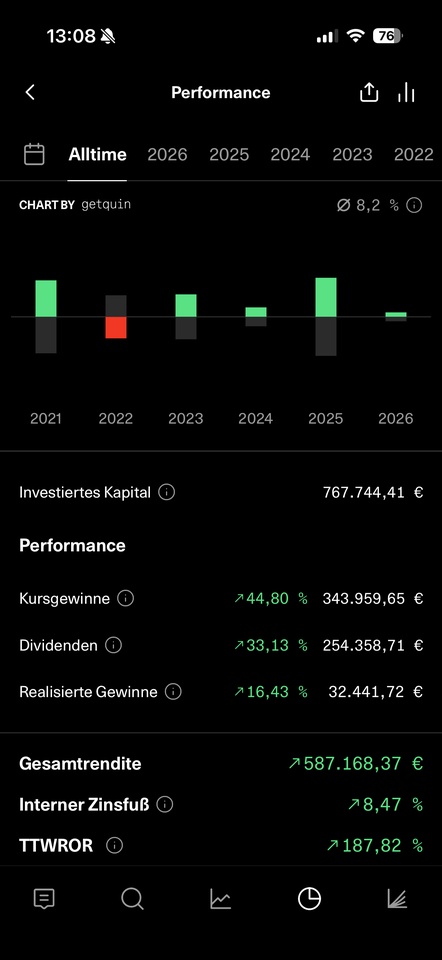

I hardly realize any profits and reinvest the dividends.

Time beats timing... always.

Stay horny and keep it hard you louts. $

Puestos

117I hardly realize any profits and reinvest the dividends.

Time beats timing... always.

Stay horny and keep it hard you louts. $

Good morning everyone! I’m really happy to have found what I consider a great entry point into Vinci. With a bit of luck, it moved up right after my purchase. Moments like this reinforce my strategy of building a portfolio with what I believe are excellent companies with strong fundamentals. Looking forward to holding this one for the long term and seeing how it develops!$Vinci

$MICC (+4,48 %) I bought Magnum a couple of days ago and now its 4% up$

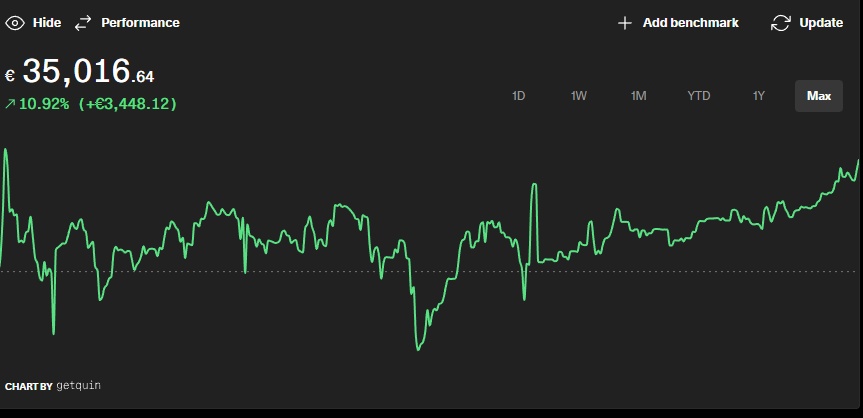

Impressed by my performance in these turbulent times.

Which dividend stock do you think is a bargain right now? Long term.

$TDIV (-0,63 %)

$PG

$O (-1,2 %)

$ASRNL (-0,6 %)

$JNJ (-1,21 %)

$JEGP$AD (+1,69 %)

$VPK (+0,99 %)

$NOVO B (+4,77 %)

$ULVR (+0,02 %)

$WINC (+0,85 %)

$VHYL (+0,8 %)

With monthly payers, everyone screams Realty Income $O (-1,2 %) - and forgets $Riocan Canadian concrete, real rents, monthly cash flow. Not a hype stock, not a TikTok favorite, but a stoic dividend donkey. While others tremble, RioCan trudges on, throwing off cash every month. I love my shares: savings plan running, nerves calm, calendar smiling. If you only listen to volume, you miss substance. If you have patience, you cash in. Month after month. Quiet. Hard. 🇨🇦💰

A fatigue signal is also to be had less monthly payers from the US.

