$DPZ (+0,2 %)

$HIMS (-0,67 %)

$KTOS (-1,49 %)

$DOCN (-2,73 %)

$FME (-0,84 %)

$KDP (+0,41 %)

$AMT (-0,26 %)

$HD (-0,35 %)

$WDAY (-1,53 %)

$FSLR (+0,29 %)

$TEM (-1,01 %)

$O (-0,54 %)

$MELI (-0,31 %)

$HPQ (-0,23 %)

$LCID (+0,31 %)

$DRO (-2,65 %)

$HSBA (+0,07 %)

$FRE (+0,35 %)

$AG1 (-1,81 %)

$CRCL (-1,86 %)

$UTHR (-0,29 %)

$LDO (-1,32 %)

$IDR (-2,4 %)

$NTNX (+0,22 %)

$PARA (-0,55 %)

$NVDA

$TTD (-0,63 %)

$AI (-0,72 %)

$CRM (-1,04 %)

$SNPS (-0,65 %)

$SNOW (+0,08 %)

$PSTG (-1,02 %)

$ZIP (-0,78 %)

$ZM (-0,11 %)

$NU (-0,46 %)

$RR. (-1,48 %)

$MUV2 (+0,94 %)

$BIDU (+0,35 %)

$CELH

$DTE (+0,6 %)

$STLAM (-1,38 %)

$WBD (-0,23 %)

$HAG (-2,41 %)

$QBTS (-1 %)

$LKNCY (-1,21 %)

$BABA (+0,92 %)

$G24 (+0,18 %)

$HTZ (-0,14 %)

$PUM (+0,89 %)

$AIXA (-2,38 %)

$RUN (-0,7 %)

$INTU (-1,3 %)

$WULF (-1,96 %)

$MNST (-0,11 %)

$SQ (-1,23 %)

$ADSK (-0,17 %)

$MP (-1,28 %)

$RKLB (-2,48 %)

$SOUN

$SMR

$CRWV (-2,13 %)

$CPNG (+1,41 %)

$DUOL

Puma

Price

Debate sobre PUM

Puestos

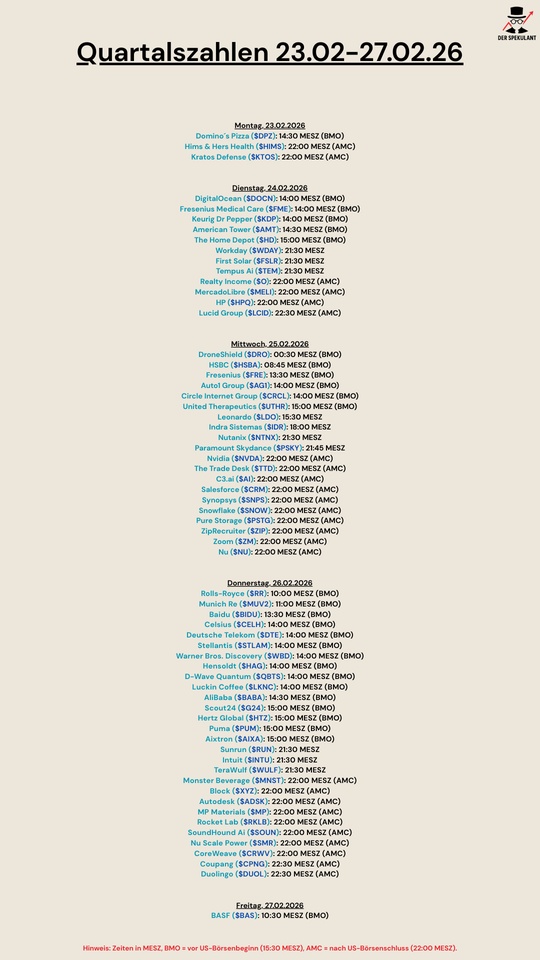

68Quartalszahlen 23.02-27.02.2026

The Chinese sporting goods manufacturer Anta acquires a 29 percent stake in Puma from the French billionaire family Pinault

.... Fǔr 1.5 billion euros. Anta emphasizes that there are currently no takeover plans for Puma, although the acquisition is speculated to be the first step in this direction.

PUMA after the recent rises - first all-clear?

After the heavy volatility of recent weeks, the PUMA share is finally showing strength again. The recent price increase is not only technical, but also has a fundamental tailwind.

The entry of Anta Sports as a new major shareholder (~29%) has restored confidence in the market. Even though it has been clearly communicated that no complete takeover is planned, the deal provides stability, imagination and strategic options - exactly what the share has been lacking recently.

From a technical perspective, PUMA was able to break away from the low and recapture important resistance levels. Momentum is clearly positive in the short term, even if the share is likely to remain volatile.

⚠️ What remains important:

PUMA is still in the midst of operational restructuring. The turnaround is not a foregone conclusion, but the market seems to be ready to award advance praise again.

