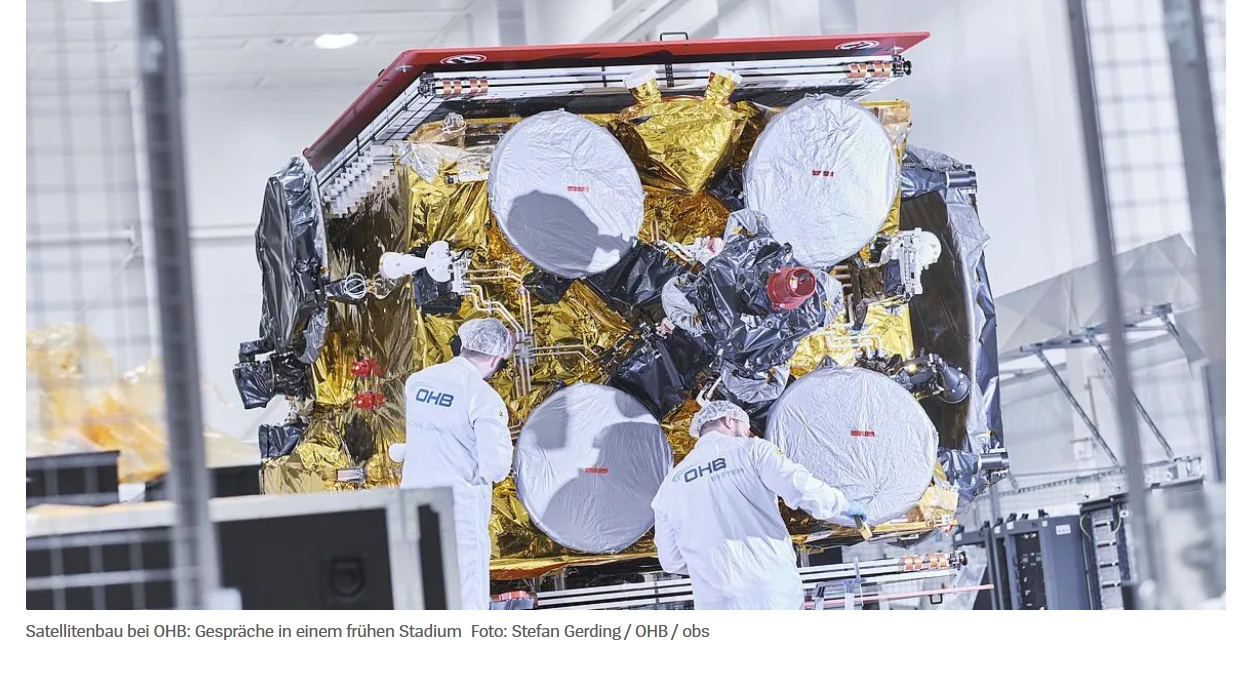

Last year, Rocket Lab $RKLB (-0,84 %) announced its intention to acquire the German company Mynaric. Mynaric produces specialty lasers for space applications, but they ran into financial difficulties, which ultimately led to the acquisition by Rocket Lab. This is a very relevant acquisition for Rocket Lab, especially with regard to its future Space Services business (commercialization of satellite constellations).

However, the acquisition has still not been approved by the Ministry of Economic Affairs (required due to dual-use). As Mynaric's technology is not only economically but also militarily relevant, the decision-makers are probably hesitant. The current relationship with the USA, where Rocket Lab has its headquarters despite its New Zealand roots, is certainly not very conducive either.

Now, however, the tide is turning, but not in Rocket Lab's favor. According to media reports, Rheinmetall $RHM (-1,05 %) is also interested in acquiring Mynaric and may already be in negotiations. Rheinmetall is apparently already emphasizing behind closed doors that a "national solution" should be preferred.

Now to my opinion: I think it is right and urgent that the takeover of Mynaric by Rocket Lab is not approved. It is the right decision to integrate this technology into Germany's largest defense company, not only to ensure our security in geopolitically heated times, but also to build a national space champion. It is the right decision for Germany, which is why I also believe that the Ministry of Economics will decide accordingly. Of course, it is possible that the takeover will still succeed with massive concessions, but only time will tell.

Since Rocket Lab is my largest and most successful position in the portfolio, it is difficult for me to speak out in favor of Rheinmetall in this matter, but I am not only a shareholder, but also a resident of this country, which is why I have made this decision. For Rocket Lab, the failure would be a very bad signal, as Mynaric has been an important part of their space services strategy. Of course, there are still many reasons for Rocket Lab and I remain optimistic about its future. We will probably find out how this story ends later this year, but I would like to see Mynaric stay in Germany.