Hello everyone

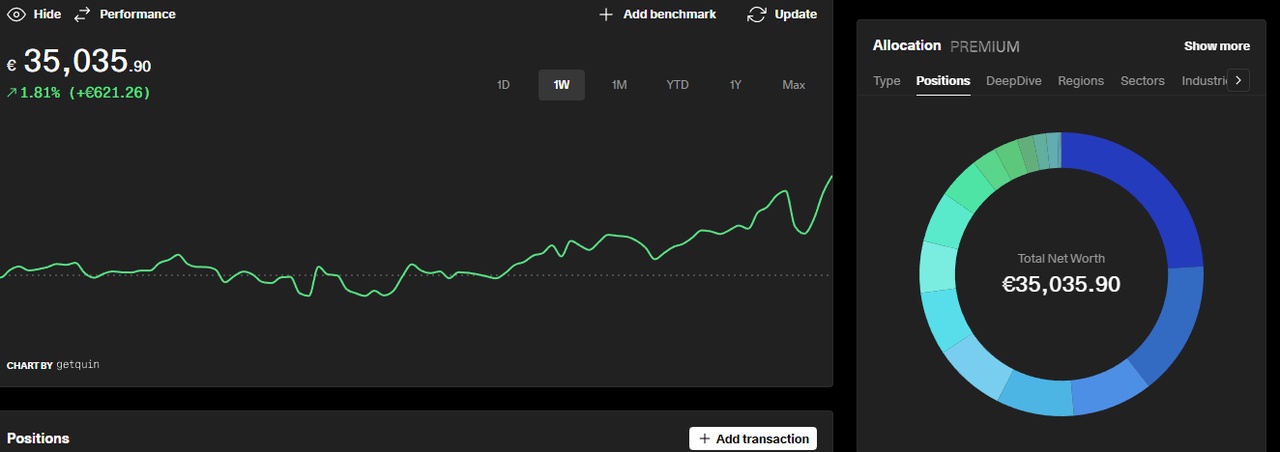

I thought it was time for an introduction to me and my current portfolio.

Briefly about me, I'm Chris, 27 years old, work in IT and moved to Switzerland a good 7 months ago. I'm definitely very happy with my decision, even though it wasn't easy.

Apart from that, I love good food and am absolutely fascinated by cars and motor racing. I'm neglecting traveling a bit at the moment, but I also really enjoy it.

My dad laid the foundation stone of my depot when I was born. I saw it for the first time after my 18th birthday and was pretty excited. Unfortunately, I wasn't excited enough to continue with it. I then became more interested at the end of 2024, beginning of 2025 and so it was that I made my first transaction in April and $NVDA (+1,53 %) bought shares.

My approach is to build a highly focused portfolio of high-quality individual stocks. Around 10% of my portfolio is currently in $BTC (-0,35 %) , $ETH (-0,36 %) & $Sol are currently invested.

There are basically two reasons why I decided against a core-satellite structure.

A fee of CHF 50 + stamp duty has to be paid for each transaction and therefore a savings plan does not make sense in my opinion. My basic idea was to save in 3 different ETFs each month.

Furthermore, I find $BRK.B (+1,16 %) as a core position more attractive than an ETF, as they benefit from their capital strength especially in times of crisis and can make strategic acquisitions.

My next sales are as follows:

Once the sales are completed, my cash position will be around 20%. I currently have the following shares on my list that are eligible for purchase:

$RKLB (+3,35 %) I actually wanted to buy this stock in December, but couldn't because it is not traded at my bank.

It is quite possible that the portfolio performance is not quite right because I have linked the positions manually, as getquin does not offer a link to my bank.

Thanks also to those who post so many interesting articles on strategies and reviews of stocks here, such as @Tenbagger2024, @Multibagger, @Epi, @BamBamInvest & many many others! Thank you, thank you, thank you!

