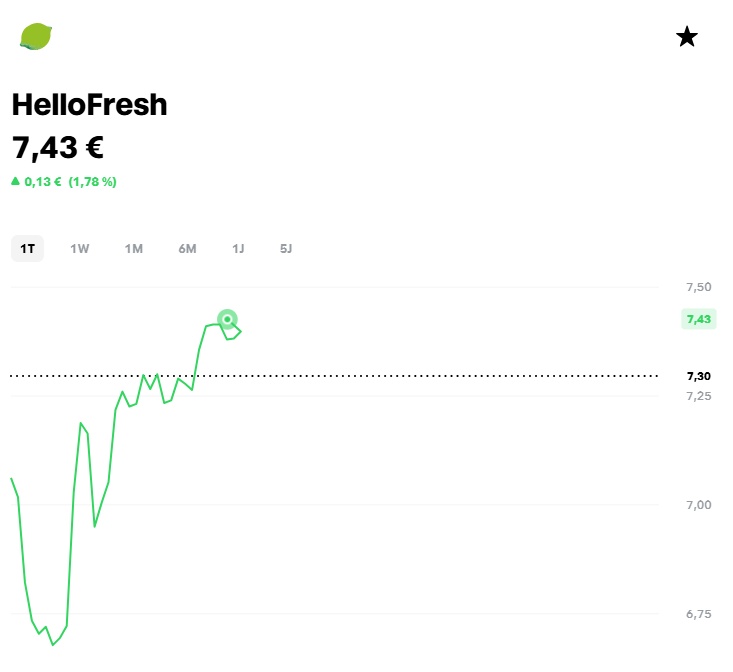

Hellofresh

Price

Debate sobre HFG

Puestos

84HelloFresh firmly rejects allegations by Grizzly Research

- HelloFresh describes the allegations made in the Grizzly Research report regarding performance, governance and future prospects as unfounded, outdated or taken out of context.

- The company is preparing a detailed statement to be published in the coming week.

- The statements about CEO Dominik Richter are false and misleading - he used the liquidity generated by pledging shares for further purchases of HelloFresh shares.

- Richter has not sold any shares in the last five years and currently holds more shares than at any time in the last ten years. There is no margin call risk.

- HelloFresh emphasizes its focus on increasing efficiency, improving margins and disciplined capital allocation as well as on transparency and shareholder interests.

💬 The company is responding clearly to the short-seller allegations and is underlining its confidence in its own future with insider purchases and operational discipline.

Under observation for the long term

$AOF (-2,29 %)

ATOSS Software SEa German company specializing in workforce workforce management software specialized in workforce management software.

$STLAM (+2,04 %)

Stellantis N.V.one of the world's largest automotive groups

as an additional option $HFG (-1,66 %) but here I evaluate further....

Quartalszahlen 11.08-15.08.2025

$SZG (-3,5 %)

$HYQ (+0,5 %)

$ABX (+1,09 %)

$BBAI (+5,19 %)

$PLUG (+3,03 %)

$GPRO (-0,37 %)

$TEG (+2,17 %)

$1SXP (+0,94 %)

$SE (-3,4 %)

$ETOR (+0,38 %)

$NCH2 (-0,52 %)

$TUI1 (-0,16 %)

$VWS (-0,21 %)

$R3NK (+0,07 %)

$EOAN (+2,34 %)

$CSCO (+0,41 %)

$SLI (+5,43 %)

$HFG (-1,66 %)

$HTG (+0,17 %)

$HLAG (+2,33 %)

$TKA (-6,03 %)

$DOU (-1,02 %)

$RWE (+1,97 %)

$BIRK (-0,85 %)

$9618 (+1,2 %)

$DE (-0,33 %)

$FR (+3,63 %)

$NU (+1,41 %)

Earnings update 29.04. 📈

Lufthansa: $LHA (-0,36 %)

- Q1 revenue: €8.13bn (expected: €8.04bn)

- Q1 adj. EBIT: € -722 million (expected: € -718 million)

- Passenger airlines weaker than expected.

- Forecast 2025 confirmed: Significantly higher adj. EBIT than 2024.

- Task force for rapid capacity adjustment in the event of weaker demand.

- North American traffic strong in Q1 (+25% US passengers in March).

HelloFresh: $HFG (-1,66 %)

- Q1 revenue: € 1.93 billion (-7%), adjusted EBITDA: € 58.1 million (+250%).

- Efficiency program bears fruit.

- 2025 forecast confirmed: Sales -3% to -8%, EBITDA € 450-500 million.

Novartis: $NOVN (+1,63 %)

- Q1 net profit: USD 3.6 bn (+33%).

