Accumulating the king as well 🫡 $BTC (-2,06 %)

Debate sobre BTC

Puestos

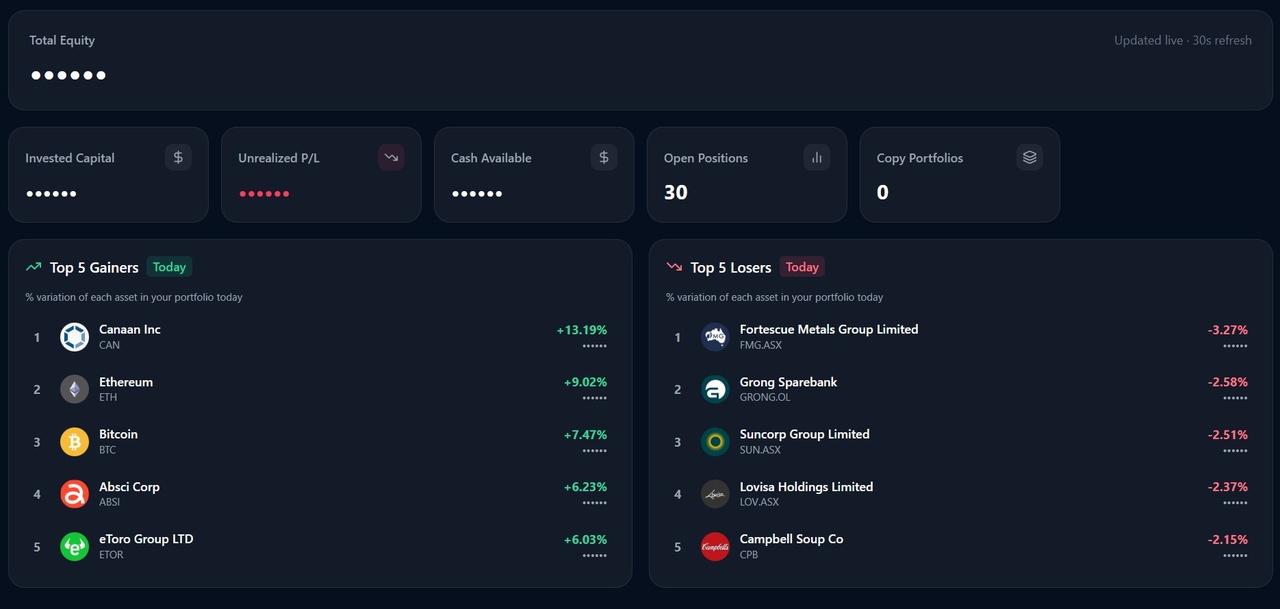

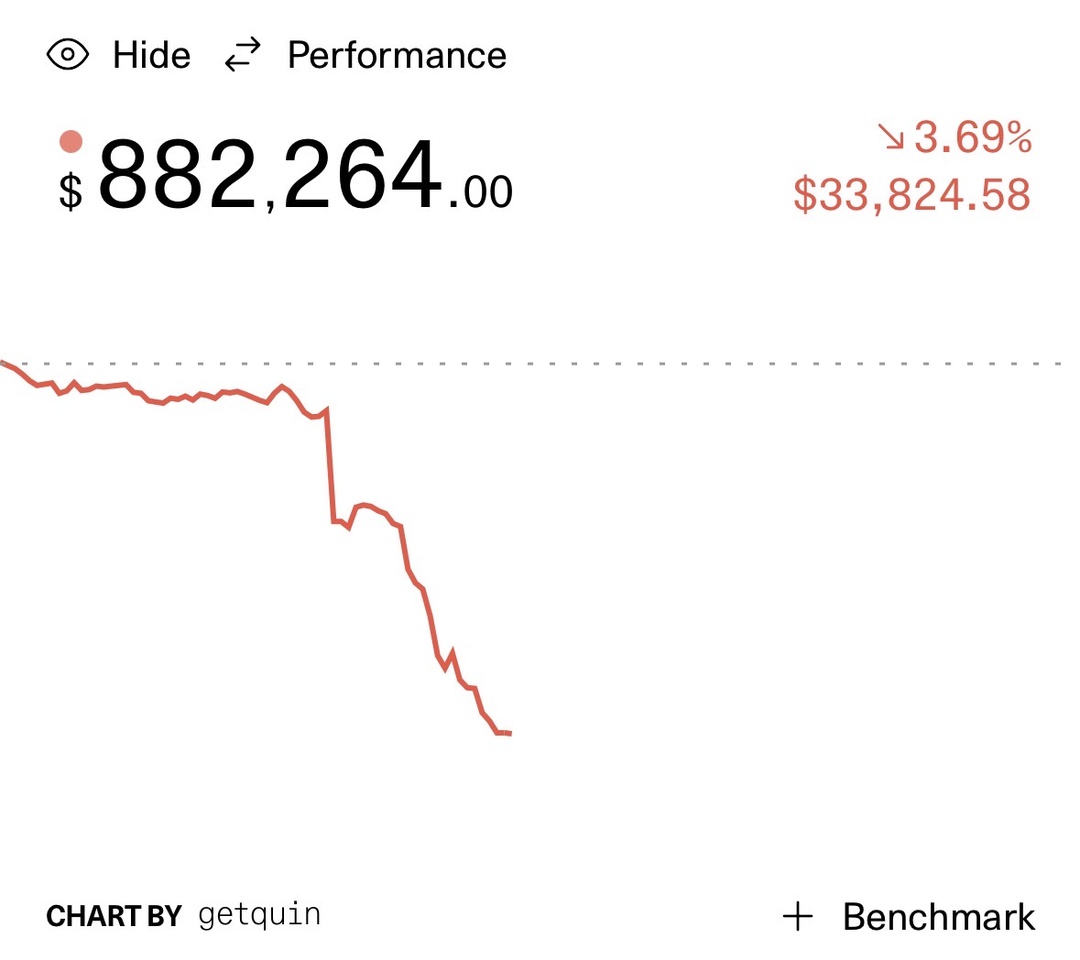

3442Market Update — March 4, 2026: Ripples After Recent Drop

The markets are trying to recover today after heavy volatility earlier in the week, triggered by the ongoing conflict involving the U.S., Israel and Iran. What started as a sharp sell-off in stocks and a surge in oil prices has recently shown signs of stabilisation.

What’s Driving the Swings:

After several days of geopolitical escalation, investors have been on edge. Energy prices spiked as the conflict threatened key shipping routes, inflation fears picked up, and risk-off sentiment drove broad sell-offs in equities in the first part of the week. Recessionary fears and market nerves led to significant selling pressure in major indexes.

Today, however, markets are attempting to bounce back.

• SP 500 and Nasdaq 100 are trading higher as reports emerge that Iran may have approached the U.S. to discuss conflict de-escalation.

• Markets are sensitive to geopolitical headlines — both positive and negative — which is driving this seesaw action.

Some Context

Earlier in the week, the SP 500 and Nasdaq had fallen sharply as the conflict intensified, causing risk-off positioning and boosting demand for safe-haven assets. Oil and gas surged, and broader macro fear caused volatility to jump as investors reassessed inflation and rate expectations.

But the latest reports of possible negotiations and stabilisation efforts have helped stocks claw back some losses — particularly in technology stocks after earlier declines.

What This Means Now

Markets are still in a state of uncertainty, not calm — but short-term buyers have stepped in on dips, reacting to evolving geopolitical news. If conflict concerns ease, there is potential for further recovery. If tensions escalate again, volatility will likely rise and risk assets may slide once more.

Several positions closed the day in positive territory, contributing to steady portfolio progression. The gains were broad-based and aligned with the current volatility structure the strategy is built around.

No aggressive moves — just disciplined execution, position sizing, and patience paying off.

As always, risk remains controlled and exposure is intentional.

