$MNDY (-0,84 %)

$TSN (-0,73 %)

$OXY (+0,48 %)

$WULF (-2,68 %)

$PLUG (-3,07 %)

$RKLB (-6,56 %)

$CRWV (-9,31 %)

$9984 (-2,04 %)

$IOS (+0,53 %)

$MUV2 (+0,8 %)

$SE (+0,41 %)

$NBIS (-9,32 %)

$RGTI (-4,09 %)

$$BYND (-7,46 %)

$OKLO

$IFX (-1,28 %)

$EOAN (-0,64 %)

$TME (+0 %)

$VBK (-2,02 %)

$HDD (+1,13 %)

$ONON (+3,08 %)

$JMIA (-0,25 %)

$MRX (+1,34 %)

$HTG (-0,69 %)

$DTE (+0,29 %)

$R3NK (-0,34 %)

$HLAG (+0,9 %)

$JD (+0,43 %)

$700 (-0,38 %)

$DIS (-0,28 %)

$ENEL (+1,57 %)

$AMAT (+1,53 %)

$NU (+1,09 %)

$ALV (+1,65 %)

$SREN (+1,28 %)

$BAVA (+0,4 %)

HomeToGo

Price

Debate sobre HTG

Puestos

4Quarterly figures 10.11-14.11.25

Quartalszahlen 11.08-15.08.2025

$SZG (-0,55 %)

$HYQ (-1,06 %)

$ABX (-1,19 %)

$BBAI (-6,76 %)

$PLUG (-3,07 %)

$GPRO (+0 %)

$TEG (-1,04 %)

$1SXP (+0 %)

$SE (+0,41 %)

$ETOR (+1,14 %)

$NCH2 (-0,32 %)

$TUI1 (-1,14 %)

$VWS (+0,21 %)

$R3NK (-0,34 %)

$EOAN (-0,64 %)

$CSCO (+1,04 %)

$SLI (+1,93 %)

$HFG (-1,37 %)

$HTG (-0,69 %)

$HLAG (+0,9 %)

$TKA (+5,16 %)

$DOU (+2,68 %)

$RWE (+0,8 %)

$BIRK (+0,75 %)

$9618 (+0,35 %)

$DE (+0,58 %)

$FR (+11,01 %)

$NU (+1,09 %)

HomeToGo - The German Airbnb? [Stock analysis]

1 Brief overview

2 History

3 Marketplace

4 HomeToGo_Pro

5 Business figures

6 Share price decline

7 Holding structure

8 First quarter of 2025

9 Opportunities and risks

10 Valuation

11 Conclusion

Brief overview

Market capitalization: 305 million euros

P/E RATIO/KGVE: N/M

Annualized return: -33.81 % p.a.

Analyst rating: Buy

Company history

HomeToGo $HTG (-0,69 %) was founded in Berlin in 2014 and serves as an intermediary between travelers and vacation rental companies. The then start-up started by bringing together all available vacation rentals on one platform, whereby the customer is sent to the respective external provider when booking (offsite bookings). To this end, the company cooperated with Booking.com or FeWo, for example. The business model was then slowly transformed into a marketplace that covers the entire booking process. In 2020, additional services were introduced for landlords (today: HomeToGo_Pro). Over time, the company has also made a number of acquisitions, including the purchase of Casamundo, Tripping.com and, most recently, Interhome. With 60,000 partners and over 20 million vacation rentals listed in over 30 countries, HomeToGo has a leading market position. The IPO followed in 2021 with an issue price of 10 euros.

Marketplace

At 151 million euros (+34.3 %), the marketplace accounted for around 67 % of total sales. The segment is subdivided into two further areas: Bookings directly on HomeToGo (onsite) and Advertising, which includes the offsite booking business and advertising business on the marketplace. The onsite business is definitely considered to be more important with a 60% share of revenue, which fortunately also grew by 66.8% in 2024. The slowly increasing take rate (Q4: 12.5%) is also a good sign.