To anticipate the obvious question of why I don't transfer my custody account to another provider due to high fees and limited share availability:

Please let me know what you think of my custody account. 😃

Have a nice Sunday evening!

Best regards

Chris

$RKLB (+3,35 %) has doubled since my post, and although I expect a short-term setback, this is by no means the end of the line in the long term!

IPO of SpaceX

The IPO of SpaceX will push Rocket Lab even further. Just for comparison, the valuation of SpaceX is to be carried out at a KUV of around 100!

It will also draw more attention to the space industry, which is also $RKLB (+3,35 %) and $ASTS (+12,89 %) z B will give a boost...

Future growth

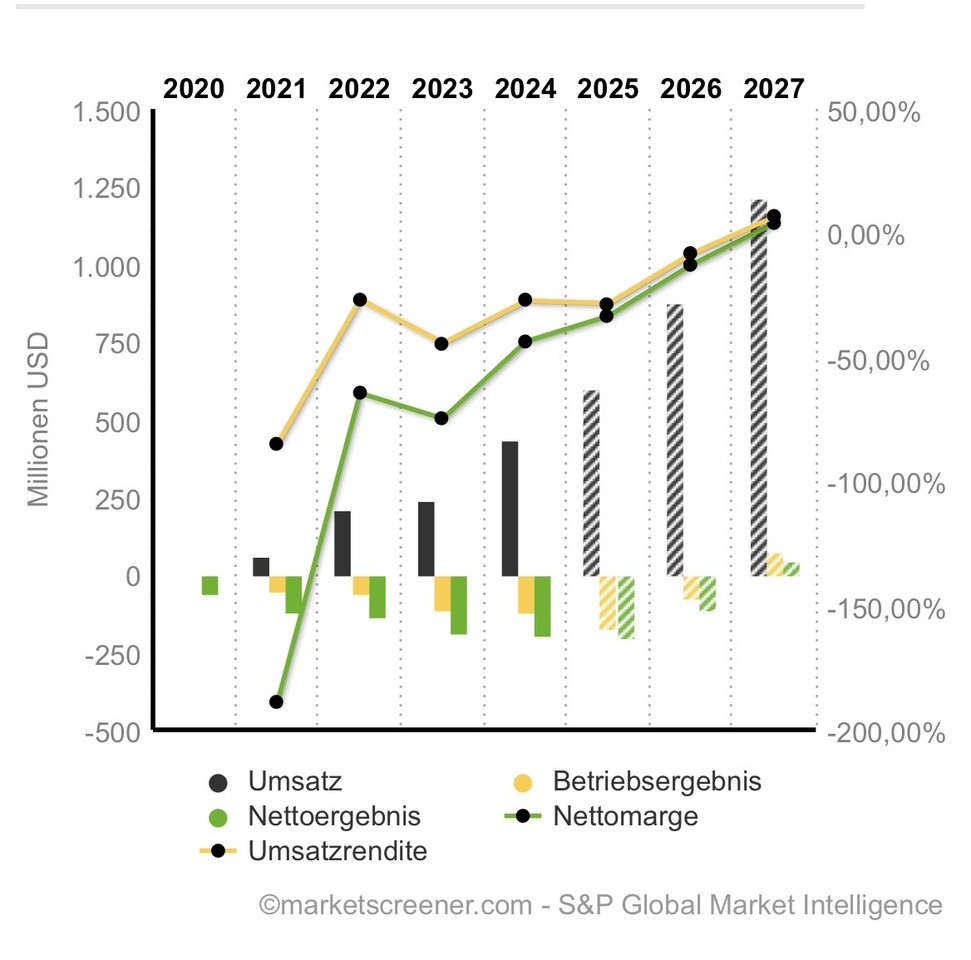

Just take a look for yourself:

Revenue is expected to exceed the billion mark by 2027 and Rocket Lab is expected to be profitable in the same year!

Rocket Lab is growing rapidly and for the next 10 years I would not dare to name a similar company that can show similar growth as $RKLB (+3,35 %) (except maybe $PNG (-2,63 %) )...

