The markets are trying to recover today after heavy volatility earlier in the week, triggered by the ongoing conflict involving the U.S., Israel and Iran. What started as a sharp sell-off in stocks and a surge in oil prices has recently shown signs of stabilisation.

What’s Driving the Swings:

After several days of geopolitical escalation, investors have been on edge. Energy prices spiked as the conflict threatened key shipping routes, inflation fears picked up, and risk-off sentiment drove broad sell-offs in equities in the first part of the week. Recessionary fears and market nerves led to significant selling pressure in major indexes.

Today, however, markets are attempting to bounce back.

• SP 500 and Nasdaq 100 are trading higher as reports emerge that Iran may have approached the U.S. to discuss conflict de-escalation.

• Markets are sensitive to geopolitical headlines — both positive and negative — which is driving this seesaw action.

Some Context

Earlier in the week, the SP 500 and Nasdaq had fallen sharply as the conflict intensified, causing risk-off positioning and boosting demand for safe-haven assets. Oil and gas surged, and broader macro fear caused volatility to jump as investors reassessed inflation and rate expectations.

But the latest reports of possible negotiations and stabilisation efforts have helped stocks claw back some losses — particularly in technology stocks after earlier declines.

What This Means Now

Markets are still in a state of uncertainty, not calm — but short-term buyers have stepped in on dips, reacting to evolving geopolitical news. If conflict concerns ease, there is potential for further recovery. If tensions escalate again, volatility will likely rise and risk assets may slide once more.