- Forecast raised: Sales growth now expected in the high single-digit percentage range.

Mutares: $MUX (-0,24 %)

- Q1 revenue: €1.53bn (+13%), net result holding company: €29.5m.

- Exits planned for 2025 (>€200m gross proceeds expected).

- Partial sale of Steyr Motors generates € 74m.

Symrise: $SY1 (+3,13 %)

- Q1 organic growth: 4.2%, sales: € 1.32 bn.

- Full-year forecast confirmed: 5-7% organic growth, EBITDA margin ~21%.

DWS Group: $DWS (-0,63 %)

- Q1 revenues: €753m (+3%), net income: €199m (+13%).

- Record inflows: € 19.9 billion.

- Cooperation with Deutsche Bank in the Private Credit segment.

Deutsche Bank: $DBK (-1,15 %)

- Q1 pre-tax profit +39%, highest quarterly profit in 14 years.

- Revenue growth and cost reductions drive earnings above expectations.

Does anyone know what led to the 5% drop?

Unfortunately the AGM is hidden behind login data

edit: https://www.wallstreet-online.de/nachricht/19553792-beachtet-symrise-aktie-zeigt-schwaeche-30-06-2025

29.04.2025

Lufthansa starts the year with another high loss + Hellofresh suffers from sluggish demand for cooking boxes at the start of the year + Symrise on course for annual targets

Lufthansa $LHA (-0,36 %)starts the year with another high loss

- Despite significantly higher revenues, Lufthansa has once again started the year with figures in the deep red.

- While several strikes had had an expensive impact in the previous year, operating costs rose noticeably in the first quarter.

- In addition, Easter only fell in the second quarter this time.

- However, despite the customs dispute with the USA, the Group counted significantly more travelers from the United States in March than a year earlier, as it announced in Frankfurt on Tuesday.

- Bookings from the USA continued to increase.

- This is another reason why CEO Carsten Spohr is sticking to his goal of increasing profits in day-to-day business (adjusted EBIT) in the current year and "significantly" exceeding the previous year's figure of around 1.65 billion euros.

- In the first quarter, the Group's turnover rose by ten percent year-on-year to 8.1 billion euros.

- The operating loss adjusted for special items (adjusted EBIT) decreased by 15 percent to 722 million euros.

- In the passenger business, however, the loss widened to 934 million euros.

- At the bottom line, the Group's loss increased by more than a fifth to 885 million euros due to lower tax relief.

Hellofresh $HFG (-1,66 %)suffers from sluggish demand for cooking boxes at the start of the year

- Hellofresh suffered a decline in sales at the start of the year due to the continued sluggish business with cooking boxes.

- Revenues in the first quarter fell by around seven percent year-on-year to 1.93 billion euros, as the Berlin-based MDax company announced on Tuesday.

- In mid-March, the management had already predicted a difficult first quarter.

- While sales of cooking boxes shrank by 13.5 percent, the ready meals division grew by 10.5 percent.

- Hellofresh confirmed its forecast for the year.

- Adjusted for special effects, earnings before interest, taxes, depreciation and amortization (adjusted EBITDA) soared by around 250 percent to 58.1 million euros due to the ongoing savings program.

- Savings in personnel costs and production were particularly noticeable in the cooking box business.

- Meanwhile, the growing ready meals business is still making an operating loss.

- The bottom line for shareholders was a loss of 123.8 million euros after 83.9 million in the same quarter of the previous year.

- Hellofresh continues to expect a decline in sales of three to eight percent in the current year.

- The adjusted operating profit is expected to be between 450 and 500 million euros and thus at least reach the level of two years ago.

- Back in March, the food delivery company announced a savings program: from 2026, a total of 300 million euros are to be saved annually.

Symrise $SY1 (+3,13 %)on course for annual targets

- Despite a slower start to the year, Symrise believes it is on track to achieve its annual targets.

- Sales in the first quarter rose by just under two percent year-on-year to around 1.32 billion euros, as the manufacturer of fragrances, flavors and food additives announced on Tuesday.

- Excluding exchange rate effects as well as acquisitions and disposals of parts of the company, the increase amounted to 4.2 percent.

- Business with additives for beverages and sweets as well as fragrances for expensive perfumes provided a tailwind, while the sunscreen business was slower due to very strong figures from the previous year.

- Group sales were roughly in line with market expectations, while organic growth was slightly higher.

- The company confirmed its annual targets.

- Accordingly, organic growth should continue to reach 5% to 7% in 2025.

- Earnings before interest, taxes, depreciation and amortization (EBITDA) are expected to account for around 21% of sales, which would continue the margin recovery of the previous year.

