$EQNR (+5,14 %) EUR 2.99 quarterly dividend on February 27 ??? You too? What's going on at getquin?

Equinor

Price

Debate sobre EQNR

Puestos

41Vår Energi delivers successful well test results at Goliat Ridge

Vår Energi $VAR (+0,52 %) announces the completion of the appraisal well with two production tests on the Zagato structure in the Goliat Ridge field in the Barents Sea, confirming the quality of the reservoir and increasing the recoverable volumes.

confirmed the quality of the reservoir and increased the recoverable volumes.

The well was drilled approximately seven kilometers northeast of the Goliat field operated by Vår Energi. The production tests confirmed the good quality of the reservoirs and an oil quality similar to that of the Goliat field.

The most recent well tested two intervals, each with maximum flow rates of more than 4000 barrels of oil per day, confirming the quality of the reservoir.

confirming the quality of the reservoir.

Torger Rød, COO of Vår Energi, said:

This success reinforces our confidence in the potential of the Goliat Ridge discovery and we see an opportunity to add significant additional resources

as tie-back projects to Goliat. The recent discoveries reinforce Vår Energi's position as a leading exploration company on the Norwegian Continental Shelf (NCS) and further strengthen our ability to sustain high-quality production of 350-400 thousand barrels of oil equivalent per day beyond 2030.

Vår Energi and its license partner Equinor $EQNR (+5,14 %) have drilled a total of five wells and one sidetrack well in the area. Including the latest well, the Goliat Ridge

is estimated to contain a total of 35 to 138 million barrels of oil equivalent (mmboe) of discovered recoverable resources, with additional potential resources increasing the total potential to over 200 mmboe.

A tie-in to the nearby Goliat FPSO is planned, with first production targeted for 2029.

production is targeted for 2029.

Vår Energi was recently awarded a license for an area adjacent to the Goliat field as part of the 2025 Awards in Predefined Areas (APA), which provides

additional prospects in line with the Goliat Ridge discovery.