LG Small investors 👋😊

@Shiya

@Semos25

@Hotte1909 - I think these are the biggest Rocket Lab bulls here, or have I forgotten someone?

Rocket Lab

Hello everyone,

As part of my "portfolio concentration strategy", I've done a proper clear-out and taken a closer look at the companies I've kept. So $RKLB (+3,35 %)

$IREN (+11,14 %)

$SOFI (+0,75 %)

$PNG (-2,63 %)

$HIMS (+4,19 %) .

The analysis actually took me quite some time, but I hope that I have developed the necessary conviction to buy in a crash (-50% and more) instead of panicking. If any of you also find the company exciting, perhaps my analysis will also help you. If it's too long for you, just let me know. And if you're not interested at all, then please let me know, because then I don't have to go to the trouble of formulating it all again. Feel free to repost this post so that it doesn't get lost sooo quickly...

As I said, the first company I looked at in detail was Rocket Lab $RKLB (+3,35 %) .

I have subdivided the analysis into the following sub-areas:

1. foundation and history (short)

2. success story of Electron

3. neutron, a new dimension

In the second part:

4.the importance of service and the true core of Rocket Lab

5. quarterly figures Q3 25

6.my personal opinion + risks

1.foundation and history

Rocket Lab was founded in New Zealand in 2006. Company founder Peter Beck wanted to launch small satellites into space at low cost. Previously, satellites and small payloads always had to be carried as "co-flyers" on large rockets. This meant that they always had to "fly along", so to speak. What was missing was the flexibility of having a small rocket itself to get into space cheaply AND flexibly. Over time, Rocket Lab moved its headquarters to the United States because that's where most of their customers, as well as NASA, are located. However, as far as I understand it, they still have some of their development and launch sites in New Zealand.

But let's start from the beginning...

In the early years, the company worked on suborbital rockets and engines, but had the ambitious goal of developing an orbital-capable rocket over time. In 2009, the first rocket was tested, Ätea-1, which only flew to an altitude of around 100 km and was relatively small (payload of a few kilograms). The payload was very low and the planned successor Ätea-2 was not realized, but the focus was on the next size of rocket. Rocket Lab subsequently began to build the Launch Complex 1 rocket launch site in New Zealand. Electron, a rocket that was still under development, was to be launched from there. This was already something historic, as it was the world's first private rocket launch site for orbital rockets. And now Electron comes into play.

