Take advantage of the$PG (+0,98 %) take advantage of...

Furthermore, I have $CHD (-0,07 %) and $BEI (+0,02 %) stocked up.

Puestos

27Take advantage of the$PG (+0,98 %) take advantage of...

Furthermore, I have $CHD (-0,07 %) and $BEI (+0,02 %) stocked up.

The sensible use of saved capital in retirement requires good planning. Especially if you want money to flow out of it regularly to secure or sweeten the third stage of your life.

Financial brokers then like to offer pension insurance based on a single payment, often called an immediate annuity.

With a normal life expectancy, the return is usually not generous because insurers usually invest very conservatively. In addition, the costs and profit margins of the insurance company further reduce the return. Consumer advocates point out that you usually have to live to be 94 years or older before you receive the investment sum back via guaranteed pensions.

It is often more profitable to park the money in a call money account.

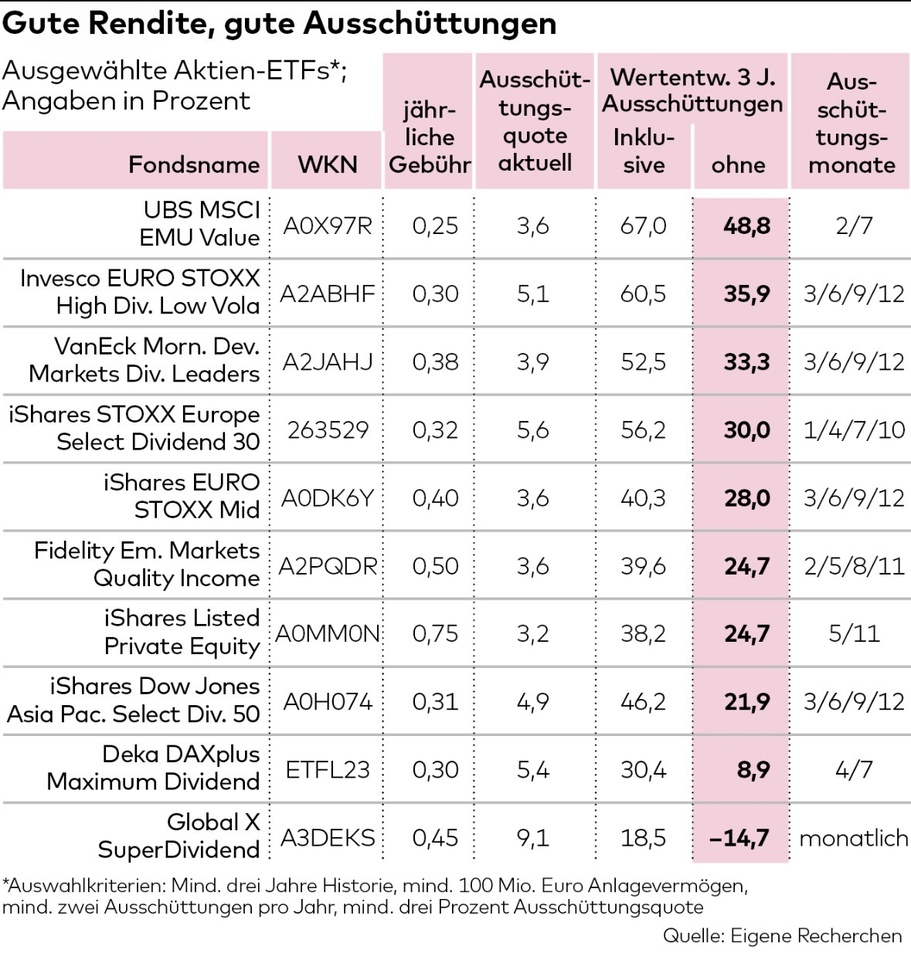

Investments with regular distributions are an alternative. Investors are spoiled for choice between several thousand dividend-paying equity funds.

What are the relevant selection criteria? Quality and cost structure.

For some, the level of distributions may also be an important criterion in the selection process. But caution is advised here: For example, the payout ratio of the Global X Super Dividend ETF $SDIP (+0,2 %) is currently over nine percent. With an investment sum of 100,000 euros, this results in a monthly inflow of around 750 euros before tax.

This is possible because the ETF invests stubbornly in the 100 companies with the highest dividends worldwide, but without any consideration of the sustainability of these distributions and the quality of the companies.

This in turn means that, without the dividends, the ETF generated a return of zero over one year and even minus 14% over three years. Investors therefore received high regular payouts, but the investment capital decreased significantly at the same time.