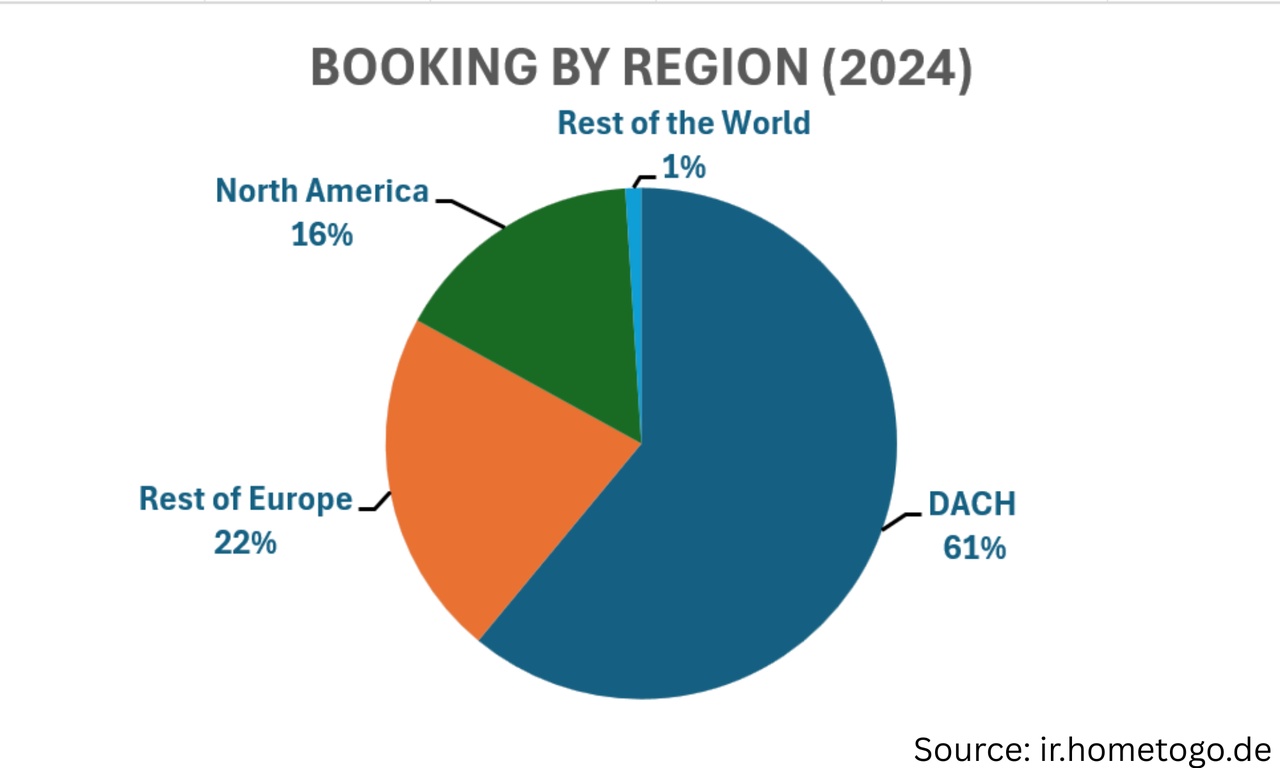

At 17.3%, the cancellation rate was significantly higher than in previous years (2022: 13.6%; 2023: 14.5%), but is still within reasonable limits. The business is currently on the cusp of profitability with an adjusted EBITDA margin of 1.9 %. A good indicator of future sales development is the gross bookings value, which increased by 20.7 %. The most important market is the German-speaking region.

HomeToGo_Pro

SaaS solutions for vacation rental companies are offered under the name HomeToGo_Pro. Those offering apartments on various marketplaces can use the software to synchronize prices and prevent double bookings. In 2024, this business grew to 70 million in revenue (+24.8%) and is comparatively highly profitable with an adjusted EBITDA margin of 14.1%.

Business figures (excluding Interhome takeover)