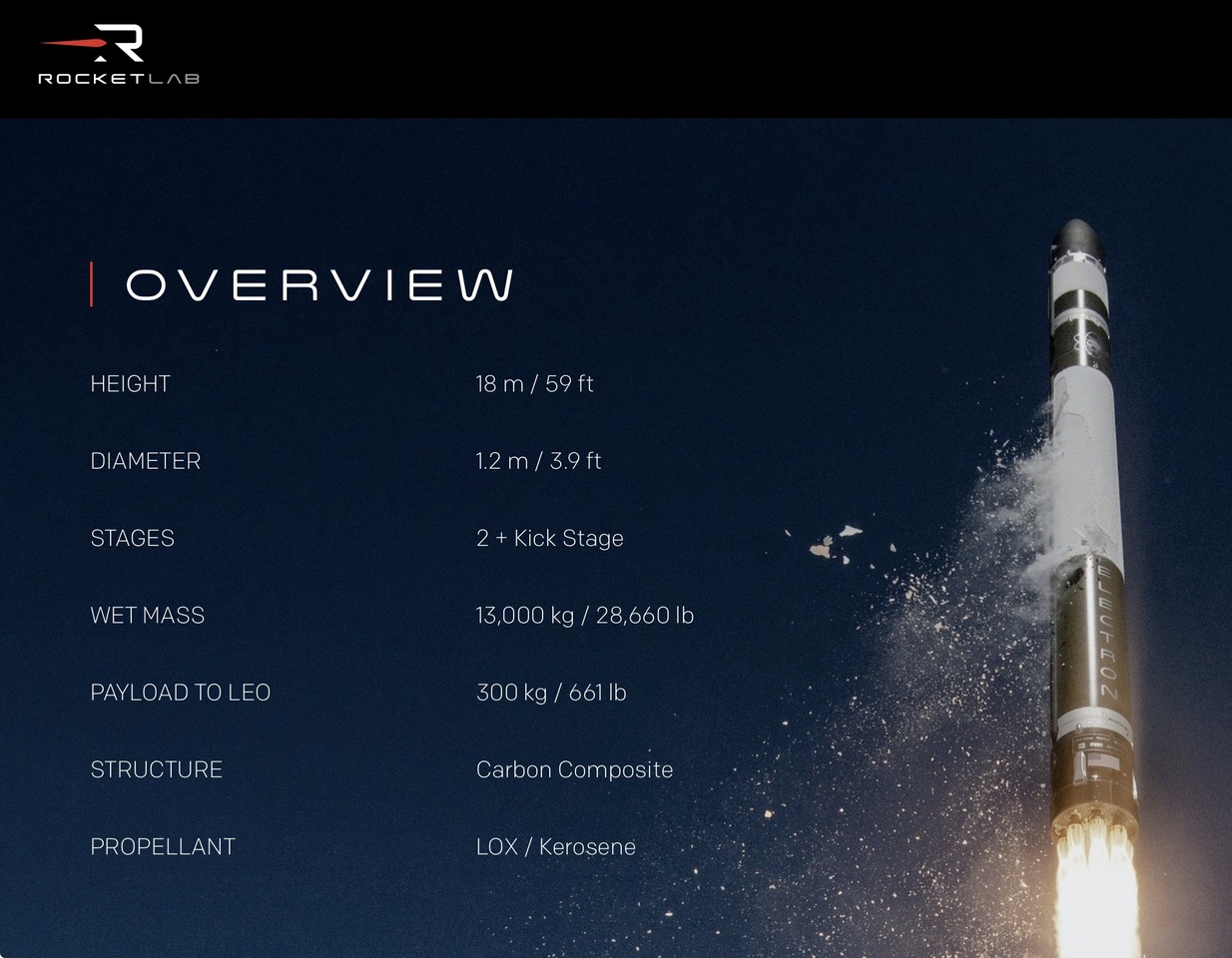

2nd Electron

Peter Beck recognized early on that there was a gap in the space sector. Large rockets such as Ariane-5 or Falcon-9 were expensive, but there was really no way to launch small satellites and payloads into orbit. Universities, research institutions and private space companies were looking for a cheap solution for small satellites without having to wait a long time for a ride.

The idea behind Electron

These goals were new and until then there was no company that wanted to achieve something like this.

Here is a brief overview of what Rocket Lab did to achieve these goals.

-3D printed engines (cheaper, faster production)

-Carbon instead of aluminum or steel (lighter)

-Electrically powered propellant pumps (simpler, cheaper)

As the technical details are not so important to me as an investor, I have not delved into the smallest detail.

After 11 years of development, the first tests followed:

May 2017: first Electron test flight - reaching space, important milestone.

January 2018: second test flight - successful launch into orbit, paving the way for commercialization.

November 2018: first commercial launch - start of regular missions for customers.

And Electron is a real success!

Here is the number of launches per year since 2018:

2018 - 3 launches

2019 - 6 launches

2020 - 7 launches

2021 - 6 starts (Corona)

2022 - 9 starts

2023 - 10 starts

2024 - 16 starts

2025 - 18 launches until November

With the exception of the coronavirus year 2021, more Electron launches were carried out in each year than in the previous year.

To date, almost 70 Electron rocket launches have been carried out, making Electron THE most important rocket in its segment. Although the cost per kilogram of payload is relatively high, customers are obviously willing to pay this price for the flexibility.

Just to compare the costs:

A rocket launch with the Electron costs around USD 7.5 million, while SpaceX's Falcon 9 costs around USD 65 million per launch.

Of course, it has to be said that the comparison doesn't quite fit, because the Falcon 9 rocket has a MUCH higher payload than the Electron. But it is still interesting for small research institutes or small companies that may not have 60/70 million dollars for a rocket. In addition, the launch is also correspondingly more flexible because you can carry out more launches per year and at shorter notice.