- Symrise will comment specifically on the profit trend when it publishes its half-year figures.

Tuesday: Stock market dates, economic data, quarterly figures

Japan stock exchange holiday

- ex-dividend of individual stocks

- Henkel VZ EUR 1.85

- Banco Santander EUR 0.11

- Henkel 2.02 EUR

- Vivendi 0.04 EUR

- Akzo Nobel EUR 1.54

- Inditex 0.84 EUR

- Signify 1.56 EUR

- Quarterly figures / company dates USA / Asia

- 12:00 Spotify | UPS quarterly figures

- 12:30 General Motors | Honeywell quarterly figures

- 12:45 Pfizer quarterly figures | Astrazeneca analyst conference

- 13:00 Coca-Cola | Kraft Heinz quarterly figures

- 13:15 Paypal quarterly figures

- 15:00 Citigroup | American Express AGM

- 19:00 IBM AGM

- 20:00 Meta AGM

- 22:00 Booking Holdings | Starbucks | Edison International | First Solar | Snap quarterly figures

- 22:05 Visa | Mondelez quarterly figures

- Without time information: Paccar | Universal Music | Corning | Jetblue Airways Quarterly figures

- Quarterly figures / Company dates Europe

- 07:00 Deutsche Bank | Lufthansa | Novartis | DWS | Hellofresh | HSBC

- 07:00 Banco Bilbao | Stratec | Capgemini | Volvo Car annual results

- 07:30 Adidas | Symrise | Mutares quarterly figures

- 08:00 Porsche AG | Astrazeneca | BP | AB Foods quarterly figures | Deutsche Bank PK

- 08:30 Hellofresh analyst and press conference

- 09:00 Flatexdegiro PK on the 1Q figures | Porsche AG PK

- 09:30 DWS | Banco Bilbao Analyst Conference

- 10:00 Lufthansa | Adidas PK

- 10:30 Hochtief AGM

- 11:00 Deutsche Bank | Symrise Analyst Conference

- 11:30 Lufthansa Analyst Conference

- 14:00 Novartis | BP Analyst Conference

- 14:00 Deutsche Börse Analyst and Investor Conference 1Q

- 15:00 Adidas Analyst Conference

- 18:00 ASM International quarterly figures

- 19:00 Telekom Austria quarterly figures

- 22:00 Logitech quarterly figures

- Economic data

08:00 DE: GfK Consumer Climate Indicator May FORECAST: -26.0 points previously: -24.5 points

09:00 DE: ECB Director Cipollone, speech on "Financial and trade fragmentation: risks and policy alternatives"

09:00 ES: GDP (1st release) 1Q FORECAST: +0.6% yoy/+3.1% yoy 4th quarter: +0.8% yoy/+3.4% yoy

09:00 ES: HICP and consumer prices (preliminary) April HICP FORECAST: +2.0% yoy previously: +2.2% yoy

09:40 DE: ECB Banking Supervisor Donnery, speech on the ECB's supervisory priorities for 2025

10:00 EU: ECB, M3 money supply and lending March M3 money supply FORECAST: +4.0% yoy previous: +4.0% yoy | ECB publication of consumer survey results

11:00 EU: Economic Sentiment Index April Eurozone Economic Sentiment Forecast: 94.5 Previous: 95.2 Eurozone Industrial Confidence Forecast: -10.3 Previous: -10.6 Eurozone Consumer Confidence Forecast: -16.7 Previous: -16.7 Previous: -14.5

11:00 EU: Eurozone Business Climate Index April

16:00 US: Consumer Confidence Index April FORECAST: 87.7 previous: 92.9

Dates week 12

As every Sunday, the most important news from the past week, as well as the dates for the coming week.

Also as a video:

https://youtube.com/shorts/cpIdQFYiLeY?si=gaKXoxc1Q7c_VbNC

Sunday:

Due to industrial overcapacity, deflation is depressing prices in China. Prices there fell by an average of 0.7% compared to the same month last year. The reason for the decline was probably a high basis for comparison from the previous year, as well as government programs to boost consumption.

Monday:

$HFG (-1,66 %) Hellofresh shocks the markets with a sales warning, down more than 10%. Analysts at JP Morgan continue to see the price target at 15 euros. This is because EBITDA is expected to rise again. Hellofresh is dispensing with expensive marketing campaigns, which hurts sales but may increase profits.

Tuesday:

$VOW3 (+0,98 %) Volkswagen is struggling with a drop in sales and profits. Overall, 2.3% fewer vehicles were sold. Sales for 2024 increased minimally by one percent to 324.7 billion euros. Profit fell from 17.8 to 12.3 billion euros.

