Update my savings plans - What is being removed? What will be added?

After my share savings plans have remained virtually unchanged for the last 1.5 years, it's time for an update in March. At the same time, I will try to use the new inline images function. @christian Thank you!

Which shares will be removed?

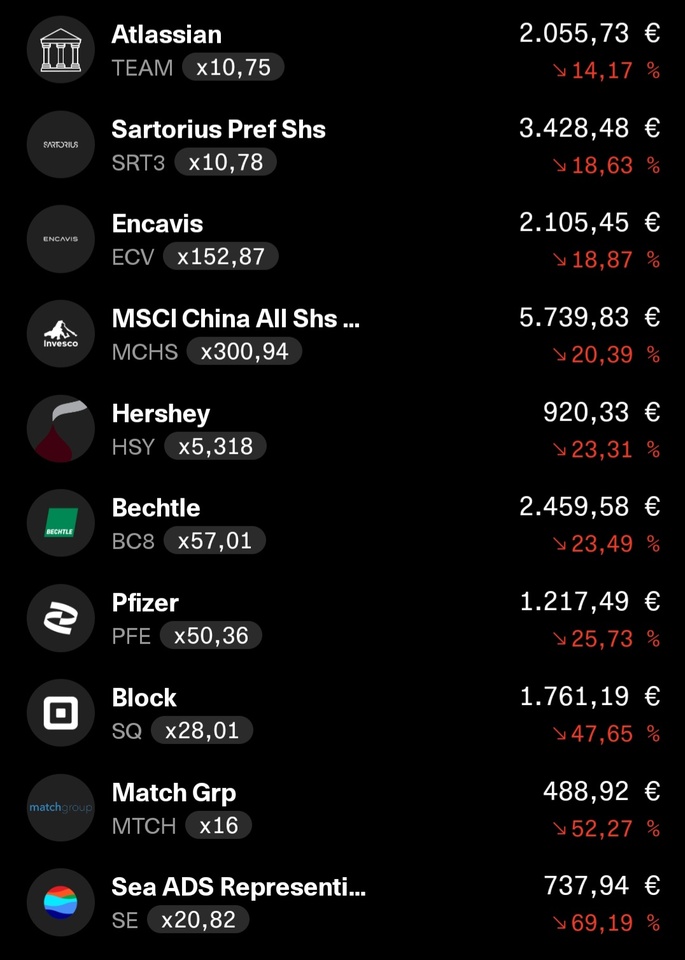

I am throwing a total of 3 shares out of my savings plans. These shares will not thrown out of the portfolio, they will just no longer be saved in.

- NVIDIA

$NVDA (+0,77 %) is the largest position in my portfolio and I still have a strong conviction in the share and the company. Nevertheless, for the time being I don't want to increase the position through acquisitions - Palo Alto Networks $PANW (-1,7 %) for similar reasons as NVIDIA. Here, too, the position has become very large as a result of the very strong share price performance (temporarily number 2, currently number 4). Cybersecurity remains a major topic, but the current position size is sufficient for me. In addition, with Crowdstrike $CRWD (+0,08 %) another share from the sector

- Sartorius $SRT3 (+2,37 %) will also remain in the portfolio. Here it's actually more of a gut feeling that I see better opportunities elsewhere

What else will be adjusted:

I will adjust the weighting a little and save a slightly higher amount in pharma stocks to increase the pharma share a little. Tech remains number 1 with just under 37% of the savings contributions. This is followed by pharma with 16%

Which shares will be added to the savings plan?

A total of 3 shares will be added to the savings plan from March onwards, which will also be completely new to the portfolio. These 3 shares come twice from the tech sector and once from the non-basic consumer sector. Geographically, they are spread across France, Canada and the USA.

Share 1: Hermés

Let's start in Europe and France with Hermés $RMS (-0,85 %)

Hermés is not nearly as big as LVMH. While LVMH generates sales of over 80 billion, Hermés is "only" just over 10 billion. This puts LVMH in first place among the largest luxury groups in terms of revenue, while Hermés is only in eighth place behind companies such as Dior, Richemont and Kering.