Market share with Electron

I couldn't find a direct market share online, but theoretically it should be possible to calculate this:

According to Wikipedia, 259 orbital rocket launches were carried out in 2024 and thus Rocket Lab had a global market share of approx. 6.18% of orbital rocket launches with 16 launches of Electron.

In 2025 (as of 26.11), 281 launches were carried out, giving Rocket Lab a global market share of approx. 6.41% (+0.22% YoY). So you can see that

the global rocket launch market continues to grow year over year and

Rocket Lab is not only defending its market share but is even gaining market share.

At first glance, these figures do not seem bad, but if you put them in relation to the dominant company SpaceX, you can understand why Rocket Lab is not satisfied with Electron.

SpaceX carried out a total of 134 orbital rocket launches in 2024, giving it a market share of over 50%. Over 90% of the rocket launches came from the Falcon 9 rocket, which I mentioned earlier. This is in a completely different segment to Rocket Lab's Electron. This is precisely why Rocket Lab decided a few years ago to develop a completely new rocket:

3rd Neutron

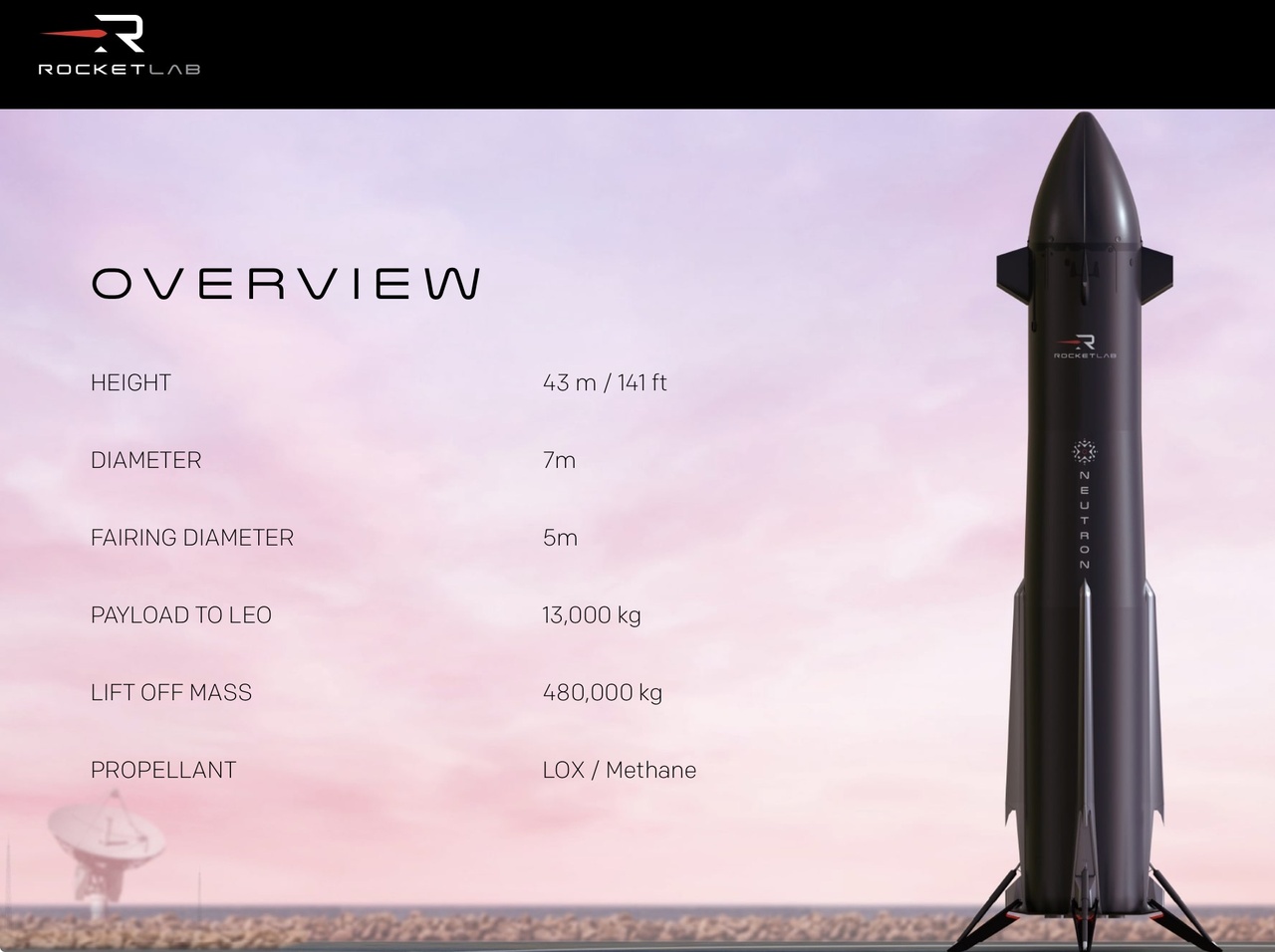

Neutron catapults Rocket Lab into a completely new league. With a payload of 13,000 kg and a length of approx. 43 m, Neutron is an attack on the most successful rocket at present, namely Falcon-9.

As with Electron, Rocket Lab is again relying on 3D printing to make the parts light and flexible. One part of the rocket, the first stage, is to be reusable in order to reduce costs for Rocket Lab.

Originally, the launch of Neutron was supposed to take place this year, but has been postponed to mid-2026. On the one hand, I see this as a risk if the launch is delayed even further. On the other hand, a failed launch this year would not really be any better than a successful launch next year. The company emphasizes that it wants to avoid a false start and therefore wants to improve a few things before attempting a launch.

If Neutron then successfully launches, it will be really exciting!

Even if the price per kg payload of $3,800 - $4,000 is still higher than that of the Falcon-9 at $2,900 - $3,100, there would probably be enough customers who would use Neutron.

