot. It has $HAG (-2,92 %) become. A stock that I added to my portfolio after the IPO out of pure curiosity with a low buy-in. I found the topics of radar and sensor technology exciting, a defense manufacturer that does not fire ammunition. I didn't expect the stock to take off like this, but then came the government's entry, the war in Ukraine, etc.

There are always different views on the subject of armaments, many in the community are in $RHM (-2,33 %) or $R3NK (-2,59 %) invested. At the end of the day, these companies have a right to exist, whether someone wants to invest or not is up to them.

I wish you all continued good luck with your investments.

New purchase Austria Steyr Motors

By 2027, the company, which is listed in the Scale segment of the Frankfurt Stock Exchange, aims to increase its turnover to

140 million euros by 2027. The order backlog already stretches over

200 million euros by 2028.

The chances of further major orders are also good: if the German Armed Forces go ahead with their plans to procure around

1,000 Leopard 2 tanks, this would result in sales potential of around EUR 100 million for Steyr.

100 million euros.

High growth at an attractive valuation

As CEO Cassutti recently confirmed at a capital market conference, demand can be met in the coming years without major investments.

Among other things, he intends to use the net cash position for selective acquisitions and possibly for geographical expansion into Asia.

All in all, the Steyr story is impressive

with excellent growth prospects, high visibility, good profitability and a strong balance sheet. With a

P/E ratio of 15 and an

EV/EBIT of 11 for 2026, the valuation of the share (EUR 50; AT0000A3FW25) is significantly lower than that of sector peers

Hensoldt, $HAG (-2,92 %)

Renk and $R3NK (-2,59 %)

Rheinmetall. $RHM (-2,33 %)

Part of the discount is undoubtedly justifiable due to the smaller size of the company. The expected average EPS growth of approx.

of around 50% on average for the years 2025-2027 is slightly above the sector average.

Steyr Motors' first year on the stock market is drawing to a close.

The Austrian engine manufacturer has so far gained 250% in value amidst sometimes heavy fluctuations - driven by the NATO countries' armaments plans and a steadily growing order book.

Steyr specializes in high-performance engines with a high power density and long service life. These engines are mainly used in special vehicles for military use, in boats (military and civilian) and as auxiliary power units for battle tanks and locomotives.

Around two thirds of sales are generated with military customers, including the Dutch vehicle manufacturer Defenture and Rheinmetall.

The company's M16 diesel engine is used, for example, by several NATO special forces as well as the Spanish and Irish armed forces.

Steyr is also a supplier for the standard transport vehicle of the Australian Army and for boats of the US Navy Seals. In the civilian sector, Siemens AG is the largest customer that installs Steyr units in locomotives.

Due to increased demand as a result of the Russian attack on Ukraine, the former niche supplier is increasingly becoming a sought-after supplier to the defense industry.

In the first half of 2025, turnover increased by 17.1% year-on-year to EUR 23.1 million. For the year as a whole, CEO Julian Cassutti anticipates an increase in turnover of at least

40% (2024: EUR 41.7 million) with an expected output of at least

1,250 motor units (2024: 729 units). Thanks to the focus on premium products for special applications and a high proportion of service, profitability is pleasingly high: in 2025, the EBIT margin is expected to be over

20 % (2024: 15.5 %).

Ambitious targets, high visibility

In view of the high order backlog of over EUR 300 million as at June 30 and the sustained high demand, achieving the forecast for 2025 appears just as realistic as the medium-term targets.

RENK is a leading global supplier of highly specialized drive and control technology

In the first half of 2025, incoming orders rose by a whopping 47% to €921 million - a new record level. The total order backlog has now reached €5.9 billion. The Vehicle Mobility Solutions (VMS) segment performed particularly strongly, continuing to be the Group's growth driver with incoming orders of €681 million (+66%).

Further highlights:

- Book-to-bill ratio: 1.5x - RENK receives more orders than are currently being delivered.

- Sales growth: +22% to € 620 million, adjusted EBIT increased by 29% to € 89 million.

- Annual forecast: Executive Board confirms target of over € 1.3 billion in sales and € 210-235 million in EBIT for 2025.

- Positive outlook: The Executive Board expects further major orders in the 4th quarter.

Conclusion: RENK continues to benefit enormously from the high demand in the defense sector. The full order books ensure growth and planning security for the coming quarters as well.

$R3NK (-2,59 %) -> 25 shares were invested as the first tranche

Valores en tendencia

Principales creadores de la semana