$UCG (+1,16 %)

$MNDY (-0,84 %)

$KER (+1,36 %)

$BARC (+1,39 %)

$OSCR (-3,64 %)

$CVS (-0,72 %)

$SPOT (+1,17 %)

$DDOG (-4,15 %)

$BP. (-1,45 %)

$SPGI (-0,01 %)

$HAS (+0,27 %)

$KO (+0,78 %)

$JMIA (-0,25 %)

$MAR (-0,64 %)

$RACE (-0,43 %)

$UPST (-4,3 %)

$NET (-7,53 %)

$LYFT (+0,25 %)

$981 (+0 %)

$NCH2 (-0,32 %)

$DSY (-0,14 %)

$1SXP (+0 %)

$HEIA (+0,43 %)

$ENR (+0,35 %)

$DOU (+2,68 %)

$OTLY (-3,81 %)

$TMUS (+0,47 %)

$SHOP (+2,19 %)

$KHC (+1,13 %)

$FSLY (+0,79 %)

$HUBS (-2,72 %)

$CSCO (+1,04 %)

$APP (-5,89 %)

$SIE (+1,82 %)

$RMS (+4,02 %)

$BATS (+2,33 %)

$MBG (+1,16 %)

$TKA (+5,16 %)

$VBK (-2,02 %)

$DB1 (+1,23 %)

$NBIS (-9,32 %)

$ALB (-0,08 %)

$BIRK (+0,75 %)

$ADYEN (+0,81 %)

$ANET (-3,29 %)

$PINS (+5,61 %)

$AMAT (+1,53 %)

$ABNB (+1,55 %)

$TWLO (+1,26 %)

$RIVN (-1,6 %)

$COIN (+3,15 %)

$TOM (+0 %)

$OR (+1,71 %)

$MRNA (+0,22 %)

$CCO (+2,34 %)

$DKNG (-0,68 %)

Verbio

Price

Debate sobre VBK

Puestos

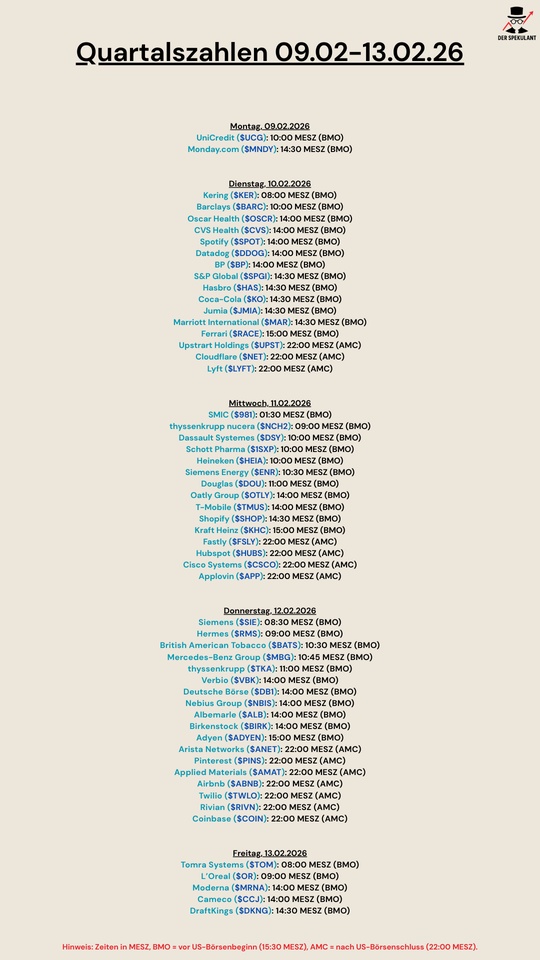

49Quarterly figures 09.02-13.02.26

GHG quota

$VBK (-2,02 %) Turnaround GHG quota price means turnaround at Verbio. Profitable times ahead.🤓

Cabinet decision on the further development of the GHG quota is imminent.

Quarterly figures 10.11-14.11.25

$MNDY (-0,84 %)

$TSN (-0,73 %)

$OXY (+0,48 %)

$WULF (-2,68 %)

$PLUG (-3,07 %)

$RKLB (-6,56 %)

$CRWV (-9,31 %)

$9984 (-2,04 %)

$IOS (+0,53 %)

$MUV2 (+0,8 %)

$SE (+0,41 %)

$NBIS (-9,32 %)

$RGTI (-4,09 %)

$$BYND (-7,46 %)

$OKLO

$IFX (-1,28 %)

$EOAN (-0,64 %)

$TME (+0 %)

$VBK (-2,02 %)

$HDD (+1,13 %)

$ONON (+3,08 %)

$JMIA (-0,25 %)

$MRX (+1,34 %)

$HTG (-0,69 %)

$DTE (+0,29 %)

$R3NK (-0,34 %)

$HLAG (+0,9 %)

$JD (+0,43 %)

$700 (-0,38 %)

$DIS (-0,28 %)

$ENEL (+1,57 %)

$AMAT (+1,53 %)