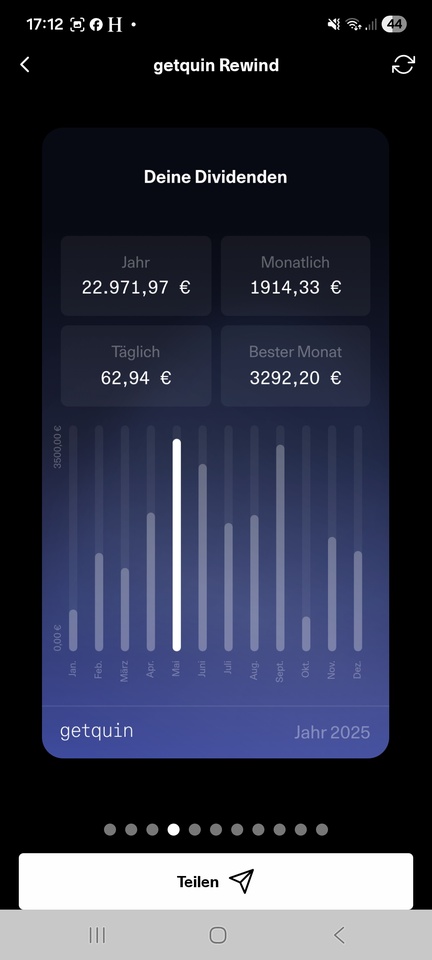

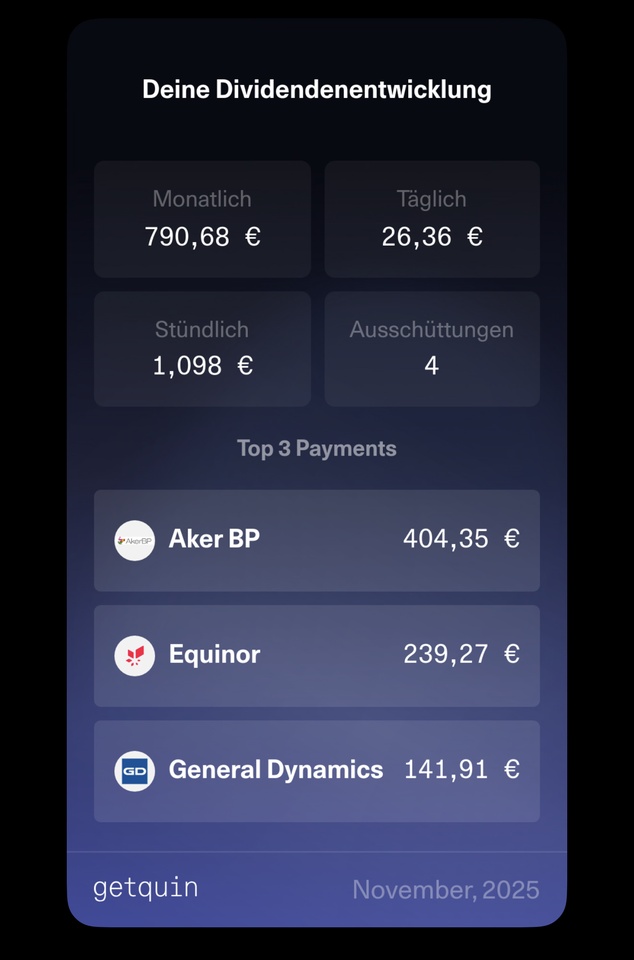

Dividendenopi inside (Part 1 )..... Dividendenopi Rewind2025

A little later, but not too late, I'll also have my say at the end of the year, together with an insight into the goings-on of the Opi before @Tenbagger2024 , @SAUgut777 and some others get impatient, as you know, old people are a bit slower. I would also like to take this opportunity to thank and appreciate all those who contribute here on GQ with great analyses and strong contributions, critical comments and a wonderful exchange. I'm deliberately not naming any individuals now, otherwise I won't be able to finish. All of you together are great, whether you're a veteran or a newcomer. The community is alive and I am happy to be a part of it. Thanks also to @christian and the Getquin team, who make this possible by maintaining the platform, even if things sometimes don't run smoothly. The Bavarian says: Basst scho

The year 2025 was exciting and, from my point of view, successful in terms of my expectations. If you don't feel like evaluating a boring dividend strategy, don't want to read about overnight and fixed-term deposits, aren't interested in certificates and don't like the Sparkasse, you are welcome to leave here after Rewind 2025. Many thanks to everyone else for reading and, if necessary, commenting.

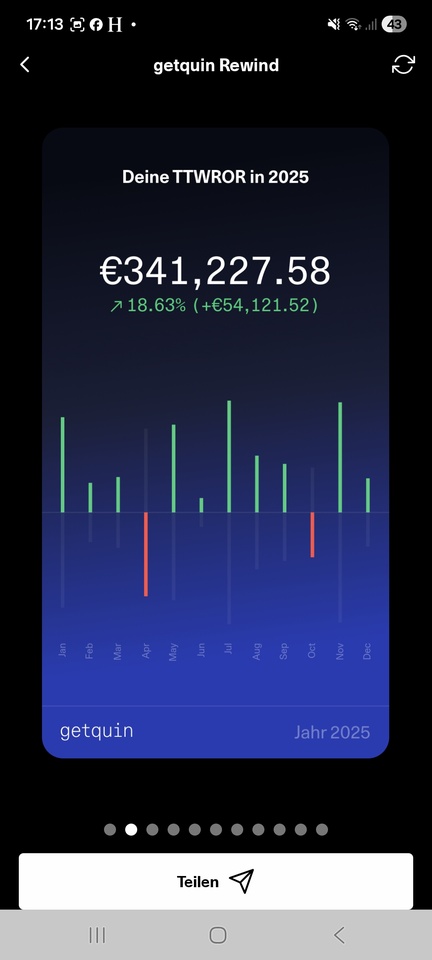

At least as far as the majority of shares are concerned, I am known to be invested in dividend stocks in order to generate the highest possible cash flow. I am now almost 62 years old and do not value excessive performance but would like to make a living from the income from my assets and decided to stop working at the beginning of the year when the company where I was employed was dissolved. I see myself as a buy and hold a while. Nothing lasts forever, especially with high-dividend shares. There are regular reallocations without getting into an operational frenzy. In 2025, for example $TRMD A (-0,36 %) and a large position $HAUTO (+2,51 %) had to leave the portfolio, the high dividend expectations were significantly reduced. The $QYLE (-0,58 %) has not recovered from April, $EQNR (+5,14 %) and $VICI (-0,12 %) led to the brink of capital loss despite respectable dividends and had to give way, as did $MUX (-0,66 %) with its inconsistencies. New additions were $NN (-1,67 %) , $PFE (+1,05 %) , $DTE (-0,64 %) and a first position at the end of the year $ARCC (-1,04 %) You can see the composition in my profile. I generally try to limit myself to +/- 20 positions and weight them according to purchase. A maximum of 20k per position is invested. This results in the calculation of my dividends and expected income. In its current composition, the portfolio shown here has a value of just over € 340,000 as at 31.12.2025 and has generated gross dividends of just under € 23,000 this year. This corresponds to a dividend yield of 6.73%

The time-weighted yield was 18.63% and therefore well above average, at least better than 67% of the getquin community. I wasn't able to beat the DAX, but at least I outperformed the S&P500 and beat the relevant MSCI World index by some distance. Even on a 5-year view I am on a par. Tobacco stocks did very well $BATS (-1,48 %) , $IMB (+0,95 %) and $MO (-0,92 %) , $HSBA (-2,36 %) , and $RIO (-0,64 %) and of course $965515 (+1,67 %) that I physically hold and the $EWG2 (+0,5 %) .