Now it's getting a bit hypothetical:

Financially, Neutron would pretty much increase Rocket Lab's revenue significantly. The target per launch is around $50 million (Rocket Lab revenue 2024 -> $436.2 million). If you now imagine that Rocket Lab can also continuously increase the launch frequency with Neutron and that we will have around 15 launches with Neutron in 2030 (I think this is quite realistic and conservative) and Electron is also successfully rolled out further (around 40 launches in 2030 would be quite possible), I have made the following simple calculation:

15 (Neutron) x 50 million $

+

40 (Electron) x 7.5 million $

=

1,050 million (1.05 billion)$ turnover with rocket launches only

Rocket launches currently account for around 26.3% of sales.

So in my optimistic-realistic scenario, one can expect total sales of around $4 billion.

I think it is rather unlikely that Rocket Lab's valuation is still at $20bn, but more on that later.

In my opinion, that alone would justify the valuation, but the company would not be a bargain at the moment. After all, Neutron hasn't even launched yet and 18 launches this year times $7.5 million would result in sales (not profits) of less than $150 million.

But this is where something comes into play that I didn't even consider when investing - the other 73.7% of sales...

This part of the analysis (Services division, Q3 25 figures and my personal

assessment) will come tomorrow evening, if I can manage it... (it's already online : https://getqu.in/TQJcW6/ )

Please give me feedback, because this is my first analysis and be honest. Please also give me criticism on what I can improve. I think this is my first "serious" post on getquin 😅.

LG Small investor ✌️

PS @Shiya You already did a much deeper and nicer analysis some time ago!!! But I thought I'd take another look at the company personally!

Sources:

https://www.finanzen.net/bilanz_guv/rocket_lab#:~:text=Rocket%20Lab%3A%20GuV%20%28in%20Mio,USD

@Multibagger

@Tenbagger2024

@Aktienfox

@BamBamInvest

@HoldTheMike

@Semos25

@Hotte1909

@Iwamoto

@TomTurboInvest

@Wiktor_06

@TradingHase

First purchase of the year! Enter the wallet $WKL

Principales creadores de la semana