Sales and new purchases Update

I have disposed of some shares in my portfolio and some new ones have made it into the portfolio

Sold:

$ASML (-1,31 %) (+77.44 %) went well for me, I will possibly get back in if there is a strong setback

$PUM (+0,89 %) (+5.76) I don't see much potential at the moment

$NOVO B (-13,52 %) (2.53 %) I am waiting for a setback and will get back in lower

new additions to the portfolio today:

added to the portfolio last week:

Investing anti-cyclically when it hurts: While everyone is eyeing tech, I'm collecting the "boring" $GIS. Why? Over 5% dividend yield, 37 years of continuity without a reduction and a whopping 38% discount to the 5-week high. Anyone looking for security and cash flow can hardly avoid this valuation level. Growth? Secondary. The dividend is what counts.

There are no stupid questions as long as you remain polite.

📉 Update from the category "Learning through pain"

I have now officially withdrawn from $PUM (+0,89 %) (-60%) and $LXS (-1,63 %) (-50%). I bought both with a lot of hope - and sold them with even more reality.

You could say:

👟 Puma was no longer running

Lanxess reacted allergically to my portfolio

But: losses are only real when you realize them - and I wanted to make room for something that would sell me the future instead of nostalgia. Although the realized loss of around €700 hurts a little at the moment, I can still look back on a good portfolio performance and am not crying over the two shares - past mistakes have to be made good.

🚀 AMD topped up

Yes, the stock has already done well.

Yes, I'm actually already well up on it.

And that's exactly why: let winners run > hold losers out of pity.

Conclusion:

Sometimes the best turnaround is not the stock itself, but your own decision.

On to new mistakes :D

Praying that this goes through 🙏🏼

What do you think? Realistic scenario?

Are any of you still invested? $PUM (+0,89 %)

Biggest losers in 2025 (in euros 🐻)📉 Which ones do you see potential in?

-72% The Trade Desk $TTD (-0,63 %)

-72% Fiserv $FI (-0,73 %)

-65% Dogecoin $DOGE (+0,77 %)

-65% Cardano

-61% Gerresheimer

-60% Enphase Energy $ENPH (-0,43 %)

-59% CarMax $KMX (-1,68 %)

-57% Strategy $MSTR (-2,31 %)

-56% Deckers Outdoor

-56% Alexandria Real Estate

-50% Redcare Pharmacy

-50% PUMA $PUM (+0,89 %)

-50% lululemon

-49% Dow

-49% Novo Nordisk $NOVO B (-13,52 %)

-48% MARA $MARA (-2,01 %)

-48% Molina Healthcare

-47% FactSet

-47% Charter Communications

-47% HelloFresh

-45% Wolters Kluwer

-43% Solana $SOL (-3,83 %)

-43% Cocoa

-42% UnitedHealth $UNH (-0,43 %)

-41% Atlassian

-41% Li Auto

-40% Copart

-40% Meituan

-38% PayPal

-38% Chipotle Mexican Grill

-36% TeamViewer

-35% GameStop $GME (-0,57 %)

-35% Orsted $ORSTED (-1,31 %)

-33% Pernod Ricard $RI (-3,6 %)

-33% Evotec

-33% Symrise

-31% Marvell Technology $MRVL (-0,48 %)

-30% Comcast

-30% Natural Gas

-30% Kraft Heinz $KHC (+0,15 %)

-30% Adobe $ADBE (-1,06 %)

-29% Salesforce $CRM (-1,04 %)

-28% Nike $NKE (-0,66 %)

-28% Adidas $ADS (+0,85 %)

-27% Sugar

-27% XRP $XRP (-0,55 %)

-26% Stellantis $STLAM (-1,38 %)

-25% JD .com

-24% Procter & Gamble $PG (+0,06 %)

-23% Arm $ARM (-1,22 %)

-22% Ferrari $RACE (-0,44 %)

-22% Porsche AG $P911 (-0,78 %)

-21% Zalando $ZAL (-2,04 %)

-21% NEL ASA $NEL (-2,51 %)

-21% Ethereum $ETH (-2,04 %)

-18% Bitcoin $BTC (-1,9 %)

-16% Brent Oil

-16% Delivery Hero

-13% Vonovia $VNA (-0,31 %)

-12% Coinbase $COIN (-1,85 %)

-11% SAP $SAP (-1,28 %)

-7% Amazon $ (-0,74 %)AMZN (-0,74 %)

On the road to financial freedom - December update 📊

First things first. I hope you all had a peaceful Christmas season and were able to spend a few lovely days with family and friends! 😊

Even though December isn't quite over yet, I'd like to give you a quick update on the past month before the new year and take a brief look at the performance since I started at getquin in September.