That's all there is to the part of my investments shown here in GQ. What follows is a piece of my life story and the first part inside Dividendenopi.

As I said, I now live off my assets. This amounts to just under € 1.2 million in all the forms of investment I hold. Is that enough for a carefree life? For me in any case. Because on top of that, I have a debt-free, owner-occupied property (a single-family home with a large garden in a quiet rural location near a city of 600,000 inhabitants) and a rented two-family home, appropriately enough, as a neighboring property. Partly financed, rent surplus after installment to the bank a good € 700 per month, flows completely into the maintenance reserve. Claims from BAV, life insurance, building society savings contracts will be added on top in the next few years, but are not taken into account here. There's even a savings account with €18,000..... half of which belongs to my wife and she doesn't want to close it.

My wife (still) works and has a decent income despite working part-time and has other liquid assets in the lower six-figure range. She does it herself, the stock market is the devil's work. Her story is not included here either.

So I / we are doing pretty well after all. It wasn't always like that, anyone who is or was self-employed knows that. But consistent financial planning is important, no matter what the situation, as is sticking to your savings rate. I started investing in real estate at the beginning of the 1990s and have been liquidating it over the last few years. In conjunction with my own wealth accumulation and an inheritance, I am now in a comfortable situation for me.

What do I do with the rest of the money outside the getquin portfolio? A good € 500,000 is (still) in call money and fixed-term deposit accounts. Interest rate hopping on call money and fixed-term deposits from 2 years ago yields around 3% on call money and over 4% on fixed-term deposits. The remaining capital is invested in certificates. Mainly in fixed-coupon express certificates with quarterly payout and partly in bonus certificates with CAP and barrier.

My investments currently generate a net monthly cash flow of € 4000, which is enough for me to live on. Plus € 800 ALG on top until the beginning of 2027.... But before the company closed, I only worked 16.5 hours a week. With my wife's income, that's a good €6500, which is bearable. You can certainly do more with your assets, depending on your needs. We live rather modestly, don't have any children and aren't the consumer type.

How am I invested outside of dividends, why certificates and which broker, where and how overnight and fixed-term deposits? I thought that would go beyond the scope of this article, so I'll come back to it in a second part. Thanks for your participation so far and see you soon

Significantly, you can see here that not having children is now the best provision for old age. Not an accusation, just an observation. 🤷♂️

Equinor, Vår Energi and Petoro approve investment for Isflak development at Johan Castberg

Vår Energi ASA$VAR (+0,52 %) and

and its partners have approved the first follow-on development to extend plateau production

from the Johan Castberg field in the Barents Sea until 2030.

The Equinor $EQNR (+5,14 %) operated Johan Castberg license has made a final investment decision

for the Johan Castberg-Isflak development.

The partnership also plans to

six new Increased Oil Recovery (IOR) wells and a development of the Drivis-Tubåen discovery.

The projects bring total reserves of 27 million barrels of oil equivalent (mmboe) net to Vår Energi and have a strong break-even price

and a high return on investment.

The Isflak development is expected to commence production in the fourth quarter of 2028 and consists of two wells and a subsea template that will be tied back to the existing subsea infrastructure in the Johan Castberg field.

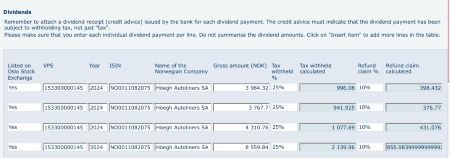

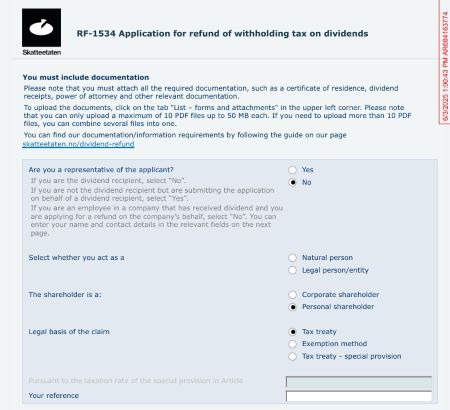

Withholding tax refund Norway, part 2

The second article on the refund of withholding tax on Norwegian shares. You can find the first part with instructions and preparations for registering with the Norwegian authorities here: , Quellensteuerrückerstattung Norwegen Teil 1 . Once again, please note that this application is only possible for tax residents in Germany.