Savers should therefore always pay attention to how the ETF invests. There are various positive counter-examples, such as the Invesco Euro Stoxx High Dividend Low Volatility ETF $EUHD (+0,46 %). Although this also focuses on high-dividend companies, it also selects according to qualitative criteria. Result: Although the payout ratio is currently "only" 5.1% per year, this amounts to around EUR 425 per month before tax for an investment sum of EUR 100,000.

However, the ETF has also achieved growth of almost 36% over the past three years, and including distributions, the gain was even over 60%. There are similarly good ETFs for various other investment regions or sectors.

Bond ETFs, on the other hand, are rarely a real alternative for private investors. Although distribution rates of four or five percent can be achieved, this is ultimately only possible with high-risk bonds or US securities with a corresponding currency risk. In addition, a positive return can rarely be achieved over and above the distribution.

A (possibly riskier) alternative is to invest in individual shares with high dividends. However, quality is even more important here. "We value companies with a strong balance sheet that are characterized by a high equity ratio and above-average returns on capital and sales," says Franz Kaim from Kidron Vermögensverwaltung in Stuttgart.

Continuity is also important. "The so-called dividend aristocrats are the gold standard for income-oriented investors," says Rainer Laborenz, Managing Partner of Azemos Vermögensverwaltung in Offenburg. "Companies that have increased their dividends for at least 25 consecutive years are included in this select group."

There are currently around 150 dividend aristocrats worldwide, 117 of which are from the USA and 33 from the rest of the world. The best-known names include Coca-Cola $KO (+0,78 %)Procter & Gamble $PG (+0,98 %) and Johnson & Johnson $JNJ (-0,5 %) from the USA, Fresenius from Germany $FRE (-0,06 %) and Unilever $ULVR (+1,38 %) from Great Britain.

Other attractive dividend stocks recommended in a WELT survey of ten leading asset managers in Germany include Allianz $ALV (+1,65 %)BASF $BAS (+0,7 %)Beiersdorf $BEI (+0,02 %)Deutsche Post $DHL (+0,52 %) and Munich Re $MUV2 (+0,8 %).

In other European countries, they rely on BAT $BATS (+2,33 %), BP $BP. (-1,45 %), Nestlé $NESN (-0,62 %), NN Group $NN (+2,06 %)Shell $SHEL (-0,01 %) and Swiss Life $SLHN (+1,1 %).

In the USA, names such as Altria $MO (-0,33 %), Chevron $CVX (-0,5 %)Cisco $CSCO (+1,04 %), Coca-Cola, Kimberly-Clark $KMB (+0,5 %) , McDonald's $MCD (+0,34 %) or Pepsi $PEP (+0,19 %).

Source: Text (excerpt) & table: Welt, 05.12.25

👋 Introduction & background

Hey everyone!

I'm 33, married and dad to two small children (18 months and 2 months old). I've been working in the automotive industry since 2011 and in management consulting since 2019. ⚙️🚗💼

My wife is an engineer and also works in the automotive industry. 👩🔧🚗

I've been with getquin since 2022, but so far I've been reading along rather than actively posting. 👀

My wife is currently on parental leave and receives parental allowance. I will go on parental leave in Q2 2026 (also with parental allowance), then she will start working again. This means that only one of us will receive a full salary until the end of 2026 - but we'll still be sticking to our savings and investment quota. 👶💶

💰 Current status:

A good mid-six-figure amount has already been saved in our custody accounts. 📈

👶 Children & investments

For each child, we invested €10,000 in the Vanguard FTSE All World ($VWRL) (+0,63 %) invested. In addition, each child receives €150 per month in the same ETF - via junior custody accounts at ING. 📊

💍 My wife's investments

She invests monthly:

- 🌎 500 € in the MSCI World ($XDWL) (+0,59 %)

- 💸 500 € in the Vanguard FTSE All World High Dividend ($VHYL) (+0,81 %)

📈 My investment strategy

Long-term, diversified and with a focus on cash flow & wealth accumulation.

🔹Core portfolio (ETF & Bitcoin)

€1,000 flows in every month:

- 💵 €600 in SPDR S&P 500 ($SPY5) (+0,61 %)

- 🌍 €200 in Vaneck Morningstar Developed Markets Dividend Leaders ($TDIV) (+0,23 %)

- ₿ 200 € in Bitcoin ($BTC) (-4,41 %)

🔹 Individual share savings plans (€25/ €600 each)

Target per company: €10,000 investment amount.