𝗧𝗵𝗶𝘀 𝗶𝘀 𝘁𝗵𝗲 𝗽𝗲𝗿𝗳𝗲𝗰𝘁 𝘁𝗶𝗺𝗲 𝘁𝗼 𝗰𝗼𝗽𝘆 𝗺𝗲 𝗼𝗻 𝗲𝗧𝗼𝗿𝗼—𝗱𝗼𝗻’𝘁 𝗺𝗶𝘀𝘀 𝘁𝗵𝗶𝘀 𝗼𝗽𝗽𝗼𝗿𝘁𝘂𝗻𝗶𝘁𝘆 𝘁𝗼 𝗴𝗿𝗼𝘄 𝗮𝗹𝗼𝗻𝗴𝘀𝗶𝗱𝗲 𝗺𝘆 𝘀𝘁𝗿𝗮𝘁𝗲𝗴𝘆.

😎 𝗗𝗶𝘀𝗰𝗹𝗮𝗶𝗺𝗲𝗿: This is my personal opinion and is for informational purposes only. You should not interpret this information as financial or investment advice

$ETH (-2,22 %)

$BTC (-2,06 %)

$TSLA (+0,68 %)

$AMZN (+0,83 %)

$NVDA (+0,1 %)

Never doubt Bitcoin.…

The same people who mocked it will FOMO at the top $BTC (-2,06 %)

#crypto

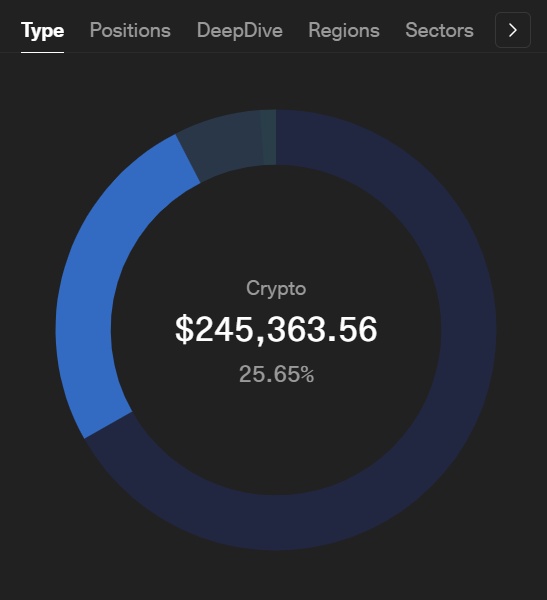

Crypto Allocation

Our crypto allocation is currently ~25%, holding $BTC (-2,06 %)

$HYPE (-3,69 %)

$ETH (-2,22 %)

$GRASS (-3,76 %)

$SAHARA (-9,29 %) and $SPX (-1,82 %) , the aim is to bring it to around 30%, even though we were, at first, exclusively focused on crypto. Any suggestions? 👀

BTC - Bullish without bottom?

Now that $BTC (-2,06 %) and altcoins have been bullish about the conflict in the Middle East and are now showing a breakout from the downtrend, one should zoom out and visualize the structure of the trend.

LILA - The price is still in a falling trend channel

YELLOW - Continuation pattern (bearish wedge)

WHITE - The most recent price movement suggests a fake-out like in mid-January

GREEN - The first bottom was formed at $60K

RED - A crucial area that could provide support and will be reached before the end of the downtrend

Projection

A V-shaped recovery, which is currently being hinted at, is extremely rare to see at the end of a bear market.

It is likely that the $60K mark will be broken and the bottom will be found in the $50K area - this would correspond to a classic 5-stage downtrend.

However, if another continuation pattern becomes visible in this area, it would go to the $38K area...

What is your strategy? Buy the dip, blunt savings plan or wait for a bottom?