Wednesday:

$P911 (+1,47 %) Porsche earns significantly less. Similar to VW, profits are down by around 30%. The dividend is to remain stable. Turnover is also expected to stagnate in 2025.

Not only is Rheinmetall's share price rising $RHM (+1,84 %) Rheinmetall is rising, sales are also increasing significantly. Rheinmetall could grow by 34% in 2024. Growth of 25-30% is also expected for 2025. Rheinmetall achieved sales of just under 10 billion euros in 2024. The order backlog grew to 55 billion euros. The dividend is set to rise from 5.70 to 8.10 euros per share.

$TMV (-1,67 %) Teamviewer is celebrating its 20th anniversary, which means the tech company from Göppingen has been around longer than the average lifespan of a German company (around 12 years). Click here for a summary of the company's history:

US inflation data comes in lower than expected, market bounces back. Compared to the same month last year, prices rose by 2.8%. An increase of 2.9% was expected.

Thursday:

The fashion group $BOSS (+0,21 %) Hugo Boss from Metzingen wants to increase its dividend to 1.40 euros per share. At 4.31 billion euros, turnover was three percent above the previous year's figure and higher than ever before. Declining sales in China were a particular burden on the Group. Profit therefore fell by 17% to 217 million euros. In the coming year, turnover is expected to stagnate, but profitability is set to increase.

Companies such as $DTG (+1,25 %) Daimler Truck fell significantly after Donald Trump announced that he would relax the emissions regulations for trucks. Daimler in particular has invested billions of dollars in recent years to make its trucks environmentally friendly.

With the inflation rate in the USA already below expectations, producer prices are also below expectations. This is particularly interesting, as producer prices are a leading indicator for inflation in the future.

https://www.ariva.de/amp/usa-erzeugerpreise-steigen-weniger-als-erwartet-11567717

Friday:

As with $VOW3 (+0,98 %) VW, BMW's profits are also on the decline. BMW achieved a profit of 7.7 billion euros, 37% less than a year ago. Turnover fell by 8.2% to 142 billion euros. China is the main problem for BMW.

These are the most important dates for the coming week:

Wednesday: 04:00 Interest rate decision (Japan)

Wednesday: 19:00 Interest rate decision (USA)

Thursday: 12:00 Interest rate decision (BoE)

Can you think of any other dates? Write it in the comments 👇

Insights from the HelloFresh analyst conference - focus on profitability, efficiency increase and strategic realignment in 2025

Today I would like to give you a detailed insight into the conference call of HelloFresh ($HFG (-1,66 %) ), in which the results for the fourth quarter and full year 2024 were presented and the strategy and outlook for 2025 were explained.

Dominik Richter, the Group CEO, opened the conference and emphasized that Hello Fresh's goal is and remains to change the way people eat forever. For the first eight years, the company focused exclusively on Meal Kits, its largest and most profitable business segment to date. Over the last four years, however, HelloFresh has successfully built a market-leading position in Ready-to-Eat (RTE) meals and scaled its brands in this segment 20-fold, while achieving AEBITDA profitability and improved unit economics.

In addition, initial steps were taken into pet food, premium meat mail order and nutritional supplements to further diversify the addressable market potential (TAM) and revenues. HelloFresh is currently in a transition phase, which began last summer.

A central point of Richter's presentation was the strategic realignment, in which profitability is deliberately prioritized over pure growth. After two years of declining profits, the focus for 2025 is on two main goals: firstly, the successful implementation of an efficiency program, which was already launched in the second half of 2024, and secondly, a significant improvement in the customer offering for both Meal Kits and RTE, in order to ultimately achieve higher margins and a stronger cash flow. return to growth in the Meal Kits segment with higher margins and stronger cash flow.

The plan is to significantly enhance the customer experience through a wider menu choice, better value for money and improved service. The implementation of the efficiency program is crucial for short-term profitability and to generate cash flow for long-term investments. The efficiency program covers various areas of the company and is expected to lead to double-digit AEBITDA margins in the Meal Kits segment in the short term. segment in the short term. Initial successes of the program were already observed in the second half of 2024, in particular through higher ROI thresholds for marketing spend, which led to a deliberate acquisition of fewer but more profitable customers, and better support for existing customers.

The CapEx expenditure was reducedand the network is being adapted to future demand. In General & Administrative (G&A), management structures were simplified, regional teams merged and personnel savings achieved.