Currently participating:

$DB1 (+1,23 %) , $UNP (+1,06 %), $RACE (-0,43 %) , $MRK (+0,19 %) , $MUV2 (+0,8 %) , $DGE (+3,91 %) , $DE (+0,58 %) , $TXN (+0,98 %) , $AWK (-1,21 %) , $ADP (-9,57 %) , $PLD (+2,09 %) , $HEN (-0,43 %) , $ITW (+0,32 %) , $UNH (-0,11 %) , $LLY (-1,18 %) , $BEI (+0,02 %) , $MCD (+0,34 %) , $DTE (+0,29 %) , $WMT (-1,92 %) , $COST (-0,19 %) , $WM (-1,44 %) , $JPM (+0,53 %) , $BLK (+1,63 %) , $SY1 (+1,28 %)

🔹 Cash reserve

💰 Set aside at least €1,000 every month to be able to strike flexibly when opportunities arise.

🏘️ Real estate strategy

We live in our own home and own a rental apartment that pays for itself. ✅

Further real estate purchases are planned. 🏡📈

🎯 Target (15-20 years)

Financial freedom - with the option of part-time or complete independence from employment. Focus on more time for family, projects and quality of life. ✨

How do you structure your portfolios? What is your strategy and what are your long-term goals?

I look forward to the exchange!

15 of the 40 DAX companies are expected to achieve record profits in 2025.

However, five shares of the record profit groups are trading at least 20 percent below their previous high. This makes these stocks interesting because it reduces their valuation. One share is even trading 75 percent below its record high.

Handelsblatt profiles these five shares with a view to the companies' share valuations and business prospects.

75 percent below record high: Zalando

Zalando is currently trading $ZAL (-0,93 %) is currently 75 percent below its all-time high, although the company is expected to earn more in the current financial year than ever before.

23 out of 31 analyses recommend buying the share at the current reduced price level, only two recommend selling.

However, shareholders should not be blinded by the supposedly favorable valuation, as the high average P/E ratio of 60 is distorted by losses and very meager profits from the early days as well as the brief euphoria for online retail shares during the pandemic.

42 percent below record high: Symrise

Analysts forecast for Symrise $SY1 (+1,28 %) on average 514 million euros net profit, after the previous record profit of 478 million euros in the previous year. The operating profit before interest and taxes is expected to be 21.5 cents per euro. The previous forecast was 21 cents.

16 out of a total of 24 analysts recommend buying the share. One argument is the high dividend continuity. In spring, the payout increased for the 15th time in a row. Nothing stands in the way of another increase in 2026 in view of rising Group profits.

39 percent below record high: Beiersdorf

With a price loss of 30 percent over the past six months, the shares of consumer goods manufacturer Beiersdorf $BEI (+0,02 %) is one of the worst performers in the DAX.

Nevertheless, Beiersdorf is on the verge of another record profit. After a net profit of 912 million euros in the past financial year, analysts are forecasting an average of just under one billion euros for 2025.

17 out of 26 analysts recommend buying the share, two recommend selling. Despite imminent record profits, the share is trading more than a third below its record high. With a P/E ratio of 20 based on the profits expected in the next four quarters, the share is still not cheap. However, it is valued 20 percent lower than the average of the past 20 years.

30 percent below record high: Siemens Healthineers

Hardly any other DAX-listed company is as globalized as the Siemens medical technology subsidiary. Siemens Healthineers generates 95 percent of its sales abroad. $SHL (+2,12 %) abroad. This makes the company independent of the German market.

The manufacturer of surgical robots, computer tomographs and radiotherapy equipment posted a net profit of 1.9 billion euros last year. Analysts are forecasting a record profit of 2.2 billion euros for the current financial year.

With a P/E ratio of 18.8 based on the profits expected in the next four quarters, the share is moderately valued and 15 percent lower than the historical average. However, the Siemens subsidiary has only been listed on the stock exchange since 2018.

23 out of a total of 25 analysts who regularly analyze the Group recommend buying the share. None recommend selling. This gives Siemens Healthineers by far the best rating of the shares portrayed here.

20 percent below record high: SAP

In the past quarter, SAP's earnings before interest and taxes (EBIT), adjusted for special effects $SAP (+1,12 %) earnings before interest and taxes (EBIT) adjusted for special items rose by around a third to 2.6 billion euros compared to the same period last year. The cash inflow, which is important for investors, increased by 83 percent to just under 2.4 billion euros.

For the year as a whole, analysts are forecasting an average net profit of 6.8 billion euros. That would be more than ever before and more than twice as much as in 2024. In the previous year, however, provisions worth billions of euros for employee severance programs distorted the balance sheet.