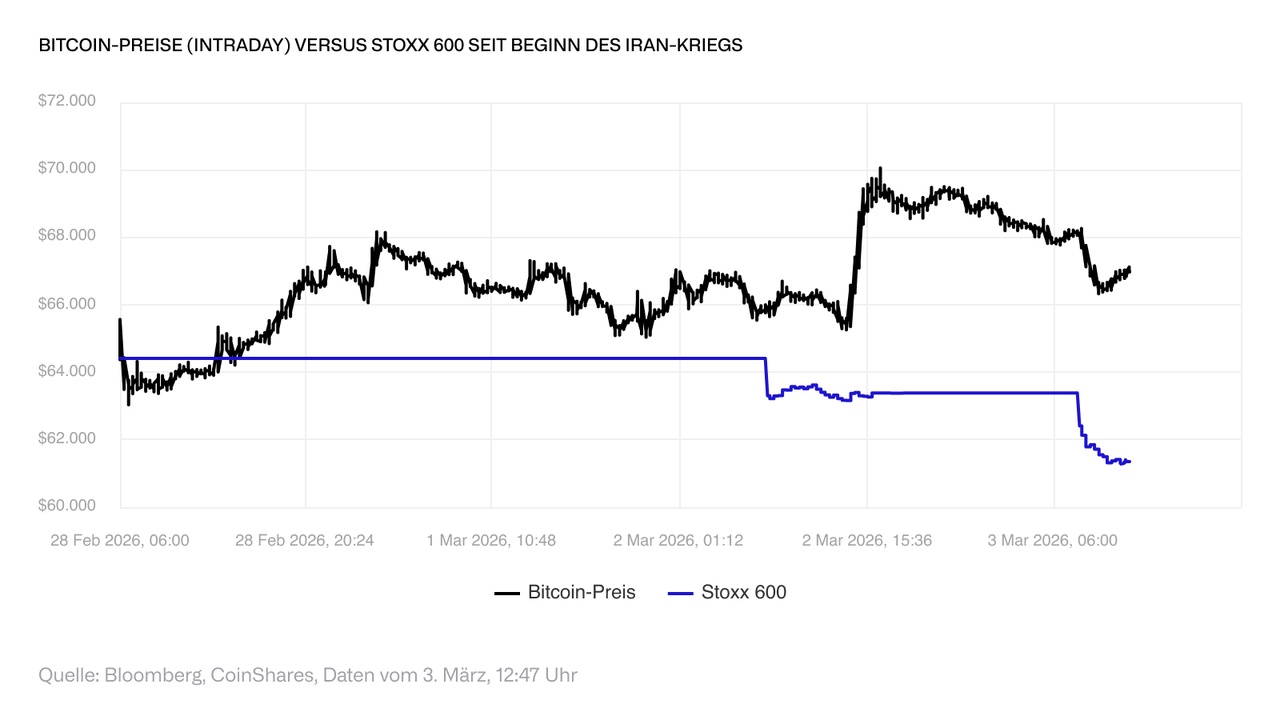

Geopolitical shockwaves shake the markets - crypto as a safe haven?

In the face of escalating tensions in the Middle East, the price of oil rose by 10% and $GOLD gained 3.5%, confirming its traditional role as a safe haven - but Bitcoin is defying expectations, remaining stable and even attracting inflows. Investors appear to be using the correction as both an entry point and a hedge, pointing to a potentially growing role for cryptocurrencies in times of geopolitical uncertainty and volatile markets.

Geopolitics drives oil and gold higher

Geopolitics once again dominated the markets over the weekend after President #trump used Saturday to further escalate tensions. The withdrawal of British embassy staff from Iran had already indicated rising risks, so markets were not completely unprepared. The crucial question is not only whether the #iran can be contained, but also how quickly potential disruptions could spread. Iran controls the Strait of Hormuz, one of the world's most important energy routes. Withdrawals by insurers and visible congestion of tankers indicate that the situation is already operationally relevant and not just rhetorical. Drone activity and signals of support from Hezbollah and the Houthi militia increase the likelihood that the conflict will escalate. The 10% rise in the oil price reflects this fragility, while gold is fulfilling its traditional role as a safe haven with a gain of 3.5%.