👉🏻 December:

Start: 1,253,497 euros + 19,000 cash

End: 1,336,908 euros + 400 cash

Deposit: 3,000 euros

Profit: +61,811 euros (+4.86%)

As in previous months, the portfolio benefited from the continued strength of gold in December. The overweight in K92 Mining ($KNT (+0,07 %)), Equinox Gold ($EQX (+0,12 %) ), B2Gold ($BTO (+1,2 %) ) and, more recently, Euro Sun Mining ($ESM (+1,43 %) ) has contributed significantly to the good performance. My sale of SantaCruz Silver ($SCZ) (+11,67 %) in November, on the other hand, unfortunately proved to be an expensive mistake. I lost 50% of my profit, but as you know, you're always smarter afterwards and who could have guessed that silver would go through the roof like this.

Otherwise, not much has changed in my portfolio. I have now fully reinvested the 19,000 euros in cash. Among other things, I have taken an initial position in Vonovia ($VNA (-0,31 %) ) and Zalando ($ZAL (-2,04 %) ). I have also added some Ubisoft ($UBI (+2,71 %) ) and Fuchs Petrolub ($FPE (-0,74 %) ). I only took profits on Puma ($PUM (+0,89 %) ) and significantly reduced my position here when the share price was driven up again by takeover rumors.

As already mentioned, an extremely successful stock market year 2025 comes to an end tomorrow. The performance alone since I started with getquin in September has left me surprised. I wish every year was like this, but ... well. It will probably remain a pipe dream, but I'm all the happier for it! 😊

👉🏻 September - December:

Start: 1,022,339 euros

End: 1,336,908 euros + 400 cash

Return (adjusted): +235,305 euros (+21.39%)

A large part of the performance is of course due to (mainly unrealized) price gains, especially in my two largest positions (K92 Mining and Equinox), which now have a very high impact on the overall performance due to their size. However, other trades have also played their part. For 2025 as a whole, I expect to generate around EUR 115,000 in realized capital gains. Of this, around EUR 20,000 is attributable to dividends received, EUR 20,000 to trading profits with K92 Mining and other various gold/silver mines and around EUR 75,000 to the remaining shares (e.g. Alibaba, Xiaomi, Volkswagen, Porsche, 1&1, Ceconomy, etc.), to name just a few.

I am aware that the main ingredient for such a performance is luck (or inside information). Since I don't have the latter, let's agree on luck... 😉

For this reason, I am setting my targets for 2026 correspondingly lower. My main goal is always to receive around 5% of my assets in the form of investment income. Based on today's values, this would mean a range of 70,000 - 90,000 euros. I no longer set myself a target for my total assets. Although my salary can be planned, it is of secondary importance in the overall picture and, as we all know, you can't plan for price gains on the stock market... 👍🏼

➡️🆓: On my way towards 4 million total assets, the target achievement rate is now 44%. 😊

So, enough chatter. I wish you all a happy new year, happiness, satisfaction, health and, of course, success on the stock market in 2026! 🍀

Enjoy the quiet time! I'm off for 3 weeks in the sun and then I'll see you again at the end of January!

See you in a few days! 😊

PUMA share price jumps 14%

Let's see if that works out... I'm still well in the red with the paper.

That sounds really exciting: Puma shares will once again become the focus of market interest on Thursday - this time due to fresh takeover speculation, which could get the recently hard-hit share price moving again. As early as mid-September, a report by Manager Magazin had already given rise to speculation.

At the time, it was reported that several hedge funds were considering a takeover of the Franconian sporting goods manufacturer.

At the time, the news caused a short-term jump in the share price, but the euphoria did not last long. The share price soon turned downwards again and even slipped to its lowest level since 2015 last week.

Now, however, there seems to be new momentum in the discussion. The news agency Bloomberg reports, citing informed sources, that there is serious interest in Puma from China. In particular, the sporting goods giant Anta Sports, which has expanded rapidly in recent years and gone on an international shopping spree, is said to be examining a possible takeover. Bloomberg also mentions two other names that are making the industry sit up and take notice: Li Ning - one of the leading Chinese sporting goods groups - and Japan's Asics, which has been a force to be reckoned with for decades, particularly in running. $PUM (+0,89 %)

Depot roast

Dear Community,

After reading all the posts with great enthusiasm, I would like to hear your opinion on my portfolio today.

A few words about me:

I am 27 years old and bought my first share around 2019. Since then, I've unfortunately made a few mistakes and made a mistake ($KER (+3,45 %) , $NOVO B (-13,52 %) , $PUM (+0,89 %) ). At that time, I unfortunately always had the approach that if it had fallen sharply, it had to go up again at some point...

That's why I've now increased my ETF holdings somewhat. The idea is to build up the portfolio mainly with ETFs and to improve the return with a few shares. However, I'm not really satisfied with the return yet...

I currently invest €3100 a month together with my partner, mainly in the $IWDA (-0,32 %) and $VWCE (-0,39 %) .

500€ flow into $BTC (-1,9 %) .

I am looking forward to your opinion.

P.s.: I am aware that the stocks in the MSCI world, ftse world and s&p are duplicated. There are historical reasons why they are in my portfolio and they don't bother me at the moment.

Valores en tendencia

Principales creadores de la semana