27 buy recommendations are offset by four hold and three sell ratings. One reason for the fairly strong vote despite the high valuation is the high level of resilience: a good 85% of revenue is based on recurring and therefore reliable business. This makes the IT group virtually independent of economic fluctuations.

Source text (excerpt) & graphic: Handelsblatt, 23.09.25

Today there is an article on the most important findings from Beiersdorf ($BEI (+0,02 %)) from the first quarter of 2025.

CEO Vincent Warnery emphasized that Beiersdorf met expectations in the first quarter of 2025 after a very strong year in 2024. The results of the first quarter were influenced by a high prior-year base, but would support the outlook for the full year. The Derma business (Eucerin and Aquaphor) was particularly emphasized, which once again showed a strong performance with organic sales growth of 11.4 %. Eucerin is not only growing in established markets, but is also expanding successfully into new countries.

At the same time, the foundation for future success is being laid in China by realigning the NIVEA business with strategic innovations in order to win in the skin care segment. Overall, the Consumer segment recorded organic sales growth of 2.3%. Excluding China, growth even amounted to 4%, which is in line with the forecast for the year.

- NIVEA increased sales by 2.5% despite an exceptionally strong first quarter of 2024 and negative effects from the repositioning in China. Strong skin care categories and outstanding double-digit sales growth in North America contributed significantly to this result.

- Eucerin and Aquaphor achieved strong double-digit organic sales growth of 11.4%, as mentioned above, driven by successful face and body care products, innovation launches and the continued strength of Aquaphor.

- The Health Care business (Hansaplast and Elastoplast) recorded fantastic double-digit sales growth of 10.8%, supported by the launch of the next generation of plasters.

- La Prairie sales declined by 17.5% organically, reflecting the best quarter last year and mainly due to ongoing challenges in China and travel retail and related inventory reductions.

- Tesa grew by an impressive 10.7%, partly due to quarterly fluctuations and a very low year-on-year basis, but also supported by a strong electronics business, while changes in the automotive market continued to impact the business.

Warnery emphasized that the overall Group results were well in line with expectations with organic sales growth of 3.6%. He reiterated that the NIVEA innovations for 2025 are impressive and that profitable growth is expected to accelerate in the coming quarters with the planned product launches and relaunches. The Derma business continues its excellent growth trajectory across all regions, with particularly strong growth in emerging markets (+18.5 %) and North America (+10.4 %).

Warnery paid particular attention to the successful launch of thiamidol-based products. Following the successful launch of Eucerin Face in the USA in the previous year, the momentum continued with the market entry of the ingredient thiamidol. New products from the Eucerin Radiant Tone collection went on sale in the first quarter of 2025. In China, a bold approach is being taken to realign the NIVEA business away from less strategic and price-sensitive personal care categories towards premium segmentation in skin care, expansion via digital channels and accelerated innovation. While these efforts would have a negative impact on NIVEA's short-term results in China, they are the basis for future growth in this key market. The launch of thiamidol in China in 2026 following regulatory approval in the previous year is an important milestone.

The "Win with Care" growth strategy is also proving successful, particularly the expansion into new markets and groundbreaking innovations. Chantecaille recorded strong growth of 15.9% in the first quarter, and the launch of thiamidol under this brand (Blanc Peony collection) is expected to open up new growth opportunities. The global launch of the epigenetic anti-ageing lotion has been very successful with high repurchase rates. In the Health Care segment, the launch of the new generation of patches (Second Skin Protection) is setting new standards.

With regard to the outlook for 2025, Warnery confirmed the forecast for organic sales growth in the Consumer segment of 4% to 6% and an improved EBIT margin (excluding special effects) of 50 basis points compared to the previous year. For the tesa segment, the forecast for organic sales growth of 1% to 3% and an EBIT margin of around 16% was confirmed. At Group level, organic sales growth of 4% to 6% and an EBIT margin slightly above the previous year (excluding special effects) are expected. However, uncertainties in the global economy and geopolitical tensions were also mentioned as risk factors.

In the subsequent Q&A, analysts asked various questions:

Jeremy Fialko (HSBC) asked about the impact of tariffs and possible consumer restraint in the US. Warnery explained that the direct impact of US tariffs would be limited as the majority of products sold in the US are manufactured either in the US or Mexico. The greater concern is consumer sentiment, although Beiersdorf is outperforming the market. Regarding La Prairie, he reiterated the expectation of an improvement over the course of the year, following inventory reductions in the first quarter.