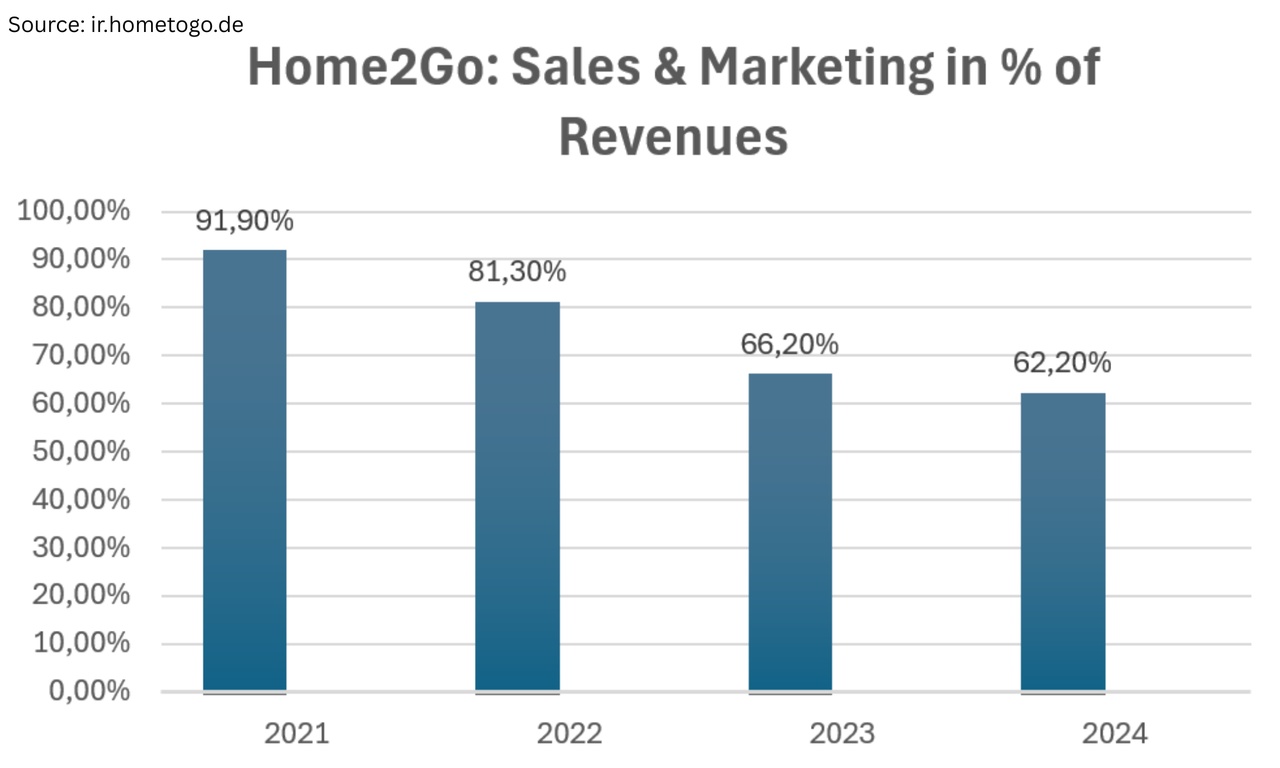

With a profit margin of -13%, the company is currently still unprofitable, but there is a clear path to profitability. In 2023, the figure was still -17% and in 2022 even -37%. The free and operating cash flow was also not yet positive last year. Marketing costs are an important factor in achieving profitability. When the company was still relatively unknown, a lot naturally had to be invested in advertising. Even today, the marketing ratio is still quite high at 60 %. At Airbnb and Booking.com, this was only 20 % / 30 % in the same period. It would be illusory to believe that HomeToGo can achieve similar figures. Airbnb and Booking.com are globally recognized brands. Nevertheless, the number of returning customers will gradually increase and turnover has risen faster than advertising expenditure in the past anyway. So there is still a lot of savings potential relative to turnover. A good double-digit profit margin of 10-20% will therefore be achievable over time. The impressive gross margin of 95 % supports this thesis.

The past sales growth figures are also impressive. In the last 4 years, the company has been able to increase turnover by 34% per year. However, part of this growth was acquired through the many takeovers. With an equity ratio of 72%, the company is nevertheless in a solid financial position.

Disclaimer

This is not investment advice. These are personal assessments that cannot replace professional advice. If you don't want to miss any further stock analyses from me, please subscribe to my free sub-subscription (link in profile). I

Interhome

HomeToGo acquired Interhome, Europe's second largest vacation rental management and brokerage company. Together with Interhome, revenue would amount to EUR 330 million in 2024 instead of EUR 212.3 million. The EBITDA margin would increase by 3% to 9%. The purchase price is 150 million Swiss francs + additional payments up to the value of 85 million Swiss francs. The whole thing will be financed by a capital increase (85 million euros), cash payments and new debt. Although the capital increase is not pretty, the increasing monopolization of HomeToGo in the classic vacation apartment business is positive from the investors' point of view. The valuation of Interhome is also fair. It pays a maximum of 11 times EBITDA and 1.8 times sales.

Share price decline

The share performance does not speak very well for HomeToGo. What is striking is that this share price slump occurred primarily in the first year on the stock exchange (-70 %). This cannot be explained by the quarterly figures. HomeToGo increased and often exceeded its own forecasts and kept the relevant short-term promises of the IPO prospectus. However, I think the decisive factor was the poor stock market climate at the end of 2021 and the high valuation with a P/E ratio of 6. A certain loss of confidence may also have played a role. More on this later.