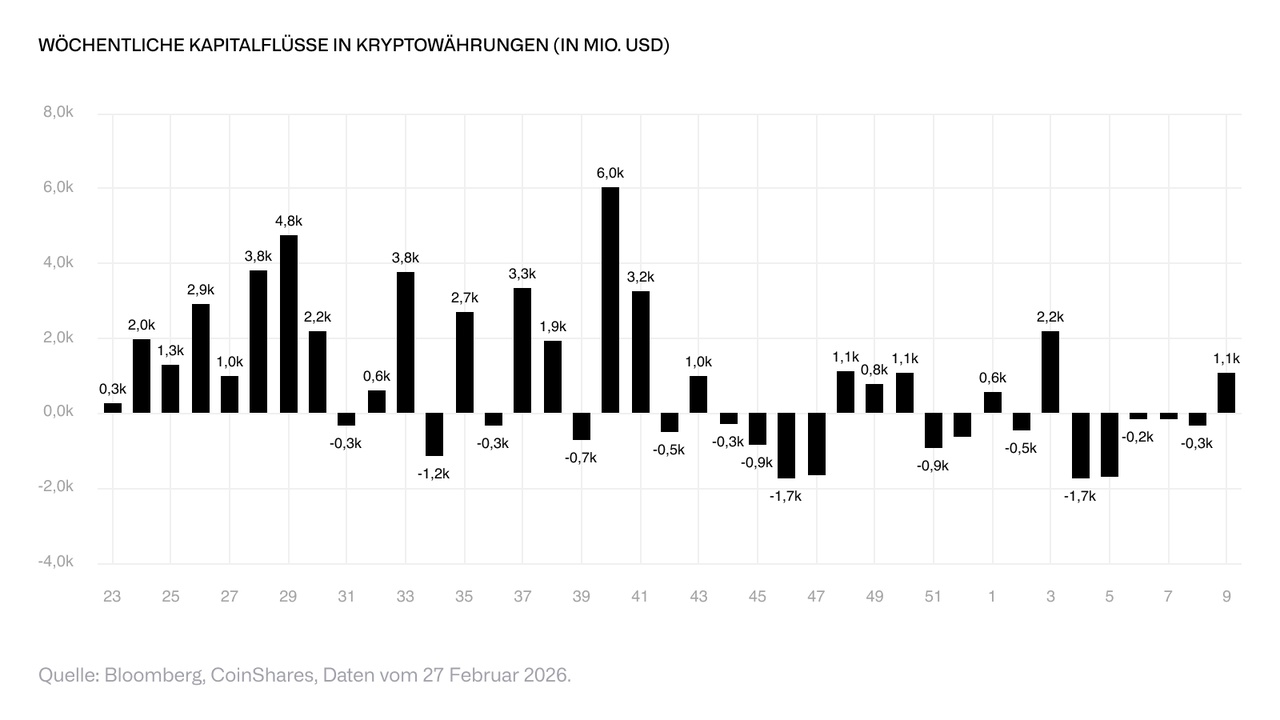

Bitcoin defies uncertainty - inflows return

Even more remarkable is the reaction of Bitcoin. Historically, Bitcoin, as the only liquid asset that is also traded at the weekend, has usually reacted negatively in phases of forced risk reduction. This time, however, the cryptocurrency remained stable and even rose despite increasing uncertainty. The lack of significant liquidations despite rising yields and geopolitical tensions suggests that positioning is more balanced compared to previous episodes. Over the past five months, major market participants have turned over around USD 30 billion and technical and fundamental lows have already been reached. Last week, inflows returned: USD 1 billion flowed in after USD 4 billion had previously flowed out over five weeks, and a further USD 500 million was added on Monday alone. This suggests that investors see the correction as both an entry opportunity and a hedge in the current geopolitical situation.

The chart shows the intraday price development of $BTC (-2,06 %) from the start of the conflict at 6:15 GMT on February 28 to the current time, as well as the relative price performance of the Stoxx 600, illustrating the significant outperformance of Bitcoin since the outbreak of the conflict. The flat sections in the equity index reflect periods when exchanges were closed, highlighting the liquidity constraints of equities compared to continuously tradable Bitcoin.

Macroeconomics tighten financial conditions

The macroeconomic environment is making the situation even more difficult. The Producer Price Index rose by 0.5% month-on-month, above the expected 0.3%, while the core rate reached 0.8%, mainly driven by trade-related services. With energy prices now rising sharply, rate cut expectations are likely to be postponed further, tightening financial conditions compared to a few weeks ago. If energy-driven inflation delays monetary easing, traditional risk assets could come under pressure. However, if geopolitical tensions intensify and confidence in global financial and trade structures - particularly along critical routes such as the Strait of Hormuz - erodes further, scarce and non-government assets such as Bitcoin could benefit in the medium term.

Via the CoinShares Bitcoin ETP $BITC (-1,91 %) you can also invest in Bitcoin.

GQ Community - please explain crypto to me

For a long time I looked at the crypto market and saw nothing but a digital casino.