Celine Pannuti (JPMorgan) followed up on the outlook for the full year and asked about the momentum in the second quarter. Warnery explained that the second quarter is likely to be at the lower end of the sales growth range due to the timing of Easter (impact on sun protection) and the later launch of major new products. On the question of Epicelline, he said that it was the most successful product launch to date, but still accounted for a small proportion of the derma business.

David Hayes (Jefferies) discussed the performance in the USA, where strong growth in NIVEA and Derma was impacted by Coppertone. Warnery confirmed this and explained that the mass sun care market was declining and Derma brands were gaining market share. For Coppertone, however, there were also positive developments in the sports sector and in facial care. Regarding the China realignment, he explained that the negative impact (approx. 6 percentage points on the Africa/Asia/Australia region) would decrease over the course of the quarters, as the streamlining of the portfolio and distribution partners took place in Q4 2024 and Q1 2025 and the successes with Luminous in e-commerce are now taking effect.

Callum Elliott (Bernstein) wanted to understand in more detail why the China performance should improve in Q2/Q3. Warnery pointed to the continued success of Luminous in cross-border e-commerce and the absence of negative effects from inventory reductions and the discontinuation of distribution partners. Regarding a global reduction in focus on certain personal care categories, he explained that this primarily relates to China, with the exception of deodorants, where ambitions remain high.

Jean-Olivier Nicolai (Goldman Sachs) asked about press reports on NIVEA's loss of market share in Germany. Warnery acknowledged a slight loss of market share in priority countries, but emphasized that NIVEA is gaining market share globally (albeit slightly). He cited competition from private labels and local, ingredient-based brands as reasons for this. Countermeasures such as influencer marketing and a stronger digital presence would be taken. In future, price increases would be more targeted at product launches.

Guillaume Gerard Delmas (UBS) asked about a "Plan B" in the event of a deterioration in consumer sentiment. Warnery emphasized that Beiersdorf was well positioned with brands such as NIVEA, which cover a broad price spectrum, and that there was therefore no specific "Plan B", but rather that the strength of the existing brands and their pricing opportunities would be used. Astrid Hermann added that profitability and investments are managed in an agile manner and that the company has learned from the COVID period how to deal with uncertainties. Regarding the weaker growth rates in Eastern Europe and Latin America in the first quarter, Ms. Hermann explained this with very high year-on-year figures and, in Eastern Europe, additionally with concluded price negotiations with individual customers, which is positive for the future.

Paolo Laudani (Reuters) asked about possible production relocations to the USA and the company's DEI targets there. Astrid Hermann explained that no short-term changes to the production strategy in the USA were currently planned, but that this would be continuously reviewed. Warnery emphasized that diversity and inclusion are important for Beiersdorf, without relying on quotas or positive discrimination. In the USA, there is already a 50/50 management level between men and women.

Fon Udomsilpa (RBC) asked whether a strategic repositioning similar to that in China was also planned in other regions. Warnery replied in the negative and explained that the situation in China was special, while Beiersdorf had started successfully in other large markets such as the USA and India with a strategy based on skin care and then gradually expanded.

Karel Zoete (Kepler) asked about the timing of the launch of new NIVEA core innovations in Europe. Warnery explained that most major product launches are planned for the second half of the year. Regarding La Prairie and its dependence on China, he said that China's share of the overall business has been reduced (below 40%) and efforts are being made to expand the business in other regions such as the US, Europe, India and Japan.

Conclusion:

Beiersdorf's analyst conference painted a mixed picture, but overall optimism prevailed. The Derma business continues to be a strong growth driver and the realignment in China, although a burden in the short term, is seen as a necessary step for future growth, particularly with regard to the launch of Thiamidol.

The innovation pipeline for NIVEA in 2025 looks promising, and the successful launch of new products such as Epicelline underlines the company's innovative strength. Challenges remain in the La Prairie segment and in the mass sun care market in the USA.

The confirmed annual forecast indicates that Beiersdorf is confident of achieving its targets despite global uncertainties. It remains exciting for us to see how the strategic initiatives, particularly in China, will play out in the coming quarters and whether the ambitious growth targets can be achieved.

I hope you enjoyed this summary!

