Hello everyone,

I am 28 and would like to invest for the long term. My savings rate is around 600€-800€ per month.

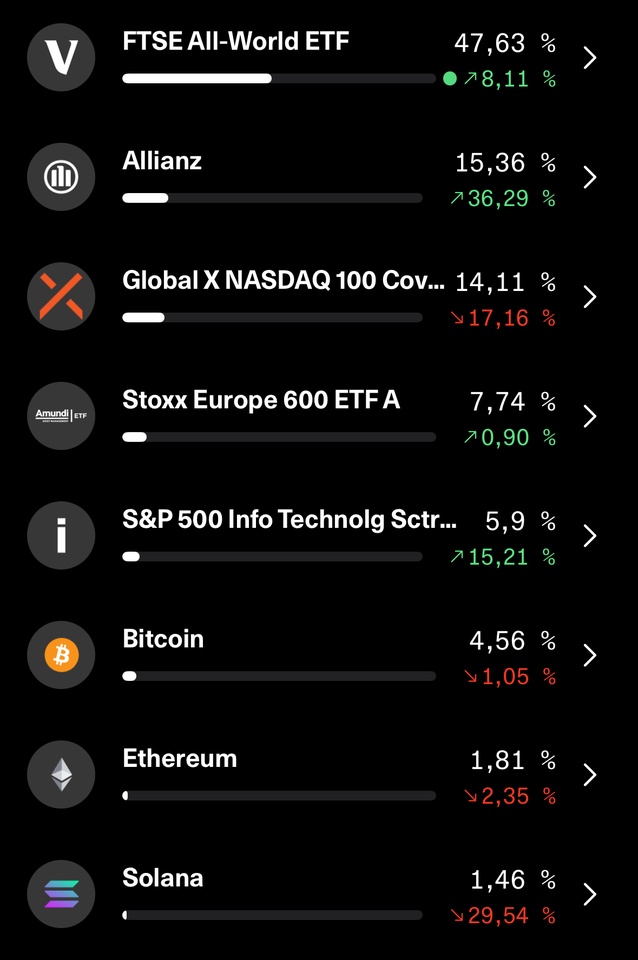

Briefly about the current positions:

The $VWRL (+0,02 %) position is in the savings plan.

$ALV (-0,34 %) The savings plan ran initially and I am currently simply holding the position and not expanding it any further.

$QYLE (+0,47 %) was also once in a savings plan. The aim here was to generate cash flow, but I would now rather reallocate in order to get a higher return in the long term.

$MEUD (+0,03 %) runs in the savings plan to increase the European share.

$IUIT (+0,43 %) I like to buy more when there are setbacks and use it as a yield booster. Also in the savings plan.

$BTC (-0,75 %)

$ETH (-0,72 %)

$SOL (-0,99 %) are partly older. I am considering expanding them.

I would be pleased to hear your ideas and opinions on what you would do - also with regard to regrouping and structuring the savings plans.

Thank you very much for your encouragement!