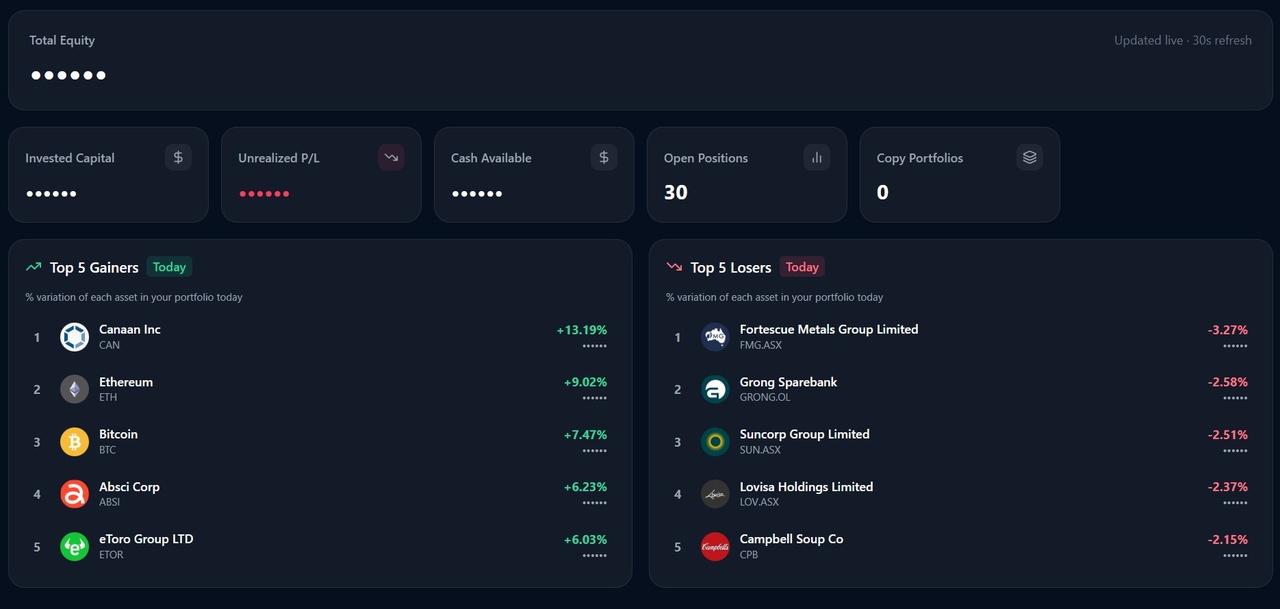

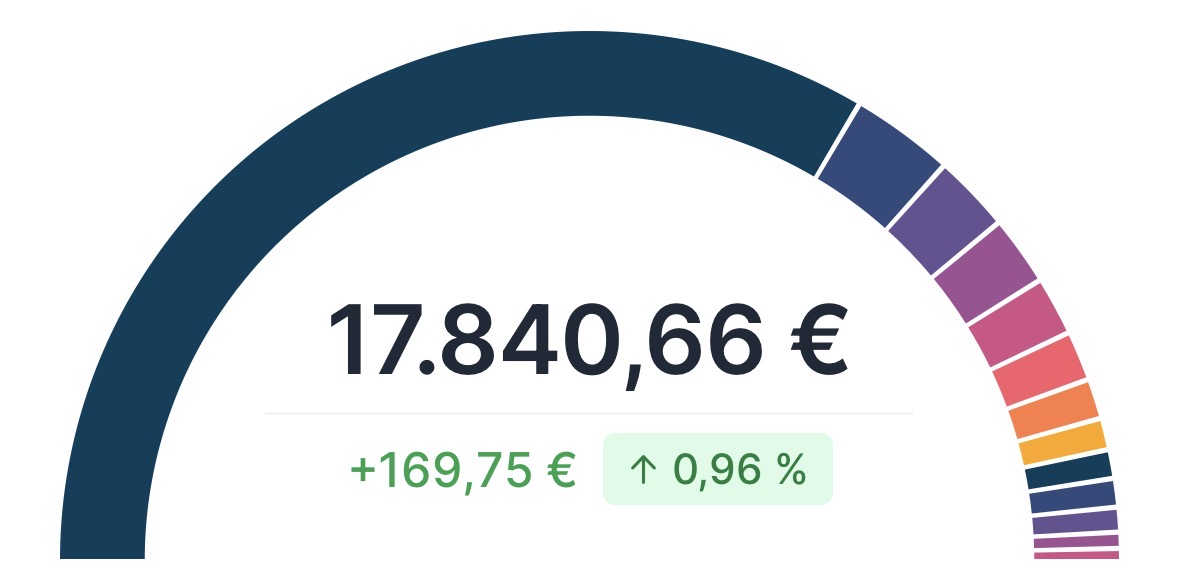

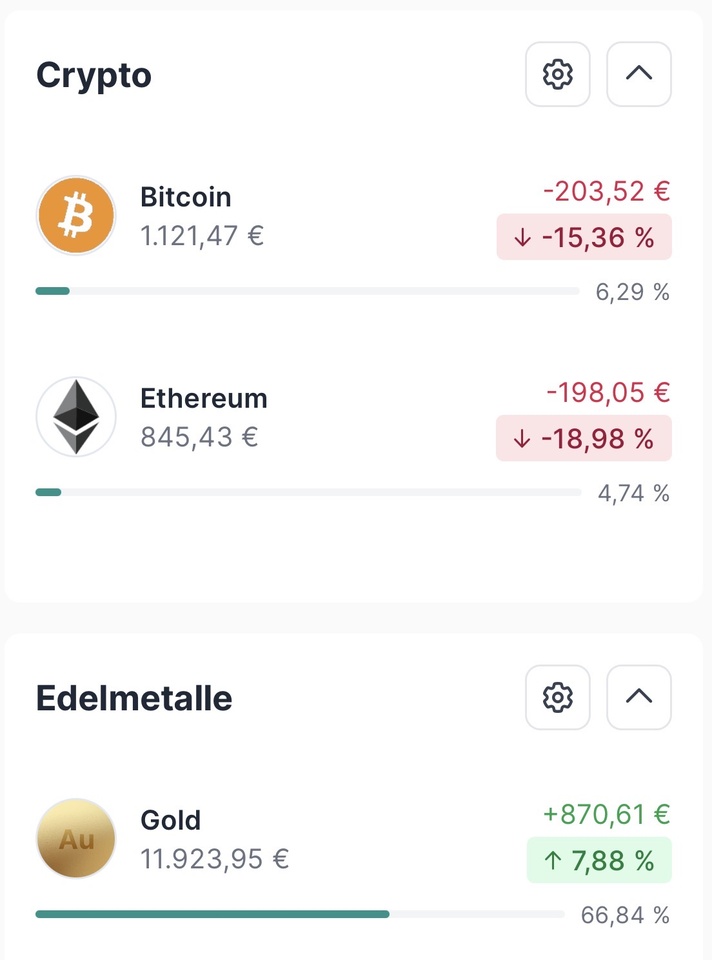

Several positions closed the day in positive territory, contributing to steady portfolio progression. The gains were broad-based and aligned with the current volatility structure the strategy is built around.

No aggressive moves — just disciplined execution, position sizing, and patience paying off.

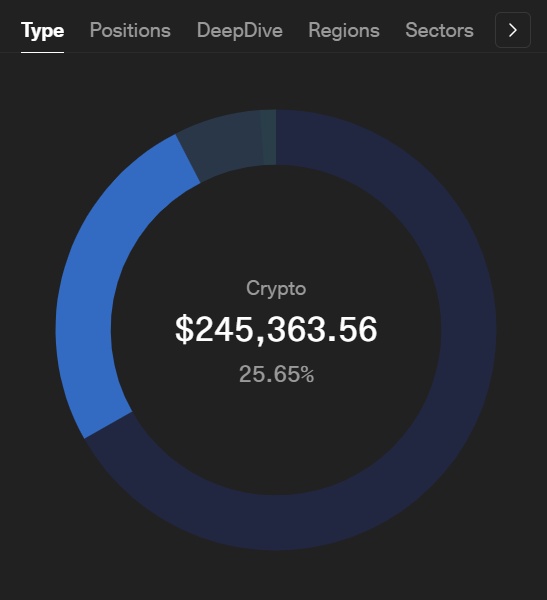

As always, risk remains controlled and exposure is intentional.