Slump in the DAX: investors are seeing red

There is a great deal of uncertainty on the stock markets at the moment, and this is being further fueled by US President Trump's aggressive tariff policy. On the last trading day of the week, investors have to accept massive losses in the Dax. Of the 40 companies listed in the leading German index, only two shares were able to record a positive closing price. The remaining 38 stocks experienced double-digit declines in some cases. Deutsche Bank was particularly affected $DBK (+2,11 %)which fell by 9.77 percent, and MTU Aero Engines $MTX (+1,02 %)whose shares fell by 8.11 percent. Deutsche Börse, Infineon $IFX (-1,28 %) and Siemens Energy $SIE (+1,82 %) also suffered losses of more than 7 percent. The Dax itself closed 4.95 percent lower at 20,641.72 points.

Trade war continues to weigh on the markets

Pressure on the markets remains high as uncertainty over trade relations between the USA and China persists. China's announcement that it would impose counter-tariffs on US goods has heightened fears of a full-scale trade war. At times on Friday, the Dax fell by up to 5.6 percent to 20,579 points. The MDax and EuroStoxx50 also suffered significant losses. There were significant declines in the banking sector in particular, which is heavily dependent on economic developments. Deutsche Bank and Commerzbank $CBK recorded losses of up to 12.1 and 9.3 percent respectively. Volatility on the markets is likely to remain high as long as the uncertainty surrounding customs policy persists.

Slight stability at Adidas and Beiersdorf

Despite the general downward trend, there were also some bright spots in the Dax. The shares of Adidas $ADS (+1,94 %) were able to maintain their position as the lone frontrunner with a plus of 0.54 percent. Symrise $SY1 (+1,28 %) and Beiersdorf $BEI (+0,02 %) also remained relatively stable, with Symrise recording a minimal gain of 0.01%, while Beiersdorf fell by 0.37%. Investors are hoping that the negative spiral of tariffs and counter-tariffs can be halted through negotiations, but the uncertainties remain and could continue to weigh on the markets.

Sources:

https://www.n-tv.de/wirtschaft/Das-sind-die-groessten-Verlierer-im-Dax-article25682125.html

https://www.n-tv.de/wirtschaft/Dax-schmiert-ab-US-Zoelle-China-Zoelle-und-jetzt-article25681044.html

Dear Community, usually classic consumer staples such as P&G $PG (+0,98 %) or Unilever $ULVR (+1,38 %) usually come through times of falling share prices relatively unscathed and sometimes even gain popularity as a crisis-proof foundation with strong dividends.

About two weeks ago, I opened a small leveraged position on Beiersdorf $BEI (+0,02 %) as I consider the share to be very undervalued and most analysts share this opinion. The position is really small as I have never traded leveraged products before and see it more as a nice exercise than a path to riches. I'm currently up around 3% (which is not five euros due to the small size) and the knockout is €88, so there's really a lot of room.

I have to say, however, that I had clearly underestimated Trump's disastrous tariffs.

Of course, no one here has a crystal ball, but perhaps the older guys can share their experiences? Do collapsing share prices also take non-cyclical consumer goods down with them in the long term or are they completely invulnerable and even rise unconcernedly? Or do they now rise for a few days at the moment of the shock because of the short-term influx and then stagnate as general consumption also becomes more restrained and more cheap brands are bought for the household? That unemployment in the US and Europe will rise and consumption will become even more expensive due to higher prices is to be expected, or do you see it differently? I wonder whether I should simply take my current profit or whether I can continue to assume that the fair value of Beiersdorf is around EUR 145 (which was my firm conviction a week ago).

Which Dax shares do you have in your portfolio?

Source: https://t.co/1KCO9l8ZsE

#dax

#dividend

#dividende

#dividends

$ADS (+1,94 %)

$AIR (+0,87 %)

$ALV (+1,65 %)

$BAS (+0,7 %)

$BAYN (-4,34 %)

$BMW (+0,52 %)

$BEI (+0,02 %)