Richter also presented the highlights of the fourth quarter and full-year 2024 results. The revenue growth rate for 2024 was 0.9% at constant exchange rates, with strong growth in RTE offsetting the decline in Meal Kits. The contribution margin was further improved, driven by productivity increases in RTE production in North America and in North American Meal Kits. This was partially offset by the decline in the volume of Meal Kits and start-up costs for new fulfillment centers in Germany and the UK.

The AEBITDA margin for Meal Kits reached 9.8 % for the full year and even exceeded 14% in the fourth quarter5 . The AEBITDA margin for RTE was 1.6% for the year as a whole, but was impacted by high start-up costs in the first half of 2024; in the fourth quarter, it reached over 5%, a significant increase on the previous year. The free cash flow per diluted share amounted to EUR 0.425 . A share buyback program of EUR 150 million was completed and a new program of EUR 75 million was launched.

In the year 2024 114 million orders were delivereda decrease of around 4% compared to 2023, as the focus was placed on higher value customers. This focus was more pronounced in the fourth quarter and led to a decline in orders of around 7%, with North America being hit harder with a decline of 10% than the international business at 5%. The decline was exclusively due to fewer new customers as a result of the change in marketing strategy, while existing customers continued to show very robust order patterns. The positive sales growth was mainly driven by the increase in the average order value (AOV) by almost 5 %. In the USA, AOV rose more strongly than internationally due to the higher proportion of high-priced RTE meals.

For the full year 2024, sales growth amounted to 0.9 % at constant exchange rates, with sales falling by 3 % across the Group in the fourth quarter (North America -4 %, international -1 %). The trends from the fourth quarter are largely expected to continue in the first quarter of 2025, as the efficiency programme is based on reduced marketing expenditure and the prioritization of profitability over growth.

For the full year 2025, sales are expected to decline by 3 % to 8 % at constant exchange rateswith the first quarter expected to be at the lower end of this range. Meal kit sales are expected to decline by more than 10% (Q1 in the mid to high negative 10s), while RTE is expected to grow in the low to mid 10s (Q1 slightly below 10%).

In the subsequent question and answer session analysts asked questions on various topics:

Sven Sauer (Kepler Cheuvreux) asked about the RTE outlook for 2025 and why growth is expected to be so low. Dominik Richter explained that the RTE business has grown 20-fold in the last four years and that they want to learn from the experience with Meal Kits in order to achieve sustainable growth in sales and profits. sustainable growth in turnover and profit. and profits. This includes investing in the brand and customer offering without overdoing the marketing, and adapting the TAM to customer growth. Growth in the low to mid-teens is considered appropriate for 2025.

Nizla Naizer (Deutsche Bank) inquired about the the extent of the planned cost savings over the next few years. Christian Gartner referred to the Capital Markets Day in ten days' timeat which more detailed information will be provided. Naizer then asked about the assessment of current consumer sentiment in the USA . Gartner confirmed that a slowdown in consumption is being observed in the USA, which has also been factored into the forecast given.

Andrew Ross (Barclays) wanted to minimize the the decline in sales in the Meal Kits segment for 2025 in more detail. Dominik Richter explained that this was a consequence of the deliberately reduced new customer acquisition in the last six months and a further decline in marketing investments. The aim is to achieve to have a significantly improved customer offering by the back-to-school and then return to growth with a better product and higher profitability.

Marcus Diebel (JPMorgan) asked about the the different sales trends in North America and internationally in view of the reduced marketing expenditure. Christian Gartner said that the marketing spend in North America was reduced earlier and more . The international market is more heterogeneous and includes earlier phase markets such as France, where marketing spend is actually increasing with good ROIs. However, the ROI threshold for marketing is the same in both segments. When asked about Germany and the UK Gartner explained that marketing expenditure there was lower in the run-up to the crisis than in North America, which is why the decline is now less pronounced.

Christian Salis (Hauck & Aufhaeuser) inquired about the European RTE product launch in Germany. Dominik Richter expressed his satisfied with the consumer demandwhich is currently being curbed somewhat. However, there is still a lot to do, particularly in terms of menu size and the consideration of different dietary preferenceswhich are much more extensive in the USA. A major focus for 2025 will be on the own production of large parts of the foodto increase product variety.

The HelloFresh analyst conference clearly showed that the company has a clear focus on profitability and increasing efficiency for 2025. focus on profitability and increasing efficiency. efficiency. After years of strong growth, particularly in the RTE segment, the company is now consciously accepting a phase of lower sales growth in order to improve margins, reduce costs and invest in an improved customer offering.

The strategic realignment aims to generate profitable growth in the long term. The outlook for 2025 is ambitious and signals a significant increase in profitability and free cash flow.

It remains exciting to see how the strategic initiatives will play out in the coming quarters!

Valores en tendencia

Principales creadores de la semana