𝗧𝗵𝗶𝘀 𝗶𝘀 𝘁𝗵𝗲 𝗽𝗲𝗿𝗳𝗲𝗰𝘁 𝘁𝗶𝗺𝗲 𝘁𝗼 𝗰𝗼𝗽𝘆 𝗺𝗲 𝗼𝗻 𝗲𝗧𝗼𝗿𝗼—𝗱𝗼𝗻’𝘁 𝗺𝗶𝘀𝘀 𝘁𝗵𝗶𝘀 𝗼𝗽𝗽𝗼𝗿𝘁𝘂𝗻𝗶𝘁𝘆 𝘁𝗼 𝗴𝗿𝗼𝘄 𝗮𝗹𝗼𝗻𝗴𝘀𝗶𝗱𝗲 𝗺𝘆 𝘀𝘁𝗿𝗮𝘁𝗲𝗴𝘆.

😎 𝗗𝗶𝘀𝗰𝗹𝗮𝗶𝗺𝗲𝗿: This is my personal opinion and is for informational purposes only. You should not interpret this information as financial or investment advice

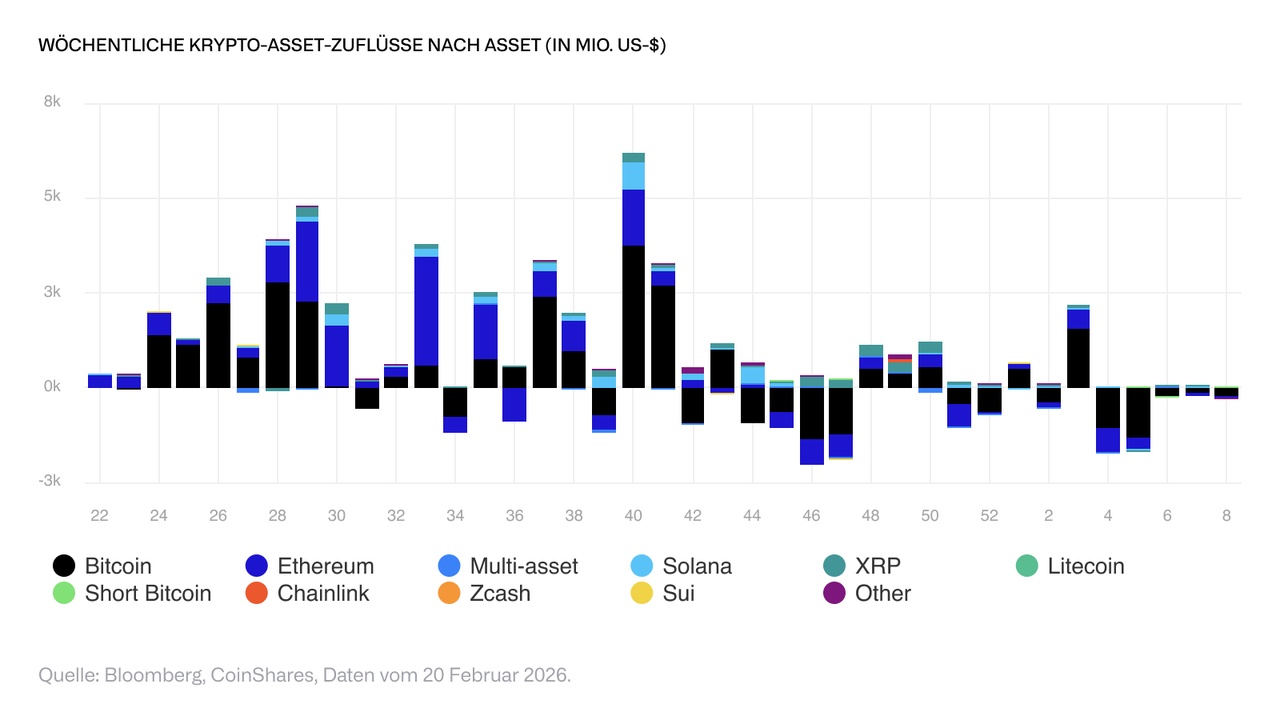

$ETH (-0,74 %)

$BTC (-1,19 %)

$TSLA (+0,72 %)

$AMZN (+1,5 %)

$NVDA (+0,37 %)