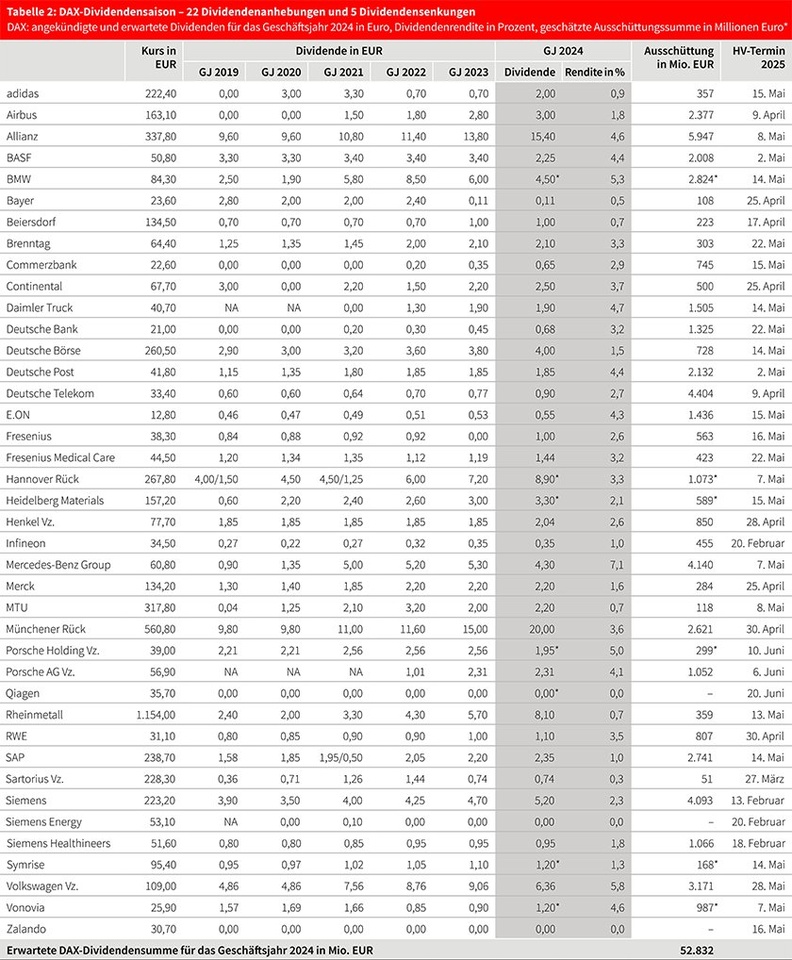

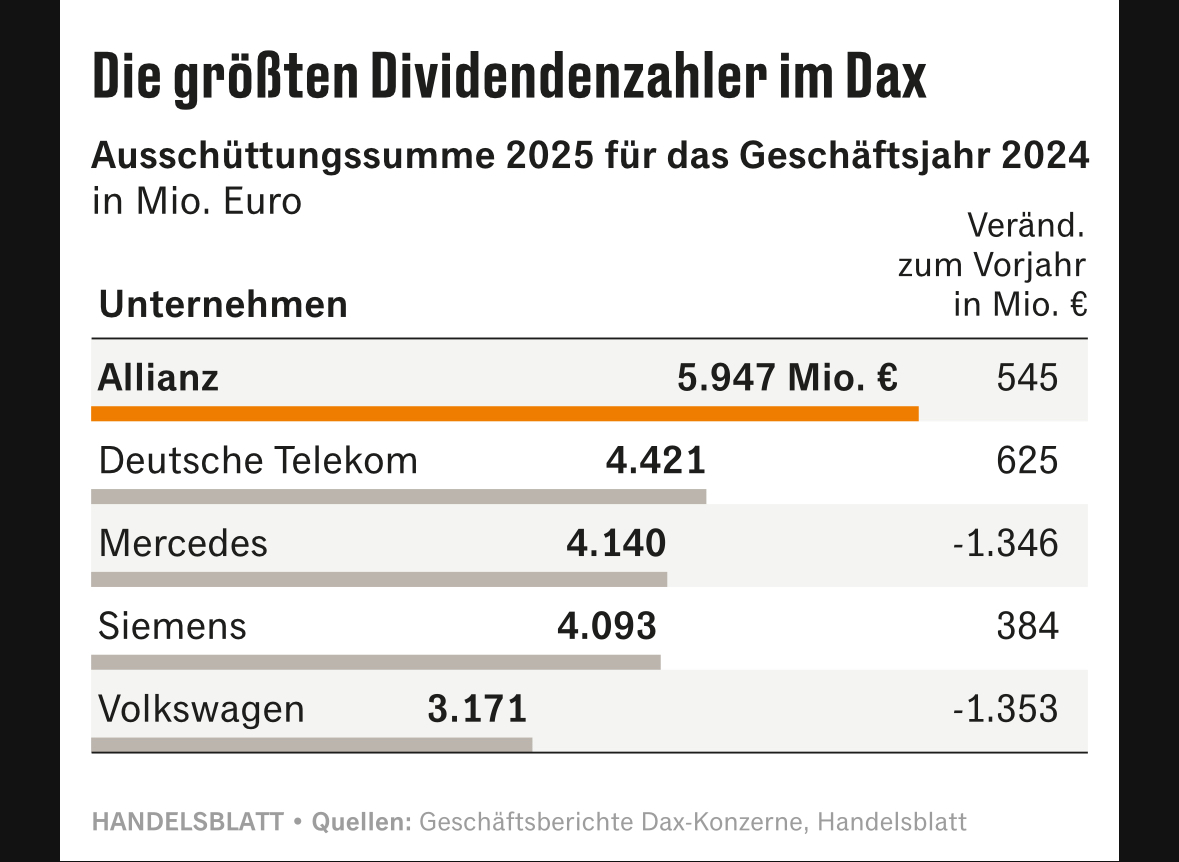

At 53 billion euros, the 40 DAX companies are likely to pay out almost one billion euros more this year than a year ago - more than ever before.