In terms of market capitalization it looks quite different. Of course, LVMH is also in first place here with currently over 420 billion, while Hermés is already in second place with ~240 billion.

While I have been holding LVMH for a long time, I would like to expand the luxury segment in my portfolio with Hermés.

So what speaks for Hermés?

- An extremely strong gross margin of over 70% and a net margin of over 40%. You can apparently take any money out of the (Hermés) pocket of the top 0.1% ;)

- Although it is non-basic consumption is a less cyclical business model. Because Hermés only targets an extremely small and extremely wealthy circle, economic fluctuations are virtually irrelevant for Hermés. Similar to a Ferrari, for example, and unlike classic non-basic consumer goods

- A share price that feels like it has only been pointing upwards for years

-> Yes, for these reasons, Hermés is not cheap with a P/E ratio of over 40, which is precisely why I want to build up the position with a savings plan

Share 2: Broadcom

Let's continue with another AI share, namely Broadcom

$AVGO (-1,56 %)

Broadcom is another share from the semiconductor sector. With a current P/E of ~40, the company is also not cheap. However, the forward P/E ratio is only ~25.

In addition, the company has strong sales, earnings and, above all, dividend growth. So it is exactly what I am looking for.

An interesting fact: According to Broadcom, 99% of all Internet traffic passes through at least one Broadcom chip. In my eyes, this makes it a classic share, without which our modern life and work would no longer function.

Another fact: Broadcom bought Symantec a few years ago, so there is also a bit of cybersecurity fantasy here. In addition to the well-known AI hype

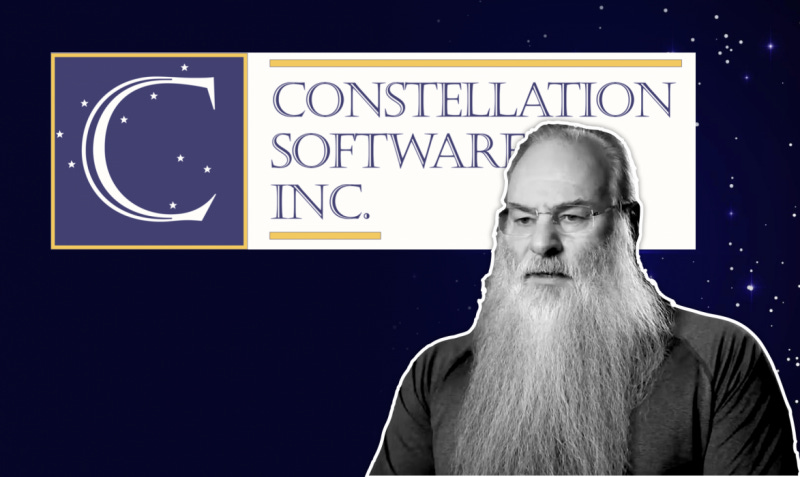

Share 3: Constellation Software

Share 3 goes to Canada with Constellation Software

$CSU (-1,61 %)

Have you always wondered what Gandalf did after The Lord of the Rings? He moved to Canada and built a tech empire there!

This is actually Mark Leonard, which he founded about 30 years ago. In fact, the company can be compared in part to Warren Buffett and Berkshire.

The company primarily buys small software companies and builds them up. Unlike private equity, for example, the aim is not to sell them at a profit or float them on the stock market. The aim is to build them up and hold them for the long term. In total, over 500 companies have already been acquired in this way.

Most of the acquisitions are rather small (less than 5 million) and usually involve very specialized software companies. It is therefore not about companies that will become the next Microsoft, SAP or Salesforce, but about software that is needed for very specialized areas.

Here, too, we are seeing strong sales growth, a constantly positive share price performance and a gross margin of almost 90%!

What do you think of these shares? Do you have one of these shares in your portfolio or on your watchlist?

#depot

#aktien

#stock

#portfolio

#update