$NU (+1,09 %)

$ALV (+1,65 %)

$SREN (+1,28 %)

$BAVA (+0,4 %)

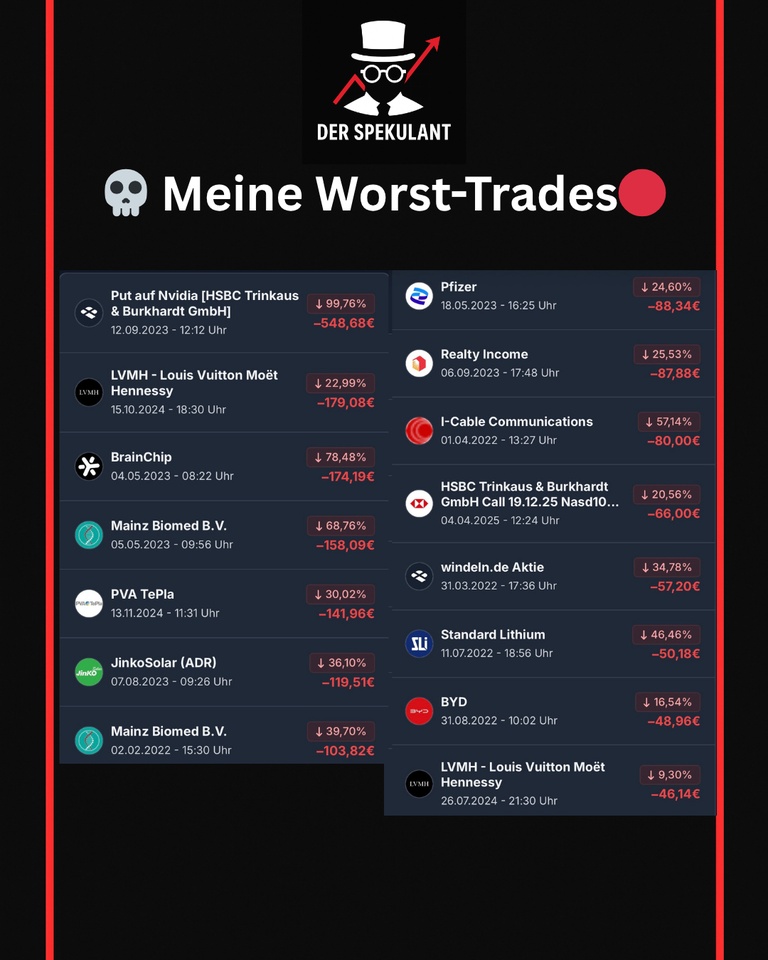

💥 15 top trades vs. 15 flop trades - full transparency!

Today I'm going to show you my best and worst trades since the start of my investment journey. No show, no excuses - just real numbers and learnings.

🟢 My top 15 trades

📈 From Rheinmetall to Palantir to Ferrari - some positions really took off.

Biggest single gain: +131 % for Rheinmetall💪

→ The majority came from strategically placed opportunities, not luck.

🔴 My flop 15 trades

📉 Nvidia put, Mainz Biomed, BrainChip... The biggest flop?

-99.76 % with a warrant on Nvidia 😬

→ The lesson: highly speculative bets quickly go against you - especially without a plan.

📘 My most important learning

I learned this lesson in my first year of investing:

Short-term trading may work from time to time - but not in the long term.

Today I have a clear strategy:

✅ Core-satellite

✅ Focus on quality

✅ Discipline & long-termism

🧠 Why am I sharing this?

Transparency is not a buzzword for me - it's a duty.

Losses are part of it. If you only talk about your profits, you're only telling half the truth.

#Trading

#Fehler

#Investieren

#Transparenz

#Learnings

#DepotEinblick

#DerSpekulant

#Getquin

$RHM (-0,17 %)

$NVDA (+1 %)

$MC (+4,98 %)

$MYNZ

$BRN (+1,7 %)

$COIN (+3,15 %)

$RACE (-0,43 %)

$TSLA (-0,19 %)

$WDL1 (+0,13 %)

$PLTR (+0,16 %)

$PTON (-0,81 %)

$9866 (+3,08 %)

$MULN

$MRNA (+0,22 %)

$VBK (-2,02 %)

$JKS (+1,46 %)

$TPE (-1,47 %)

$PFIZER

$SLI (+1,93 %)

So hopefully you're now keeping your hands off, wait, what does the basic information for securities say about "derivative financial instruments"?😅🤷🏼♂️

Verbio assessment

Palim Palim dear swarm intelligence,

Can someone tell me more about $VBK (-2,02 %) tell me more? I find the title quite interesting, just can't tell whether it's a media flash in the pan or a possible 🚀?

Have a nice weekend everyone!

Verbio

$VBK (-2,02 %) What is your opinion on the share?

I have now started to invest in it and would like your opinion on Verbio.

It still looked good here

https://getqu.in/BO1mJo/ https://getqu.in/BO1mJo/

Valores en tendencia

Principales creadores de la semana