As a placeholder $EQNR (+5,14 %) , $HAUTO (+2,51 %) , $VAR (+0,52 %) , $MOWI (-0,3 %) , $MPCC (-0,46 %) , $TEL (+0,36 %) , $AKRBP (+1,51 %) , $TOM (+0,92 %)

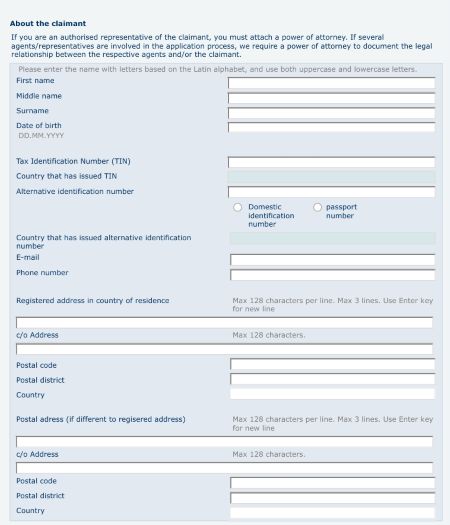

Open the start page Altinn – Start - the language to English and if you have activated the automatic Google translator you can even go to German - log in, go to International, then log in without social security number/D-number, enter user name and password and log in. To find the right form, enter RF_1534 in the search, then the form Request for refund of withholding tax on dividends will open. You have a kind of "menu field" on the left-hand side which you can use to switch to the individual pages of the form.

Fill in the two pages for the applicant. Don't forget the tax ID ( Tax Identification Number ), but this is a mandatory field anyway. In the large field Registered address in country of residence, enter only the street and house number.

You will now need the dividend vouchers showing the withholding tax deduction.

Then open the Dividends form. There you will see three lines for your entries, which can be expanded as required.

In principle, you must enter Yes in the first field for the question of stock exchange listing in Oslo. This is the case if the ISIN of your share begins with NO... . In the second field, enter the VPS number of the depositary of your shares. This is clearstream, the currently valid number is 153300000145. In some forums you can still find the old number beginning with 05. In the third field you enter the year for which you are applying for the refund, up to 5 years retroactively are possible. Then enter the ISIN of your share as you can see it on the dividend voucher and the name of the company according to the voucher. In the sixth field, enter the dividend payment in Norwegian kroner according to the receipt. The number formatting requires the decimal point to be entered as a period! Then enter the percentage tax deduction, in this case 25%. You can choose different percentages for the refund claim. Take 10% here! Even if it is tempting to enter the full 25%, it works but will be displayed as an error when the form is checked at the latest. Repeat the whole process until you have entered every single dividend statement. So do not add up the dividends from one year, each payment must be entered individually.

This is actually the main task if you have several shares from Norway in your custody account. Once this is done, continue to the payment details page. Under Account Type, click on Other account and enter Euro as the currency, unless you have a corresponding foreign currency account with your bank. Then enter the IBAN and, to be on the safe side, the BIC and the name of the bank.

If there is anything else you would like to say about the application, you have the opportunity to make a note at the bottom of the page.

That's almost it. At the top left above the form name, go to the menu item List - Forms and attachments. You can now upload all dividend statements here. Once again the important note: You can a maximum of 10 PDFs of 50 MB each attached. One PDF is the certificate of residence. If you still have more than 9 individual receipts, combine them into one PDF by company and attach it.

Done, click on check and if everything is ok the document will be sent and you will receive a confirmation in your account.

Finally, a few comments:

Pay attention to the time limit in the form, so that it doesn't end and you have to type in all the entries again from the beginning.

There are a few brokers in Germany who will do this work for you for a fee. There you would have to apply for advance exemption from withholding tax. According to my research, and also confirmed in writing, DKB definitely does this. However, this is only a partial exemption, i.e. this 10%. The remaining 15% must be reclaimed via the tax return.

You can apply directly to the Norwegian tax authorities free of charge.

If you would like to take the route I have described, then quickly obtain your certificate from the tax office and submit the application at the beginning of the new year. Experience has shown that the decision and the refund are possible within a short time. Later in the year, waiting times of at least 6 to 9 months are common. Fortunately, there is even interest on the amount to be refunded if the authorities take longer to process the application. The transfer of the refund may be subject to a fee at some banks, ask your broker how much this is.

I hope this has made you a little less afraid of the refund and if you have any questions, please use the comments function. Greetings from your grandpa 😉😇