Between the 10,000% "to the moon" pumps and the endless sea of meme coins, it’s hard not to feel like the whole thing is just a giant game of bulls***.

I’ve spent the last few weeks watching YouTube videos and I have to admit that the Bitcoin ecosystem is an absolute masterpiece. Seeing it explained as a decentralized, self-sustaining machine changed my perspective from " bulls*** " to "speculative innovation."

Very good videos:

https://www.youtube.com/watch?v=vclZlAFXpEI

https://www.youtube.com/watch?v=-D3ChoNtlX8

Please recommend more!

My Current Setup (Noob)

I’ve decided to start small. A low allocation just to start playing the game. Currently, I’m running a 90/10 split: (100€ monthly)

- 90% Bitcoin ($BTC (-2,06 %)): It’s the king for a reason I guess.

- 10% Binance Coin ($BNB (-1,34 %)): Just because of the 25% discount on trading fees on binance and it is too good to ignore.

I’m fully aware I’m still "uneducated" in this space. I love the idea of decentralized tokens, but I’m struggling to understand the utility of other altcoins without them feeling like a roll of the dice.

Is a 90/10 BTC/BNB split too "safe," or is it the smartest way to start?

Are there other "beautiful machines" (actual utility projects) I should look into that are not just hype and noise? Because when I look at $ETH (-2,22 %) for example isn't it just Bitcoin but worst?

The 100€ montlhy deposit on binance is all automated but is it the best? I transfer to binance and then it auto converts 25€ each week to btc and bnb. I feel that I am paying more in spread for than I usually pay on spot trading for some reason. Please help

$BTC (-2,06 %) , $ETH (-2,22 %) , $SOL (-2,32 %) , $USDT (+0,23 %) , $USDC (+0,83 %) , $XRP (-1,61 %) , $AVAX (-0,16 %) , $BNB (-1,34 %) , $ADA (-2,56 %) , $SHIB (-3,27 %) , $DOT (-0,1 %) , $DOGE (-5,33 %) , $LUNA (-2,1 %) , $ASML (+0,61 %) , $NVDA (+0,1 %) , $NVO (+1,28 %) , $NOVO B (+1,69 %) , $V (-0,85 %) , $PLTR (+1,55 %) , $MSFT (+1,35 %) , $NFLX (+0,67 %) , $IREN (-4,65 %) , $NBIS (+0,6 %) , $DAPP (-0,46 %) , $CIFR (-5,8 %) , $DUOL , $MCD (-0,87 %) , $MA (-1,13 %) , $MARA (-4,73 %) , $SE (+8,15 %) , $OSCR (-4,06 %) , $UNH (-0,26 %) , $CRM (+5,07 %) , $NOW (+6,92 %)

Good morning, BTC

We probably need to reduce our $BTC (-2,06 %) share, it’s a bit too correlated.

But do we take good decisions here? Not sure 🤭

Inflows of one billion US dollars mark shift in sentiment for digital assets

Investment products on digital assets recorded inflows of USD 1 billion last week, ending a five-week period of outflows that totaled USD 4 billion. From a macroeconomic perspective, it is difficult to attribute the change in sentiment to a single trigger. However, the previously weak price performance, the break of important technical support levels and renewed accumulation by large $BTC (-2,06 %)-holders are likely to have contributed to the trend reversal. Anecdotally, it can also be observed that recent client discussions are almost exclusively about attractive entry levels and no longer about reducing the allocation to this asset class.

Bitcoin was the main beneficiary, attracting USD 881 million. At the same time, inflows into short Bitcoin products amounting to USD 3.7 million illustrate that opinions continue to diverge. Ethereum also saw inflows totaling USD 117 million - the highest since mid-January. Both $ETH (-2,22 %) and #bitcoin are still net negative since the beginning of the year.

$SOL (-2,32 %) In contrast, inflows of USD 53.8 million were recorded last week and total USD 156 million since the start of the year. At $LINK (-1,38 %) (Chainlink) saw inflows of a moderate USD 3.4 million, while there were no significant outflows.

You can invest in Bitcoin, Ethereum, Solana and Chainlink via the following vehicles:

Valores en tendencia

Principales creadores de la semana