The reason for the strong development is high consolidated profits and unexpectedly rising dividends at a good dozen companies, including $ALV (+1,65 %) Allianz, $MUV2 (+0,8 %) Munich Re and $RHM (-0,17 %) Rheinmetall.

At 109 billion euros net profit, the DAX companies are likely to have earned as much in 2024 as in the previous year, according to Handelsblatt calculations. Slump in earnings for the three car manufacturers $BMW (+0,52 %) BMW, $MBG (+1,16 %) Mercedes and $VOW (+0,93 %) VW will be offset by companies in other sectors, in particular the major insurers Allianz, Munich Re and $HNR1 (+1,13 %) Hannover Re, but also $DTE (+0,29 %) Deutsche Telekom, $HEN (-0,43 %) Henkel and $EOAN (-0,64 %) Eon.

More than a dozen DAX companies have announced higher dividends than the market had previously expected. For example $ALV (+1,65 %) 15.40 euros per share after 13.80 euros in the previous year. Analysts had forecast just under 15 euros. The insurer is thus distributing just under six billion euros. This is a record in the German corporate landscape.

The biggest jump is at $MUV2 (+0,8 %) Munich Re: The reinsurer is increasing its dividend by five euros per share to 20 euros.

The two healthcare specialists $FRE (-0,06 %) Fresenius and $FME (+1,61 %) Fresenius Medical Care, the brand manufacturer $HEN (-0,43 %) Henkel, the automotive supplier $BTR Continental, the $CBK (+1,34 %) Commerzbank, $RHM (-0,17 %) Rheinmetall and $HNR1 (+1,13 %) Hannover Re have raised their dividends, in some cases significantly more than expected. This is also due to rising profits, which justify a higher profit share for shareholders.

The largest dividend payers in the DAX are

Like the car manufacturers, a number of companies in the DAX remain below the usual international payout ratios, including the family-run groups $BEI (+0,02 %) Beiersdorf and $MRK (+0,31 %) Merck. They pass on less than 30 percent of their profits. This leaves enough of a buffer so that dividends do not have to be reduced immediately in more difficult times.

Germany's most valuable group, $SAP (+1,12 %) SAP, with a payout ratio of 85%, is pushing the limit: net profit of 3.1 billion euros in the past year compares with a total dividend payout of 2.7 billion euros. However, the profit was burdened by a one-off effect.

So far, a total of 20 companies have increased their dividends, with only $BAS (+0,7 %) BASF and the three car manufacturers. Four companies have yet to do so: $RWE (+0,8 %) RWE, $SY1 (+1,28 %) Symrise and $VNA (+0,18 %) Vonovia are likely to increase their dividends, while analysts expect $PAH3 (+2,68 %) analysts expect a reduction at Porsche Holding.

Source (excerpt) & chart: Handelsblatt, 15.03.25

In the world of SAP $SAP (+1,12 %) Executive Board salaries are rising sharply, mainly due to a booming share price. CEO Christian Klein earns 19 million euros, a large part of which is based on performance targets linked to turnover and the share price. Chief Financial Officer Dominik Asam earns 3.2 million euros, while Thomas Saueressig receives 8.2 million euros for the Consulting & Customers division.

At Beiersdorf $BEI (+0,02 %) the core brand Nivea remains strong, with sales of 5.6 billion euros and organic growth of 9 percent. However, the luxury brand La Prairie is struggling in China with a 6.2 percent decline in sales. Tesa recorded slight growth of 1.9 percent to 1.7 billion euros, while the return on sales could fall slightly.

Amazon $AMZN (+2,51 %) unveiled a new quantum computing chip called Ocelot, which makes error correction more efficient and could reduce costs by up to 90%. In contrast to competitors such as Google and Microsoft, Amazon is focusing on integrating error correction directly into the chip architecture instead of just increasing the qubit count. The prototype could accelerate the development of more resource-efficient quantum computers in the future.

Source:

Principales creadores de la semana