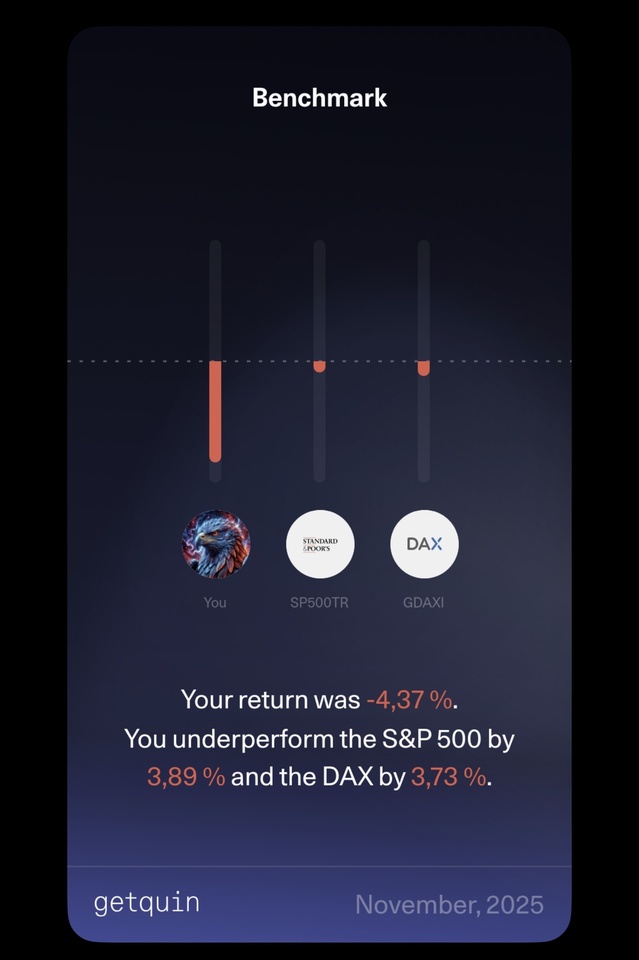

November Performance...

Bitcoin has caused a significant correction in the portfolio, which is nothing unusual given the high weighting.

In November, there were more purchases in the energy sector ($EQNR (+5,14 %)

$AKRBP (+1,51 %)

$CNQ (+2,56 %) )

With $RHM (+1,13 %) I also took advantage of the sell-off and now hold 15 shares.

In addition to Bitcoin, my overall allocation is still overweight in the AI, defense and energy (oil/gas) sectors.

Cash is at ~16%, with a downward trend.

That's it already!

Have a relaxed Tuesday evening 🍻

Withholding tax refund Norway... short interim report

I know I still owe the second part and am already working on the third part.... and ask for your indulgence. The more queries I get, the more information I collect and the more I want to share. As a placeholder $HAUTO (+2,51 %) , $VAR (+0,52 %) , $EQNR (+5,14 %) .....

Since the topic of advance exemption from Norwegian withholding tax has come up again and again recently in order to avoid the - in the eyes of some - laborious process of applying for it in Norway and at the German tax office, I have taken a closer look at DKB, which was mentioned by @SAUgut777 DKB, which was mentioned in this context.

The upstream AI is really stubborn, resistant to questions and in the end just as unfriendly as my questions 😂😂👍, but at least I was then allowed to send the conversation to DKB in a contact form filled out by the AI that contained all the relevant points 👌👌. And from then on, I had to deal with real people who were very friendly and cooperative. At this point, a big compliment to DKB's customer service and the quick reactions, I was more than positively surprised!!!

The end result is that DKB is the only bank so far to offer this service for my inquiries, but the core sentence :

"Dear Mr. Wxxxxx,

an advance waiver is not offered. This is an advance reduction. In accordance with the DTA between Norway and Germany, the Norwegian withholding tax rate is reduced from 25% to 15%.

I wish you a pleasant day."

For DKB account holders, this means that they will get back the 10% that the Norwegian tax authorities refund for you in the way I have described. According to DKB's fee overview, there is a fee of € 30 for this. The remaining 15% must therefore still be claimed via the KAP annex.

Now everyone can decide for themselves whether they want to invest the fee or make the effort themselves. It won't be quicker via DKB either, the Norwegian tax authorities are quite overloaded with applications. I received a short message that it can take up to 15 months at the moment....

So be aware, despite the sometimes very attractive dividends in Norway, that you will first have less than 50% net in your account and then have to do some work to get at least half of the withholdings back.

With this in mind, I will soon publish a shortened second part and follow up with a third part that takes into account the tax aspects and broker-specific features.

Energy shares - focus on Canada & Norway

The world's hunger for energy is increasing and, according to the latest estimates, "peak oil" is further in the future than previously thought.

High geopolitical risks, artificially limited supply and robust demand = (in my opinion) a structurally bullish oil outlook.

Today I would like to introduce you to 3 stocks from the "hated" 🛢️Öl and natural gas sector.