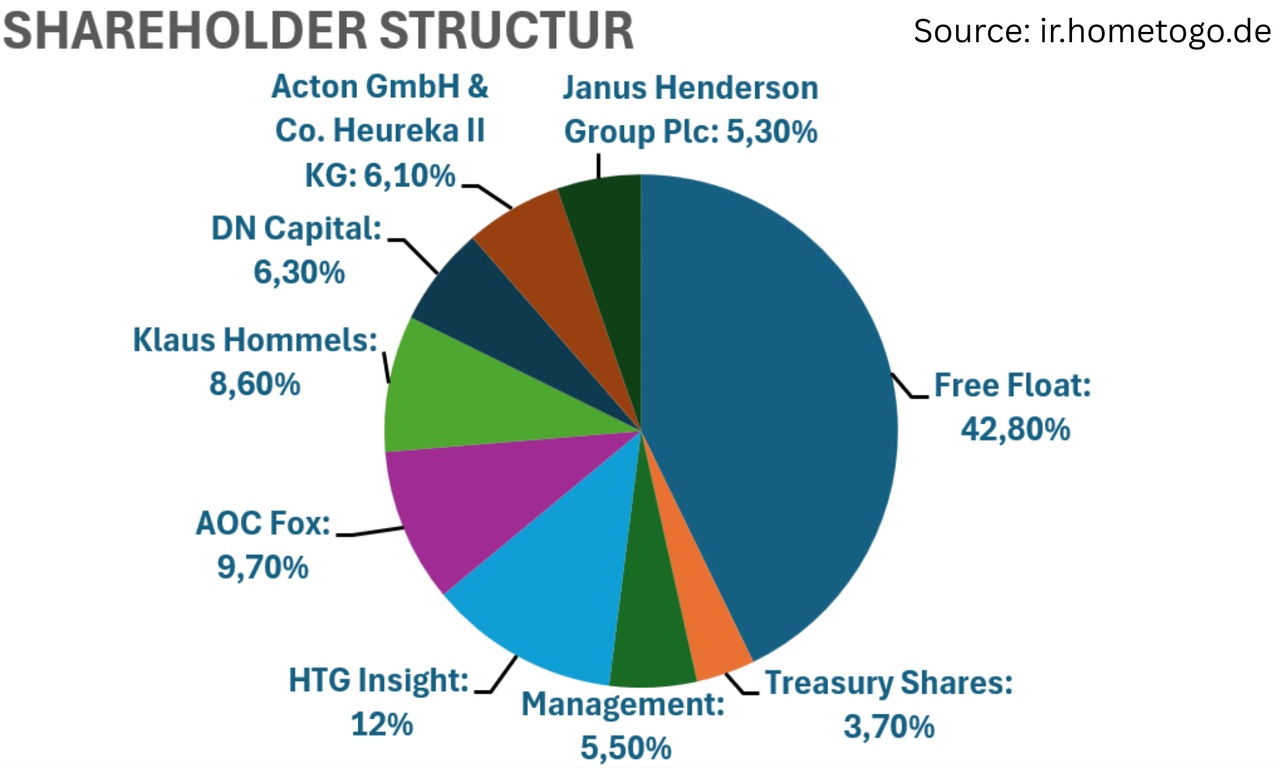

Holding structure

30 % of HomeToGo is held by private investors who have invested in the company over time. Fortunately, the management still holds 5.5% of all shares. The Luxembourg holding company HTG Insight is a mystery to me. I have not been able to find out who exactly is behind it. Due to the high shareholdings of investment companies (42.8%), the proportion of freely tradable shares is low. This is more common with subsidiaries that are floated on the stock exchange.

first quarter 2025

In summary, the first quarter was disappointing. Booking revenue rose by just 5.7% to 88.1 million in the first quarter. Revenue fell by 5.4% to 34.4 million euros. The slump at HomeToGo_Pro is striking at -16.6%. In the same quarter a year ago, turnover in this segment was still up by 35.3%. The reason given for the weak first three months of the year was the federal elections held in Germany in February, which caused uncertainty among consumers. It is good to see that the take rate increased further to 13.1% and that the outlook remains unchanged. This was mainly due to May so far, in which booking turnover increased by 15 %. For 2025, a positive free cash flow and turnover of 300 million euros (+40%) are expected for the first time.

Opportunities and risks

With the help of the many takeovers, the company will expand its market power in the future. This will help to further increase the take rate. The high gross margin already mentioned also shows that there is still plenty of potential to increase margins. In general, the sector will also provide a tailwind. According to a study, the vacation apartment market is set to grow by 11.4 % annually between 2025 and 2023. One negative aspect is the share's high illiquidity, which can be explained by the opaque holding structure and the low free float. An investment in the share is therefore not attractive or permitted for institutional investors. The concealment of who is behind HTG Insight is also strange. Furthermore, one cannot place too much trust in the management. In my opinion, dubious promises for the longer-term future have been made time and again, only to disappear again meekly. For example, an EBITDA margin of over 35% was targeted for 2028/2029. At the same time, booking revenue was expected to amount to 1 billion euros, but this would now have to increase by 31/37% per year. I think that is far too ambitious.

Conclusion

HomeToGo seems to be a very exciting company. My hope is that the share price will be driven by the projected profitability. A takeover by a larger travel company also seems possible.

Sources

[4] https://ir.hometogo.de/investors/financial-publications?url_redirect=true

+ 2

Valores en tendencia

Principales creadores de la semana