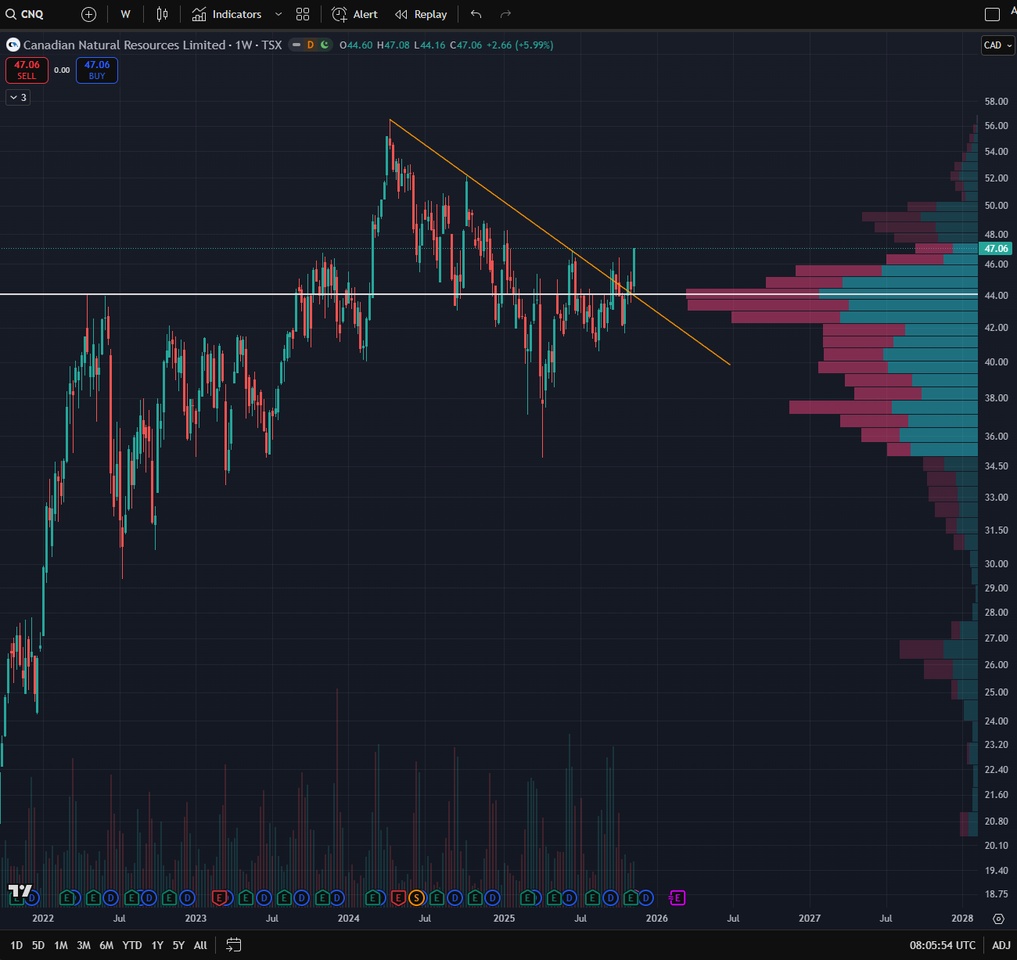

Stock 1:

Canadian Natural Resources $CNQ (+2,56 %)

📍Overview of the company:

Canadian Natural Resources is a leading Canadian energy company primarily engaged in the production and processing of crude oil and natural gas.

Its business model includes the mining of bitumen oil sands and their processing into synthetic crude oil, conventional oil and NGL production as well as major natural gas production in Western Canada and selected offshore locations.

Geostrategically, CNQ benefits from a relatively stable regulatory environment in Canada and owns long-term, long-life production assets.

Analysts value the stock at a fair value of around $54-55, which suggests a moderate upside potential of close to +15-20% from the current price of around $47, assuming commodity prices and operating conditions remain stable.

💰Dividend yield (TTM): 5.187%

📈Notes on the chart:

What I like here is that $CNQ (+2,56 %) has clearly broken the weekly downtrend to the upside.

The price is also above the volume POC, which should now form a support.

I am already invested and plan to buy on setbacks.

Share 2:

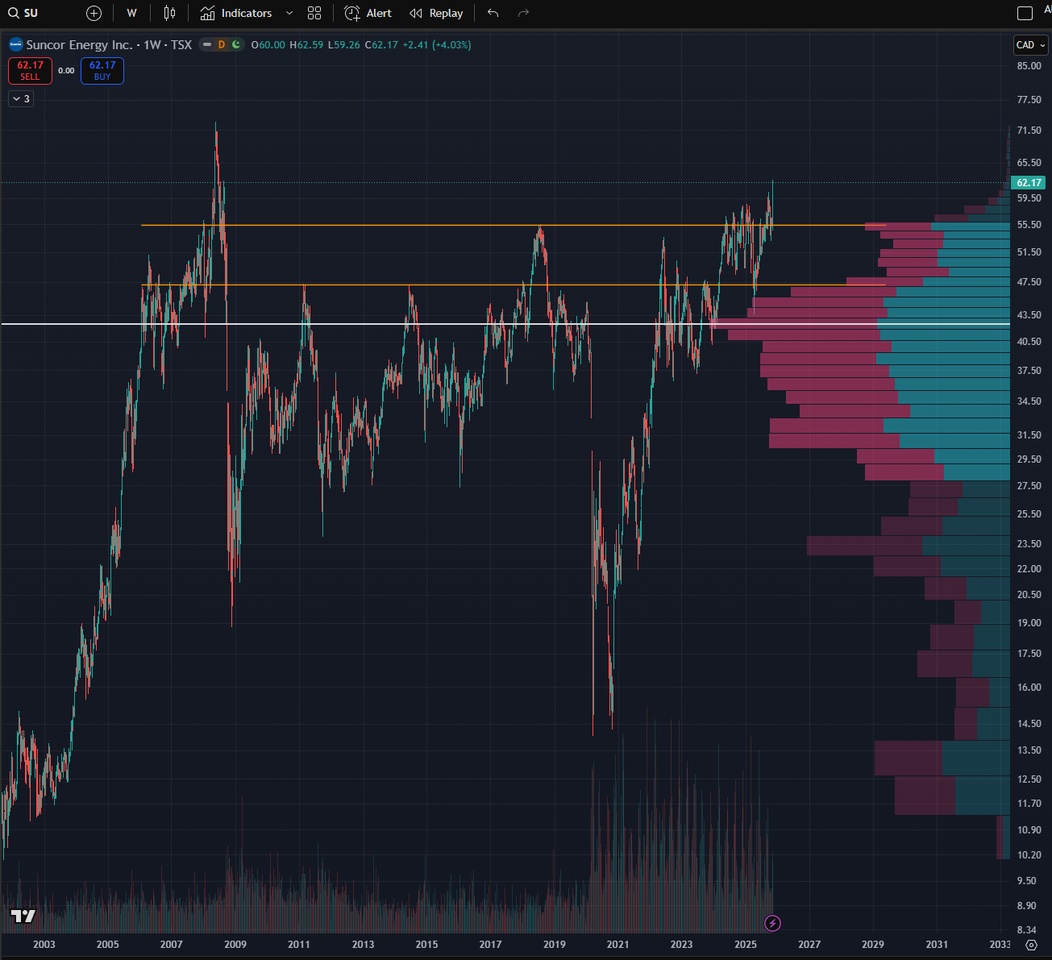

Suncor Energy $SU (-1,27 %)

📍Overview of the company:

Suncor Energy is one of Canada's largest integrated energy companies, making its money primarily from oil sands production, processing into synthetic crude oil, and downstream operations such as refineries and a large Canadian service station network.

Thanks to its strong presence in the politically stable regions of Alberta and Ontario, Suncor is considered to have a relatively secure geostrategic position, as Canada is one of the most reliable oil supply countries and oil sand reserves can be extracted over an extremely long period of time.

Risks arise primarily from North American regulation and ESG pressure, rather than from geopolitical conflicts.

Analysts currently generally see the fair value of SU shares at around C$70-75, while the price on the TSX chart is around C$62 - this results in a moderate expected upside potential in the low double-digit percentage range, depending on oil prices and operating performance.

💰Dividend yield (TTM): 3.816%

📈Notes on the chart:

$SU (-1,27 %) had a long sideways phase in which the price first consolidated at the ~C$47.2 resistance and for the entire past year at around ~C$55.

Now it looks as if the price has broken out of this range to the upside.

The next price target is the ATH from May 2008 (~C$73).

Here, too, I am already invested and continue to buy.

Share 3:

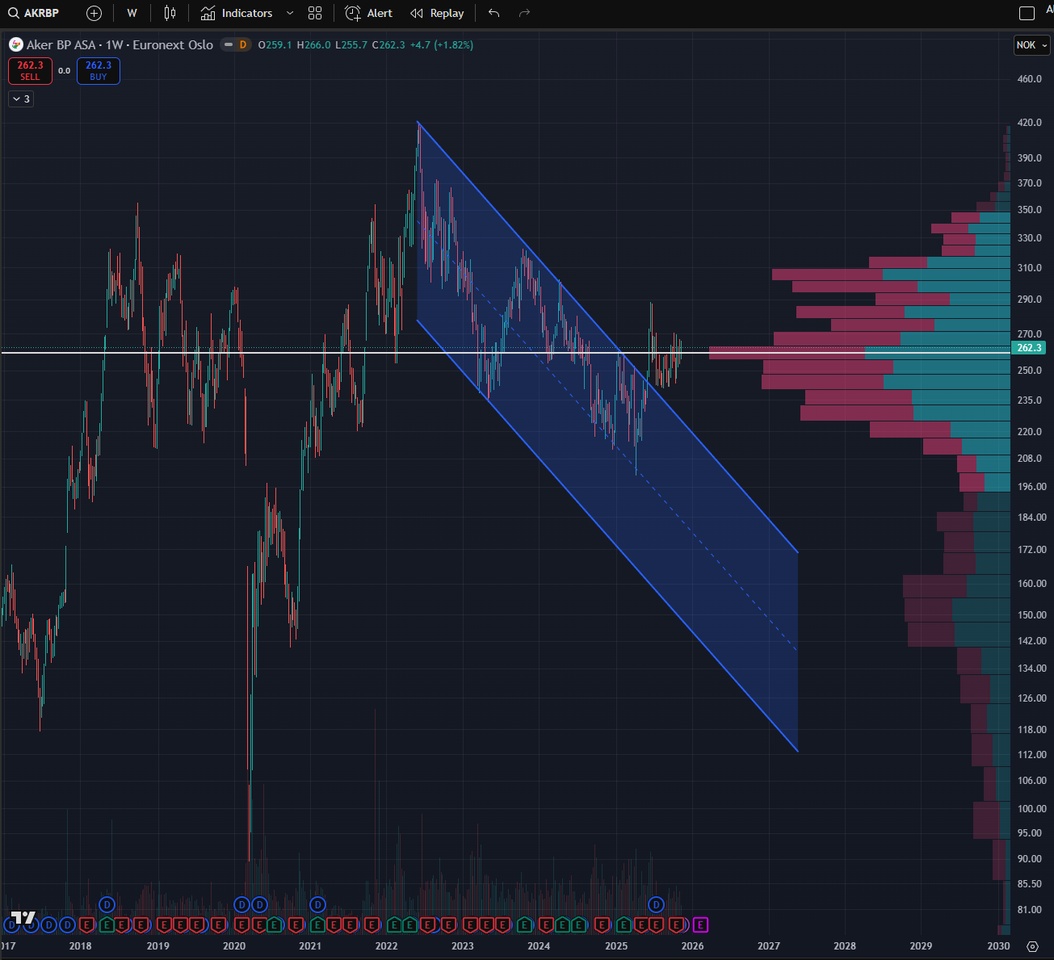

Aker BP ASA $AKRBP (+1,51 %)

📍Overview of the company:

Aker BP ASA is one of the largest independent oil and gas producers in Norway and makes its money mainly through the production of crude oil and natural gas on the Norwegian Continental Shelf.

The company operates several large fields such as Johan Sverdrup, Skarv, Valhall and Alvheim and is characterized by low production costs and high operational efficiency.

Geostrategically, Aker BP is considered very secure, as Norway is politically stable, has reliable regulation and the North Sea assets are not dependent on conflict zones - a clear advantage over many global producers.

Analysts are largely positive on Aker BP; consensus estimates see a fair value slightly above the current price level, supported by robust cash flows, high dividends and expected production increases.

Overall, Aker BP is seen as a high-quality, geostrategically stable oil stock whose valuation depends primarily on the long-term oil price.

💰Dividend yield (TTM): 10.05%

📈Notes on the chart:

Aker BP has successfully broken out of the downtrend since 2022 and is currently consolidating just above the long-term volume POC.

I am invested and will continue to buy if possible.

💬 Closing words

As of today, I am invested in the energy sector with 8.2% of my portfolio.

In addition to the stocks presented, I am also invested in $CVX (+0,14 %) , $EQNR (+5,14 %) , $OXY (+2,14 %) , $TTE (+1,19 %)

Do you have an "insider tip" from the energy sector that you would like to share? 🤔

First purchase TotalEnergies

In order to expand my share of the energy sector in Europe, I made my first purchase today. $TTE (+1,19 %) bought today.

This means that the share of the energy sector in my portfolio is now just under 7%.

The last purchases were:

New dividend portfolio

I would like to start a completely new portfolio that will primarily revolve around dividends.

As a core I was thinking of $TDIV (-0,25 %)

Would you say this is a good core?

If not I would add $VHYL (-0,37 %) add.

Additionally I would like to have a CC ETF as a kind of support, probably $JEGP (-0,32 %) and or $SXYD (-1,24 %)

I would like to represent the NASDAQ with $EQQQ (-1,56 %) but I will represent it with $ASML (-5,28 %) and $2330 will be added.

Allianz $ALV (-1 %) and Munich Re $MUV2 (-1,26 %) I definitely want to include, but they are too expensive for me financially, so I was thinking of the $EXH5 (-1,06 %)

Oil shares are represented by $VAR (+0,52 %) and one more.

Do you have any recommendations?

I am thinking about $CVX (+0,14 %)

$EQNR (+5,14 %) and $PETR4 (+2,49 %)

I would also like renewable energies, but I'm not familiar with them.

Do you have any suggestions?

Becoming a defensive company $ULVR (-0,98 %)

$D05 (-0,04 %)

$O (+0,36 %) and of course $NOVO B (-0,55 %) Being.

$BATS (-1,48 %) I already have in a portfolio, would it be too much of a lump to add $MO (-0,92 %) to add to it?

I still have $KHC (+2,07 %) on the watchlist but the split is not going so well, would it be wise to start with a savings plan?

Apart from that $RIO (-0,64 %)

$NKE (-1,76 %)

$1211 (-0,15 %)

$SOFI (-1,27 %) and $HAUTO (+2,51 %) will be represented with smaller positions.

What is your opinion?

Would you improve anything?

What else would you add, especially in EE and defensive stocks?

Feedback is very important to me here, so far I have just been wandering aimlessly around the stock market without a fixed plan and strategy.

This is my first attempt to build something serious.

Greetings to all Getquins out there!

Valores en tendencia

Principales creadores de la semana